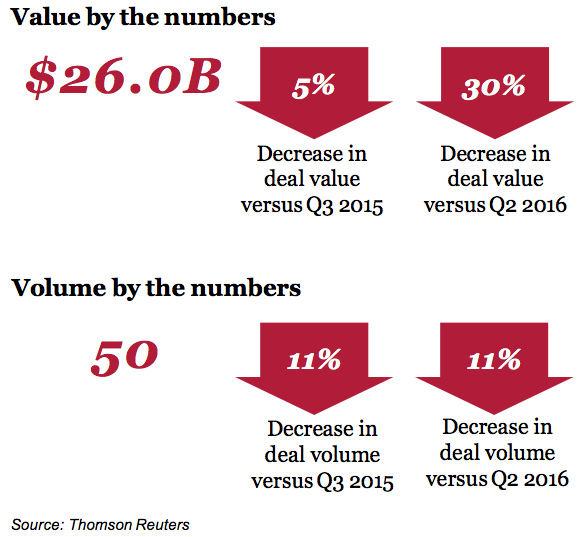

iDeal – Defining M&A Analytics

By Charles Knight, Iain Macmillan – Deloitte An M&A analytics solution that provides deeper, more meaningful insights from data to deliver real-time answers and analyses throughout the M&A lifecycle. The Mergers & Acquisitions (M&A) lifecycle is awash in data. It starts long before the diligence phase and picks up steam when companies share, solicit, and parse information for go … Read more