M&A News M&A News: Global M&A Deals Week of January 8 to 14, 2024

- M&A News

M&A News: Global M&A Deals Week of January 8 to 14, 2024

- IMAA

SHARE:

This week’s highlights in the world of finance feature key developments in top global Mergers and Acquisitions (M&A) deals. As a crucial indicator of economic trends and corporate strategies, the Institute for Mergers, Acquisitions, and Alliances’ (IMAA) M&A news reveals a robust market with major players actively pursuing growth and diversification. The focus on the 2024 top global M&A deals of the week unveils significant transactions that not only represent substantial financial investments but also signal shifts in market dynamics and corporate expansions.

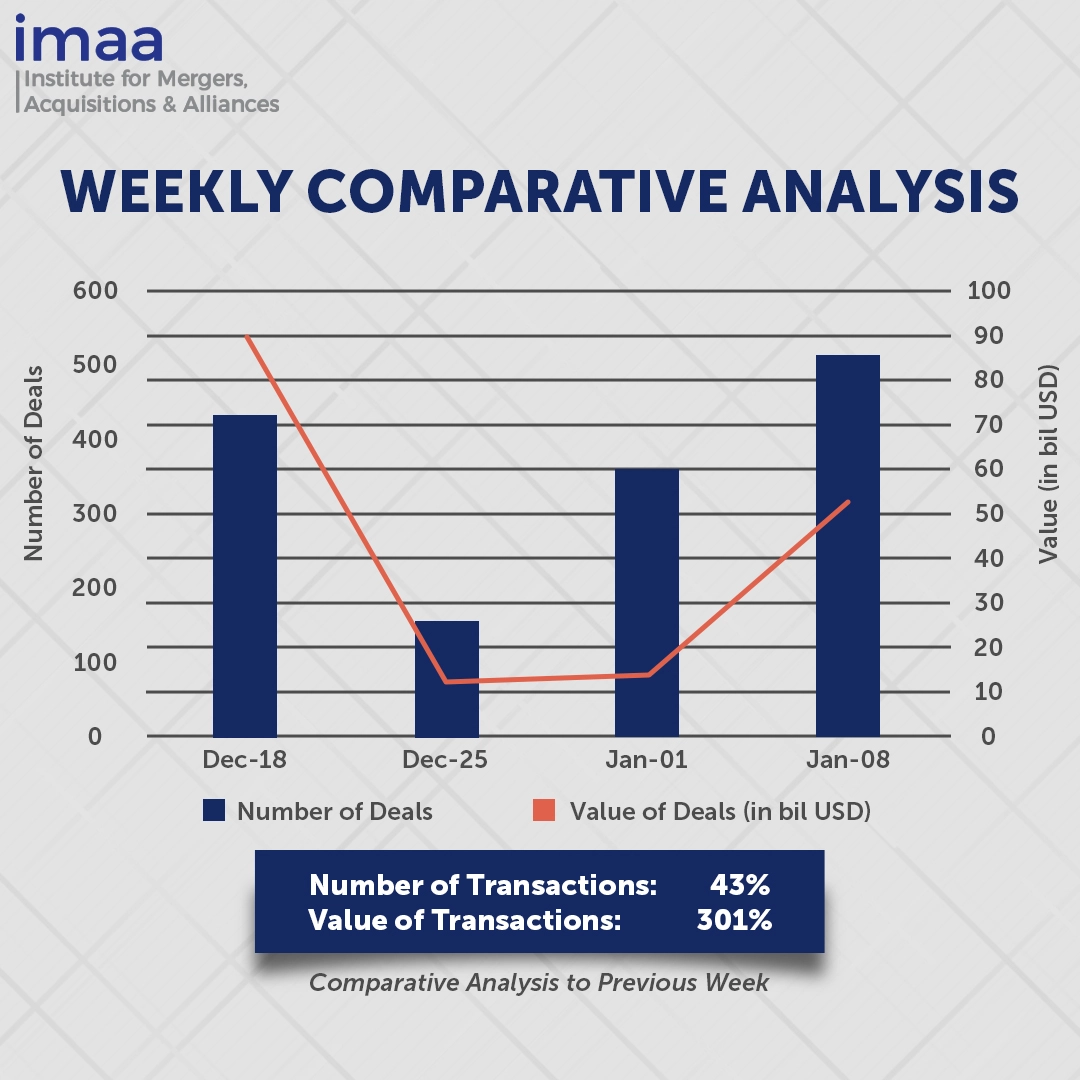

Between January 8 and January 14, the global market witnessed a surge in Mergers and Acquisitions (M&A) activity, with a total of 515 deals amounting to USD 52.49 billion. Out of these transactions, 11 surpassed the USD 500 million threshold, collectively contributing USD 46.33 billion, constituting a substantial 88% of the total M&A deal value for the week.

The standout deal during this period Hewlett Packard Enterprise Company’s announced acquisition of Juniper Networks, Inc, valued at USD 14 billion. This transaction signifies a notable development in the enterprise IT market, following Cisco’s acquisition of data and security software company Splunk for USD 28 billion in September and Broadcom’s USD 69 billion acquisition of cloud software company VMware, which concluded in November. Another noteworthy deal surpassing the USD 10 billion mark was Blackrock’s acquisition of Global Infrastructure Partners, totaling USD 12.51 billion. Significantly, the United States dominated the M&A landscape during this week, hosting 8 out of the top 10 deals.

In terms of week-on-week comparisons, there was a significant increase in both the number of deals and their total value. The number of deals rose by 43%, increasing from 359 in the first week of 2024 to 515 in the current week. Concurrently, the deal value experienced a substantial upswing, progressing from USD 13.10 billion to USD 52.49 billion, marking a significant threefold increase in value.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of January 8-14, 2024 in detail:

Deal No. 1: Hewlett Packard Enterprise to acquire Juniper Networks, Inc. for USD 14 Billion

Deal No. 2: Blackrock, Inc. to Acquire Global Infrastructure Partners for USD 12.51 Billion

Deal No 3: Chesapeake Energy Corporation to Acquire Southwestern Energy Company for USD 7.40 Billion

Deal No. 4: Boston Scientific Corporation to Acquire Axonics, Inc. for USD 3.68 Billion

Deal No. 5: LondonMetric Property Plc to acquire LXI REIT Plc for USD 2.40 Billion

Deal No. 1:

Hewlett Packard Enterprise to Acquire Juniper Networks, Inc. for USD 14 Billion

Hewlett Packard Enterprise (United States) is set to acquire Juniper Networks, Inc. (United States), a prominent player in AI-native networks, in an all-cash deal valued at USD 40 per share, totaling approximately USD 14 billion. This strategic move aims to propel AI-driven innovation within HPE.

The integration of Hewlett Packard Enterprise (HPE) and Juniper signifies a significant shift in HPE’s portfolio mix towards high-growth solutions, fortifying its high-margin networking business. This, in turn, accelerates HPE’s strategy for sustainable and profitable growth. The synergy of HPE and Juniper’s complementary portfolios enhances HPE’s edge-to-cloud approach, positioning the company as a leader in an AI-native environment founded on a robust cloud-native architecture.

Anticipated benefits include operational efficiencies and annual cost synergies of USD 450 million within 36 months post-closure. HPE foresees robust growth in free cash flow, coupled with the maintenance of capital allocation policies, facilitating a reduction in leverage to approximately 2x within two years post-closure. Post-acquisition, HPE commits to ongoing investments in innovation and go-to-market strategies for its networking business, a key driver of its growth.

Hewlett Packard Enterprise’s acquisition of Juniper Networks marks the year’s first significant tech merger. Juniper is the largest among recent acquisitions in IT management and AI.

The expected closing of the transaction is slated for late 2024 or early 2025. HPE has enlisted J.P. Morgan Securities LLC and Qatalyst Partners as its financial advisors, while Goldman Sachs & Co. LLC is serving as Juniper’s exclusive financial advisor.

Deal No. 2:

Blackrock, Inc. to Acquire Global Infrastructure Partners for USD 12.51 Billion

Global asset management giant BlackRock, Inc. (United States) is set to acquire Global Infrastructure Partners (GIP), the world’s largest infrastructure manager, in a cash and stock transaction valued at over USD 12.51 billion.

This strategic move positions BlackRock as the second-largest global manager of private infrastructure assets, fortifying its alternatives business with a combined client AUM surpassing USD 150 billion across equity, debt, and solutions. The deal not only enhances deal flow and co-investment opportunities but also solidifies BlackRock’s standing as a key player in the infrastructure investment landscape.

GIP boasts prime assets, including major international airports, key ports, and significant holdings in green energy and shale oil. Notable among them are Sydney and London Gatwick airports, the Port of Melbourne, the Suez water group, and a substantial stake in a major shale oil pipeline. The merger with BlackRock, known for its complementary infrastructure offerings, creates a robust global infrastructure franchise with distinctive origination and asset management capabilities. The management team from GIP will spearhead the combined infrastructure management platform.

BlackRock’s pursuit of GIP, recognized as a premier player in the alternatives industry, commenced in September. The timing aligns with BlackRock’s strategy to tap into the escalating demand for long-term investment funds concentrating on decarbonization, energy security, and power grids.

The completion of the transaction is anticipated in the third quarter of 2024. Perella Weinberg Partners served as the primary financial advisor to BlackRock, while Evercore assumed the role of lead financial advisor to GIP.

Deal No. 3:

Chesapeake Energy Corporation to Acquire Southwestern Energy Company for USD 7.40 Billion

Chesapeake Energy Corporation (United States) is poised to acquire its gas rival, Southwestern Energy Company (United States), in an all-stock transaction valued at USD 7.40 billion, translating to USD 6.69 per share. Post-transaction, Chesapeake shareholders will hold about 60%, with SWN shareholders at 40%. This strategic acquisition solidifies Chesapeake’s position as a major player in the U.S. natural gas landscape, propelling it to become a frontrunner in the industry.

The merger is set to create a premier energy entity, armed with a leading natural gas portfolio strategically located near high-demand markets. This positions the rebranded company as the first U.S.-based independent entity capable of robust international competition. The newly formed company is uniquely positioned to deliver affordable, environmentally conscious energy, catering to the surging domestic and international demand, while ensuring sustainable cash returns to shareholders. The merger is expected to have an immediate positive impact on key per-share financial metrics, including operating cash flow, free cash flow, cash dividends, net asset value, and return on capital employed (ROCE).

This move follows a series of multi-billion deals in the U.S. energy sector, reflecting a trend of companies seeking lucrative acreage to rebuild depleting assets. The Southwestern bid is Chesapeake’s most significant effort to enhance its natural gas assets since emerging from bankruptcy in 2021. In the preceding year, Chesapeake bolstered its foothold in the gas-rich shale plays of the U.S. Northeast through the USD 2.5 billion acquisition of Chief E&D.

This transformative merger is expected to be completed in the second quarter of 2024. Chesapeake has enlisted the financial advisory services of Evercore and J.P. Morgan Securities LLC, while Goldman Sachs & Co. LLC, RBC Capital Markets, LLC, BofA Securities, and Wells Fargo Securities, LLC are advising Southwestern Energy.

Deal No. 4:

Boston Scientific Corporation to acquire Axonics, Inc. for USD 3.68 Billion

Boston Scientific (United States) has recently announced its intention to acquire California-based Axonics, Inc. (United States) in a deal valued at approximately USD 3.68 billion. The acquisition, set at USD 71 in cash per share, underscores Boston Scientific’s strategic move to bolster its Urology business. Axonics, a key player in neuromodulation systems, specializes in addressing urinary and bowel dysfunction.

Notably, Axonics has made significant strides in advancing sacral neuromodulation therapy for bladder and bowel dysfunction, as well as urethral bulking for women dealing with stress urinary incontinence. These areas represent high-growth segments within the field of urology.

The acquisition grants Boston Scientific access to Axonics’ diverse product portfolio, which includes an innovative device designed to deliver electrical stimulation, aiming to restore communication between the brain and the bladder. This strategic move not only enhances Boston Scientific’s capacity but also reinforces their ability to assist urologists in effectively addressing patients grappling with these frequently persistent conditions.

Anticipated to be finalized in the first half of 2024, the deal marks a strategic move for Boston Scientific in expanding its Urology offerings. J.P. Morgan Securities LLC is serving as the financial advisor to Axonics in this transaction.

Deal No. 5:

LondonMetric Property Plc to acquire LXI REIT Plc for USD 2.40 Billion

LondonMetric Property Plc (United Kingdom), a prominent company listed on the FTSE 250, has recently entered into an agreement to acquire LXI REIT Plc (United Kingdom), a fellow UK landlord, in a deal valued at GBP 1.9 billion (approximately USD 2.40 billion). After the merger is finalized, LondonMetric shareholders will hold a majority stake of around 54%, while LXI shareholders will retain the rest.

This move positions LondonMetric as a leading triple net lease Real Estate Investment Trust (REIT) in the UK, leveraging its management platform for new opportunities in the country’s real estate market. The resulting merged portfolio will boast an alignment with structurally supported sectors, with a substantial 93% exposure to logistics, healthcare, convenience, entertainment, and leisure.

The merger aims to ensure income longevity and security through an internally managed REIT, seeking economies of scale and operational efficiencies, with a focus on sustainable earnings and progressive dividends. The combined entity is set to become the fourth-largest listed REIT in the UK, boasting a market capitalization of around GBP 4 billion.

The merger is also anticipated to yield significant benefits, including substantial cost and operating synergies, a reinforced capital structure, and enhanced credit characteristics, making the entity more resilient in the market. Notably, this This move follows another all-share merger in the London-listed property sector earlier in the week involving Belvoir Group PLC and Property Franchise Group PLC.

The completion of this transformative combination is expected by the end of March, with Barclays Bank PLC serving as the lead financial adviser for LondonMetric and Lazard & Co. advising LXI.

This concludes our coverage of this week’s M&A news of the top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter