Publications Taxation Of Cross-Border Mergers And Acquisitions: Austria 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: Austria 2014

- Christopher Kummer

SHARE:

By KPMG

Introduction

The Austrian tax environment for mergers and acquisitions (M&A) changed significantly in 2005, when Austria implemented an attractive new tax group system and reduced its corporate income tax rate to 25 percent.

This chapter addresses the most important questions that arise with acquisitions in Austria:

- What should be acquired: the target’s shares or its assets?

- What acquisition vehicle should be used?

- How should the acquisition vehicle be financed?

Tax is, of course, only one piece of transaction structuring. Company law governs the legal form of a transaction and accounting issues are also highly relevant when selecting the optimal structure. These areas are outside the scope of this chapter, but some of the key points that arise when planning an M&A transaction are summarized.

Recent developments

In 2005, the tax group system was introduced, which, under certain conditions, enables the purchaser to take advantage of goodwill depreciation of up to 50 percent of the acquisition costs, even in the case of a share deal. In addition, interest expense at the level of the group parent can be offset with potential profits of the target company. Current draft legislation would abolish goodwill depreciations for transactions after 28 February 2014.

Asset purchase or share purchase

Large acquisitions in Austria usually take the form of a purchase of the shares of a company, rather than of its business and assets, because capital gains on the sale of shares may be exempt for the seller. Even though an asset deal usually remains more attractive for the purchaser, the introduction of the tax group system in 2005 has increased the relative attractions of share deals for the purchaser. The proposed abolition of goodwill depreciation may cause asset deals to become more attractive again.

Purchase of assets

The main tax effects of an asset deal consist of a new cost basis of the purchased assets (step-up) for the purchaser, and a capital gain (in the amount by which the purchase price exceeds the cost of the asset) realized by the vendor. According to Austrian tax law, the purchase or transfer of a participation in a partnership qualifies as an asset deal.

An asset deal should provide the buyer with the opportunity to buy only the assets actually desired and to leave unwanted assets, especially unwanted risks, behind. For this reason, an asset deal may be preferable if the target corporation has potential liabilities or, for example, owns real property.

Capital gains from the sale of business property are subject to corporate income tax of 25 percent.

Purchase price

The purchase price must be allocated to all identifiable assets of the acquiring operation. Each identifiable asset is supposed to be accounted for at its fair market value on the basis of which the depreciation or amortization is computed (potential step-up). Any portion of the purchase price that cannot be assigned must be accounted for as goodwill.

Goodwill

Goodwill purchased from a third party must be amortized over a period of 15 years for tax purposes.

Depreciation

Depreciation of other assets charged in the accounts is generally accepted for tax purposes. Austrian tax legislation enables the cost of certain assets to be written off against taxable profits at a specified rate by means of capital allowances. Allowances are available with respect to certain tangible assets (e.g. industrial and agricultural buildings) and intangible assets (except self-created intangible assets).

The annual rate of tax write-off for industrial and agricultural buildings as well as buildings for banks and insurance companies is 3 percent on a straight-line basis, provided that a minimum of 80 percent of the building is used for business operations. If less than 80 percent of the building is used for business operations, the annual rate of depreciation decreases to 2 percent for industrial and agricultural buildings or to 2.5 percent for banks and insurance companies.

Tax attributes

Tax losses are not transferred on an asset acquisition. They remain with the company or are extinguished. However, each identifiable asset has to be accounted for at its fair market value on the basis of which the depreciation is computed. Thus, the buyer has high depreciable amounts, which decrease the taxable base in the future. Any portion of the purchase price that cannot be assigned must be accounted for as goodwill. Goodwill purchased from a third party has to be amortized over a period of 15 years for tax purposes.

Value added tax

Austria levies valued added tax (VAT) at a rate of 20 percent. For the transfer of certain assets, a reduced rate of 10 percent or tax exemptions may be available. For example, the transfer of shares is exempt from VAT. Certain reorganizations covered by the Reorganization Tax Act (RTA) are deemed to be non-taxable for VAT purposes.

There are no specific rules for the transfer of a whole business. The VAT base is calculated based on the purchase price plus transferred liabilities, less tax-exempt or non-taxable items.

Transfer taxes

Stamp taxes on certain documents and transactions are levied when there are contracts or documents effecting the transaction from an Austrian stamp tax point of view. From 2011 onwards, loan agreements and credit facilities do not trigger stamp tax. A contract relating to an asset deal as such is generally not subject to stamp tax, but the detailed written documentation regarding the transfer of certain assets and liabilities could trigger stamp tax. the liability for stamp tax can often be avoided by careful structuring of documentation.

Transfers of Austrian land and buildings are subject to Austrian real estate transfer tax (RETT). The rate is 3.5 percent plus a 1.1 percent court registration fee.

Purchase of shares

Although the purchase price for shares usually reflects the fair value of the target’s net assets (including goodwill), the purchase price has to be accounted for as the acquisition cost of the shares, and is, therefore, generally not depreciable.

However, under the group taxation system, goodwill of up to 50 percent of the purchase price can be depreciated tax-effectively if certain conditions are met. Careful tax planning will be required in the early stages of a transaction to maximize goodwill depreciation. However, there is currently draft legislation available to abolish goodwill depreciation.

The tax treatment of capital gains from the transfer of shares in a corporation depends, according to the Austrian Income Tax Act and the Austrian Corporate Income Tax Act, on the vendor’s tax status.

- Corporations: Capital gains from the transfer of participations in Austrian corporations are taxable at the level of an Austrian corporate seller. For a foreign seller, treaty protection can often be obtained under an applicable double tax treaty. For participations in foreign corporations, the participation exemption provides for a tax exemption if certain conditions are met.

- Individuals: Capital gains from the disposal of shares qualify as taxable income. The tax rate is reduced to 25 percent but there is the possibility to apply for the regular tax rate (from 0 to 50 percent). As of 1 April 2012, minority shares (amounting to less than 1 percent within the previous 5 years) cannot be sold without attracting income taxes. Shares sold before 1 April 2012 may be subject to taxation of up to 50 percent if the speculation period has not elapsed.

Due to the introduction of the tax group system in 2005, goodwill depreciation is under certain conditions also available for a share deal at the level of the purchaser under certain conditions.

A deduction is available for the amortization of goodwill and of hidden reserves in depreciable assets of the target company if the shares of an Austrian company with an active business are acquired (no intragroup acquisitions) and that company is subsequently included in the group taxation. However, several conditions must be met for the goodwill depreciation to become available:

- Acquisition of participation higher than 50 percent

- Goodwill depreciation is not applicable if the participation is acquired by a company associated with the affiliated group or if the acquirer holds 20 percent or more and exerts a dominant influence

- Existence of a direct participation.

- Target is an unlimited taxable corporation in Austria (goodwill depreciation is not available for acquisitions of foreign group members).

- Acquired corporation must carry on a business

- Formation of a tax group with the acquired corporation.

The goodwill is calculated by deducting the pro rata book-equity and the pro rata hidden reserves in the non-depreciable assets from the acquisition costs. Total depreciable goodwill is capped at 50 percent of the acquisition cost of the shares.

The deductions are available without corresponding taxation of the goodwill and hidden reserves in the target company, but reduce the acquisition cost (book value) of the participation. Goodwill depreciation has to be allocated over a period of 15 years. According to draft legislation, goodwill depreciation will be abolished for transactions after 28 February 2014.

Tax indemnities and warranties

In a share acquisition, the purchaser is taking over the target company together with all related liabilities, including contingent liabilities. The purchaser, therefore, normally requires more extensive indemnities and warranties than in the case of an asset acquisition.

Where significant sums are at issue, it is customary for the purchaser to initiate a due diligence exercise, which would normally incorporate a review of the target’s tax affairs. However, there are also transactions where the principle of caveat emptor (let the buyer beware) applies, and where warranties and indemnities would not be given.

Tax losses

Tax losses of the target company, in principle, transfer along with the company. A company’s brought forward income-type losses (such as trading losses) cannot be offset against the profits of other companies through group relief, but they can be set off against the company’s own future profits. The Austrian legislation provides a further restriction on the use of brought forward tax losses; their use can be partly or entirely denied by the tax authorities.

Loss carry forwards cannot be offset against future profits after an ownership change, if the so-called Mantelkauf provision applies. According to the regulation as set out in the Austrian Corporate Income Tax Act, the use of tax loss carry forwards by an Austrian company is denied if, from an overall point of view, the company is considered to have lost its identity. This is assumed in the case of:

- a substantial change in the economic and organizational structure

- a substantial change in the ownership of the company concerned.

This limitation does not apply if the changes mentioned earlier take place in the course of a reorganization, the aim of which is the maintenance of a workplace.

Crystallization of tax charges

The purchaser should obtain an appropriate indemnity from the seller that tax charges have been fully paid.

Pre-sale dividend

In certain circumstances, the seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that the dividend may be subject to no (when the dividend is paid to an Austrian corporation or the European Union (EU) Parent-Subsidiary Directive is applicable to a corporation resident in the EU) or only a low effective rate of Austrian tax, but reduces the proceeds of sale and thus the gain on sale, which may be subject to a higher rate of tax. The position is not straightforward, however, and each case must be examined on its merits.

Transfer taxes

No stamp duty applies for the purchase of shares in an Austrian company.

The transfer of a company owning Austrian real estate is subject to RETT at a rate of 3.5 percent based on three times the tax value (Einheitswert). RETT can often be avoided by careful structuring.

Choice of acquisition vehicle

There are several potential acquisition vehicles available to a foreign purchaser, and tax factors often influence the choice. Austria levies capital tax of 1 percent on the introduction of new capital to an Austrian company or branch. Capital tax can often be avoided by careful structuring. According to draft legislation available, capital tax will be abolished from 2016 onwards.

Local holding company

An Austrian holding company is typically used where the purchaser wishes to ensure that tax relief for interest is available to offset the target’s taxable profits or the taxable profits of other Austrian companies (or the Austrian permanent establishments of non-Austrian companies) already owned by the purchaser.

In the case of a share deal, the creation of a tax group can decrease the future taxable profit of the member companies.

The holding company can offset a tax-deductible interest (see this chapter’s information on deductibility of interest) and goodwill amortization against Austrian taxable profits of the target company in the combined post-acquisition group.

If the purchaser is unable to form a tax group (because, for example, it only acquires a minority share), interest (see this chapter’s information on deductibility of interest) is deductible at the holding company level. In the absence of a tax group, interest expense cannot be offset against taxable profit; it merely increases the tax loss carry forwards at the holding level. Moreover, in the case of a share deal without a tax group, goodwill depreciation is not available.

For an asset deal, interest and borrowing expenses as well as goodwill depreciation are fully deductible at the level of the Austrian holding company without the creation of a tax group. (See below information on deductibility of interest.)

Foreign parent company

The foreign purchaser may choose to make the acquisition itself, perhaps to shelter its own taxable profits with the financing costs. Dividend taxation and capital gains taxation on exit depend on the residency of the foreign purchaser (the availability of treaty protection, its position with regard to the dividend provisions of the EU Parent-Subsidiary Directive, etc.). thus, any intermediate holding company should have sufficient substance to cover its exposure in the event that a structure is challenged under the substance-over-form principle.

Non-resident intermediate holding company

If the foreign country taxes capital gains and dividends received from overseas, an intermediate holding company resident in another territory could be used to defer this tax and perhaps take advantage of a more favorable tax treaty with Austria. However, the purchaser should be aware that the Austrian authorities take a rather restrictive view on treaty shopping and thus the ability to structure a deal in a way designed solely to obtain tax benefits is restricted.

Local branch

A foreign purchaser may structure the acquisition through an Austrian branch, as an alternative to the direct acquisition of the target’s trade and assets. Austria does not impose additional taxes on branch profits remitted to an overseas head office. the branch will be subject to Austrian tax at the normal corporate rate, currently 25 percent. If the Austrian operation is expected to make losses initially, a branch may be advantageous since, subject to the tax treatment applicable in the head office’s country, a timing benefit could arise from the ability to consolidate losses with the profits of the head office.

Joint venture

Joint ventures can be either corporate (with the joint venture partners holding shares in an Austrian company) or unincorporated (usually an Austrian partnership). Partnerships are generally considered to provide greater flexibility from a tax viewpoint. For example, if the joint venture will incur initial losses, the partners should be able to use their shares of those losses against the profits of their existing Austrian businesses.

In practice, there may be non-tax reasons that lead a purchaser to prefer a corporate joint venture. For example, a corporate body may enable the joint venture partners to limit their liability to the venture (assuming that lenders do not insist on receiving guarantees from the partners). One fairly common structure involves the parties establishing a jointly owned Austrian company that borrows to acquire the Austrian target.

Choice of acquisition funding

A purchaser using an Austrian acquisition vehicle to carry out an acquisition for cash will need to decide whether to fund the vehicle with debt, equity, or a hybrid instrument which combines characteristics of both. The principles underlying these approaches are discussed below.

Debt

The principal advantage of debt is the potential tax-deductibility of interest, as the payment of a dividend does not give rise to a tax deduction. However, from 2011 onwards, interest on loans taken out to acquire participations from related companies is no longer deductible for corporate income tax purposes. (See this chapter’s information on deductibility of interest.)

Another potential advantage of debt is the deductibility of expenses, such as guarantee fees or bank fees, in computing trading profits for tax purposes (this is only available in the case of an asset deal; the position of a share deal in connection with a tax group is currently under discussion). These payments will be distributed over the term of the loan or credit. There are currently discussions and an outstanding court decision on whether financial expenses on loans taken out to acquire participations from related companies are also no longer deductible.

Austrian legislation does not include any thin capitalization rules. In practice, a loan of an affiliated party is deemed to constitute hidden equity if it is granted to substitute for the shareholder’s equity.thus, evidence has to be provided that a supply of equity would clearly not have been necessary at the time the loan was granted and that the loan is not a substitute for the required equity.

Moreover, the companies’ capital ratio should be in line with commercial practice. A debt-to-equity ratio of 3:1 or even 4:1 should generally be sufficient provided there are no unusual circumstances. To avoid a re-classification of the loan as hidden equity, documentation of the arm’s length nature of the loan will be required.

Deductibility of interest

Interest paid or accrued on debt is generally tax-deductible for the paying corporation, if the arm’s-length condition is met, the loan is properly documented and the company has a reasonable financing structure.

Interest on debts connected with an asset deal is deductible for tax purposes.

From 2005 onwards, interest deduction has also been granted by law to share deals. From 2011 onwards, in case of a share deal, interest on loans taken out to acquire participations from related companies is no longer deductible for corporate income tax purposes.

Payments to affiliated companies have to comply with the arm’s length principle to be recognized for tax purposes. Interest payments to related parties may be classified as a hidden dividend, to the extent that the consideration is not arm’s length or the underlying debt is classified as hidden equity.the tax authorities take a restrictive view of what constitutes an acceptable interest rate. According to draft legislation currently available, interest payments to foreign affiliates is no longer tax-deductible if the foreign recipient is subject to taxation of less than 10 percent. Fifty percent of such expenses are deductible if the foreign recipient is subject to taxation of less than 15 percent but more than 10 percent. This regulation applies to interest expenses after 28 February 2014 (and to existing loan agreements).

Withholding tax on debt and methods to reduce or eliminate it

Austria does not levy any withholding tax on interest on loans paid to a foreign company, although this could become an issue for loans secured by Austrian real estate.

For non-resident companies, interest income is generally taxable only if the income is attributable to a permanent establishment in Austria. No withholding tax is levied on intercompany interest payments to non-resident companies. However, interest derived by non-resident companies from loans secured by immovable property in Austria is subject to income tax by assessment at the normal corporate income tax rate, unless an exemption or a reduced rate applies under an applicable income tax treaty.

Austrian tax law includes no thin capitalization rules. Payments of interest to an affiliated company that represent an amount that would not have been payable in the absence of the relationship are not deductible for Austrian tax purposes. In the case of a re-classification into hidden equity, withholding tax at a rate of 25 percent would be imposed on interest payments under domestic law. This withholding tax can be reduced or eliminated under a tax treaty or the EU Parent-Subsidiary Directive.

Checklist for debt funding

- The use of bank debt avoids transfer pricing problems, and the re-qualification of a loan into hidden equity.

- Consider whether the level of profits will be sufficient to absorb tax relief on interest payments.

- A tax deduction may be available at higher rates in other territories.

- No withholding tax applies on interest payments to non-Austrian entities.

Equity

A purchaser may use equity to fund its acquisition or wish to capitalize the target post-acquisition.

Austria levies capital tax at 1 percent on equity contributions by a direct shareholder (or a subsidiary of the direct shareholder) to an Austrian corporation. The same applies to contributions by a limited partner to a limited partnership in which a corporation is an unlimited liability partner. Special exemptions apply in cases of tax reorganization. The common practice of the Austrian tax authorities allows the capital duty to be avoided by making an indirect contribution. according to draft legislation, capital tax will be abolished from 2016 onwards.

Under domestic law, there is no withholding tax on dividends paid by an Austrian company to another domestic corporation if shareholding is at least 10 percent. If the EU Parent-Subsidiary Directive is applicable, no withholding tax on dividends paid to companies resident in the EU applies. Relief of withholding tax at source is available under certain conditions. A reduction of dividend withholding tax may also be available under a tax treaty. Dividends are not deductible for Austrian tax purposes.

The use of equity, although offering less flexibility should the parent subsequently wish to recover the funds it has injected, may be more appropriate than debt in certain circumstances, such as:

- Where the target is loss-making, it may not be possible to obtain immediate tax relief for interest payments. thus, the possibility of a re-classification of the loan into hidden equity would apply and the interest payments would be deemed to be dividends.

- Where the company is thinly capitalized, it would be disadvantageous to increase borrowings without also obtaining an injection of fresh equity. A tax-efficient structure normally requires a mix of debt and equity that provides adequate interest cover for Austrian tax purposes.

- There may be non-tax reasons for preferring equity. For example, in certain circumstances, it may be desirable for a company to have a low debt-to-equity ratio. this is one of the factors that have encouraged the use of hybrid funding instruments (see later in this chapter).

- The use of equity could also be more appropriate where participations are acquired from related companies as interests on loans of these acquisitions are no longer deductible. (See this chapter’s information on deductibility of interest.)

Austrian law includes a variety of special provisions that apply to mergers and acquisitions. These provisions relate to areas ranging from corporate law, antitrust law and employment law to environmental law and tax law. Special tax treatment for M&As was introduced in the reorganization tax act of 1992 (RTA). Since this law closely links the tax treatment of M&As to the legal structure chosen to effect a merger or acquisition, substantial thought needs to be given to the company law aspects of the proposed structure, as well as to its tax consequences under the RTA. Provided that certain conditions are met, a tax-neutral reorganization is often possible under the RTA. The RTA also provides for some beneficial provisions regarding capital tax and real estate transfer tax under certain conditions.

Hybrids

Consideration may be given to hybrid financing – that is, instruments treated as equity for accounting purposes in the hands of one party and as debt (giving rise to tax-deductible interest) in the other. Various hybrid instruments and structures have been devised to achieve an interest deduction for the borrower with no income inclusion for the lender. a new regulation has been introduced in 2011 limiting investments of an Austrian company abroad via hybrid instruments. Specialist advice should be obtained if such financing techniques are contemplated or already in place.

Further, a new restriction on interest to low-taxed affiliates (see above) is planned to be implemented from March 2014 onwards.

Discounted securities

The tax treatment of securities issued at a discount to third parties normally follows the accounting treatment.

Deferred settlement

An acquisition often involves an element of deferred consideration, the amount of which can only be determined at a later date on the basis of the business’s post-acquisition performance. As a general rule, the overall purchase price, including discounted estimated earn-out payments, has to be capitalized on the level of the purchaser. According to a court decision, a higher earn-out payment increases the overall purchase price. Otherwise, a lower earn-out payment should decrease the purchase price, but this is currently a gray area. Specialist advice should be sought on whether subsequent changes of the valuation should be treated as profit and loss (P&L) neutral or P&L-effective.

Other considerations

Concerns of the seller

The tax position of the seller can be expected to have a significant influence on any transaction. In certain circumstances, the seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that the dividend may be subject to no or only a low effective rate of Austrian tax but reduces the proceeds of sale and thus the gain on the sale. However, the position of the Austrian authorities becomes ever more restrictive in this respect (new rules in the CIT guidelines) and should be reviewed very carefully.

Company law and accounting

In general, under the earlier mentioned Austrian law, an acquisition can be structured as either a share or an asset purchase. If a share purchase is chosen, significant tax benefits can be achieved by the subsequent establishment of a tax group. Alternatively, it may prove useful to effect further stages of reorganization after the acquisition to achieve a favorable tax result. Company law provides the vehicles needed to reach the most advantageous tax results.

Taxpayers are usually bound by the form they choose for the transaction. However, the government may challenge the tax characterization of the transaction on the grounds that it does not clearly reflect the substance of the transaction. Thus, the way parties choose to structure a transaction may have substantial tax consequences. In any event, it is highly recommended that acquisition structuring issues are discussed in good time and the parties properly record the intended tax treatment of the transaction in the documents associated with the transaction.

Group relief/consolidation

From 2005 onwards, the old system of the Austrian tax unit (Organschaft) has been replaced by the new group taxation system enabling the pooling (no consolidation) of tax P&L of Austrian-resident group companies. Additionally, it will be possible to use the tax losses of foreign subsidiaries directly held by Austrian group companies. However, these losses are, among other things, subject to a clawback at the time the foreign subsidiary earns profits against which the foreign loss carry forward can be offset. Further restrictions with respect to foreign group members are likely to be implemented soon.

The following benefits are offered by the new group taxation system:

- lowering of the minimum participation (over 50 percent)

- removal of some other integration requirements (economic, financial, and operational control by the parent)

- possibility of joint taxation of national and international corporations

- limitation of the commitment period to 3 years

- possibility of goodwill depreciation (likely to be abolished from March 2014 onwards).

Generally, the following requirements for the formation of a tax group have to be met:

- a participation of more than 50 percent.

- majority of voting rights.

- maintenance of the tax group for at least 3 years.

- filing of a separate application for group taxation with the competent tax office (a tax unit under the old tax unit scheme will not be automatically replaced by the group taxation system).

Basically, all unlimited taxable corporations in Austria may act either as a parent company or as a group member under the new group taxation system. A foreign company subject to limited tax liability in Austria is comparable to an EU corporation (listed in the appendix of the Austrian Income Tax Act), in that it may act as a parent company or a group member.

The participation of over 50 percent in group members may either be held directly or indirectly (via a partnership) or, in addition to a small direct participation, via another group corporation.

The conditions of the group taxation offer significant benefits compared with the former tax unit regime under which it was not only necessary to have a higher (in general, 75 percent) participation, but the entity was also required to exercise financial, economic and operational control to such an extent that the subsidiary was in effect directed by the parent.

The reduction of these additional conditions means that, for the first time, it will for the first time, be possible for mere holding companies to act both as group parent or group member. To avoid the risk of a challenge to the grouping, it is advisable that a holding company acting as a group parent has minimal substance.

Before 2011, interest expenses arising from a leveraged share acquisition in a future group company were automatically deductible against the profits of the target business without the need for any complex restructuring. Since 2011, interest on loans taken out to acquire participations from related companies is no longer deductible for corporate income tax purposes. Further restrictions on interest deduction are planned to be implemented.

P&L of Austrian group members will be pooled, resulting in final tax savings. As Austria does not have the right to tax the profits of foreign group members, only losses of foreign-resident group members need be assigned to the parent company. This reduces the Austrian tax base, resulting in cash flow benefits for the group. However, according to draft legislation, cross-border deduction of losses generated by foreign companies will be limited to an extent of 75 percent of the profits earned in Austria. In addition, only foreign companies that are residents of an EU-member state or another state with which a tax treaty providing a comprehensive assistance agreement (‘major information clause’) is in place can be included in an Austrian tax group.

An important point about pre-group tax loss carry forwards (LCFs) is that pre-group tax LCFs of unlimited taxable group members may only be offset against the profits of the group company itself, not against profits of other group members, whereas tax LCFs of the group parent can be offset against the group profit.

The general rule of the 75 percent restriction, according to Section 2 paragraph 2b of the Austrian Income Tax Act regarding the offset of LCF with future profits, is only applicable at the level of the parent company. At the level of each group member, pre-group tax LCFs can be matched up to 100 percent with individually generated profits.

Due to the use of losses and goodwill depreciation, an impairment of a group member at the group-parent level during the life of the group will not be tax-effective and cannot be clawed back upon termination of the group. In contrast, participations in corporations not included in the tax group are still available for impairment of the participation under the general tax rules. When restructuring transactions, specific rules for the goodwill depreciation have to be observed.

Transfer pricing

Austrian tax law does not provide for legally specified transfer pricing rules. However, the Organisation for Economic Co-operation and Development guidelines are applied and transfer pricing documentation is reviewed in the course of a tax audit as a matter of general routine. Moreover, in 2010, the Austrian tax authorities published Austrian Transfer Pricing Guidelines. Transactions with foreign permanent establishments and foreign-affiliated parties and arrangements between related parties have to comply with the arm’s length principle.

Dual residency

There are few advantages to using a dual resident company.

Foreign investments of a local target company

The shareholding of an Austrian corporation in a foreign company might qualify for the holding privilege if the minimum holding of at least 10 percent minimum has been held for at least one year. Dividends are tax-exempt unless the switch-over provision (that is, application of the credit instead of the exemption method for dividends received from low-taxed passive foreign companies) applies. In the year of the purchase of the participation (or the year the company holds a participation of 10 percent or more in the foreign company for the first time), the taxpayer has an irrevocable option to decide whether the participation is treated as tax-neutral or taxable.

If a tax-neutral participation qualifying for the holding privilege is sold, the capital gains are tax-free (capital losses are not tax-effective). Despite this, the Austrian holding privilege provides for a switch-over provision applicable in the case of low-taxed, passive subsidiaries. In this case, the tax exemption would change to a tax credit. Further, dividends are not tax-exempt if they are tax-deductible in the foreign country where the distributing company is resident.

If the option for a taxable participation is chosen, capital gains are taxable at the standard rate of 25 percent and capital losses can be claimed for tax purposes over a period of 7 years.

Comparison of asset and share purchases

Advantages of asset purchases

- The purchase price (or a proportion) can be depreciated or amortized for tax purposes.

- Tax deduction for interest payments connected with the acquisition.

- No undisclosed risks/liabilities of the company are inherited.

- No deferred tax liabilities on retained earnings.

- Possible to acquire only part of a company’s business.

- Profitable operations can be absorbed by loss companies in the acquirer’s group, thereby effectively gaining the ability to use the losses.

Disadvantages of asset purchases

- Possible need to renegotiate supply, employment and technology agreements, and change stationery.

- Higher capital outlay is usually involved (unless the debts of the business are also assumed).

- Higher tax burden, especially if the vendor is an individual, which may increase the purchase price.

- Accounting profits are reduced by the amortization of acquired goodwill.

- Any loss carry forwards remain with the vendor.

Advantages of share purchases

- Likely to be more attractive to the vendor (lower tax burden, especially for individuals), which can lead to a lower purchase price (compared with an asset deal).

- Tax loss carry forwards of the target company can be used in the future (subject to limitations).

- Existing supply or technology contracts may provide advantages.

- Real estate transfer tax (if land property is acquired) can be avoided under certain conditions.

- Interest deduction available unless a participation is acquired from an affiliated company.

Disadvantages of share purchases

- Limited deduction of the purchase price compared to an asset deal.

- Deferred tax liability at the company level equal to the difference between fair value and tax book value of the net assets.

- Any prior undisclosed risks and liabilities remain with the target company and are acquired by the buyer, so warranties are recommended.

- No deduction of interest on loans taken out to acquire participations from related companies.

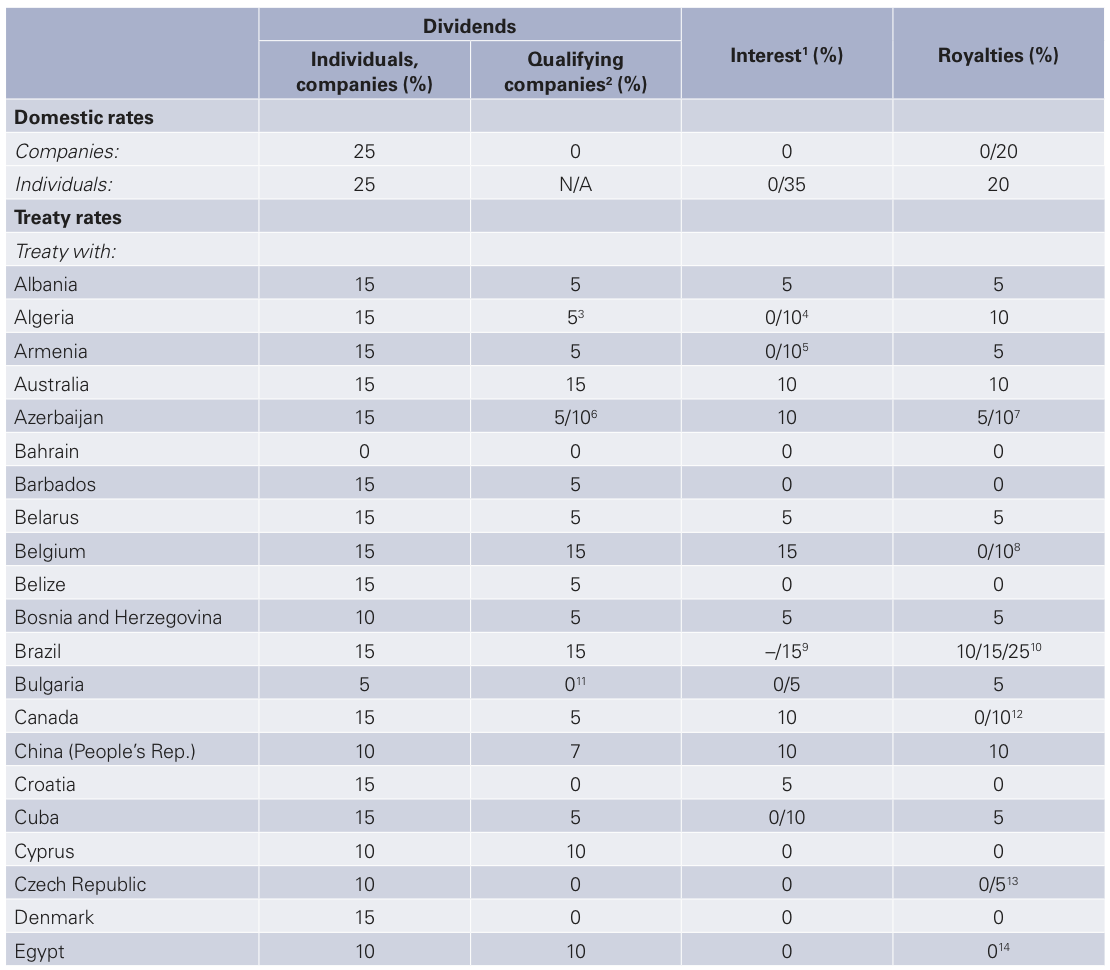

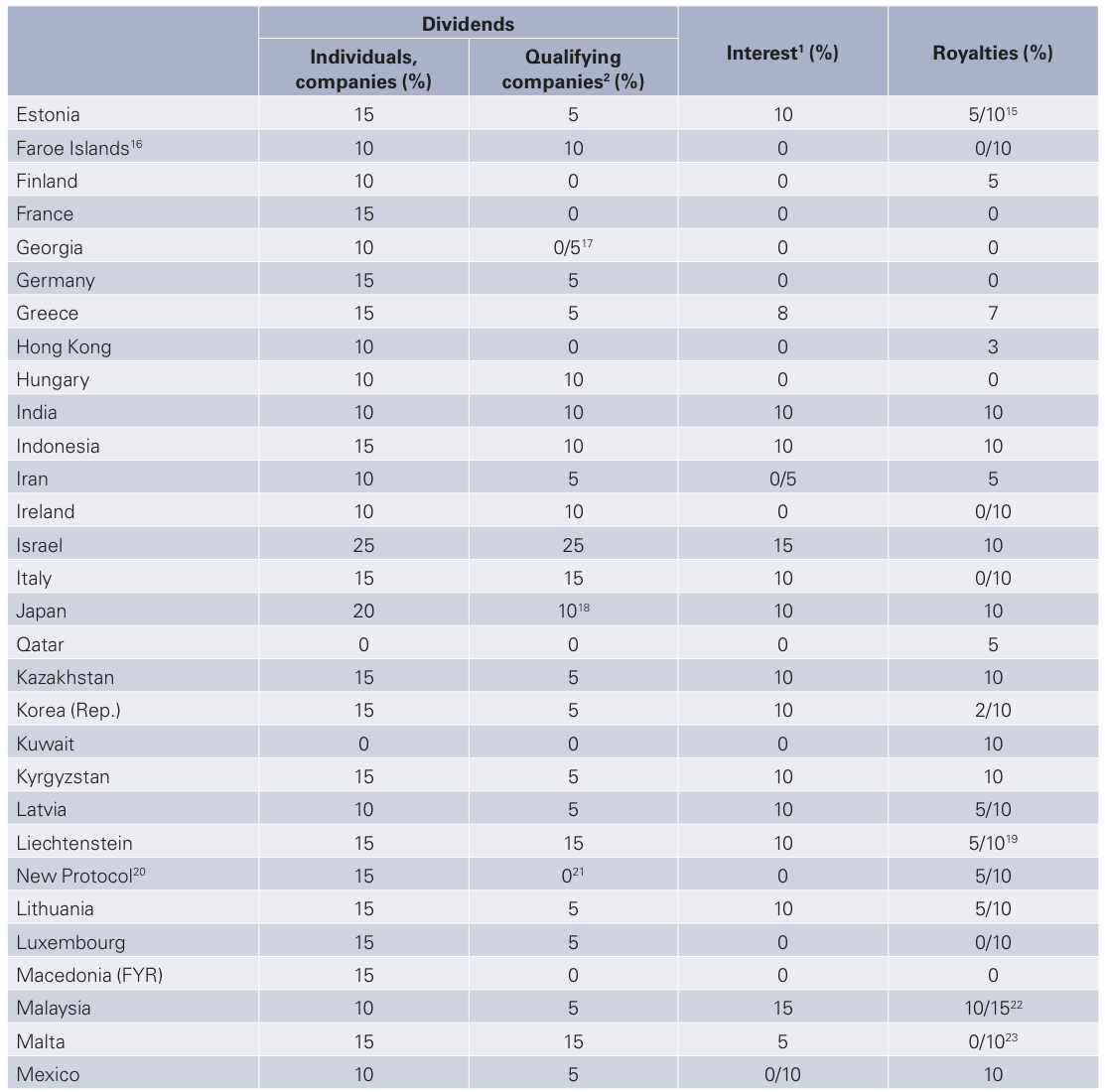

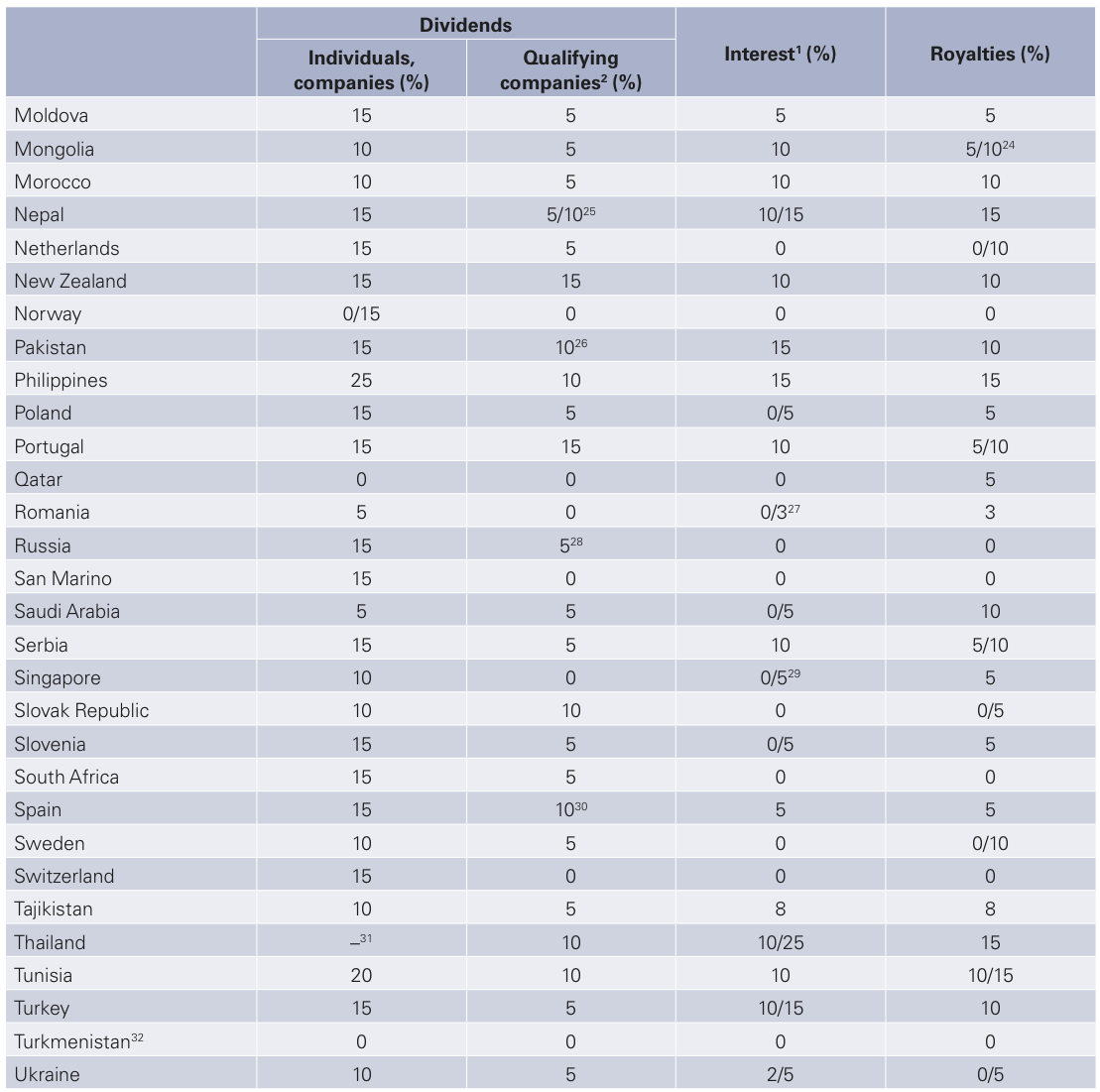

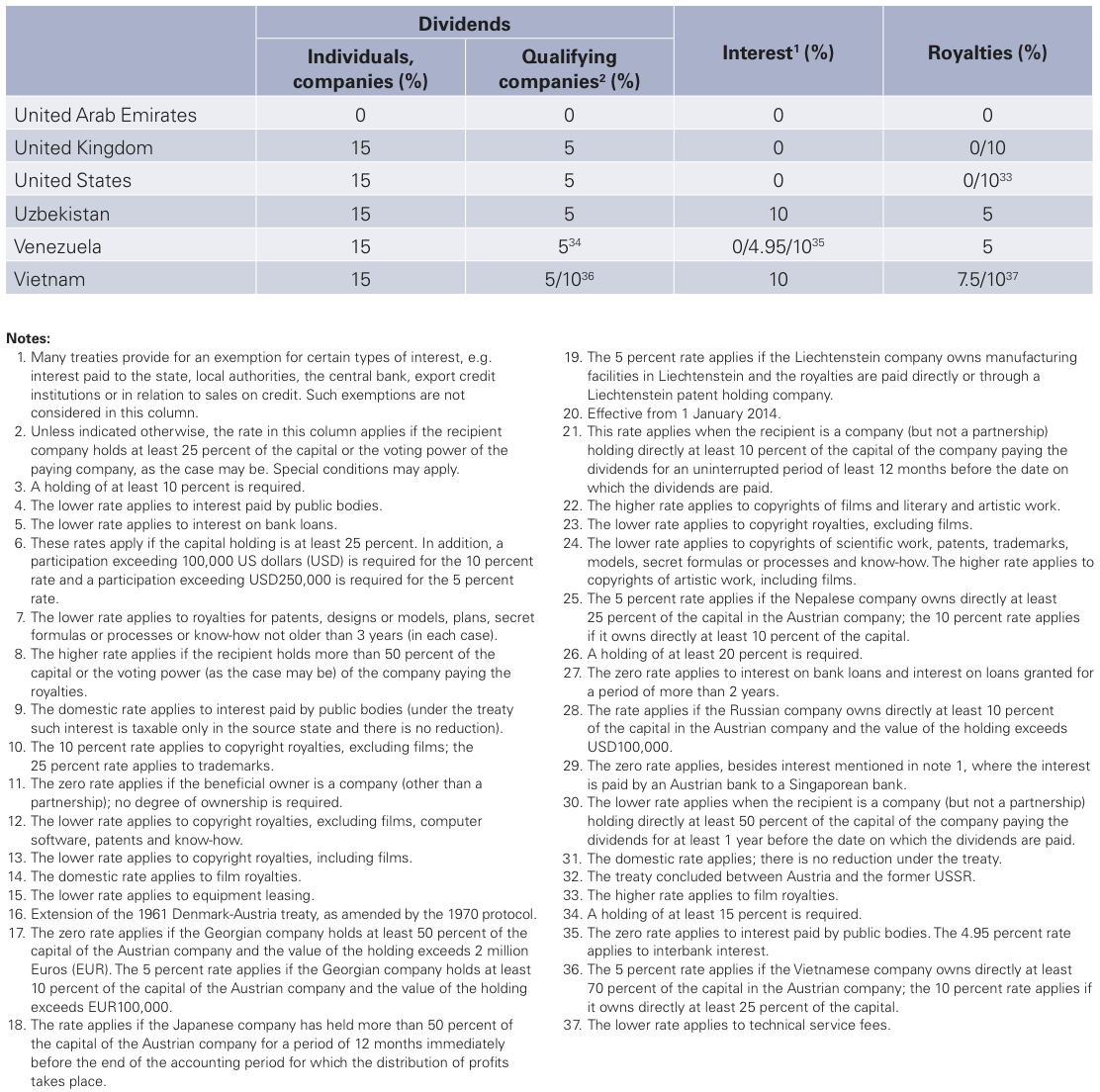

Austria – Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Austria’s tax treaties. This table is based on information available up to 1 November 2013.

Source: International Bureau of Fiscal Documentation, 2014

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter