M&A News M&A News: Global M&A Deals Week of February 12 to 18, 2024

- M&A News

M&A News: Global M&A Deals Week of February 12 to 18, 2024

SHARE:

The Institute for Mergers, Acquisitions, and Alliances (IMAA) consistently offers the latest in weekly mergers and acquisitions news, serving as a source for M&A professionals who are keen on staying abreast of global M&A activities. Through its detailed weekly M&A news coverage, IMAA highlights the top grossing transactions across various industries, providing a comprehensive snapshot of the corporate world’s evolving landscape. This overview aims to shed light on the dynamic and significant movements within the mergers and acquisitions sector, offering insights into the strategic deals that shape the global market’s direction.

Between February 12 and February 18, the global market saw 424 Mergers and Acquisitions (M&A) deals, totaling USD 52.66 billion. Among these, 12 transactions surpassed the USD 500 million mark, aggregating to USD 46.73 billion, representing approximately 89% of the total deal value for the week.

The highlight deal was Diamondback’s proposed USD 26 billion acquisition of Endeavor Energy Resources. This deal underscores a trend of significant consolidations in the US Oil & Gas sector as companies strategically position themselves for future drilling opportunities and cost efficiencies. Other notable transactions include Exxon Mobil Corp.’s USD 60 billion acquisition of Pioneer Resources, Chevron Corp.’s USD 53 billion purchase of Hess Corp., and Occidental Petroleum Corp.’s USD 10.8 billion agreement to buy CrownRock LP, all occurring over the past four months. Despite global efforts to transition away from fossil fuels, the demand for oil remains robust, with consumption projected to increase through 2030.

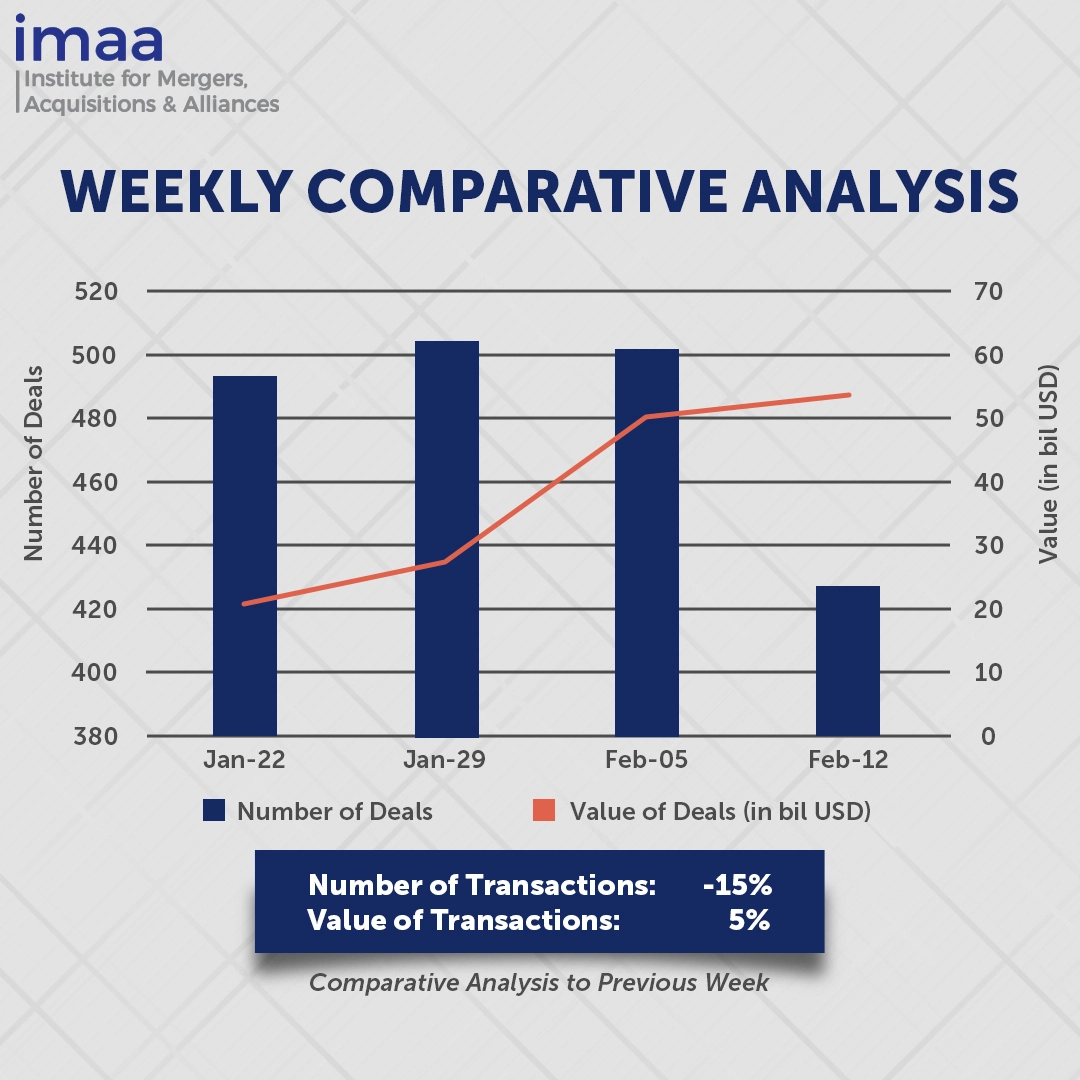

A week-on-week analysis reveals a 15% decrease in the number of deals compared to the previous week, declining from 501 to 424. Conversely, the total deal value experienced a 5% increase, climbing from USD 50.09 billion to USD 52.66 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of February 12 – 18, 2024 in detail:

Deal No. 1: Diamondback Energy, Inc. to Acquire Endeavor Energy Resources, LP for USD 26.00 Billion

Deal No. 2: Renesas Electronics Corporation to Acquire Altium Limited for USD 5.90 Billion

Deal No. 3: Gilead Sciences, Inc. to Acquire CymaBay Therapeutics, Inc. for USD 4.30 Billion

Deal No. 4: Martin Marietta Materials, Inc. to Acquire 20 Active Aggregates Operations in Alabama, South Carolina, South Florida, Tennessee, and Virginia for USD 2.05 Billion

Deal No. 5: Believe Founder and CEO Denis Ladegaillerie, EQT, and TCMI Inc. to Acquire Believe S.A. for USD 1.64 Billion

Deal No. 1:

Diamondback Energy, Inc. to Acquire Endeavor Energy Resources, LP for USD 26.00 Billion

Diamondback (United States) has unveiled its plan to acquire Endeavor Energy Partners (United States), the largest privately held oil and gas producer in the Permian Basin, in a deal valued at about USD 26 billion, including debt. The acquisition will be structured as a cash-and-stock transaction, with approximately 117.3 million shares of Diamondback common stock and USD 8 billion in cash.

Upon completion of the acquisition, Diamondback’s shareholders will possess approximately 60.5% ownership in the newly merged company, while Endeavor’s shareholders will retain the remaining 39.5%. The strategic move positions the combined entity as the third-largest oil and gas producer in the Permian Basin, trailing industry giants Exxon Mobil and Chevron.

The merger is a calculated effort to establish a notable North American independent oil company, capitalizing on the synergy between Diamondback and Endeavor’s assets for enhanced crude production efficiency. The merged company is anticipated to have a combined pro forma scale of approximately 838,000 net acres and 816,000 barrels of oil equivalent per day (BOE/d) in net production. Annual synergies from the merger are projected to reach USD 550 million, contributing to over USD 3 billion in net value over the next decade.

The transaction is slated to conclude in the fourth quarter of 2024. Leading the financial advisory roles are Jefferies LLC for Diamondback and J.P. Morgan Securities LLC for Endeavor.

Deal No. 2:

Renesas Electronics Corporation to Acquire Altium Limited for USD 5.90 Billion

Renesas Electronics, a prominent Japanese chip manufacturer known for supplying chips to major players in the global automotive industry like Toyota and Nissan, is poised to expand its horizons through the acquisition of Altium, a leading Australian PCB Design Software firm. The deal, valued at AUS 9.1 billion (USD 5.9 billion) in cash, underscores Renesas’ strategic drive to diversify its business operations.

The acquisition marks a strategic convergence of Altium’s advanced cloud platform capabilities with Renesas’ robust suite of embedded solutions, encompassing high-performance processors, analog, power, and connectivity components. This move aims to strengthen Renesas’ financial position and deliver value to shareholders by advancing its digitalization strategy. The transaction is projected to contribute to earnings immediately, with potential revenue and cost synergies anticipated post-transaction.

