M&A News M&A News: Global M&A Deals Week of January 29 to February 4, 2024

- M&A News

M&A News: Global M&A Deals Week of January 29 to February 4, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions, and Alliances’ (IMAA) weekly M&A news update provides the latest information on the global landscape of mergers and acquisitions. Through these updates, IMAA shares insights into the latest trends and significant transactions across industries.

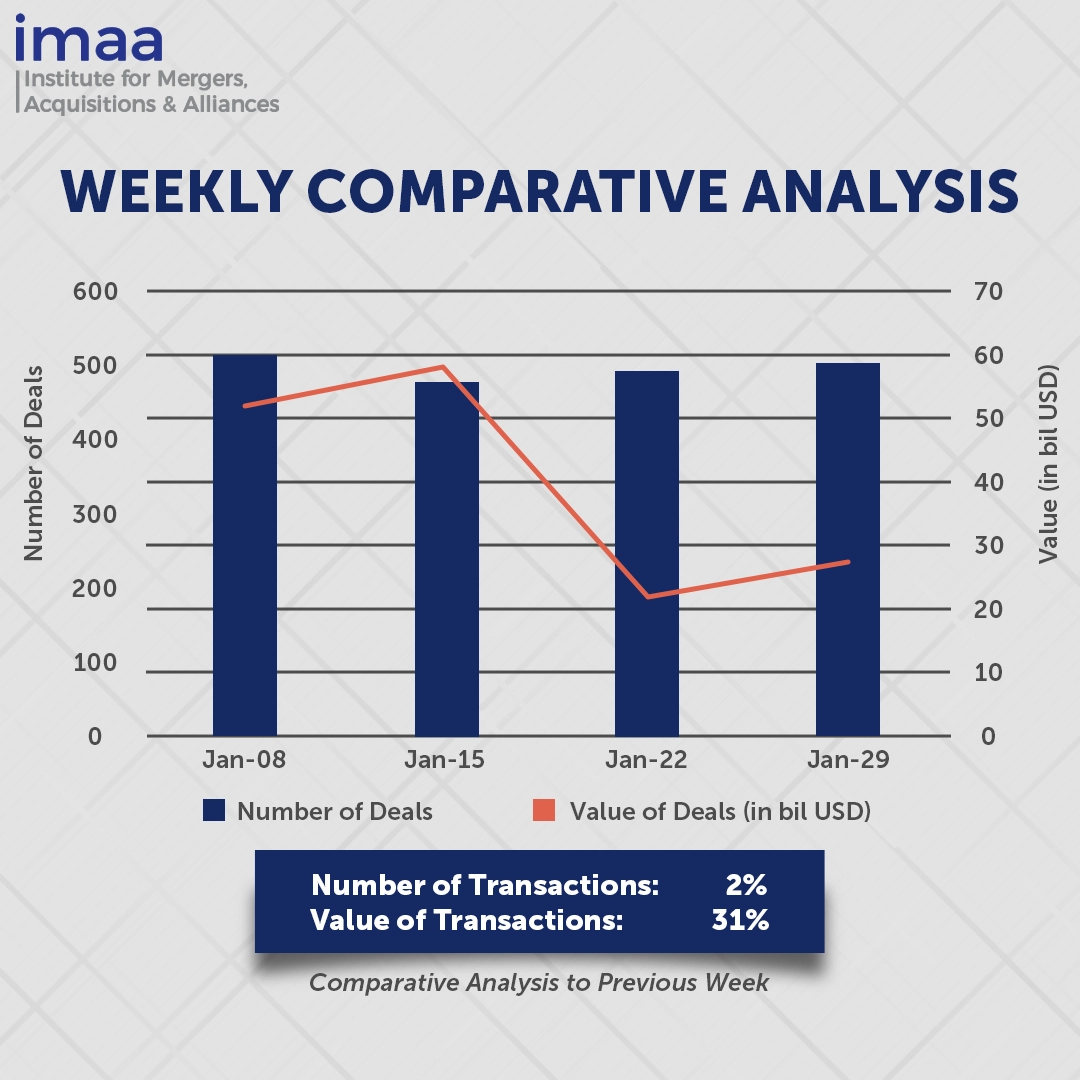

Following this context, the report for the week spanning January 29 to February 4, the global market witnessed a total of 504 Mergers and Acquisitions (M&A) deals, collectively amounting to USD 26.94 billion. Among these, 13 transactions surpassed the USD 500 million threshold, accumulating a total worth of USD 21.46 billion, contributing to roughly 80% of the total deal value for the week.

The standout deal during this period was WillScot Mobile Mini’s proposed acquisition of McGrath RentCorp, valued at USD 3.8 billion. WillScot Mobile Mini has demonstrated a pattern of strategic acquisitions over recent years, boasting a strong track record of business integrations that generate significant synergies. Notable among its recent acquisitions is the purchase of 616 Global Clearspans in October 2023, a leading national provider of temporary and semi-permanent clearspan structures based in Tucson, AZ, further enhancing WSC’s comprehensive range of temporary space solutions. Additionally, in August 2023, the company made significant strides in the cold storage sector through the acquisitions of Cold Box in California and A&M Cold Storage in Ohio.

Examining week-on-week data, there was a 2% increase in the number of deals, rising from 494 in the preceding week to 504 during this period. Similarly, deal value experienced a notable 31% surge from USD 20.63 billion to USD 26.94 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of January 29 – February 4, 2024 in detail:

Deal No. 1: WillScot Mobile Mini Holdings Corp. to Acquire McGrath RentCorp for USD 3.8 Billion

Deal No. 2: Health Care Service Corporation to Acquire Medicare Advantage, Cigna Supplemental Benefits and CareAllies Businesses for USD 3.3 Billion

Deal No 3: Motor Fuel Group to Acquire 337 Morrisons petrol forecourts & more than 400 Ultra-Rapid EV sites of Wm Morrison Supermarkets for USD 3.16 Billion

Deal No. 4: CANAL+ SA to Acquire MultiChoice Group Limited for USD 2.50 Billion

Deal No. 5: Amphenol Corporation to Acquire Carlisle Interconnect Technologies Inc. for USD 2.03 Billion

Deal No. 1:

WillScot Mobile Mini Holdings Corp. to Acquire McGrath RentCorp for USD 3.80 Billion

WillScot Mobile Mini Holdings Corp. (United States), known for its innovative temporary space solutions, is set to acquire McGrath RentCorp (United States), a reputable business-to-business rental company based in Livermore, California. The acquisition, valued at USD 3.8 billion in cash and stock, will involve 60% of McGrath’s outstanding shares converted into cash consideration and the remaining 40% into stock consideration, granting McGrath shareholders an approximately 12.6% stake in the combined entity.

This strategic move aims to bolster WillScot Mobile Mini’s position as a North American leader in turnkey space solutions by leveraging a complementary geographic footprint and diversifying its platform across key customer segments. Bringing together two complementary businesses, the merger seeks to enhance the diversity of customer offerings and strengthen recurring cash flow profiles.

WillScot Mobile Mini anticipates the combined company generating approximately USD 700 million in annual free cash flow within the first full year post-closure, with further enhancements expected over time. The merged entity will boast a robust financial profile, highlighted by combined 2023 revenues of USD 3.2 billion and adjusted EBITDA of USD 1.4 billion. It expects to achieve USD 50 million of run-rate operating synergies within 24 months of closing.

The transaction is expected to close in the second quarter of 2024. BofA Securities acted as the financial advisor to WillScot Mobile Mini, while Goldman Sachs & Co. LLC advised McGrath.

Deal No. 2:

Health Care Service Corporation to Acquire Medicare Advantage, Cigna Supplemental Benefits and CareAllies Businesses for USD 3.30 Billion

Bloomfield-based health insurance giant, The Cigna Group (United States), has made a strategic decision to divest its Medicare division, encompassing Medicare Advantage plans, Cigna supplemental benefits, Medicare Part D drug benefits, and CareAllies, which offers administrative services and contracting support to medical care providers.

The buyer, Health Care Service Corp. (HCSC), the largest customer-owned health insurer in the United States, has agreed to acquire the Medicare division for USD 3.3 billion. Additionally, HCSC has entered into a four-year agreement for Cigna’s Evernorth Health Services unit to manage pharmacy benefits.

Based in Chicago, Health Care Service Corp. operates Blue Cross and Blue Shield health insurance plans across several states, boasting over 18 million health plan enrollees nationwide. HCSC aims to bolster its presence in the Medicare Advantage market, an area where it currently has limited offerings compared to other major health insurers. This acquisition aligns with HCSC’s strategic vision, offering numerous benefits such as expanding product portfolios, implementing robust clinical programs, and extending geographic coverage.

Medicare Advantage plans are increasingly popular among seniors, with more than half of America’s seniors over the age of 65 opting for them. These plans offer additional benefits and services beyond traditional Medicare, including disease management and nurse help hotlines, with some also including vision, dental care, and wellness programs.

Cigna’s Medicare division serves a significant customer base, including 3.6 million Medicare beneficiaries, 600,000 Medicare Advantage plan members, over 450,000 Medicare Supplemental plan members, and 2.5 million members enrolled in Medicare Part D.

The transaction is expected to conclude in the first quarter of 2025, with Barclays and J.P. Morgan Securities LLC serving as financial advisors to HCSC, and Centerview Partners LLC advising The Cigna Group with additional counsel provided by Morgan Stanley & Co. LLC.

Deal No. 3:

Motor Fuel Group to Acquire 337 Morrisons petrol forecourts & more than 400 Ultra-Rapid EV sites of Wm Morrison Supermarkets for USD 3.16 Billion

Morrisons (United Kingdom), a prominent Yorkshire-based supermarket chain, recently announced an agreement with Motor Fuel Group (United Kingdom) for the acquisition of 337 of its petrol forecourts and more than 400 associated sites across the UK. The purpose behind this acquisition is to facilitate the development of Ultra-Rapid electric vehicle (EV) charging infrastructure. The move aligns with the UK’s goals of ending new diesel and petrol car sales by 2035 and achieving net-zero emissions by 2050. Both Morrisons and Motor Fuel Group (MFG) are under the ownership of the US private equity group, Clayton, Dubilier & Rice.

This transaction, valued at GBP 2.5 billion (approximately USD 3.16 billion), signifies a commercial partnership between Morrisons and MFG. Morrisons will retain a minority stake of 20% in MFG, highlighting a commitment to the long-term success of this collaboration.

Under the agreement, Morrisons will continue supplying food and groceries to the forecourts, with potential expansion into the MFG estate through its wholesale operation. MFG plans to invest in installing 800 ultra-rapid EV charging points across the acquired sites within the first five years, offering a charging time of approximately 10 minutes for 100 miles of range.

This investment positions MFG as a significant player in the ultra-rapid EV charge point landscape in the UK, with over 1,300 sites serving customers weekly. Additionally, MFG is set to become the second-largest convenience store operator in the UK, catering to communities nationwide. The proceeds from the sale will enable Morrisons to further invest in its grocery and food-making businesses, while also strengthening its capital structure.

The acquisition follows Clayton, Dubilier & Rice’s ownership of MFG, a deal scrutinized by competition regulators. Following assessment by the Competition and Markets Authority, the sale of 87 MFG petrol forecourts was deemed sufficient to address regulatory concerns, a transaction that has since been completed.

Deal No. 4:

CANAL+ SA to Acquire MultiChoice Group Limited for USD 2.50 Billion

Vivendi’s pay-TV division, Canal+ (France) has recently proposed acquiring the South African pay-TV company MultiChoice Group for ZAR 46 billion (USD 2.50 billion), building upon its existing 31.7% stake in the company. This offer values shares at ZAR 105 each, representing a 40% premium over MultiChoice’s most recent closing price.

The envisioned merger between Canal+ and MultiChoice aims to create a stronger entertainment platform in the global market. Through this integration, the combined entity seeks to offer consumers a wider selection of sports, local, and international content.

As Africa’s leading pay-TV provider, MultiChoice has consistently invested resources to compete with global streaming giants like Netflix, Amazon, and Disney, which have entered the local programming arena. In an increasingly competitive media landscape, regional players must contend with the resources of global media companies, making scale crucial for success.

Canal+’s bid for MultiChoice comes amidst French billionaire Vincent Bolloré’s proposal to restructure Vivendi’s expansive media and entertainment portfolio into four separate entities, while Canal+ itself is actively considering an independent listing, indicating broader strategic shifts within Vivendi.

However, regulatory challenges loom for Canal+, as South African broadcasting rules impose ownership caps. Currently, foreign ownership of broadcasters is limited to 20% of voting rights, with discussions about potentially raising this limit to 49%. The success of the acquisition would depend on MultiChoice’s board expressing interest and navigating regulatory processes.

Deal No. 5:

Amphenol Corporation to Acquire Carlisle Interconnect Technologies Inc. for USD 2.03 Billion

Amphenol Corporation (United States), renowned for its pioneering building products and solutions, is poised to acquire Carlisle Interconnect Technologies, Inc. (United States) from Carlisle Companies Inc. for USD 2.03 billion in cash, marking a strategic move to broaden its portfolio for clients operating in challenging environments.

Carlisle Interconnect Technologies, Inc. (CIT) specializes in providing interconnect solutions for harsh environments, primarily serving the commercial air, defense, and industrial sectors. Projected 2024 sales for CIT are approximately USD 900 million, with an adjusted EBITDA margin of 20%. The company’s product range, including wire and cable, cable assemblies, contacts, connectors, and sensors, complements Amphenol’s existing interconnect and sensor solutions.

This acquisition is anticipated to drive long-term growth in the commercial air, defense, and industrial markets, with positive impacts on Amphenol’s earnings per share expected within the first-year post-closure.

Amphenol, along with other defense industry groups, has benefited from increased spending on next-generation technologies amid geopolitical tensions. This trend has helped offset weaker demand for laptops and tablets in the broader consumer electronics market.

The deal is set to conclude by the end of the second quarter of 2024 and will be financed through a combination of Amphenol’s available cash and existing credit and commercial paper facilities. Evercore is serving as Amphenol’s financial advisor for the transaction.

This concludes our coverage of this week’s M&A news of the top global mergers and acquisitions deals. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter