A survey report based on the opinions of 132 senior executives worldwide

By Mike Johnson – Towers Perrin

Executive summary

Three main conclusions emerge from this survey:

M&A does deliver

European merger and acquisition (M&A) transactions are surprisingly successful: over 70% of respondents report their M&A deals achieved targeted objectives. New desk research into 50 large mergers and acquisitions in Europe backs-up the respondents’ claims. In 45% of the deals the share price of the merged company outperformed the rest of its sector in the following year. Both the operational and financial success-rate of M&A deals revealed by the survey contradicts previous studies into M&A performance and should embolden companies considering M&A activity.

People issues are critical

The prominence given to companies’ human capital before and during M&A deals is critical to the success of the transaction. The survey examines the differing strategies of involving human resources functions by senior managers responsible for managing M&A. Transactions that place HR considerations and capabilities centrally have a higher success rate than deals that neglect HR.

And

HR expertise is key factor for success

The survey results suggest that the more capable the HR department, the greater the chances of M&A success. Yet the most common responsibility given to HR during the M&A process is to provide ad hoc advice to senior managers, rather than carrying out a structured and formal role. Therefore, while the survey reveals a greater level of M&A success than is commonly perceived, it also suggests there is still significant room for improvement by ensuring HR involvement.

About this survey

“The role of human capital in M&A success” was researched and written by Towers Perrin in co-operation with the Economist Intelligence Unit. The main author of the report is Mike Johnson. Michael Kapoor has contributed additional material. John Jeffcock and Laura Nightingale of Winmark Research conducted background research.

The research effort for this report comprised three key initiatives:

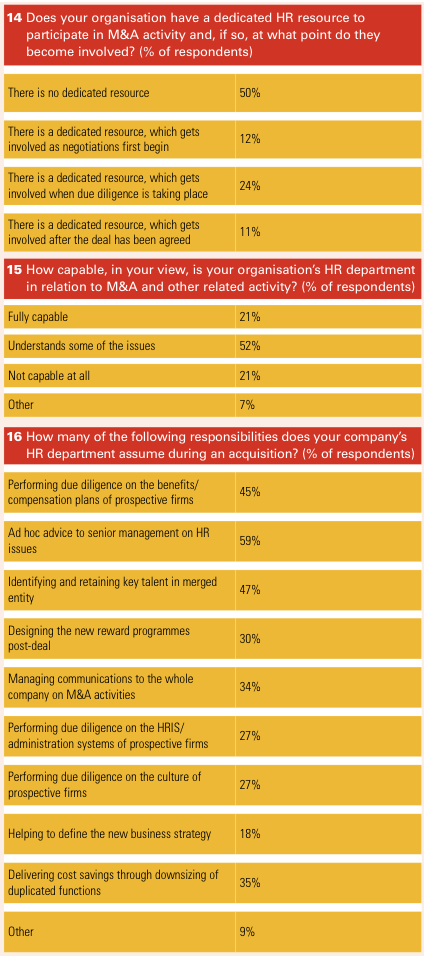

■ In-depth interviews were conducted with a cross-section of senior human resource professionals in Europe and the US who had all recently experienced a merger.

■ The Economist Intelligence Unit and Towers Perrin conducted a global online survey in August/September 2002, exploring the attitudes of 132 senior international executives.

■ Extensive desk research was conducted into the outcomes of 50 significant merger and acquisition (M&A) deals involving European firms over the last 10 years.

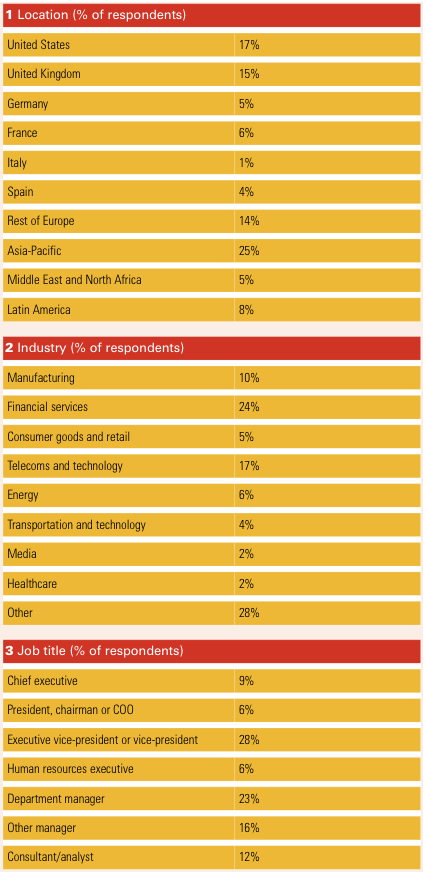

The survey is made up of a broad cross-section of business opinion from Europe (45%), Asia Pacific (25%), the United States (17%), Middle East (5%) and rest of world (8%). Sixty per cent of respondents are senior managers, from CEOs to department managers, and only 5% are human resource professionals. In revenue terms, 42% of businesses have turnover in excess of US$1billion and are from a variety of industries, led by financial services (24%), telecoms and technology (17%), service sector (16%) and manufacturing (10%). A total of 132 respondents took part.

M&A activity can increase shareholder value

M&A activity is undoubtedly complex, challenging and unpredictable. But this survey report finds convincing evidence to suggest that M&A deals are not nearly as prone to failure as is commonly supposed.

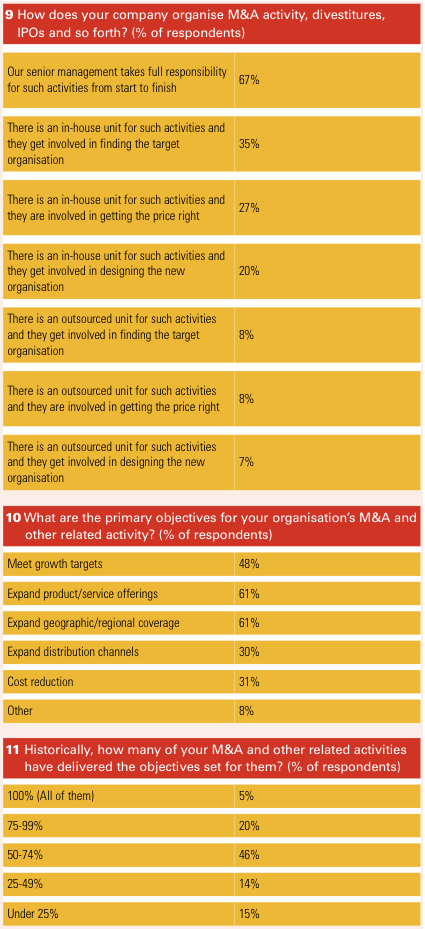

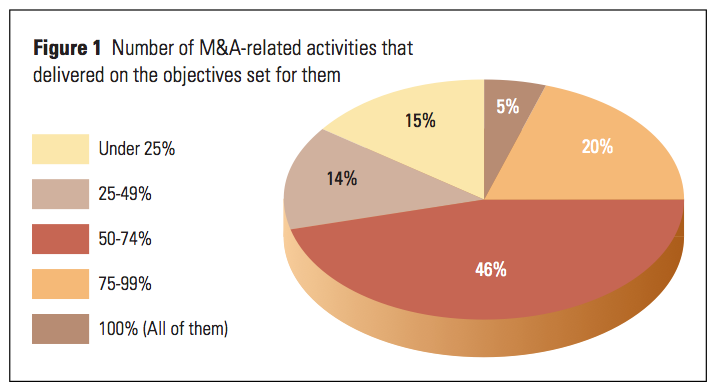

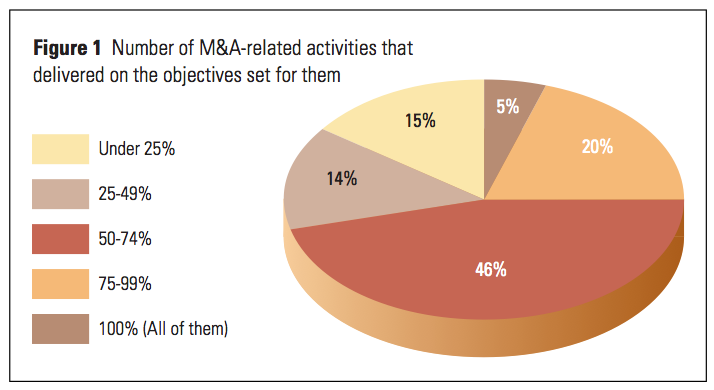

In our survey, 71% of respondents (see figure 1) state that more than half of all merger-related activity in the company has delivered on targeted objectives. One-quarter say that more than three-quarters of their M&A deals have delivered on their objectives. Not only that, but the survey respondents believe that 55% of all employees perceive merger activity to be either successful or very successful.

And this isn’t just retrospective glossing. New research conducted by Towers Perrin and the Economist Intelligence Unit into 50 large mergers and acquisitions in Europe show that in 45% of the deals the share price of the merged company outperformed the sector average in the year following the merger – the period of greatest upheaval and instability. Success stories are more numerous than one might expect.

This isn’t to suggest that M&A activity is easy. The survey results still expose a fairly high failure rate – a candid 30% of respondents report that less than half their deals met the targets set for them. But success is certainly attainable.

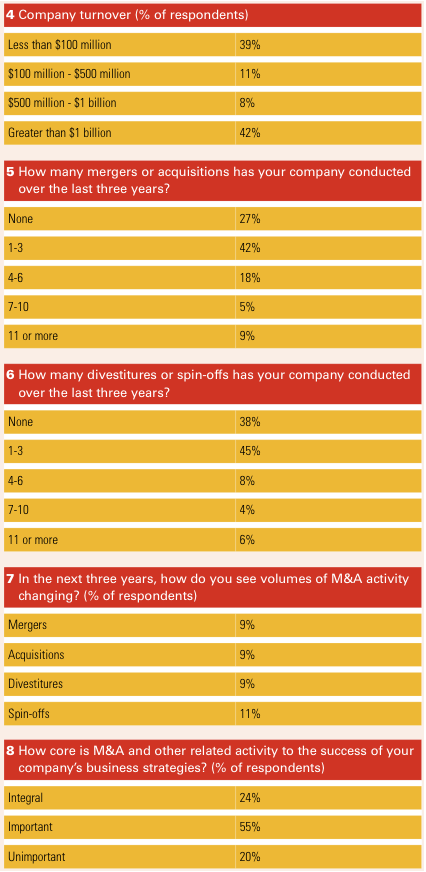

That helps to explain why companies are unwilling to turn their back on M&A activity. Forty-two per cent of our survey respondents say they had completed between one and three deals; 18% between four and six; 5% between seven to ten; and 9% eleven or more. Companies continue to believe that M&A activity is central to their business. Asked how core M&A was to the success of their company’s business strategies; 79% of survey respondents state it was either “integral” or “important”. Only 20% of respondents report that it was “unimportant”.

Of course, these are not vintage M&A times. The value of worldwide announced deals in the first nine months of 2002 fell to $299.2bn, according to data from Thomson Financial, down from $1.4trn in the same period in 2001. But a majority of respondents expect M&A activity to increase in the near term, although opinions vary on when the upsurge might come. Timing is less important than the message that an upswing in M&A is coming, fuelled by an eventual rebound in the economy and equity markets and, more fundamentally, by the need for companies to grow globally.

People-related issues are critical to achieving success

M&A activity delivers on expectations and objectives more frequently than is commonly supposed, but the management challenges are still immense.

Mergers are not for amateurs, chorus the HR professionals interviewed for this report. “Whatever you do, avoid using the merger as a career step,” says one. “You need seasoned professionals in place to do the job, at least in the short and medium term.”

And you’ll need to know your management capabilities before the hard work begins. “A merger will quickly reveal management weaknesses like no other event,” says an HR director. “This is not the time to discover that your people management is not too good and it certainly isn’t a time to try and sort it out.”

But it can be turned into a great management development experience for those who want it. “At the time of a merger you are in a virtual construction zone; things fall out of the sky and hit you,“ says a financial services executive. “You have a choice. You can get out and find a quieter place to work, or you can pull on a hard-hat and get on with it.” If you choose the latter course, “you’ll learn so much in that merger period, it’s like cramming five years’ normal management experience into 12 months.”

Getting the HR contribution in M&A right

As part of the research process we interviewed a cross-section of senior human resource professionals in Europe, the US and Asia who had all recently experienced a merger (either as acquirer or target). From those interviews we distilled the following critical HR-related factors:

Communication

Speed in communication, integration of systems, and decisions on staffing levels are vital. In the early days success can boil down to “impeccable timing”. “Quick”, “accurate”, “constant” and “clear” are the critical communication watchwords. Getting employees – at all levels – to understand what has happened and to pull together is paramount.

Communicate the fact that successful mergers offer growth prospects for staff, as the acquiring firm brings a wider variety of available jobs and career paths.

Avoid the pitfall of mixed messages. Telling shareholders that there will be “major cost savings” (usually meaning job losses), while informing employees that they “will be treated fairly and there will only be minimal job cuts”, leads to bad feeling and confusion.

Set early objectives

The best way to show that the merger works is quickly to announce some new business deals. Rapidly formed task forces from both companies can prove that the merger was also a practical moneymaker. The first 100 days will set the tone for the merged company. If the “people” side of the deal is going to work it has to happen within that time frame.

One way to avoid instant culture clash is to promote the benefits of having acquired a new and complementary talent pool.

Role of senior management

CEO and senior management MUST invest their own time. Regular walkabouts by top managers, accompanied by their immediate reports, are essential to retain motivation and persuade each side that their own leaders are not being sidelined.

Workforce management

Get that talent inventory completed quickly and make sure you secure the people who are mission-critical. Unexpected departures of long-serving executives send a very bad signal.

If there have to be job cuts, go deep the first time and do it quickly. Avoid a constant, demoralising stream of announcements of redundancies.

Remember that life can be toughest at the bottom of the hierarchy. Employees in the branches and plants are the most starved of information. So you need to explain why the deal is good for them and their future job security.

If people really matter, why don’t HR departments?

People issues are recognised as being of paramount importance in successful M&A. Yet our survey finds that HR departments play only a modest formal role in most deals.

The majority of our survey respondents do not have a dedicated HR resource to participate in M&A activity. Of those that do, most do not get involved until after the planning and strategy-setting phases of a merger or acquisition – the precise point at which a full and frank assessment of the culture and key people at the target organisation should be taking place.

Asked “How capable is your organisation’s HR department in relation to M&A and other activity?” just 21% of our survey respondents say that they were “fully capable”, while 52% believe that they “understood some of the issues”, and a further 21% say they were “not capable at all.”

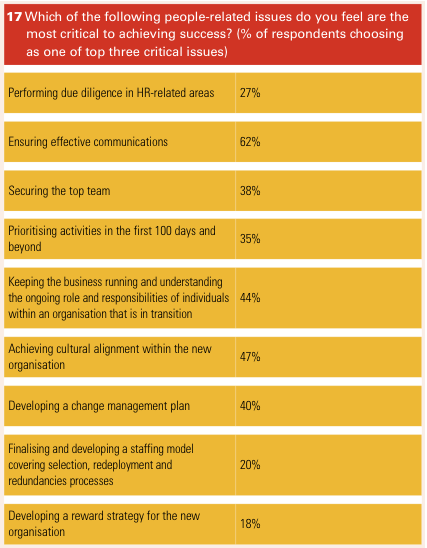

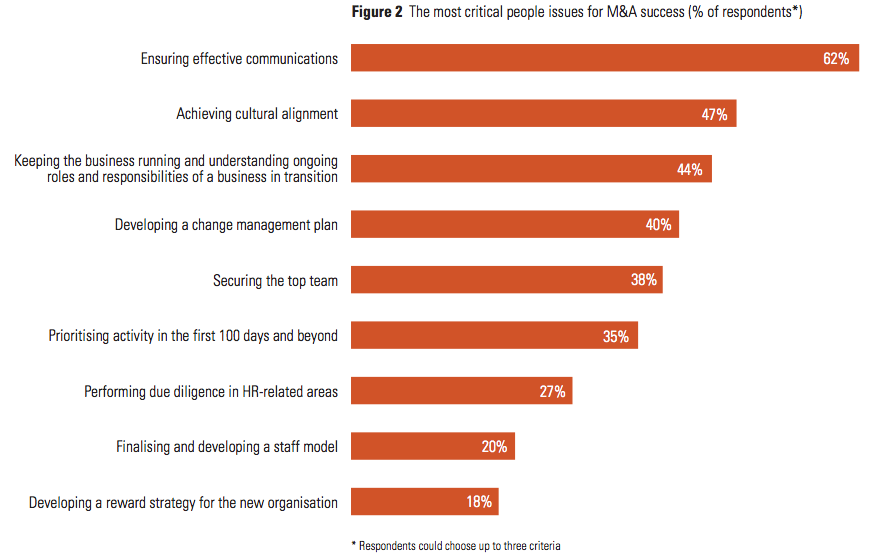

Our survey respondents were also asked both to identify the people issues that have a critical impact on M&A activity and to identify the roles entrusted to human resources professionals during the M&A process.

Disclosure restrictions often make it difficult for management to tell people within a company about upcoming mergers or acquisitions. Even so, HR has a tremendous potential value to add across a range of M&A priorities.

Six key priorities

1 Ensuring effective communications

A critical factor in getting employees from both “sides” to think in the same way is to assign responsibility quickly and clearly for communications to a very senior manager who knows what messages are being sent out and how they are being received. HR needs to support that process by helping to disseminate consistent messages across the new organisation.

2 Achieving cultural alignment

Culture is created and changed by people, yet in only 27% of the companies surveyed did the HR department have a remit to participate in performing cultural due diligence. Not every HR department is equipped to carry out these kinds of tasks, but all will have expertise and knowledge to contribute.

3 Developing a change management plan

HR again needs to be fully engaged. They have the skills to assess your existing staff and the employees at the target company, although outside support is almost always required to act quickly on a global or cross-border basis.

4 Securing the top team

This may well be in the CEO’s personal action file, but when it comes to negotiation and knowledge of market rates and probable outcomes, HR again acts as a valuable in-house support function.

5 Due diligence

Assessing the liabilities of the target company ensures the M&A transaction is accurately priced. The focus should not merely be on the inherited costs, but also on future additional costs associated with the integration of compensation and benefit integration. Finally, to ensure an accurate due diligence process it is important that HR understands the way the purchase price is being determined so that any hidden liabilities are swiftly identified and factored into the M&A negotiation.

6 Integrating the deal

In acquisitions, studies show that there is direct correlation between speed of integration and the success of the deal. Rapid combining of the companies’ total reward programmes is therefore vital if the merged company’s employees are to be successfully aligned with the senior management’s business objectives. It is also important for HR to examine the new employment proposition it is offering to its employees in “word and deed” and ensure that it fits with the company’s business needs, as well as employee expectations.

Our survey provides some insight into the positive impact that a deeper HR involvement in the M&A process can have. The vast majority of respondents (88%) who felt that their HR departments were fully capable met their objectives on 50% or more of their mergers. More than half of the respondents who said that their HR departments were not capable at all said that fewer than 50% of their M&A deals delivered on objectives. In other words, it appears that the more capable the HR department, the greater the chances of M&A success.

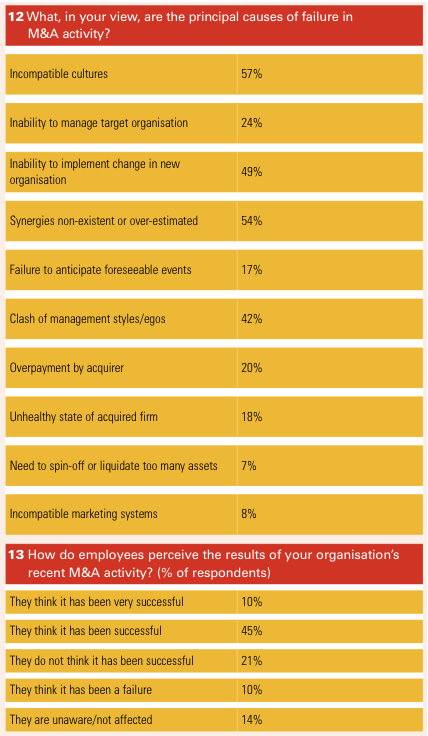

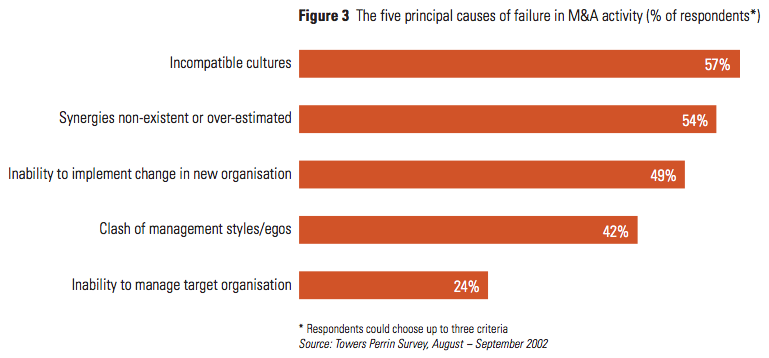

Reasons for failure in M&A activity

What are the principal causes of M&A failure? There are many candidates, but “people issues” are at or near the top of the list. According to one interviewee: “Even if the business rationale for a deal is unquestionably the right one, the people in the system can support its success or cause its failure, through passive resistance, personal/political agendas, or a simple clash of working cultures.”

The comment of a senior European human resources executive in a global oil company is typical: “The human aspects of M&A deals are paramount. But I can preach for the next 50 years and a lot of people just won’t get it. It has to do with the mistaken belief that there is something that exists that is an ‘organisation’, as if it were an abstract entity. It’s nothing but people. Period.”

An HR executive would say that, of course. But only a small percentage of our survey respondents work in HR departments. The top five causes of M&A failure identified by the survey respondents are all deeply rooted in the “softer” management issues of integrating different cultures, leadership teams and workforces.

Our survey asked respondents to identify the people issues that have a critical impact on M&A activity and the roles entrusted to human resources professionals during the M&A process.

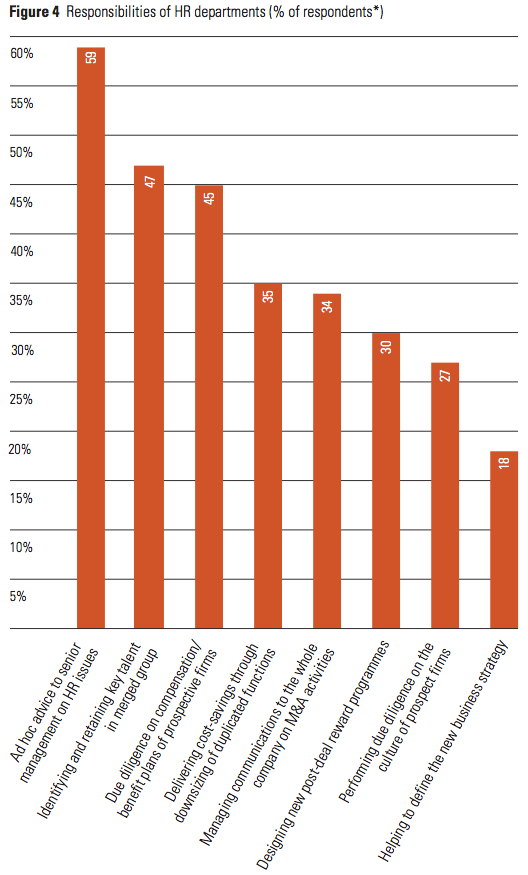

There is a striking contrast between the roles given to HR departments (see Figure 4) and the importance managers place on critical HR responsibilities (see Figure 2). The people issues that respondents felt were most critical, such as effective communications and achieving cultural alignment, are not HR responsibilities in most of our sample firms.

The most common responsibility given to HR (and the only one to be identified by a majority of respondents) is to provide ad hoc advice to senior managers. In other words, the majority of HR departments do not have a structured and formal role to play in their companies’ M&A activity.

Regional outlook

Most business commentators and analysts predict a resurgence in M&A activity by the fourth quarter of 2003. This survey adds to that weight of consensus.

Our survey respondents came from a broad geographical base. Broadly speaking, executives concurred on the questions posed but there were some interesting nuances in their answers depending on location: M&A is most likely to be central to the strategies of European firms. This reflects the relative maturity of the three main markets covered by the survey. US industry has largely already been through rapid consolidation – US companies’ focus is now more likely to be dealing with returning larger entities to profitability. Europe is still believed to be in the middle of consolidation, albeit a slowed process because of depressed stock markets. Most industry commentators expect M&A volumes in Asia to pick up a few years into an Asian economic recovery. Many Asian countries also need regulatory relaxation before large cross-border M&A deals can be completed.

The report finds that across Europe, 32% of firms think M&A is integral, compared with 21% in Asia and just 9% in the United States. UK firms place particular emphasis on M&A activity, with 47% of them describing it as integral. The smaller sizes of the European and Asian home markets may explain why they look to M&A more readily than US firms – it’s a necessary route to cross-border expansion and growth.

European and Asian firms are also likelier to achieve their M&A objectives than US companies, with 75% and 70% of them respectively meeting their targets on more than half their deals. Only 53% of US firms could claim the same.

Conclusion

This report argues that people issues are critical to the success of M&A deals. It has also revealed the low level of involvement that many HR departments have in those deals. Since HR departments have (or should have) knowledge and expertise to contribute on these issues, how can this gap be narrowed? The answer lies partly within the boardroom, partly within HR itself, and partly outside the organisation.

Inside the boardroom

Ultimately, senior management is responsible for the success of M&A deals. We have outlined the need for the CEO and the senior management team to make themselves visible to employees of the new company and to coordinate the integration of all corporate functions, such as internal communications. They must also take responsibility for ensuring that the HR department is systematically involved in the M&A process, and, if need be, for assigning a budget to bring in outside specialists. Otherwise firms risk losing control of key human capital issues – even as they boast that people are their greatest asset.

Inside the HR department

A new breed of HR professional is required, one that can think strategically and communicate directly with senior management about the people issues of M&A activity. Indeed, there are signs that just such people are emerging — organisational development experts and corporate integrationists with the skills and insight to bring together the diverse parts of a business empire and make people work together in pursuit of the business’s objectives. Disparate benefits and compensation policies also need to be integrated to align the company’s employees with the senior management team’s business objectives. The role of HR departments in the due diligence process is also vital to ensure the M&A transaction is accurately priced.

Outside the organisation

Often HR departments cannot get involved in M&A deals to the extent that they should. Why? Because, particularly in the case of big global and cross-border mergers, they just don’t have the manpower or the experience to do the work with the speed required. For these departments, the answer is to bring in resources and expertise from a trusted outside partner.

M&A deals are important to companies’ strategies. People issues are critically important to M&A deals. If senior managers pay enough attention to human capital, if they enable HR to play a fully engaged and constructive role in the M&A process, and if they budget for outside help where it is needed, that way lies success.

This survey serves as a warning signal. While people may be the heart and soul of a business, not enough time and effort is expended getting these often brittle, fragile people issues into the right context. Companies are living things, fluid and constantly changing. Without bringing people skills to the agenda of the merger and acquisition process we close off a whole area of expertise that is a must-have for today’s business operations. The effort required may be substantial, but so, too, are the potential rewards.

Appendix 1: Desk research results

By looking at the various characteristics of a number of companies before, during and after the process of either a merger or acquisition we were able to investigate how share price, employee numbers and board members were affected by such activity.

From an initial sample of 50 large mergers and acquisitions involving European companies in the past ten years, sufficient data was produced for 36 companies to be included in the final analysis.

For each company we looked for information from the year before the merger, during the year of the merger and the year after the merger. A number of sources were used to identify relevant information, including annual reports, the London Business Library, and the London Stock Exchange. Online sources that were of use included Hoovers.com and Fame, along with individual company websites. A number of journals and newspapers were used to find supporting qualitative analysis.

After finding historical share prices for each individual company we calculated the percentage by which the company’s shares had either risen or fallen during the M&A process. This value was then compared to an overall share growth rate for the sector in which the company operated. To calculate the sector growth rate for each company from the original sample, share data was gathered for five other companies from the same sector. An average of the share growth of these five was then compared to the original company’s share growth rate.

Cross-tabulations were then used to assess how various company characteristics impacted on other areas of business activities. Our principal findings were as follows:

■ In 45% of cases companies that had been through M&A activity outperformed the market when compared against the sector average. The remaining 55% performed below the sector average in terms of share value.

■ In 52% of cases the chairman, CEO and CFO of the merged company all came from the acquiring company management and in 48% of cases they came from both. Management teams comprising people from both companies tended to have a greater chance of outperforming the sector average for share-price growth.

■ 46% of companies going through M&A made immediate job cuts. Over half of companies that gained employees after a merger or acquisition saw share prices grow at a rate above the sectoral average. In contrast 82% of companies that lost employees saw their share price fall below the sectoral average growth rate.

There are some caveats associated with the research. Firstly, the sample size is a small one, especially when used in cross-tabulating, so results should be treated with appropriate caution. Secondly, fluctuations in employee numbers may have been affected by additional M&A activity by the acquiring company. Thirdly, timeframes have been strictly defined to enable consistent comparison – our cross-tabulations looked at the performance of the merged company in the 12 months following the merger. Not all the benefits, or indeed all the disadvantages, of a merger may emerge in that time period.

With these qualifications in mind, our research indicated that the best performing merged companies were likely to have top management that consisted of both companies’ management teams and that had increased headcount. The worst performing companies were likely to be led by the acquirer’s management alone and to have lost employees.

Appendix 2: Survey results