Altium boasts a commendable financial track record, raking in USD 263 million in revenue, with a 36.5% EBITDA margin and 77% recurring revenue. This solidifies Altium’s position as an attractive asset for Renesas.

For Renesas, the acquisition of Altium marks its fourth significant deal since 2017, indicative of its proactive stance towards expanding its presence in lucrative sectors such as data centers and consumer electronics.

The completion of the acquisition is scheduled for the second half of 2024.

Deal No. 3:

Gilead Sciences, Inc. to Acquire CymaBay Therapeutics, Inc. for USD 4.30 Billion

Gilead Sciences, Inc. (United States) has set its sights on bolstering its liver portfolio through the strategic acquisition of Drugmaker CymaBay Therapeutics, Inc (United States). In a landmark deal, Gilead will procure CymaBay for a substantial USD 32.50 per share in cash, amounting to a total equity value reaching USD 4.3 billion.

A key asset in this acquisition is CymaBay’s leading experimental drug, seladelpar. Projections suggest that seladelpar could achieve sales of USD 1.9 billion by 2029. This promising drug candidate has demonstrated its ability to regulate crucial metabolic and liver disease pathways. This acquisition seamlessly complements Gilead’s existing liver-focused product portfolio, reflecting its steadfast dedication to delivering groundbreaking medications to patients worldwide.

The transaction is poised to conclude in the initial quarter of 2024. Gilead has enlisted the expertise of BofA Securities, Inc. and Guggenheim Securities, LLC as financial advisors, while Centerview Partners LLC and Lazard are serving as financial advisors to CymaBay.

Deal No. 4:

Martin Marietta Materials, Inc. to Acquire 20 Active Aggregates Operations in Alabama, South Carolina, South Florida, Tennessee, and Virginia for USD 2.05 Billion

Martin Marietta Materials, Inc. (United States) is set to acquire 20 construction aggregates operations from Blue Water (United States) in a substantial USD 2.05 billion cash transaction, solidifying its standing as one of the foremost aggregate producers in the United States.

The acquisition encompasses operations situated in Alabama, South Carolina, South Florida, Tennessee, and Virginia. Aggregates, essential raw materials sourced from pits and quarries, including sand, gravel, and crushed stones, serve as fundamental components in construction projects.

These transformative transactions will diversify Martin Marietta’s product portfolio and fortify its margin profile. The transactions are designed to enhance the company’s resilience throughout economic cycles while fostering future growth opportunities, both through acquisitions and organic expansion, while maintaining financial flexibility. Furthermore, this expansion complements Martin Marietta’s existing footprint in the southeast region and opens doors to new markets.

In conjunction with the recent acquisition of Albert Frei & Sons, Inc. in Colorado, these deals secure access to approximately 1 billion tons of proven, high-quality reserves and are anticipated to generate in excess of USD 180 million in annualized EBITDA.

The completion of the Blue Water acquisition is slated for later this fiscal year, pending regulatory approvals and customary closing conditions.

Deal No. 5:

Believe Founder and CEO Denis Ladegaillerie, EQT, and TCMI Inc. to Acquire Believe S.A. for USD 1.64 Billion

A consortium comprised of Denis Ladegaillerie, the Founder and CEO of Believe S.A., alongside EQT (Sweden) and TCMI Inc. (TCV) from the United States, has announced its intention to acquire the French music company, Believe. The consortium’s offer places a valuation of EUR 1.523 billion (USD 1.64 billion) on Believe’s entire share capital, which is calculated based on the outstanding 101,547 million shares.

The consortium plans to acquire shares representing a total of 71.92% of Believe’s share capital in the initial transaction. Subsequent to these acquisitions, the Consortium will initiate a mandatory tender offer, setting the cash price at 15 euros per share.

Believe SA serves over 1.3 million independent artists globally, offering comprehensive solutions in marketing, artist development, production, publishing, branding, live events, and financing. The company operates in more than 50 countries and collaborates with over 150 digital streaming providers, including Spotify, YouTube, Apple Music, and Amazon. Through this partnership with the Consortium, Believe aims to leverage robust operational and financial support to continue its growth trajectory.

The completion of the acquisition of shares is anticipated to occur in the second quarter of 2024.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of February 12-18, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter