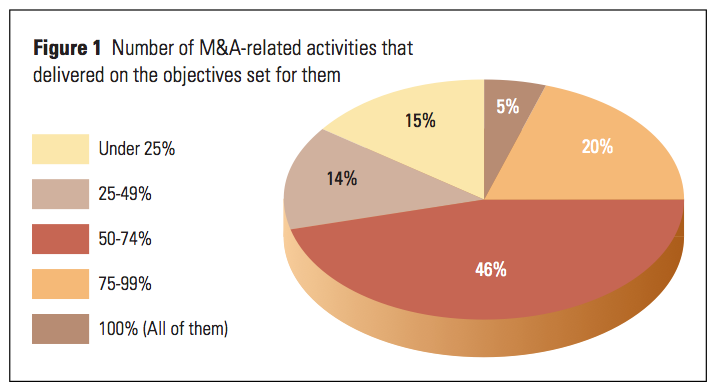

Mergers And Acquisitions: Reducing M&A Risk Through Improved Due Diligence

By Jeffery S. Perry, Thomas J. Herd – A.T. Kearney “The art of doing due diligence is being lost. Buyers aren’t analyzing the operations and books of prospective acquisitions with nearly enough vigor” (Fortune, 3 September 2001). For the past few years, sad stories of gigantic merger failures have been told and retold in the media – for example, the … Read more