M&A News M&A News: Global M&A Deals Week of December 25 to 31, 2023

- M&A News

M&A News: Global M&A Deals Week of December 25 to 31, 2023

SHARE:

Wrapping up the final week of 2023 with a distinctive shift in trends, the global mergers and acquisitions (M&A) landscape presented a stark contrast between a few high-value transactions and an overall downturn in market activity. This trend is captured in the Institute for Mergers, Acquisitions, and Alliances (IMAA) weekly overview of the top global M&A deals. Continue reading to uncover the key transactions and the prevailing trends that defined the M&A world in this critical closing week of the year.

From December 25 to December 31, the global market reported 157 mergers and acquisitions (M&A) deals totaling USD 12.21 billion. Among them, five transactions surpassed the USD 500 million threshold, contributing significantly to USD 9.69 billion, or 79% of the total M&A deal value for the week.

The week’s standout transaction was Bristol-Myers Squibb’s announcement of the acquisition of RayzeBio Inc., amounting to USD 4.15 billion. This move comes on the heels of their acquisition of Karuna Therapeutics in the preceding week, contributing to a robust streak of business development for BMS, which committed to around USD 24 billion in acquisition and licensing deals during the second half of 2023. It’s also worth noting that three out of the top five deals this week occurred in the Oil & Gas Sector, collectively contributing USD 4.34 billion or 36% of the total deal value for the week.

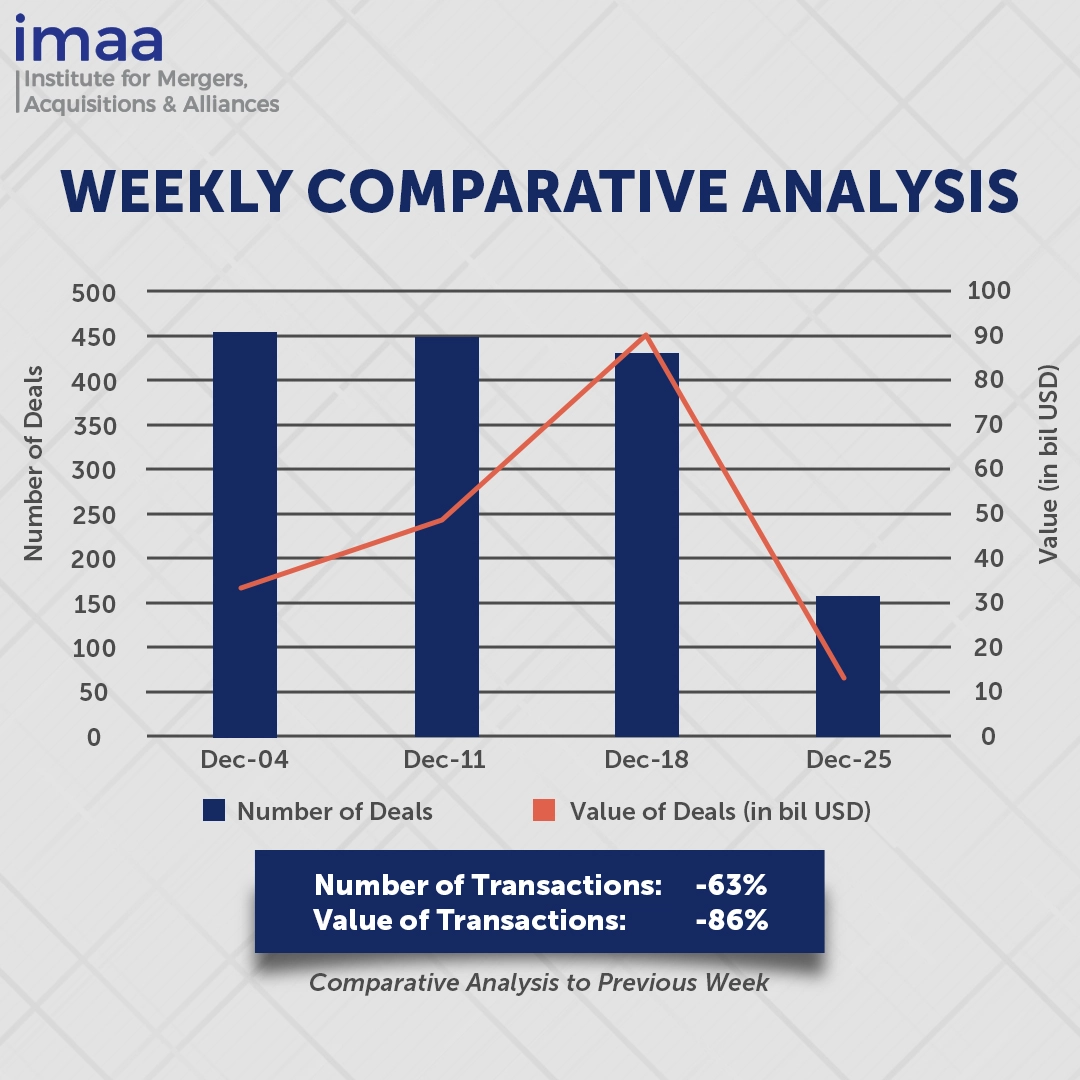

Comparatively, as we step into the New Year, there has been a 63.4% decrease in the number of deals, dropping from 429 to 159. The same trend applies to deal value, witnessing an 86.4% decline from USD 89.9 billion to USD 12.2 billion compared to the previous week.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of December 25 – 31, 2023 in detail:

Deal No. 1: Bristol-Myers Squibb Company to Acquire Rayzebio, Inc. for USD 4.15 Billion

Deal No. 2: The William Companies Inc. to Acquire Portfolio of Natural Gas Storage Assets of Hartree Partners LP for USD 1.95 Billion

Deal No 3: Focus Impact BH3 Acquisition Co. to Acquire XCF Global Capital, Inc. for USD 1.75 Billion

Deal No. 4: AstraZeneca to Acquire Gracell Biotechnologies Inc. for USD 1.20 Billion

Deal No. 5: Caisse de dépôt et placement du Québec (CDPQ) to Acquire Transportadora Associada de Gas S.A. (TAG) for USD 641 Million

Deal No. 1:

Bristol-Myers Squibb Company to Acquire Rayzebio, Inc. for USD 4.15 Billion

Bristol Myers Squibb (United States) has announced its strategic acquisition of RayzeBio (United States), a leading radiopharmaceutical company, at a cash price of USD 62.50 per share, aggregating to an overall equity valuation of approximately USD 4.15 billion. This transaction marks a significant milestone for Bristol Myers Squibb as it bolsters its diverse oncology portfolio by incorporating RayzeBio’s promising pipeline of radiopharmaceuticals and advanced manufacturing infrastructure for precision cancer therapies.

The acquisition propels Bristol Myers Squibb into a forefront position within the rapidly expanding field of targeted cancer treatments, specifically those involving the precise delivery of radioactive payloads to solid tumor cells. RayzeBio, a pioneering Radiopharmaceutical Therapeutics (RPT) firm, is currently advancing its lead program through a Phase 3 clinical trial, aiming to revolutionize cancer treatment.

With this agreement, Bristol Myers Squibb also secures access to RayzeBio’s state-of-the-art manufacturing facility in Indianapolis, Indiana, further fortifying its capabilities in producing groundbreaking therapeutic solutions. Notably, this deal follows closely on the heels of Bristol Myers Squibb’s strategic move back into neuroscience, where it recently acquired Karuna Therapeutics for a substantial USD 14 billion.

The pharmaceutical giant has exhibited a robust commitment to growth, having orchestrated multi-billion-dollar transactions totaling around USD 24 billion in the latter half of 2023 alone. This strategic positioning aligns with Bristol Myers Squibb’s overarching goal of advancing innovative solutions for diverse medical needs.

The deal closure is slated for the first half of 2024. Bristol Myers Squibb has enlisted the expertise of BofA Securities, Inc., as its financial advisor, while Centerview Partners LLC is providing financial advisory services to RayzeBio.

Deal No. 2:

The William Companies Inc. to Acquire Portfolio of Natural Gas Storage Assets of Hartree Partners LP for USD 1.95 Billion

The Williams Companies, Inc. (United States) has confirmed an agreement to acquire a portfolio of natural gas storage assets from a Hartree Partners LP affiliate (United States), valued at USD 1.95 billion. The deal encompasses six underground storage facilities in Louisiana and Mississippi, boasting a combined natural gas capacity of 115 Bcf.

This strategic acquisition aligns with Williams’ commitment to strengthening its position in the natural gas sector, enhancing storage capabilities, and improving market connectivity to meet growing demand. The focus remains on owning and operating premium assets linked to thriving markets, particularly addressing the rising demand fueled by LNG exports and power generation.

Williams emphasizes the strategic significance of the Gulf Coast location for the natural gas storage platform, positioning WMB to meet the increasing demand for LNG and electrification loads from data centers along the Transco corridor.

Expected to conclude in January 2024, this transaction plays a key role in advancing Williams’ strategic goals. Bank of America Securities provides financial advisory support to Williams, while Evercore and Wells Fargo Securities, LLC served as financial advisors to Hartree.

Deal No. 3:

Focus Impact BH3 Acquisition Co. to Acquire XCF Global Capital, Inc. for USD 1.75 Billion

XCF Global Capital, Inc., a New York-based sustainable fuels producer, is set to go public through a merger with special purpose acquisition company (SPAC) Focus Impact BH3 Acquisition (United States), created by Focus Impact Acquisition Corp. The disclosed valuation for this strategic move is USD 1.75 billion.

Owning multiple facilities in North America, XCF Global is a notable player in renewable diesel production, currently recognized as a leading North American producer. The company is strategically expanding into sustainable aviation fuel and other biofuels.

The Letter of Intent (LOI) outlines collaboration between Focus Impact BH3 and XCF to optimize sustainable fuel production and distribution. These agreements position XCF to leverage anticipated regulatory shifts in the United States and Europe. The expected policy changes are likely to drive growth in biofuel demand, supporting the expansion of biofuel plant infrastructure.

Cohen & Company Capital Markets, a division of J.V.B. Financial Group, LLC, served as the exclusive financial advisor to XCF Global Capital in this journey toward public listing.

Deal No. 4:

AstraZeneca to Acquire Gracell Biotechnologies Inc. for USD 1.20 Billion

AstraZeneca (United Kingdom) is slated to purchase Gracell Biotechnologies, a Chinese cancer therapy firm, for a considerable USD 1.2 billion. This move aligns with the Anglo-Swedish pharmaceutical company’s goal of advancing its cell therapy endeavors and expanding its footprint in China, the world’s second-largest pharmaceutical market.

Gracell’s key asset, GC012F, is a FasTCAR-enabled BCMA and CD19 dual-targeting autologous chimeric antigen receptor T-cell therapy currently in the clinical stage. Positioned as a potential treatment for multiple myeloma and other conditions like hematologic malignancies and systemic lupus erythematosus, this candidate underscores AstraZeneca’s commitment to innovative solutions. Gracell’s CAR-T cell therapy involves extracting T-cells from patients, modifying them to target cancer, and reintroducing them into the patient’s body.

The financial transaction, an all-cash deal, represents a significant addition to AstraZeneca’s portfolio with the inclusion of several experimental therapies. Gracell’s valuation in this agreement is set at USD 2 per ordinary share or USD 10 per American Depository Share.

This acquisition follows AstraZeneca’s recent licensing of an obesity drug from Chinese Biotech firm Eccogene in November and its announcement in August regarding a contract manufacturing collaboration with CanSino Biologics for its messenger RNA technology vaccine program.

Expected to conclude in the first quarter of 2024, this strategic acquisition is poised to enhance AstraZeneca’s global standing and contribute to its ongoing pursuit of innovative medical solutions.

Deal No. 5:

Caisse de dépôt et placement du Québec (CDPQ) to Acquire Transportadora Associada de Gas S.A. (TAG) for USD 0.64 Billion

NGIE Brasil Energia, a key player in Brazil’s renewable energy sector, recently announced a deal with global investment group Caisse de dépôt et placement du Québec (CDPQ) (Canada). In this agreement, ENGIE Brasil Energia will sell a 15% stake in Transportadora Associada de Gás S.A. (TAG) to CDPQ for BRL 3.1 billion (about USD 0.64 billion).

While ENGIE S.A. maintains a 32.5% stake, ENGIE Brasil Energia will reduce its share from 32.5% to 17.5%, ensuring continued involvement in TAG’s shareholders’ agreement at a 50% equity holding. Simultaneously, CDPQ will acquire the remaining 50%.

TAG holds a significant position as Brazil’s primary natural gas transporter, with a vast 4,500 km gas pipeline network, covering 47% of the country’s gas infrastructure. The network offers development potential for extensions, additional connections, gas storage, and green gases transport.

This strategic move grants CDPQ governance rights in TAG similar to ENGIE’s. It follows the joint acquisition of a 90% share in TAG by ENGIE and CDPQ in June 2019, with the completion of the remaining shares in 2020.

ENGIE Brasil Energia’s partial divestiture aligns with ENGIE’s strategy, emphasizing new renewable power plants and transmission lines. This allows the company to leverage its expertise in networks and focus on strategic growth.

The financial close is expected by the end of January 2024.

This concludes 2023’s coverage of the weekly top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter