M&A News M&A News: Global M&A Deals Week of February 5 to 11, 2024

- M&A News

M&A News: Global M&A Deals Week of February 5 to 11, 2024

SHARE:

The Institute for Mergers, Acquisitions, and Alliances (IMAA) delivers insightful weekly mergers and acquisitions news, providing an authoritative perspective on the top global M&A deals. Through its comprehensive updates, IMAA captures the essence of the global mergers and acquisitions landscape, offering a deep dive into the significant transactions that shape industries worldwide. This week’s coverage not only spotlights the latest trends and high-value transactions but also emphasizes the dynamic nature of the M&A sector. By highlighting key developments and emerging patterns, IMAA’s M&A news serves as a critical resource for understanding the evolving dynamics of global corporate mergers and acquisitions, making it an indispensable guide for professionals and enthusiasts alike.

During the week spanning February 5 to February 11, the global market witnessed a total of 501 Mergers and Acquisitions (M&A) deals, collectively amounting to USD 50.09 billion. Of particular significance, 17 transactions exceeded the USD 500 million mark, amassing a total value of USD 43.57 billion, which accounted for approximately 87% of the week’s total deal value.

The most significant deal of the week involved Novo Holding’s proposed acquisition of Catalent Inc, valued at USD 16.5 billion. Novo Nordisk, facing pressure to scale up production of its diabetes and obesity medications, particularly the Ozempic-Wegovy duo, sees the acquisition of Catalent as a strategic move to alleviate its supply chain constraints.

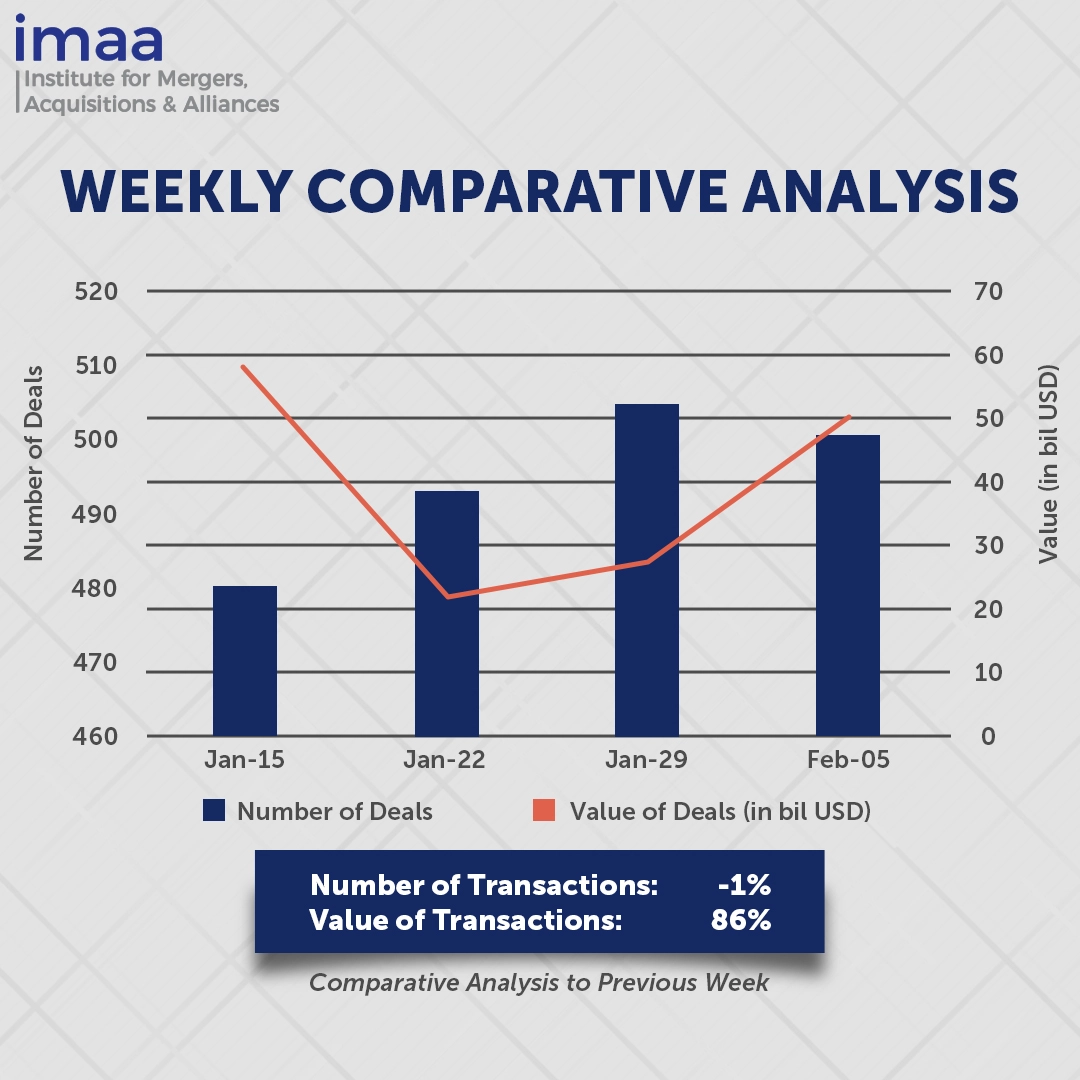

A comparative analysis of week-on-week data reveals a marginal 1% decrease in the number of deals, dropping from 504 in the preceding week to 501 during this period. In contrast, the deal value experienced a significant 86% surge, leaping from USD 26.94 billion to USD 50.09 billion. Interestingly, this week’s top 10 deals boasted values exceeding USD 1 billion each, contributing significantly to the substantial increase in deal value compared to the previous week.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of February 5 – 11, 2024 in detail:

Deal No. 1: Novo Holding A/S to Acquire Catalent, Inc. for USD 16.50 Billion

Deal No. 2: FMP, Argonaut, Infinity Management, IT.Elaboration, and Merdian-Servis to Acquire Yandex LLC for USD 5.20 Billion

Deal No. 3: Owens Corning to Acquire Masonite International Corporation for USD 3.90 Billion

Deal No. 4: Barratt Developments plc to Acquire Redrow plc for USD 3.18 Billion

Deal No. 5: Novartis data42 AG to Acquire MorphoSys AG for USD 2.90 Billion

Deal No. 1:

Novo Holding A/S to Acquire Catalent, Inc. for USD 16.50 Billion

Danish pharmaceutical company Novo Holdings has announced its acquisition of Catalent, Inc. (United States) in an all-cash transaction valued at USD 16.50 billion. Under the terms of the deal, Novo Holdings will purchase all outstanding shares of Catalent for USD 63.50 per share.

Catalent, Inc. is recognized globally for its role in assisting pharmaceutical, biotech, and consumer health partners in optimizing product development, launch, and supply chain management for patients worldwide.

As part of the acquisition strategy, Novo Holdings plans to divest three Catalent fill-finish sites and related assets to Novo Nordisk, a company in which Novo Holdings holds a controlling interest. These sites, situated in Italy, USA, and Belgium, represent crucial components of Catalent’s operations.

The decision to transfer these sites to Novo Nordisk aligns with the latter’s imperative to bolster production capabilities, particularly concerning filled injection pens and semaglutide, a key ingredient in medications like Ozempic and Wegovy. While these new sites won’t immediately resolve supply chain challenges, they are poised to enhance filling capacity starting from 2026 onward.

The transaction aligns with Novo Holdings’ strategy of investing in established life science companies. Novo Holdings will retain the rest of Catalent’s assets, adding to its portfolio of life sciences services.

The merger is expected to close by the end of the calendar year 2024, after which Catalent will become a private company and cease trading on the New York Stock Exchange. Citi and J.P. Morgan are advising Catalent, while Morgan Stanley is advising Novo Holdings on the transaction.

Deal No. 2:

FMP, Argonaut, Infinity Management, IT.Elaboration, and Merdian-Servis to Acquire Yandex LLC for USD 5.20 Billion

Dutch-based Yandex NV is set to divest its Russia-based businesses for RUB 475 billion (USD 5.20 billion), about half of its market value, adhering to a Russian Government rule imposing a minimum 50 percent discount on Russian asset sales by parent companies in “unfriendly” countries, such as the Netherlands due to EU sanctions against Russia.

Known as “Russia’s Google,” Yandex gained prominence through its diverse range of online services, encompassing search, advertising, and ride-hailing within the Russian market.

The acquisition will be led by a consortium of senior managers from Yandex’s Russian operations, funded through a special purpose limited liability company named “FMP.” Additional investors include Argonaut, a closed-end mutual investment fund owned by Russian oil giant PJSC Lukoil; “Infinity Management,” owned by venture capitalist Alexander Chachava; “IT.Elaboration,” owned by Pavel Prass, CEO of investment manager Infinitum Asset Services; and “Meridian-Servis,” owned by businessman Alexander Ryazanov, a former politician.

This transaction culminates from over 18 months of meticulous planning. The sale will occur in two stages, with the first closing expected in the first half of 2024, followed by the second closing about seven weeks later.

Post-transaction, Yandex N.V. will disassociate from the Yandex brand. The divested assets represent a significant portion, constituting over 95% of Yandex Group’s revenue, assets, and employee base, will enable Yandex N.V. to focus on its remaining technology ventures, including Avride, Nebius AI, Toloka AI, and TripleTen.

Deal No. 3:

Owens Corning to Acquire Masonite International Corporation for USD 3.90 Billion

Owens Corning (United States), a significant player in the global building and construction materials industry, has announced its intention to acquire Florida-based doormaker Masonite International Corporation (United States) in a deal worth USD 3.90 billion. Under the terms of the agreement, Owens Corning will purchase Masonite at a price of USD 133 per share in cash.

Masonite currently operates 64 manufacturing and distribution facilities, primarily in North America. By integrating Masonite’s doors business, Owens Corning aims to expand its product lines and brands, particularly in the residential building materials sector. This strategic move is expected to increase Owens Corning’s revenue from North American residential applications to 60% of its total revenue.

The acquisition is expected to yield significant cost synergies of around USD 125 million annually, driven by increased scale and operational efficiencies, with the majority of savings anticipated within two years post-acquisition. Moreover, the move is forecasted to bolster Owens Corning’s financial metrics, projecting revenue of approximately USD 12.6 billion and adjusted EBITDA of USD 2.9 billion on a pro forma basis.

This acquisition follows Masonite’s unsuccessful attempt to acquire Florida manufacturer PGT Innovations, which was halted due to the emergence of a competing bidder. Masonite opted not to engage in a bidding war and withdrew its offer for PGT Innovations in January.

The transaction is slated to close in the middle of the year and will be funded through a combination of cash and debt financing provided by Morgan Stanley.

Morgan Stanley & Co. LLC is acting as the lead financial advisor to Owens Corning, while Goldman Sachs leads the financial advisory team for Masonite, with additional support from Jefferies.

Deal No. 4:

Barratt Developments plc to Acquire Redrow plc for USD 3.18 Billion

Barratt Developments (United Kingdom), a top housebuilder, has agreed to acquire rival Redrow plc (United Kingdom) in an all-share deal valued at GBP 2.5 billion (USD 3.18 billion). The resulting combined entity, to be named Barratt Redrow Plc, is poised to emerge as the largest homebuilder in the United Kingdom.

As per the agreement, Redrow shareholders will hold approximately 32.8% of the combined group, while Barratt shareholders will retain around 67.2%.

The merger aims to increase home deliveries substantially, targeting over 22,000 homes annually in the medium term. This represents a significant increase compared to Barratt’s anticipated delivery of 13,500 to 14,000 homes in fiscal 2024. Additionally, the merger is expected to generate annual cost savings of GBP 90 million, with combined revenues reaching GBP 7.5 billion.

Despite challenges such as higher interest rates, the UK housing sector exhibits resilience, evident in the continuous ascent of house prices for the fourth consecutive month in January, reaching their peak since October 2022. This acquisition underscores Barratt Redrow Plc’s proactive adaptation to market shifts, fortifying its competitive edge and fostering growth opportunities.

The transaction marks a significant development in the UK’s housebuilding sector and is expected to close in the second half of the year. Following the merger, the newly formed entity will operate under well-established brands such as Barratt Homes, David Wilson Homes, and Redrow.

Deal No. 5:

Novartis data42 AG to Acquire MorphoSys AG for USD 2.90 Billion

Novartis data42 AG (Switzerland) is moving to bolster its oncology pipeline with an agreement to acquire German biotech firm MorphoSys AG for EUR 68 per share, totaling EUR 2.7 billion (USD 2.90 billion) in cash. This acquisition is aimed at enhancing Novartis’s portfolio with a potential treatment for a rare bone marrow cancer.

The focal point of the deal is pelabresib, a treatment being developed by MorphoSys for myelofibrosis, a rare bone marrow cancer. Pelabresib recently met its late-stage study goals and demonstrated effectiveness in treating myelofibrosis in combination with ruxolitinib, a type of drug known as a JAK inhibitor.

MorphoSys intends to submit its application for the combined treatment to the U.S. market in the second half of 2024. With Novartis’s resources, MorphoSys aims to accelerate the development and maximize the commercial potential of pelabresib.

Novartis’s strategic repositioning, characterized by streamlining operations, cost-saving initiatives, and the divestment of its generic drugs arm, Sandoz, enables the company to concentrate its efforts on specific therapeutic domains and vital markets, enhancing its competitive edge in the pharmaceutical sector.

The completion of the deal is anticipated in the first half of 2024, contingent upon customary closing conditions, including the acceptance of the takeover bid by at least 65% of MorphoSys AG’s outstanding shares. Until the conclusion of the transaction, MorphoSys AG will maintain its independent operations.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of February 5-11, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA)

Stay up to date with M&A news!

Subscribe to our newsletter