M&A News M&A News: Global M&A Deals Week of January 15 to 21, 2024

- M&A News

M&A News: Global M&A Deals Week of January 15 to 21, 2024

SHARE:

The weekly overview of the top global M&A deals from the Institute for Mergers, Acquisitions, and Alliances (IMAA) sheds light on the latest developments in the world of global mergers and acquisitions (M&A). The M&A news coverage for the third week of January 2024 provides insightful data into the dynamic and evolving landscape of global M&A activities. It highlights significant trends, high-value transactions, and emerging patterns in the corporate world, offering a comprehensive overview of the week’s noteworthy developments in mergers and acquisitions.

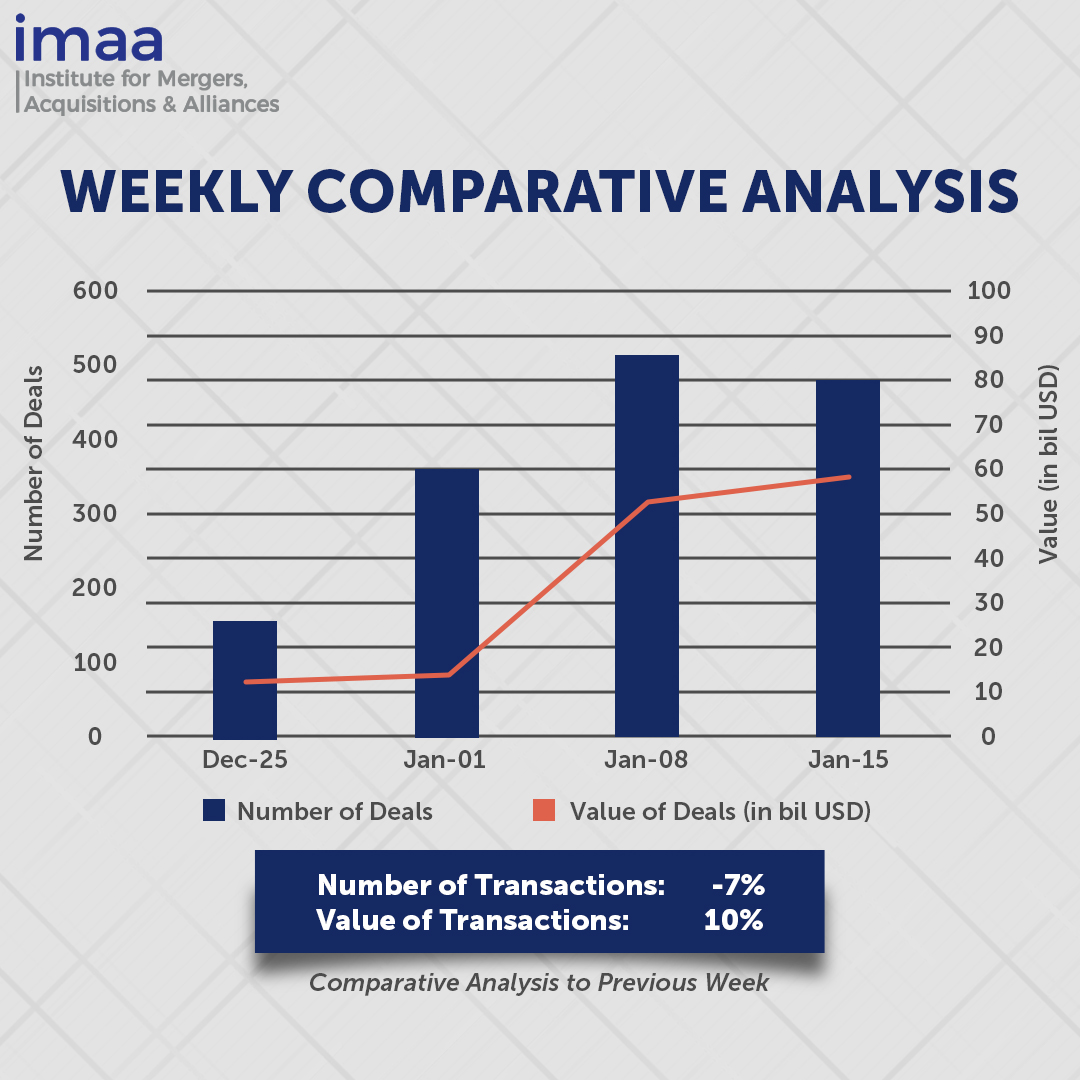

For the week spanning January 15 to January 21, the global market reported a total of 480 Mergers and Acquisitions (M&A) deals, amounting to USD 57.87 billion. Notably, 92% of this substantial deal value was driven by 9 transactions surpassing the USD 500 million mark, contributing a noteworthy USD 53.14 billion.

A notable highlight during this period was the acquisition of Ansys, Inc by Synopsis, Inc, with a total value of USD 35 billion. This deal currently holds the title for the largest M&A transaction in 2024 to date. Notably, this development signals a notable uptick in M&A activities within the tech industry, following closely on the heels of Hewlett Packard Enterprise’s announcement of a USD 14 billion bid for Juniper Networks just last week, which had also claimed the top spot at that time.

Comparing week-on-week data, there is a 7% decrease in the number of deals, declining from 515 in the previous week to 480 in the current week. Despite the lower deal count, the total deal value increased by 10%, rising from USD 52.49 billion to USD 57.87 billion. This data underscores the dynamic nature of the M&A landscape, where shifts in deal count do not always correspond to changes in the overall deal value.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of January 15-21, 2024 in detail:

Deal No. 1: Synopsis, Inc. to Acquire ANSYS, Inc. for USD 35 Billion

Deal No. 2: SH Residential Holdings, LLC to Acquire M.D.C. Holdings, Inc. for USD 4.90 Billion

Deal No 3: Blackstone Real Estate Advisors L.P. to Acquire Tricon Residential Inc. for USD 3.50 Billion

Deal No. 4: First Exploration & Petroleum Development Company Limited; Petrolin Group; ND Western Limited; Waltersmith Refining & Petrochemical Company Limited; Aradel Energy Limited (Reinassance) to acquire The Shell Petroleum Development Company of Nigeria Limited for USD 2.40 Billion

Deal No. 5: Global Growth, LLC to acquire Quadro Acquisition One Corp. for USD 2.26 Billion

Deal No. 1:

Synopsis, Inc. to Acquire ANSYS, Inc. for USD 35 Billion

Synopsys (United States), a semiconductor design and software company, is set to acquire Ansys (United States), an engineering and product design software firm, in a deal valued at USD 35 billion, comprising cash and stock components. This strategic move aims to strengthen their position in silicon to systems design solutions, marking one of the notable tech transactions in recent times.

Synopsys is a key player in providing software for chip designers, and Ansys specializes in physics simulations, gaining importance with advancements like stacked silicon wafers. The merger is characterized by their complementary business models and potential for expansion. This integration is expected to fortify Synopsys’ Silicon to Systems strategy, spanning the core EDA segment and extending into sectors like Automotive, Aerospace, and Industrial, where Ansys has a strong presence. The collective entity is anticipated to enhance Synopsys’ financial standing, delivering high-growth, high-margin, recurring revenue. Projections indicate an expected expansion of Non-GAAP Operating Margins by approximately 125 Basis Points and Unlevered FCF Margins by around 75 Basis Points within the first year post-closing.

The tech industry witnessed a decline in mergers and acquisitions throughout 2023 due to factors like increased antitrust scrutiny and startup valuations. However, recent months have seen a resurgence in substantial deals within the enterprise technology realm, including Cisco’s acquisition of Splunk for USD 28 billion in September and Hewlett Packard Enterprise’s USD 14 billion bid for Juniper Networks, announced just last week.

The anticipated closure of this Synopsys-Ansys deal is slated for the first half of 2025. Evercore is advising Synopsys on the financial front, while Qatalyst Partners is providing counsel to Ansys.

Deal No. 2:

SH Residential Holdings, LLC to Acquire M.D.C. Holdings, Inc. for USD 4.90 Billion

Sekisui House, a prominent Japanese housing manufacturer, is poised to acquire Denver-based homebuilder M.D.C. Holdings (United States) through SH Residential Holdings, LLC, a subsidiary of its U.S. headquarters, for USD 63.00 per share in an all-cash transaction valued at USD 4.9 billion. The acquisition is set to propel Sekisui House into the ranks of the top five homebuilders in the United States.

With a track record of delivering over 2.62 million homes globally, Sekisui House brings a wealth of experience and cutting-edge building practices from Japan. M.D.C. Holdings, a key player in the U.S. market with a 50-year history of delivering high-quality homes, is expected to benefit from Sekisui House’s advanced technologies. This collaboration is anticipated to elevate the quality of homes delivered by M.D.C. Holdings in its key operational states.

The acquisition aligns with Sekisui House’s Global Vision of “making home the happiest place in the world.” MDC will join the Sekisui House family of brands, including Woodside Homes, Holt Homes, Chesmar Homes, and Hubble Homes. This strategic integration will expedite Sekisui House’s goal of building 10,000 homes outside of Japan by fiscal year 2025.

The acquisition takes place amidst a challenging landscape in the U.S. housing market, marked by a persistent sales downturn attributed to a surge in mortgage rates since 2022 and soaring property prices. Despite a substantial drop in sales of pre-owned homes, the market for new construction homes has exhibited resilience, posting a 3.9% year-to-date increase in sales as of November. Homebuilders adapted to the market dynamics by reducing prices and offering incentives, such as covering closing costs and adjusting interest rates, thereby sustaining sales and buoying homebuilder stock prices.

The acquisition is anticipated to be finalized in the first half of 2024. Sekisui House has enlisted the services of Moelis & Company LLC and Mitsubishi UFJ Morgan Stanley Securities as financial advisors, while Vestra Advisors, LLC assumes the role of exclusive financial advisor to M.D.C. Holdings.

Deal No. 3:

Blackstone Real Estate Advisors L.P. to Acquire Tricon Residential Inc. for USD 3.50 Billion

Blackstone Real Estate (United States) is set to acquire all outstanding shares of Tricon Residential (United States) at a purchase price of USD 11.24 per share, reflecting a substantial USD 3.5 billion. Post-closure, BREIT will retain an approximately 11% ownership stake.

Under Blackstone’s ownership, Tricon Residential aims to fulfill its USD 1 billion development pipeline, concentrating on new single-family rental homes in the U.S. Additionally, it plans to allocate USD 2.5 billion for the construction of new apartments in Canada, working collaboratively with existing joint venture partners. The company is committed to further enhancing the quality of its existing single-family homes in the U.S. through an additional USD 1 billion in planned capital projects over the next several years.

In response to Canada’s pressing affordable housing crisis, the government’s initiative to eliminate the federal 5% consumption tax on the construction of new rental apartment buildings is anticipated to play a significant role in bolstering supply.

The anticipated closure of this transaction in the second quarter of the year aligns with ongoing efforts to address Canada’s housing challenges. Notably, Tricon has secured financial advisory services from Morgan Stanley & Co. LLC and RBC Capital Markets, LLC, while Blackstone is being advised by BofA Securities, Deutsche Bank Securities Inc., J.P. Morgan Securities LLC, and Wells Fargo.

Deal No. 4:

First Exploration & Petroleum Development Company Limited; Petrolin Group; ND Western Limited; Waltersmith Refining & Petrochemical Company Limited; Aradel Energy Limited (Reinassance) to acquire The Shell Petroleum Development Company of Nigeria Limited for USD 2.40 Billion

Shell is slated to divest its Nigerian onshore oil and gas subsidiary, the Shell Petroleum Development Company of Nigeria Limited (SPDC), in a deal valued at up to USD 2.4 billion. Renaissance Africa Energy will acquire SPDC, with an initial consideration of USD 1.3 billion and additional cash payments of up to USD 1.1 billion. The supplementary payments pertain mainly to prior receivables and cash balances in the business, with the majority expected to be settled upon the completion of the transaction.

The acquiring entity, Renaissance, comprises ND Western Limited, Aradel Holdings Plc, the Petrolin Group, FIRST Exploration and Petroleum Development Company Limited, and the Waltersmith Group.

This acquisition stands as a pivotal achievement for Renaissance, solidifying its strategic foothold in the Nigerian market and paving the way for transformative growth and innovation in the country’s oil and gas sector.

Shell has actively sought to sell its Nigerian oil and gas business since 2021, addressing issues such as spills and theft. This move aligns with Shell’s previously stated intention to exit onshore oil production in the Niger Delta, focusing future investments in Nigeria on Deepwater and Integrated Gas positions.

The deal ensures the preservation of SPDC’s full range of operating capabilities post-change of ownership. This encompasses the technical expertise, management systems, and processes that SPDC employs on behalf of all the companies in the SPDC joint venture.

For SPDC, this represents a significant transition as the company moves to its next chapter under the ownership of a Nigerian-led consortium. Having been a pioneer in Nigeria’s energy sector for decades, SPDC is poised for a new phase of development and growth.

Deal No. 5:

Global Growth, LLC to acquire Quadro Acquisition One Corp. for USD 2.26 Billion

Quadro Acquisition One (United States) is set to acquire a cluster of seven companies operating in diverse sectors, including sports collectibles, software, cloud-based IT, and healthcare services, amounting to an enterprise value of USD 2.26 billion. These entities are associated with Global Growth (United States), a private equity firm established by Greg Lindberg. The trading name and symbol for Quadro SPAC, post its merger with Global Growth Companies, will be determined at a later date.

The Global Growth Companies represent a collection of well-established businesses with consistent recurring revenue streams and formidable entry barriers.

The anticipated merger between Quadro SPAC and Global Growth Companies is poised to yield several advantages, including improved access to capital markets through public company debt and equity financing, as well as heightened transparency facilitated by public company financial reporting and governance.

Upon the completion of the deal, expected by the close of 2024, the combined entity is set to be listed on the Nasdaq, further solidifying its presence in the market.

This concludes our weekly M&A News coverage of the top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter