M&A News M&A News: Global M&A Deals Week of January 1 to 7, 2024

- M&A News

M&A News: Global M&A Deals Week of January 1 to 7, 2024

SHARE:

Analyzing the top global Mergers and Acquisitions (M&A) deals at the beginning of 2024 reveals key insights into the corporate world’s evolving dynamics. These trends, captured in the weekly M&A news insights by the Institute for Mergers, Acquisitions, and Alliances (IMAA), highlight the pivotal transactions shaping the global market. This overview sets the stage for understanding the specific deals and trends in the M&A landscape as we delve into the details of the first week of January 2024.

During the initial week of 2024 (January 1 – 7), the global market recorded 359 Mergers and Acquisitions (M&A) deals with a combined value of USD 13.1 billion. Among these, four transactions exceeded the 500 million USD mark, contributing significantly to USD 10.75 billion, representing 82% of the total M&A deal value for the week.

The most prominent deal in this period was APA Corporation’s announcement of the acquisition of Callon Petroleum Company, valued at USD 4.55 billion. Deals within the Oil & Gas sector maintained a consistent presence among the top transactions for the fourth consecutive week.

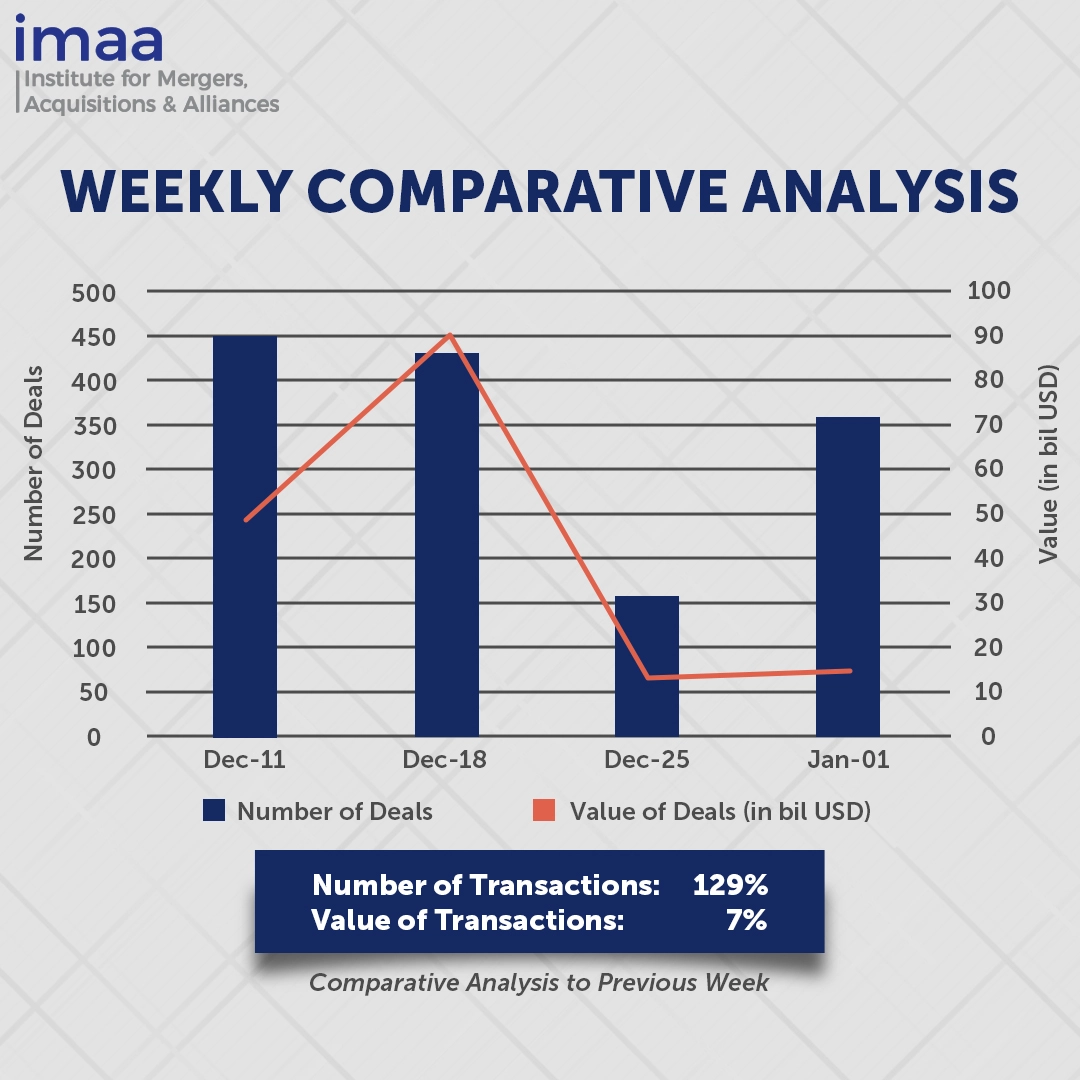

Comparing week-on-week data reveals a 129% increase in the number of deals, rising from 157 in the last week of 2023 to 359 in the first week of 2024. Similarly, the deal value experienced a 7% uptick, progressing from USD 12.21 billion to USD 13.10 billion—a notable recovery following the holiday period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of January 1-7, 2024 in detail:

Deal No. 1: APA Corporation to Acquire Callon Petroleum Company for USD 4.55 Billion

Deal No. 2: Miter Brands to Acquire PGT Innovations, Inc. for USD 3.11 Billion

Deal No 3: Data Infrastructure Trust to Acquire Indian Operations of American Tower Corp. for USD 2.52 Billion

Deal No. 4: Beijing New Building Materials Public Limited Co. to acquire Carpoly Chemical Group Co. Ltd. for USD 0.57 Billion

Deal No. 5: Myers Industries to Acquire Signature Systems Group, LLC for USD 0.35 Billion

Deal No. 1:

APA Corporation to Acquire Callon Petroleum Company for USD 4.55 Billion

APA Corporation (United States) is set to enhance its position in the energy sector through the acquisition of Callon Petroleum Company, a prominent US shale oil driller. The all-stock transaction, valued at approximately USD 4.55 billion, including debt (equivalent to USD 38.31 per share), marks a strategic move by APA to bolster its operations in the Permian Shale Basin spanning West Texas and New Mexico. Callon’s extensive assets, comprising around 145,000 drilling acres, will substantially contribute to APA’s production portfolio, positioning nearly 64% of its output within the United States. The Permian Basin has emerged as a focal point for oil and gas producers seeking to expand their resource inventory.

This deal comes amid other notable agreements in the energy sector, such as ExxonMobil’s acquisition of Pioneer Natural Resources for about USD 60 billion and Chevron’s USD 53 billion purchase of Hess.

The transaction is consistent with APA’s portfolio strategy and complements its existing Permian assets, expanding its opportunity set in the Delaware region. After the deal closes, existing APA shareholders will own approximately 81% of the combined company, with existing Callon shareholders holding nearly 19%.

The expected closure of the deal is in the second quarter of 2024. Citi and Wells Fargo Securities LLC are acting as financial advisors to APA, while Morgan Stanley & Co. LLC and RBC Capital Markets, LLC are serving as financial advisors to Callon.

Deal No. 2:

Miter Brands to Acquire PGT Innovations, Inc. for USD 3.11 Billion

In a surprising twist of events, PGT Innovations, Inc. (United States), a significant player in the premium windows and doors sector, has received an unsolicited proposal from Miter Brands (United States) to acquire all outstanding shares of its common stock at USD 41.50 per share in cash (3.11 Billion in total). This marks Miter’s third attempt at acquisition, following PGT Innovations’ recent agreement with Masonite International Corp. (DOOR) at USD 41.00 per share, comprising a combination of cash and Masonite stock. Miter Brands has been revising its proposal since October when PGT declined an initial USD 33 per share bid.

Miter Brands operates under the trademark owned by MI Windows and Doors, LLC., standing as a major supplier of precision-built and energy-efficient windows and doors for both new construction and replacement segments. With over 10 manufacturing facilities across the United States, Miter Brands is a key player in the industry.

The board of directors at PGT Innovations, guided by independent financial and legal advisors, is set to conduct a comprehensive evaluation of Miter Brands’ proposal, exploring the potential for it to result in a superior offer. Amidst this assessment, PGT Innovations urges its shareholders to refrain from taking immediate action, maintaining a cautious approach. The company is resolute in navigating this situation while keeping the best interests of its shareholders at the forefront.

PGT Innovations has enlisted Evercore as its exclusive financial advisor. These developments underscore the strategic significance of PGT Innovations in the market, as multiple entities recognize and vie for its value.

Deal No. 3:

Data Infrastructure Trust to Acquire Indian Operations of American Tower Corp. for USD 2.52 Billion

American Tower Corp. (ATC India) has recently finalized an agreement with Data Infrastructure Trust (India), an Infrastructure Investment Trust affiliated with Brookfield Asset Management. As per the terms, Data Infrastructure Trust will acquire the complete equity interests in American Tower’s operations in India (ATC India) for INR 210 billion, approximately USD 2.52 billion.

Data Infrastructure Trust presently holds Brookfield’s telecom tower businesses in India under Summit Digitel and Crest Digitel. This transaction stands as one of the largest telecom infrastructure deals within the country, signifying American Tower’s exit from the Indian market. Concurrently, it represents Brookfield’s third notable telecom acquisition in India over the past four years, underscoring the investment firm’s strategic focus on India’s flourishing economy and the rapidly growing smartphone usage trend.

Brookfield’s acquisition is poised to diversify Data Infrastructure Trust’s revenue streams while expanding its network of connections with all major mobile network operators in India. This move aligns with Brookfield’s optimism regarding the robust growth potential in India, where the economic trajectory outpaces that of many other large nations.

The expected conclusion of this transformative transaction is set for the second half of 2024. Noteworthy financial institutions, Citi and CDX Advisors, are actively serving as financial advisors to American Tower, further cementing the strategic and professional underpinnings of this substantial deal.

Deal No. 4:

Beijing New Building Materials Public Limited Co. to acquire Carpoly Chemical Group Co. Ltd. for USD 0.57 Billion

Beijing New Building Materials (BNBM), the new materials subsidiary under China National Building Materials Group, has unveiled plans to acquire a substantial 78.34% stake in Carpoly Chemical Group (China), a reputable manufacturer in the paint and coating industry. The proposed transaction, with an estimated value of approximately CN¥ 4.07 billion, equivalent to USD 573 million, is currently pending approval from China’s anti-monopoly authorities. Should the regulatory process conclude successfully, Carpoly is set to transition into a subsidiary under the umbrella of BNBM.

This strategic move is anticipated to be a pivotal development for BNBM, enhancing its market footprint within the competitive paint and coating sector of China. Presently, BNBM’s involvement in this industry is limited to the northern region of the country. The acquisition is projected to bring about a substantial expansion, increasing the company’s production capacity by more than tenfold.

Carpoly Chemical Group, headquartered in Jiangmen, Southern China, specializes in the research, development, production, and sales of decorative paints, timber coatings, and various related products. This collaboration is poised to contribute significantly to BNBM’s diversification and growth in the dynamic Chinese market.

Deal No. 5:

Myers Industries to Acquire Signature Systems Group, LLC for USD 0.35 Billion

Myers Industries (United States), a leading player in the industrial products manufacturing and distribution sector, has announced a strategic move to acquire Signature Systems (United States), a respected leader in composite ground protection solution in a USD 0.35 billion acquisition deal. This significant transaction is poised to enhance Myers’ overall margin and profitability profile, establishing a robust foundation for sustained growth. The incorporation of Signature into Myers aligns seamlessly with the company’s ambitious Horizon 1 objectives, aiming to achieve a revenue milestone of one billion dollars with an impressive 15% EBITDA margin.

Signature Systems perfectly fits Myers’ targeted acquisition criteria, boasting a strong market position and offering distinctive, branded products catering to rapidly expanding end markets. Headquartered in Flower Mound, TX, with production operations in Orlando, FL, Signature specializes in manufacturing and distributing high-quality composite ground protection products. Additionally, the company is a key player in providing turf protection solutions for stadiums and event venues across North America.

This strategic acquisition, slated to conclude in the first quarter of 2024, will be financially backed by a newly established credit facility amounting to USD 0.35 billion. Myers enlisted the expertise of Moelis & Company LLC as their exclusive financial advisor, while Signature was advised by William Blair & Company LLC in this transformative transaction.

This concludes our coverage of this week’s M&A news of the top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter