M&A News M&A News: Global M&A Deals Week of February 19 to 25, 2024

- M&A News

M&A News: Global M&A Deals Week of February 19 to 25, 2024

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) offers insightful weekly updates on mergers and acquisitions news, meticulously compiling the most recent M&A activities globally. These updates serve as a critical resource for M&A professionals and enthusiasts alike, keen to stay informed on the latest developments in the world of corporate mergers and acquisitions. By highlighting key transactions and identifying emerging trends, IMAA’s weekly M&A news coverage is an invaluable tool for understanding the complex dynamics of the global M&A marketplace.

For the week spanning February 19 to February 25, the global market recorded 409 Mergers and Acquisitions (M&A) transactions, totaling USD 60.56 billion. Among these, 10 transactions exceeded the USD 500 million mark, contributing to a combined value of USD 55.11 billion, accounting for approximately 91% of the total deal value for the week.

The standout deal during this period is Capital One Financial Corporation’s proposed acquisition of Discover Financial Services, valued at USD 35.3 billion. This deal occurs amidst increased pressure on Discover, including regulatory scrutiny, particularly concerning competition in the U.S. credit card market.

Another significant development was Polymetal’s decision to divest its business interests in Russia, echoing Yandex NV’s recent announcement to shed its Russian operations earlier in the month, both moves being prompted by imposed sanctions.

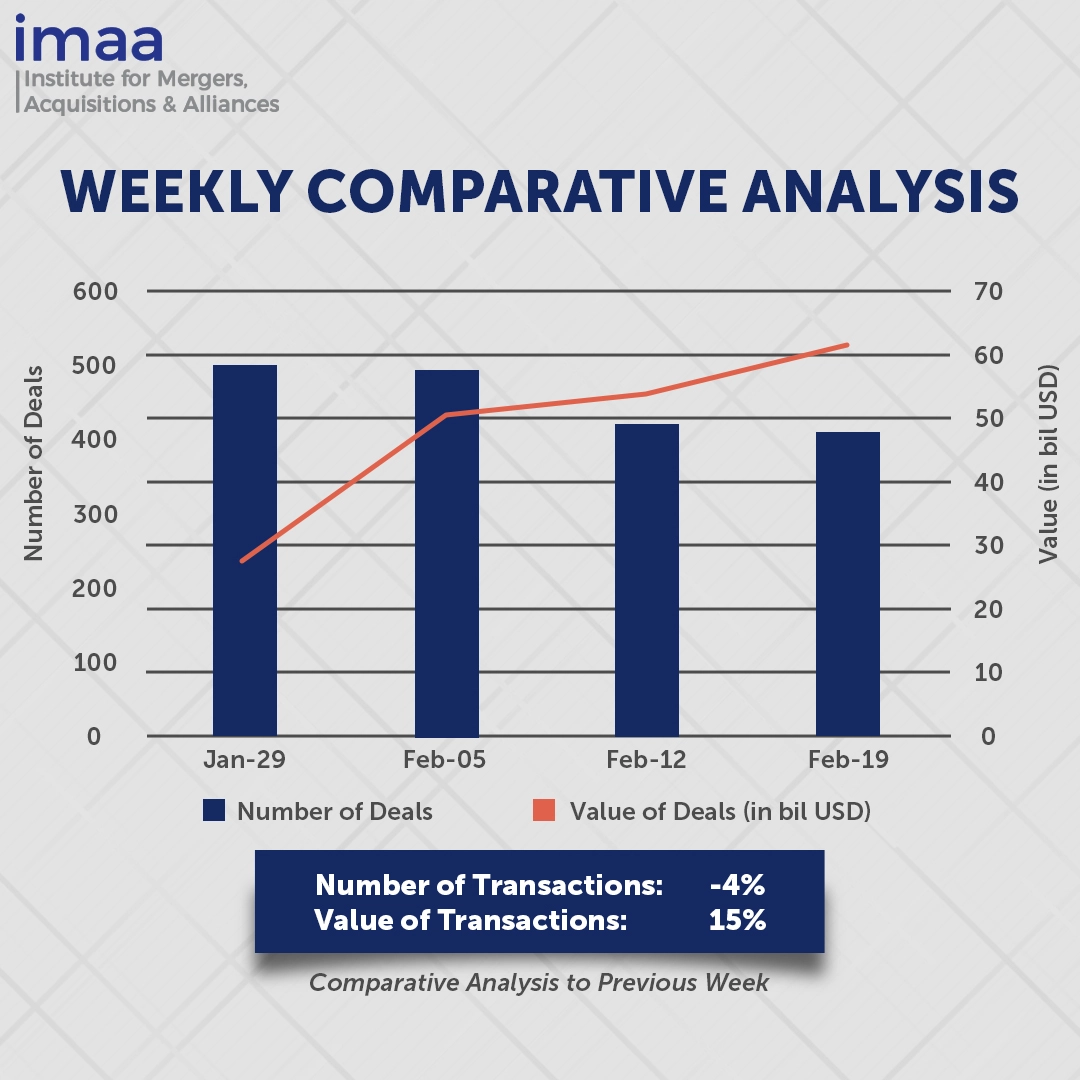

A comparative analysis from the previous week reveals a marginal 4% decline in the number of deals, decreasing from 424 to 409. However, there was a contrasting 15% surge in the total deal value, rising from USD 52.66 billion to USD 60.56 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of February 19 – 25, 2024 in detail:

Deal No. 1: Capital One Financial Corporation to Acquire Discover Financial Services for USD 35.34 Billion

Deal No. 2: Chord Energy Corporation to Acquire Enerplus Corporation for USD 3.80 Billion

Deal No. 3: Mangazeya Mining LLC to Acquire Joint Stock Company Polymetal for USD 3.69 Billion

Deal No. 4: Compagnie de Saint-Gobain S.A. to Acquire CSR Limited for USD 2.80 Billion

Deal No. 5: Walmart Inc. to Acquire VIZIO Holding Corp. for USD 2.30 Billion

Deal No. 1:

Capital One Financial Corporation to Acquire Discover Financial Services for USD 35.34 Billion

Capital One (United States) is set to acquire Discover Financial Services (United States) in an all-stock deal valued at USD 35.34 billion, representing a significant development in the financial sector. The merger aims to expand Capital One’s credit card offerings and deposit base, establishing the company as the largest US credit card issuer by loan volume. The combined entity is expected to encompass 70 million merchant acceptance points across over 200 countries and territories, catering to more than 100 million customers. This transaction stands out as the largest M&A activity in 2024, by far.

In addition to enlarging its market presence, the merger is expected to provide Capital One with a new revenue stream through merchant fees. Projections indicate that the consolidation will generate expense synergies of USD 1.5 billion by 2027, along with a respectable return on invested capital of 16% within the same timeframe.

Post-closure, Capital One shareholders will hold approximately 60% ownership, while Discover shareholders will retain about 40% ownership in the merged company.

The transaction is scheduled to conclude in late 2024 or early 2025. Centerview Partners LLC advised Capital One, while PJT Partners and Morgan Stanley & Co. LLC served as financial advisors to Discover, facilitating a well-guided and strategically sound merger process.

Deal No. 2:

Chord Energy Corporation to Acquire Enerplus Corporation for USD 3.80 Billion

US-based energy firm Chord Energy has announced its plans to acquire Calgary-based Enerplus, in a transaction valued at USD 3.80 billion, comprising cash and stock components. The merger positions the combined entity as a dominant player in the Williston Basin, boasting extensive, cost-efficient resources spanning approximately 1.30 million net acres. With a consolidated fourth-quarter 2023 production reaching 287 MBoepd and a heightened capacity for generating free cash flow, the company is strategically primed to reinvest in its operations and reward shareholders.

Upon completion, shareholders of Chord and Enerplus will hold ownership stakes of approximately 67% and 33%, respectively, in the merged entity. The transaction arrives amidst a backdrop of increasing efforts among drillers to secure future drilling opportunities and optimize operational efficiency.

The acquisition is anticipated to finalize by mid-year 2024. Citi leads the financial advisory team for Chord, with Wells Fargo Securities, LLC, and J.P. Morgan Securities LLC also providing financial counsel. Evercore spearheads the financial advisory efforts for Enerplus, complemented by BMO Capital Markets and CIBC Capital Markets serving as co-financial advisors.

Deal No. 3:

Mangazeya Mining LLC to Acquire Joint Stock Company Polymetal for USD 3.69 Billion

Polymetal is set to divest its Russian arm, Polymetal JSC (Russia), in a deal worth USD 3.69 billion with Siberian gold miner Mangazeya Plus Company, a division of Sergei Yanchukov’s Mangazeya Mining. As a result, Polymetal International will no longer be counted among the world’s top 10 gold miners.

The deal, finalized under the shadows of the Ukraine conflict, reflects the challenging circumstances that compelled Polymetal to sell its Russian assets, which fell under U.S. sanctions in 2023. These assets have been the backbone of Polymetal’s operations, contributing approximately 70% of its production and over 50% of its core earnings.

Despite the divestiture, Polymetal International will continue its operations as Kazakhstan’s second-largest gold producer. Following the completion of the transaction, the company plans to utilize USD 1.15 billion of dividends received to settle intra-group debt. With a strategic focus on robust cash flow generation and maintaining a resilient balance sheet, Polymetal International aims to explore growth prospects in Kazakhstan and select Central Asian regions.

The deal is projected to conclude by the end of Q1 2024, marking a strategic shift for Polymetal International and Mangazeya Plus.

Deal No. 4:

Compagnie de Saint-Gobain S.A. to Acquire CSR Limited for USD 2.80 Billion

French construction materials group Saint-Gobain is in the process of acquiring Australian rival CSR Limited for AUD 4.30 billion (USD 2.80 billion). This move aligns with the industry trend of consolidation, driven by a shift towards more sustainable materials and an interest in entering the Australian market.

Should the acquisition proceed, it would enable Saint-Gobain to diversify its portfolio and enhance growth prospects in the residential and commercial building products sectors across Australia and New Zealand.

CSR Limited’s Board has unanimously decided to pursue the offer, and Saint-Gobain is currently undergoing final confirmatory due diligence. The completion of the transaction is not assured at this stage, and Saint-Gobain remains committed to keeping the market duly informed regarding the ongoing progress.

Deal No. 5:

Walmart Inc. to Acquire VIZIO Holding Corp. for USD 2.30 Billion

Walmart, the largest US retailer, has agreed to acquire Vizio (United States), a well-known TV maker, in a deal valued at USD 2.30 billion or USD 11.50 per share in cash. This acquisition is aimed at strengthening Walmart’s advertising business and enhancing its competitiveness against Amazon’s ad business.

Walmart has been a significant seller of Vizio devices, and this acquisition underscores its intention to leverage Vizio’s SmartCast Operating System. This system enables users to access free ad-supported content on their TVs, presenting Walmart with an opportunity to bolster its advertising business. By integrating Vizio’s technology, Walmart expects to expand its advertising reach and offer advertisers a more comprehensive platform to engage with consumers.

The acquisition aligns with Walmart’s strategy to diversify revenue streams beyond its core retail operations. By capturing a larger share of brands’ advertising expenditure, Walmart aims to complement its low-margin retail business with higher-margin advertising revenue.

Following the completion of the acquisition, VIZIO’s Class A common stock will no longer be publicly listed, indicating Walmart’s consolidated control over the company’s operations.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of February 19-25, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter