Global Capital Confidence Barometer – Dealmaking Returns?

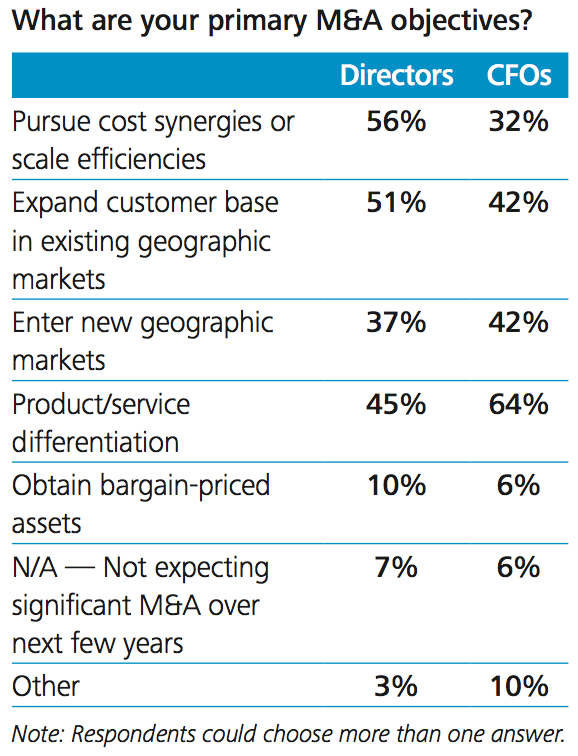

By Pip McCrostie – Ernst & Young Growth mandates — driven by increased confidence and credit availability — will spur M&A activity across mature and emerging markets. Our latest Capital Confidence Barometer suggests a return of deal activity after a five-year period of falling M&A globally. The fundamentals are in place to foster M&A: confidence in the global … Read more