M&A News M&A News: Global M&A Deals Week of December 18 to 24, 2023

- M&A News

M&A News: Global M&A Deals Week of December 18 to 24, 2023

SHARE:

This week’s overview of global Mergers and Acquisitions (M&A) deals provides an insightful snapshot into the dynamic world of corporate transactions. From high-value acquisitions to strategic mergers, the Institute for Mergers, Acquisitions, and Alliances (IMAA) weekly summary of the top 5 M&A deals offers a concise yet comprehensive overview of these latest transactions. Continue reading to learn more about the key deals and trends that are defining the world of M&A this week.

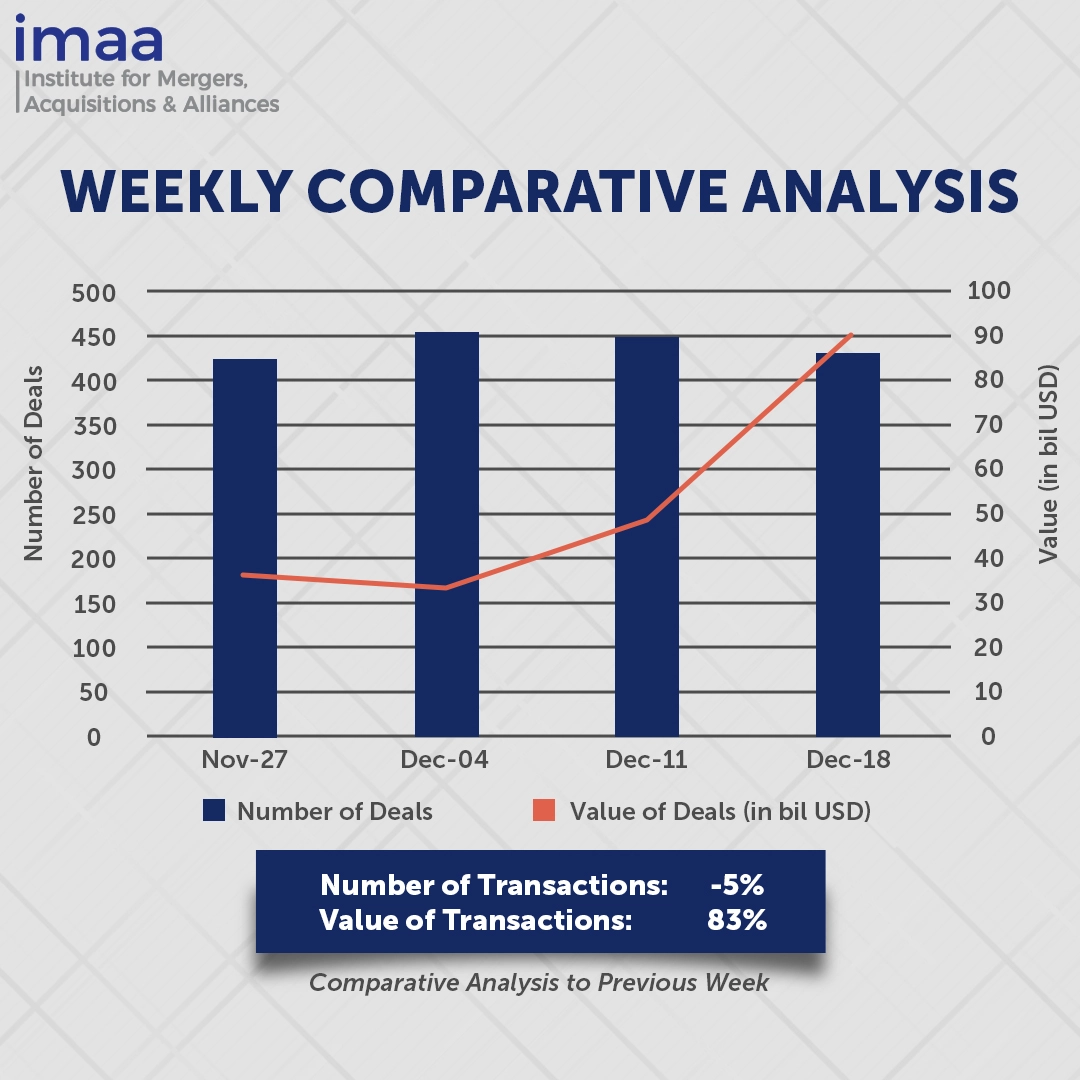

During the week spanning from December 18 to December 24, the global market witnessed the announcement of 429 significant mergers and acquisitions deals, collectively amounting to an impressive USD 89.94 billion. Notably, nineteen of these transactions surpassed the USD 500 million threshold, contributing substantially to a remarkable USD 82.23 billion —equivalent to a striking 91% of the total M&A deal value for the week.

Of particular significance, four of this week’s deals boasted values exceeding USD 11 billion. Leading the pack was Nippon Steel’s acquisition of United States Steel Corp, commanding a hefty USD 14.9 billion. Securing the second position were Bristol-Myers Squibb’s announced acquisition of Karuna Therapeutics, valued at USD 14 billion. In addition to the noteworthy Bristol Myers Squibb-Karuna deal, a discernible trend emerged as several prominent pharmaceutical players revealed significant acquisitions throughout the year. In March, for instance, Pfizer made a strategic move, putting a hefty USD 43 billion on the table to acquire Seagen, significantly expanding its foothold in cancer treatments. Just the month before, AbbVie stepped into the spotlight with a substantial investment of around USD10 billion in ImmunoGen, reinforcing its portfolio and presence in the competitive field of cancer-fighting treatments.

In comparison with the preceding week, there was a 5% decrease in the number of deals, dropping from 451 to 429. However, there was a noteworthy surge in deal value, soaring from USD 49.25 billion to an impressive USD 89.94 billion, marking a substantial 83% increase.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of December 18 – 24, 2023 in detail:

Deal No. 1: Nippon Steel North America Inc. to Acquire United States Steel Corp. for USD 14.90 Billion

Deal No. 2: Bristol-Myers Squibb Company to Acquire Karuna Therapeutics Inc. for USD 14.00 Billion

Deal No 3: Aon Plc to acquire NFP Corp for USD 13.40 Billion

Deal No. 4: Harbour Energy PLC to Acquire Upstream Assets and Exploration Rights of Wintershall Dea AG for USD 11.20 Billion

Deal No. 5: Studio Business of Lions Gate Entertainment Corp to Spin Off with Screaming Eagle Acquisition Corp to Create Lionsgate Studio at USD 4.60 Billion

Deal No. 1:

Nippon Steel North America Inc. to Acquire United States Steel Corp. for USD 14.90 Billion

In a strategic move to capitalize on government incentives aimed at reshaping the U.S. industrial landscape and fostering domestic manufacturing, Japanese steel giant Nippon Steel is set to acquire U.S. Steel Corp (United States) through its wholly owned subsidiary, Nippon Steel North America Inc. (United States), in a substantial USD 14.90 billion deal. This acquisition marks a significant expansion of Nippon Steel’s global presence, complementing its existing production hubs in Japan, ASEAN, and India.

As the world’s fourth-largest steel producer, Nippon Steel’s acquisition of U.S. Steel Corp. positions Nippon Steel Corporation (NSC) for accelerated growth, heightened profitability, and long-term value creation. The move is driven by factors such as robust domestic steel demand, shifts in the global economic landscape, and the impact of new U.S. legislation.

The transaction, an all-cash deal at USD 55.00 per share, translates to an equity value of around USD 14.1 billion, in addition to assuming debt, resulting in a comprehensive enterprise value of USD 14.90 billion. The completion of this strategic acquisition is anticipated in the 2nd or 3rd quarter of 2024.

Noteworthy financial institutions are playing pivotal roles in facilitating this deal, with Citi serving as the financial advisor to NSC and Barclays Capital Inc., Goldman Sachs & Co. LLC, and Evercore acting as financial advisors to U.S. Steel.

Deal No. 2:

Bristol-Myers Squibb Company to Acquire Karuna Therapeutics Inc. for USD 14.00 Billion

Bristol Myers Squibb (United States), a global pharmaceutical leader, is set to bolster its neuroscience drug portfolio through the acquisition of Karuna Therapeutics Inc. (United States), a biopharmaceutical company renowned for its innovative antipsychotic developments. This all-cash transaction, valued at USD 14.00 billion (USD 330.00 per share), reflects Bristol Myers Squibb’s strategic initiative to fortify its position in the pharmaceutical market.

Karuna’s KarXT stands out with its novel mechanism and is presently under review by the U.S. Food and Drug Administration for treating schizophrenia in adults. Additionally, the drug is undergoing trials addressing Alzheimer’s disease psychosis.

This acquisition aligns with Bristol Myers Squibb’s overarching strategy to counter declining revenues attributed to generic competition. Notably, this marks the company’s second acquisition announcement in the last three months, following the disclosure in October regarding the acquisition of Mirati Therapeutics, an oncology-focused company. By diversifying its extensive portfolio, Bristol Myers Squibb aims to establish a presence in the challenging yet promising schizophrenia space, where treatment options are limited.

The transaction with Karuna is anticipated to conclude in the first half of 2024. Financial advisory services for Bristol Myers Squibb are provided by Gordon Dyal & Co. and Citi, while Goldman Sachs & Co. LLC serves as the exclusive financial advisor to Karuna.

Deal No. 3:

Aon Plc to Acquire NFP Corp for USD 13.40 Billion

Aon Plc (United Kingdom), a distinguished professional services firm, is set to acquire NFP Corp (United States), a prominent middle-market provider specializing in risk, benefits, wealth, and retirement plan advisory solutions. This strategic move represents Aon’s expansion into the middle-market segment within the realms of insurance brokerage and wealth management. The acquisition, valued at approximately USD 13.40 billion, will be financed through a combination of USD 7 billion in cash and USD 0.4 billion in Aon stock.

This transaction is pivotal, positioning the merged entities to seamlessly deliver tailored content and capabilities to the middle-market segment. NFP will continue to operate as an independent but interconnected platform, presenting itself in the market as “NFP, an Aon company.” Aligned with Aon’s overarching strategy, the acquisition aligns with the Aon United program, which has been operational since 2010, aiming to leverage the firm’s global capabilities for the benefit of its clients.

This development comes on the heels of Aon’s recently announced restructuring charge, totaling approximately USD 900 million, with an anticipated annual cost savings of around USD 350 million. These savings will predominantly be directed toward technology enhancements and workforce optimization. Aon remains steadfast in its commitment to long-term financial objectives, including mid-single or greater organic revenue growth, expanded adjusted operating margins, and double-digit free cash flow.

The exclusive financial advisor to Aon in this transaction was UBS Investment Bank, while Citi served as a financial advisor and is actively involved in advising Aon on transaction financing. Evercore played a key role as lead financial advisor, with support from BofA Securities, Inc., Deutsche Bank Securities Inc., Jefferies LLC, and TD Securities on the NFP side of the transaction.

Deal No. 4:

Harbour Energy PLC to Acquire Upstream Assets and Exploration Rights of Wintershall Dea AG for USD 11.20 Billion

Harbour Energy, a UK-listed company, has recently finalized an agreement to acquire Wintershall Dea’s upstream assets for a substantial USD 11.20 billion. The assets are currently owned by Germany’s BASF and the investment firm LetterOne.

The comprehensive portfolio includes Wintershall Dea’s upstream assets spanning various countries, such as Norway, Germany, Denmark, Argentina, Mexico, Egypt, Libya, and Algeria. Additionally, the acquisition encompasses Wintershall Dea’s licenses for CO2 Capture and Storage (“CCS”) in Europe, excluding its Russian assets.

This strategic move by BASF marks a significant milestone in its plan to exit the oil and gas sector. Simultaneously, Harbour Energy is poised to undergo a remarkable transformation, positioning itself as one of the world’s foremost independent oil and gas companies, marked by geographical diversity. The acquisition will notably contribute substantial gas-weighted portfolios in Norway and Argentina, along with complementary growth projects in Mexico.

The acquisition by Harbour Energy represents the company’s fourth major acquisition, marking a transformative leap forward in its quest to establish a uniquely positioned, large-scale, geographically diverse independent oil and gas enterprise.

The deal is slated for closure in the fourth quarter of 2024, with Barclays serving as the financial adviser for Harbour in this transaction.

Deal No. 5:

Studio Business of Lions Gate Entertainment Corp to Spin Off with Screaming Eagle Acquisition Corp to Create Lionsgate Studio at USD 4.60 Billion

Lionsgate (United States) has unveiled plans to merge its studio business, content library, and talent management and production company with the Special Purpose Acquisition Company (SPAC) Screaming Eagle Acquisition Corp (Cayman Islands). The resulting entity, Lionsgate Studios, will be established as a distinct publicly traded company, reflecting an enterprise value of around USD 4.60 billion. This transformative transaction is anticipated to generate approximately USD 350 million in funding for strategic initiatives, with a notable commitment of USD 175 million from prominent blue-chip investors.

The integration of Lionsgate’s studio business with Screaming Eagle through the SPAC deal marks a significant enhancement in the company’s strategic optionality for both Starz and the studio division. Initially contemplating the sale or spin-off of Starz, acquired for USD 4.4 billion in 2016, Lionsgate pivoted its strategy last year, prioritizing the separation of the studio business as the preferred financial maneuver to unlock greater value. (Starz—a premium cable channel and streaming service) Furthermore, the transaction is designed to maintain Lionsgate’s robust capital structure while positioning the studio business as a distinct, publicly traded entity with a unified voting class of stock. Lionsgate Studios, operating as a platform agnostic studio, will enjoy increased flexibility in licensing content to third parties at competitive rates.

Anticipated to conclude in the spring of 2024, the deal is being facilitated with financial advisory support from Morgan Stanley for Lionsgate and Citigroup Global Markets for Screaming Eagle.

This concludes our coverage of this week’s top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter