Publications Mergers & Acquisitions Quarterly Switzerland – Third Quarter 2013

- Publications

Mergers & Acquisitions Quarterly Switzerland – Third Quarter 2013

- Christopher Kummer

SHARE:

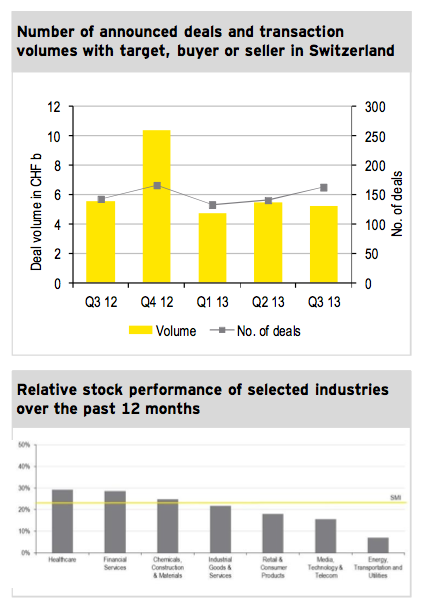

It was a mixed picture in the Swiss M&A market in the third quarter of 2013, with a significant increase in the number of announced deals compared to the previous quarters on the one hand, but lower deal volume compared to the previous quarter on the other.

Looking ahead, M&A activity is expected to respond positively to the confirmation of continued expansionary monetary policies by Swiss National Bank and US Fed, as well as improving economic fundamentals in Switzerland and the Eurozone. Despite encouraging signs, some corporate leaders may still be cautious in light of ongoing challenges, e.g. the current US fiscal cliff and, hence, be hesitant to undertake business expansions.

Swiss M&A market Q3 2013 and outlook 2013/2014

M&A market Q3 2013

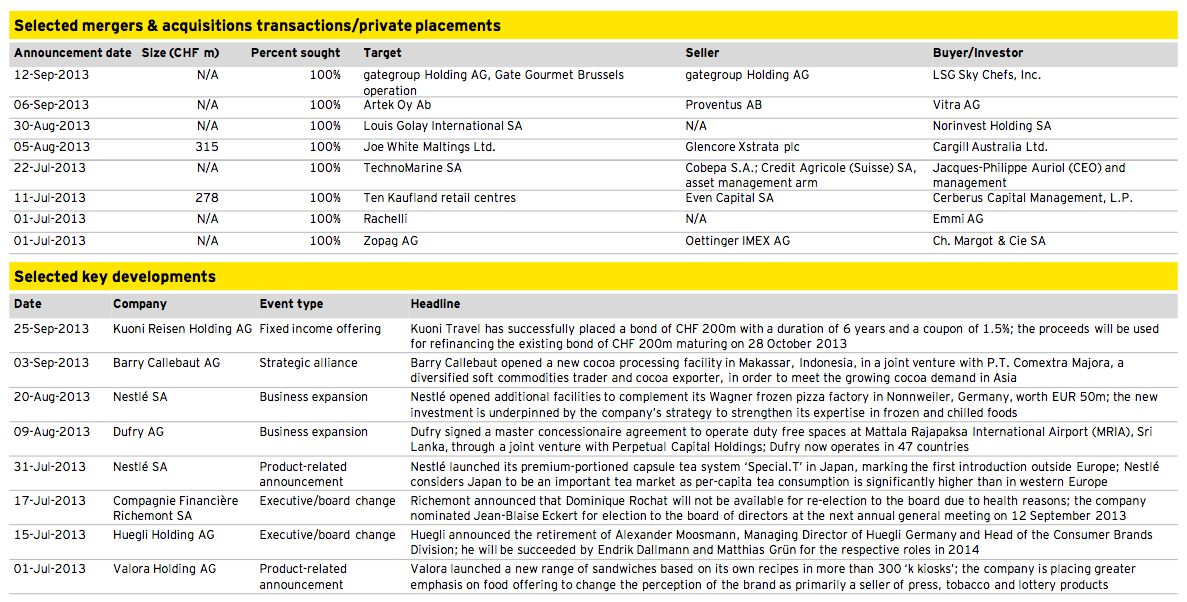

► With disclosed deal volume of CHF 5.2b in Q3 2013, the Swiss M&A market continued to perform on a low level, confirming the trend of the previous quarters in 2013. In comparison to Q2 2013 and Q3 2012, total deal volume decreased by 4% and 6%, respectively.

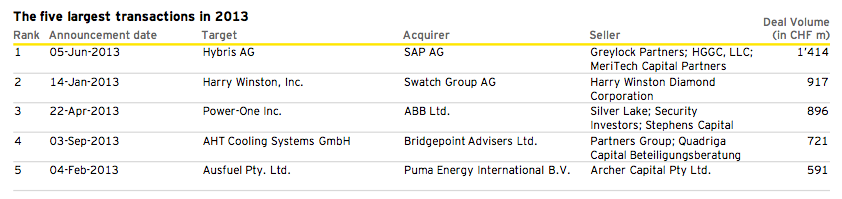

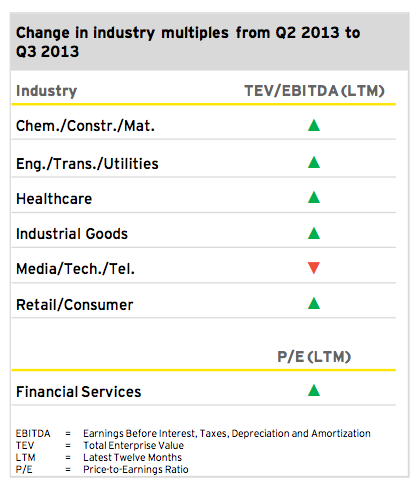

► Low market volume is explained by the limited number of large deals in the third quarter, with just seven transactions valued above CHF 250m. The largest deal of the quarter was the exit of AHT Cooling Systems by Partners Group and Quadriga Capital to Bridgepoint Advisers, valued at CHF 721m.

► In contrast, the number of Swiss M&A transactions gained momentum, with 162 deals announced in Q3 2013. This reflects an increase of 22 transactions compared to the previous quarter, and an increase of 20 deals compared to the same quarter of the previous year.

► After a slight decrease in Q2 2013, the Swiss Market Index (SMI) picked up its pace again and rose by approximately 4% in the third quarter of 2013.

► The SMI development was underpinned by unexpectedly strong economic data for Europe on one hand and by political issues, such as the threat of an US military attack on Syria, on the other.

► Over the last twelve months ended 30 September 2013, the SMI increased by about 23%, which is five percentage points lower than in the previous quarter.

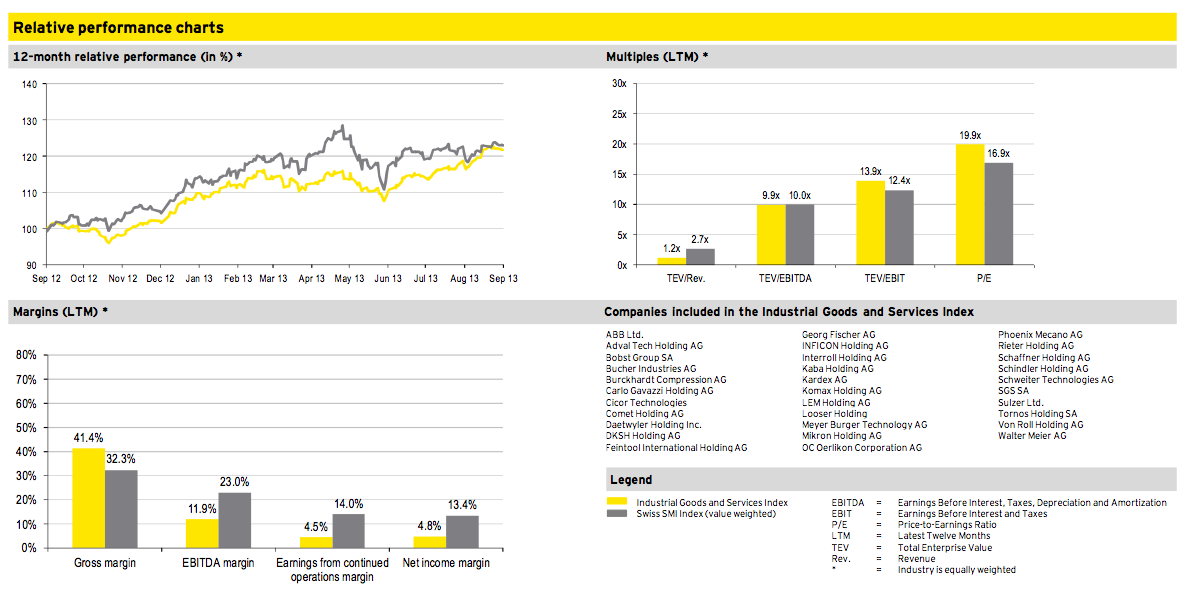

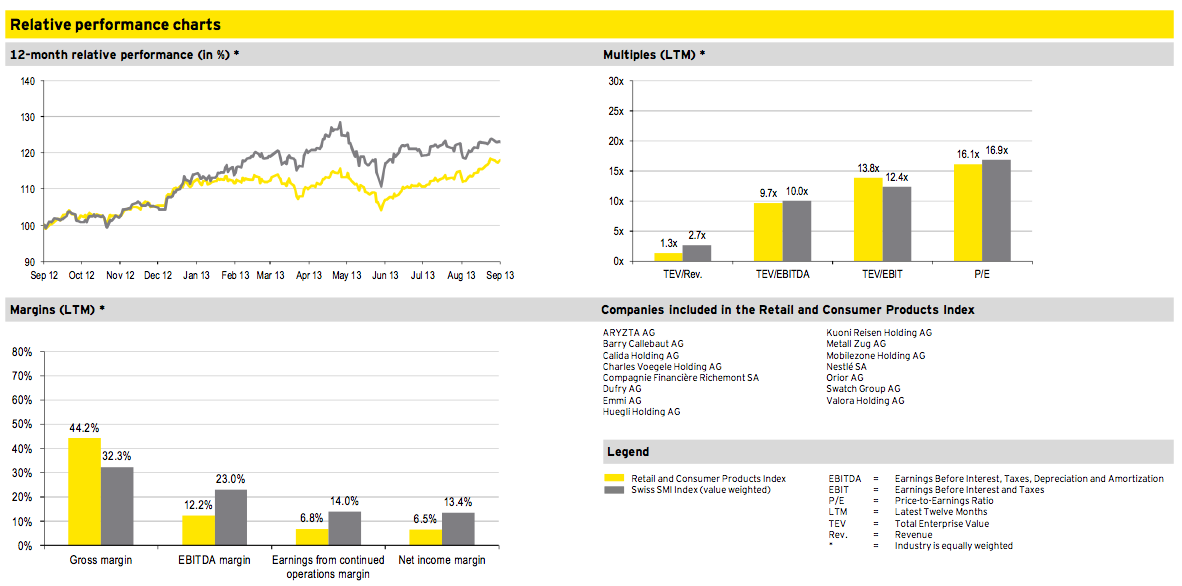

► As in Q2 2013, all equally-weighted industry indices trended upward over the last twelve-month period.

Transactions by industry

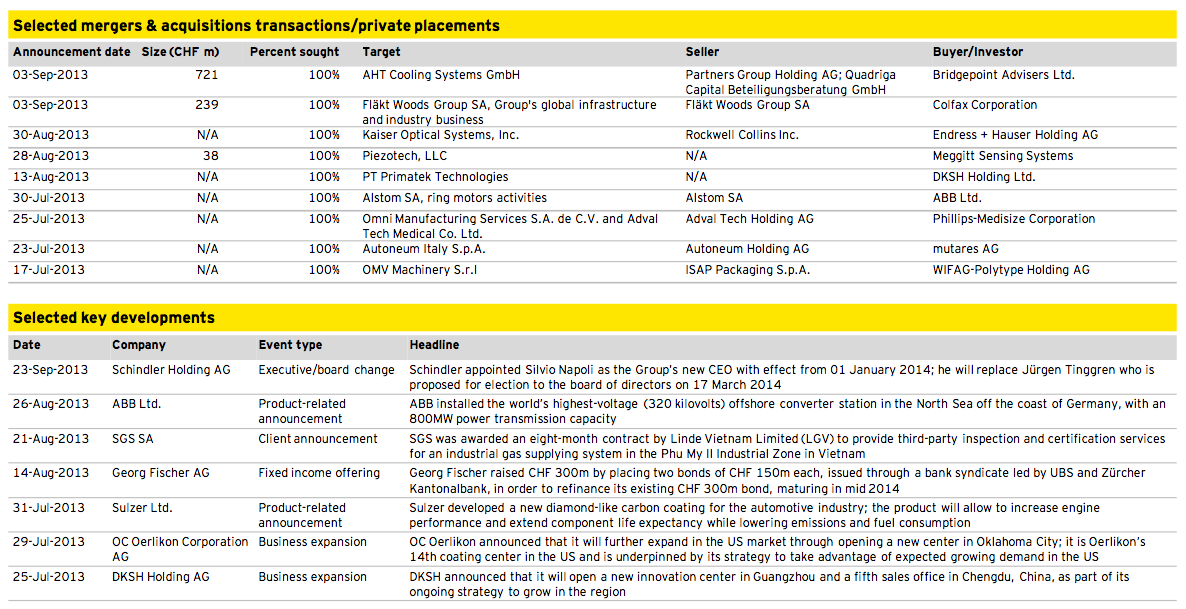

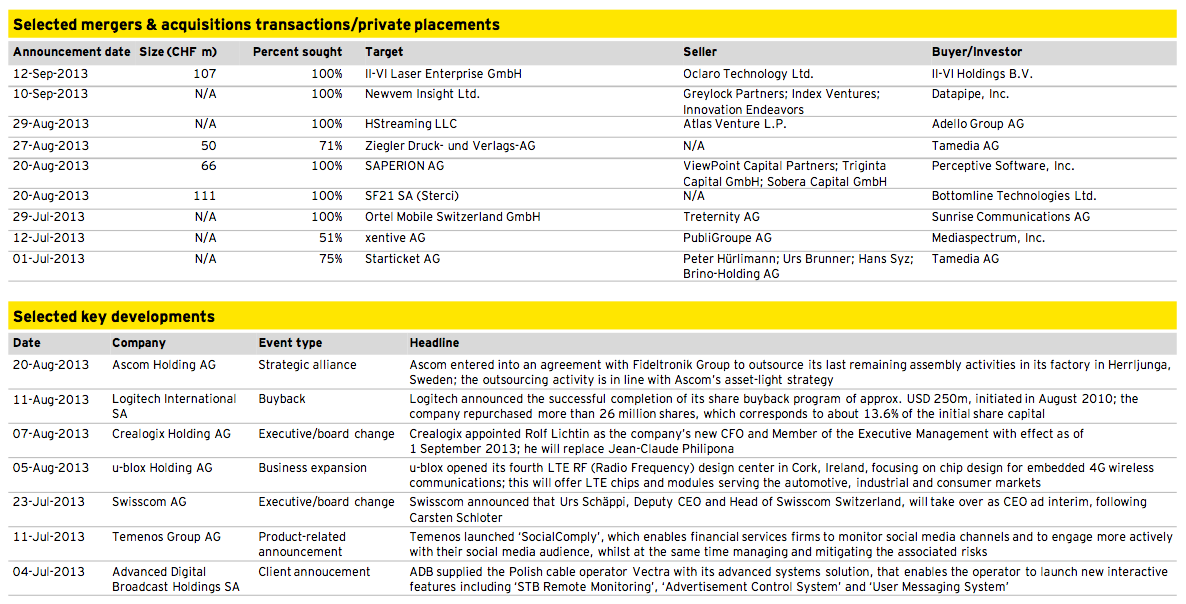

► With 21% of all announced deals stemming from Media, Technology and Telecommunications, this sector accounted for the largest share of deal activity in the third quarter of 2013, followed by the Industrial Goods and Services sector, contributing 16%.

► The largest disclosed deal within Media, Technology and Telecommunications was Bottomline Technologies’ acquisition of SF21 SA (Sterci) for approximately CHF 111m.

► The divestment of AHT Cooling by Partners Group and Quadriga Capital represented the largest transaction within the Industrial Goods and Services sector.

► Compared to the previous quarter, Swiss M&A activity in Q3 2013 was more diversified across different industries, resulting in smaller shares of the aforementioned top sectors.

► The Industrial Goods and Services sector recorded the largest loss, falling nine percentage points in Q3 2013, whereas the biggest gain with a plus of seven percentage points was recorded in Other Industries.

Transactions by size

► The third quarter of 2013 was characterized by a significant increase in mid-market transactions and a concurrent drop in small transactions, when compared to Q2 2013.

► Although the shift from small to mid-market deals contributed to higher total market volume, this positive development was outweighed by the limited volume of large deals. Thus, total market volume in Q3 2013 declined.

► In Q3 2013, deal size was disclosed in approximately one quarter of all announced transactions, similar to figures from previous quarters.

Outlook 2013/2014

► The Swiss State Secretariat for Economic Affairs (SECO) increased its annual GDP growth forecast for 2013 by 0.4 percentage points to 1.8% in September 2013, compared to its forecast in June 2013; the upwards adjustment was mainly attributable to persisting strong domestic demand.

► SECO’s annual GDP growth outlook for 2014 was adjusted to 2.3% in September 2013 (previously 2.1%); the positive outlook is especially underpinned by an anticipated recovery of the Eurozone economy, which experienced the first positive quarterly GDP growth in Q2 2013, after six consecutive negative quarters.

► Announcements by the US Fed as well as the Swiss National Bank in September 2013 to continue their expansionary monetary policies might spur Swiss M&A activity in the mid-term. However, uncertainty around the impact of persisting with expansionary monetary policy and increasing interest rates, together with ongoing challenges in regards to the US fiscal cliff, might dampen M&A activity.

► Business owners that had been holding back disposals due to weak economic conditions and low valuations are expected to gear up for transactions as market confidence increases.

► Even though signs of an economic recovery in the Eurozone are getting stronger, some corporate leaders may still be cautious in light of recent and in some cases ongoing downsizing, which could make them reluctant to undertake business expansions.

► All in all, the outlook on Swiss M&A activity is cautiously optimistic, based on improving economic fundamentals and increased market confidence in recent months, but also taking into account high market volatility and selected macroeconomic risk factors in the European Union, especially with regard to southern European countries.

Private equity statistics: Germany, Switzerland and Austria

Private equity Q3 2013

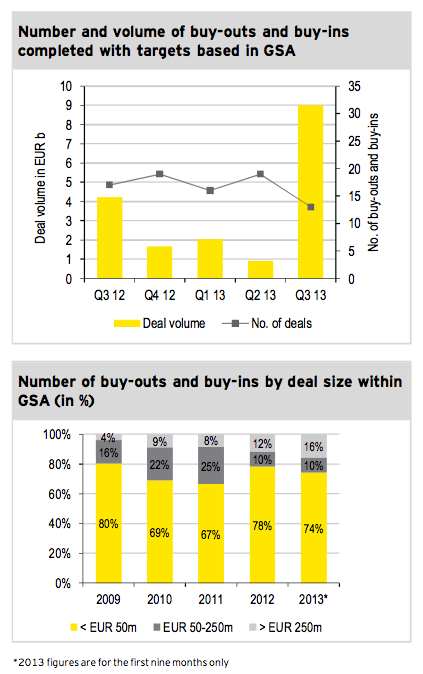

► In the third quarter of 2013, a total of 13 private equity deals have been recorded in Germany, Switzerland and Austria (GSA). This represents a decrease of six deals compared to Q2 2013 and four deals compared to the same quarter of the previous year.

► Total disclosed PE deal volume amounted to EUR 9.0b for GSA, which is almost ten times the volume seen in the previous quarter and reflects an increase of 113% in comparison to Q3 2012.

► The significant increase in terms of disclosed deal volume was mainly attributable to three German buy-outs: the largest deal in GSA was the divestment of Springer Science+Business Media, which was sold by EQT Partners AB and GIC Special Investments Pte Ltd. to BC Partners Ltd. for about EUR 3.3b. The second largest transaction was CVC Capital Partners Ltd.’s acquisition of ista International GmbH, which was purchased from Charterhouse Capital Partners LLP for EUR 3.1b. The third largest deal was Cinven Ltd.’s acquisition of CeramTec GmbH, which was bought from Rockwood Specialties Group Inc. for EUR 1.5b.

► The completion of several large deals resulted in a significant increase in the share of large transactions, with 16% of all PE deals in GSA being valued above EUR 250m in the first nine months of 2013. This represents the highest share of large deals within the last five years.

► In terms of number, buy-outs and buy-ins in GSA in Q3 2013 accounted for approximately 10% of all completed transactions in Europe, reflecting a decrease of six percentage points compared to Q2 2013.

► By contrast, PE deals from GSA contributed about 45% to the total disclosed European deal volume compared to 11% in the previous quarter. This is mainly attributable to the increase in large transactions as described above.

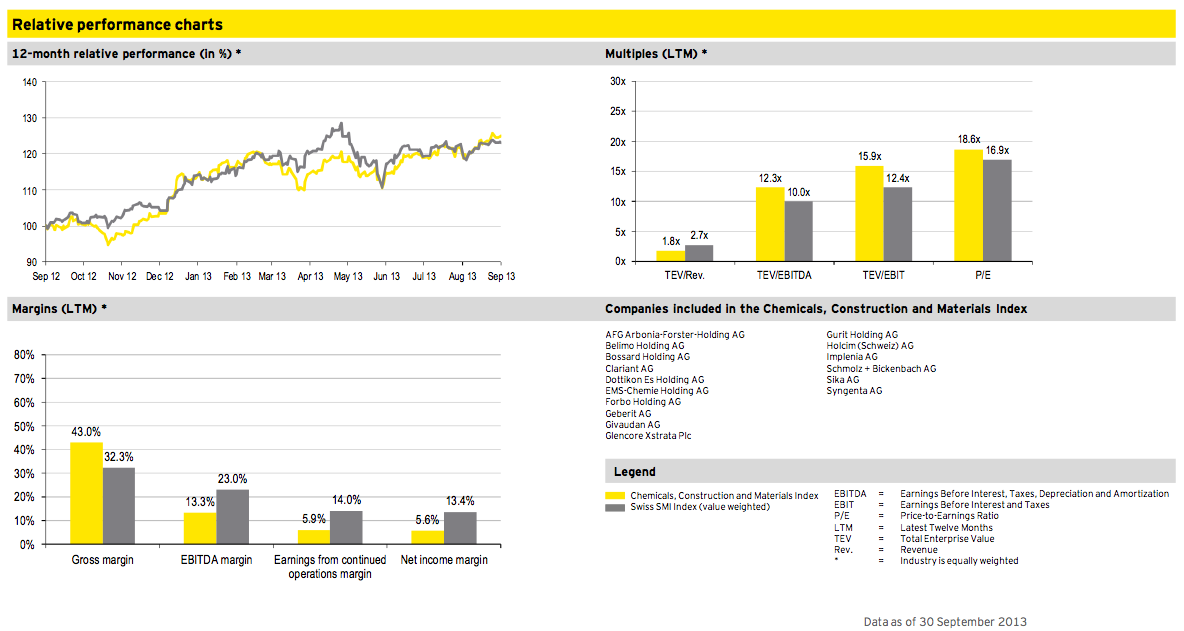

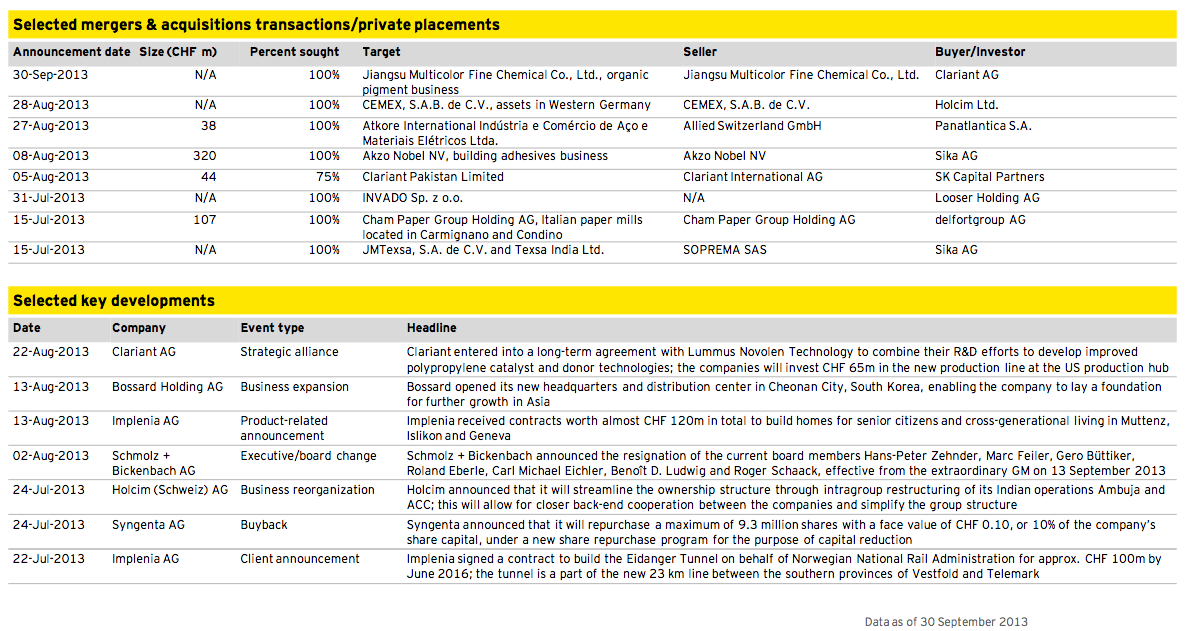

Chemicals, Construction and Materials

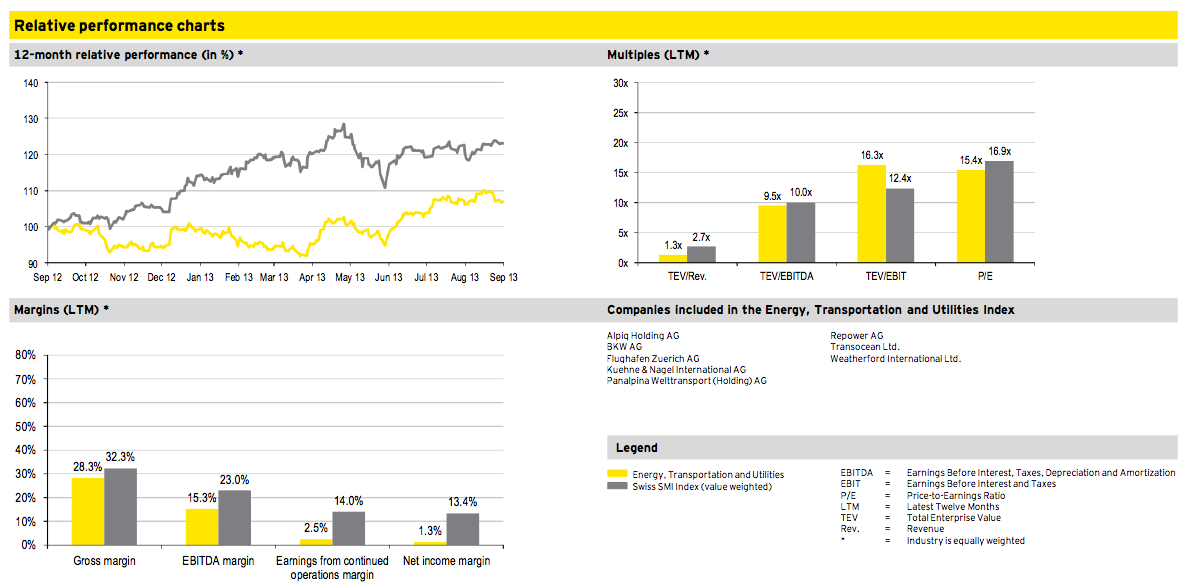

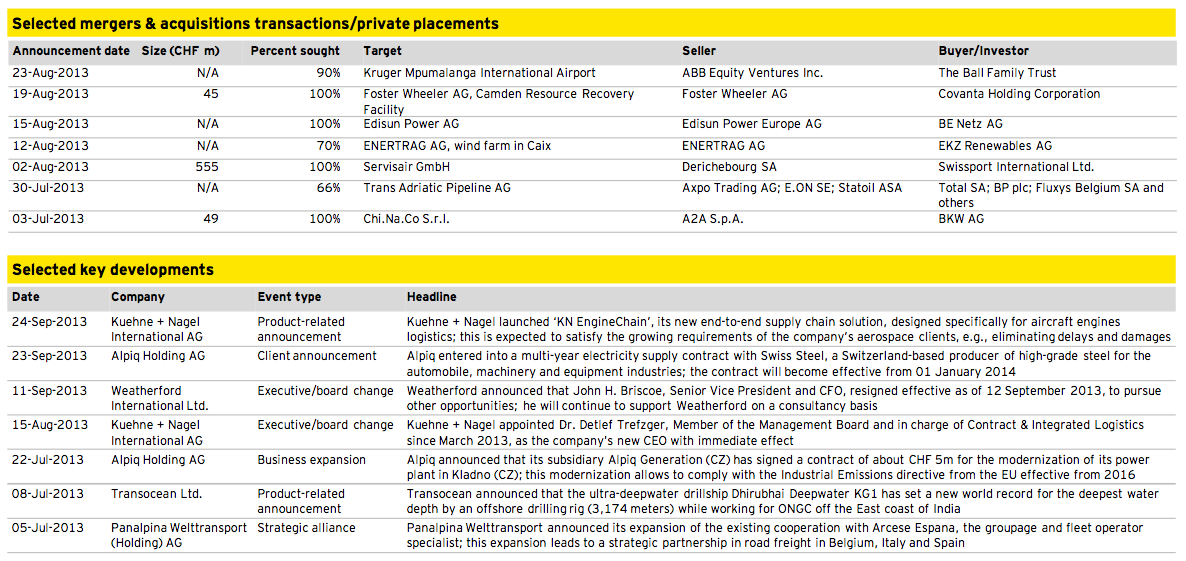

Energy, Transportation and Utilities

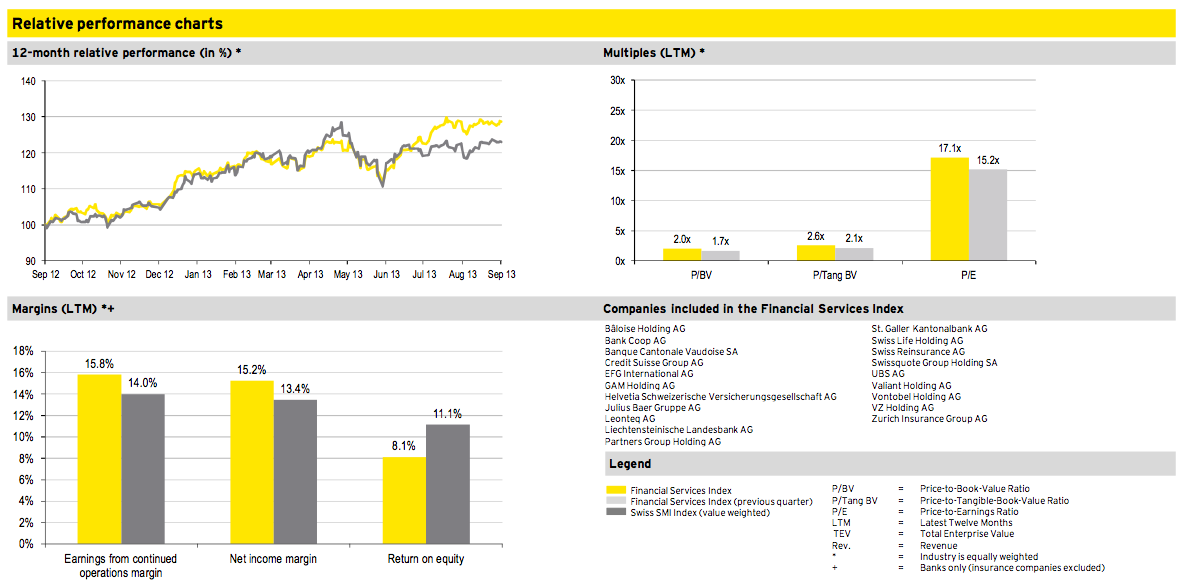

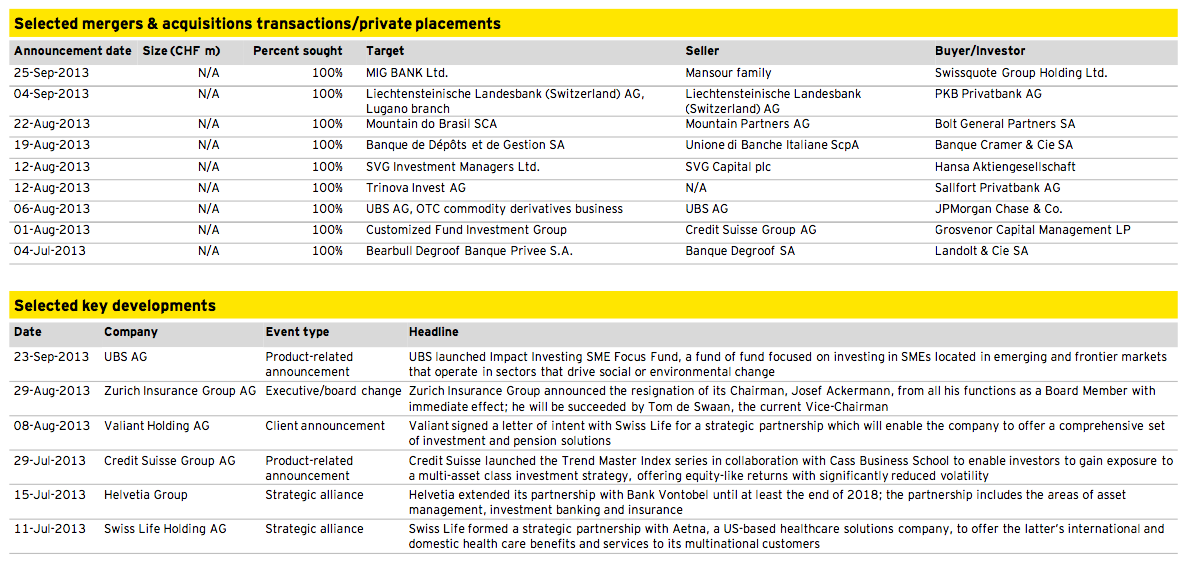

Financial Services

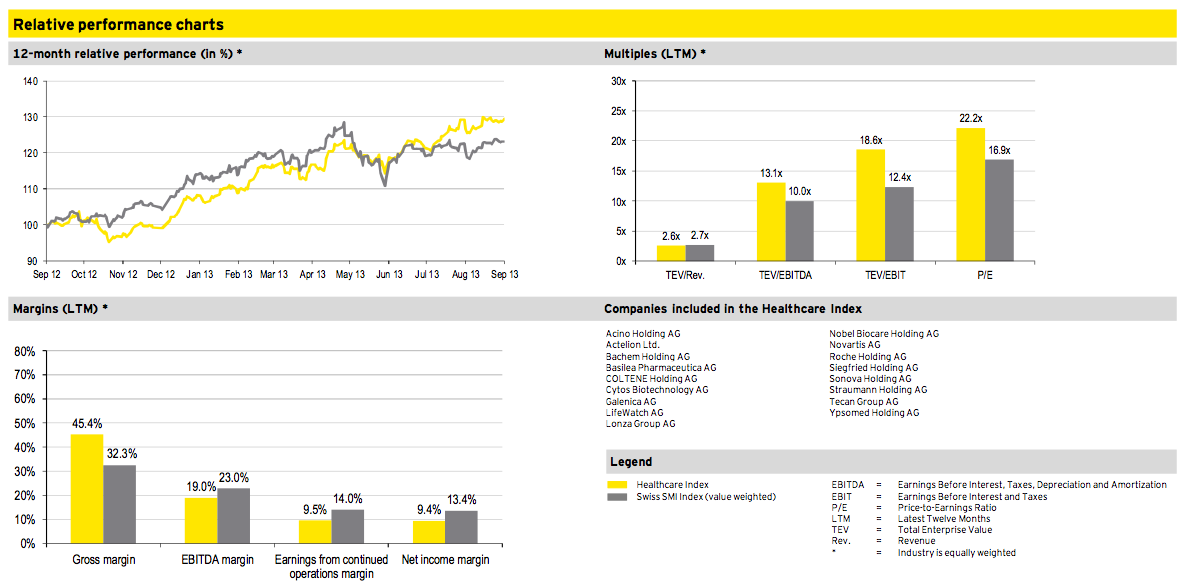

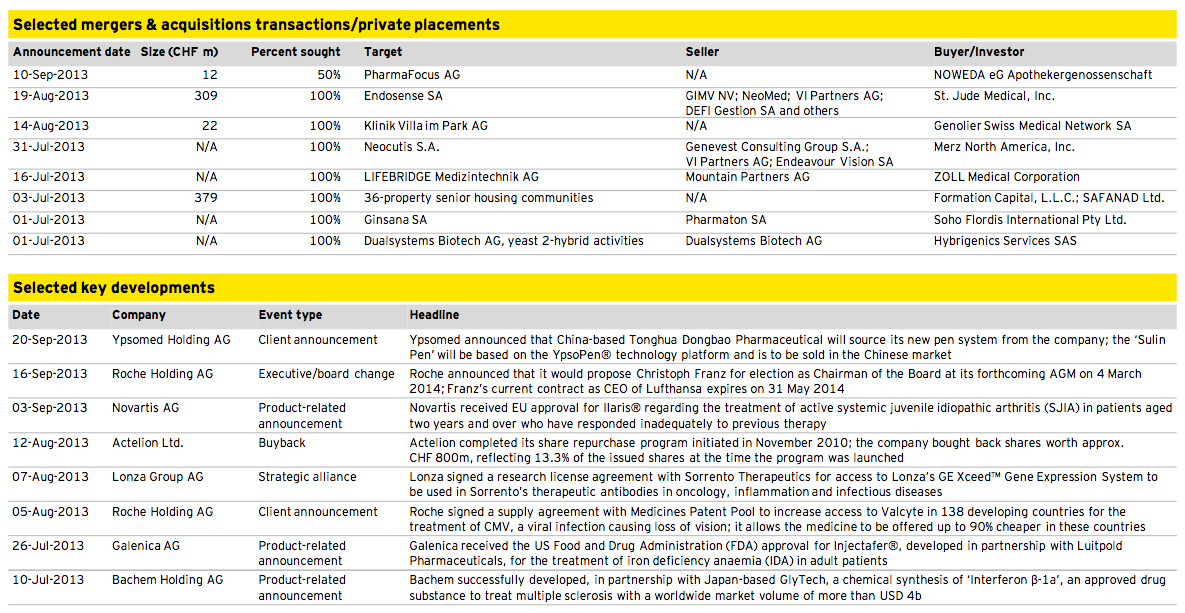

Healthcare

Industrial Goods and Services

Media, Technology and Telecommunications

Retail and Consumer Products

Deal of the quarter

Transaction overview

Deal summary

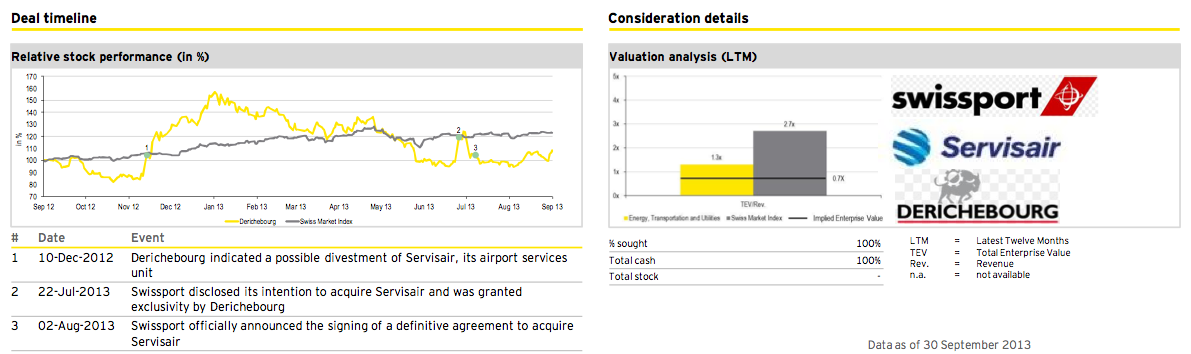

For our deal of the quarter in Q3 2013, we outline the takeover of Servisair SAS by Swissport Group. To finance this acquisition from Derichebourg, Swissport has issued a USD 390m senior secured add-on note. The deal is expected to be closed in the fourth quarter of 2013, subject to regulatory approval. In recent months, Swissport completed several transactions including the acquisition of Costa Rican Interairport Services in April 2013 as well as the acquisition of Flightcare Spain and Belgium from FCC Versia SA in September 2012.

Servisair is a French provider of aviation ground services, operating at 118 stations in 20 countries. Servisair employs approx. 15,000 people and offers services including ground handling, cargo, fueling, load control and airport services.

Deal rationale

► Swissport intends to take advantage of Servisair’s complementary service offering as well as its diversified client portfolio.

► In addition, the two companies expect to leverage cost synergies through efficiency gains at overlapping airports.

► Derichebourg indicated that it was seeking to dispose of Servisair in order to lower its debt. The company announced that the transaction will reduce its debt by EUR 330m, reflecting half of Derichebourg’s net debt position.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter