HR Mergers & Acquisitions Expert (HRM&A)

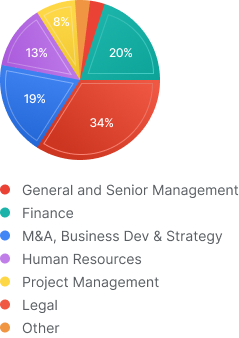

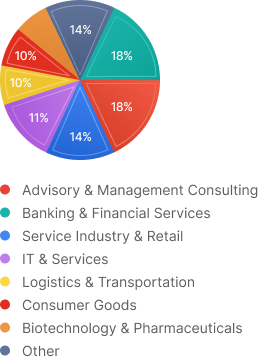

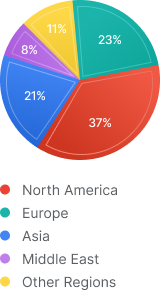

The HRM&A program is designed to meet the needs of Human Resource professionals involved in M&A transactions in both corporate and consulting roles. The HRM&A program covers all aspects of the transaction process relevant for HR including strategy, due diligence, Post Merger Integration (Best of PMI), and compensation and benefits. Gain knowledge in best practices for the M&A process and better understand the HR function and its significance during pre-deal or the post-merger integration phase. The HRM&A designation prepares HR practitioners in preparing for the challenges and practical realities of M&A transactions.