A User’s Guide to Successful M&As

by Arthur D. Little

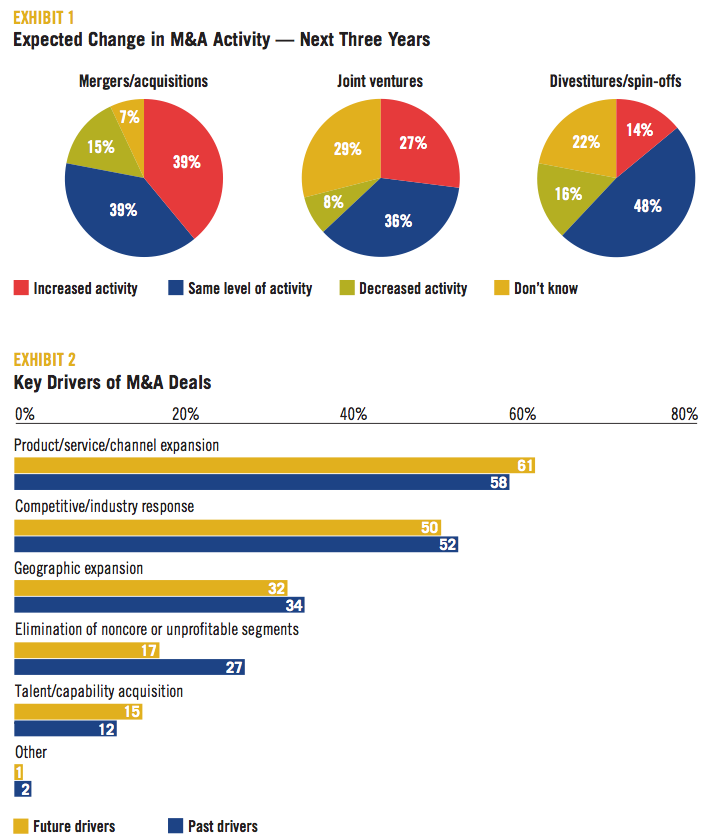

The global number of mergers and acquisitions has rebounded strongly since 2004. Many top executives are wondering whether it’s worth getting back into M&A as a tool for growth – and if so what best-practice maximises the chances of success. As Vantrappen and Kilefors explore in their article, not all mergers and acquisitions make sense. They provide a summary of what academia has to say, the steps to success and what executives need to do to make the best from the complicated world of M&A. […] Read more