Publications 2024 M&A Mid-Year Outlook

- Publications

2024 M&A Mid-Year Outlook

- IMAA

SHARE:

Table of Contents

Global M&A Industry Trends

The M&A show must go on. Save the date.

After high hopes in January of an upswing in dealmaking activity, a thick fog of uncertainty descended on M&A markets, clouding M&A prospects and causing a precipitous decline in deals during the first half of 2024. What caused this fog, and, more importantly for dealmakers, how quickly could it lift? Breaking through the clouds, we have identified some macro factors, including a few surprising market anomalies that we believe hold the key to unlocking dealmakers’ confidence and charting a return to a healthier level of M&A activity.

If there is one certainty in all this uncertainty, it is that M&A activity will bounce back—although likely faster in some sectors than others. The M&A show must go on, even if the timing is uncertain. This is in large part because the need to do deals is greater than ever. As we noted in our 2024 M&A Outlook, each month that goes by with a restricted flow of deals creates more pressure on the strategic and economic fundamentals that underpin transactions. The lower levels of M&A activity over the past two and a half years have created pent-up demand (and supply), particularly in the private equity (PE) universe. In addition, corporates are turning to M&A to accelerate growth and reinvent their businesses at a time of dynamic change: AI is disrupting business models, and it seems as though everyone is investing in it. CEOs’ desire to accelerate their companies’ growth in a low-growth economy is also creating opportunities for M&A. And within sectors, specific factors are favouring a buy-versus-build approach in many situations.

None of the above imperatives will go away anytime soon. Thus, it is not a matter of if M&A will rise again. It is a matter of when. Behind the scenes, we are seeing an uptick in activity among sellers, with sale preparations mounting, full-potential business plans being developed and many vendor due diligence engagements already underway. While somewhat anecdotal—and too early to show in the reported deals data—this activity bodes well for buyers, too, as more quality assets are expected to come to market in the next six months.

“The daunting combination of high interest rates, current valuations and political uncertainty has been a showstopper for many deals. Nevertheless, the strategic need for M&A continues to grow stronger, creating pent-up demand which will be unleashed as these uncertainties resolve.”

–Brian Levy, Global Deals Industries Leader, Partner, PwC US

The deals imperative

PE portfolios are ripe for sale. At the beginning of the year, according to PitchBook, PE firms held more than 27,000 portfolio companies globally, about half of which had been on the books for at least four years—typically the length of time at which they are primed for exits. Fast-forward to mid-2024, and the majority of those investments have aged another six months. Many PE firms in the process of raising new funds are being questioned by investors about the limited realisation of returns, increasing the pressure to sell. PE funds that fail to make distributions from existing fund investments may find it more challenging to raise new capital.

AI could be a catalyst for all sorts of transaction types. AI—particularly generative AI—has the ability to disrupt companies, from corporate behemoths to startups, as well as sectors and even entire industries. Although generative AI is still in the early stages, its impact on business and society is already starting to be significant. AI has the capability to create massive cost efficiencies, enable new revenue streams, open new channels to customers, and enhance the value proposition on the one hand and commoditise it on the other. The AI wave is coming, and we believe the powerful forces at play will require companies to reevaluate their strategies, business models, markets and competitors. The transactions created by all this movement may range from traditional M&A to partnerships, alliances and other innovative relationships we have not previously seen.

Inorganic growth is required to overcome anaemic organic growth. Macroeconomic factors and monetary policy actions in many countries have created an environment of low economic growth in which organic revenue growth will be much harder to achieve. Consequently, companies may need to turn to M&A as part of their inorganic growth strategies to fire up their top lines.

Sector-specific factors require an M&A approach

Numerous sector-specific factors which benefit from an inorganic strategy point to a likely increase in M&A activity. We highlight some of these below:

- pharmaceutical companies acquiring biotech companies to fill pipeline gaps left by upcoming patent cliffs.

- automotive companies acquiring connected, automated, shared and electric assets or investing in mining companies to secure access to critical minerals for battery production as they continue their journey towards electrification.

- technology companies investing in AI, cyber and cloud capabilities in response to digitalisation and technological disruption.

- energy companies consolidating in the upstream subsector to drive greater efficiencies through scale and to gain access to new oil and gas reserves.

So just how is the M&A market performing?

In January, with interest rates apparently at their peak and widely expected to decline, dealmakers were primed for an uptick in activity that would finally put an end to one of the worst M&A bear markets in a decade. Instead, central banks kept rates higher for longer than anticipated, and while some promising megadeals were announced in the first few weeks of the year, the momentum fizzled. At the half-year mark, deal volumes were down 30% compared to the first half of 2023, and many dealmakers have been left wondering how much worse things can get. However, deal values have held their own, growing 5% in the first half of 2024 mainly because of megadeal activity in the technology and energy sectors.

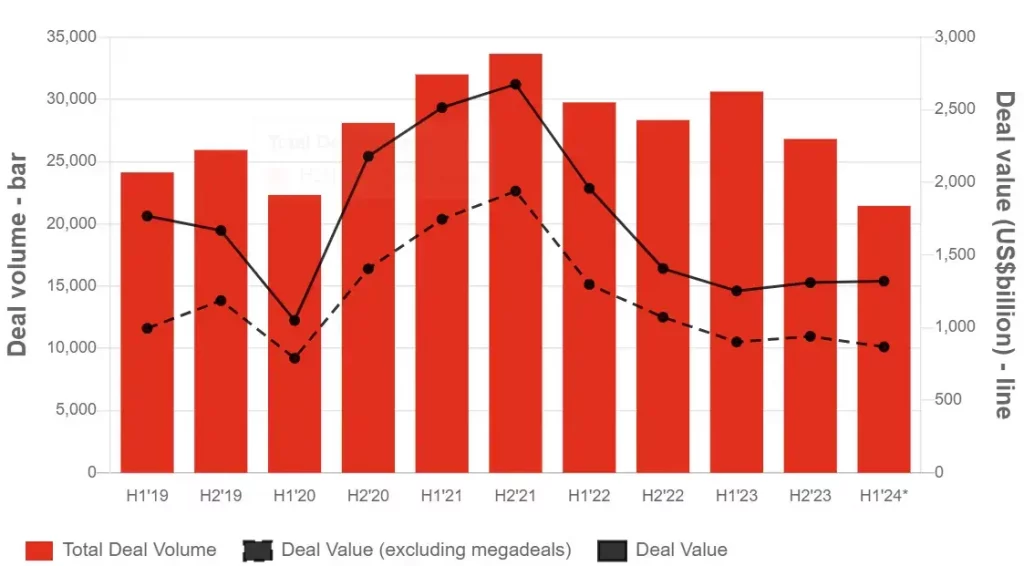

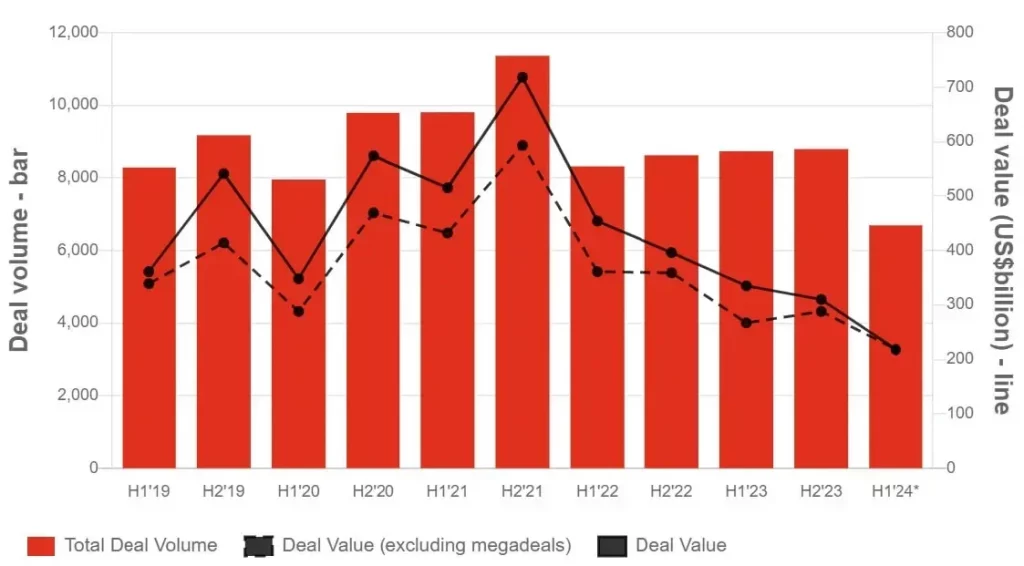

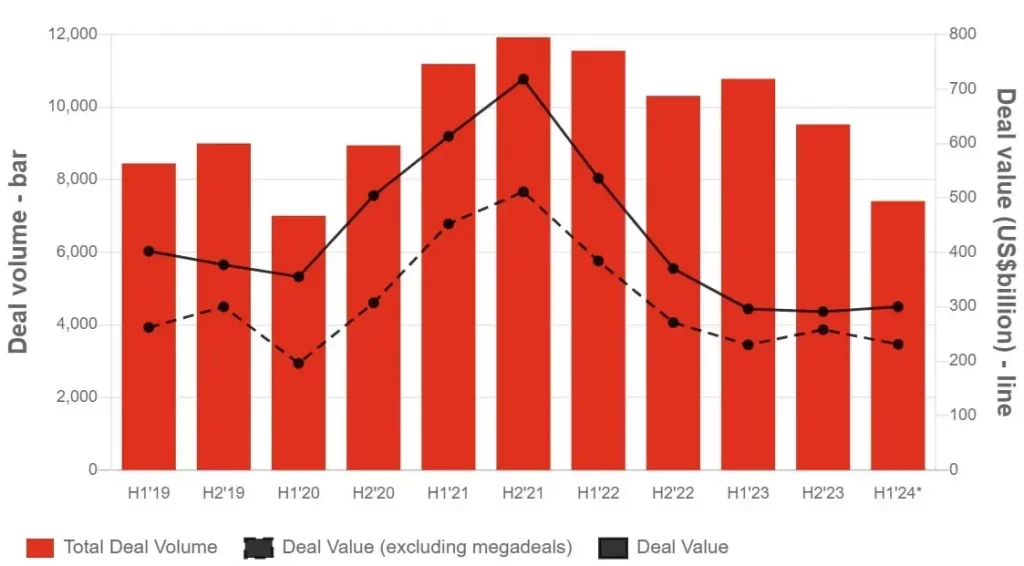

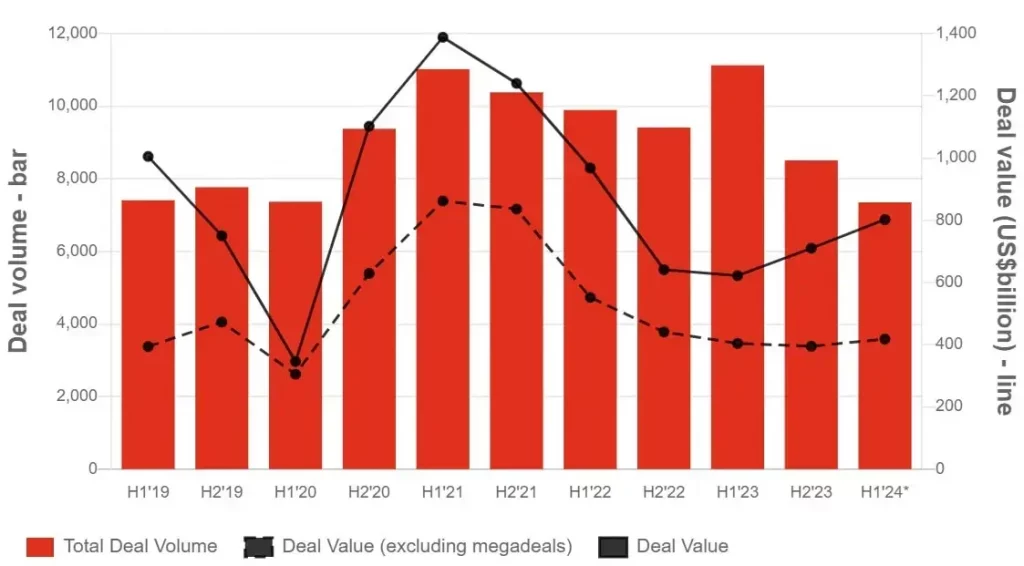

Deal volumes and values, 2019-H1'24*

Click the tabs to view the chart and commentary for each region.

Note: To facilitate meaningful comparisons with prior half-yearly periods, the data for the first half of 2024 (H1’24*) covers the first five months of the year, extrapolated to represent a six-month period. Refer to the “about the data” note below for further information.

Sources: LSEG and PwC analysis

Global: In the first half of 2024, while the value of M&A deals rose by 5% compared to the first half of 2023, overall transaction volume fell by 30%, continuing a downward trend that started in 2022. In the first half of 2024, deal volumes were just over 21,000 and deal values reached $1.3tn. This is a far cry from the record levels of activity in the second half of 2021, which saw almost 34,000 deals and deal values of $2.7tn.

Also noteworthy is the greater impact this downturn is having on PE firms than on corporates. M&A activity involving a financial sponsor was down 39% in the first half of 2024. For corporates, the decrease was 23%. While that is still significant, it means that the corporate share of the M&A pie has increased from 60% in the previous two years to 64%. This can be attributed in part to a competitive advantage from corporates’ lower dependence on debt.

PE has fared better from a deal value perspective, primarily because of some larger deals in the first half of the year. While the top corporate deals this year easily surpassed the largest PE ones, the deals PE firms have been involved in suggest that the industry’s appetite to do larger deals is coming back. Some of the larger PE buyout deals announced so far this year include the $12.6bn acquisition by an investor group led by private equity firms Stone Point Capital and Clayton, Dubilier & Rice of the remaining stake in Truist Insurance Holdings; BlackRock’s $12.5bn proposed acquisition of Global Infrastructure Partners; and Permira’s $6.9bn proposed acquisition of Squarespace, Inc.

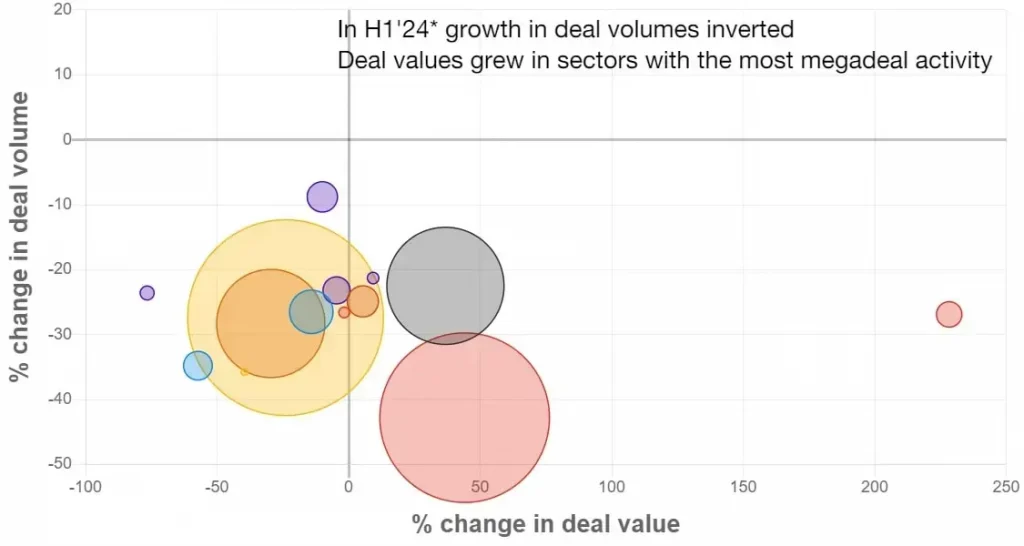

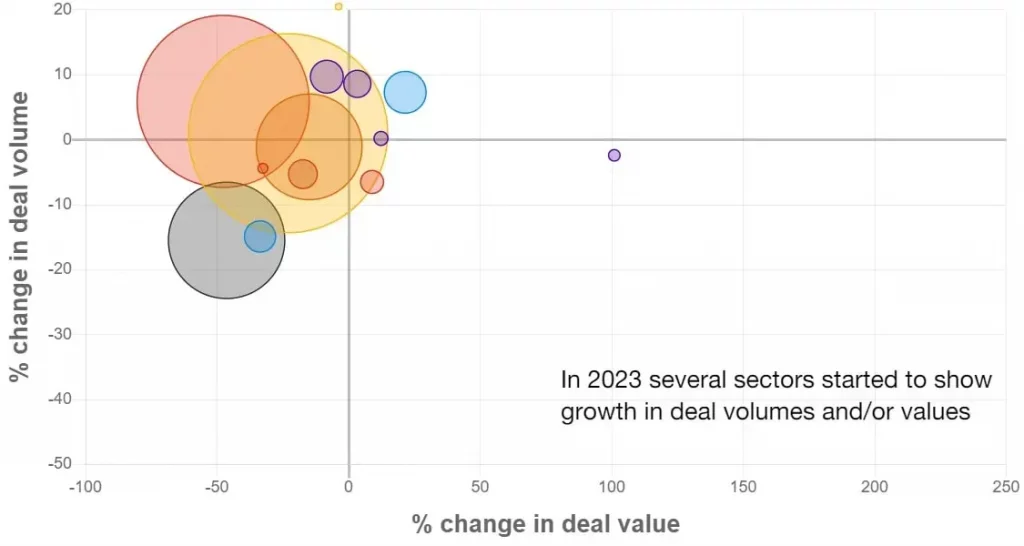

Sector M&A trends invert

Typically, there are some sector bright spots in any M&A downturn. But the current market hasn’t spared any sector from the decline in deals activity. Even sectors most affected by global megatrends—such as technology and energy—went underwater as M&A deal volume trends inverted across all sectors. Deal values fared slightly better, increasing in four sectors—technology, financial services, oil and gas and hospitality and leisure—largely because of recent large deal activity, including Capital One’s proposed $35.3bn merger with Discover Financial Services, Synopsys’s proposed $32.5bn acquisition of software company Ansys and Diamondback’s proposed $25.8bn acquisition of upstream oil and gas company Endeavor Energy Resources.

Change in global deal volumes and values by sector, 2022-H1'24*

Select the bubbles on the chart to view the information for each sector

Note: H1’24* is extrapolated based on the five months through May. The percentage change is calculated as the change in deal volume or deal value between periods. The size of the bubble represents the relative size of the sector based on deal volumes. Refer to “about the data” for more details.

Sources: LSEG and PwC analysis

An M&A recovery: obstacles to clear

Several factors have contributed to the slower M&A market over the past two years, and looking at prior periods of uncertainty can often provide clues as to how things may play out. But this time, some striking anomalies appear to have turned historical convention on its head. Understanding the various forces at play may help dealmakers better assess risks, scenario plan and develop strategies, giving them more confidence to act when the time is right.

- Interest rates: Will higher-for-longer rates mean lower-for-longer M&A? In the bond market, US Treasury bond yields have been inverted for almost two years, meaning that short-term bonds yield more than longer ones. Historically, an inverted yield curve was considered a predictor of a pending recession, but a recession hasn’t happened yet. Larger economies such as the United States are managing to stay on track, partly because of continued government stimulus and a robust labour market. Recent interest rate cuts announced by Switzerland, Sweden, Canada and the European Central Bank may signal that further rate cuts are coming. These long-awaited interest rate cuts will be welcomed by dealmakers seeking to fund acquisitions via debt. Today’s higher interest rates squeeze returns, putting a greater emphasis on a potential deal’s value creation story.

- Valuations: Sustained current levels mean higher hurdles for returns. The gap between buyers and sellers remains significant in many sectors, in part because assets that have transacted over the last year have tended to be the stronger ones which have traded at good multiples. This has given some owners artificial hope as to the multiples they can expect to get on ordinary assets. PE owners, in particular, have some trepidation that other portfolio assets—if transacted—may reveal values below limited partners’ expectations. The still-buoyant stock market is also a factor—with valuations that are pumped up, in part by the promise of generative AI, despite the slower-than-anticipated action on interest rates. It’s as if financial markets have priced in central bank rate cuts well before they happen. Uncertainty can be good for M&A activity if depressed markets allow dealmakers the opportunity to take risks. But in this case, the combination of uncertainty and high valuations is a showstopper.

- Elections: Political uncertainty is postponing major corporate decisions, but voting will be over by year-end. This year has already seen a burst of electoral activity, with further elections in the United Kingdom, United States and other countries due to take place in the second half of the year. That’s also when the outcomes of June elections in France, India and the European Parliament will be digested. Dealmakers and markets tend to be wary of elections because of the uncertainty they create about policy direction. And central banks tend to be wary of making moves on interest rates if the timing could be construed (rightly or wrongly) as politically motivated. In the United States, that means the Federal Reserve could wait until the end of the year or early 2025 before finally delivering the rate cuts that the market has long hoped for.

- Geopolitics: Global tensions have grown and are contributing to the fog. No easy or quick resolutions to the war in Ukraine or the conflict in the Middle East seem likely. Indeed, the risk of escalation can’t be ignored. The United States–China relationship also continues to weigh on markets, not least in a US election year. All of this contributes to the uncertain geopolitical climate.

- A resolution of each uncertainty—individually or collectively—could spur a major shift in the market. A weakening economy, especially if it tips into recession, could prompt rate cuts, but it may make growth challenging, a separate uncertainty for dealmakers to grapple with. The recent European Central Bank rate cuts, along with those of some other countries, may provide a glimmer of hope that momentum around interest rates is already shifting. A financial market correction could close valuation gaps—although so far this year, stock markets have continued on a bull run, and many are at record highs. We expect that by the end of the year, economic data will determine the direction of rates and, barring surprises, election results should be largely confirmed. The sooner current challenges resolve, without new challenges arising to replace them, the more favourable market conditions will be for M&A.

M&A market signals to guide dealmakers forward

While the factors listed above contribute to M&A market hesitation, we are also seeing significant markers that can help guide dealmakers out of the fog. We list the main ones here.

Exit pressure grows

The huge pressure on PE by investors to return capital, noted above, is a major marker. While IPO markets have been practically shut over the past two years, we have seen a timid return of IPOs in some sectors, notably tech. If that upward trajectory continues, the larger portfolio companies may find the IPO path to be a viable exit strategy once again. However, in the near term, we expect many companies will plan for optionality, with a dual-track approach to exits. While optimism for an IPO recovery remains and the backlog of companies waiting to go public has grown, the window for IPOs in 2024 is narrow because of the upcoming elections. Moreover, investors remain cautious in the wake of recent disappointing post-IPO performance. This has set the bar higher for a successful IPO, which may continue to benefit the M&A exit route.

Debt and financing for M&A

Financing for M&A is more readily available now than it was over the past two years. The investment-grade debt market, high-yield bond market and leveraged loan market all showed stronger issuance activity in the first half of 2024 than in the first half of 2023. The United States and European high-yield bond markets and leveraged loan markets are on track to almost double 2023 amounts: debt issuance in the US and European high-yield bond markets reached $201bn in the first half of 2024 compared to $223bn for the whole of 2023, and US and European leveraged loan market issuances totalled $359bn compared to $379bn for the same period.

The onward march of private capital

In the first quarter of 2024, private capital accounted for an estimated 24.1% share of deals, up from 20.6% in 2022, according to data from Preqin. Private capital’s assets under management globally grew at about 8 percent annually over the past five years to about $13.3tn in total in 2023. The largest firms have achieved double-digit growth over the past five years, despite considerable market turbulence from the COVID-19 pandemic and rising interest rates. And some of these behemoths are creating private capital platforms that enable alternative investment managers to become more active. Sovereign wealth funds and family offices are also sources of fresh funds for private capital investing. Together with the return of syndicated bank lending, this means that capital to finance deals is plentiful—although it comes at a cost.

Investment in the energy transition

The energy transition is expected to create significant M&A opportunities as investors place bets on the role it will play in helping society achieve net-zero goals. Companies will need to take an innovative approach to reconfiguring their business models to achieve this major transformation, and M&A will play an important role. Moreover, investment will need to come from multiple sources, including both the public and private sectors, to fund the huge medium-term cost. Government actions such as policy changes to enhance investment or involvement in specific projects will create large government-backed pools of capital—provided rising government debt and higher interest rates don’t crimp such investment—and the potential for returns will attract investors into these areas. In any case, the sheer scale of investment required makes private capital a key part of the solution, and new funds are already emerging with a specific focus on investing in the energy transition. This is expected to lead to M&A and other deals, including joint ventures and partnerships, to enable companies to shore up supply chains and secure access to their energy needs through transforming—or even reinventing—themselves.

Corporates transform operating and business models

To accelerate their transformation journeys, corporates are evaluating their portfolios to identify gaps—in capabilities, talent and technology—and non-core assets to divest. Synopsys’s proposed acquisition of Ansys, is an example of the desire to combine each firm’s capabilities—Synopsys’s semiconductor electronic design automation solutions and Ansys’s simulation and analysis capabilities—to accelerate strategy and growth in attractive adjacent areas. The Home Depot’s acquisition of SRS Distribution, a residential specialty trade distribution company, is intended to accelerate its growth with pro customers and increase the total addressable pro market. Unilever’s recently announced decision to separate its ice cream business from its other brands and Sanofi’s proposed separation of its consumer healthcare business are two recent examples of portfolio reviews leading to large carve outs, a trend we expect to continue with other large corporates.

Restructuring and distressed M&A

Higher interest rates and difficult market conditions have put additional stress on many companies, leading to an increase in restructuring activity. Automotive, retail and certain real estate asset classes are seeing higher levels of distress, so we expect to see a further uptick in distressed M&A in the second half of 2024 in these sectors. Distressed M&A will offer new opportunities for acquisitive companies looking to fill gaps in competencies and geographies.

Megadeals are back

Thirty-three megadeals were announced during the first five months of 2024, a 22% increase from the same period a year ago. One country—the United States—and two sectors—technology and energy—saw most of the activity, often for specific reasons. In energy, for example, the worldwide transition to renewable energy sources is accelerating consolidation in the oil and gas sector. In the technology sector, the promise of AI and technological advances are keeping the sector active. If megadeals start to spread beyond these two sectors, that will indicate a broader market upturn is starting to take place.

Corporates versus PE

Suddenly, it’s the corporates, not PE, that seem to have the upper hand. The agility that cash-rich corporates have today is a clear competitive advantage versus a PE model requiring significant and expensive leverage. Corporates’ share of deal activity has increased. But they need to act fast if they are to capitalise further on the opportunity. Corporate dealmakers who adopt a wait-and-see approach may find themselves watching from the sidelines, as PE will innovate and use creative structures to close part of the gap. It’s only a matter of time before the PE engine gears up again.

Key actions for dealmakers: Preparing to break through the clouds

Given the uncertain timing of an M&A rebound, and the underlying challenges to completing transactions today, it is more important than ever for dealmakers to have a strategic roadmap for inorganic growth. Being prepared is the dominant message. But what does that mean in practice?

For buyers, that means the following:

- ensuring M&A strategy is aligned with corporate strategy, including transformation and business model reinvention

- evaluating how AI will impact business models—for the acquiror and the target

- conducting deeper data analysis and due diligence to increase confidence in the business case

- putting a plan in place to identify and retain key talent

- refining an approach to sustainability to both preserve and create value

- developing a compelling equity story with a robust value creation plan

- getting early buy-in from investment committees and boards

For sellers, that means the following:

- conducting regular strategic reviews to ensure the company’s portfolio is optimised—including considering the disposal of non-performing or non-core parts of the business

- performing in-depth pre-sale preparation, including comprehensive business due diligence and scenario planning

- ensuring credible links between offering documents and supporting data, including historical and projected financial information

Both buyers and sellers will need to be open to alternative structures, including partnerships, alliances, rolling part of a seller’s equity interest, earnouts and other forms of capital structuring.

“Strong preparation and restoring confidence will be key for the resurgence of M&A activity. We are already seeing signs that deal preparation is gearing up, and once confidence follows, we expect the market—and dealmakers—will move quickly.”

–Lucy Stapleton, Incoming Global Deals Leader, Partner, PwC UK

Finally, momentum can be a self-fulfilling prophecy. Even in the current climate of uncertainty, with interest rates still high and valuations above expectations, the resolution of one or more of the uncertainties discussed here could be enough to provide the much-needed boost to the market and restore dealmakers’ confidence. In any case, for the PE industry, deals are their lifeblood, and we are confident PE firms will navigate the challenges in due course. For corporates, the strategic need for M&A with the technological pace of change and disruption is an imperative.

After all, the M&A show must go on.

Originally published at PwC

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter