Publications AI M&A Software Deals – Analysis of Numbers and Values

- Publications

AI M&A Software Deals – Analysis of Numbers and Values

Discover the transformative journey that mergers and acquisitions activity is bringing to the artificial intelligence software industry.

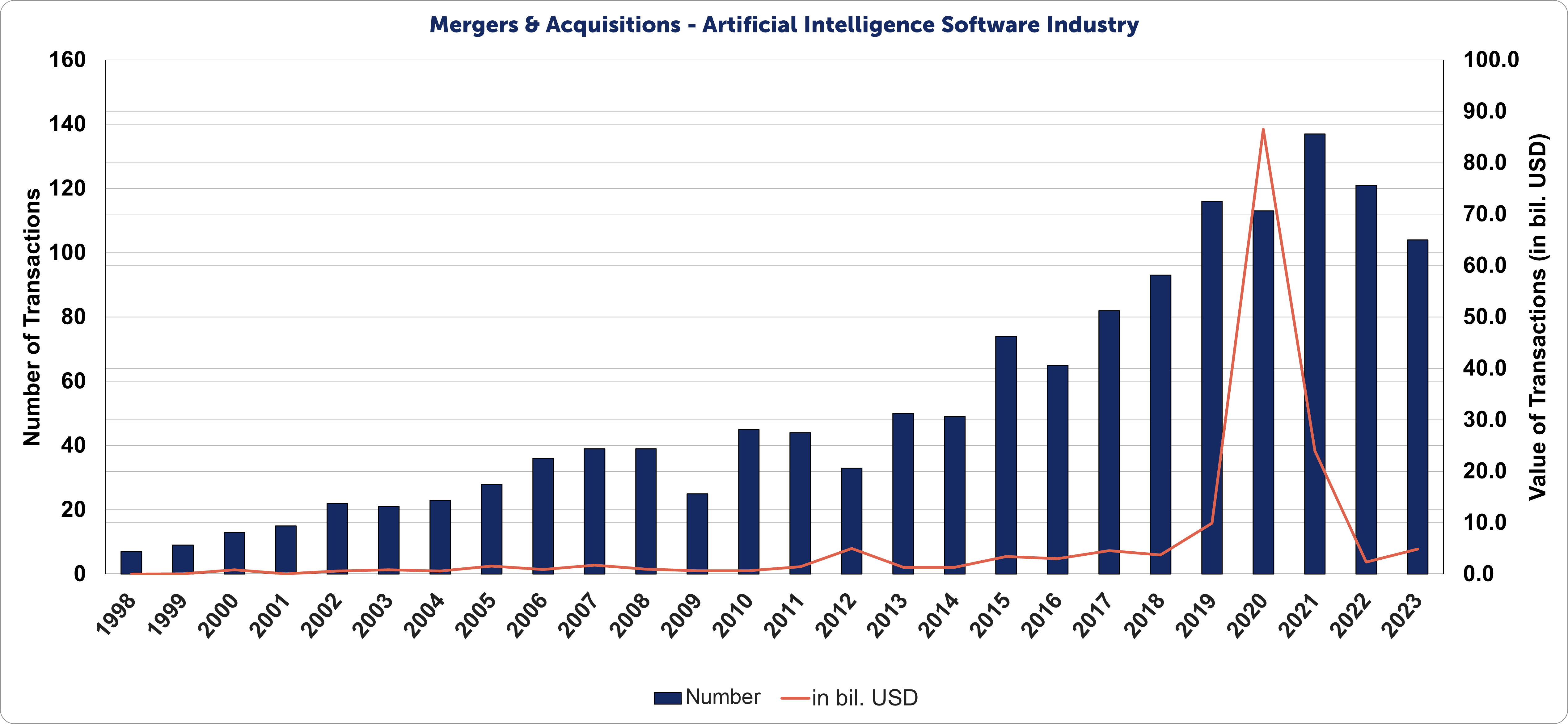

From 1985 to 2023, the artificial intelligence (AI) software industry has been instrumental in driving technological advancement, completing 1,404 transactions with a total value of 160 billion USD. This underscores the industry’s critical role in fueling economic and technological progress globally.

The Institute for Mergers, Acquisitions, and Alliances (IMAA) provides a comprehensive dataset detailing M&A activities within the AI software sector. This dataset not only tracks the number and value of transactions but also delves into key financial metrics like Enterprise Value to EBITDA and Enterprise Value to Revenue. Such detailed analysis sheds light on the sector’s growth trajectory over nearly four decades.

The historical M&A data in the Artificial Intelligence (AI) Software industry benefits analysts, business leaders, investors, entrepreneurs, and policymakers. It provides deep insights into market trends, facilitating strategic decisions on market timing. This information helps in crafting informed investment and operational strategies, crucial for navigating market dynamics.

As we navigate through this extensive data, we unveil the trends and patterns that have defined the industry’s growth and transformation during this period.

At a Glance: M&A Activity in the Artificial Intelligence Software Industry from 2021 – 2023

2021 M&A Activity

Overall Transactions | Overall Value |

137 Deals | USD 24 Billion |

In 2021, the artificial intelligence software industry recorded a total of 137 merger and acquisition transactions, with an overall value of USD 24 billion.

This substantial activity not only reflects the strong market confidence in AI as a pivotal driver of future growth but also marks the industry’s critical contribution to the ongoing digital transformation across various sectors.

2022 M&A Activity

Overall Transactions | Overall Value |

121 Deals | USD 2.3 Billion |

In 2022, the artificial intelligence software industry experienced a shift in its M&A activity, with the year recording 121 transactions totaling USD 2.3 billion. This marked an 11% decline in the volume of deals and a significant 90% decrease in the value of deals, highlighting a downturn in M&A activity compared to the performance observed in 2021.

2023 M&A Activity

Overall Transactions | Overall Value |

104 Deals | USD 4.9 Billion |

As opposed to 2022, the M&A activity in the artificial intelligence software industry in 2023 had a further decrease of 14% in the number of deals, with 104 deals in total, but saw a significant increase of roughly 108% in value, totaling USD 4.9 billion.

Download the IMAA Dataset on M&A Activity in the Artificial Intelligence Software Industry

IMAA’s dataset on M&A activity in the AI software industry offers practical insights for understanding the sector’s evolution. Entrepreneurs can use this information for refining product development and market strategies, while policymakers might leverage it to craft more effective technology advancement policies. This data, detailing past trends and financial evaluations, supports informed strategic decisions, contributing to the sector’s sustainable growth and guiding innovation in a more measured and realistic manner.

Artificial Intelligence Software Industry M&A Activity Dataset

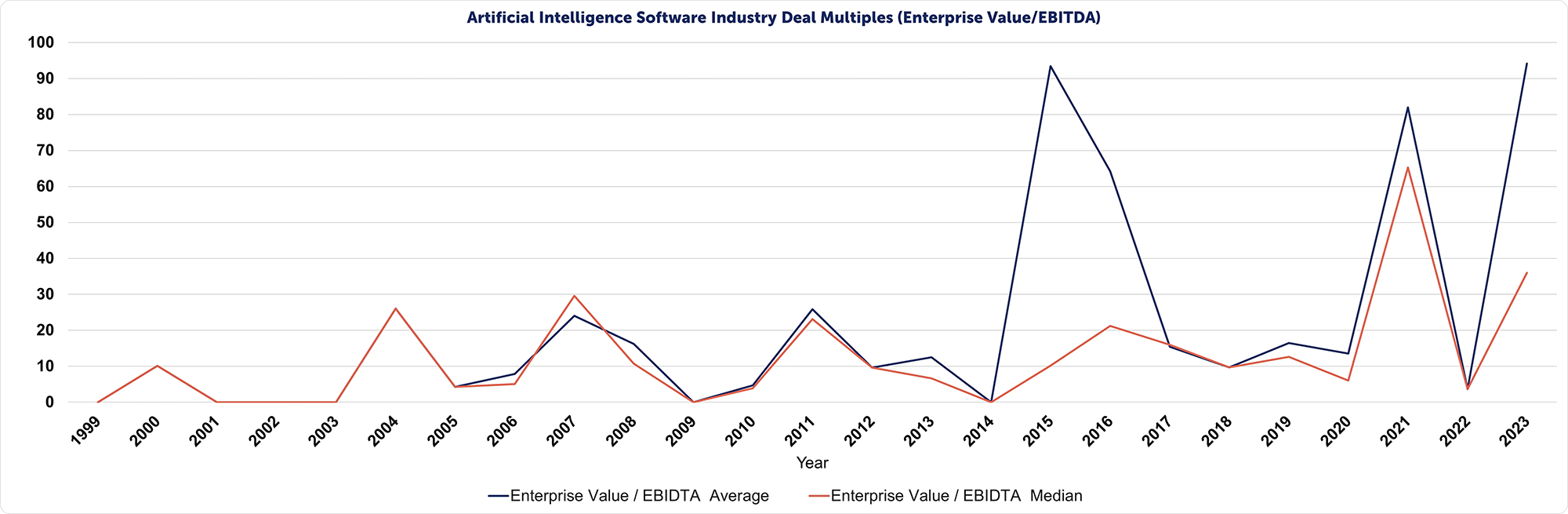

Deal Multiples (Enterprise Value/ EBITDA)

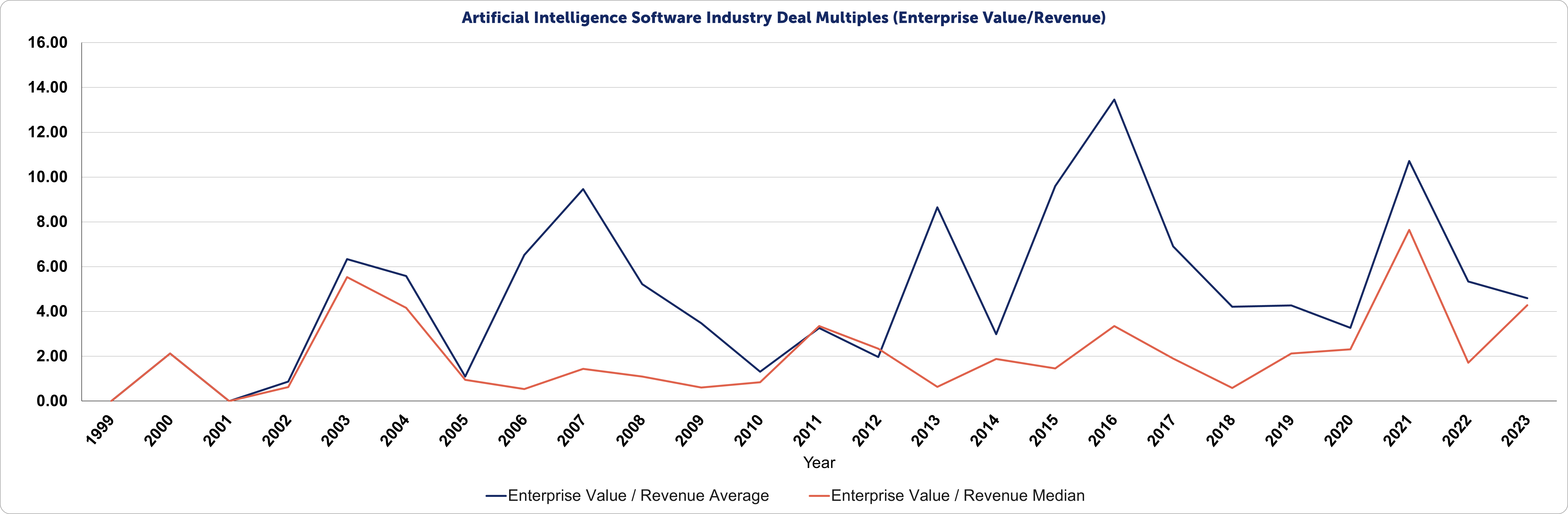

Deal Multiples (Enterprise Value/ Revenue)

For more datasets on M&A activities, visit our M&A Activity for the Sports Services Industry page.

Stay up to date with M&A news!

Subscribe to our newsletter