M&A News M&A News: Global M&A Deals Week of March 4 to 10, 2024

- M&A News

M&A News: Global M&A Deals Week of March 4 to 10, 2024

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

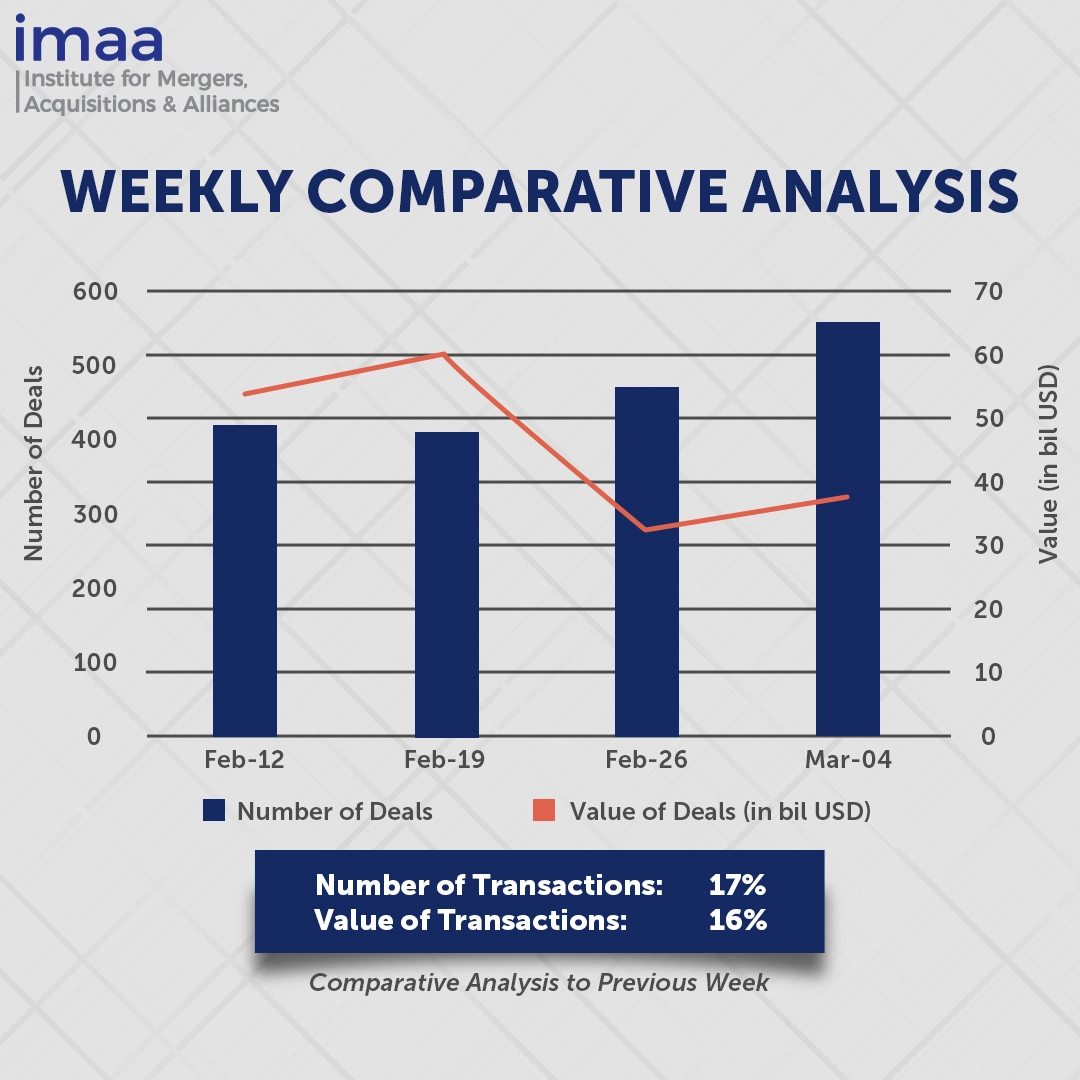

During the week of March 4th to March 10th, the global market recorded 549 Mergers and Acquisitions (M&A) transactions, collectively valued at USD 37.06 billion. Among these, 16 transactions surpassed the USD 500 million threshold, contributing to a combined value of USD 29.11 billion, constituting approximately 79% of the total deal value for the period.

A notable deal during this period involved Mondi plc’s proposed acquisition of DS Smith plc, valued at USD 6.5 billion. This move by Mondi signifies the industry’s second recent multi-billion-dollar consolidation effort within the paper and packaging sector, following Smurfit Kappa’s acquisition of WestRock Co. for USD 11.2 billion announced last September.

Comparing week-on-week data reveals a 17% increase in the number of deals, rising from 471 to 549. Similarly, the total deal value experienced a 16% boost, moving from USD 32.05 billion to USD 37.06 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of March 4 – 10, 2024 in detail:

Deal No. 1: Mondi Plc to Acquire DS Smith Plc for USD 6.50 Billion

Deal No. 2: Cinven Limited to Acquire Alter Domus Participations S.à r.l., Société à responsabilité limitée for USD 5.32 Billion

Deal No. 3: Nationwide Building Society to Acquire Virgin Money UK Plc for USD 3.70 Billion

Deal No. 4: Iberdrola, S.A. to Acquire Avangrid, Inc. for USD 2.50 Billion

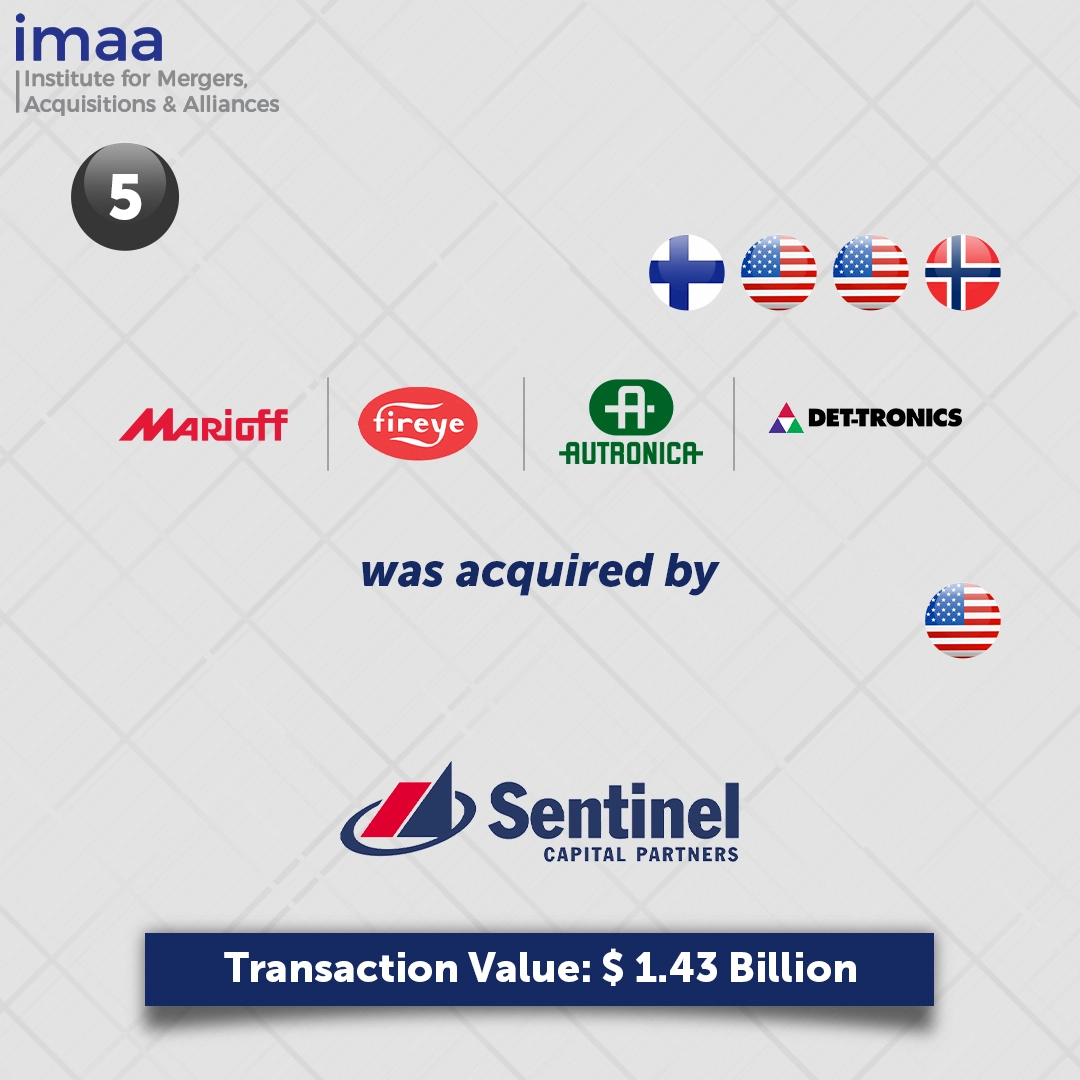

Deal No. 5: Sentinel Capital Partners, L.L.C. to Acquire Marioff Corporation Oy / Fireye / Detector Electronics Corporation / Autronica Fire and Security AS for USD 1.43 Billion

Deal No. 1:

Mondi Plc to Acquire DS Smith Plc for USD 6.50 Billion

British packaging firm Mondi Plc (United Kingdom) has proposed a GBP 5.14 billion (USD 6.50 billion) acquisition of rival DS Smith Plc (United Kingdom), aiming to create one of the world’s largest packaging companies.

Upon completion, Mondi shareholders would hold a majority stake of 54%, with DS Smith shareholders retaining 46% of the combined company.

The merger presents an opportunity to establish a leading pan-European entity in sustainable paper-based packaging solutions. Leveraging Mondi’s and DS Smith’s respective strengths across the corrugated value chain, the merger aims to optimize operations, utilizing Mondi’s efficient virgin containerboard mills, a strong converting network, and strategically located integrated recycled containerboard production facilities.

Rothschild & Co is leading the financial advisory for Mondi, while DS Smith is advised by Goldman Sachs International, Citi, and J.P. Morgan.

Deal No. 2:

Cinven Limited to Acquire Alter Domus Participations S.à r.l., Société à responsabilité limitée for USD 5.32 Billion

Private equity firm Cinven Limited (United Kingdom) has agreed to acquire a majority stake in Alter Domus, a Luxembourg-based fund administrator, in a deal valued at EUR 4.90 billion (USD 5.32 billion), inclusive of debt.

Alter Domus, a leading global fund administrator, manages assets exceeding USD 2.5 trillion, operating in 23 jurisdictions and serving 90% of the top 30 global asset managers. Since 2021, the company has seen a 54% increase in revenue and a 69% growth in Assets under Administration (AuA).

Cinven’s decision to invest in Alter Domus was driven by the latter’s strong financial performance, market leadership, and successful track record in mergers and acquisitions. This investment aligns with Cinven’s focus on opportunities in the fund services subsector.

The acquisition provides Alter Domus with a pathway for long-term strategic growth, emphasizing technology enablement and international expansion.

The deal is pending regulatory approvals and customary closing conditions, with advisory services provided by Goldman Sachs International for Alter Domus.

Deal No. 3:

Nationwide Building Society to Acquire Virgin Money UK Plc for USD 3.70 Billion

Nationwide Building Society (United Kingdom) is in talks to acquire Virgin Money UK Plc (United Kingdom) through an all-cash deal worth GBP 2.90 billion, or roughly USD 3.70 billion, marking the largest UK banking deal since the 2008 global financial crisis. If finalized, this acquisition would establish the UK’s second-largest mortgage and savings group.

Upon approval, this acquisition would mitigate competition among major banks, resulting in a formidable entity boasting a total asset value of GBP 366 billion, an extensive network of nearly 700 branches, and a customer base exceeding 23 million.

Initially, Virgin Money will function as a distinct business within Nationwide, with a gradual integration process leading to the retirement of the Virgin Money brand over the next six years.

This potential transaction aligns with the growing trend of consolidation in the retail and mortgage banking sectors, as companies seek to enhance their loan portfolios and streamline operational costs by eliminating redundancies.

Nationwide has until April 4 to present a formal offer, subject to approval by Virgin Money shareholders.

Deal No. 4:

Iberdrola, S.A. to Acquire Avangrid, Inc. for USD 2.50 Billion

Spanish utility giant Iberdrola, SA has expressed its intent to acquire the remaining 18.4% stake in its U.S. subsidiary, Avangrid, Inc. further solidifying its position in the American networks sector. At present, Iberdrola holds a majority 81.6% ownership. This strategic move aims to enhance Iberdrola’s influence in the U.S. energy landscape, particularly focusing on markets characterized by high credit ratings and regulated operations.

The proposed cash bid stands at USD 34.35 per share, totaling USD 2.50 billion.

Avangrid, based in Connecticut, currently holds assets worth USD 44 billion and operates in 24 US states. In the networks segment, Avangrid owns and operates eight electric and natural gas companies, serving over 3.3 million customers in New York and New England. Additionally, it manages a portfolio of renewable energy generation facilities across the United States.

As of now, Avangrid has not made a decision regarding Iberdrola’s proposal. In a statement, the company confirmed receiving the proposal but clarified that no formal offer has been presented or accepted.

Deal No. 5:

Sentinel Capital Partners, L.L.C. to Acquire Marioff Corporation Oy / Fireye / Detector Electronics Corporation / Autronica Fire and Security AS for USD 1.43 Billion

Carrier Global has announced the sale of its Industrial Fire Business, which comprises well-known brands Det-Tronics, Marioff, Autronica, and Fireye, to equity firm Sentinel Capital Partners (United States) for USD 1.43 billion. The business unit operates in 20 countries and employs around 1,400 individuals.

The transaction is expected to generate net proceeds of over USD 1.10 billion for Carrier, which will be utilized to reduce debt.

This move represents the latest progression in Carrier’s ongoing portfolio transformation, following recent strategic maneuvers such as the acquisition of Viessmann Climate Solutions and the impending sales agreements involving Carrier’s Global Access Solutions and Commercial Refrigeration businesses to Honeywell and Haier, respectively. The forthcoming divestiture of Carrier’s combined commercial and residential fire businesses signifies the final phase of its announced business exits.

Sentinel Capital specializes in various investment areas, including corporate divestitures and going-private transactions, primarily within the United States and Canada, making it a fitting partner for Carrier’s divestiture endeavors.

The transaction is slated for closure in the third quarter of 2024.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of March 4 – 10, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter