Direct And Indirect International Experience Of Shareholders, Ownership Structure And Cross-Border M&A

by Elsevier Ltd.

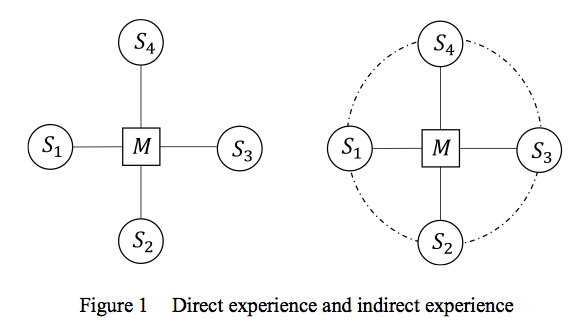

Prior research suggests that international experience only are directly learnt by firms’ international operations. In this study, we argue that majority shareholders are part and parcel of the network of internal and external international experience. Based on the sample of 307 cross-border M&A of 741 majority shareholders in 188 Chinese listing enterprises for the 2005–2014 time period, we measure direct international experience and indirect international experience using centrality analysis in two-model social network. […] Read more