Publications Post-Merger And Acquisition Integration In An Enterprise Solutions Environment

- Publications

Post-Merger And Acquisition Integration In An Enterprise Solutions Environment

SHARE:

By Eric M. Gauthier – Accenture

Mergers and acquisitions are never easy. All too often M&As fail to integrate quickly, fail at operations and fail to achieve stated synergies. The stark reality is that while CEOs are under intense scrutiny to create shareholder value at all times, effective M&A execution can be the difference between creating and destroying value.

But what if one of the companies involved in an M&A is in the midst of an enterprise solutions implementation, or has just completed one? Today either situation is often the case. In the 1990s companies spent hundreds of millions on enterprise solutions implementations. What happens to these implementations after a merger or acquisition is complete has significant strategic and financial implications.

The magnitude of executing a post-M&A integration in an enterprise solutions environment is often wildly underestimated. This is because enterprise solutions integration is often considered an IT integration project rather than an effort that will have an impact on company-wide operations and on the ability to execute strategic change.

Realizing enterprise solutions planning benefits post M&A

Different business drivers, priorities and expectations characterize an enterprise solutions implementation and an M&A integration. The desire to complete M&A transactions quickly with little or no business disruption is preeminent. Enterprise solutions initiatives, on the other hand, are traditionally regarded as slow, costly undertakings that, ironically, sometimes outlive the tenure of the CEOs who spearheaded them.

But what should a company do if it is trying to accomplish potentially conflicting goals of a speedy M&A and a complex, lengthy enterprise solutions program at the same time? What are the keys to successful post-M&A integration when enterprise solutions integration must also take place? Accenture has identified three critical components in this environment.

1. Manage expectations for enterprise solutions return on investment. Maintaining the level of business process integration that justified an enterprise solutions project in the first place may be critical to maintaining value after a merger or acquisition. Doing so will likely require additional investment, which will have an impact on the previously expected return on investment. Expectations for positive returns in any particular situation will depend on:

• the existing level of integration before the M&A;

• the level of integration required between the two merging companies, which often will depend on the nature of the M&A deal; and

• the enterprise solutions integration approach and model, such as moving to a new enterprise solutions architecture or keeping one of the existing enterprise solutions models. All in all, this means many companies must accept the need to invest more in enterprise solutions while deferring expectations for a positive return on investment.

2. Strategically time the enterprise solutions integration. Organizations, in general, are looking to leverage their core enterprise solutions by extending their enterprises’ customer relationship management, procurement, supply chain and portal capabilities. Advanced functional modules to meet these needs are now available. Less-monolithic, component-based, plug-in and web-enabled architectures are emerging as well, and they will keep evolving over the next several years. In addition, other enterprise solutions delivery options, such as the application service provider business model, may offer potential benefits.

• Merging companies will need to consider several key factors when planning and timing their post M&A enterprise solutions integration effort, including:

• whether to integrate current software or to wait for the next generation;

• choosing between a short-term tactical integration approach versus long-term strategic one; and

• evaluating the impact if more than one merger or acquisition is planned.

3. Choose the appropriate enterprise solutions architecture model and migration path. Key to Accenture’s approach is “smart speed.” M&As require speed and flexibility; the enterprise solutions component must respond to this need for speed. This requires a large, complex, multidivision, multiregion enterprise solutions integration, which may take years to complete.

Smart speed includes:

• Early planning, particularly in the formulation stages of the M&A transaction to force participating companies to understand the flow of information and business processes, which will need to be linked as well as confront integration issues up front.

• Involving the IT organization(s) up front, not as an afterthought.

• Dedicating post-M&A integration teams, not “spare-time job” resources.

• Minimizing the business-disruption window by identifying innovative deployment strategies.

• Creating a governance model, including executive sponsorship and a global decision-making process.

Future business benefits will depend on the recommended enterprise solutions architecture and its ability to enable the company business strategy and business synergies expected from the merger or acquisition. In developing an approach, understanding the business drivers, such as acquiring new products or services or opening new geographical markets or gaining a new customer base, is key to ensuring that the integration effort is aligned with strategic intent.

Once the business drivers and corresponding value proposition have been identified, three major steps must take place.

1. Define the enterprise solutions system strategy, with options ranging from distributed independent systems to a single, fully centralized system.

2. Define the post-M&A enterprise solutions migration strategy, with the following four major options: Retain one model, retain both models, choose the “best of breed” components from each model or move to a new model.

3. Define the deployment strategy, including ensuring a productive first 100 days, keeping future M&As in mind.

In most cases, it will be appropriate and necessary to define both a short-term tactical approach, which will focus on mandatory requirements such as financial integration, and a long-term strategic approach from which the future enterprise solutions architecture will be built.

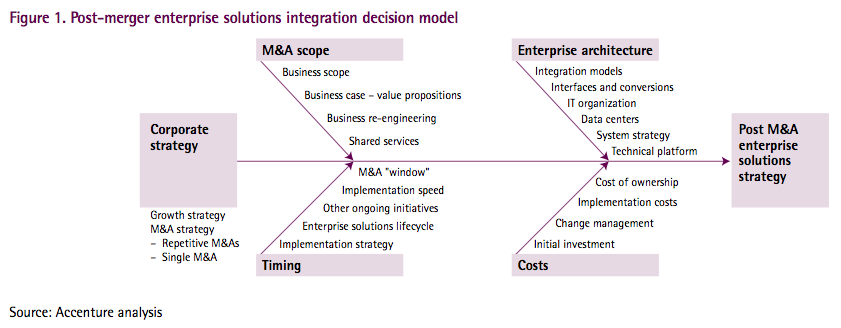

The nature of the M&A deal and the integration objectives of the two companies will, for the most part, drive the post-M&A enterprise solutions integrated thinking. Accenture has developed an integration decision model that includes more than 20 criteria (see Figure 1) to consider when going through such an evaluation.

Although a minor integration effort may be limited to a simple data migration project, a complex, global enterprise solutions integration can be similar to an initial implementation. Such a daunting project can intimidate even the most seasoned executive. The guidelines covered in this article may not only help executives prevent the collision of competing demands, but also help the new company reap the benefits of enterprise solutions planning.

Stay up to date with M&A news!

Subscribe to our newsletter