M&A News M&A News: Global M&A Deals Week of February 26 to March 3, 2024

- M&A News

M&A News: Global M&A Deals Week of February 26 to March 3, 2024

SHARE:

The Institute for Mergers, Acquisitions, and Alliances (IMAA) provides weekly mergers and acquisitions news updates, including the top global M&A deals. These updates give M&A professionals a clear view of the latest trends and significant transactions in the corporate world, making it easier to keep up with the fast-paced nature of global mergers and acquisitions.

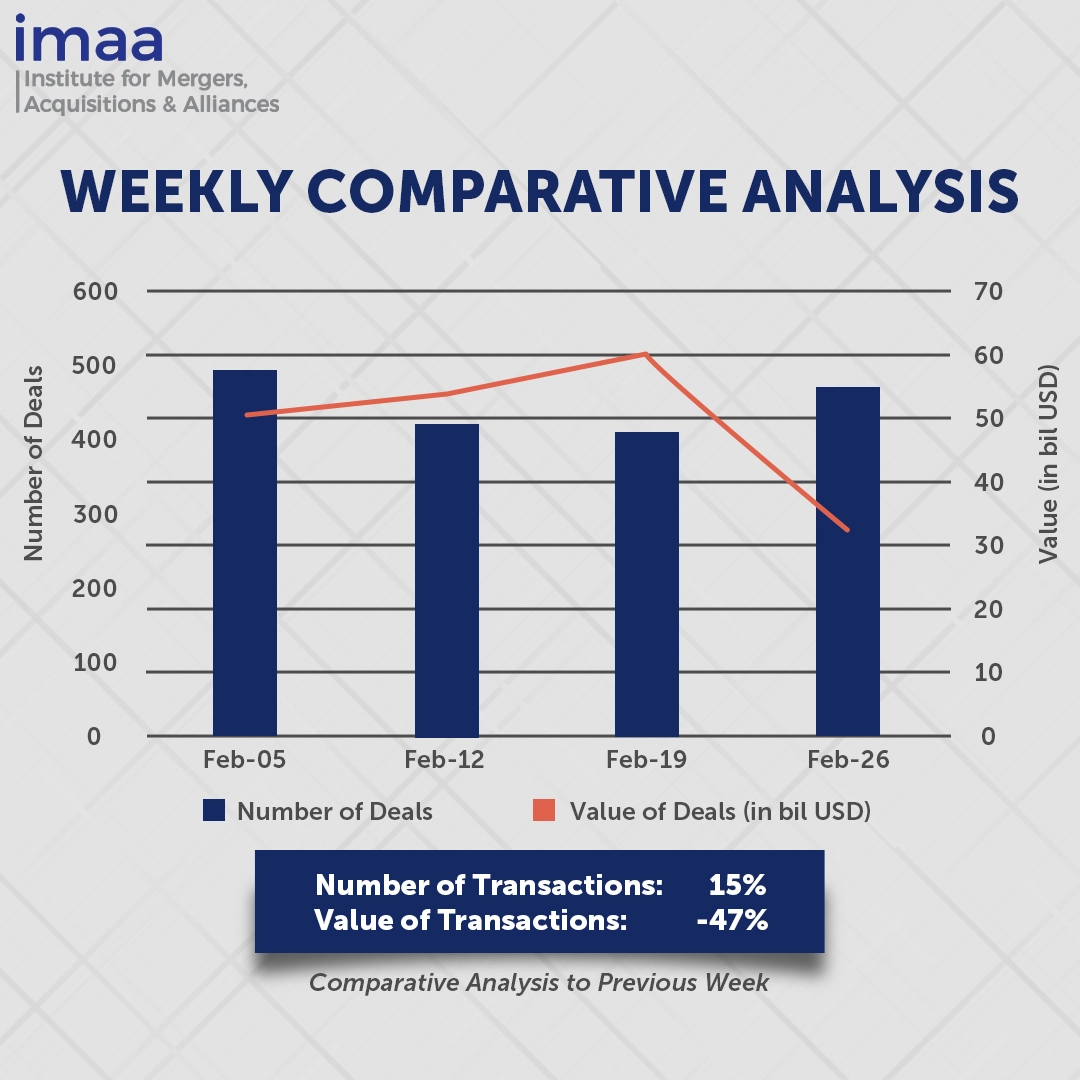

During the week from February 26 to March 3, the global market saw 471 Mergers and Acquisitions (M&A) transactions, totaling USD 32.05 billion. Thirteen transactions exceeded the USD 500 million mark, contributing to a combined value of USD 23.79 billion, accounting for approximately 74% of the total deal value for the week.

The highlighted deal during this period is New Mountain Capital’s proposed acquisition of R1 RCM Inc., valued at USD 5.80 billion. However, some investors argue that New Mountain’s proposed price of USD 13.75 a share undervalues RCM, considering the company’s long-term earnings projections. New Mountain has been exploring a buyout of R1 since at least late January. Shares in R1 have been underperforming in the public markets since late 2022, sparking speculation that the company could thrive better as a privately owned operator.

A week-on-week analysis indicates a 15% increase in the number of deals, rising from 409 to 471. However, there was a significant 47% decline in the total deal value, dropping from USD 60.56 billion to USD 32.05 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of February 26 – March 3, 2024 in detail:

Deal No. 1: New Mountain Capital to Acquire R1 RCM Inc. for USD 5.82 Billion

Deal No. 2: KKR & Co. Inc. to Acquire End-User Computing Division of Broadcom Inc. for USD 4.00 Billion

Deal No. 3: MNC Capital Partners, L.P. to Acquire Vista Outdoor Inc. for USD 2.90 Billion

Deal No. 4: First Advantage Corporation to Acquire Sterling Check Corp. for USD 2.22 Billion

Deal No. 5: Golden Energy and Resources Limited and M Resources Pty Ltd to Acquire Illawarra Metallurgical Coal for USD 1.65 Billion

Deal No. 1:

New Mountain Capital to Acquire R1 RCM Inc. for USD 5.82 Billion

Private equity firm New Mountain Capital, L.L.C (United States) has proposed an acquisition bid totaling approximately USD 5.82 billion, equating to USD 13.75 per share, to take control of Healthcare IT firm R1 RCM Inc. (United States).

With a substantial stake amounting to nearly one-third of R1’s shares, New Mountain Capital stands as the firm’s second-largest investor.

Headquartered in Utah, R1 specializes in leveraging technology to enhance the overall patient experience and financial performance of healthcare providers. With a substantial client base of over 1,000 organizations nationwide, encompassing more than 27,000 providers, R1 orchestrates approximately 60 million patient and clinician engagements annually.

While discussions are currently underway, it remains uncertain whether these talks will culminate in a finalized transaction. Notably, some investors have voiced concerns, contending that the proposed offer undervalues the company significantly.

Deal No. 2:

KKR & Co. Inc. to Acquire End-User Computing Division of Broadcom Inc. for USD 4.00 Billion

KKR & co. Inc. (United States) has announced its intention to acquire Broadcom Inc.’s End-User Computing Division (United States) in a deal valued at around USD 4.00 billion. Following the transaction’s closure, the End-User Computing Division (EUC Division) will transition into an independent entity, poised to leverage enhanced access to growth capital and a renewed strategic emphasis on empowering customers and partners globally through cutting-edge digital workspace solutions.

Originally a part of VMware before its acquisition by Broadcom, the EUC Division has earned recognition for its comprehensive suite of digital workspace solutions. Among its standout offerings are Horizon and Workspace ONE, acclaimed for their leadership in desktop and application virtualization, as well as Unified Endpoint Management (UEM) for enterprises.

As part of the transition, the EUC Division will adopt KKR’s comprehensive employee ownership program, fostering a sense of ownership among all employees within their respective roles alongside KKR.

The anticipated closure of the transaction is slated for 2024. Evercore, Deutsche Bank Securities Inc., and Jefferies LLC are advising KKR on financial matters, while Citi serves as the exclusive financial advisor to Broadcom.

Deal No. 3:

MNC Capital Partners, L.P. to Acquire Vista Outdoor Inc. for USD 2.90 Billion

Sporting-goods powerhouse Vista Outdoor Inc. (United States) has attracted a takeover proposal from Investment firm MNC Capital Partners, L.P. offering USD 35 per share in cash, totaling USD 2.90 billion.

Vista Outdoor boasts a diverse portfolio, encompassing over three dozen esteemed brands known for their excellence in designing, manufacturing, and marketing sporting and outdoor products. Notable brands under its purview include Bushnell, CamelBak, Bushnell Golf, Foresight Sports, Fox Racing, Bell Helmets, Camp Chef, Giro, Simms Fishing, QuietKat, Stone Glacier, Federal Ammunition, Remington Ammunition, among others.

In response, Vista Outdoor’s Board of Directors is meticulously evaluating the MNC proposal, mindful of their fiduciary responsibilities and existing commitments tied to a merger agreement with CSG. Previously, Vista had been engaged in negotiations with Czech defense enterprise Czechoslovak Group, contemplating the sale of its sporting goods arm for USD 1.91 billion.

Morgan Stanley & Co. LLC has been appointed as the exclusive financial adviser to Vista Outdoor, while Swaine & Moore LLP serves as its legal adviser throughout this process.

Deal No. 4:

First Advantage Corporation to Acquire Sterling Check Corp. for USD 2.22 Billion

First Advantage Corporation (United States), a renowned leader in employment background screening and identity verification solutions, has announced its acquisition of rival Sterling Check Corp. (United States) in a cash and stock transaction valued at USD 2.22 billion, inclusive of debt.

Bringing together First Advantage and Sterling signifies a strategic alignment of complementary technology solutions and services. Their combined offerings cater to employers across diverse sectors such as healthcare, retail & e-commerce, transportation, manufacturing, financial services, and more, empowering them to effectively manage risks and recruit top-tier talent.

The deal is projected to generate at least USD 50 million in run-rate synergies, translating to immediate double-digit EPS accretion on a run-rate synergy basis. Furthermore, the consolidated entity will enjoy enhanced revenue diversification across customer segments, industries, and geographical regions. This will mitigate seasonality risks and optimize resource allocation and operational efficiency.

Following the transaction’s closure, First Advantage shareholders are anticipated to possess approximately 84% ownership in the merged entity, while Sterling shareholders will hold around 16%.

The completion of the acquisition is slated for the third quarter of 2024. J.P. Morgan Securities LLC has served as the primary financial advisor to First Advantage, with Goldman Sachs & Co. LLC and Citigroup Global Markets Inc. acting as financial advisors to Sterling.

Deal No. 5:

Golden Energy and Resources Limited and M Resources Pty Ltd to Acquire Illawarra Metallurgical Coal for USD 1.65 Billion

South32 is in the process of selling Illawarra Metallurgical Coal (Australia) to Golden Energy and Resources Pte Ltd (Singapore) and M Resources Pty Ltd (Australia) in a significant transaction valued at USD 1.65 billion. This comprises an upfront and deferred cash consideration totaling USD 1.30 billion, coupled with contingent price-linked considerations potentially reaching USD 350 million.

Illawarra is a longwall mining operation that produces around 5 million metric tons per year. The sale also includes South32’s 16.67% shareholding in Port Kembla Coal Terminal, Ltd., located near Wollongong. Illawarra Metallurgical Coal is known for producing high-quality metallurgical coal essential for steel production and will continue its operations under the new ownership.

Golden Energy and Resources and M Resources are recognized for their commitment to environmental and safety standards and are expected to sustain the coal’s contribution to the local steel industry and the regions of Illawarra and Macarthur.

This strategic move aligns with South32’s overarching vision to realign its portfolio towards commodities indispensable for the global transition to a low-carbon economy, thereby amplifying shareholder value.

The transaction is anticipated to be completed in H1 FY25. Upon completion, the buyer will assume economic and operating control of Illawarra Metallurgical Coal, along with all current and future liabilities. BofA Securities and Herbert Smith Freehills have been appointed as financial and legal advisers, respectively, for South32.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of February 26 to March 3, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter