Publications Bridging The Gap: M&A Are CFOs And Boards Aligned?

- Publications

Bridging The Gap: M&A Are CFOs And Boards Aligned?

- Christopher Kummer

SHARE:

By Deloitte

Overview and methodology

In March and April 2013, Corporate Board Member magazine in association with Deloitte conducted a survey of corporate directors and chief financial officers (CFOs) from companies with revenue of $500 million and above.

The goal was to identify specific areas of convergence and divergence in respondents’ views regarding risk oversight and value creation in merger and acquisition (M&A) activities.

This survey is one in the Bridging the Gap series, which — as noted by its title — reflects our understanding that CFOs and directors can increasingly create value by working together more closely to manage and oversee corporate risk. In identifying converging and diverging views, the survey series aims to discover areas in which board members and CFOs can contribute experience, expertise, and insight that enhance value creation and mitigate risk.

This document reports the key findings of the Bridging the Gap: M&A (Spring 2013) survey. Directors’ and CFOs’ divergent views will, of course, reflect their differing roles and responsibilities vis-à-vis M&A. Given this, the findings indicate areas in which directors and CFOs may do well to foster greater communication and closer collaboration. This is not to say that greater communication will necessarily generate the same views, but rather that parties with divergent views in an organization generally benefit from closer communication and collaboration.

Overall, the results indicate that:

- A majority of directors and CFOs agree that their companies’ M&A strategy is to seek smaller, more strategic deals.

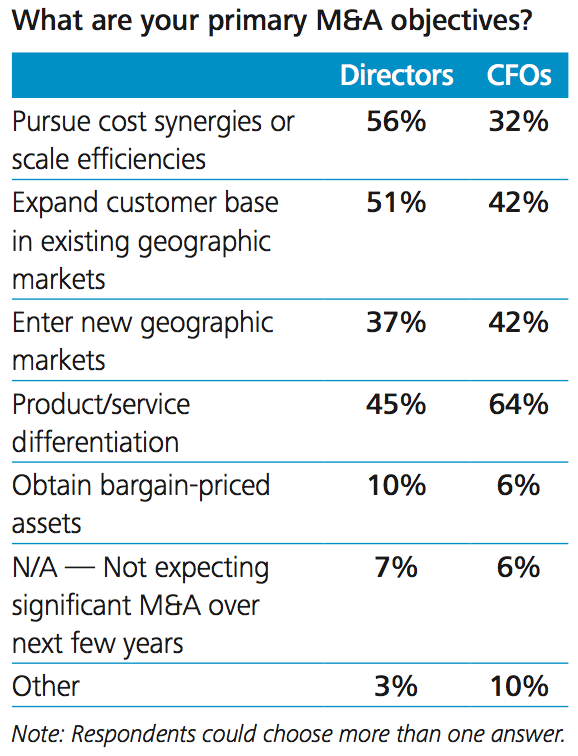

- Regarding primary purposes of M&A, CFOs were far more inclined than directors to cite differentiating or diversifying products or services. Directors were more inclined than CFOs to cite the pursuit of cost synergies or scale efficiencies as a primary M&A objective.

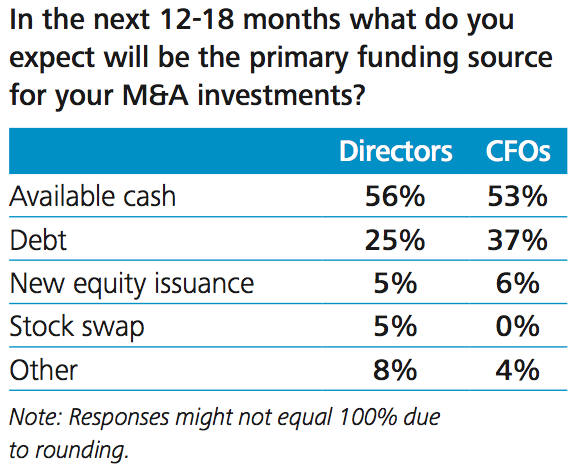

- Both directors and CFOs expect to deploy cash as the primary means of funding M&A transactions. However, CFOs are more inclined than directors to view debt as the primary source of funding.

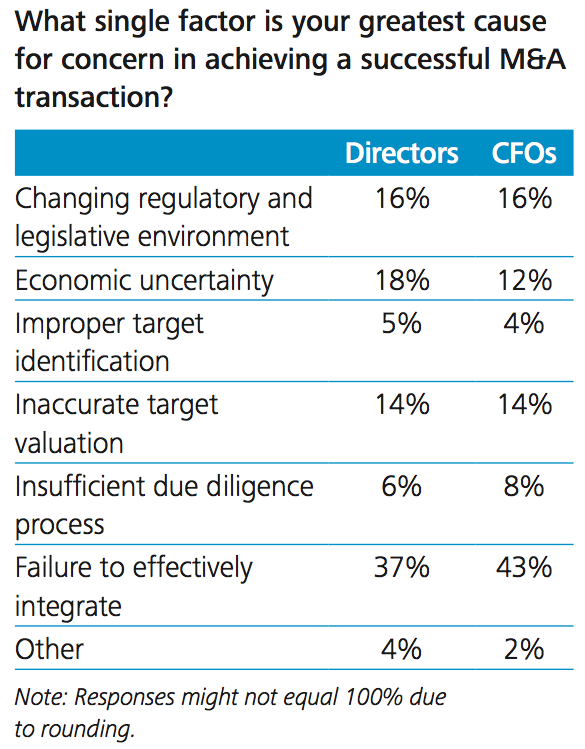

- Directors and CFOs agree that the greatest cause for concern in achieving M&A success is integration failure. As to the greatest cause for concern during integration, both most often cited achieving cultural fit.

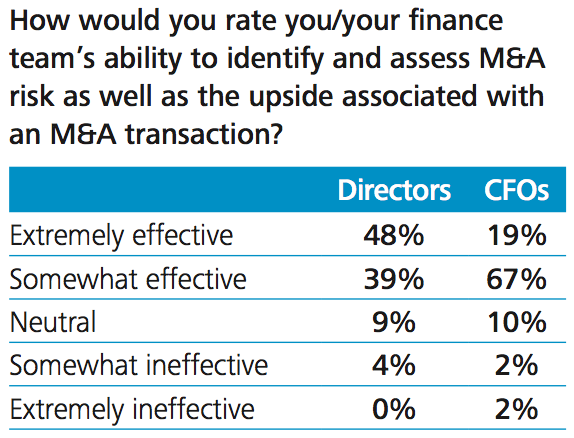

- Directors were more inclined to rate the finance team’s risk-related M&A abilities as “extremely effective” than CFOs. CFOs were less inclined to rate the board as “extremely effective” in this area.

Overall M&A strategy

Directors and CFOs were fairly well-aligned regarding M&A strategy for the next 12-18 months, with the largest percentage of respondents in each group expecting to seek smaller, strategic deals. Their agreement in this regard may constitute a strong indicator of the type of M&A activity over the next year to year-and-a-half.

This alignment may reflect both parties’ concern about the future pace, strength, and durability of economic recovery. CFOs and directors desire, in most cases, to grow their businesses faster than the baseline rate of economic expansion. But under current circumstances, strategies should allow for the risks associated with a continuing uncertain recovery. Thus, deals that are smaller yet strategic, appeal to boards and to CFOs.

Although the majority of respondents are not actively seeking major deals, a good portion of directors (22 percent) and CFOs (27 percent) prefer the posture of being ready to respond “to any opportunities that arise,” which would include major deals. In addition, 18 percent of each group views “seeking major transformational deals” as the organization’s M&A strategy. (Only small percentages of respondents cite “deferring major deals” as their M&A strategy.)

Taken together, these answers may reflect many large companies’ healthy cash positions and a general readiness to respond to opportunities, particularly at favorable valuations. Clearly, however, the more popular posture is to seek smaller, strategic deals. This overall preference may indicate that directors and CFOs recall the disappointing results and write-downs taken by many companies in the past, particularly on large acquisitions. The risks associated with smaller acquisitions are typically lower and easier to control, while the strategic benefits may be easier to credibly analyze and articulate.

M&A objectives

CFOs were far more likely to feel a primary purpose of M&A is to differentiate or diversify products or services (64 percent) compared with directors (45 percent). This may reflect the CFOs’ closer proximity to producing and selling the company’s products and services, and to the goals of securing new products and accessing new markets. Directors are aware of these challenges but do not work directly with people who face such responsibilities on a daily basis, as the CFO does.

This finding may also indicate lack of enough direct discussion between the board and the CFO regarding inorganic growth strategies. To foster discussion around inorganic growth strategies and help bridge this gap, the parties might pose the question, “What, specifically, do we want our strategy for achieving inorganic growth to be?”

Directors (56 percent) and CFOs (32 percent) also diverged on the pursuit of cost synergies or scale efficiencies as a primary M&A objective. This may reflect directors’ more “big picture” viewpoint and, perhaps, CFOs’ disappointing experience regarding achievable synergies and efficiencies.

Divergence also occurred in the area of existing versus new geographic markets. Directors’ tendency to see expansion of existing geographic markets (51 percent) as a primary M&A objective may reflect a general belief that transactions and existing geographic markets create less risk than new geographic markets (37 percent) and fewer related board-level governance challenges in those markets regarding the newly acquired entities.

Divergence of views regarding M&A objectives may emanate, at least in part, from board members talking among themselves or with the senior executive and operating officers without the CFO present. In those conversations, discussions of M&A objectives may range more widely than in those with the CFO present or between the board and the CFO.

In addition, the objective of pursuing synergies focuses on achieving scale by consolidating functions and building up volume to increase profitability and returns. Similarly, buying an existing business and its market share aims to boost revenue and profits. Most directors are comfortable with these strategies. If those strategies can be applied in new geographic markets, then directors are more likely to readily understand the transaction, provided they understand the location and its demands.

Meanwhile, being closer to daily operations, CFOs may more readily support product and service differentiation and market growth strategies and more skeptically view the pursuit of synergies and efficiencies.

M&A funding sources

Both directors and CFOs expect to deploy cash as the primary means of funding M&A transactions. It stands to reason that the two would be consonant on a financial fundamental such as this, particularly in this time of strong cash positions at many large companies.

Although both groups have virtually the same view of new equity as a funding source — in a distant third place — they diverge on their view of debt as a funding source. CFOs clearly are (37 percent) more inclined to view debt as a primary source of funding than directors (25 percent). Perhaps CFOs take a more positive view of increasing leverage than directors, who may be more interested in de-leveraging at this point to increase return on shareholder equity, than in using leverage to fund M&A activity. CFOs may also view debt more favorably given low prevailing interest rates coupled with a desire to conserve cash, even when cash levels are healthy.

Although equity prices are high, new stock issuances will dilute the position of current shareholders and is more expensive and complicated than either cash or debt. In fact, many companies have been buying back stock over the past several years to strengthen their stock price and equity base. Thus, both directors and CFOs expressed relatively low expectations that new equity issuance would be the primary M&A funding source.

Greatest concern in M&A success

Directors and CFOs agree that the single greatest cause for concern in achieving M&A success is failure to effectively integrate the post-merger entity or the target company, with 37 percent of directors and 43 percent of CFOs citing this answer.

Integration was the most often-cited concern by a wide margin over the next greatest concern for either directors or CFOs. The next most often-cited for directors was economic uncertainty (18 percent), and for CFOs it was the regulatory and legislative environment (16 percent).

The “environmental factors” of regulation and legislation and economic uncertainty (the first two items in the chart) were together cited by a total of 34 percent of directors and 28 percent of CFOs. Concerns over proper target identification and valuation registered even lower.

Thus, concerns over integration — and over M&A success factors in general — are an area of congruent thinking for directors and CFOs.

Greatest risk to integration

Given that integration between their company and the target company poses the greatest concern regarding M&A success, respondents’ views on the greatest risks to integration are of particular interest.

Approximately half of directors (47 percent) and CFOs (51 percent) cited achieving cultural fit as their greatest cause for concern. This recognizes that organizational cultures tend to be entrenched and resistant to change.

As difficult as it can be, integration of systems and back-office operations can be often accomplished with less risk thanks to more predictable methods for achieving it. Cultural integration remains more unpredictable, and thus a riskier proposition. If it cannot be achieved, the tactics of either leaving the target’s culture in place or forcing the dominant culture onto the target offer two less than optimal alternatives.

The good news is that directors and CFOs both view achieving cultural fit as a significant risk to successful integration. This may imply recognition that cost synergies and scale efficiencies — and thus the full expected value of the transaction — can be realized only by achieving cultural fit.

To mitigate this risk, a company can put strong leaders from each organization in charge of achieving cultural fit and arm them with a well-grounded plan to execute rigorously from Day 1 (or earlier). In general, successful integration depends on having a dedicated, full-time team managing and overseeing the integration process. It cannot be delegated as a part-time job to people who will likely give priority to the usual responsibilities on which they will be evaluated. One leading practice is to have a specific, temporary board subcommittee dedicated to overseeing integration, particularly after large M&A transactions.

For 32 percent of CFOs, the second most often-cited concern was customer retention, cited by only 20 percent of directors. Directors’ second greatest concern during integration was synergy capture (25 percent), cited by only 11 percent of CFOs. This is another area of divergence, which may reflect the differing views of objectives cited earlier (in response to “What are your primary M&A objectives?”). CFOs’ greater concern over customer retention may relate to their relatively high focus on product/service differentiation as an M&A objective. Similarly, directors’ greater concern over risks to synergy capture may relate to their relatively high focus on cost synergies or scale efficiencies as an M&A objective. In other words, a primary objective may dictate where one sees the greatest risk.

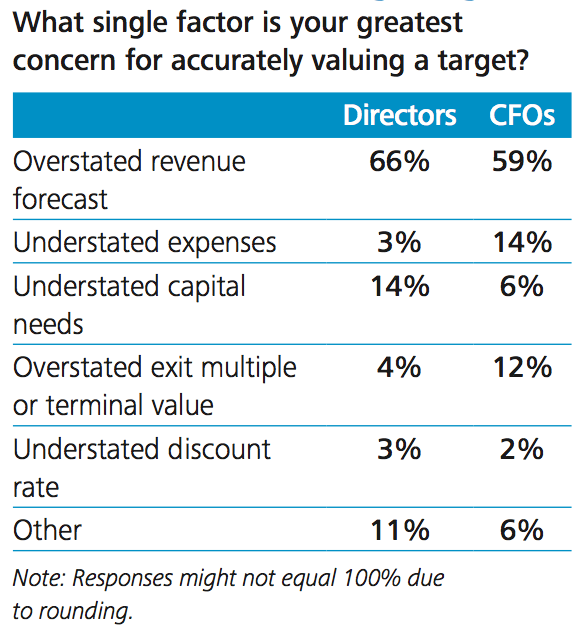

Greatest concern in valuing a target

When it came to respondents’ greatest concern regarding accurate valuation of an M&A target, directors (66 percent) and CFOs (59 percent) were well-aligned in the view that overstated revenue forecasts were number one, by far.

In general, buyers and target companies can be expected to differ in predictable ways when it comes to valuation. But these natural tendencies are being exacerbated by prevailing business and economic uncertainties. This is evidenced by directors and CFOs both assigning relatively low concern to the other factors, such as expenses and capital needs.

Valuation is driven in large part by revenue growth forecasts and future revenue growth will likely be affected by economic growth. Target companies may be expected to view their cash flow projections optimistically, believing that recovery will likely drive market opportunities and growth. Yet how quickly — and how successfully — the post-transaction company may be able to exploit growth opportunities has become an open question under current circumstances.

Buyers may also be tending toward conservatism given past disappointments and the write-downs taken during the financial crisis of 2007-2008. Add to that the weakness of the U.S. economic recovery, strong recessionary pressures in the EU, and falloffs in economic performance elsewhere in the world, and you have strong reinforcement for a conservative view.

CFO and finance team — and board — M&A effectiveness

Notable differences between directors and CFOs occurred regarding their views of the CFO’s and finance team’s effectiveness in an M&A transaction. Directors more often rated their CFO and finance teams highly (with 48 percent citing “extremely effective”) compared with only 19 percent of CFOs assigning themselves and their teams that rating. Similarly, 39 percent of directors rated their finance teams as “somewhat effective” while two-thirds of CFOs did so.

Perhaps this can be explained by CFOs’ modesty, but it’s also possible that CFOs are being somewhat self-critical, due to a belief that they could be doing more in areas such as deal analysis, modeling, valuation, and negotiation.

However, divergence also occurred in each group’s ratings of the board’s M&A effectiveness.

Boards rated their own M&A effectiveness higher than CFOs did. A total of 87 percent of directors cited the board as “very effective” or “somewhat effective” while a total of 64 percent of CFOs assessed their boards as “very effective” or “somewhat effective.” In addition, a total of 19 percent of CFOs rated their boards as “somewhat ineffective” or “extremely ineffective” in this area, while a total of only 4 percent of boards did so.

Apart from any overly modest, inflated, or critical views of effectiveness, the larger and essential point is that boards and CFOs must communicate and collaborate closely on matters related to M&A transactions. These transactions represent significant uses of funds, and risks associated with realizing the sought-after benefits are substantial. By communicating closely and working together productively, directors and CFOs can better guide the rest of the leadership team toward sound management of M&A risks and fuller realization of the value of M&A transactions.

In closing

While directors and CFOs are largely consonant in their overall view of M&A strategy and valuation, this Bridging the Gap survey indicates that their views could be more aligned in other areas. This is particularly the case with respect to primary M&A objectives, and especially with regard to cost synergies and scale efficiencies.

One way to increase communication and effectiveness in this arena could be for the board and the CFO and finance team to make M&A objectives, strategies, and risks explicit, both in general and for each transaction. As noted previously, regular discussion between the board and the CFO around inorganic growth strategies and ways to implement them to achieve strategic goals could help bridge this gap. Another tactic could be for the two parties to acknowledge and consider their respective assumptions regarding M&A in general and regarding specific transactions.

There are various methods of increasing communication and effectiveness in these areas. One is to employ the Thesis-Antithesis- Synthesis (TAS) tool, in which a team states a thesis – an assumption essential to the success or failure of the business – then to state its antithesis, which is its exact opposite. Then the team examines the implications of the thesis and antithesis for the enterprise and identifies a unified approach that generates a “best of both worlds” scenarioi.

As with such tools, the particular one that a team uses is of secondary importance to the actual practice of using a recognized method of making assumptions explicit and then addressing them. Using a tool, facilitator, or method of “changing the conversation” can help a leadership team toward greater communication and collaboration, whether or not their views become more congruent.

In addition, we offer the following thoughts on how boards and management teams may address certain areas of divergence identified in this survey:

1. Differing views of M&A objectives. During strategic discussions, CFOs might more clearly communicate with boards regarding the future risks and benefits of diversifying product and service offerings and how those risks and benefits may be “ranked” relative to those of cost synergies to be potentially realized from M&A transactions. While recognizing that board members may be inclined to see the principle benefit of M&A transactions as synergies and scale efficiencies, management can also be candid about realistically achievable synergies and efficiencies. In addition, it is important to consider whether investment bankers’ projections of M&A benefits may be optimistic.

2. CFOs are more inclined than directors to view debt as a primary source of funding. When appropriate, CFOs could improve communication with boards on the benefits of additional leverage in funding a cash acquisition. For instance, they might discuss the impact of the transaction on certain financial leverage ratios, such as the debt, capitalization, interest coverage, and fixed assets to net worth ratios, and profitability ratios, such as return on assets, return on fixed assets, and especially return on equity. CFOs can use these ratios — particularly comparative measures of returns — to demonstrate the positive effects of increased leverage. In addition, they might cite the advantages of conserving cash and borrowing at a time of low rates.

3. CFOs are less inclined to rate the board as extremely effective in its risk-related M&A abilities. Assuming board members recognize that they could improve their risk-related M&A abilities, there are several areas they could potentially explore, including (1) board composition, where they may consider their current M&A skills and experience, (2) board effectiveness, where they could evaluate their performance in addressing M&A issues in terms of agenda items and time management, and (3) post-mortem assessments, where interviews could be conducted with individual board members (perhaps by an internal or external facilitator) to determine how well they have evaluated and monitored M&A transactions and their outcomes.

Given the risks, potential benefits, and the specific roles each party plays in M&A, these transactions represent an area in which boards and CFOs would likely do well to bridge any gaps in communication, perception, and understanding. Successful M&A decisions and post-event implementation depend upon strong alignment between the board and senior executives. While there is clearly room for divergent views, those views and the underlying rationales are best acknowledged, discussed, and resolved before a transaction is undertaken.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter