M&A News M&A News: Global M&A Deals Week of December 11 to 17, 2023

- M&A News

M&A News: Global M&A Deals Week of December 11 to 17, 2023

SHARE:

In the latest overview of global Mergers and Acquisitions (M&A) news, the Institute for Mergers, Acquisitions, and Alliances (IMAA) highlights the top 5 global deals of the week, each playing a pivotal role in reshaping various industry landscapes. This week’s deals reveal a nuanced picture: while the quantity of deals shows a modest decline, there’s an observable uptick in the total value of these transactions.

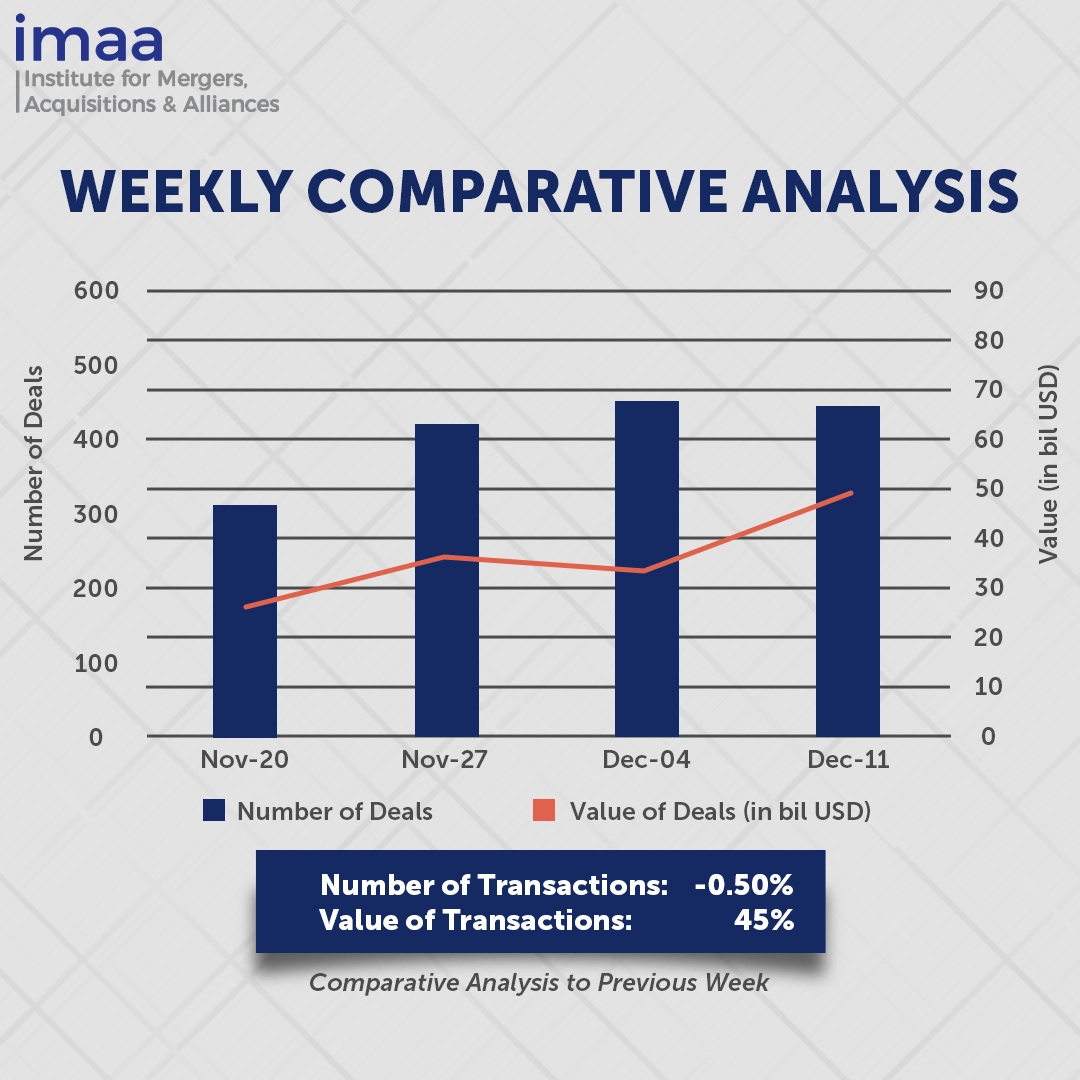

During the week of December 11 to December 17, the global market witnessed 451 Mergers and Acquisitions (M&A) deals, totaling 49.25 billion USD. Nineteen of these deals exceeded 500 million USD, contributing to a substantial 43 billion USD, —equivalent to a striking 87% of the total M&A deal value for the week.

The most substantial deal of the week unfolded as Occidental Petroleum acquired CrownRock LP for a noteworthy sum of 12 billion USD. Notably, two of the top five deals for the week revolved around the Oil & Gas Sector, featuring Occidental Petroleum’s acquisition of CrownRock and TG Natural Resources’ acquisition of Rockcliff Energy.

Comparing with the previous week, there was a slight 0.50% drop in the number of deals from 453 to 451. However, there was a notable increase in deal value, rising from 33.87 billion USD to 49.25 billion USD, marking a 45% increase.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of December 7 – 11, 2023 in detail:

Deal No. 1: Occidental Petroleum Corp to acquire CrownRock, L.P. for USD 12 Billion

Deal No. 2: Dai Nippon Printing, Mitsui Chemicals, and JIC Capital Co. Ltd. to acquire Shinko Electric Industries Co. Ltd. for USD 4.71 Billion

Deal No 3: Wetteri Oyj to acquire Suvanto Trucks Oy for USD 4.47 Billion

Deal No. 4: Abu Dhabi National Oil Company to acquire Fertiglobe PLC for USD 3.62 Billion

Deal No. 5: TG Natural Resources LLC to acquire Rockcliff Energy LLC for USD 2.70 Billion

Deal No. 1:

Occidental Petroleum Corp to acquire CrownRock, L.P. for USD 12 Billion

Houston-based Occidental Petroleum Corp (United States) has reached an agreement to acquire CrownRock L.P. (United States), an oil and gas producer located in Midland, in a cash and stock deal valued at approximately USD 12 billion, inclusive of the assumption of CrownRock’s debt.

This strategic move is set to fortify Occidental’s leading position in the Permian portfolio by integrating around 170 thousand barrels of oil equivalent per day and about 1,700 undeveloped locations. Occidental anticipates an immediate increase in free cash flow, contributing to enhanced value for its shareholders. The acquisition is expected to boost Occidental’s daily oil and gas production by roughly 14 percent.

If the deal concludes successfully, it would signify a notable achievement for Occidental, a major player in the U.S. oil production sector. This transaction aligns with recent industry trends, following ExxonMobil’s USD 59.5 billion acquisition of Pioneer Natural Resources in October and Chevron’s announcement of a USD 53 billion deal to acquire Hess Corporation.

The anticipated closing of the deal is set for the first quarter of 2024. BofA Securities is acting as Occidental’s financial adviser for the transaction, while Goldman Sachs Group Inc. and TPH&Co. are serving as joint-lead financial advisers for CrownRock.

Deal No. 2:

Dai Nippon Printing, Mitsui Chemicals, and JIC Capital Co. Ltd. to acquire Shinko Electric Industries Co. Ltd. for USD 4.71 Billion

Japan Investment Corp (JIC) (Japan), Dai Nippon Printing (Japan), and Mitsui Chemicals (Japan), backed by the Japanese government, are set to acquire Shinko Electric Industries (Japan) for a sum of JPY 684.9 billion (USD 4.71 billion). The transaction involves the sale of Shinko Electric Industries Co., Fujitsu Ltd.’s chip packaging subsidiary, as part of Fujitsu’s strategic divestment from non-core operations.

Upon completion of the buyout, Shinko Electric will be predominantly owned by JIC (80%), with Dai Nippon Printing holding a 15% stake and Mitsui Chemicals securing a 5% interest.

This acquisition by JIC signifies its ongoing involvement in the semiconductor industry, which is under the purview of Japan’s influential trade ministry. JIC believes that by privatizing Shinko Electric, it can provide robust support for the company’s advanced chip packaging endeavors.

Japan maintains a stronghold in semiconductor packaging, boasting major players like Shinko, Ibiden, and Toppan Holdings, all integral contributors to the global chip-supply chain. The move underscores Japan’s commitment to reinforcing its position in the competitive landscape of semiconductor technologies.

Deal No. 3:

Wetteri Oyj to acquire Suvanto Trucks Oy for USD 4.47 Billion

Oulu-based Wetteri Oyj (Finland), is in the process of acquiring Suvanto Trucks Oy (Finland), a notable player in the sale and maintenance of used trucks. The strategic move involves the comprehensive acquisition of all shares of Suvanto Trucks Oy, marking Wetteri’s fourth significant acquisition in its growth trajectory within the automotive sector.

This initiative is part of Wetteri’s broader goal to establish an extensive nationwide sales network specifically for used heavy vehicles. Suvanto Trucks Oy, with its specialization in the sale and maintenance of used trucks, has been primarily active in Turku, Tampere, and Vantaa.

Upon completion of this acquisition, Wetteri is poised to solidify its position in the heavy vehicles business, emerging as the sole Finnish entity dedicated to building a comprehensive national dealership network for used heavy vehicles.

The agreed-upon purchase price for this acquisition stands at EUR 4.2 billion, equivalent to approximately USD 4.47 billion. Anticipated to conclude by the first quarter of 2024, this strategic move underscores Wetteri’s commitment to expanding its influence and market reach in the automotive sector.

Deal No. 4:

Abu Dhabi National Oil Company to acquire Fertiglobe PLC for USD 3.62 Billion

Abu Dhabi National Oil Co (ADNOC) (United Arab Emirates) has recently finalized an agreement to acquire OCI’s entire stake in Fertiglobe PLC (United Arab Emirates) for USD 3.62 billion, marking a significant step in ADNOC’s strategic venture into the global chemicals market. The completion of this transaction is anticipated in 2024, ushering in a new phase for Fertiglobe.

This strategic move positions ADNOC as the majority shareholder in Fertiglobe, aligning seamlessly with the company’s ambitious chemicals strategy and its overarching goal to establish a robust global growth platform for ammonia. Recognized as a pivotal lower carbon fuel and hydrogen carrier, ammonia is slated to play a crucial role in the ongoing energy transition.

For Fertiglobe, this transaction serves as a catalyst for future growth, empowering the company to expedite the exploration of novel market and product opportunities. Additionally, it enables Fertiglobe to broaden its focus on clean ammonia as an emerging fuel and hydrogen carrier, aligning with evolving industry trends.

Upon the successful conclusion of the deal, ADNOC’s ownership stake in Fertiglobe will rise to 86.2%, solidifying its position as a key player in the chemical sector. Meanwhile, the free float traded on ADX will persist at 13.8%.

Deal No. 5:

TG Natural Resources LLC to acquire Rockcliff Energy LLC for USD 2.70 Billion

In a strategic move, Tokyo Gas’ majority-owned subsidiary, TG Natural Resources LLC (United States), is set to secure complete ownership of Rockcliff Energy (United States), a Quantum Energy Partners portfolio company, for a substantial sum of USD 2.7 billion.

Tokyo Gas has strategically expanded its foothold in the U.S. upstream sector through TG Natural Resources, which was integrated as its subsidiary in 2020. Capitalizing on the anticipated surge in gas demand in the U.S., driven by the construction of new LNG export terminals, Tokyo Gas Group’s Medium-term Management Plan for FY 2023-2025, known as “Compass Transformation 23-25,” outlines the company’s commitment to scaling up its shale gas operations.

TG Natural Resources has been proactively pursuing the acquisition of high-quality assets in proximity to its existing holdings in Texas and Louisiana. This acquisition is poised to position TG Natural Resources as the cornerstone of Tokyo Gas’ international revenue stream. The transaction is slated for completion by the conclusion of 2023. J.P. Morgan Securities acted as financial advisors to Rockcliff, while Goldman Sachs & Co. LLC and Bank of America advised TG Natural Resource.

This concludes our coverage of this week’s top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter