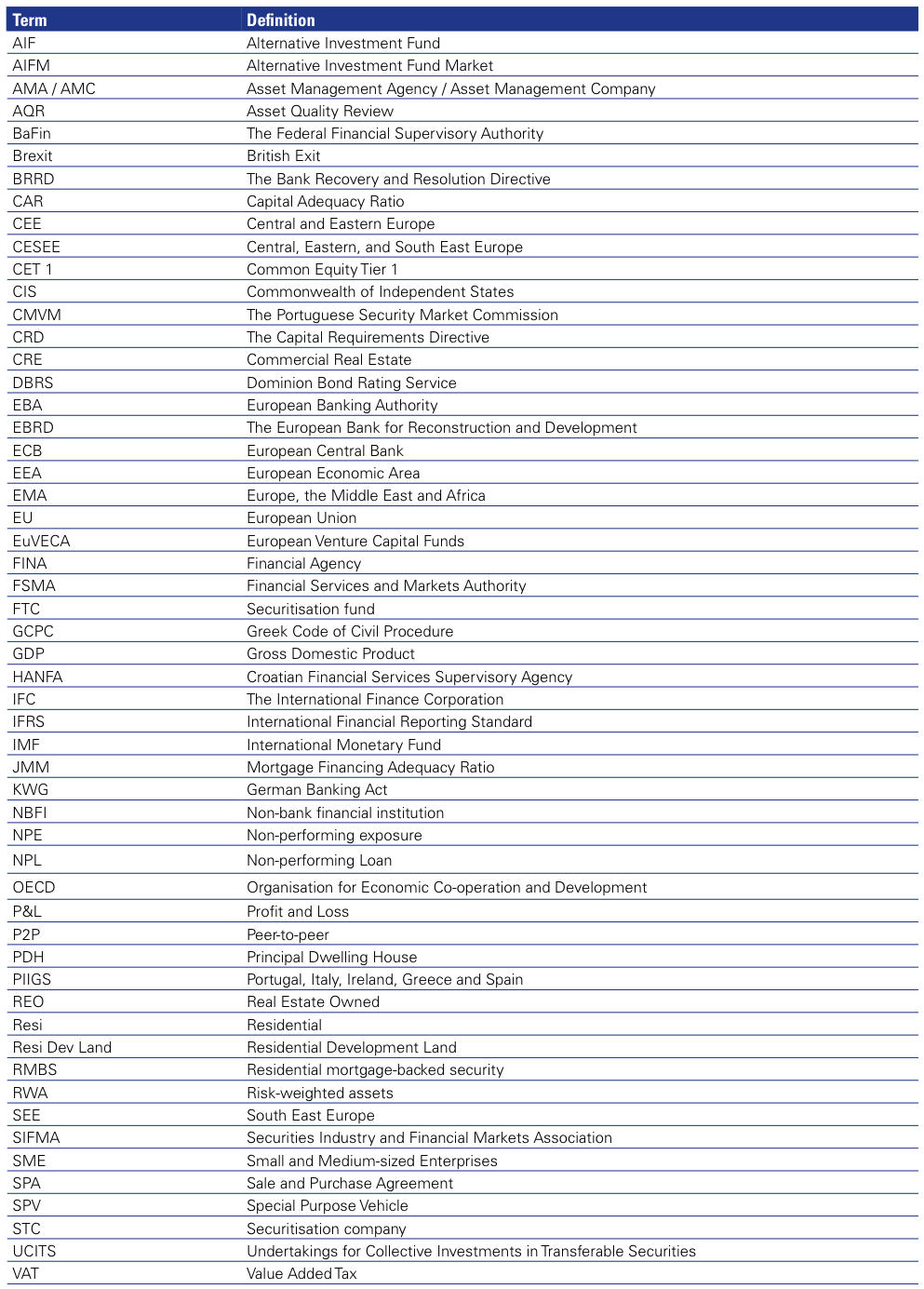

By Andrew Jenke, Nicholas Colman – KPMG

Foreword

Welcome to KPMG’s European Debt Sales 2016 report. In this report, we identify and discuss those key topics relevant to the European bank deleveraging landscape that we think will take centre stage in 2016. We also take a look back to see how the loan sale markets performed in 2015 across more than twenty countries across Europe.

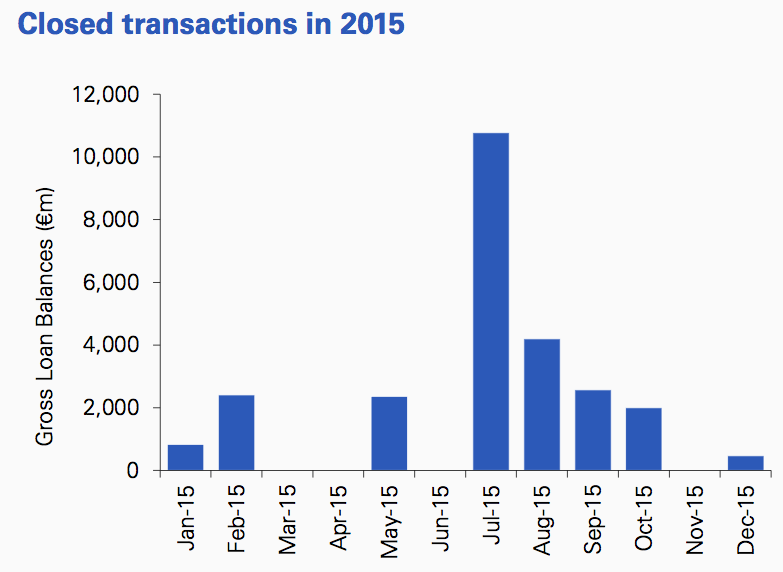

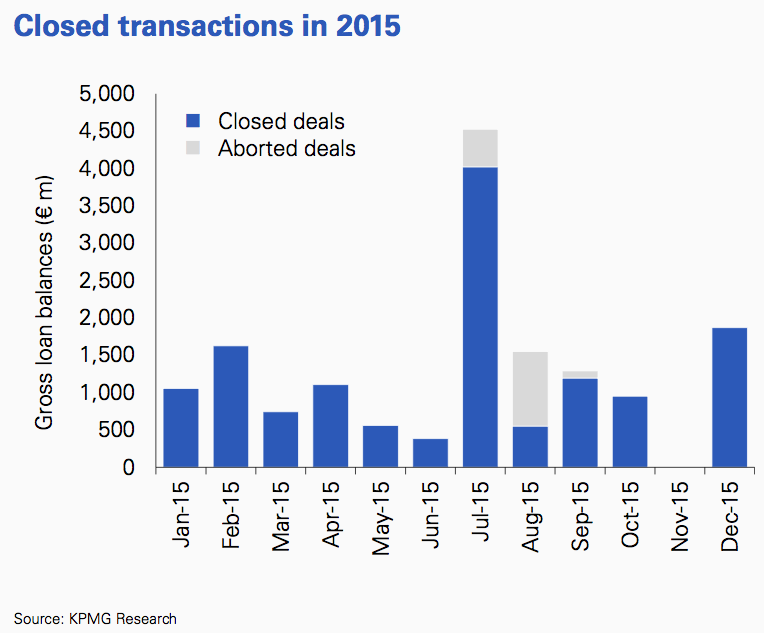

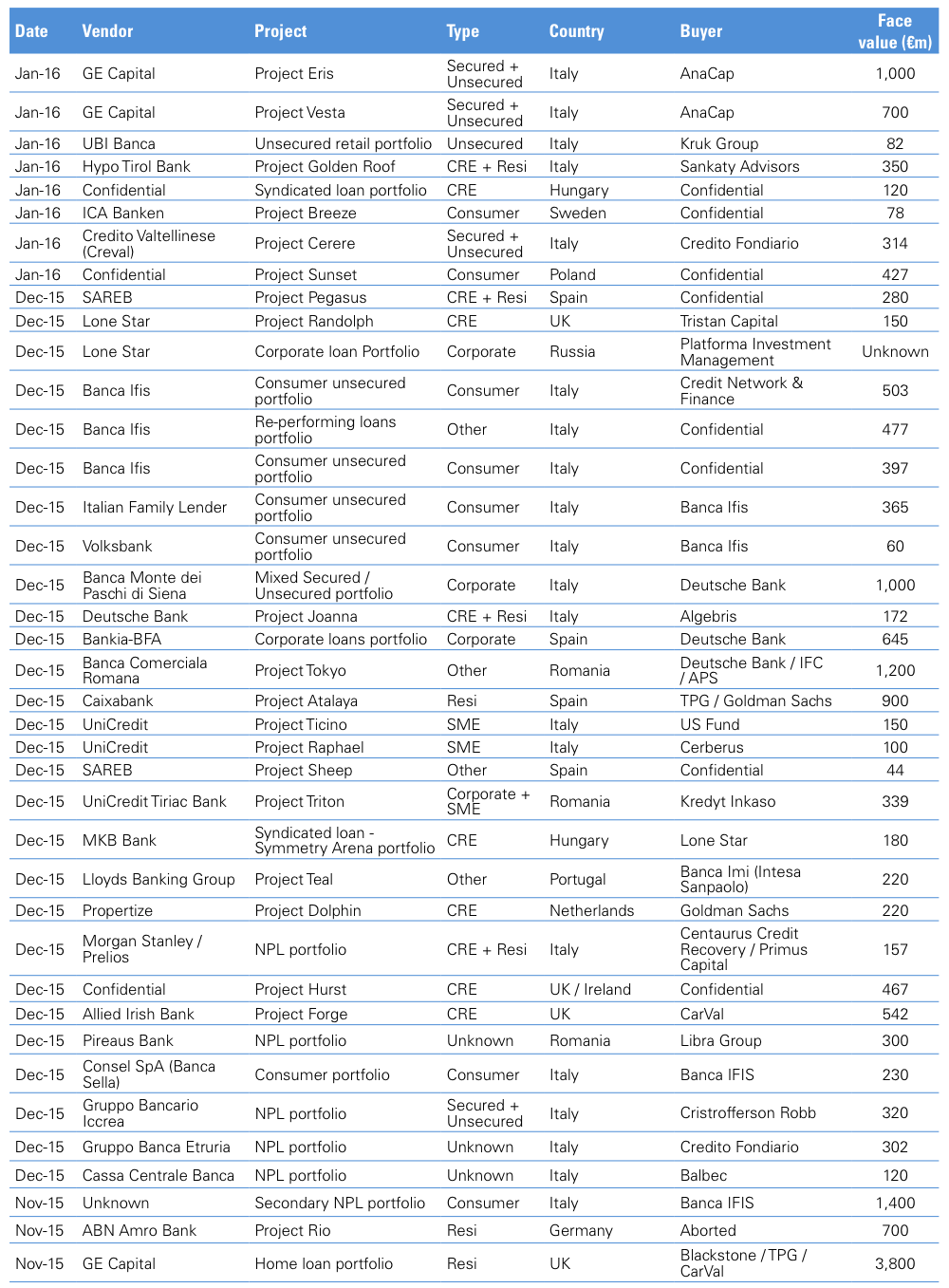

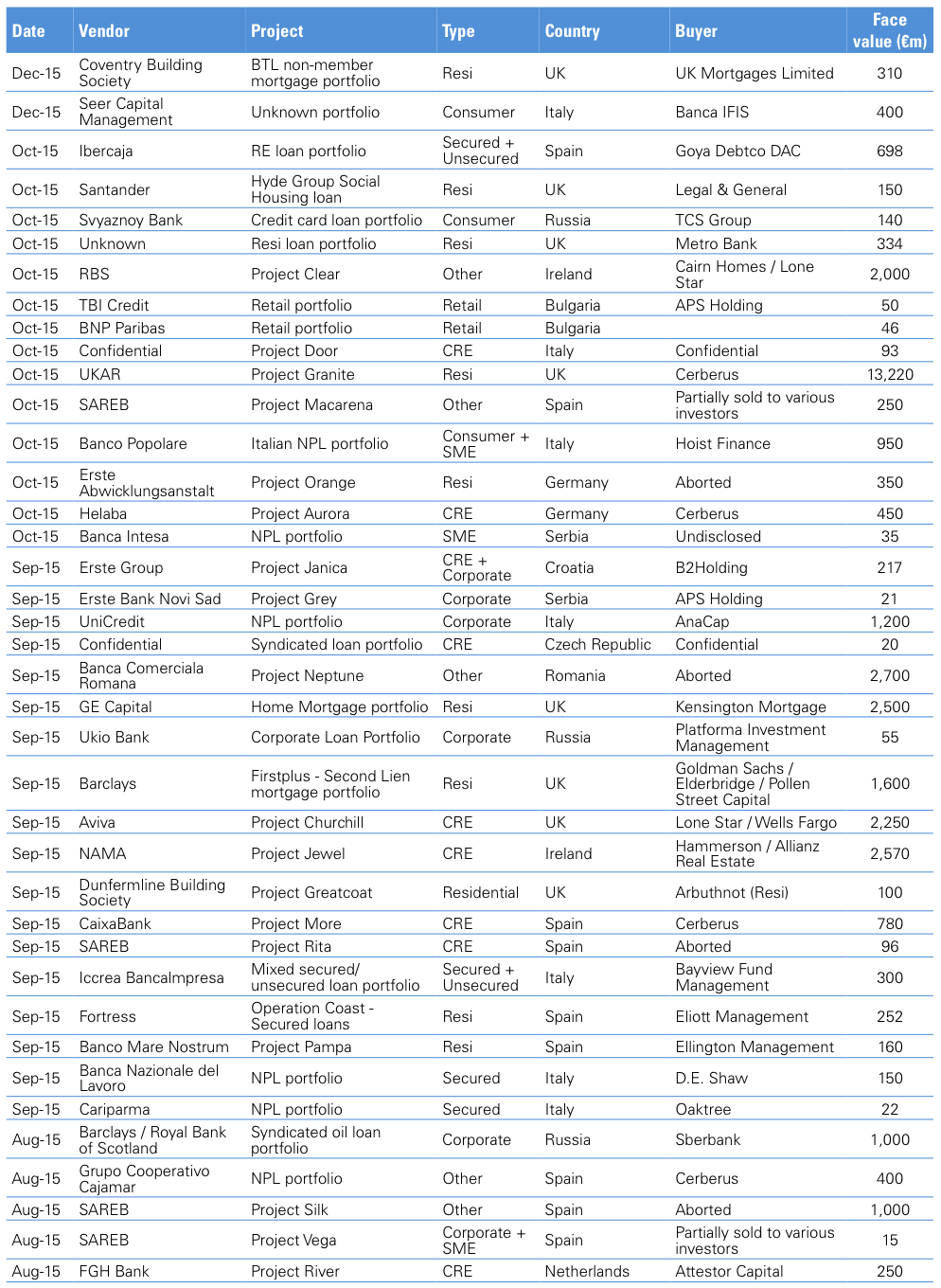

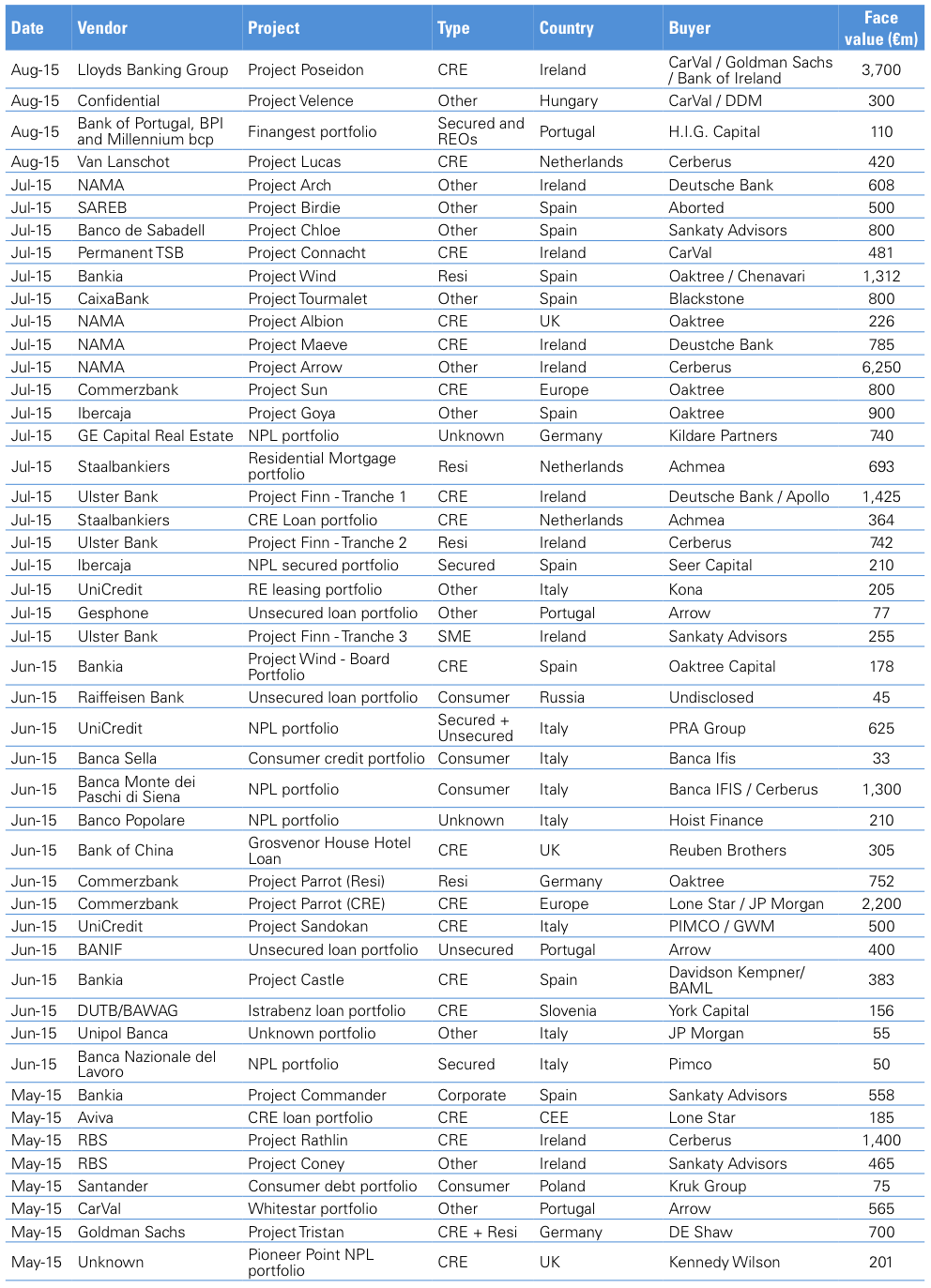

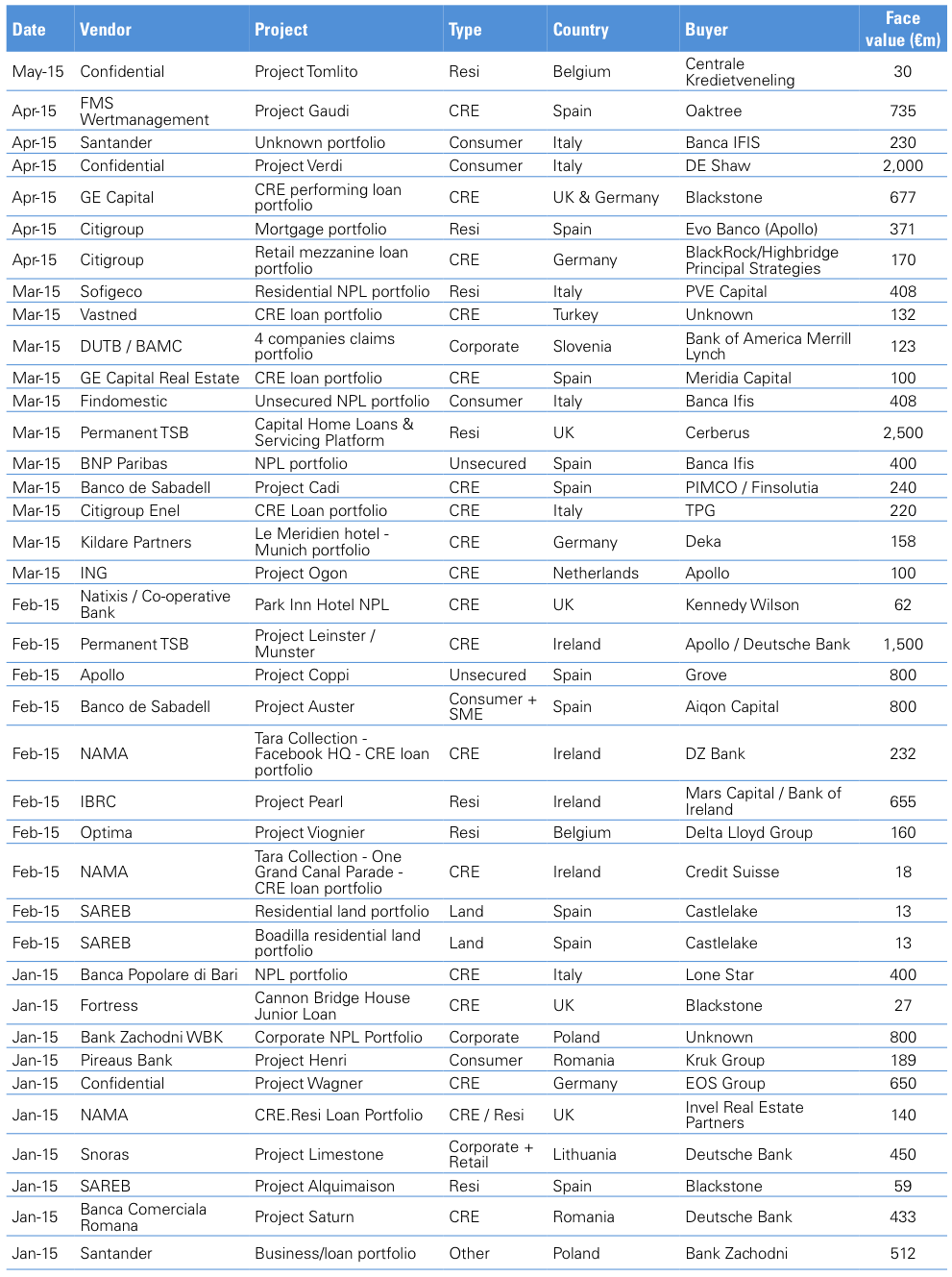

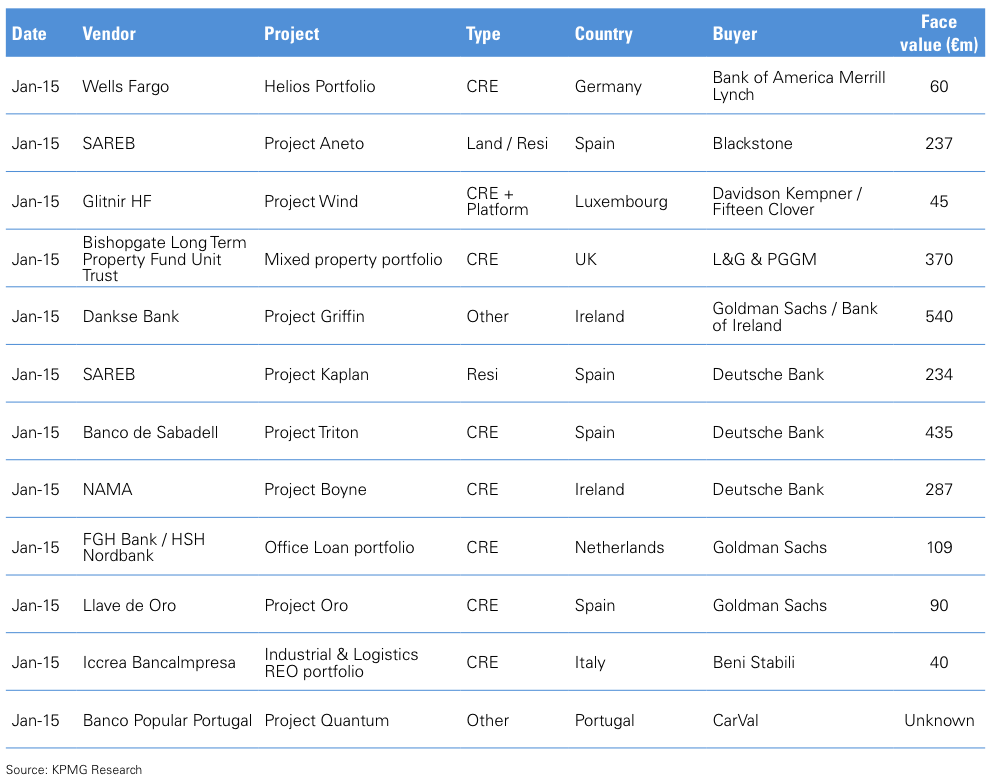

2015 was another strong year for European loan sales, with over €104 billion in closed transactions across 30 European countries. Hot spots over the past year included the United Kingdom (UK), Ireland, Italy, and Spain, where over €86 billion of transactions closed. Pleasingly, the pipeline remains strong for 2016, with over €32 billion in ongoing transactions, and continued interest from domestic and international investors looking to purchase European loan portfolios.

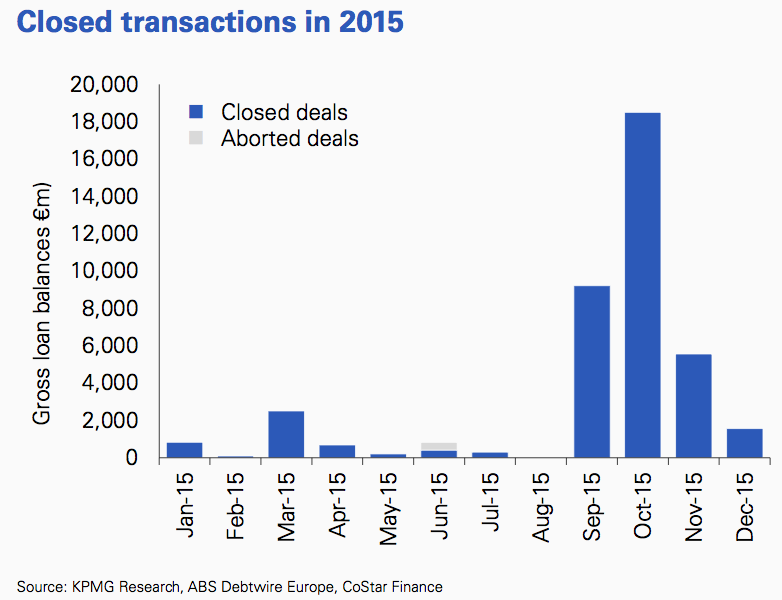

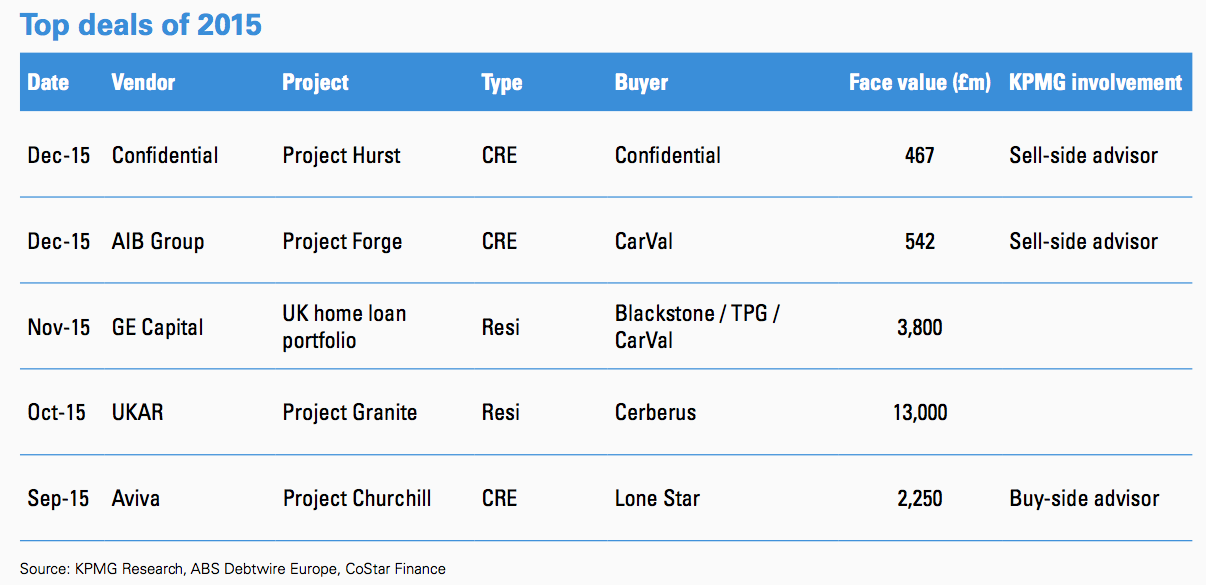

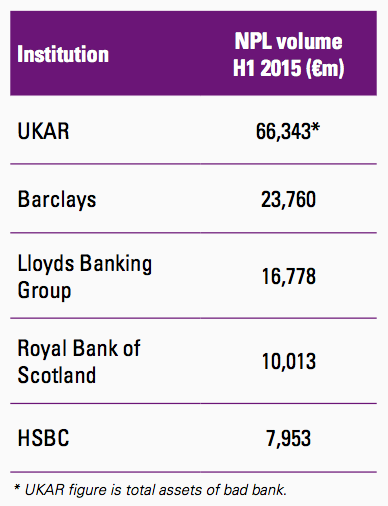

– The UK recorded the highest volume of loan sales, with over £30 billion of transactions closed in 2015. This number was boosted with the sale of UK Asset Resolution’s £13 billion Project Granite to Cerberus, which was the year’s largest single loan sale transaction in Europe. As the UK returns to growth, 2016 activity will be driven by competition amongst banks, funds, and financiers to profitably originate and grow.

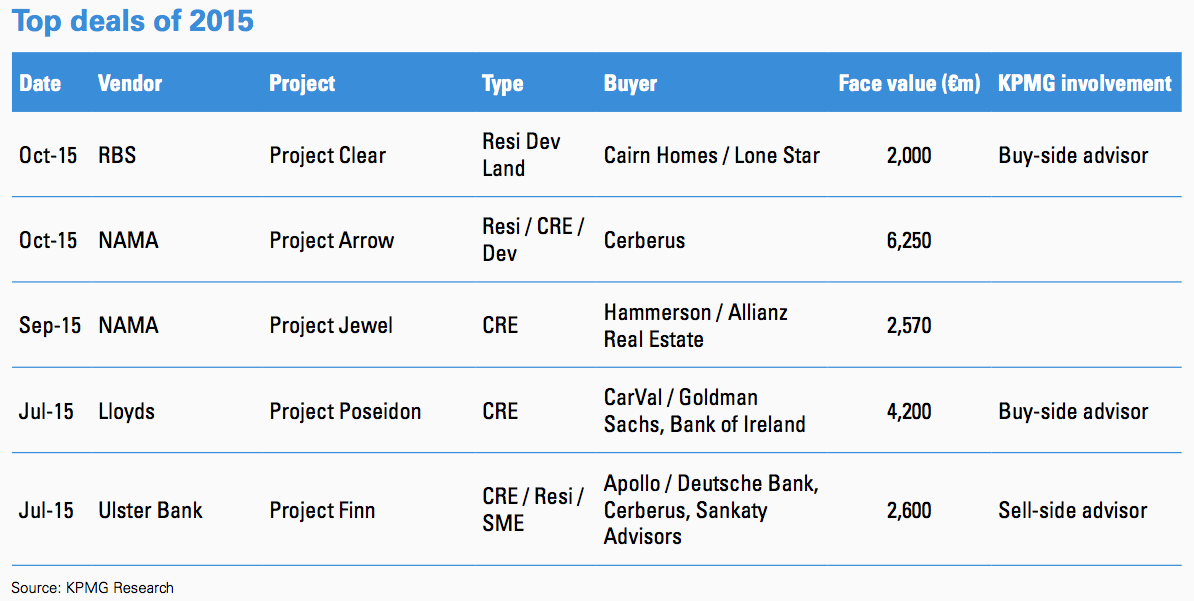

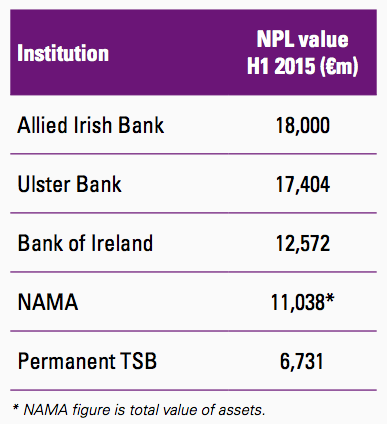

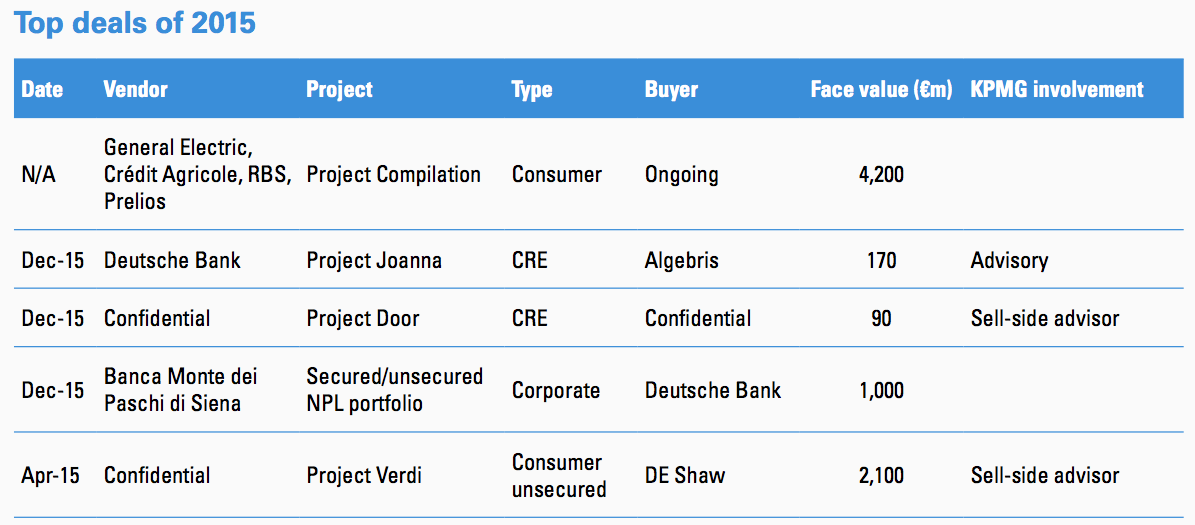

– Banks in Ireland continued to contract their balance sheets, with over €24 billion of closed transactions in 2015. The Royal Bank of Scotland and Lloyds Banking Group substantially completed their Irish deleveraging plans, with the sales of the €2.6 billion Project Finn and the €4.2 billion Project Poseidon, respectively. Similar to the UK, Ireland’s deleveraging story has now shifted from larger commercial real estate (CRE) and corporate loans to addressing residential mortgage non-performing loans (NPLs), granular CRE/ small and medium-sized enterprises (SME) NPLs, and importantly, addressing the profitability drag resulting from low yield tracker mortgages.

– Intense competition between buyers for portfolios in the UK and Ireland since 2013 has led investors to turn their eyes southward toward the recovering economies of Spain and Italy for acquisitions. Spain recorded over €15 billion in closed transactions, with Italy just behind with over €13 billion in 2015. Notably, both markets have now begun the process of selling real estate owned (REO) and real estate secured debt in larger volumes, which has drawn greater attention from buyers and financiers.

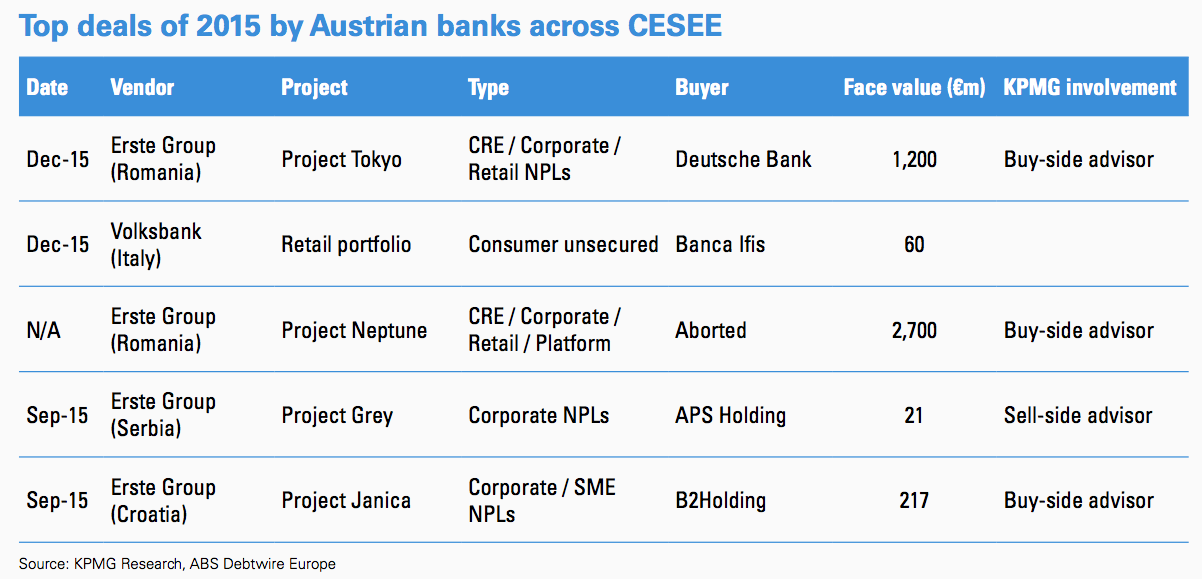

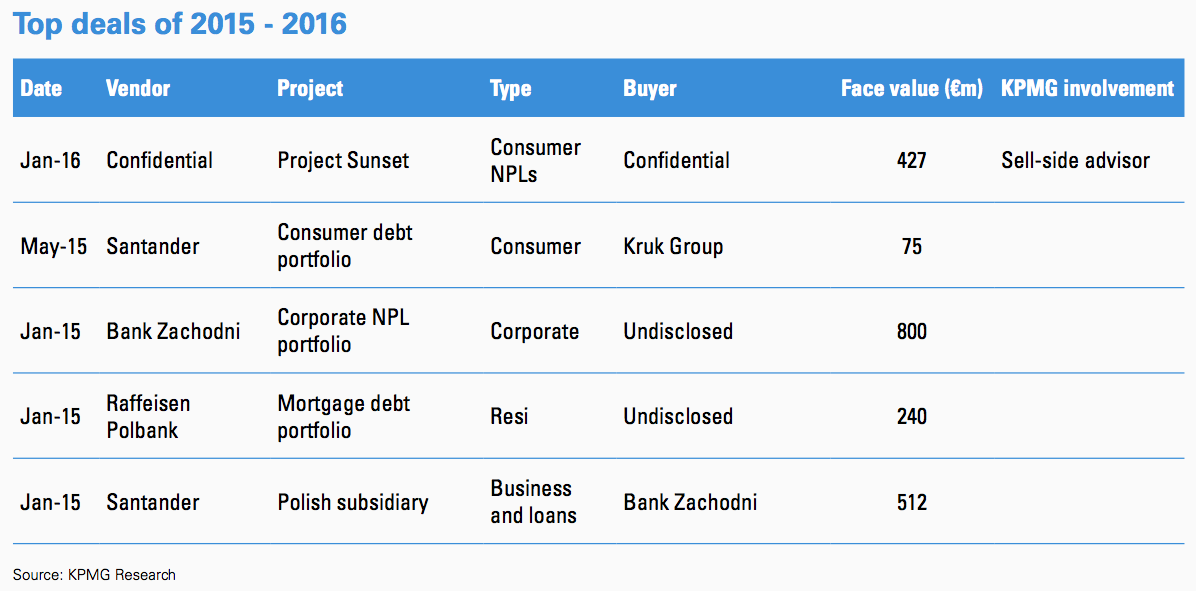

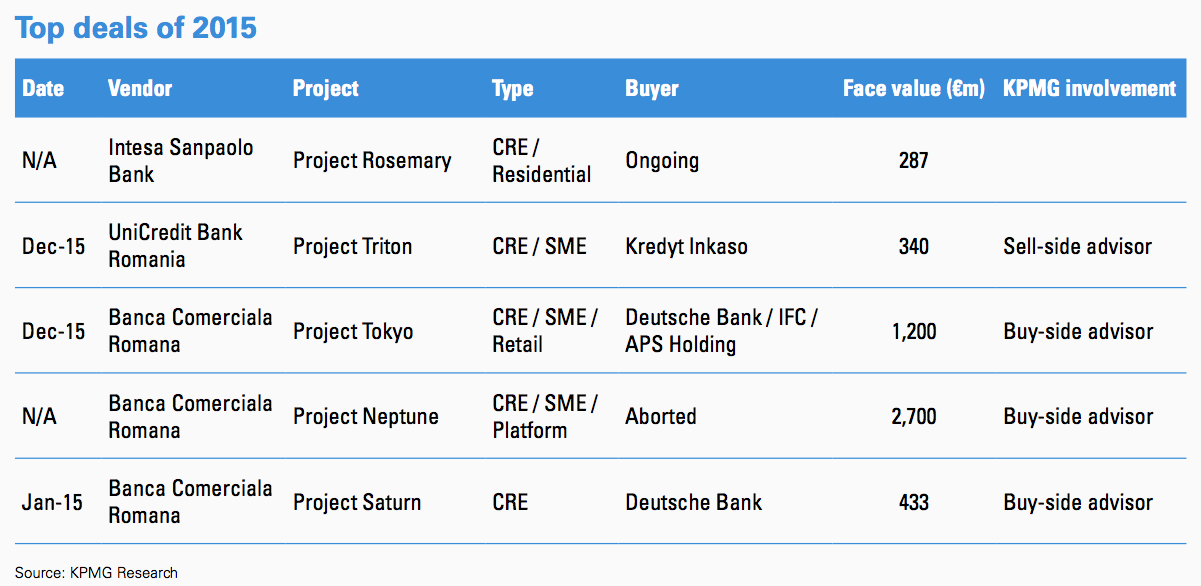

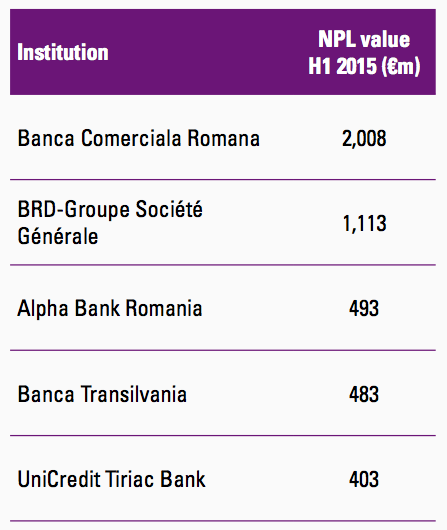

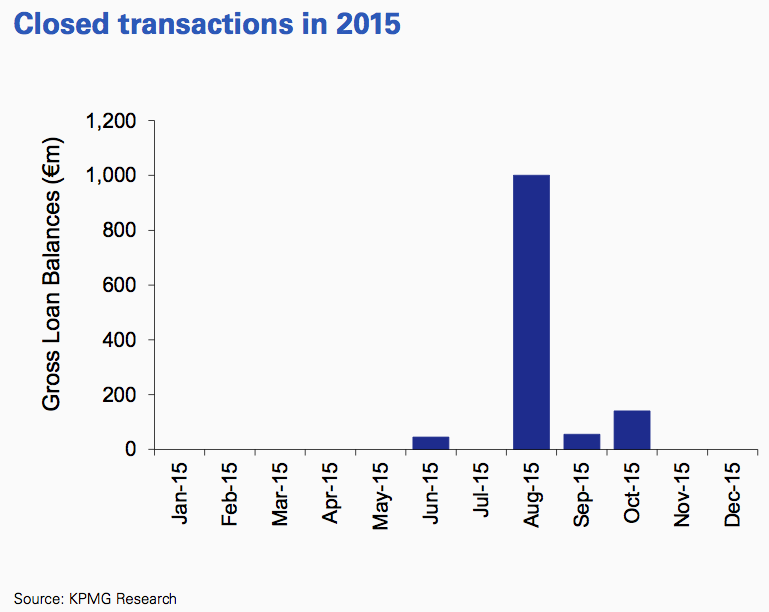

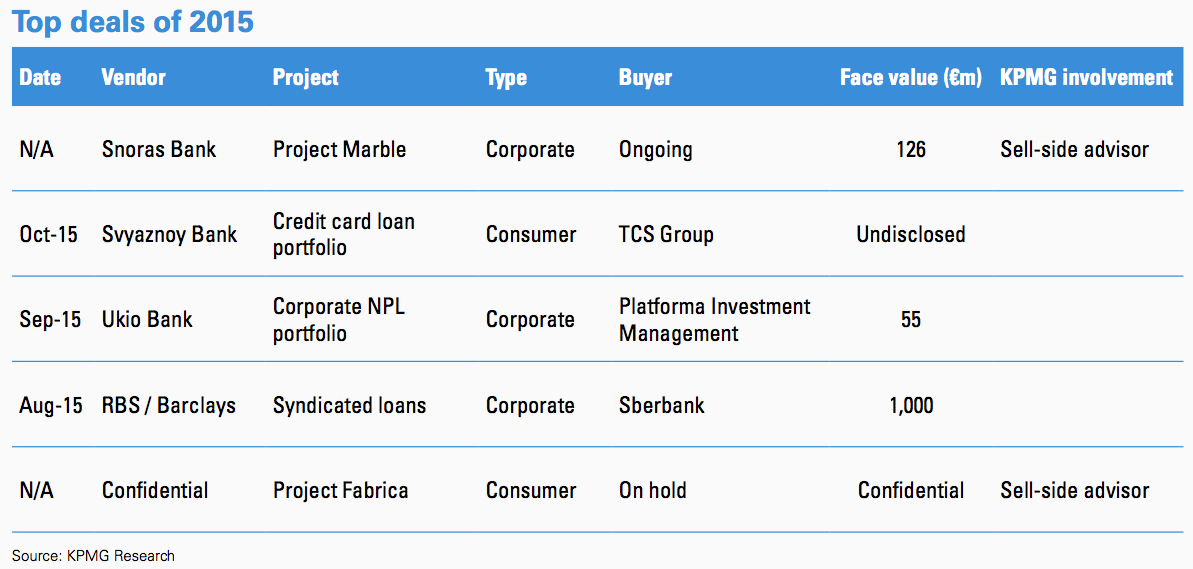

– Countries in Central and Eastern Europe (CEE) continue to mature as loan sale markets, with over 35 transactions brought to market across all asset classes. Notably, Hungary saw its first successful secured loan sale by MKB Bank to Lone Star, and Romania saw the largest successful sale in CEE this year, the €1.2 billion Project Tokyo sold by Banca Comerciala Romana (Erste Group) to Deutsche Bank.

– Many investors have also started to look towards Greece and Cyprus for future investment opportunities as they work to revive their banking sectors, address problem loans, and as their banks continue to divest their overseas subsidiaries across CEE. Whilst political concerns remain in both countries, investors are being rewarded for their activity.

Trend watch

Regulation and its effect on European banking

While it remains the exception, rather than the rule, for European regulators and supervisors to dictate strategic decisions to banks, the aggregate impact of regulation has become a decisive driver of strategy for most European banks. Regulators and supervisors have a pervasive influence, which they exert through a combination of levers.

European bank regulation and supervision

The European Banking Authority (EBA) is the prudential authority for banking within the European Union (EU); it has driven the creation of the European Single Rulebook, a single set of prudential rules for financial institutions throughout the EU. Systemically important banks also need to comply with rules issued by the G20 Financial Stability Board (FSB) and in many cases the Federal Reserve in the United States (US). Since November 2014, all significant Eurozone credit institutions are directly supervised by the ECB Single Supervision Mechanism (SSM), while UK banks continued to be supervised by the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA).

The SSM’s top priority for 2016 is to review Business Model and Profitability Risk. It will challenge banks to prove that they can create capital, sustainably, even in a low yield environment. It is also very concerned by high NPL ratios in several markets and is starting to push banks for reduction targets. In parallel, the SSM is performing a Targeted Review of Internal Models (TRIM), to probe risk weights across the sector. This is expected to drive an increase in Risk-Weighted Assets (RWAs), and as capital intensity rises, ROE falls.

Synthesizing all regulation and supervision is an extremely complex task. How does it, in aggregate, impact European banks’ strategy? Our view is that regulators are encouraging European banks to simplify and shrink. The costs of being large or complex are steadily ratcheting up, through higher Supervisory Review and Evaluation Process (SREP) capital requirements (imposed by the SSM) and G-SIB buffers required by the FSB. Many banks conclude that they could increase ROE and market capitalisation by scaling back or breaking up capital intensive units.

Bank resolution – Single Resolution Board

One entity which would not object to banks simplifying and shrinking is the Single Resolution Board (SRB), based in Brussels, which took on full powers from 1 January 2016, and represents the second pillar of Banking Union in the Eurozone (after SSM in 2014). The SRB, an EU agency, has a substantial mandate to resolve European banks in distress, either through forced transactions, transfer of assets to an asset management agency (AMA), or use of ‘bail-in’. As we have seen recently in Portugal in December 2015, the use of such powers by any banking supervisor can have a devastating impact on investors.

Political Dynamics

European banking regulation has entered the political arena several times in recent months. In addition to Portugal, this has particularly been the case in Italy, where the government, on 28 January 2016, announced a guarantee scheme for senior tranches of securitised portfolios of NPLs. Our initial estimate is that this scheme will improve prices on NPL trades, by between 3-5% from a bank’s perspective. The economic benefit comes primarily from favourable funding rates for the SPV which issues the notes.

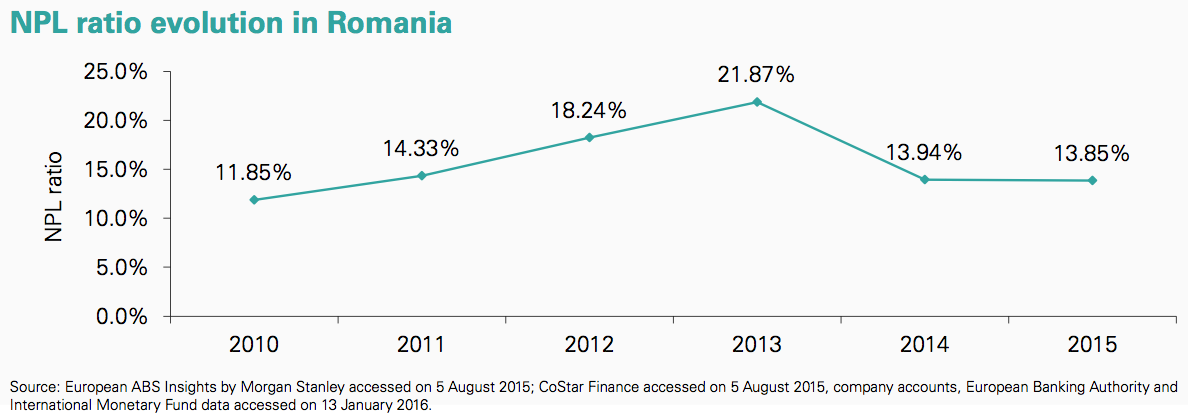

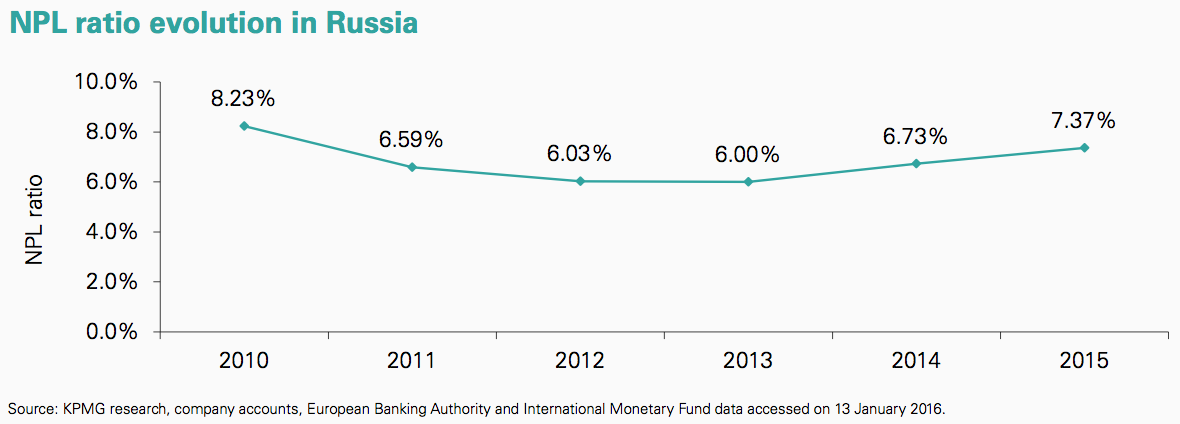

With political and economic turmoil in the emerging markets of making headlines over the past year, European banks with operations and exposure in CEE are closely monitoring the situation including the trend in NPLs. Should uncertainty increase and risk aversion become a common theme across the CEE banking sector, there may be a re-pricing of the financial market, which could increase the funding costs of banks with CEE exposure.

An uncertain Greek future

In July 2015, after much negotiation, Greece reached an eleventh-hour agreement with the troika (the European Commission, the European Central Bank, and the International Monetary Fund) to receive financial aid of €7 billion and prevent a Greek sovereign debt default. In August 2015, a further agreement was reached that provided Greece with €86 billion in financial assistance until 2018. From our conversations with investors, many are attracted by this market’s opportunities, but will remain on the sidelines until political stability is further proven and (for some investors) until capital controls imposed since July 2015 are fully lifted.

The threat of “Brexit”

There has been much discussion of a British exit (Brexit) from the Eurozone for several years. If a Brexit occurs, there may be longstanding implications for the UK as well as the EU. Many European banks have located a substantial part of their wholesale banking activities in London, making the prospect of Brexit an expensive exercise in potential relocation. The British and EU banking systems are heavily reliant on each other, with total UK claims on the EU at €790 billion in 2015, and EU borrowings from the UK close to €1.5 trillion. Some banks, such as JP Morgan, have taken pre-emptive action by moving major parts of their London banking operations into the Eurozone (Luxembourg), while others will be hoping the efforts of the British Prime Minister, David Cameron, to secure EU concessions and a referendum vote to remain in the union will succeed.

“Without giving banks a blueprint, the SSM is sketching the contours of acceptable business models. It will challenge banks in 2016 to prove that they can generate capital, even in an environment of low-yields, high NPLs and rising risk weights. For some banks the ‘math’ will not work, prompting a re-think of their pricing, products and portfolios.” – Marcus Evans, Partner, KPMG European Central Bank Office, Frankfurt

The UK and Ireland loan sale market

Over the past five years, the bad banks in Ireland and the UK have made considerable inroads with their wind- down strategies, with both NAMA and UKAR having undertaken their largest ever transactions in 2015. The pace of their activity is not expected to slow through 2016 and 2017.

Establishment and progress of “bad banks”

Bad banks have emerged in a number of countries throughout Europe over the past five years as a means of combatting the challenge of NPLs and in the resolution of troubled banks. The British and Irish governments were two of the first to establish their respective bad banks – UK Asset Resolution Limited (UKAR) and National Asset Management Agency (NAMA). UKAR was established in 2010 and is wholly owned by the HM Treasury UK, while Ireland’s NAMA was established in 2009 by the Government of Ireland. These large mandated institutions were in addition to failed banks and building societies, such as the Irish Bank Resolution Corporation (IBRC, formerly Anglo Irish Bank) in Ireland and Dunfermline Building Society in the UK.

As per a study conducted in 2Q 2015, Europe’s bad banks together hold €233 billion of non-core real estate portfolios – with the bad banks of Ireland (NAMA), Spain (SAREB) and the UK (UKAR) holding 91%of the total outstanding amount. By the end of 2015, NAMA had the highest volume of closed transactions, with over €28 billion sold in the last two years. UKAR has closed transactions totalling in excess of £15.8 billion, a total which was boosted in 2015 due to the successful sale of the £13 billion Project Granite portfolio of former Northern Rock mortgages to Cerberus.

UKAR in the UK

Since its incorporation, UKAR has divested £73.5 billion, which amounts to more than half of the total loans it acquired from the nationalised Northern Rock and Bradford & Bingley. In 2014-15, UKAR’s loan repayments fell by £0.9 billion year-on-year to £3.7 billion. In 2014, its most notable loan portfolio sale was the £2.7 billion Project Slate to CarVal and JP Morgan, which consisted of performing mortgages. In October 2015, it announced the sale of its £13 billion Project Granite portfolio to Cerberus, which significantly reduced the total loans held. UKAR still currently holds an estimated £35 billion of residential mortgages.

“The sale brings the total UKAR balance sheet reduction to £73.5 bn (63%) since formation in 2010.” – Press release: UK Asset Resolution announces successful sale of £13bn assets, 13 November 2015

Looking forward, UKAR plans to dispose of £800 million equity release lifetime mortgages, £5.5 billion of self-certified mortgages, and £22 billion of buy-to-let mortgages. It is expected that UKAR will dispose the current outstanding debt in a span of five to ten years.

NAMA in Ireland

Since its incorporation, NAMA has realised €18.7 billion from overall disposal proceeds, of which 42% (€7.8 billion) was sold in 2014 – this included two major loan sales with face values of €5.4 billion (Project Eagle, sold to Cerberus) and €1.8 billion (Project Tower, sold to Blackstone).

NAMA plans to wind down completely by 2020, after having disposed of its special bond debt. To date, it has disposed of approximately 39% of its assets since creation. At the current rate of sales, it is considered likely that NAMA will be able to wind down prior to its 2020 mandate.

Macro-Economic Factors Impacting Non-Performing Loans

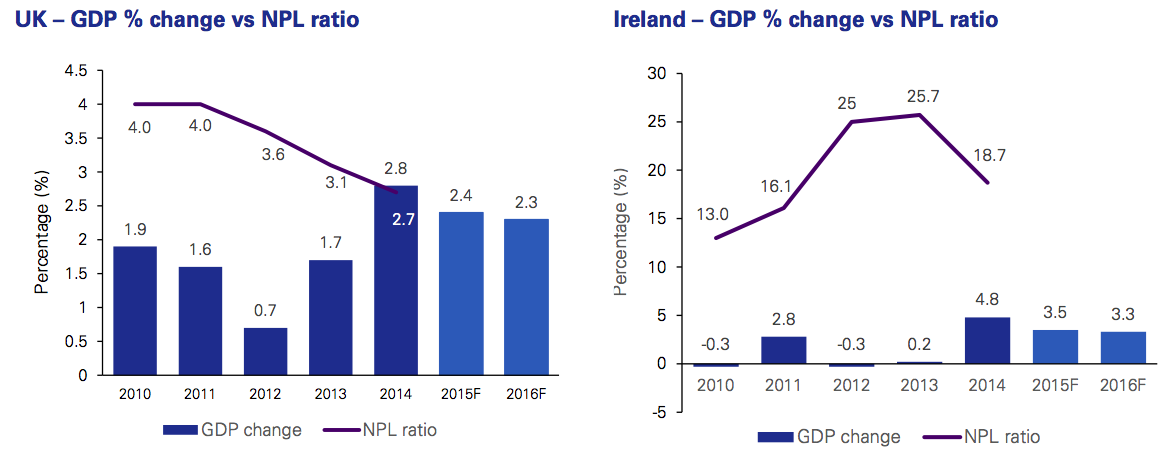

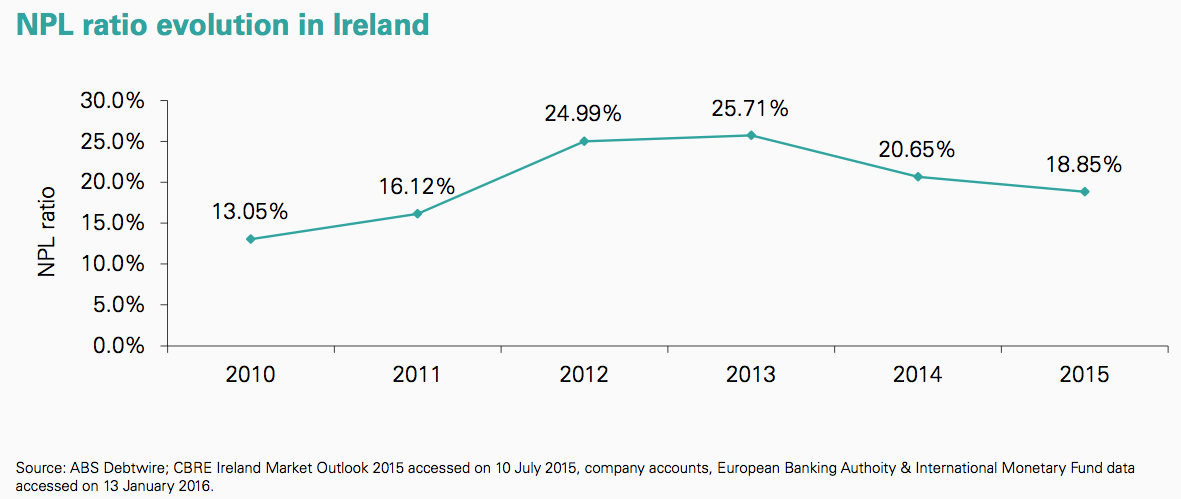

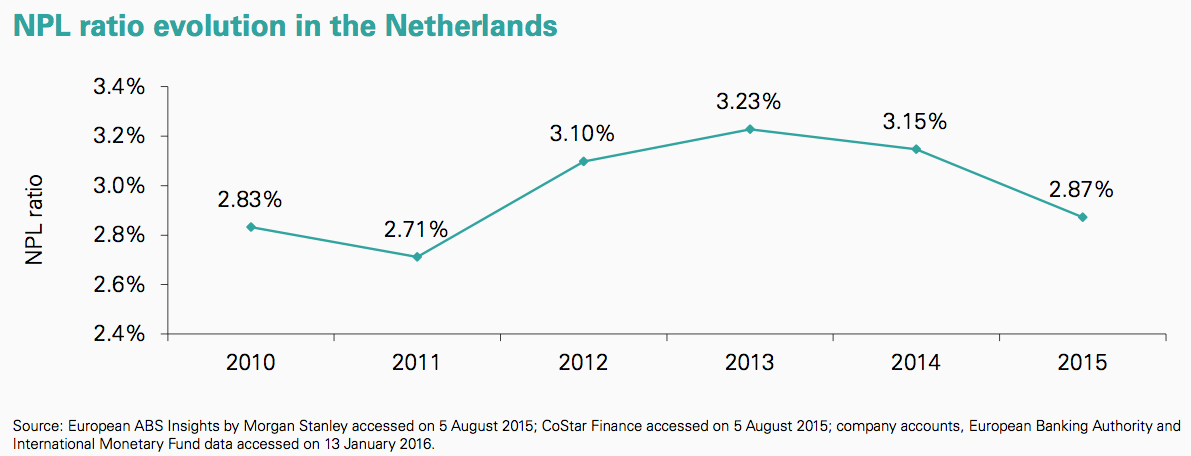

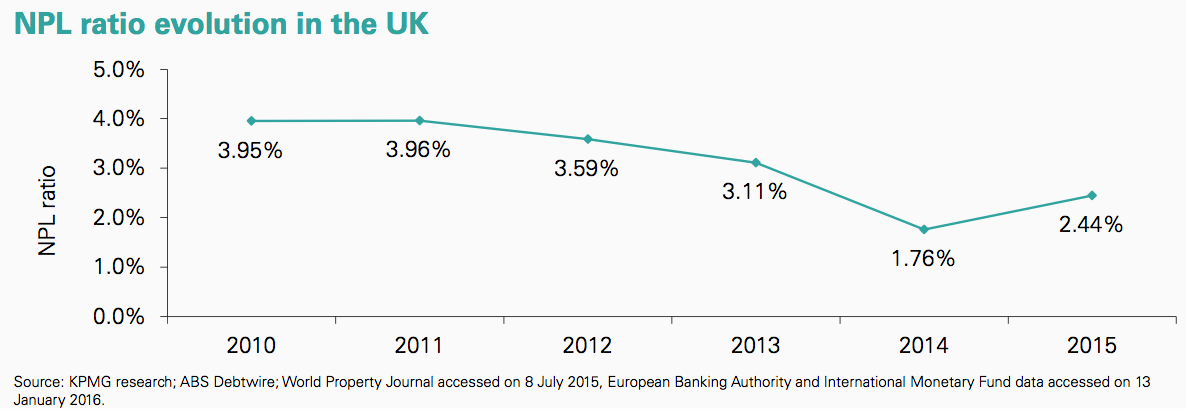

With an increase in GDP, the repayment capacity of borrowers typically increases, thus leading to an overall reduction in NPLs in the banking sector. As seen in the graph (UK – GDP % change vs NPL ratio), the NPL to gross loans ratio fell from 3.6%to 2.7% over the three year period leading to 2014, while the GDP rose from 0.7% to 2.8% over the same period. A similar trend can be seen in Ireland.

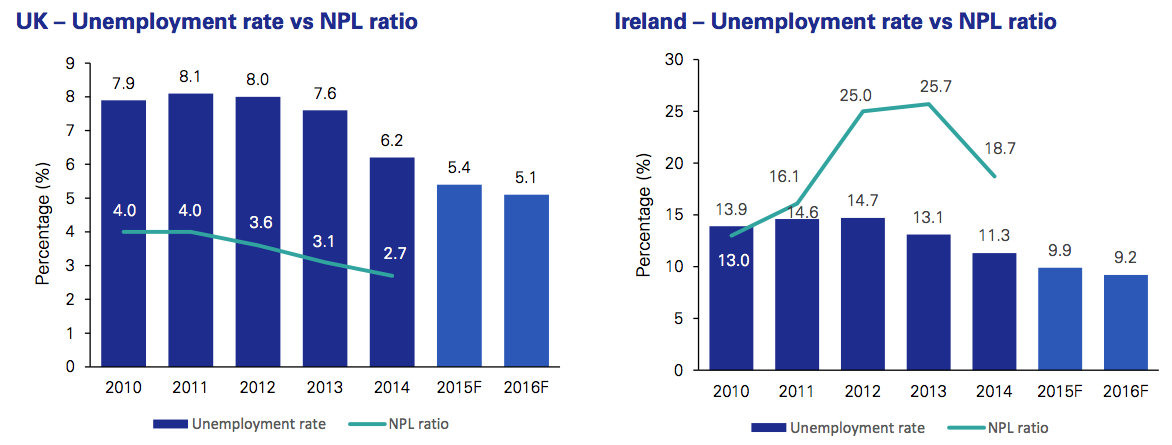

In the UK and Ireland, there appears to be a direct correlation between the unemployment rate and NPL ratio – an increase in the unemployment rate adversely impacts the repayment capacity of households, thus triggering an increase in the default rate. As seen in the graph (UK – Unemployment rate vs NPL ratio), the unemployment rate in the UK declined from 7.9% to 5.1% from 2010 to 2014, along with a fall in the NPL ratio. A similar trend can be seen in Ireland, as seen in the graph (Ireland – Unemployment rate vs NPL ratio).

In focus: Italy

Italy on the rise

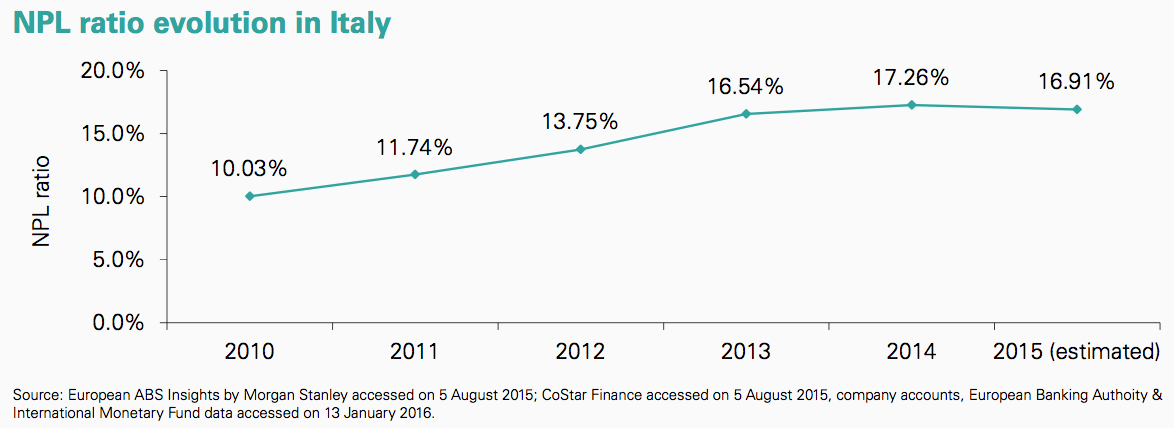

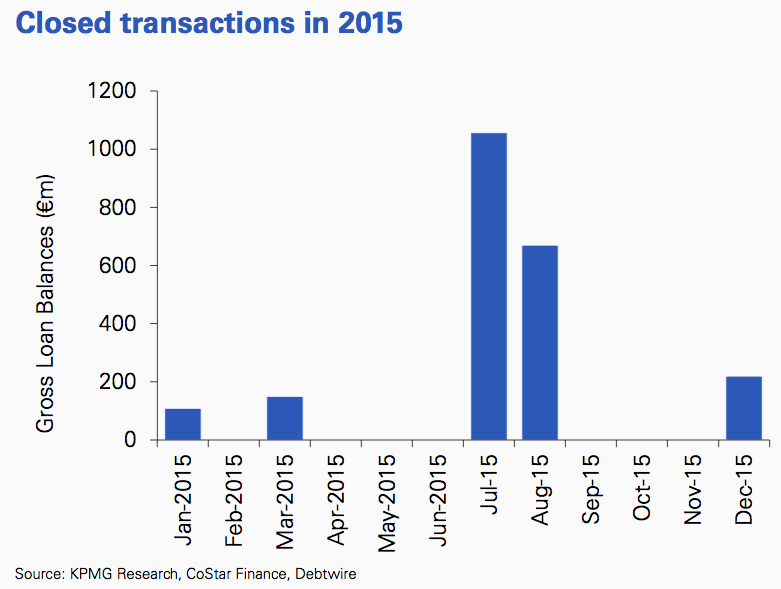

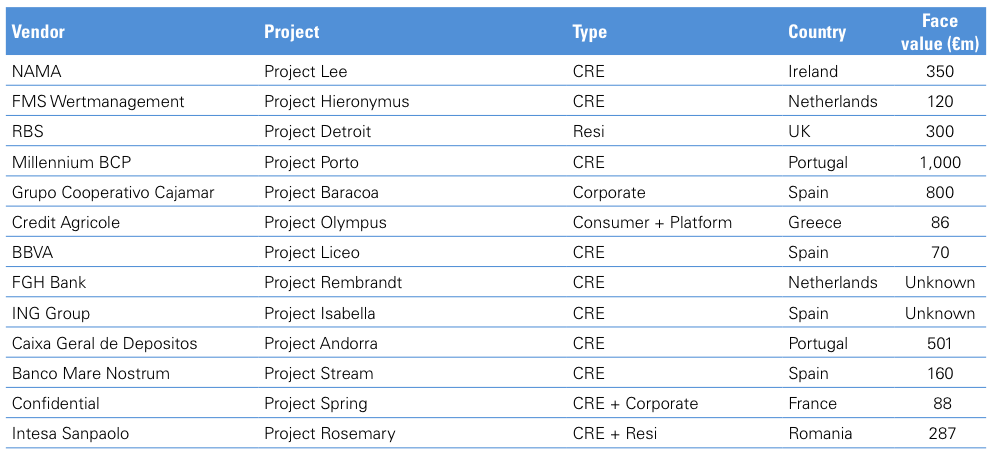

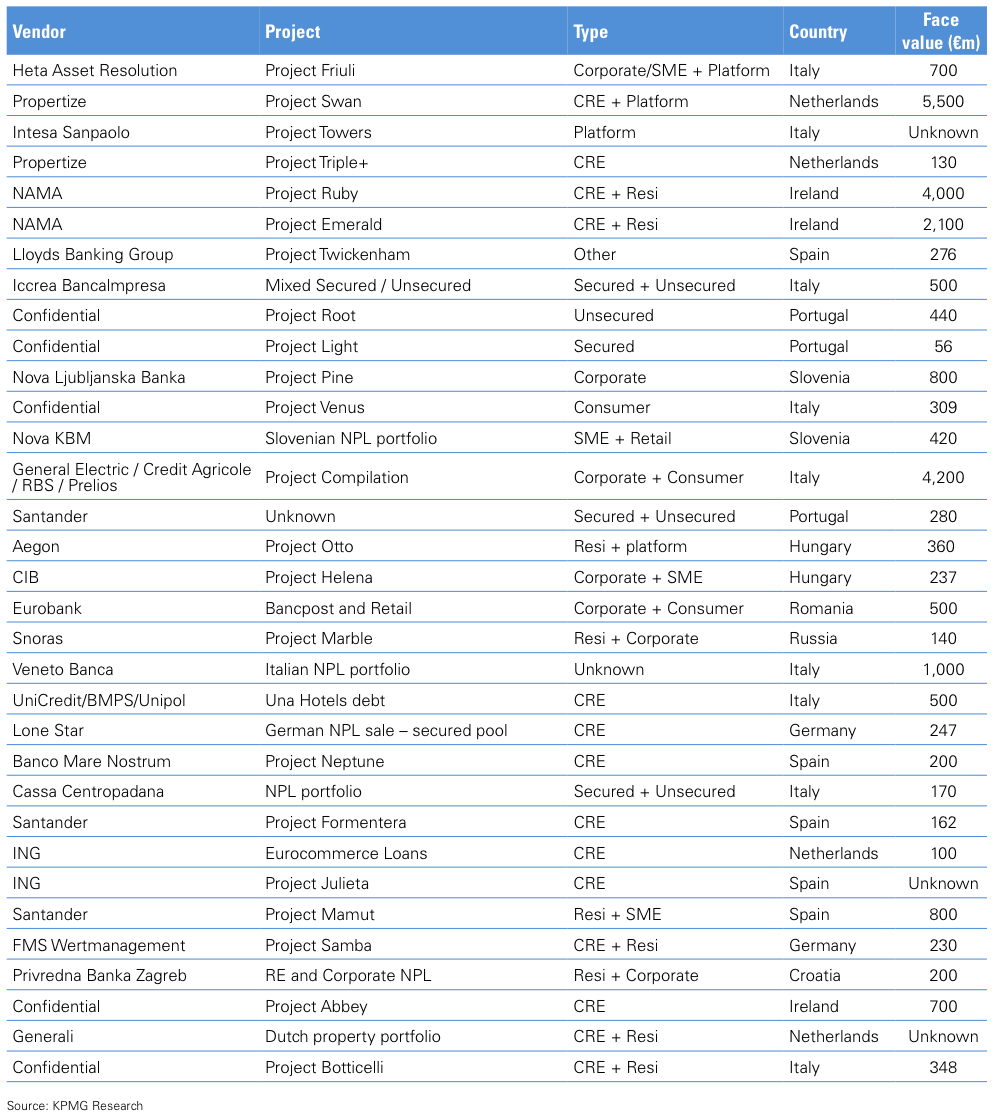

After a three-year recession that left Italy’s banks nursing in excess of €350 billion of bad loans, Italy is now a more active debt sale market. There are a large number of transactions nearing completion or in progress – of the more than €27 billion (face value) of expected sales, €18.4 billion are transactions that have been concluded, while the remaining €8.8 billion represents transactions in progress at the end of 2015.

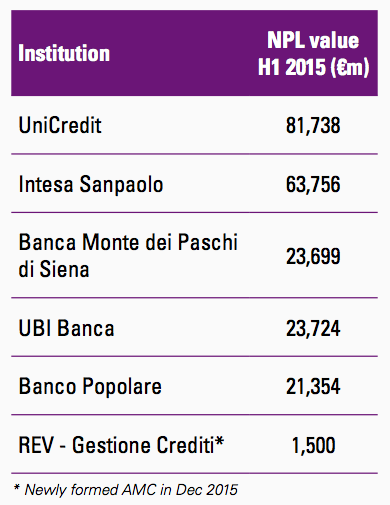

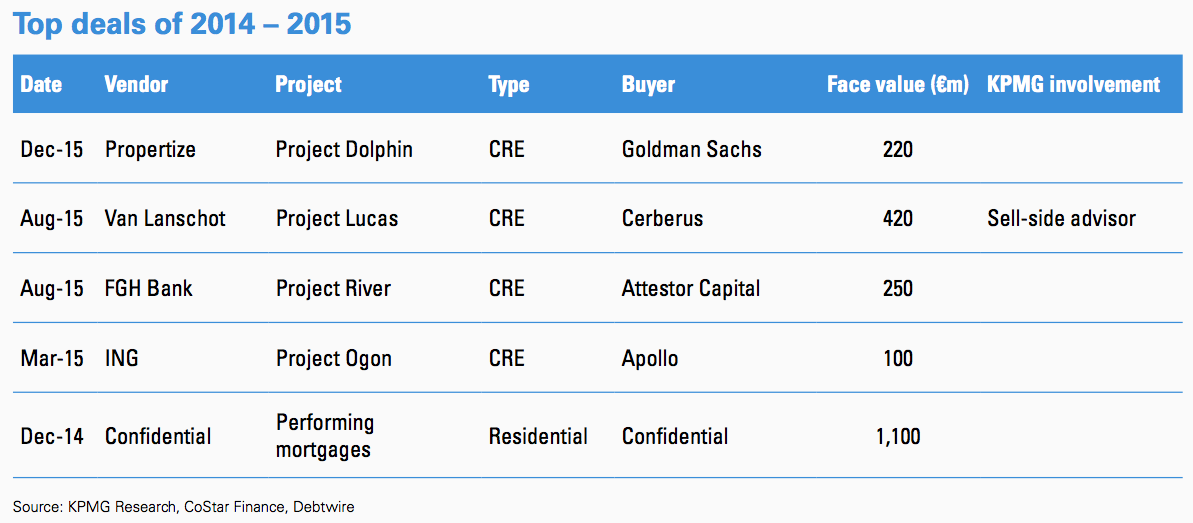

Italy became the third most active European country by closed transactions in the first half of 2015, having seen transactions resulting in over €1.4 billion in aggregate purchase prices. The number of closed transactions by volume in H1 2015 is 2.5 times that of the total closed sale volume seen in 2014. This strong activity in 2015 was largely a result of Italian banks preparing for and implementing deleveraging plans, having identified which assets to hold, restructure, or sell. This was evidenced most notably by Intesa Sanpaolo and UniCredit, Italy’s largest banks, who through 2015 formalised those aspects of its balance sheet that it deemed to be non-core. Foreign banks with exposure to Italy, such as RBS, Deutsche Bank, and GE Capital, also followed suit bringing larger secured portfolios to market in H2 2015.

Barriers and regulatory changes

NPL market activity in Italy has been limited over the past few years in contrast to the UK, Ireland, and Spain, due in large part to significant bid-ask spreads between the carrying value of loans and the price expectations of investors, a direct consequence of:

– Limitations in the quality and availability of data necessary for investors;

– Insufficient provisioning coverage by local Italian banks and constraints in sourcing additional capital to increase coverage ratios;

– Continued uncertainty over the Italian enforcement regime; and

– An average foreclosure time of three to five years, as opposed to one to two years in most Western European countries.

However, there are now clear indications that the loan sale market is gathering pace, with increasing transaction volumes, a generally more positive economic environment and strengthening property market.

The Italian government and its banks have been far from idle in tackling the NPL problem in the past year…

In June 2015, Matteo Renzi, the Italian prime minister, publicly announced a series of long-awaited measures to help manage the volume of bad debt in the Italian banking system with the aim of reviving lending in the Italian economy. An emergency decree containing measures to improve tax treatments and to streamline bankruptcy proceedings and the foreclosure process was approved; the decree introduced the following changes:

– Permitting banks to claim tax relief over losses due to bad loan write-downs in one year as opposed to the previous length of five years;

– Allowing the ‘concordato preventivo’ to have the possibility of further auctions within a restructuring process if the court-appointed judicial commissioner rules that the proposal put forward by the borrower is not compelling; and

– Allowing creditors holding a minimum 10% of the debt in a ‘concordato’ to submit substitute proposals unilaterally if the proposal put forward by the borrower does not cover 40% of the debt of the unsecured creditors.

These changes make the foreclosure and bankruptcy processes more investor-friendly, furthering the positive sentiment held by many international investors.

Intesa Sanpaolo and UniCredit have established internal non-core divisions as part of their deleveraging strategies. The two banks have also joined forces

with KKR Credit to transfer up to €1 billion of distressed assets to a platform that has the aim of providing corporate expertise and long-term capital to strained Italian businesses.

Most recently, in November 2015, the Bank of Italy authorised the resolution plans of four small Italian banks in special administration: Banca Marche, Carife, Banca Etruria and CariChieti.

The approach taken to these banks envisages the involvement of shareholders and subordinated bondholders (as provided by the BRRD) and the creation of four “good banks”, to which all balance-sheet assets except loans classed as “bad debts” will be assigned; the “bad debts” will be assigned to a newly created “bad bank” (not a licensed bank) named REV – Gestione Crediti S.p.A. which will own a NPL portfolio with gross book value of €8.5 billion, and net book value of €1.5 billion according to preliminary indicative valuation.

Furthermore, in early 2016, the Italian government is due to release a new guarantee scheme on securitised bad loans, the Garanzia Cartolarizzazione Sofferenze (GACS) with the objective to facilitate the de-risking process of Italian banks. The GACS, which will be released only on rated senior tranches at market price (thus not classified as state aid as defined by the European Commission), is expected to provide Italian banks with an opportunity to dispose of bad loans, reducing the cost of senior notes, and thus further boosting the Italian NPL sale market.

“While the Italian unsecured NPL market is very hot, the secured NPL market is only warming up: the deleveraging process has finally started. Investors are queuing up to do business on upcoming NPL portfolios.” – Fabrizio Montaruli, Partner, KPMG in Italy

In focus: Spain

Spain: A deleveraging hotspot

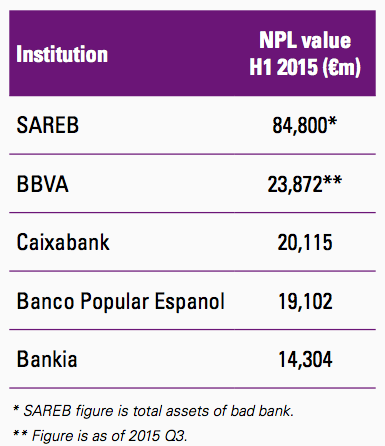

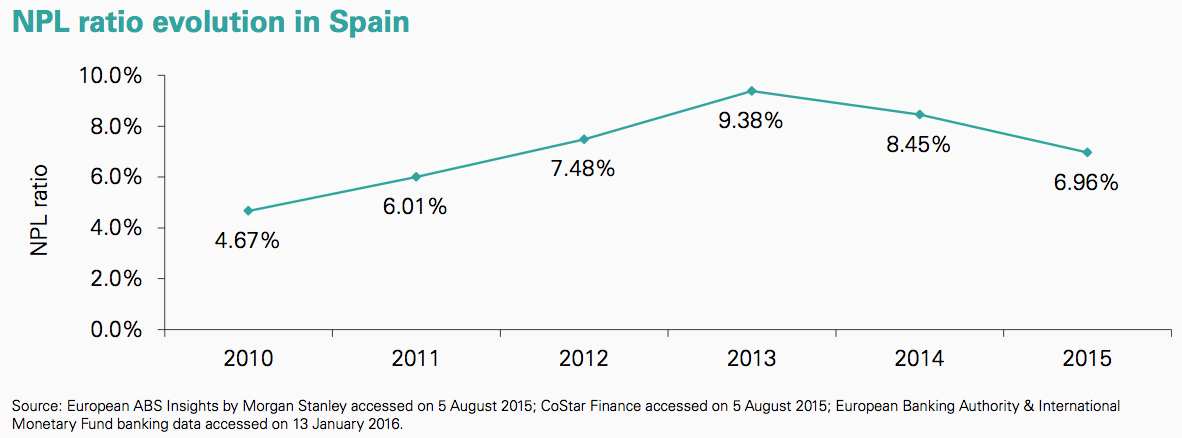

Spain is one of the hotspots in the European loan sale market, accounting for almost 17% of loan portfolio sales in 2015, with over €15 billion of loan portfolios brought to market. Bankia and Banco de Sabadell continue to be amongst the most active vendors in the Spanish market, with the aggregate total of their transactions almost one-third of the total Spanish transactions brought to market in 2015. There were also new vendors, such as BBVA, which brought its first secured portfolio to market – Project Liceo – and Banco Mare Nostrum with Projects Neptune and Pampa. As Spain lags behind the UK and Ireland in its deleveraging journey, further sales activity is expected in the coming year against the backdrop of an improving real estate market and macroeconomic situation.

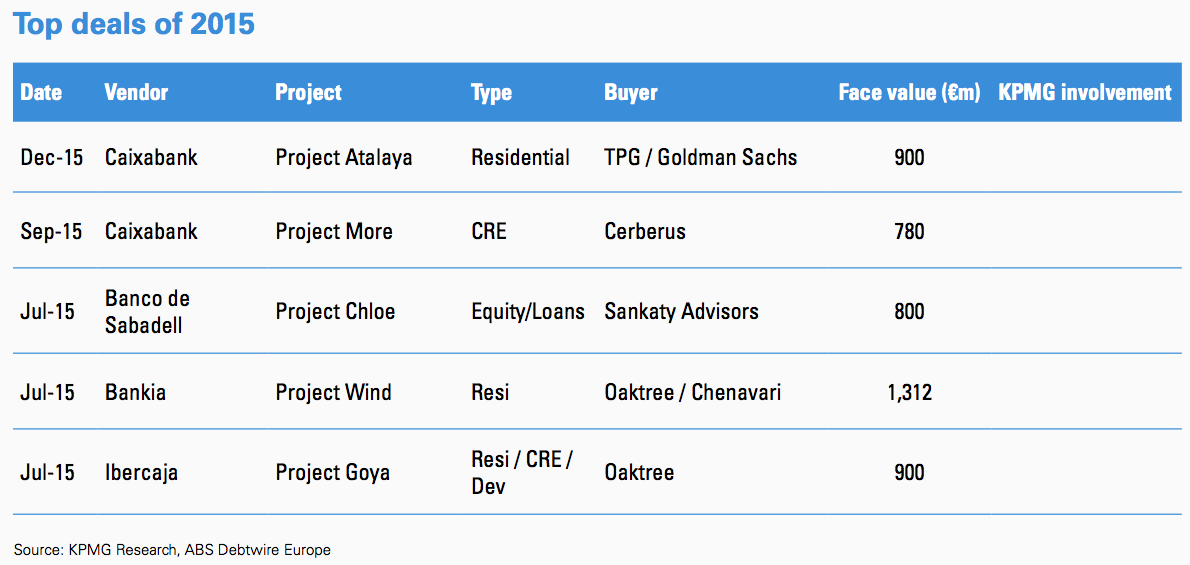

2015 saw more real estate-backed portfolios being sold, notably in the residential mortgage and CRE sectors, which together accounted for approximately 65% of the total market by volume. Many of the largest portfolios that successfully closed were residential mortgage portfolios, which made up approximately 21% of the portfolios transacted by number and 43% by face value. 2015 also saw an increase in the number of portfolios where sales were delayed or withdrawn from market due to high bid-ask spreads. However, investor sentiment for purchasing loan portfolios in Spain continues to improve, due largely to an improving macroeconomic environment leading to increased real estate values. This is driving the narrowing of the bid-ask spread, notably for real estate-backed loans.

Increasingly much larger portfolios are being brought to market, as Spanish banks are taking advantage of this improving investor sentiment. Recent “mega deals” include the sale of Bankia’s Project Wind, a €1.3 billion residential mortgage portfolio, to Oaktree and Chenavari, and Project Atalaya, a €900 million residential mortgage portfolio sold by Caixabank to TPG and Goldman Sachs.

SAREB – the Bad Bank

Sociedad de Gestión de Activos Procedentes de la Reestructuración Bancaria (“SAREB”), the bad bank formed by the Spanish government in 2012, still holds more than €60 billion of “distressed debt” (c.€31 billion book value). SAREB realised revenues of over €3.5 billion of real estate-backed loans and REOs in 2015, which is low in comparison to disposals in 2014, particularly in regards to NPL portfolio sales. This is partially due to the “Ibero project”, where SAREB entered into new servicing contracts with four servicers: Haya Real Estate (Cerberus), Altamira (Apollo–Santander), Servihabitat (TPG-Caixa) and Solvia (Sabadell). This resulted in a migration of loans and REOs to these new service providers from the original 23 transferring institutions during 2015. This, together with higher book values, contributed to a decrease in transactions during 2015.

Challenges still remain, notably in the increased number of portfolios (such as Projects Silk and Birdie) whose sales were aborted due to pricing. This may be symptomatic of wider challenges for SAREB and the market.

Spain’s economic recovery has seen portfolio sales increase, but political uncertainty and SAREB’s situation present new challenges for 2016…” – Carlos Borja G. Castello, Associate Director, Portfolio Solutions Group KPMG in the UK

SAREB’s current strategy seems to be more focused on retail exits rather than wholesale portfolio sales, as it saw far lower portfolio sale activity in 2015, accounting for less than €800 million of sales, compared to the prior year which saw more than €1.3 billion by face value transacted by SAREB. Nonetheless, this retail strategy may change due to the new accounting rules adopted in September 2015, the result of which being that SAREB has to conduct a one-by-one appraisal of its assets at fair market value by the end of 2016. However, the new final political framework may also assist SAREB in accelerating its deleveraging strategy.

Regulatory changes and uncertainty in Spain

Despite international investor interest in Spain, there still remains a number of legal challenges with the sale and purchase of distressed loans. Under the latest modification to the Spanish Insolvency Act (Royal Decree-Law 11/2014, passed on 5 September 2014) if a borrower becomes insolvent, a court-appointed receiver is then responsible for obtaining a valuation for the underlying real estate, and then revising the loan to its fair value. In the minds of some investors, the law has added uncertainty for these investors in relation to real estate secured loans, as it is viewed as a subjective change rather than a simple enforcement of mortgage.

The original intent of the government in implementing this law was to prevent creditors from using enforcement as a workout strategy for otherwise underperforming assets to prevent asset stripping and to preserve businesses. Unintended consequences of this law may include higher discounts being priced in by investors for portfolios, resulting in potentially lower realisable values for sellers.

Thus far, the impact of this regulatory change has not been significant in terms of deals, as for the most part investors in the real estate market are primarily interested in the underlying assets (in order to agree a debt for asset swap in most cases); this is already considered prior to the bidding process. However, this change may more significantly impact corporate loans, with investors intending on pursuing repayment of existing facilities in order to have access to the equity at some point in the restructuring.

The political framework in Spain also requires consideration. In late December 2015, general elections were narrowly won by the People Party (centre-right), which is currently engaged in negotiations with PSOE (center-left) and Ciudadanos (center) for a national coalition. However, a clear resolution is not expected in the short term and could lead to a new general election that may impact the broader economy. In addition to this, uncertainty surrounding the Catalonian independence issue could infringe upon investor confidence and result in decreased investment appetite in H1 2016.

Greece and its impact across CESEE

Impact of the Greek crisis on Europe

The Greek economy was one of the fastest growing economies in the Eurozone from 2000-07. During this period, it grew at an annual rate of 4.2% as foreign capital flooded into the country on the strength of a stable currency and convergence of interest rates with Europe. As a result, the Greek state borrowed heavily from other EU member countries, with sovereign debt reaching historically high levels. Unlike its “peripheral EU” counterparts and the other members of the infamous “PIIGS” nations as defined at the time, Greece’s problems were rooted in the over-indebtedness of the nation as distinct from a specific result of over exposure to real estate in its banking sector.

Greece and South-Eastern Europe (SEE)

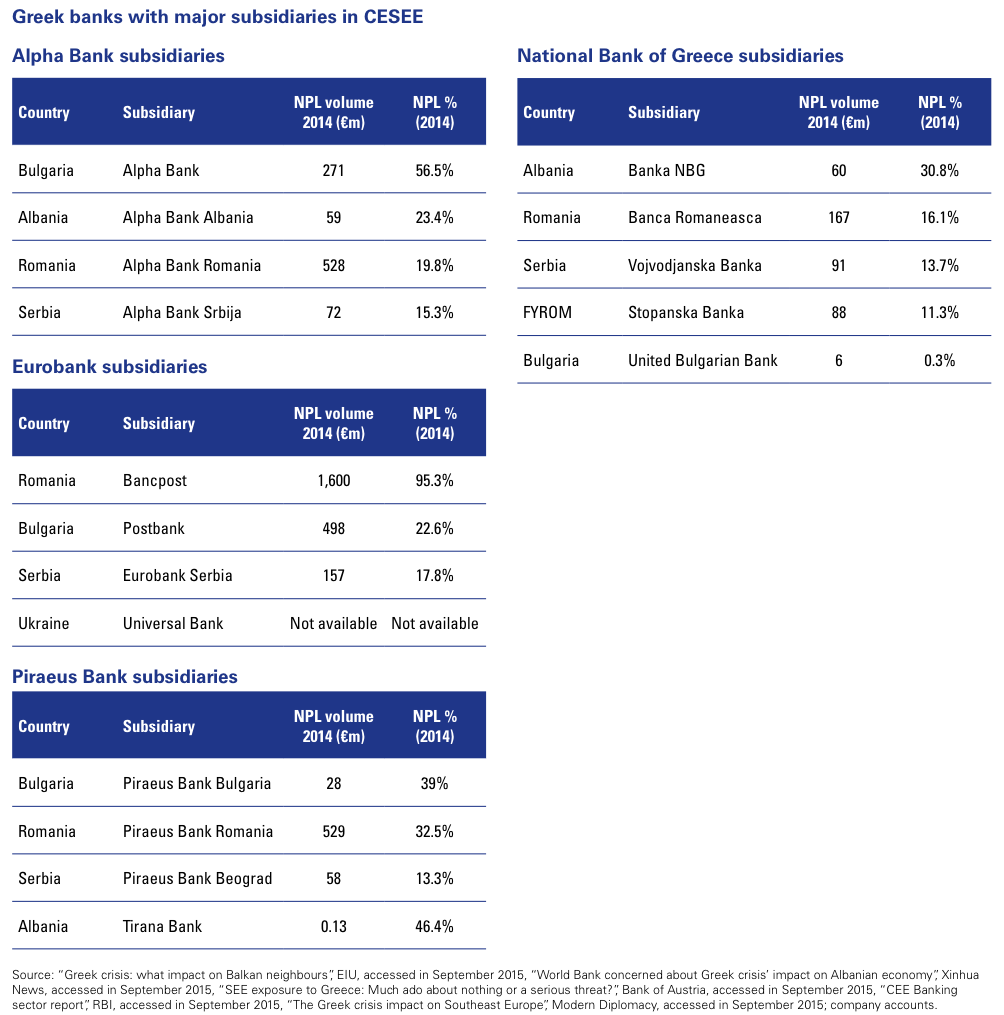

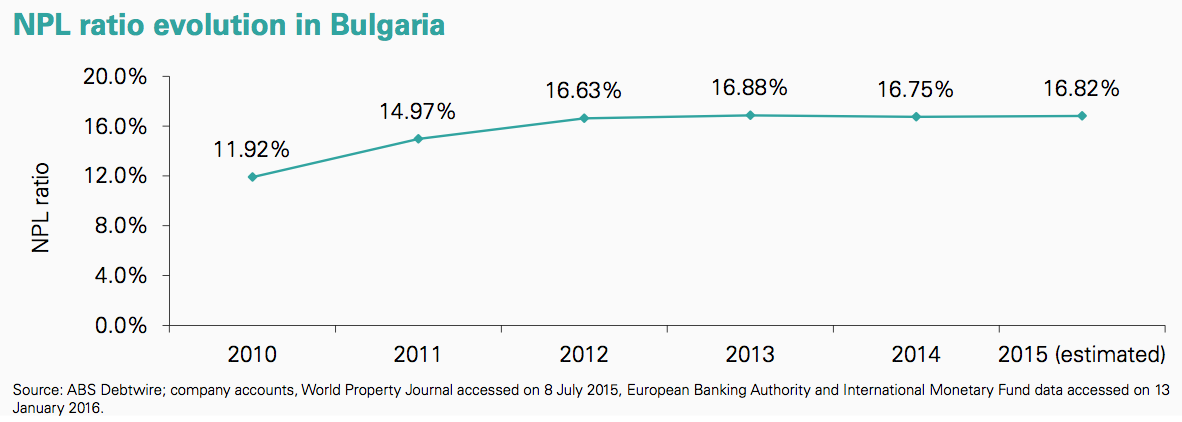

In 2009, Greece declared a budget deficit of 13%, raising concerns on the sustainability of Greek sovereign debt. Bulgaria is the country most exposed to Greece, with Greece accounting for almost 10% of its exports combined with substantial Greek investment in the country. However, it is the financial links between Greece and the SEE economies which are more significant than trade channels, as there are a sizeable number of Greek banks operating throughout SEE which account for 14–22% of assets in the regional banking sector. These subsidiaries are now experiencing rising defaults and a decline in their loan-to-deposit ratio, pointing to less financial stability. There is also further risk of deposit outflows, loss of confidence from both investors and customers, and pressure on local currencies.

Greek banks have a significant presence in SEE countries, with four out of the top 10 banks in Bulgaria and Serbia being Greek subsidiaries, and two of the top 10 in Romania. The National Bank of Greece, EFG Eurobank, Piraeus Bank, and Alpha Bank are all major players in the region, and as of 2011, their assets were nearly €70 billion. The SEE banking sector has a high loan-to-deposit ratio at 120-130%, with foreign financing generally funding the spread.

Central Bank action in the Balkans

The banking sector in the Central, Eastern, and South East European (CESEE) countries has recently seen significant reform in order to prevent the risk of contagion to their economies, which are widely exposed to the Greek banking system. The Bulgarian National Bank has now implemented a ceiling on the amount of funds that can be transferred from local subsidiaries to parent banks in Greece. Greek subsidiaries in Bulgaria no longer raise funds from their parent banks. In the Former Yugoslav Republic of Macedonia (FYROM), the central bank forced a provisional limit on the transfer of capital to Greek banks as of 28 June 2015. The Serbian central bank increased surveillance on Greek subsidiaries in Serbia and put a limit on transactions between Serbian branches and their parent banks in Greece. The Balkan banking sector increased the capital adequacy ratio (CAR) to stabilise the financial system. CAR ranges from about 20% in Serbia and Bulgaria, to 17% in Romania and 13% in FYROM.

Although the Balkans have taken initiative to protect themselves against the risk of contagion from the Greek crisis, the risk of a loss of confidence from borrowers still hangs over the region. Several local banks have recently collapsed in Serbia and Bulgaria. In June 2014, Bulgaria’s fourth-largest lender, Corporate Commercial Bank (CCB) suffered a bank run. In order to prevent the collapse of the bank, customers were prevented from accessing their savings, which were guaranteed up to €100,000 for six months.

Foreign currency lending

Widespread lending in foreign currency in Balkan countries (outright or indexed to foreign exchange) also contributed to the weakening of credit dynamics. The share of foreign exchange loans to total loans ranges from approximately a quarter in Turkey, over half in FYROM, to two-thirds to three quarters in Albania, Bosnia and Herzegovina, Serbia, Croatia, Romania and Bulgaria. Accordingly, foreign currency lending continues to be a structural feature of many banking systems and feeds into the formation of NPLs. The banking system’s exposure to unhedged borrowers in the event of currency depreciation thus remains a key source of vulnerability in many countries, notwithstanding the fact that the underlying monetary and exchange rate policy frameworks across countries are often very different.

Moreover, widespread foreign exchange lending poses a challenge not only for NPL formation but also to financial stability in many countries. The banking system’s exposure to direct market risks (as proxied by foreign exchange liabilities to total liabilities minus capital) remains high in some countries such as Bosnia and Herzegovina and FYROM, and poses additional risk in the banking balance sheets for those specific countries.

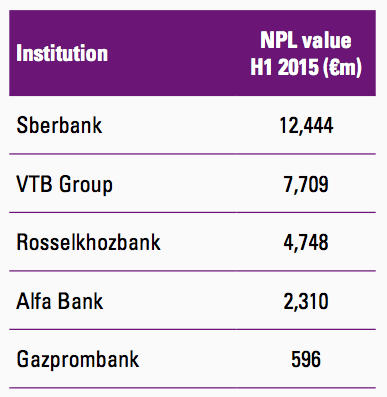

“As part of their restructuring plans, Greek banks have committed to aggressively de-leverage their CESEE exposure by 2018. We estimate this will bring €12-16 billion of banking assets to the market during this period, which on its own will revamp the local loan sale market. In December 2015, National Bank of Greece kick-started this process by selling its Turkish subsidiary, FinansBank, to Qatar National Bank.” – Vasilis Kosmas, Director, Portfolio Solutions Group KPMG in the UK

Austria and its impact on CEE

Impact of the Austrian banking sector in CEE

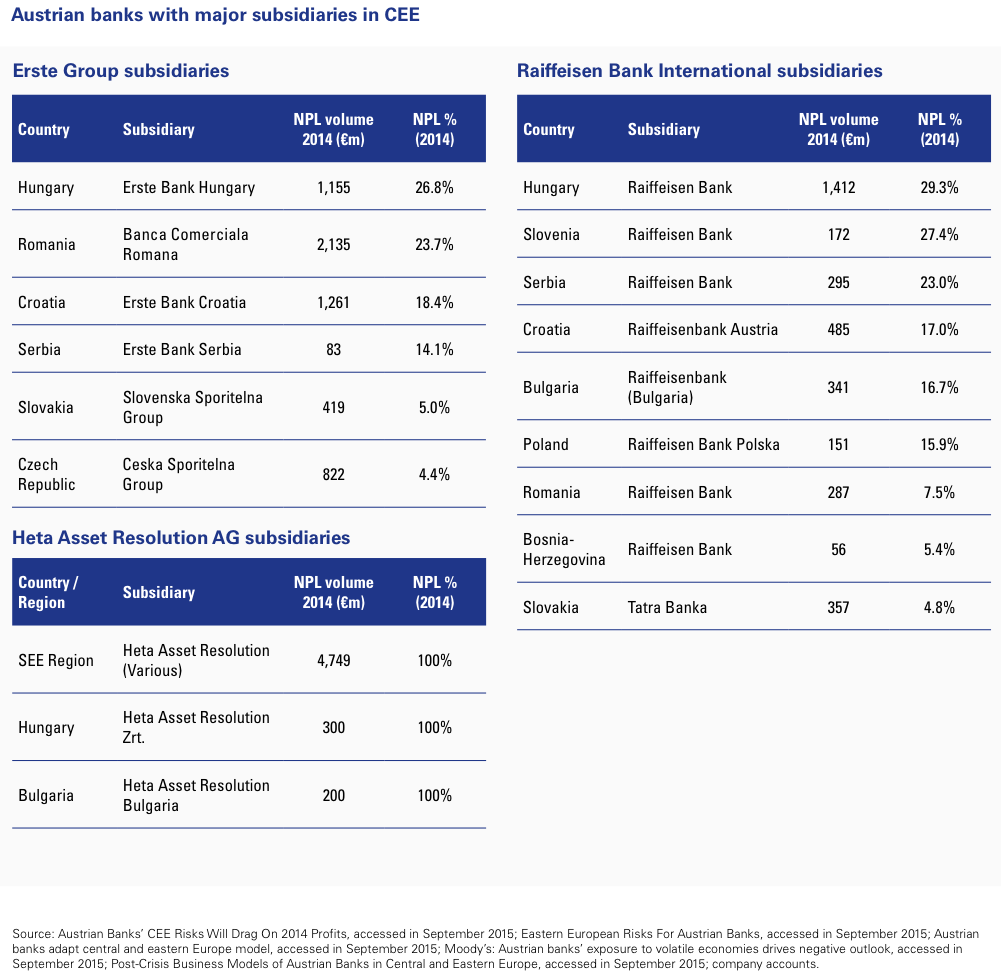

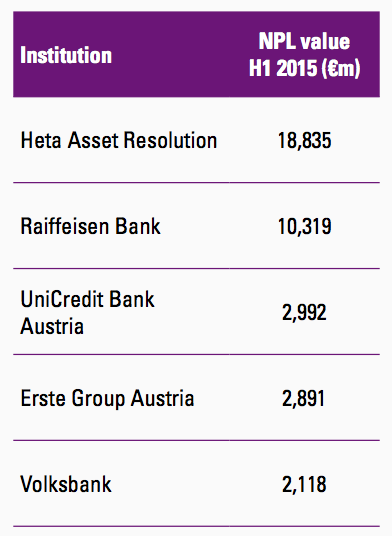

Austrian banks such as Erste Group and Raiffeisen Bank International (RBI) have a significant presence in markets across CEE, the result of a rapid expansion via subsidiaries and by offering cross-border loans to borrowers in the region. Approximately 40% of the profit of Austrian banks come from CEE countries. However, the high NPL ratio of Austrian banks has drawn attention and criticism from a number of financial analysts. In response, the senior management of Austrian banks have become more active in divesting problematic loan portfolios and handing back banking licenses in certain jurisdictions.

Heta Asset Resolution – Its effect on CEE

Heta Asset Resolution (Heta), the spin-off AMA of the nationalised Hypo Group Alpe Adria, was established by the Austrian government in October 2014, with approximately €18 billion of impaired assets. Heta was funded by the Austrian government, alongside bond issuances amounting to €10 billion, guaranteed by the state of Carinthia, which was taken up by numerous German banks and internatonal mutual funds and hedge funds. Almost half of those bonds are due in 2016 and 2017.

In March 2015, a €7.6 billion capital shortfall was identified, to which Heta responded by placing a 15-month moratorium over principal and interest payments on the bonds that it had earlier issued. This led to negative sentiment throughout the Eurozone, as it was essentially seen as a “bail-in” by bond-holders, and was the first time the Eurozone’s senior bank bond-holders, many of whom are now financial investors, were forced to take losses.

The Austrian government has also tried to reach settlement on the legal issues still pending over Hypo Group Alpe Adria’s nationalisation, while attempting to put in place plans to wind down Heta’s exposures across CEE.

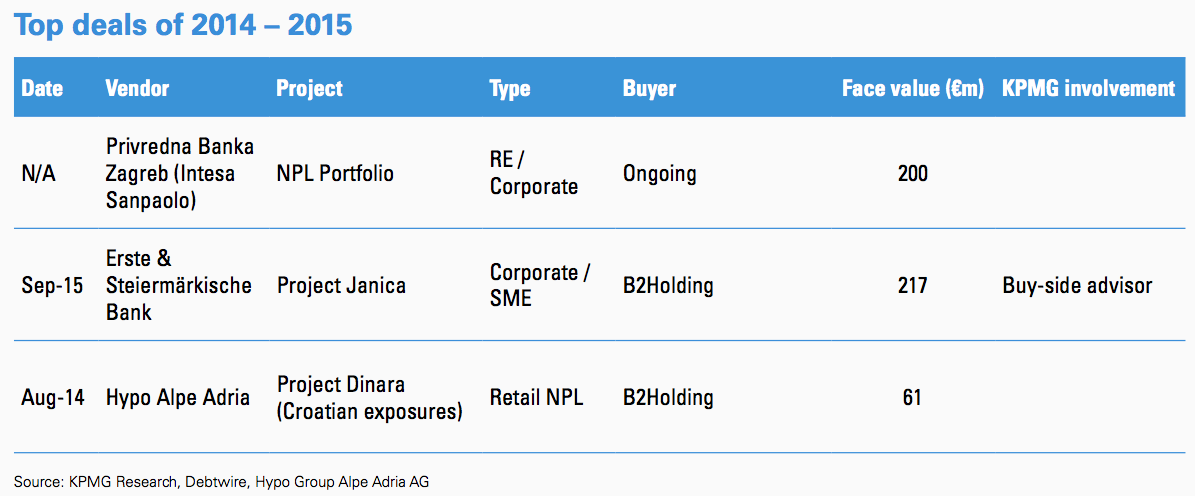

Heta is now expected to embark on an accelerated wind down of an €18 billion portfolio of exposures held across CEE countries such as Hungary, Serbia, Croatia, and Bulgaria, as well as its exposures in Austria and Italy. To date, it has successfully sold one portfolio in 2014, the €169 million Project Dinara portfolio of retail loans across four countries in the Balkans.

Austrian banks across CEE

Austrian banks’ significant exposure across CEE has also created challenges for the banking groups in recent years, with rising political tensions and low economic growth impacting margins and earnings from their CEE subsidiaries. Unfavourable legislation, such as additional bank levies, created further challenges in markets such as Hungary. The continued difficulties in operating conditions in CEE are widely expected to weaken asset quality and profitability of Austrian bank subsidiaries in the coming year; distressed loans are likely to have exceeded 9% of gross loans in 2015, which is an increase from 8.8% on 2014. We understand that the Austrian regulator would like to see Austrian banks achieve an NPL ratio of below 5% during 2016.

In the coming year, the Austrian banking sector is expected to improve overall, as a reduction in RWAs and an increase in earnings retention is expected to contribute to a more positive outlook for the sector. The domestic Austrian market itself is stable with sizeble deposits on banks’ balance sheets, which will allow the banks to continue extending loans in their higher-margin CEE markets. The loan-to-deposit ratio has been continually improving in the past years, with the current ratio at 127% in 2014 as compared to 155% in 2011.

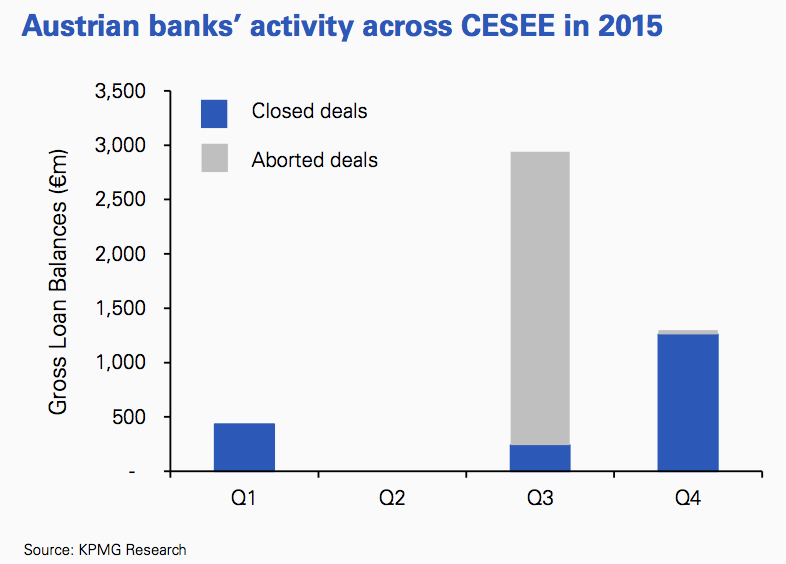

Deleveraging by Austrian banks of their CEE exposures is expected to continue in 2016. Erste Group in particular has been one of the most active vendors of loan portfolios in Romania through their local subsidiary, Banca Comerciala Romana. Most of the Austrian banking groups have already sold or are currently considering portfolio sales across CEE, including Volksbank, Bank Austria (part of the UniCredit Group), and RBI.

After a number of disappointing transaction failures in H1 2015, the second half of 2015 finished strongly with c. €2.8 billion signing in Q4. It will be key to the region that transactions continue to close in order to attract new foreign direct investment in 2016.” – Nicholas Colman, Partner, Portfolio Solutions Group KPMG in the UK

Securitisation and the ABS market

Securitsation in Europe

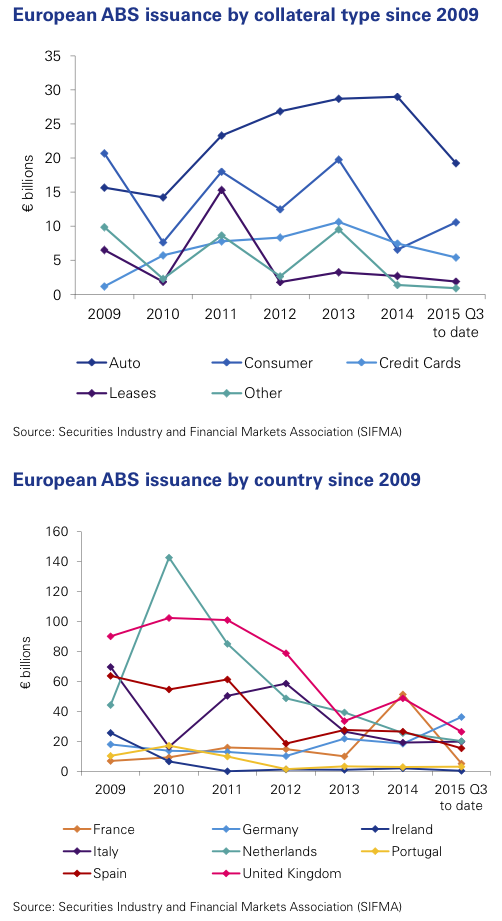

Since the financial crisis, the European Asset-Backed Securities (ABS) market has witnessed a slow and often stagnant recovery, despite having generally weathered the storm better than the US, with realised losses on pre-crisis issuance typically far smaller.

By contrast, the US mortgage-backed securities market has continued a steady recovery, with legacy agency and non-agency Residential Mortgage Backed Securities (RMBS) boosted by recent house price gains and post-crisis ABS issuance showing no signs of distress in light of tighter underwriting and eligibility criteria – a far cry from the days of sub-prime mortgages and an automotive market in distress.

Across the board however, new issuance levels remain some way off pre-crisis highs, which saw the US peak at almost $300 billion (in 2007) and Europe – led by the UK, the Netherlands, and Germany as its historically most active RMBS and automotive receivables markets – peaking at over €800 billion.

Whilst 2015 saw new issuance levels in Europe reach post-crisis highs – led most recently in the UK by the re-gearing of mortgage portfolios sold by UKAR and GE Capital and increasing activity by challenger banks – total issuance was only €50 billion and there is clearly much to be done to unlock the full potential in the market.

This is something that has long weighed on the minds of Europe’s central bankers and in particular for 2016, as the benefits of securitisation – increasingly as a means of achieving growth in SMEs through reinvigorating bank lending – are now being recognised.

Against the back-drop of a continued low (and often negative) interest rate environment, what would appear to be a recent relaxation of capital requirements imposed under Basel III, and the standardisation of securitisations in Europe, it would seem that this once out-of-favour financial mechanism is set to see its revival in 2016.

Attempts to revive the European ABS Market

It is no secret that the European Commission has been seeking to boost the European ABS market in the last 12-18 months. In particular, November 2014 saw the ECB begin a two-year bond-buying programme, designed to increase liquidity and bank lending in the market, akin to its previous successes with covered bond programmes.

The ECB has recently acknowledged that despite the implementation of its bond-buying programme, it has not yet seen a significant pick-up in the market. It has cited that regulation still presents a barrier to investment and further amendments to existing regulations are needed in order to bring more investors back to the market.

Furthermore, the ECB has not been able to decrease the high regulatory cost of ABS under Basel III and Solvency II, which has made investors (including insurers) wary of investing in the market. High capital requirements, due diligence costs and a challenging economic environment in Europe have contributed to investor uncertainty and a general lack of confidence that pervaded the market in 2015.

“In 2015, we saw global banking authorities continue their efforts to revive a once popular funding solution and European ABS issuance levels reach post-crisis highs – dominated by UK RMBS. 2016 is widely expected to see these trends continue, and whilst there remains much to be done to unlock the full potential in the market, the signs are encouraging for banks and buyers alike.” – Arun Sharma, Associate Director Portfolio Solutions Group KPMG in the UK

Investor Outlook for European ABS

Investors have called for consistency, transparency and standardisation in the regulation applied to the ABS market, as the stringent regulatory framework implemented as a result of the financial crisis has made it difficult for investors to justify the increased cost of investing in ABS.

ABS market in Europe:

– A further reduction in capital requirements applied to issuers;

– Reduction in spreads on issued debt;

– More clarity and easing of risk transfer rules;

– Improvement in the data quality of the underlying loans and assets; and

– Standardisation in the application of risk sensitivities.

That said, 2015 was a record year (since 2008), particularly in the UK, with the recent sale of mortgage portfolios by UKAR and GE Capital which effectively saturated the market, as well as new issuances by challenger banks and other non-traditional lending platforms.

With the spotlight increasingly focussed on SMEs, banks continue to struggle to keep pace with the growth of online lending platforms such as Funding Circle, that specialises in originating SME loans and who is rumoured to bring out the UK (and Europe’s) first P2P securitisation programme in early 2016.

2016 is widely expected to see new issuance post-crisis highs, led by the growth of Europe’s key ABS markets in the UK, Germany, France, the Netherlands and Italy, while insurance companies and pension funds reconsider asset allocations in the face of a continued low yield marketplace.

Country profiles

Austria

“Austrian banks are increasingly evaluating hold versus sell strategies, but are mainly pursuing NPL transactions in South Eastern Europe. Although loan portfolio transactions are slowly picking up in Austria as well, activity has largely been driven by the bad banks.“ – Bernhard Klingler, Partner, Co-head of Advisory, KPMG in Austria

Austrian banks’ activity across CESEE in 2015

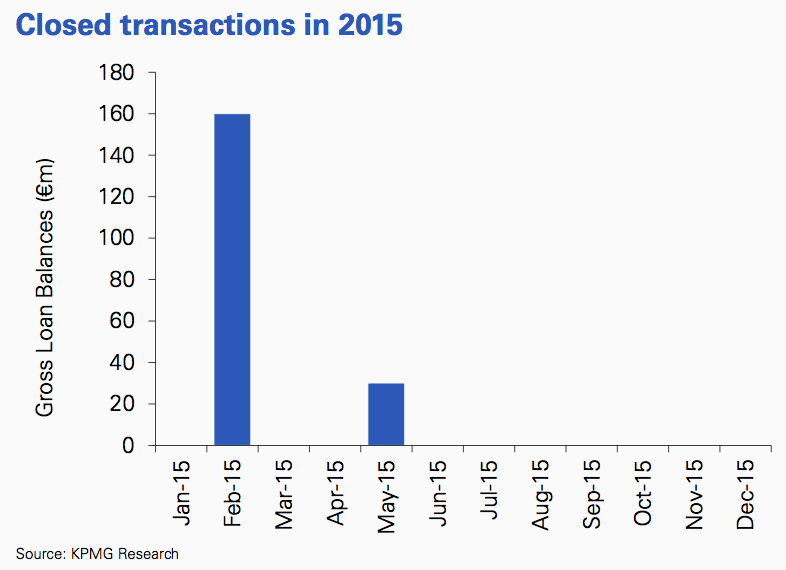

– There have been no loan portfolios transactions in the past 12 months in Austria, though this certainly does not constitute a lack of NPLs on the balance sheets of banks. All of the major Austrian banking groups have significant volumes of NPLs, though most of it is in relation to their operations throughout CEE.

– Heta Asset Resolution, the bad bank formed by the Austrian government from the nationalised Hypo Group Alpe Adria in October 2014, currently holds €18 billion of NPLs, the majority of which relates to Austrian exposures.

Other developments

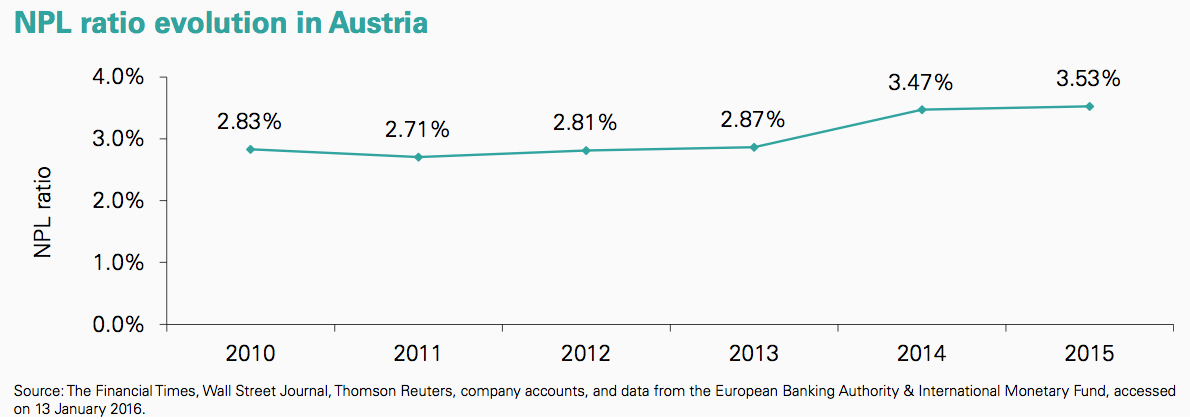

Austrian banks’ profitability is heavily reliant on their CEE operations, a region which they had rapidly expanded into before the financial crisis. The subsequent market environment in CEE has led to an increasing volume of NPLs held by Austrian banks, which led to an NPL ratio of 3.53% in 2015.

Measures that the Austrian government took to address the fallout from the financial crisis included terminating the licenses of its large banks, and turning them into bad banks mandated solely to dispose of impaired assets. A positive outcome of this government intervention has been a decrease in NPLs, with NPL volume falling to €32 billion in 2014, from €44 billion in 2013.

Regulation

– Market entry for Austrian-based Alternative Investment Funds (AIFs) is relatively easy. Austrian-based small AIFs (asset size of less than €100 million) can enjoy certain exemptions. However, these exemptions do not apply to non-Austrian entities.

– Under European Venture Capital Funds (EuVECA) designation, any non-Austrian AIF can enter into the market, subject to passports issued by EuVECA and home EU state authorisation.

Servicing

– Most of the banks in Austria service their debt in-house.

Enforcement

– Enforcement occurs through compulsory administration or seizure, and subsequent sale of the debtor’s assets.

– Creditors must request the court to issue a “Payment Order” to instruct the debtor to pay the claim, including interest and court charges, within 14 days. Failure to comply with that order results in the debt becoming enforceable.

– Insolvency proceedings last for a duration of two years on average.

Looking forward & KPMG predictions

– While the overall NPL ratio within Austria has been low due to strong underlying fundamentals (with the exception of Hypo Group Alpe Adria and Kommunalkredit, which were both nationalised), NPLs continue to be a problem for Austrian banks due to their extensive CEE operations. Due to deteriorating credit quality and challenging market conditions, Austrian banks will continue to look to sell off their banking operations (both loan portfolios and associated servicing platforms) in peripheral CEE countries.

– Past successful loan sales have mostly been concentrated in consumer portfolios. There will continue to be challenges as Austrian banks look to offload their asset-backed portfolios, particularly in SEE countries where the market is still nascent and current regulation surrounding the transfer of receivables remains unclear.

– Heta is expected to continue to dispose of its extensive volume of NPLs in the coming year, after this past year has seen it selling off its Balkans operations, and splitting off its Italian arm and subsequently bringing it to market (Project Friuli) in Q1 2016. Heta may bring further portfolios to market across its remaining Austrian and CEE portfolios, though its overall strategy has not yet been released.

Belgium

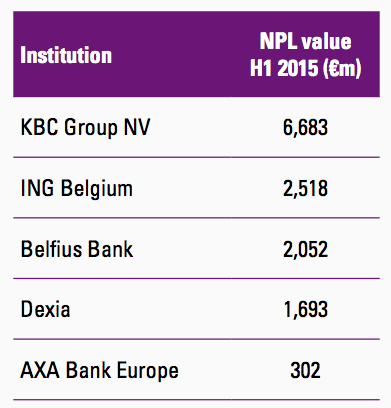

“KPMG was involved in many of the leading loan portfolio sales during the past year in Belgium as sell-side or buy-side advisor. We expect future portfolio sales values will be boosted due to the change of NPL definition in the solvency rules. Belgium is an attractive market for investors due to its transparent legal framework and concentration of exposure.” – Peter Lauwers, Partner, Head of Advisory, KPMG in Belgium

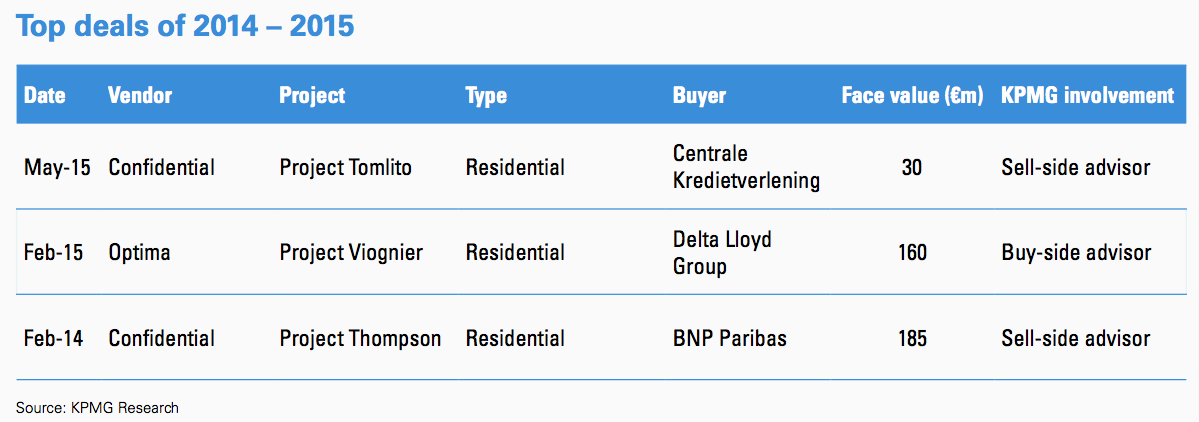

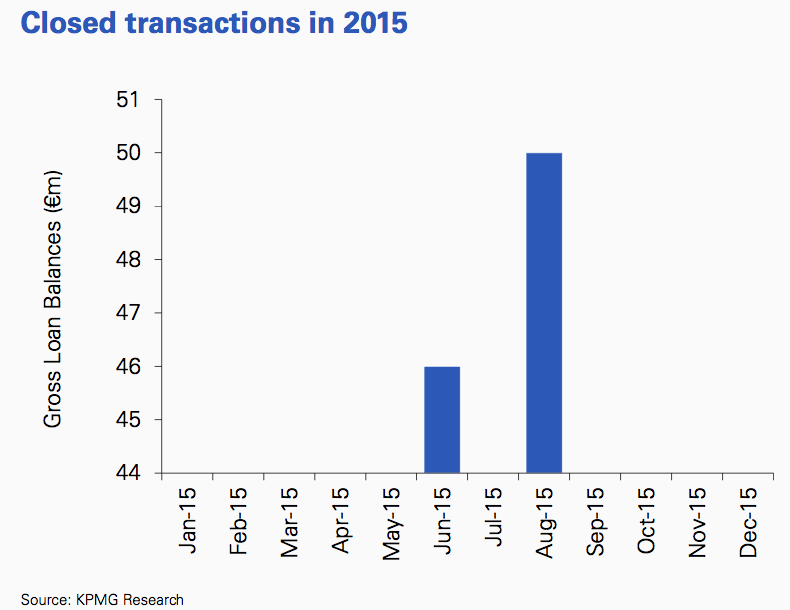

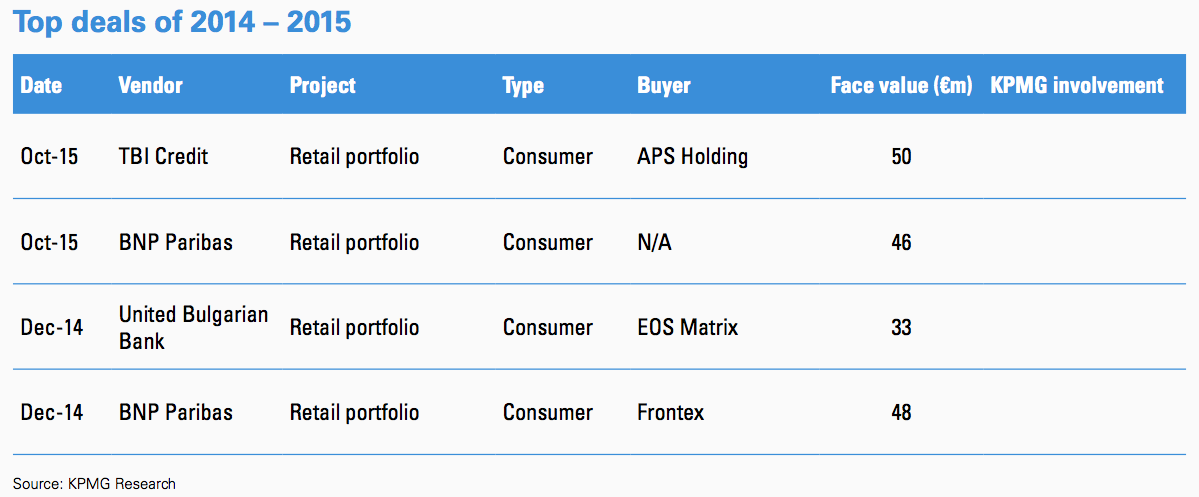

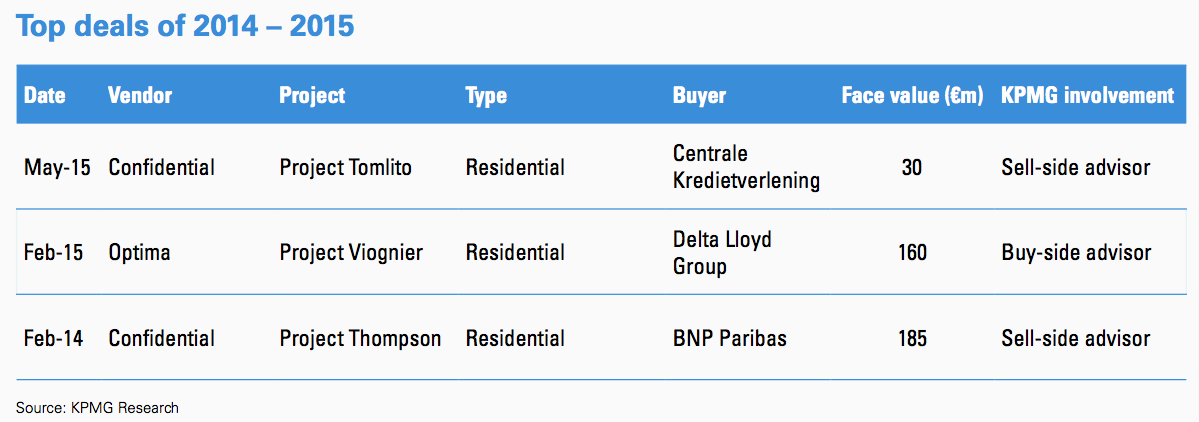

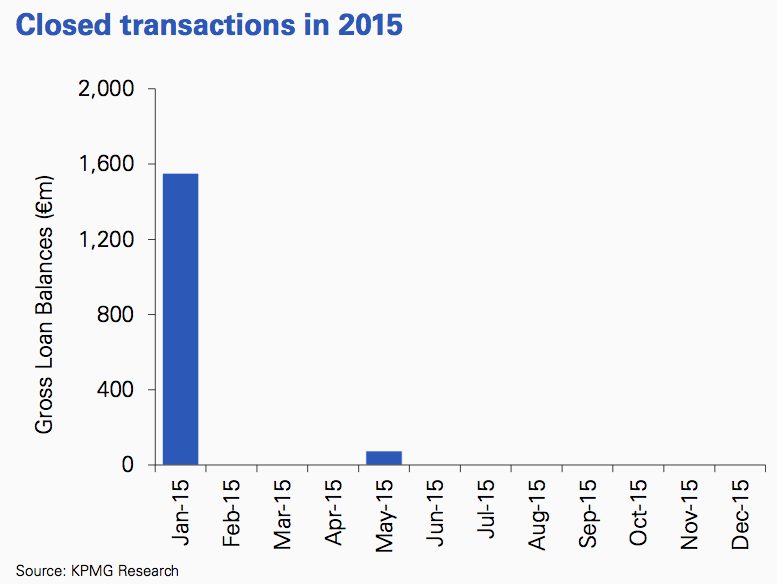

Closed transactions in 2015

– Loan sale activity in Belgium has been limited to date, with only three transactions closing in the past year. Two of the three transactions were part of the ongoing wind-down of well-seasoned securitisation structures in Belgium, and were a mix of performing and non-performing residential mortgage portfolios.

– One transaction occurred due to the decision of Optima to return its banking license in Belgium. This resulted in the sale of a performing residential mortgage portfolio in February 2015 of €160 million.

Other developments

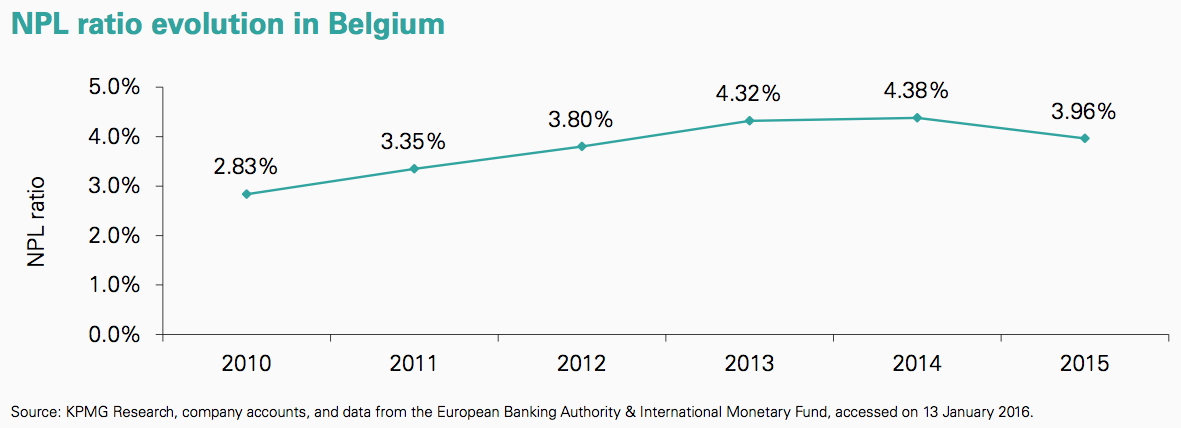

The effects of the 2008 financial crisis were clearly felt in Belgium, as the country‘s banking sector underwent large-scale restructuring, with government intervention necessary in order to protect consumer deposits. However, Belgium’s economy has been improving and stabilizing since then, with GDP growth in 2015 at 1.4%.

The Belgium banking landscape is dominated by four banks: KBC, BNP Paribas, ING and Belfius. Due to strict underwriting criteria there is a low percentage of NPLs on their balance sheets. Belgian real estate prices have also been stable during the financial crisis compared with other neighbouring countries.

Regulation

– The regulation with respect to residential mortgage loans is governed by Book VII of “Code de droit économique” of February 2013 (“the Code”) which recently entered into force. The Code integrates almost all of the legal provisions of the Belgian Mortgage Act of August 1992; there are no major changes to the applicable legislation.

– Residential mortgage loans can only be assigned to an entity which is authorised or registered as a mortgage institution (hypotheekonderneming/entreprise hypothécaire) with the Financial Services and Markets Authority (“FSMA”). Only these entities can exercise activity as a mortgage institution in Belgium: a Belgian entity that is licensed by the FMSA as a mortgage institution; an EEA credit institution or financial institution that is a specialised subsidiary of a credit institution; and a non-EEA entity that is established in Belgium and licensed by the FMSA as a mortgage institution.

Servicing

– In-house servicing remains the dominant strategy for Belgian banks, given their scale.

– There are only a few third-party primary servicers in Belgium who provide servicing to a variety of smaller assets managers and banks for both consumer and mortgage loans.

Enforcement

– The procedure for foreclosing is under the authority of the attachment judge. Any executory seizure (uitvoerend beslag/saisie exécution) needs to be preceded by an attempt to conciliation.

– If no agreement can be reached, or the borrower does not follow its debt mediation repayment plan, a foreclosure process can be started. The properties are then sold in a public auction or through a voluntary sale.

Looking forward & KPMG predictions

– Loan portfolio sales in Belgium have been limited to date given the low percentage of NPLs in the Belgian banking system. However, pressure on margins due to the low interest rate environment provide opportunities for smaller asset managers and foreign banks in Belgium to sell off portfolios with healthy yields at small discounts to par.

– The definition of NPL has been expanded under the new solvency rules implying higher capital requirements. These higher capital requirements provide an opportunity for financial institutions who may look to dispose of these assets from their balance sheets.

Bulgaria

“The Bulgarian debt sales market has lagged behind its Central and Eastern European counterparts. However, the relatively high NPL ratio and the upcoming Asset Quality Review due to be completed in August 2016 are expected to turn the trend.” – Gergana Mantarkova, Managing Partner, Deal Advisory, KPMG in Bulgaria and in the Balkans

Closed transactions in 2015

– Payday loan providers form the majority of the credit portfolio sales over the last 12 months, exceeding BGN 265 million (€135 million). The buyers are specialised local or regional collection agencies such as EOS and APS Holding. Most of the portfolios consist of retail loans; corporate loans are rarely offered.

– Loan sale activity in Bulgaria has been limited but is expected to pick up in 2016, with increased interest from local and international banks to divest problem loans.

– The largest portfolio deal to date was a €50 million NPL portfolio from a payday company, bought by APS Holding’s Bulgarian subsidiary.

Other developments

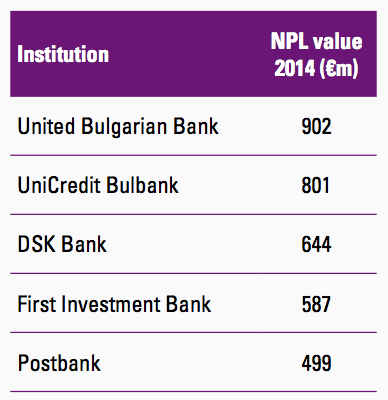

The NPL ratio remains high at 20.6% of gross retail and corporate loans, (17.3% for retail loans only). The NPL problem is further exacerbated by the reluctance of the Bulgarian banks to sell loan portfolios that may crystallise losses. A common interim approach employed in the market is to transfer NPL portfolios to related companies in order to separate problem loans from the other assets of the bank that may reduce accounting losses and the associated capital burden.

The total sale of NPL portfolios in Bulgaria for the first half of 2015 amounted to BGN 149 million (€76 million, which included telecom receivables), which is less than 20% of the total of NPLs.

Regulation

– The Central Bank introduced a capital conservation buffer (3%), as well as a systematic risk buffer (2.5%) in addition to the basic CRD IV requirements, that brings total capital requirements to 13.5% of RWAs. This is expected to force banks to revisit and clean up their books and more actively reduce loan portfolios that are capital intensive.

– Amendments in the Commercial Act in 2013 have supported the banking system in recognising mortgages/pledges established in favour of a bank, for the purposes of securing a bank loan, shall not be invalid regardless of when they are established. Consequently, bank interests are expected to be better protected going forward resulting in less fraud cases and a more efficient approach to the resolution of loans.

Servicing

– Most NPL servicing is concentrated in-house by the local banks.

– Third party servicing is represented by the Association of the Collection Agencies, which currently consists of 15 companies with over 70% market share. The acquisition of receivables requires a financial institution license, but a license is not required for debt collecting activities in Bulgaria.

Enforcement

– Enforcement procedures differ depending on the type of collateral, type of creditor and the type of pledge/mortgage.

– When enforcing mortgages, banks are relatively privileged compared to other creditors, as they are entitled to request from the respective court an issuance of an order for immediate execution, together with a writ of execution, only on the basis of a document or an excerpt from its accounting records, evidencing the bank’s receivable from the respective debtor.

Looking forward & KPMG predictions

– The NPL market in Bulgaria is expected to pick up in 2016, driven by regulation and international lenders looking to exit or reduce their exposure to Bulgaria, in addition to the AQR exercise. The Bulgarian National Bank has been pressuring banks to resolve the NPL problem; three of the six largest banks in the country have NPL ratios in excess of 20%.

– The share of NPLs in the Bulgarian banking sector is expected to increase post the release of the AQR results in August 2016, as was seen in other countries whose banking systems recently underwent an AQR. However, in the short term, it is expected that corporate and consumer indebtedness will remain at current levels, taking into account the tightened credit procedures of the banks, as well as the limited availability of attractive and stable projects to finance.

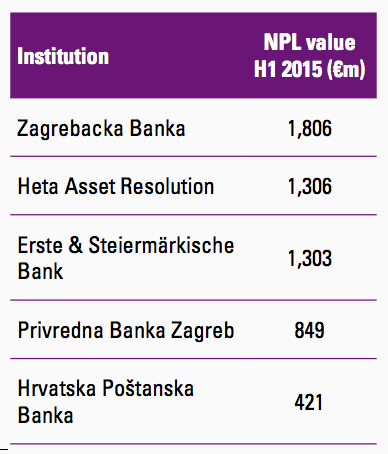

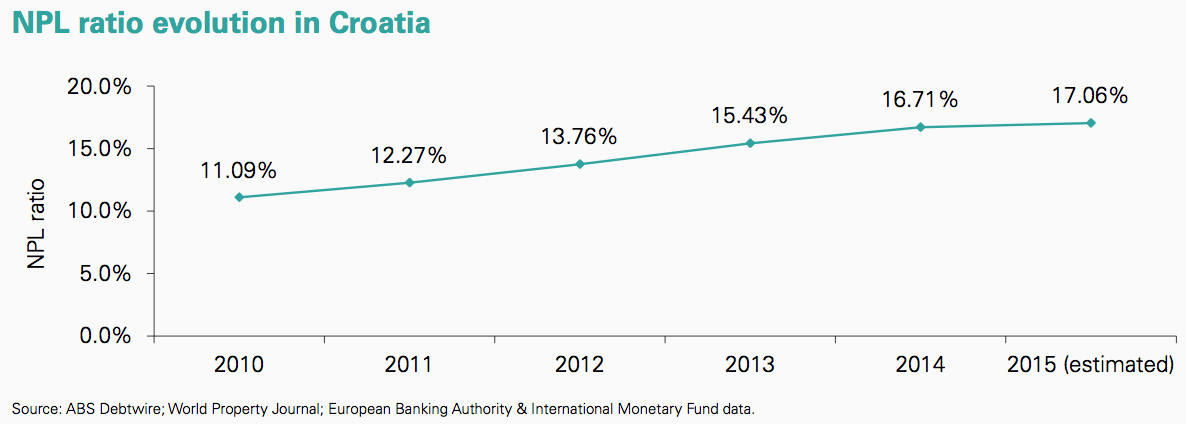

Croatia

“The deleveraging process in the Croatian banking sector started in 2014 and is expected to continue into 2016. We also expect an increase in the number of transactions in the medium term driven by subsidiaries of international banks, following some successful portfolio sales in 2015.” – Goran Horvat, Partner, Head of Financial Services and Restructuring, KPMG in Croatia and Bosnia-Herzegovina

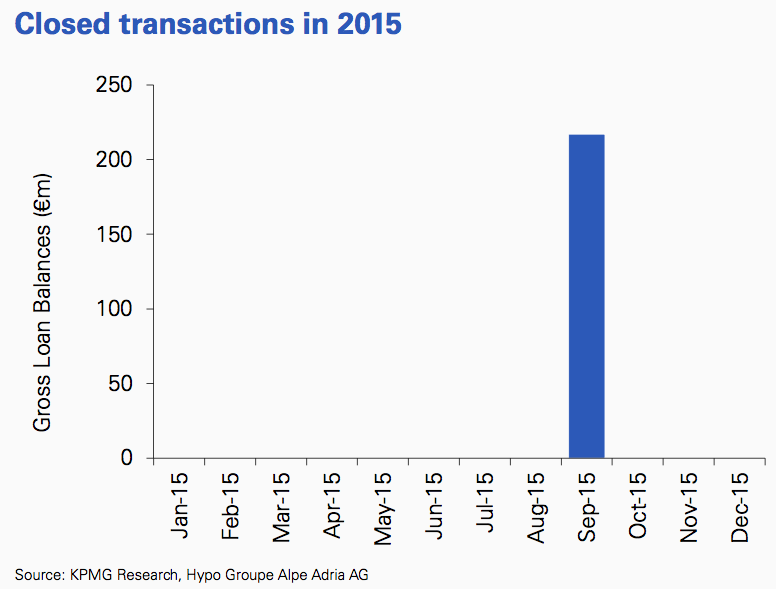

Closed transactions in 2015

– 2015 saw another portfolio sold in Croatia, the €217 million Project Janica. This follows one of the first loan sales in Croatia, which was the €61 million portion of the multi-jurisdictational Project Dinara to borrowers in Croatia.

– One of the first loan sales in Croatia, Project Dinara, was part of a Balkans portfolio sold by Hypo Alpe Adria. B2Holding has been the most active investor in Croatian loan portfolios to date, having acquired both Project Dinara and is in the final stages of closing the larger €217 million Project Janica transaction sold by Erste & Steiermärkische Bank (Erste Group).

Other developments

Croatia joined the European Union in July 2013, leading to a number of ongoing changes in the financial and legal systems to bring them in line with EU standards.

Croatia’s banking sector is highly concentrated and is dominated by foreign banks, notably the subsidiaries of large banking groups in Italy and Austria.

Regulation

– The Alternative Investment Market (AIM) in Croatia is supervised by the Croatian Financial Services Supervisory Agency (HANFA) which requires a minimum issued capital of 240,000 HRK (€32,000) for a Croatian AIFM and 1 million HRK (€133,000) for a non-Croatian AIFM.

– A foreign entity is required to have a branch in Croatia and needs prior approval from HANFA before conducting activities as an AIFM or UCITS management.

Servicing

– Under Croatian legislation, third-party loan servicing companies do not require a license as long as the operations are carried out by non-banking entities.

– Third-party servicers have to meet a number of criteria set by the Croatian National Bank, such as minimum capital maintenance and sustainability.

Enforcement

– Enforcement may require some of the following procedures: obtaining enforcement confirmation from a public notary, filing an enforcement request to the court, attaining a court decision on the enforcement, and then enforcement by public auction or by direct contracting.

– The new Croatian Bankruptcy Act that became effective on 1 Sept 2015 is expected to speed up the enforcement process, particularly in regards to pre-bankruptcy proceedings, which now fall under the jurisidiction of the commercial courts, instead of the Financial Agency (FINA). Borrowers can now only enter pre-bankruptcy proceedings if the borrower is imminently insolvent, as defined by the status of its unsettled obligations, unpaid salaries, and taxes related to salaries.

Looking forward & KPMG predictions

– Croatian commercial banks are expected to start deleveraging the remainder of their NPL portfolios in 2016, and bring them to market in the coming years. Additionally, four of the five largest banks in Croatia are subsidiaries of large multinational banking groups in Italy and Austria, and they in particular are expected to further deleverage as parent banks look to recapitalise and dispose of problem loans across their CEE operations.

– We expect investors to view Croatian loan sales with more positive sentiment with the new Croatian Bankruptcy Act in force, as it addresses some of the primary concerns of investors in regards to enforcing on Corporate and SME loans, namely the complicated court process and long time frame to resolution which had previously resulted in an enforcement time of up to five years.

– As the tourism industry continues its strong growth, Croatia has experienced increased demand in real estate, particularly along the coastline and in leisure and tourism-oriented properties. This interest has resulted in increased investor interest in primarily real estate-focused loan portfolios.

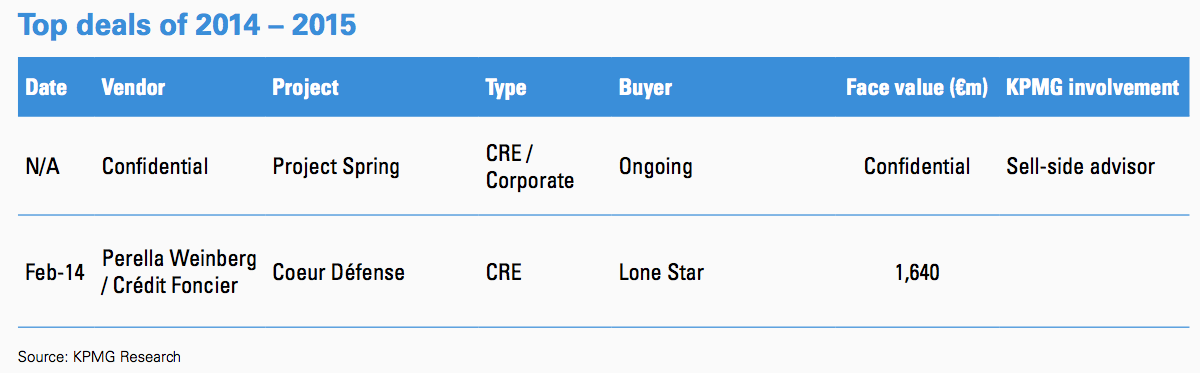

France

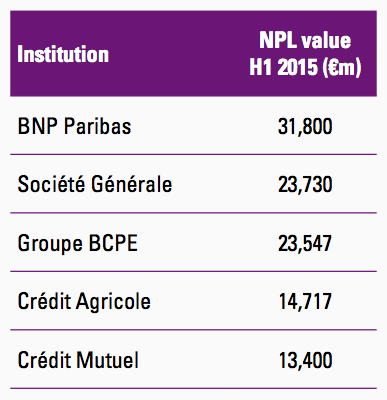

“In 2015, France saw a repeat of previous years with modest activity in its loan sale marketplace. This is in spite of there being in excess of €120 billion of NPLs in the French banking sector, the second highest volume in Europe. Whilst NPL ratios are relatively low, French banks pursue their efforts to strengthen levels of Core Tier 1 Capital ratios and there are indications that further derisking is to come, beyond the overseas assets and subsidiaries that have been sold to date.” – Cyril Schlesser, Director, Corporate Finance, KPMG in France

Closed transactions in 2015

– There have been no public loan sale transactions in France in the last 12 months. However, French banks have continued to deleverage NPL portfolios in many other European countries, including Spain, Italy, and Romania.

– 2016 sees KPMG launch Project Spring, the first loan portfolio brought to market in France. Initial feedback from investors indicates strong demand for French real estate backed loan assets, particularly against the backdrop of ever increasing competition in many other of France’s western European peers.

Other developments

Three of France’s leading banks have some of the lowest common equity Tier 1 capital ratios – at or around 10% – in Europe. Rumours regarding the potential introduction of minimum asset risk-weighting requirements under ‘Basel IV’, are an additional driver to the capital ratio reinforcement movement undertaken by French banks.

Regulation

– As a result of the potential introduction of RWA flooring requirements, French banks are understood to be lobbying the ECB in order to avoid what would be a significantly onerous requirement.

– Indeed, this comes at a time when the French banking sector is generally still to fully re-capitalise to the levels of its European peers.

Servicing

– Servicing capabilities in France are mostly limited to in-house servicing of their positions by banks – a situation not dissimilar to that of Ireland or Spain in 2010.

– In order for the French loan sale market to reach the levels seen in many European countries, it will be crucial for there to be more independent servicing capability and capacity to attract and facilitate direct foreign investment by funds and NBFIs.

Enforcement

– Enforcement of claims in France is generally structured to promote the consensual repayment of debt through an amicable agreement with major creditors.

– In the event of a failure, there are three main judicial processes available which are enforced through the court, each designed to ensure a debtor can be wound down in an orderly fashion or via an insolvent liquidation. In each case, there is a distinct focus on social implications and preservation of employment.

Looking forward & KPMG predictions

– Loans to SMEs will drive the growth of activity in the French NPL marketplace. In Europe, France is second only to Italy in terms of NPL volumes and increasing precedent deals will encourage banks to explore the sale of loans as a means of effective de-risking.

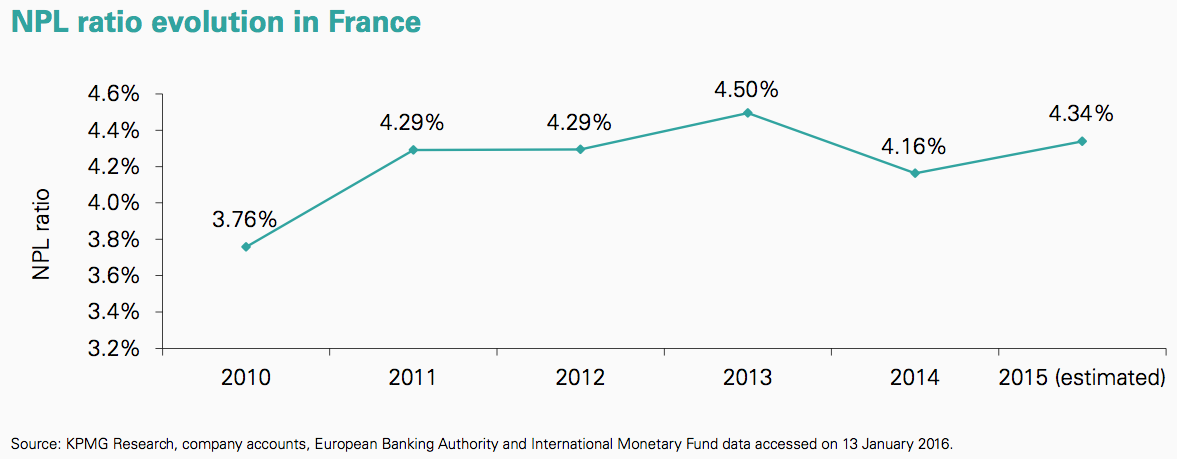

– The share of loans overdue in France is expected to continue to be constant at approximately 4% (the level which it has been at since 2009), this while NPL ratios have been declining to below 3% for most other Western European countries such as Germany and the UK. This expectation is mirrored in the GDP growth rates, which have been consistently positive in most other Western European countries, but have been lowest in France since 2010.

Germany

“There are increased NPL and non-core portfolio transactions due to improved market conditions and increased demand. We do expect a further increase of transactions, particularly in residential loan portfolios; however the overall volumes continue to be small in comparison to the market potential” – Sven Andersen, Partner, Head of Real Estate M&A, KPMG in Germany

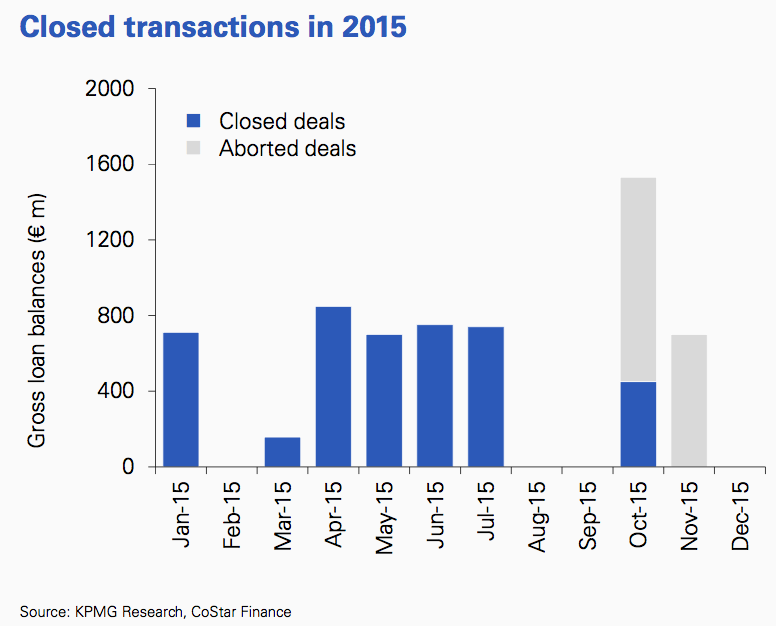

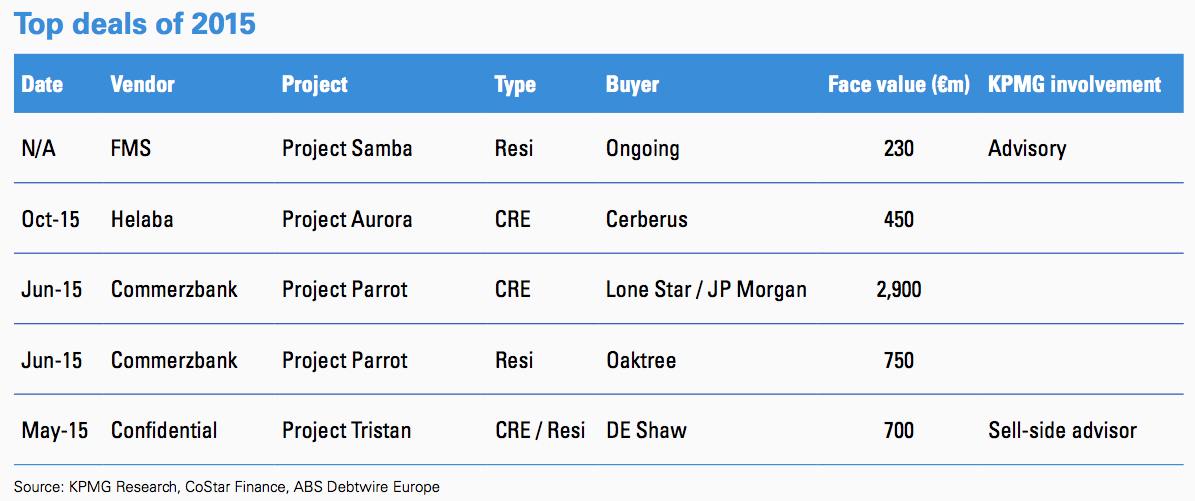

Closed transactions in 2015

– The overall volume of the loan sale market in Germany has remained significantly below expectations, despite a number of large transactions that came as a result of the winding down of Eurohypo AG (the real estate bank now 100% owned by Commerzbank).

– Foreign banks in Germany have been more active in disposing their German NPLs and non core-assets than domestic lenders. Of its domestic banks, only Helaba has sold a portfolio in H2 2015, the €450 million Project Aurora, to Cerberus.

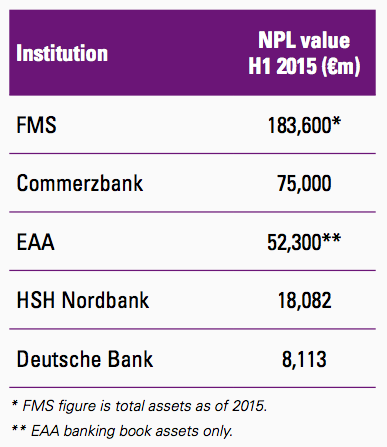

– The German bad banks, which include Erste Abwicklungsanstalt (EAA) and FMS Wertmanagement (formed from the failed banks of WestLB and Hypo Real Estate, respectively), have not brought many German portfolios to market to date despite investor expectations.

Other developments

Sales of non-performing loans by German lenders are expected to pick up in the near future as banks are expected to offload distressed assets from their balance sheets, despite the limited number of disposals in recent years.

Cost-cutting measures are among the top management priorities for German banks. For this reason, NPL portfolio sales are expected to play an important role for banks to reduce internal workout costs in the medium to long term.

Regulation

– According to the German Banking Act (KWG), the acquisition of a leveraged loan does not necessarily require a banking license.

– A buyer will require a banking license only in cases where it is undertaking lending activity, for example by providing new funds or extending an existing loan or credits to borrowers.

Servicing

– In-house servicing remains a dominant strategy for German Banks, while outsourcing is not yet widespread in dealing with NPLs.

– Servicers of German mortgage loans will need to be aware of the trade secrecy provisions of the German Act against Unfair Competition and (in relation to sanctions) the German criminal code. All of this limits the ability of servicers to serve investors.

Enforcement

– Lenders have a number of enforcement options to put pressure on a borrower for repayment of debt, including:

– Non Judicial Enforcement: the lender can secure cash flows towards the debt by enforcing the account pledge via sending notice to the bank of the borrower.

– Judicial Enforcement: Under German law, a forced sale can only be achieved by way of auction upon enforcement of the land charge.

Looking forward & KPMG predictions

– Improved market conditions and increased demand has forced government-owned “bad bank” vehicles in Germany to accelerate the sale of loan portfolios. The two state-owned bad banks of Germany (FMS and EAA) are expected to continue to reduce their exposure outside of Germany in the coming year, but their deleveraging activity in Germany is expected to continue to be low. This has resulted in easing the government debt-to-GDP ratio to 75% of GDP in 2014, down from 77% in 2013.

– The main drivers of impending NPL disposals for German banks are rising banking regulatory pressure and an increasing focus on achieving better cost efficiency. NPL portfolio sales are expected to play an important role in reducing internal workout costs for German banks in the medium to long term. Regional banks, which generally do not sell NPLs, constitute additional potential for growth embedded in the German market.

– German banks are currently adopting either a hold strategy, or are focusing on disposals of non-German NPLs. Most banks have sold or are selling their shipping loans due to regulatory pressure from the ECB, while single name sales remain the preference of most banks. Sales activity will likely increase only if BaFin, the German regulator, pushes for balance sheet clean-up.

Greece

“The Greek debt sale market is expected to be fully transformed in 2016, considering the implications arising from the recapitalisation of the banks currently in progress, the financing needs of the Greek corporates in their effort to survive, the recent legal amendments simplifying liquidation procedures as well as additional amendments underway. NPL portfolios will be a first priority for the banks.” – Christian Thomas, Partner, Head of Deal Advisory & Head of Forensic, KPMG in Greece

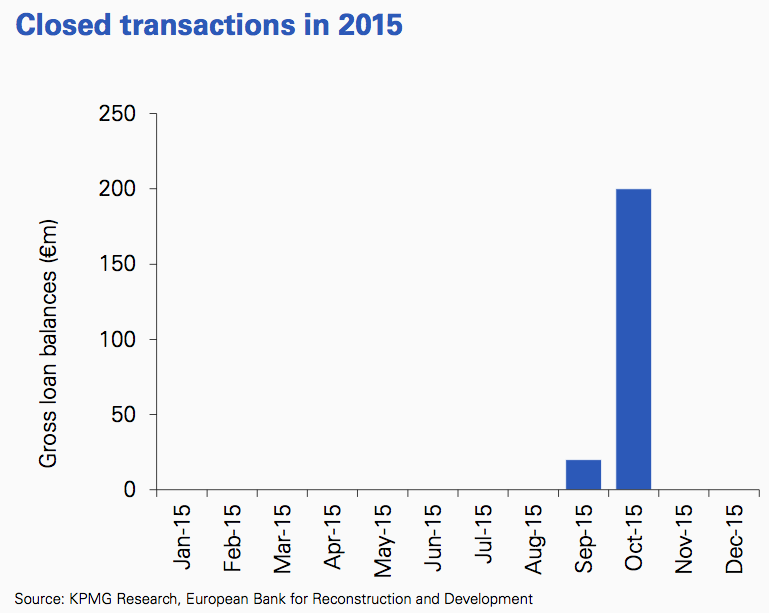

Closed transactions in 2015

– There have been no loan portfolio sales to date in Greece, though Greek banks are expected to bring NPL portfolios to market in the coming year in order to stabilise their balance sheets.

– However, household loan portfolio sales to foreign investors are expected to face opposition in the current economic and political climate of Greece.

– Greek banks are already deleveraging their NPL balance sheets throughout Eastern Europe as they seek to exit non-core operations outside of Greece.

Other developments

There has been great political and economic uncertainty surrounding Greece since the 2008 economic crisis hit Europe. Having been bailed out by the “troika” of the European Commission, European Central Bank, and the International Monetary Fund on multiple occasions, and with widespread opposition to further imposed austerity measures by the Greek public, Greece faces an uncertain economic future, and its banking system will play a crucial role in any revival of the Greek economy.

Regulation

– The Bank of Greece (BoG) Act 47/9.2.2015 allows a Credit Institution to sell NPLs to another credit or financial institution or financial vehicle, in light of the provisions of the Greek Law.

– The Greek State, based on the adopted 3rd Memorandum of Understanding, is committed, with a defined action plan (August 2015 – June 2016), to strengthen the legal and regulatory framework in order to facilitate the settlement of NPLs, while protecting vulnerable households consistent with an updated Code of Conduct established by the Bank of Greece, as well as to strengthen the corporate governance of the Greek banks in order to be fully independent and consistent with the international good practices.

– The BoG will engage a single special liquidator to ensure individual liquidators are delivering effectively against operational targets. Performance based remuneration scheme will be introduced for all special liquidators in consultation with the HFSF in order to maximize recovery.

Servicing

– There is a very limited third party servicing market for loans in Greece (particularly for loans to corporations), with most banks servicing their loan portfolios in-house.

Enforcement

– The provisions of the Greek Code of Civil Procedure (GCPC) regulate enforcement through judicial proceedings, as out-of-court enforcement is not provided.

– Enforcement proceedings commence by sending the borrower an enforcement title and a request for payment for a court bailiff. There will then be a mandatory auction of assets.

– Recent amendments in the legal framework (law 4336/2015 and CPC Art. 975) have (1) abolished absolute priority of state claims vs. borrower claims and (2) simplified liquidation procedures shortening the resolution timeline from approximately 28 months to less than 12 months; more borrower friendly legal framework amendments are expected in 2016.

Looking forward & KPMG predictions

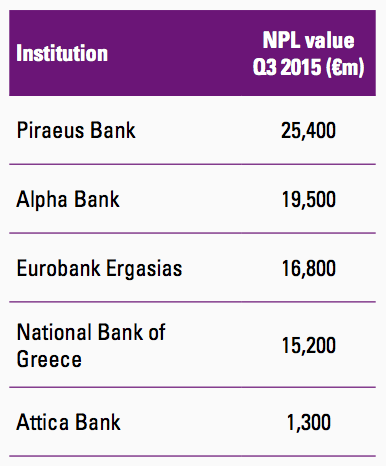

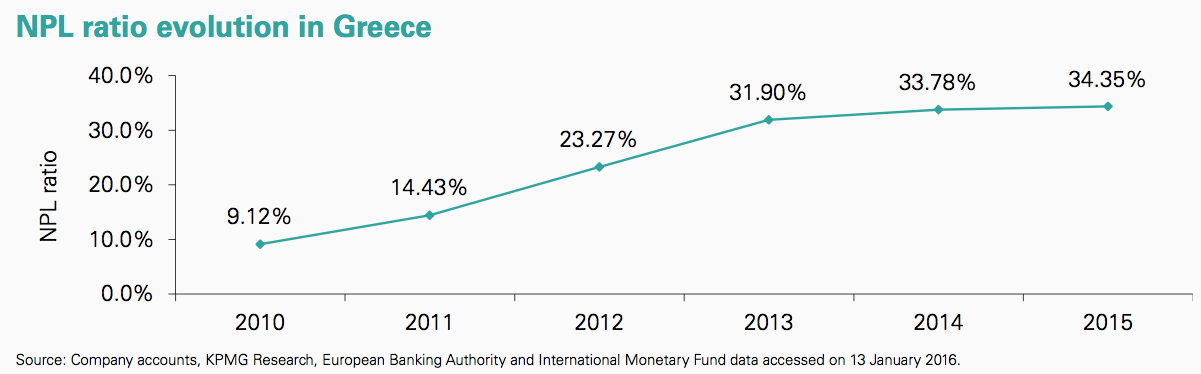

– The core challenge at the heart of the liquidity crisis facing the Greek banking system is the estimated >€100 billion of NPLs on its balance sheets that prevent the banks from providing fresh financing to the real economy. The ECB estimates that this could rise further due to the impact of political uncertainty and ongoing capital controls faced by individuals and corporates. NPLs could rise to above 45% in the coming year.

– All large Greek banks have established NPL Troubled Assets units, which may be hived out into separate vehicles to reduce the burden on core balance sheets. Greek banks are expected to start bringing NPL portfolios to market, though the political risk premiums that international investors will apply to Greek portfolios will be challenging, particularly in the case of household loans.

– One of the options being considered amongst several large Greek banks is of joint ventures with international players servicing retail/business loans. A key consideration from a Bank’s management viewpoint is to improve effectiveness while at the same time maintain economic interest in case of upside.

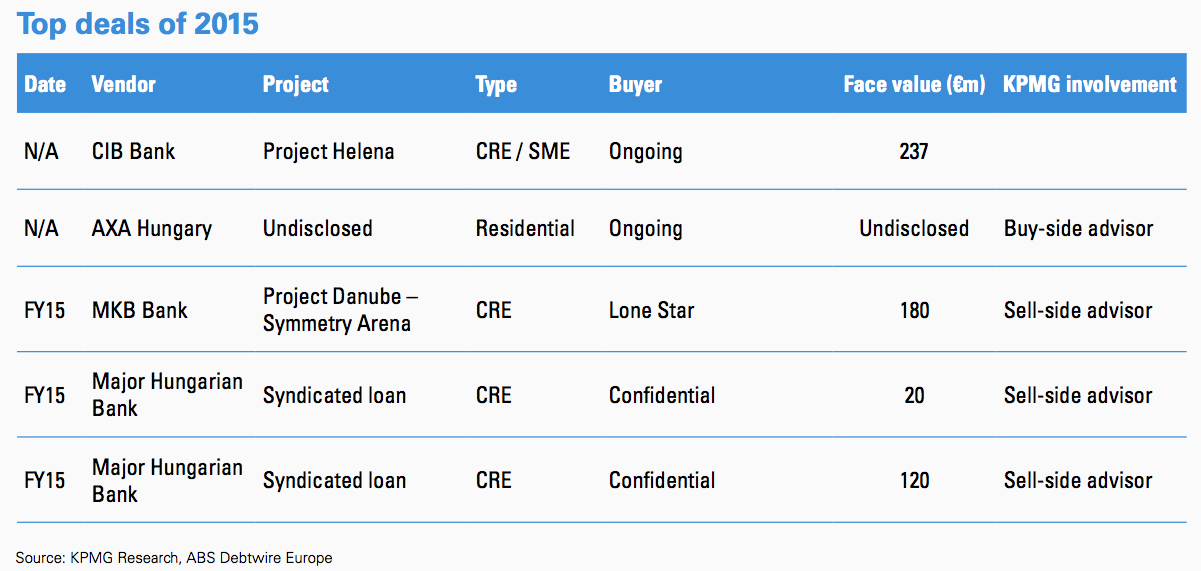

Hungary

“Most NPL holders are beginning to test the waters. Some non-banks have made strategic decisions to exit the mortgage market whatever loss this may trigger. The market will find its feet over the next months and show volume. A key to maintaining the momentum will be successfully closed transactions. KPMG have now closed three corporate loan sales in the last 12 months.” – Tamás Simonyi, Senior Director, Head of CEE Financial Insitutions M&A, KPMG in Hungary

Closed transactions in 2015

– Though there has been growing investor interest in Hungarian loan portfolios, only individual, syndicated CRE-backed positions have been sold as large ticket items so far. Most of the other sales that have taken place to date have been consumer portfolios, or loan portfolios sold as part of an entire bank sale.

– In November 2014, the National Bank of Hungary mandated the establishment of a bad bank, MARK Group, which is expected to buy project loans of over €2.2 billion and foreclosed real estate above the value of €164.4 million from banks in Hungary in order to help them clean up their balance sheets. MARK’s servicing capabilities are now operational but it has yet to acquire loans or assets.

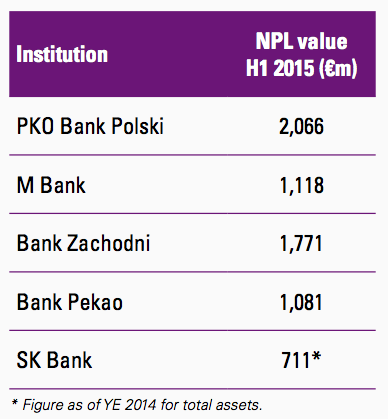

Other developments

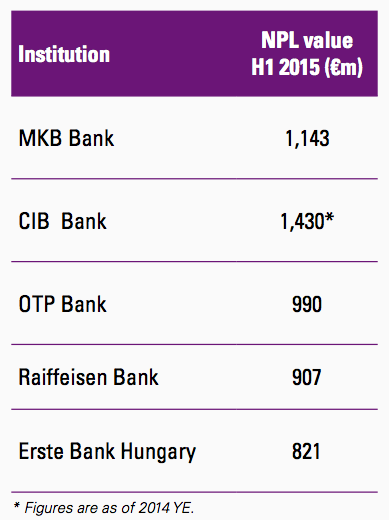

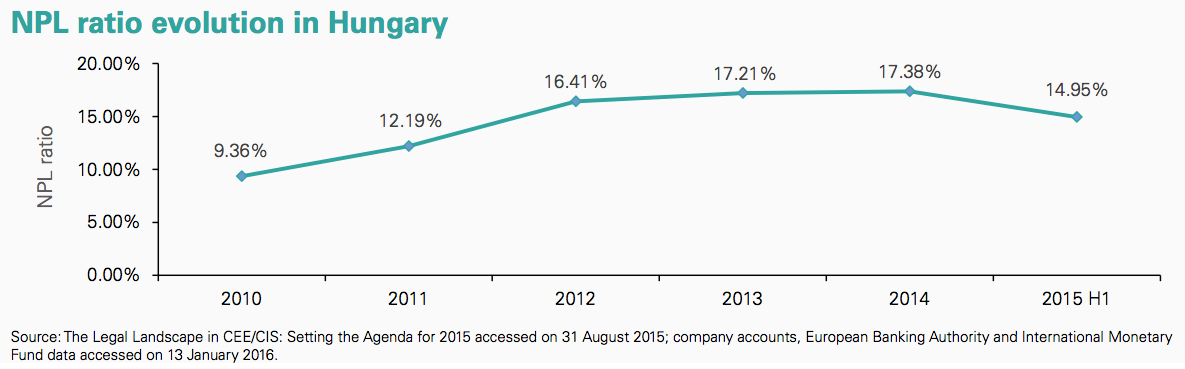

There have been several attempts over the past few years to kick-start the Hungarian debt sale market and open it to foreign investors. However, few Hungarian banks had considered bringing portfolios to market, as they believed that they could collect more efficiently than a foreign investor. In 2013, the average NPL ratio of the top 10 Hungarian banks was 18.4%. The Hungarian government responded to the NPL issue by establishing a bad bank (MARK) in November 2014 with the goal of acquiring distressed assets from Hungarian banks which had accumulated since the global financial crisis.

Regulation

– The Hungarian government recently passed a new amendment on 7 July 2015 which stipulated that loan transfers can be authorised directly by the Hungarian National Bank, bypassing the need for borrower consent.

– However, whilst the new amendment does not provide a complete solution; it aims to make a portfolio transfer easier by amending the general rule of the Hungarian Civil Code, which normally requires a borrower to agree to the transfer between lenders and terminates all security interests, unless the security provider likewise agrees.

– The cost of debt is expected to decrease, as the government plans to convert remaining foreign currency loans into HUF by the end of 2015. The government had already forced the conversion of the bulk of forex mortgages by mid-2015, with plans to do the same with car and consumer loans cumulatively worth approx. €1 billion.

Servicing

– Loan servicing is mostly done in-house by the Hungarian banks, therefore international investors have limited options for partnerships.

Enforcement

– Buyers can only enforce a purchased loan when security interests are registered and the security documents contain all terms required under Hungarian law.

– Enforcing a lender’s rights to residential real estate is highly regulated, primarily to protect existing individual occupants. The number of residential foreclosures permitted is also limited, as there is a permitted quota of 5% of homes in NPL portfolios/tranches which can be designated as “for sale”.

Looking forward & KPMG predictions

– Though the Hungarian bad bank, MARK, has been formed, it has not yet bought any loans or assets at the time of printing. This uncertainty affects investor interest and pricing in NPL portfolios, as banks may hold out from bringing portfolios to market due to expected more favourable pricing for their assets should they be transferred to MARK. Until MARK gives a clear signal as to when and if it will commence its investment activity, the uncertainty will negatively affect any potential Hungarian loan portfolio sales activity.

– The National Bank of Hungary has introduced new regulation, the Mortgage Financing Adequacy Ratio (“JMM”), effective October 2016, that will require banks to finance at least 15% of their outstanding household mortgage loans by long-term securities, mostly mortgage bonds. This will lead to new mortgage banks being established, and potentially kick-start the mortgage portfolio market in Hungary.

– Recent changes in personal bankruptcy laws that allow private individuals or households with defaulted mortgages to declare personal bankruptcy in Hungary will allow borrowers to try to avoid liquidation on their properties. As part of this law, Hungarian banks can again enforce on residential properties mortgaged under defaulted loans, which, coupled with the JMM, may lead to the first residential loan portfolios being brought to market in Hungary in 2016.

Ireland

“2016 looks to be a very active year for the Irish market. The pipeline remains strong with NAMA and RBS likely to be the most active vendors together with increasing numbers of secondary portfolio transactions. There remains a significant opportunity to gain exposure to the large volumes of refinancings, bridging the gap between senior debt advance rates and acceptable refinancing exit levels needed in the market as the earlier portfolio buyers work through their assets.” – Alan Boyne, Partner, Head of Banking, Transaction Services, KPMG in Ireland

Closed transactions in 2015

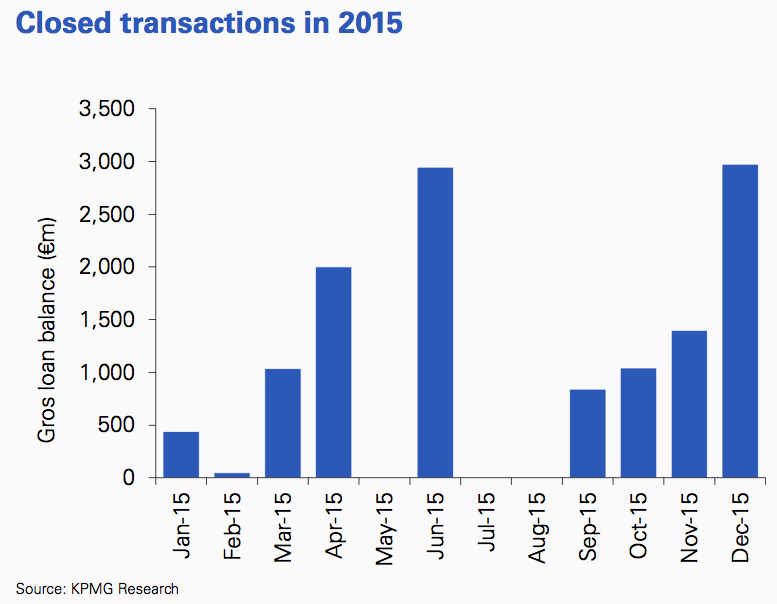

– 2015 was another bumper year for portfolio sales in Ireland, with in excess of €25 billion of loan sales transacted, largely from RBS (Ulster Bank) and ongoing sales by NAMA.

– CarVal, Cerberus, Deutsche Bank, Goldman Sachs and Bank of Ireland were some of the most active investors in the Irish loan market, having bought most of the largest transactions brought to market in the past year.

– The largest portfolio transacted was the €6.3 bn Project Arrow, which was sold by NAMA to Cerberus. Lloyds completed its last portfolio sale, the €4.2 bn Project Poseidon, which sold to CarVal, Goldman Sachs, and Bank of Ireland.

Other developments

Heavy public and political pressure mounted in 2013/2014 which sought protection for borrowers whose loans were sold by banks. Following initial plans to regulate the owners of debt, the Consumer Protection (Regulation of Credit Servicing Firms) Act 2015 (“the Act”) reflected consultation with the industry and ultimately requires credit servicing firms to be regulated by the Central Bank of Ireland, which was widely welcomed as a practical change.

Regulation

– New legislation requires all purchasers, both domestic and foreign, of Irish retail loans to become authorised as retail credit firms in Ireland.

– Existing owners of retail credit will be deemed to be authorised once they apply for authorisation within three months of the enactment of the law, making such entities subject to Central Bank of Ireland oversight with effect from 8 July 2015.

Servicing

– Investors’ high costs of maintaining and continuing investment in large servicing platforms, combined with capacity constraints, is creating opportunities for third-party servicers to grow further, and potentially for overseas servicers to enter the market.

Enforcement

– As per the new legislation, purchasers may also be subject to the Central Bank of Ireland’s administrative sanctions regime in circumstances where they are in breach of their regulatory obligations.

Looking forward & KPMG predictions

– Having acquired over €50 billion of loans in recent years, investors expect to see further strong volumes of deleveraging occurring in the Irish market over the course of the next 12 months. NAMA is expected to continue to be a key vendor as it looks to complete its sales plan, and new vendors may enter the market, such as Allied Irish Bank, which sold its first loan portfolio, a UK CRE NPL portfolio, in Q4 2015 to CarVal.

– In addition to continued deleveraging, a key trend in 2016 will be secondary trades, whereby some of the investors who bought portfolios in recent years intend to sell some of the assets they have purchased or foreclosed on in order to unlock value. This will also give rise to significant refinancing opportunities for Irish banks.

– Domestic buyer demand is expected to remain high for performing and also re-performing loans, as lenders seek to supplement their new origination levels, continuing the success of their acquisitions in 2015.

Italy

“After several years of delay, Italian banks have started the deleveraging process for non-core assets. The early rise of the real estate market will boost NPL volumes transacted within the next 12–18 months, and help to reach the volumes seen in other European countries.“ – Domenico Torini, Director, Corporate Finance, KPMG in Italy

Closed transactions in 2015

– Italy had a reasonable year in the portfolio transaction market, mainly driven by unsecured retail transactions totalling €5.5 billion.

– 2016 is expected to be a strong year for the transaction pipeline. While retail portfolios are expected to continue being brought to market, it is the secured portfolios in the pipeline that investors have long been eyeing.

– Wider consolidation and rationalisation in the Italian market will both inhibit and drive transaction activity: many sales have been recently focused on capital and survival, not deleveraging.

Other developments

In the first half of 2015, close to €8 billion of loans were traded in Italy. Many of the portfolios were consumer portfolios, however there is an increasing number of real estate-backed portfolios being brought to market.

Three of Italy’s largest banks, UniCredit, Intesa Sanpaolo, and Monte dei Paschi de Siena, have established internal bad loan divisions to house non-core assets and have set out deleveraging strategies, which include NPL sales.

Regulation

– Banks and financial institutions need to be licensed by the Bank of Italy to perform loan transactions.

– Insurance companies who want to be involved in loan transactions have to acquire an additional license from the Italian public authority supervising insurance companies; they also have to maintain a net retention threshold of 50% of the total loan amount.

Servicing

– Italian banks are under pressure to increase profitability, and a shift from in-house servicing to outsourcing/partnerships is helping them achieve this.