M&A News M&A News: Global M&A Deals Week of April 1 to 7, 2024

- M&A News

M&A News: Global M&A Deals Week of April 1 to 7, 2024

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

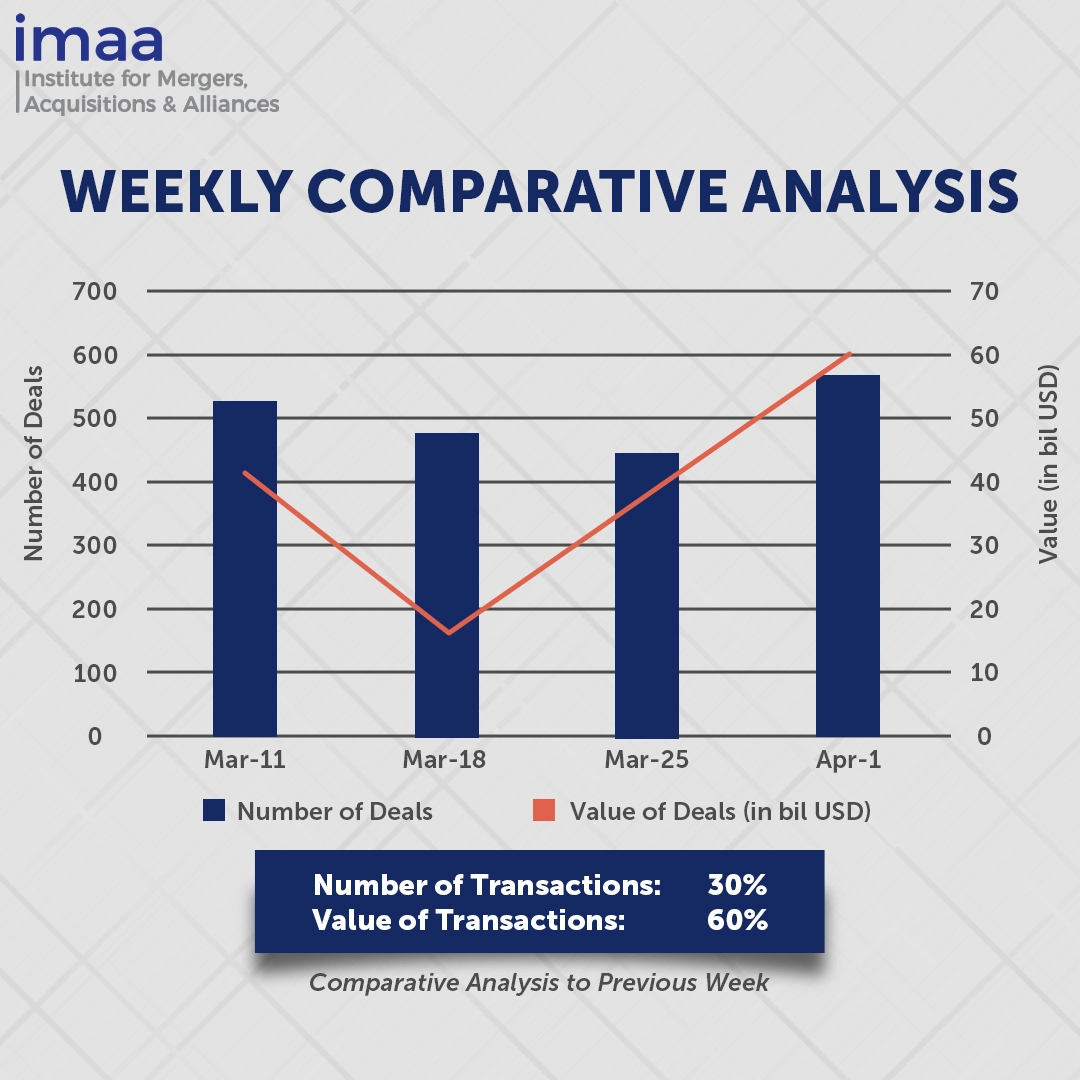

From April 1st through April 7th, the global market witnessed a notable uptick in Mergers and Acquisitions (M&A) activity, with 579 transactions announced, totaling USD 59.95 billion in cumulative value. Fifteen of these transactions exceeded the USD 500 million threshold, collectively generating USD 52.81 billion, representing 88% of the week’s total deal value.

The notable transaction during this period is Johnson & Johnson’s acquisition of Shockwave Medical, a medical device manufacturer specializing in catheter-based treatments for patients with calcified arteries. This strategic move underscores the conglomerate’s concerted effort to fortify its presence in the cardiac health sector, a commitment demonstrated by previous substantial investments, including the USD 16.6 billion acquisition of heart pump maker Abiomed in 2022 and the USD 400 million purchase of another heart-centric device maker, Laminar, in 2023.

Comparing data from the previous week, there has been a noticeable 30% increase in the number of deals, rising from 444 to 579. Similarly, the total value of these transactions has surged by 60%, escalating from USD 37.41 billion to USD 59.95 billion. Notably, the top two deals of the week each contributed over USD 13 billion to this increase in deal value.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of April 1 – 7, 2024 in detail:

Deal No. 1: Johnson & Johnson to Acquire Shockwave Medical, Inc. for USD 13.10 Billion

Deal No. 2: Silver Lake Technology Management, L.L.C. to Acquire Endeavor Group Holdings, Inc for USD 13.00 Billion

Deal No. 3: Schlumberger Limited to Acquire ChampionX Corporation for USD 7.80 Billion

Deal No. 4: Advent; Novacap Investments, Inc.; Caisse de dépôt et placement du Québec to Acquire Nuvei Corporation for USD 6.30 Billion

Deal No. 5: Formula One Group to Acquire Dorna Sports, S.L. for USD 3.80 Billion

Deal No. 1:

Johnson & Johnson to Acquire Shockwave Medical, Inc. for USD 13.10 Billion

Pharmaceutical giant Johnson & Johnson has announced its acquisition of Shockwave Medical, a leading medical device maker, for USD 13.10 billion. Under the terms of the agreement, Johnson & Johnson will purchase all outstanding shares of Shockwave at a rate of USD 335 per share in cash. This move strengthens Johnson & Johnson’s presence in cardiovascular intervention and aligns with its strategy to expand into high-growth markets.

Shockwave Medical has distinguished itself as an industry leader, pioneering innovative intravascular lithotripsy (IVL) technology for the treatment of calcified coronary artery disease (CAD) and peripheral artery disease (PAD). This acquisition grants Johnson & Johnson access to cutting-edge devices that utilize shockwaves to disrupt calcified plaque within heart vessels, mirroring techniques used in kidney stone treatment.

Upon the completion of the transaction, Shockwave will function as a distinct business unit within Johnson & Johnson MedTech, with its financials integrated into Johnson & Johnson MedTech’s Cardiovascular portfolio. This move positions Johnson & Johnson as a dominant force across four key cardiovascular segments, underscoring its commitment to providing comprehensive solutions in this rapidly evolving sector.

This acquisition builds upon Johnson & Johnson’s previous investments in the cardiovascular field, following its acquisition of Abiomed, a heart pump manufacturer, for USD 16.6 billion in 2022, and Laminar, a medical device company specializing in non-valvular atrial fibrillation (AFib), in November 2023.

The transaction is expected to be finalized by mid-2024, at which point Shockwave’s common stock will cease trading on the Nasdaq Global Select Market. J.P. Morgan Securities LLC is advising Johnson & Johnson, while Perella Weinberg Partners is advising Shockwave on the acquisition.

Deal No. 2:

Silver Lake Technology Management, L.L.C. to Acquire Endeavor Group Holdings, Inc for USD 13.00 Billion

In a significant move, private equity firm Silver Lake has unveiled its plans to acquire Endeavor Group Holdings, a major global player in sports and entertainment, for a total of USD 13 billion. Endeavor Group Holdings, known for its significant stakes in WWE and UFC, will see its stockholders receive USD 27.50 per share in cash as part of the deal.

Silver Lake currently holds the largest stake in Endeavor, owning approximately 31% of the outstanding shares.

The partnership between Silver Lake and Endeavor positions the latter to take advantage of opportunities in the rapidly evolving media and entertainment landscape, where global content spending exceeds USD 200 billion annually. Leveraging Endeavor’s diverse assets and capabilities across entertainment, sports, fashion, and music, the acquisition aims to facilitate mutually beneficial deals and experiences for clients, partners, and fans worldwide.

The deal is expected to close by the end of the first quarter of 2025. BDT & MSD Partners have played a crucial role as lead financial advisors, while Goldman Sachs & Co. LLC, JP Morgan, Morgan Stanley & Co. LLC, BofA Securities, Barclays, Deutsche Bank Securities Inc., and RBC Capital have acted as lead financing arrangers and financial advisors to Silver Lake.

Deal No. 3:

Schlumberger Limited to Acquire ChampionX Corporation for USD 7.80 Billion

Schlumberger Ltd. (SLB) has entered into an agreement to acquire its Oilfield Service rival, ChampionX, in an all-stock deal valued at USD 7.80 billion. This strategic move is aimed at reinforcing SLB’s position in the production space, leveraging ChampionX’s expertise in production chemicals and artificial lift technologies. The combined portfolios are expected to deliver enhanced value to customers through industry know-how, digital integration, and improved equipment performance.

The timing of this acquisition is noteworthy, aligning with the critical phase of oil and gas operations, where managing the asset life cycle is paramount. There’s also a growing demand for integrating emerging technologies like AI into global operations, a challenge SLB seeks to address through this acquisition.

SLB anticipates achieving annual pretax synergies of approximately USD 400 million within the first three years post-closure, primarily through revenue growth and cost savings. Additionally, SLB plans to return USD 7 billion to shareholders over the next two years. Demonstrating confidence in the transaction’s value proposition and the company’s cash flow outlook, SLB has set ambitious targets for 2024 and 2025, aiming for shareholder returns of USD 3 billion and USD 4 billion, respectively.

This marks SLB’s second acquisition in a week and its largest investment since 2016. Last week, the company announced a USD 380 million deal to acquire a majority stake in Norway’s Aker Carbon Capture.

The transaction is expected to close before the end of 2024.

Deal No. 4:

Advent; Novacap Investments, Inc.; Caisse de dépôt et placement du Québec to Acquire Nuvei Corporation for USD 6.30 Billion

Advent International, a notable investor in the payments industry, will acquire Canadian fintech company Nuvei in an all-cash deal valued at USD 6.30 billion, equivalent to USD 34 per share. This acquisition has received full support from key stakeholders, including Philip Fayer, Novacap, and CDPQ, who hold multiple voting shares within the company.

Nuvei is recognized for its advanced payment technology, offering solutions that drive the growth of its clients and partners globally. Its modular platform enables businesses across various sectors to adopt next-generation payment methods, access multiple payout options, and utilize services such as card issuing and risk management. With operations in over 200 markets and local acquiring capabilities in 50 markets, Nuvei connects to 680 local and alternative payment channels.

Following the acquisition, Philip Fayer, Novacap, and CDPQ are expected to collectively hold indirect ownership or control of approximately 24%, 18%, and 12%, respectively, of the resulting private entity.

Advent’s experience and resources in the payments space are expected to bolster Nuvei’s growth and innovation capabilities.

The deal is anticipated to close either in late 2024 or early 2025. Barclays Capital Inc. acted as the exclusive financial advisor to Advent, with RBC Capital Markets providing additional financial advisory support.

Deal No. 5:

Formula One Group to Acquire Dorna Sports, S.L. for USD 3.80 Billion

Liberty Media, the proprietor of Formula One (F1), is broadening its footprint in the motorsports realm through the acquisition of Dorna Sports, the entity behind the esteemed MotoGP World Championship, in a deal valued at EUR 3.5 billion (USD 3.80 billion). This acquisition aligns two major players in the world of motor racing, adding to Liberty Media’s diverse portfolio encompassing media, communications, and entertainment sectors.

MotoGP, known for its global following and exciting races represents a valuable addition to Liberty Media’s assets. With its solid financial performance, MotoGP offers promising growth opportunities. Liberty Media aims to support MotoGP’s development, benefiting fans, teams, commercial partners, and shareholders. Combining MotoGP and F1 under common ownership is expected to generate synergies, enhancing value for all stakeholders.

As part of the agreement, Liberty Media will acquire an 86% stake in Dorna, with the current management retaining approximately 14% equity interest.

The deal is slated for completion by the end of 2024, with financial advisory provided by Goldman Sachs for Liberty Media and Moelis & Co. for Dorna.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of April 1 – 7, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter