Publications Serial Acquirers: Getting Your Ducks In A Row

- Publications

Serial Acquirers: Getting Your Ducks In A Row

SHARE:

By Xena Welch Guerra, Tomi Laamanen, Anna Samanta, Stefan Koller – Deloitte and University of St. Gallen

Contributors: Florian Borner, Wolfgang Eckert, Kristina Faddoul, Joshua Steiner, Markus Koch, George Budden, Michael Grampp

Study rationale

Prevalence

Many Swiss companies engage in serial acquisitions to achieve long term strategic objectives – to consolidate within a fragmented market, to expand into new markets and geographies, to fill gaps in their product portfolio or for a variety of industry specific reasons.

In 2014, the Swiss M&A market witnessed a sharp increase in activity from CHF 27 billion in 2013 to CHF 178 billion in 2014, the highest since 2008 according to Mergermarket data. Yet, studies continue to confirm that mergers often fail to meet expectations and that serial acquirers are continually looking for ways to up their game. Few studies, however, have focused on the practices, insights and challenges amongst serial acquirers.

Unique challenges – unique opportunities

Most acquisition research to date focuses on the success determinants of individual deals. Companies that actively engage in multiple acquisitions acquire unique insights and face a range of unique challenges. These have not been assessed systematically in the Swiss market nor internationally.

On the one hand, the potential for complexity and resource intensity when conducting multiple acquisitions is high. Given the well known challenges associated with integrating or absorbing a single acquisition, a series of acquisitions is unsurprisingly an order of magnitude more difficult. High acquisition volumes strain managerial capacity, increase coordination demands and sometimes require fundamental organisational restructuring to secure longer term success.

On the other hand, serial acquirers are uniquely positioned to capitalise on superior acquisition capabilities. Through systematic processes, clear responsibilities and diligent post-mortem reviews, serial acquirers adapt and learn to overcome typical challenges and turn acquisition affinity into a competitive advantage.

Our study

Deloitte and the University of St.Gallen embarked on a joint study to investigate how Swiss serial acquirers organise their acquisition and integration activities, how they address their most pressing challenges and what makes them successful. The study is based on senior management interviews conducted with 25 Swiss serial acquirers. The findings uncover challenges and recent learnings, as well as key practices and insights prevalent amongst successful serial acquirers. Each chapter consists of a summary of results, anonymised quotes from the study and the point of view on the finding by a panel of Deloitte post merger integration (PMI) experts.

Our key findings

Key Finding 1: M&A teams are common, integration teams are rare

Organisational requirements – dedicated resources

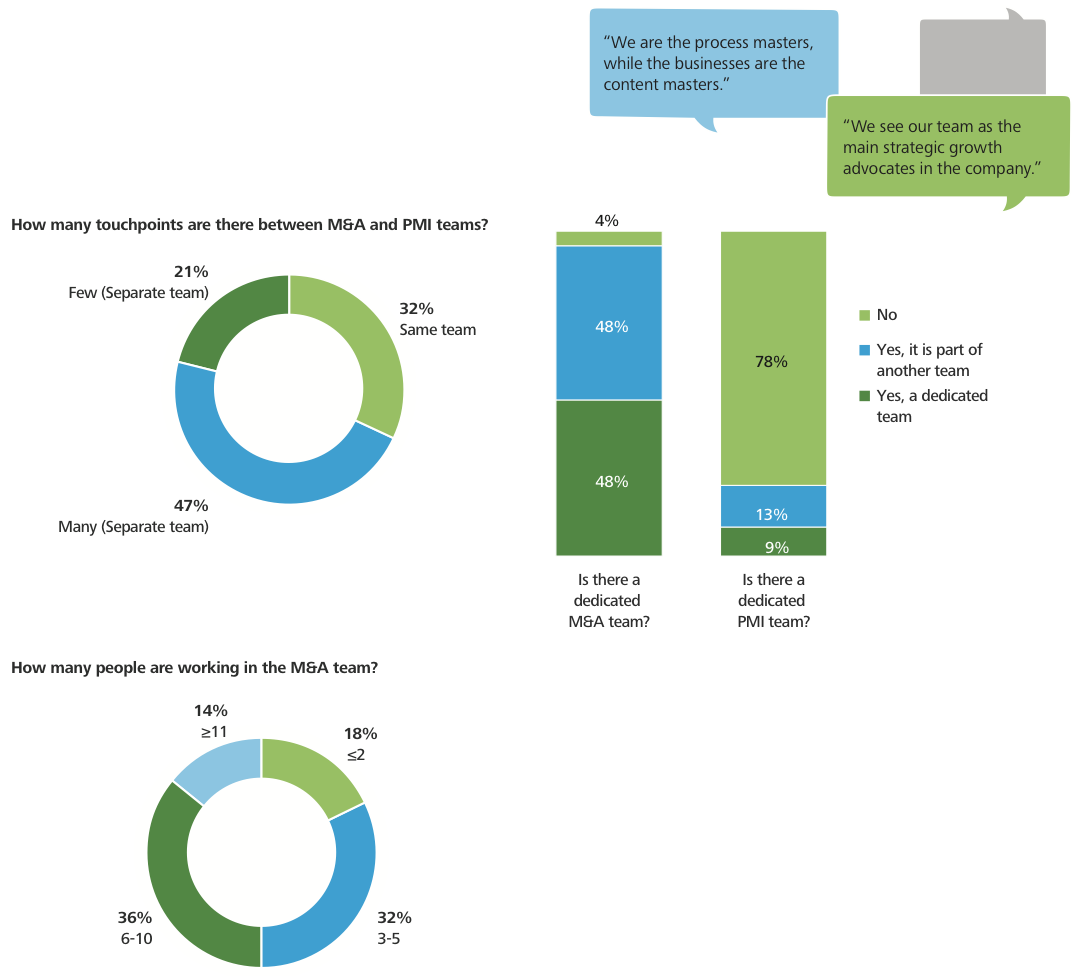

The majority of Swiss serial acquirers employ a dedicated M&A team. While about half have a dedicated M&A team, the other half employ a corporate development or strategy team whose responsibilities include M&A along with other responsibilities. Most M&A teams have been in place for more than five years and half of the teams consist of more than five people.

Almost all M&A teams report to the C-suite, with half reporting to the CEO and 44% to the CFO. Although M&A is typically a corporate function, some companies also have M&A managers in individual business units.

The M&A teams vary significantly with regard to the depth and breadth of their assigned responsibilities. While in some cases acquisition teams provide basic process support, such as administering the internal approval process and coordinating with external advisors, others take a more strategic role and closely collaborate with the business to plan and execute their acquisition strategies. While most M&A teams are responsible for deal origination until signing, only a few teams are additionally responsible for the integration.

In some companies being part of the M&A team is viewed as a valuable career step. In such teams, members usually stay between two to five years before assuming new responsibilities in the organisation.

In contrast to the prevalence of dedicated M&A teams among Swiss serial acquirers, only a small number (9%) employ dedicated integration teams. The rationale for having an integration team is to ensure the permanent availability of firm-specific integration expertise. This approach requires scale, centralisation and a steady deal flow. One of the main challenges of having a dedicated integration team is how to manage fluctuation in integration activity. Different solutions are in place amongst Swiss serial acquirers: from the integration team being part of a wider project management organisation to expanding the scope beyond integration to for example restructuring projects.

Deloitte Point of View

Serial acquirers benefit from securing integration expertise with dedicated resources to capture integration knowledge and experience. However companies should only put a dedicated team in place if there is sufficient deal flow to avoid the challenge of having to keep an integration team busy in between integrations.

Even without a dedicated integration team, serial acquirers always benefit from assigning an experienced integration director to orchestrate each integration. Past integration directors could take on an advisory role for future integrations to help share integration knowledge where no dedicated teams are in place.

For serial acquirers, deal and integration teams need to collaborate closely. Frequent touchpoints between the two teams are required to provide visibility of deal flow, create a common understanding of deal drivers and allow for a continuous learning and feedback loop to improve future deals.

Key Finding 2: Integration processes need to mature further to be as systematic as deal processes

Standardised processes and tools as a starting point

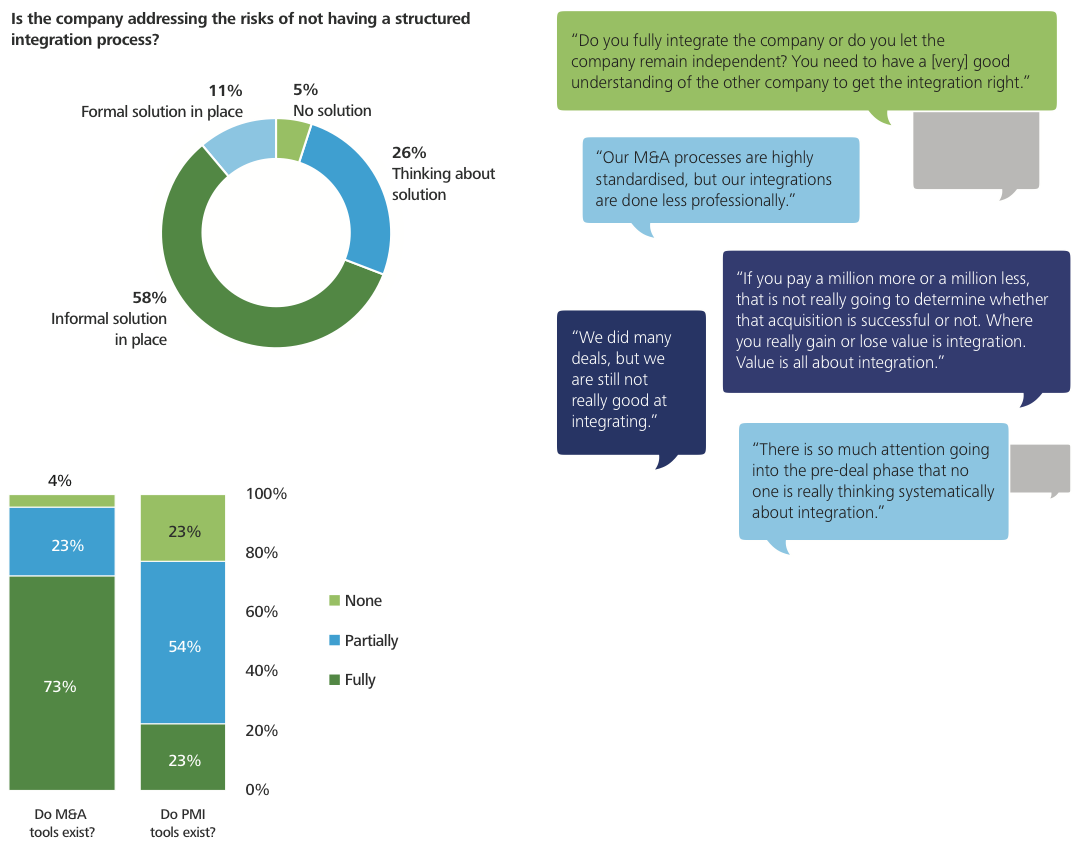

The majority of respondents have a highly standardised deal process and tool kit. The tool set typically consists of target lists, due diligence and valuation frameworks, checklists, contracts, non disclosure agreements (NDAs) and board presentations. The main benefits of having standard processes and a proven set of tools are avoiding bad deals, moving quickly on good deals, de-risking the deal process and fulfilling fiduciary duties. Serial acquirers with tools such as standard board presentations achieve comparability across deals, speedier approvals and greater confidence in deals.

Integration processes however, are less standardised than M&A processes amongst serial acquirers. On the PMI side, only 23% have a full set of standardised processes and tools. The picture here is very mixed. Some have a comprehensive integration playbook with as much structure as on the M&A-side, some have basic processes documented and others have tacit processes residing inside individuals’ heads. Where there is no dedicated team, experience and processes are often dispersed throughout the organisation.

This lack of methodology and ad hoc approach is recognised by many as a key challenge and more than half of respondents have efforts in place to develop new tools and to document lessons learned.

Standardisation both for deal making and integration strongly depends on company size and governance structure. As one might expect, large, centralised companies have a considerably higher degree of formalised processes, than do smaller, decentralised companies.

Deloitte Point of View

For serial acquirers, a standardised approach and tool set will greatly accelerate value creation and the success rate of integrations. Not having to ‘reinvent the wheel’ will save time and clarify integration priorities.

Defining and gaining executive alignment on the integration non-negotiables and guiding principles upfront will avoid conflict and lay the foundation for a more successful integration. However, due to the nature of integrations, the integration framework should allow for customisation as each deal is unique and poses a new set of challenges.

Key Finding 3: Proactive multi-channel origination is essential

Where do they come from?

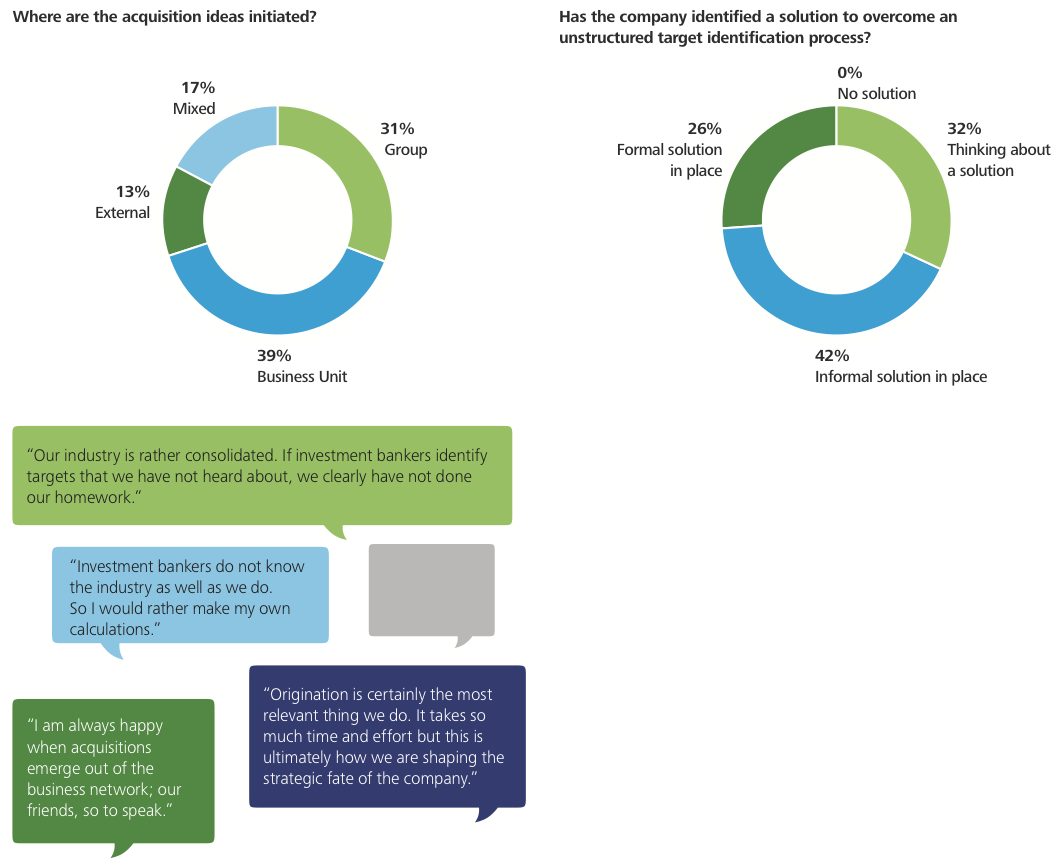

Swiss serial acquirers use multiple origination channels. Deals are either initiated externally, through the target, the seller, a financial intermediary or internally. If they are initiated internally, they either originate locally in the regions and business units of the company, or they emerge through market screening activities driven by the corporate centre.

Although most serial acquirers have developed strict criteria against which they evaluate potential targets, they vary with regard to the amount of internal resources that they deploy for continuous target screening. Some companies manage their target pipeline very actively and assign team members to maintain and update potential target lists on a very regular basis. Others provide regular trainings among their regional managers, on how to identify, assess, and approach potential acquisition targets. Again others acquire on an opportunistic basis, and evaluate targets whenever they happen to appear on their radar.

Choosing the right approach for deal origination depends on the organisation’s structure, corporate growth targets and the dynamics within the industry. While companies in consolidated industries rely on corporate initiative, companies in fragmented industries and portfolio companies tend to use business unit deal origination. Overall however, few Swiss serial acquirers exclusively rely on external support for deal origination.

Deloitte Point of View

In our point of view, it is crucial to integration success to involve the business in identifying the targets. It is important however to give them strict criteria to not waste time and also to train them in how to make the initial approach. Many deals have been lost because of a well meaning business unit manager approaching that preciously guarded family run company with the wrong message or even worse, making promises that cannot be kept.

To avoid wasting efforts, the key is to have clearly defined criteria and not be afraid of walking away from a bad deal. Serial acquirers are advised to proactively manage their pipeline and evaluate targets against defined and agreed strategic, financial and integration criteria.

Key Finding 4: Early involvement of integration team is key to integration success

Collaboration and clear responsibilities

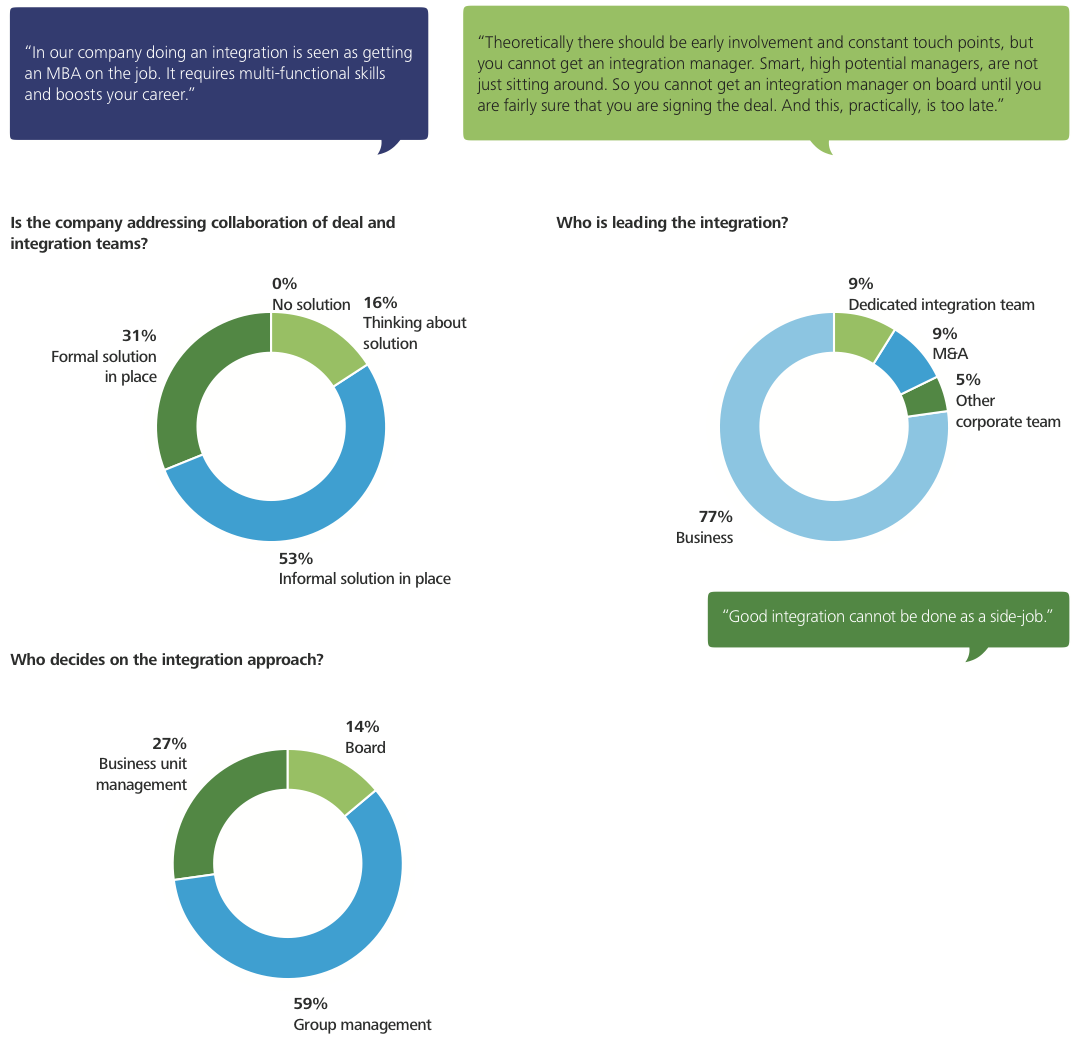

When deal making and integration teams are not aligned, achieving the deal value may be at risk. In the worst case, deals are just “thrown over the wall” from the deal team to the integration team without creating any understanding of the deal rationale and drivers.

Assigning and involving a designated integration director early in the deal process is beneficial to creating buy-in and ensuring that the deal rationale is well understood. This person is responsible for delivering a successful integration by bringing all integration workstreams together. Although the interviewed serial acquirers recognise the importance of a visible integration director role, many companies find it challenging to identify and assign capable individuals. In the best case, the integration director is a visible position and represents an important stepping stone in the firm’s career path.

Sometimes different functional backgrounds mean that the teams speak different ‘languages’. Respondents confirmed that close collaboration between the deal and integration teams improves accuracy and robustness of the synergy case. Serial acquirers benefit from ensuring regular feedback in order to create a learning cycle and prevent inaccurate synergy estimations. Most of the interviewed companies are aware of the importance of aligning deal and integration teams and the majority have a solution in place.

In the majority of companies interviewed, corporate management decides on the integration approach, whilst the business units are responsible for the implementation. Managing integrations however is time-consuming and difficult to do in addition to managing the daily business.

Deloitte Point of View

Integrations are modern management’s most complex challenge. It is essential to appoint the best employees to lead the integration and supplement with external expertise if internal capacity and capabilities are limited. Early integration planning and involvement of the integration director and team increases the chances of integration success because understanding of the deal rationale and expectations can be secured.

To attract the best talent to the integration director role, it is crucial that companies ensure that being part of an integration has a positive career impact.

Executive sponsorship is critical for integration success and ensures sufficient focus on integration results and enables swift escalation and resolution of issues.

Key Finding 5: Strong organisational platforms are required for serial integrations

Complexity and capacity constraints

Most serial acquirers acknowledge the need for strong organisational platforms, such as robust business processes and IT systems, to successfully execute serial acquisitions.

While experienced companies can integrate several targets simultaneously, this is highly dependent on the distribution of targets throughout the business units and geographical locations of the acquirer. Ideally, each product division or country organisation should not attempt more than one integration at a time according to majority of the interviewed serial acquirers but it can occur due to the nature of M&A.

Well-functioning IT and reporting systems alleviate the burden of increased complexity.

Most serial acquirers interviewed highlighted that acquisitive growth does not come without an opportunity cost. In many cases underestimated complexity and coordination demands draw attention away from ongoing initiatives, even from business as usual activities.

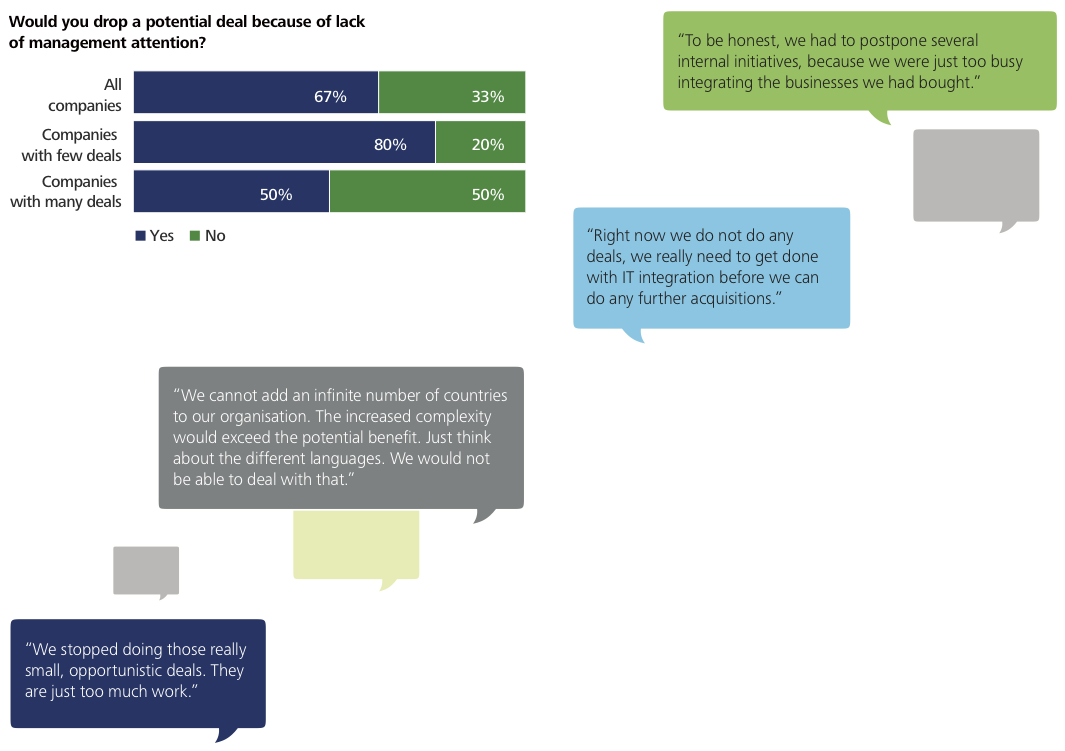

Hence, 67% of the companies interviewed would postpone or refrain from a potential deal if they did not deem it “digestible” by the business unit or if the necessary managerial attention were temporarily unavailable. Notably, serial acquirers with lower deal volumes are more likely to reject a deal under these conditions as they often do not have dedicated deal or integration teams or systematic processes in place.

Hence, 67% of the companies interviewed would postpone or refrain from a potential deal if they did not deem it “digestible” by the business unit or if the necessary managerial attention were temporarily unavailable. Notably, serial acquirers with lower deal volumes are more likely to reject a deal under these conditions as they often do not have dedicated deal or integration teams or systematic processes in place.

Deloitte Point of View

Companies contemplating growth through serial acquisitions should ensure the underlying business has strong organisational platforms to support numerous acquisitions. If, for example, IT infrastructure and systems are not well maintained and managed, adding further complexity through acquisitions may lead to performance deterioration.

It is important that a serial acquirer identifies potential capacity constraints and prepares critical support functions such as IT, HR and Finance early.

Finally, reviewing deal load and prioritising integration activity against business as usual activity will counter capacity constraints. A simple review of what initiatives can be accelerated, stopped, started or continued is important to balance resource requirements and workload.

Key Finding 6: Achieving synergies is critical but not always followed through

Expertise in value capture

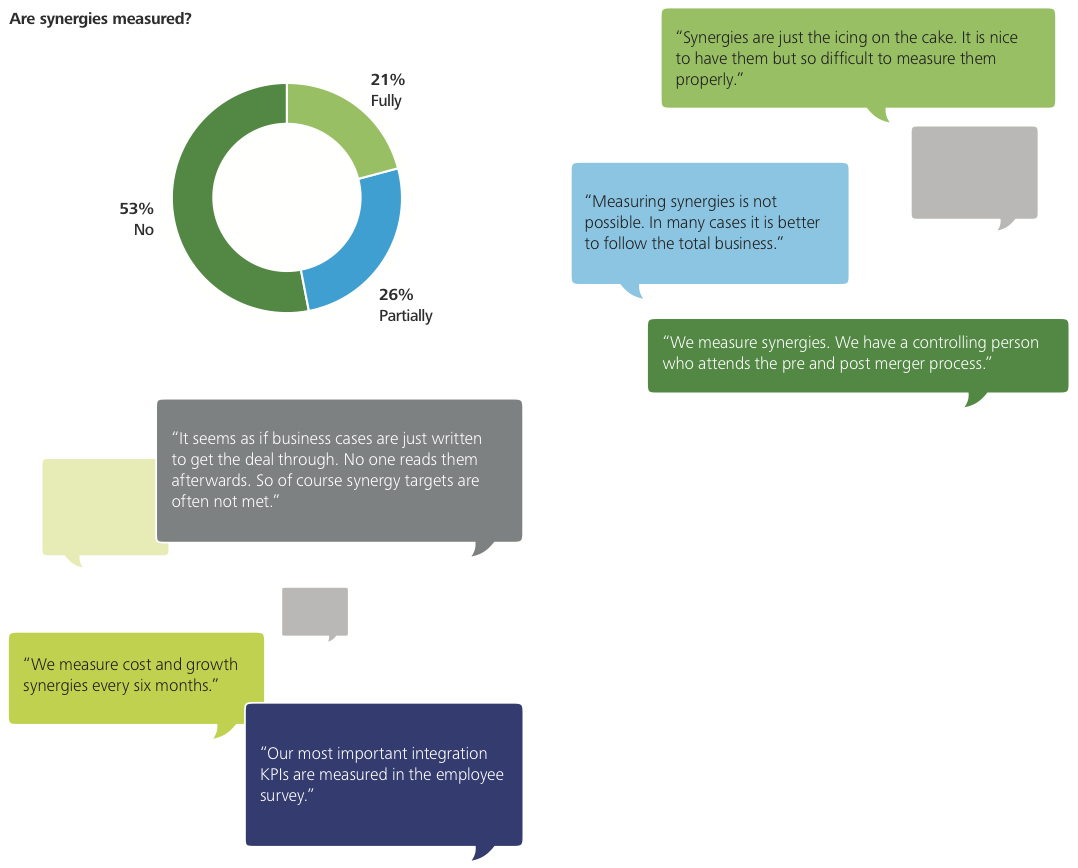

The Swiss serial acquirers we spoke to varied significantly with regard to their synergy measurement practices. Only a fifth of the interviewed serial acquirers measure synergies systematically. A further 26% partially track synergies, for example when a particularly large deal is done, by only tracking the combined business plan but not against the target’s original budget.

Whilst most serial acquirers acknowledge the relevance of defining performance criteria early in the process and tracking them consistently, many dimensions of a deal are not easily captured or too resource intensive to track appropriately on a regular basis. In particular, many companies consider revenue synergies too complex to measure systematically.

Overall, large and centralised companies more commonly measure synergies than smaller and decentralised companies, among the latter some do not attempt to measure synergies at all. Furthermore, synergy measurement is more prevalent in consolidated industries than in fragmented industries, which could be attributed to higher pressure on margins and industry maturity.

Many serial acquirers measure qualitative indicators, such as employee morale and customer retention, in addition to quantitative synergies.

Deloitte Point of View

Serial acquires that not only set clear synergy targets, but also link those synergy targets to operational integration plans are those that secure the deal value. When consequently and regularly tracked, the likelihood of securing the identified revenue and cost synergies is increased. Serial acquirers benefit from defining a synergy process and a tool set that can be used across all deals.

For serial acquirers, synergy benefits are frequently not the only priority and most likely not the only goal of an acquisition. Tracking qualitative benefits, such as employee morale and customer retention in addition to financial targets provides a more balanced view of integration success.

Key Finding 7: Learning potential yet to be unlocked

Knowledge management potential

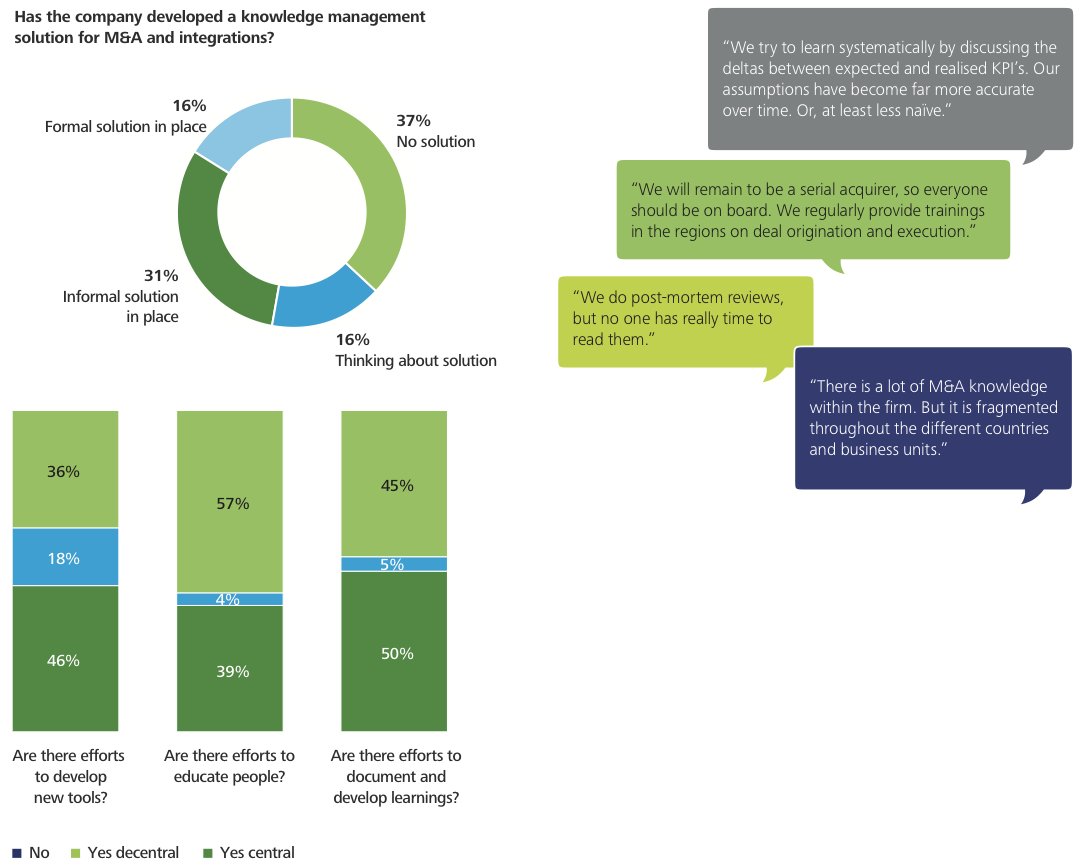

Few serial acquirers possess a systematic learning approach to fully unlock the potential in their acquisitions. Only 55% of the companies document and develop learnings, whilst only 43% train their staff in acquisition related processes. Some of these approaches include online learning spaces, regular training sessions with external speakers or roadshows to provide onsite training of tools and educate local regions on company wide M&A processes and standards.

Whilst the development and dissemination of documentation is considered important, many serial acquirers experienced that it is rather the knowledge embodied in people that is more valuable.

Hence, a certain consistency amongst key decision makers and teams is key. Some corporate functions, such as IT or Finance, assign integration experts to act as knowledge repositories, providing advice to the impacted businesses.

Although most companies conduct post-mortem reviews upon completion of an integration, few companies actually go back to the assumptions made in the business case and validate the original objectives and benefits. Many respondents admit that post-mortem reviews are often done mechanically, but offer little in the way of serious improvement attempts. In other cases, reviews are carried out by internal audit departments, which does not always provide the appropriate context for integration team members to openly discuss shortcomings and areas for improvement. Companies that do systematically engage in reflective post-deal reviews attest to improved accuracy in subsequent deal valuation and planning. More than one third of the companies are not aware of this learning potential.

Knowledge depletion among serial acquirers is known to transpire as much deal activity follows industry-specific waves of consolidation or periods of high market activity. During these times, companies invest in fortifying their M&A and integration processes, only later to reduce these efforts once deal activity slows down. Once focus shifts, key M&A and integration experts transfer to new positions and tacit knowledge is lost. Unfortunately, when deal activity increases again, many firms must re-initialise their acquisition processes from scratch. For long-term acquisition strategies, therefore, a long term horizon and steady investment in M&A capabilities appears useful.

Deloitte Point of View

Developing an approach for effective knowledge sharing is an easy quick win for serial acquirers. For example, serial acquirers who set up lessons learned sessions to capture knowledge and assign who-is-who accountable individuals within the organisation for especially tricky integration questions (i.e. regulatory matters, legal matters, works council matters) are leaders of the pack.

A series of simple training sessions to share existing knowledge is very valuable and many serial acquirers benefit from leveraging external firms insights on specific expert topics.

Post-mortem reviews are a useful tool if lessons learned are fed back into new deals and integrations.

Key take-aways

Stay up to date with M&A news!

Subscribe to our newsletter