M&A News M&A News: Global M&A Deals Week of January 22 to 28, 2024

- M&A News

M&A News: Global M&A Deals Week of January 22 to 28, 2024

SHARE:

The Institute for Mergers, Acquisitions, and Alliances (IMAA) weekly M&A news coverage presents an engaging snapshot of the global mergers and acquisitions landscape. This comprehensive coverage delves into the intricate details of transactional activities, emphasizing the evolving and significant trends in corporate mergers and acquisitions. It highlights the critical deals that have marked this notable phase in the M&A sector, setting the stage for a deeper exploration of specific transactions.

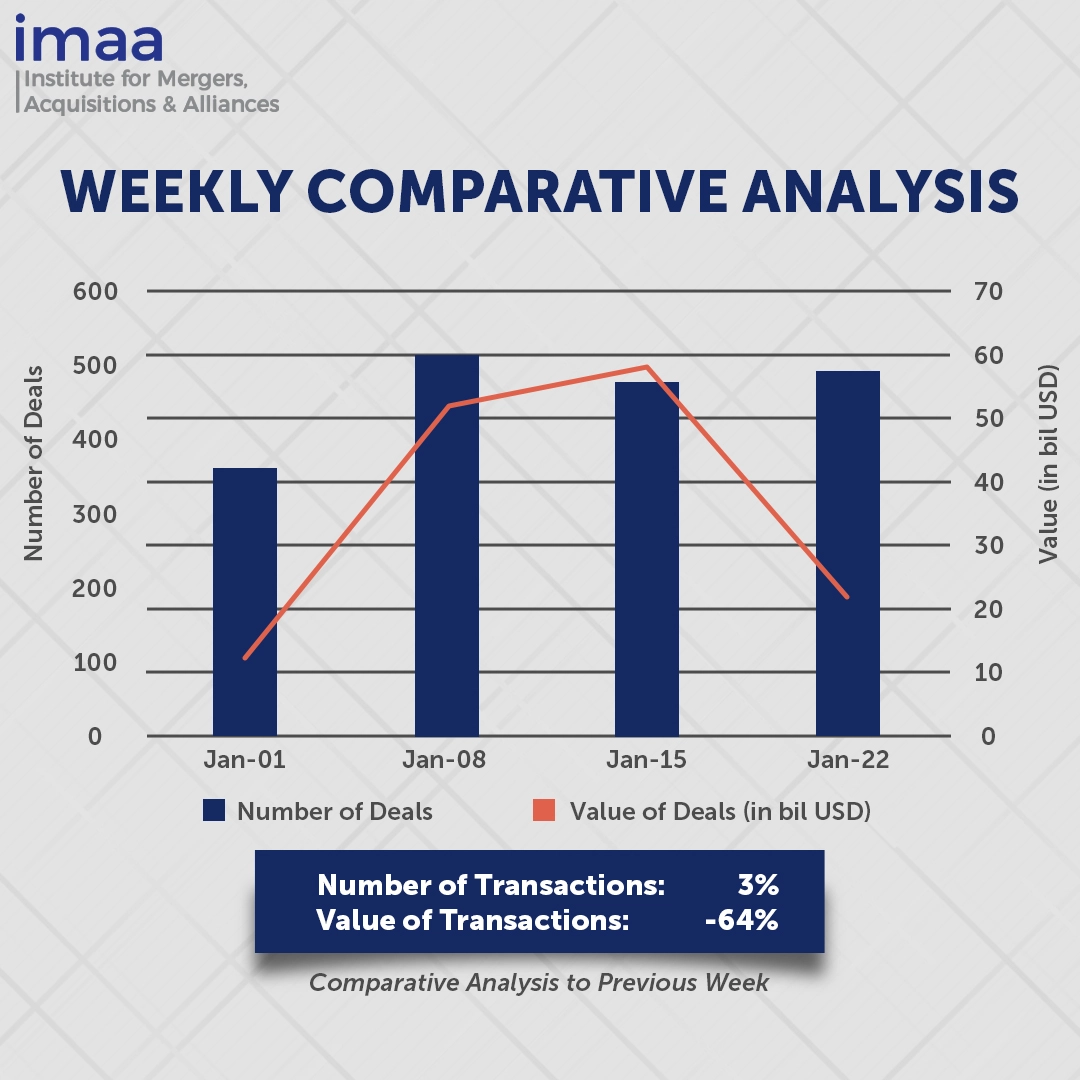

Between the week of January 22 and January 28, the global market recorded a total of 494 Mergers and Acquisitions (M&A) deals, totaling USD 20.63 billion. Approximately 79% of this total value stemmed from 7 transactions exceeding the USD 500 million mark, contributing to a total of USD 16.45 billion.

The leading deal of the week was Sunoco’s proposed acquisition of NuStar Energy LP, with a total value of USD 7.31 billion. This move followed Sunoco’s recent announcement regarding the sale of its 204 convenience stores to 7-Eleven Inc., aimed at reducing leverage and supporting future growth.

Analyzing week-on-week trends, there was a modest 3% uptick in the number of deals, rising from 480 in the previous week to 494 during this period. However, the total deal value experienced a substantial 64% decline, dropping from USD 57.87 billion to USD 20.63 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of January 18-22, 2024 in detail:

Deal No. 1: Sunoco LP to Acquire NuStar Energy L.P. for USD 7.31 Billion

Deal No. 2: La Française des Jeux Société anonyme to Acquire Kindred Group plc for USD 2.83 Billion

Deal No 3: Aventis Inc. to Acquire Inhibrx, Inc. for approximately USD 2.20 Billion

Deal No. 4: Roper Technologies, Inc. to Acquire Procare Solutions for USD 1.75 Billion

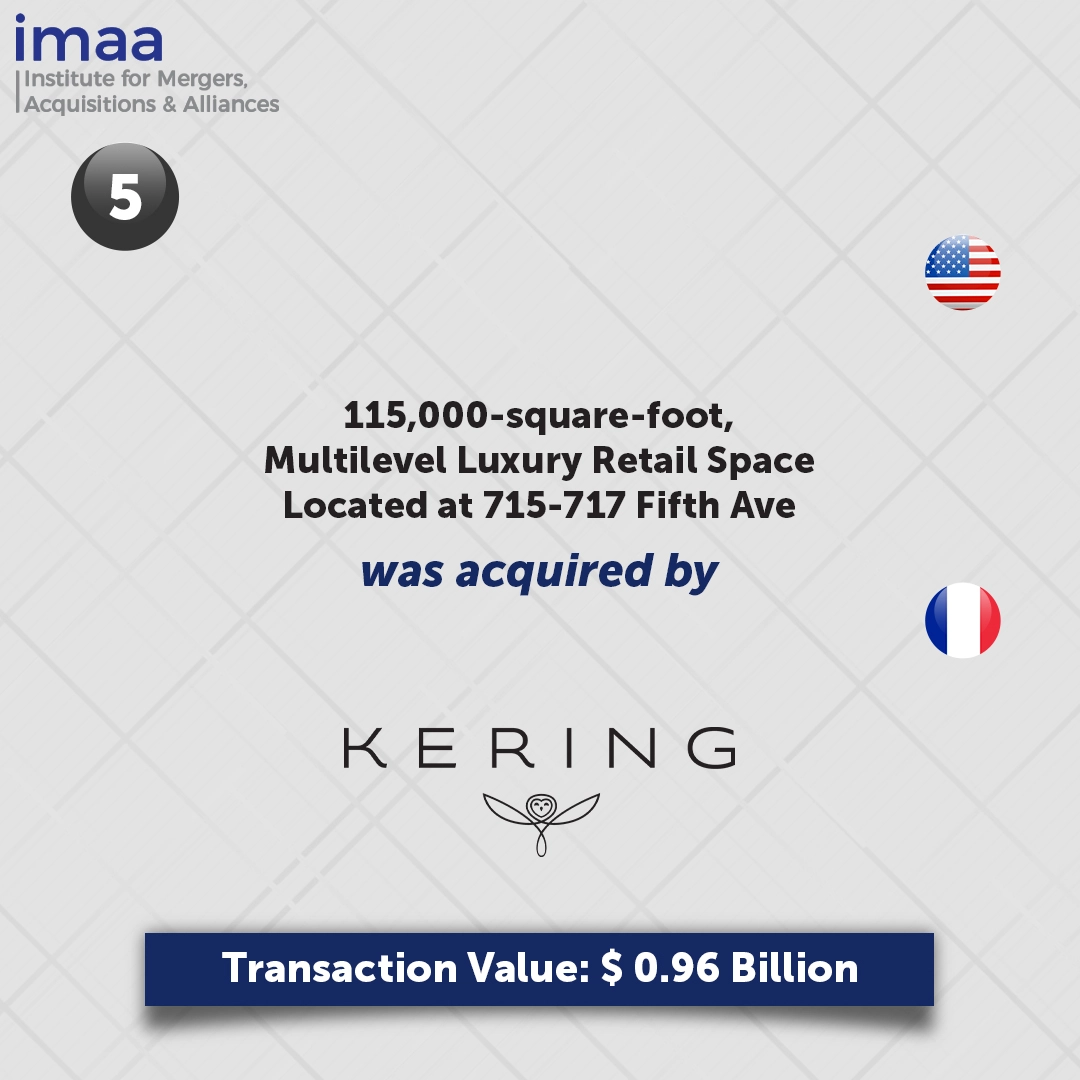

Deal No. 5: Kering S.A. Acquired a 115,000-square-foot, multilevel luxury retail space located at 715-717 Fifth Ave, NY, United States for USD 0.96 Billion

Deal No. 1:

Sunoco LP to Acquire NuStar Energy L.P. for USD 7.31 Billion

Sunoco (United States), a prominent motor fuels distributor, is set to acquire NuStar Energy (United States), an established operator in fuels storage and pipelines, in an all-stock transaction valued at USD 7.31 billion, including assumed debt.

This acquisition marks a strategic move for Sunoco, bolstering its crude oil transportation and storage capabilities with NuStar’s extensive pipeline network and terminals across the Midwest and the West Coast. NuStar’s assets include 5,400 miles of refined product pipelines, 2,100 miles of crude pipelines, 14 crude terminals, 49 refined product terminals, and 2,000 miles of ammonia pipelines.

The merger is projected to generate a minimum of USD 150 million in synergies within the third-year post-closure. Combining these two businesses aims to diversify Sunoco’s operations, increase scale, and capitalize on vertical integration benefits. The move also aligns with Sunoco’s capital allocation strategy, enhancing the partnership’s credit profile and supporting distribution growth. The deal is anticipated to provide additional cash flow for reinvestment and growth across a broader opportunity set.

The all-stock agreement follows Sunoco’s recent asset reorganization, which included the divestiture of 204 convenience stores in Texas, Oklahoma, and New Mexico to 7-Eleven in a USD 1 billion transaction, alongside the acquisition of liquid terminals in Europe.

The transaction is anticipated to close in the second quarter of 2024. Truist Securities served as the exclusive financial advisor to Sunoco, while Barclays acted in the same capacity for NuStar.

Deal No. 2:

La Française des Jeux Société anonyme to Acquire Kindred Group plc for USD 2.83 Billion

La Française des Jeux Société anonyme (France) has reached an agreement to acquire Kindred Group plc (Malta), a Sweden-listed online betting group, in a landmark deal that is set to reshape the European gambling landscape. The acquisition, valued at EUR 2.6 billion (USD 2.83 billion), entails La Française des Jeux Société anonyme (FDJ) paying SKr 130 (USD 12.47) per share in cash.

This strategic move marks a significant leap for FDJ, propelling it to the forefront of online betting operators within its native France, where it currently holds a monopoly on lottery services. Furthermore, it opens avenues for international expansion, with Kindred Group’s substantial customer base of 1.5 million active users predominantly situated in western Europe and Scandinavia.

The merger not only enhances FDJ’s global footprint but also accelerates its digital evolution, projecting a substantial increase in online business revenue from 14% to 29% following the integration.

For Kindred Group, the acquisition signifies an opportunity to expedite long-term strategic initiatives and consolidate its presence in key markets while ensuring regulatory compliance and fostering customer trust.

The decision to merge follows a period of evaluation by Kindred Group, prompted by a decline in revenues and profits in 2022, partly due to its exit from the Netherlands market.

FDJ has engaged Goldman Sachs Bank Europe SE, Succursale de Paris, and Valens Partners SAS as financial advisors, while PJT Partners (UK) Limited, Morgan Stanley & Co. International plc, and Canaccord Genuity Limited are advising Kindred.

Deal No. 3:

Aventis Inc. to Acquire Inhibrx, Inc. for approximately USD 2.20 Billion

Sanofi, a leading French healthcare company, has announced its intention to acquire the U.S. biotech firm Inhibrx through its subsidiary, Aventis Inc. This acquisition aims to enhance Sanofi’s drug development portfolio by incorporating an experimental treatment for Alpha-1 Antitrypsin Deficiency (AATD), a rare genetic disease-causing lung tissue deterioration.

Post-acquisition, Inhibrx will operate as a subsidiary under Aventis’ parent company, Sanofi. Sanofi will gain access to Inhibrx’s INBRX-101 treatment for AATD, while Inhibrx’s non-INBRX-101 assets and liabilities will be spun off into a new publicly traded company. Sanofi will retain an 8% equity stake in the newly formed entity.

The total transaction value, inclusive of the initial cash component, potential contingent payments, and assumption of Inhibrx’s debt, amounts to approximately USD 1.70 to USD 2.20 billion.

Sanofi, predominantly deriving revenue from anti-inflammatory treatments, decided to forego its 2025 earnings targets last year to prioritize the enhancement of the company’s research and development (R&D) efforts. This acquisition bolsters Sanofi’s portfolio growth strategy and complements its established track record in rare diseases and leadership in immunology and inflammation over the past three decades.

This acquisition reflects a broader trend in the pharmaceutical sector, marked by a series of recent mergers and acquisitions aimed at replenishing pipelines with promising assets. Notable recent transactions include Johnson & Johnson’s acquisition of Ambrx Biopharma for around USD 2 billion and Merck’s purchase of Harpoon Therapeutics for USD 680 million.

The transaction is expected to close in the second quarter of 2024. Sanofi has engaged Lazard as its exclusive financial advisor, while Inhibrx is represented by Centerview Partners LLC in this deal.

Deal No. 4:

Roper Technologies, Inc. to Acquire Procare Solutions for USD 1.75 Billion

Roper Technologies, Inc. (United States) has agreed to acquire Procare Solutions (United States) for a net purchase value of USD 1.75 billion from private equity firms Warburg Pincus and TA Associates. This acquisition aims to expand Roper’s portfolio of software products in the industrial technology sector. The total enterprise value of the deal, which includes a USD 110 million tax benefit, amounts to USD 1.86 billion.

Procare is a leading provider of cloud-based software designed for managing early childhood education centers. Its solutions handle various operational aspects, including parent engagement, staff scheduling, classroom management, tuition billing, and payment processing, serving over 37,000 childcare organizations.

Procare’s market leadership, essential solutions, organic revenue growth, and customer retention make it an attractive investment for Roper. The company anticipates the acquisition to contribute around USD 260 million in revenue and USD 95 million EBITDA to its Application Software segment by March 31, 2025.

This acquisition underscores Roper’s strategic capital deployment approach, emphasizing the identification and integration of high-quality, market-leading technology enterprises to bolster long-term cash flow growth.

The transaction, financed through Roper’s credit facility, is slated for closure in the first quarter of 2024. William Blair & Company, LLC served as the lead financial advisor for Warburg Pincus in this deal.

Deal No. 5:

Kering S.A. Acquired a 115,000-square-foot, multilevel luxury retail space located at 715-717 Fifth Ave, NY, United States for USD 0.96 Billion

Kering SA (France), the fashion powerhouse renowned for its ownership of esteemed brands such as Gucci and Balenciaga, has announced the acquisition of a notable property in New York City. Situated at 715-717 Fifth Avenue, on the Southeast corner of 56th Street, the property features multi-level luxury retail spaces totaling approximately 115,000 square feet, or 10,700 square meters. The acquisition, valued at USD 0.96 billion (EUR 0.89 billion), underscores Kering’s strategic focus on securing prime real estate assets for its prestigious fashion houses.

This acquisition aligns with Kering’s ongoing real estate strategy, which prioritizes securing desirable locations globally. In addition to recent acquisitions in prominent Parisian districts like avenue Montaigne and rue de Castiglione, Kering’s portfolio includes properties in Tokyo’s Omotesando and the historic Hôtel de Nocé, housing Boucheron’s flagship store in Paris. With a commitment to prudent financial management, Kering remains dedicated to a disciplined and adaptable approach in overseeing its real estate investments.

The luxury sector has faced challenges in recent months, prompting reflections on the trajectory of consumer behavior during the pandemic. While some luxury brands navigate market fluctuations, others are strategically expanding their retail presence across key shopping destinations worldwide.

This concludes our coverage of this week’s M&A news of the top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter