HR Mergers & Acquisitions Expert

HRM&A

The HRM&A program is designed to meet the needs of Human Resource professionals involved in M&A transactions in both corporate and consulting roles. The HRM&A program covers all aspects of the transaction process relevant for HR including strategy, due diligence, Post Merger Integration (Best of PMI), and compensation and benefits. Gain knowledge in best practices for the M&A process and better understand the HR function and its significance during pre-deal or the post-merger integration phase. The HRM&A designation prepares HR practitioners in preparing for the challenges and practical realities of M&A transactions.

ONSITE

30

approx hours

US $5490

US $

4,890

Early Bird

-

BOOK NOW

- Internationally recognized designations

- Copies of certifications, presentations & materials

- 1-year IMAA charter-holding membership

- 1-year access to the entire IMAA eLibrary

- Global network of charterholders and experts

- Leading faculty from academia and the industry

What to Expect From HR M&A Certification

The HR specialization is geared towards individuals who are looking to further develop their understanding of the HR function and its significance during pre-deal or the post-merger integration phase. The program content offers best practices which were developed by our distinguished faculty members after decades of experience in managing HR related projects in corporate and consulting roles.

Preparing for the risks and identifying solutions

Recognize potential roadblocks and identify solutions to prepare for the challenges HR practitioners face during a transaction including labor law and legal challenges, culture, change management, communication issues and more.

Understanding the deal structure and HR’s Role

Learn how the human resources function plays a critical role in determining the outcome of strategic financial, and operational goals of the deal.

Optimizing HR’s value through the M&A lifecycle

Identify and drive HR’s strategic value during the pre-close planning, integration, and transformation phases of the transaction.

DESIGNATION

After successfully completing the course, you will receive the HRM&A Charter. The HRM&A is the most internationally recognized designation offered in the field of M&A. This charter signals to peers, clients, employers, and other professionals that you have completed the most comprehensive M&A education program available and are proficient in all areas of the mergers and acquisitions process.

Included In The HR M&A Course

The HRM&A program is structured in four modules based on our HRM&A Framework and Body of Knowledge:

Essentials of M&A

This module covers the fundamentals of Mergers & Acquisitions:

- Deal types: What are the different types of transactions that you can use in M&A? There is a whole

range of deal types and deal continuum that we look at, e.g. the full spectrum from minority stakes to full

acquisitions, various ways to arrange a merger, leveraged buy outs (LBOs), initial public offerings (IPOs),

divestitures, spin-offs, equity carve-outs- - M&A Process: The program covers both perspectives from a buyer’s perspective (buy side) and from a

seller’s perspective (sell-side). We explore how to seek buyers or potential targets (long list & short list)

and how to run a sale in various ways (negotiations and auctions). - Strategies for M&A: We dive into the strategies for Megers & Acquisitions. How can you create

competitive advantage through M&A, diverstitures and equity alliance? - M&A Negotiation: How can you prepare for the negotiation phase? What are ways to arrange a value

creating deal? - Introduction to Due Diligence: How do you prepare for and execute a smart Due Diligence to assure value

creation? What are the different areas that can be covered in the Due Diligence process? - Success Factors in Transactions: We explore the success factors and key challenges and mistakes to avoid.

Which M&A tactics work in which industries? - Takeover Strategies and Defence Tactics: How can you prepare your company against a hostile takeover

attempt and reduce potential threats? Which are the defence mechansims that you can put into place and how affective

are they? Which ways exist to acquire a business successfully in a hostile way?

Learning Outcomes for Essentials of M&A

- Understand the different methods companies can acquire or merge another firm

- Distinguish between Management Buy Outs and Management Buy Ins

- Differentiate between spin-off, split-off & carve-outs

- Classify horizontal & vertical mergers

- Identify different strategies companies use to exit investments

- Classify types of tender offers and what constitutes them

- Analyze and compare different ownership shapes & structures

- Identify growth factors in M&A transactions

- Structure & manage M&A portfolios

- Identify value adding factors in M&A

- Identify value destroying factors

- Analyze various success measurement test & methods

- Classify drivers of profitability in M&A

- Analyze historical M&A waves and their driving factors

- Identify factors in Cross Border M&A activity

- European, Emerging markets, based on regions

- Evaluate historically largest deals

- Define characteristics of M&A waves

- Understand the buy and sell side process, covering both the traditional and holistic view

- Distinguish between the role of advisors and working with them in an M&A setting

- Establish framework for potential target buyer and seller searches

- Identifying relevant industries, companies, locations, financial advisors

- Preparing long and short lists

- How do M&A deals originate and the deal flow

- Discuss necessary agreements and documents in M&A deals

- Construct due diligence plans and activities

- Conducting and updating findings over the transaction lifecycle

- Organizing due diligence teams and data room management

- Identify various areas that require due diligence runs

- Conduct due diligence in a cross-border setting

- Create a minimalistic due diligence

- Identify warning signs in due diligence results

- Judge past and present takeovers battles

- Analyze takeover attacks and strategies for defense

Due Diligence

In the Due Diligence module, we discuss the key questions and topics to address in a due dilligence. It covers the following areas of DD in depth:

- Financial Due Diligence

- Tax Due Diligence

- Legal Due Diligence

- Human Resources (HR) Due Diligence

- Commercial Due Diligence and

- other Due Diligence areas

Learning Outcomes for Due Diligence

- Determine potential deal breakers, negotiations and quality of earnings

- Differentiate between a DD and an audit

- Recognize tax exposures and liabilities

- Analyze different types of taxes

- Structure transactions

- Analyzing current and future liabilities

- Selecting the right legal counsel

- Legal and contractual obstacles

- Analyzing employment contracts, compensation & labor agreements

- Conducting a cultural due diligence

- Running a management audit

- Conceptual & general tools for industry analysis

- Analyze current and potential customers

- Conduct a product and technology portfolio analysis

Post Merger Integration (PMI)

The Post Merger Integration module gives you a thorough introduction into the following aspects:

- Integration Governance: Project Management and Work Stream coordination

- Synergies: Identification of Growth and Cost Synergies and their realization

- Function Integration: How to integrate the different business functions, e.g. Sales & Marketing,

Finance, HR, etc. - Change Management and Cultural Issues: How to deal with differences and success with Communication and

Change Management.

Learning Outcomes for Post Merger Integration (PMI)

- Identify the major challenges in PMI

- Determine the success factors in PMI

- Integrate due diligence findings with PMI planning

- Evaluate reasons for failure in PMI

- Devise a timeline for integration planning

- Adapt to speed, based on deal size and goals

- Strategy creation for achieving quick-wins

- Create integration teams and coordinate with Integration Management Office

- Create temporary task forces and coordinate with the IMO

- Examples of PMI organizational structures

- Identify correct communications timings and channels

- Establish a plan for day 1

- Understand the guidelines for internal communication

- Plan and prepare for change management

- Recommend processes to facilitate change and communication

- Prepare tools for change management

- Classify channels for communication

- Methods to maximize value after acquisition

- Analyzing acquisition climate and target resistance

- Recognize the directions of integration

- Recognize the dependence of acquisition strategy and degree of integration

- Identify various integration phases

- Determine steps to deal with integration phases

- Coordinate with the IMO and steering committee

- Determine the extent of integration

- Maintain day-to-day business operation in parallel with integration activities

- Identify immediate synergies & quick wins

- Recognize key customer journeys

- Identify long term synergies and goals

- Achieve synergies

- Devise tools and templates for functional workplans

- Construct a workstream charter

- Managing communication channels in M&A

- Interpret various behavioral patterns

- Classify dealing with people in an M&A setting

Compensation & Benefits, HR Integration & Change Management

In the Compensation & Benefits, HR Integration & Change Management module, you will explore the

- Compensation & Benefits: Pensions & Compensation Systems

- Integrating the organization/ staffing in the integration process/communication

- Managing layoffs / outplacement

- Labor Law & Labor Agreements

- Employee representation (unions, work councils, …)

- Total Rewards

- Talent Retention

MEET OUR FACULTY

Our growing faculty of more than 60 professors represent a diverse group of professionals, coming from over 20 countries; they work as corporate executives, entrepreneurs, researchers, consultants and professors. Their expertise makes them subject matter experts, groundbreaking researchers, and award-winning authors.

This intersection of practical industry insight, theoretical knowledge, and passion for teaching that our faculty brings to each training strikes at the heart of what IMAA seeks to be.

Experts and Faculty

PREREQUISITE

- Hold an academic degree (e.g. PhD, JD, DBA, MBA or Bachelor Degree); and/or hold one or more professional designations (such as CPA, CFA, CAIA or equivalent)

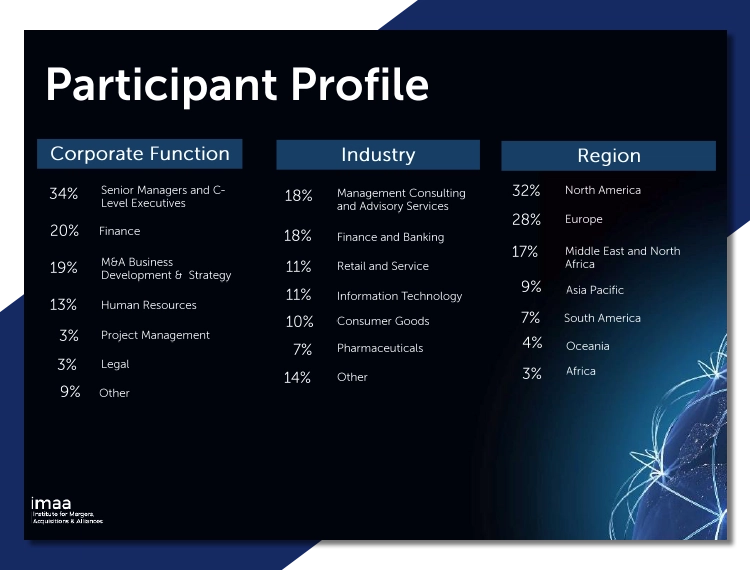

Who Participates

While you will meet an international mix of participants from various industries and functions, the HR Mergers & Acquisitions program is designed for HR professionals as well as for mid-management to senior executives in the C-Suite, project managers, heads of integration, and changes specialists. The program might also be suitable for management consultants, and advisors.

- Click to expand

HRM&A Certificate ONLINE

Online

Bundle & Save:

$4,360.00 Original price was: $4,360.00.$3,290.00Current price is: $3,290.00.

Take the only international HRM&A program online available wordwide: Real world content developed and instructed by legal M&A practitioners Well structured and balanced content to understand business and legal isses Materials specifically designed for online use You can complete the program part-time while working and without the need to travel to any course or examination ... Read more

HRM&A Onsite New York June 9-13, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

09

Jun

on 00:00 UTC

New York | Jun 2025

HRM&A September – October 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

03

Sep

on 15:00 UTC+2

Sep - Oct 2025

HRM&A Onsite Amsterdam October 6-10, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

06

Oct

on 00:00 UTC

Amsterdam | Oct 2025

HRM&A Onsite New York October 20-24, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

20

Oct

on 00:00 UTC

New York | Oct 2025

The Essentials of M&A module provides you with a solid foundation in M&A so you can deep dive in integration issues laster. This module covers: Various deal types M&A Process (buy- and sell-side) Strategies for M&A Introduction to Due Diligence Success Factors in Transactions: Takeover Strategies and Defence Tactics in Hostile M&A

The Due Diligence module covers in detail: Financial Due Diligence Tax Due Diligence Legal Due Diligence Human Resource / HR Due Diligence other Due Diligence areas (e.g. Commercial Due Diligence, Antitrust Due Diligence, Environmental Due Diligence, IT Due Diligence, etc.)

In the Post Merger Integration (PMI) module, you will gain insights about Planning and execution of PMI Project management and governance in the context of integration integration the various functions such as marketing & sales, finance, IT, HR, etc. change management in M&A

The Additional HR Issues in M&A module covers: Compensation & Benefits: Pensions & Compensation Systems Integrating the organization/ staffing in the integration process/communication Managing layoffs / outplacement Labor Law & Labor Agreements Employee representation (unions, work councils, …) Total Rewards Talent Retention For more detailed information, please refer to the content tab above.

HRM&A Certificate ONLINE

Online

Bundle & Save:

$4,360.00 Original price was: $4,360.00.$3,290.00Current price is: $3,290.00.

Take the only international HRM&A program online available wordwide: Real world content developed and instructed by legal M&A practitioners Well structured and balanced content to understand business and legal isses Materials specifically designed for online use You can complete the program part-time while working and without the need to travel to any course or examination ... Read more

The Essentials of M&A module provides you with a solid foundation in M&A so you can deep dive in integration issues laster. This module covers: Various deal types M&A Process (buy- and sell-side) Strategies for M&A Introduction to Due Diligence Success Factors in Transactions: Takeover Strategies and Defence Tactics in Hostile M&A

The Due Diligence module covers in detail: Financial Due Diligence Tax Due Diligence Legal Due Diligence Human Resource / HR Due Diligence other Due Diligence areas (e.g. Commercial Due Diligence, Antitrust Due Diligence, Environmental Due Diligence, IT Due Diligence, etc.)

In the Post Merger Integration (PMI) module, you will gain insights about Planning and execution of PMI Project management and governance in the context of integration integration the various functions such as marketing & sales, finance, IT, HR, etc. change management in M&A

The Additional HR Issues in M&A module covers: Compensation & Benefits: Pensions & Compensation Systems Integrating the organization/ staffing in the integration process/communication Managing layoffs / outplacement Labor Law & Labor Agreements Employee representation (unions, work councils, …) Total Rewards Talent Retention For more detailed information, please refer to the content tab above.

HRM&A September – October 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

03

Sep

on 15:00 UTC+2

Sep - Oct 2025

No IOL events are scheduled at this time.

HRM&A Onsite New York June 9-13, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

09

Jun

on 00:00 UTC

New York | Jun 2025

HRM&A Onsite Amsterdam October 6-10, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

06

Oct

on 00:00 UTC

Amsterdam | Oct 2025

HRM&A Onsite New York October 20-24, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

20

Oct

on 00:00 UTC

New York | Oct 2025

No Onsite events are scheduled at this time.

No Virtual Live events are scheduled at this time.

On-Demand Learning at Your Fingertips

The M&A profession is evolving – are you? Train with the global #1 M&A institution trusted by top professionals. Gain cutting-edge expertise and stay ahead – anytime, anywhere.

Get Personalized Insights

Let’s talk about your goals and explore how we can help. No pressure, just valuable insights. Discover how professionals and organizations have leveraged our expertise to achieve real results – improving governance, streamlining processes, enhancing their skills, and ultimately driving transaction success. Get personalized insights how you can do the same!

A key value proposition of IMAA is the networking opportunities offered to enrich your M&A network, increase dealmaking, and advance your career.

Upcoming Events

HRM&A Certificate ONLINE

Online

Bundle & Save:

$4,360.00 Original price was: $4,360.00.$3,290.00Current price is: $3,290.00.

Take the only international HRM&A program online available wordwide: Real world content developed and instructed by legal M&A practitioners Well structured and balanced content to understand business and legal isses Materials specifically designed for online use You can complete the program part-time while working and without the need to travel to any course or examination ... Read more

HRM&A Onsite New York June 9-13, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

09

Jun

on 00:00 UTC

New York | Jun 2025

HRM&A September – October 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

03

Sep

on 15:00 UTC+2

Sep - Oct 2025

Discover More -

Get Your Free Brochure

FAQs

Accreditation and Recognition

We are the global number #1 provider in M&A education. Participants sign up or companies send their employees in order to prepare for transactions or to enhance their qualification. Future employers reach out to us to check the credentials of candidates and their current status as a charterholder. Potential clients look to us to recommend advisors. We are a high quality provider and are recognized by many other institutions as a continued education provider. Find out more about our accreditations and recognition.

Comparison: Online vs. Onsite Program

| Feature | Online | Onsite |

| Real-life business cases | ||

| All mandatory course materials included | ||

| Lifelong online access to most current content | ||

| 1-year Individual IMAA Membership | ||

| Start right away | ||

| On-Demand video lectures & direct tutoring | ||

| Full flexibility | ||

| No time constraint | ||

| Work from anywhere in the world | ||

| Different dates & locations worldwide | ||

| Interactive discussions | ||

| Networking with peers | ||

| Complete the program in 6 days | ||

| Meet face to face with faculty |

How long does it take to complete the HRM&A Certificate?

The HRM&A Certification is designed as a part-time program for professionals. The total time of completion depends on your prior background and time you can devote to this. In total for the online program it may take about 60 hours of study. Our fastest participants complete it within 2 months.

More questions?

What is included in the fee?

Our tuition fees include all mandatory and recommended study materials. In addition you get access to our e-library.

When can I enroll for and start with the HRM&A Certificate?

You can enroll at any time for the Certificate Program online and start right away. For our onsite M&A courses please check the dates and locations.

Can I take the M&A Certificate entirely online?

Yes, you can take the entire program online from anywhere in the world or while travelling. This is what many of our participants do. For the completion of the M&A Certification there is no physical attendance necessary. However, you can combine online with onsite workshops to reach your designation.

How many participants take your M&A programs?

Our courses and programs in Mergers & Acquisitions, Due Diligence, Valuation and Post Merger Integration (PMI) have taken by more than 2200 participants from all around the world.

What is the difference to other training providers?

We are the number #1 provider and set the standards. Compared with academic executive education offerings, our faculty members are not pure academics – they have closed M&A deals as professionals themselves. So you not only gain theoretical insights, but you will learn hands-on knowledge. Compared with for-profit providers, we are purely focused on M&A trainings and bring in a solid foundation, great structured approach to learning, and the international dimension – and we reinvest in improving our offering.

What is the difference to other certificate programs?

If you compare our programs with the CFA, CAIA, CIMA, or others – we are purely focused on M&A only and are very complementary to these programs. There is very little overlap among the content and insights that our programs provide. Most of them accept our program as continued education.

Where can I ask more questions about your M&A training?

If you have additional questions, please reach out to us via chat, contact form, or give us a call. We are looking forward to hearing from you and learn about your needs and questions.

Related Courses

This course dives deep into the entire M&A process- from strategy and valuation to execution and post merger integration (PMI).

CPMI prepares you for integration issues post-merger, starting with integration planning, up to governance and project management to implement the integration.

The certification dives into the nuts and bolts of the transaction journey—auditing, consulting, deal advisory, and including insights into running a successful M&A practice.

This certification covers the legal aspects of M&A, including best practices, legal contracts, tax considerations, and deal structuring in different geographies and jurisdictions.

HRM&A covers all aspects of the transaction process relevant to human resources, including strategy, due diligence, Post Merger Integration, and compensation benefits.

This training will provide you with the fundamentals of each approach to valuation, with limitations and caveats on the use of each, as well as extended examples in application.