Publications M&A Yearbook 2011 – KPMG’s Overview Of Mergers And Acquisitions In Switzerland In 2010

- Publications

M&A Yearbook 2011 – KPMG’s Overview Of Mergers And Acquisitions In Switzerland In 2010

- Bea

SHARE:

By KPMG

Deal Trends / Executive Summary

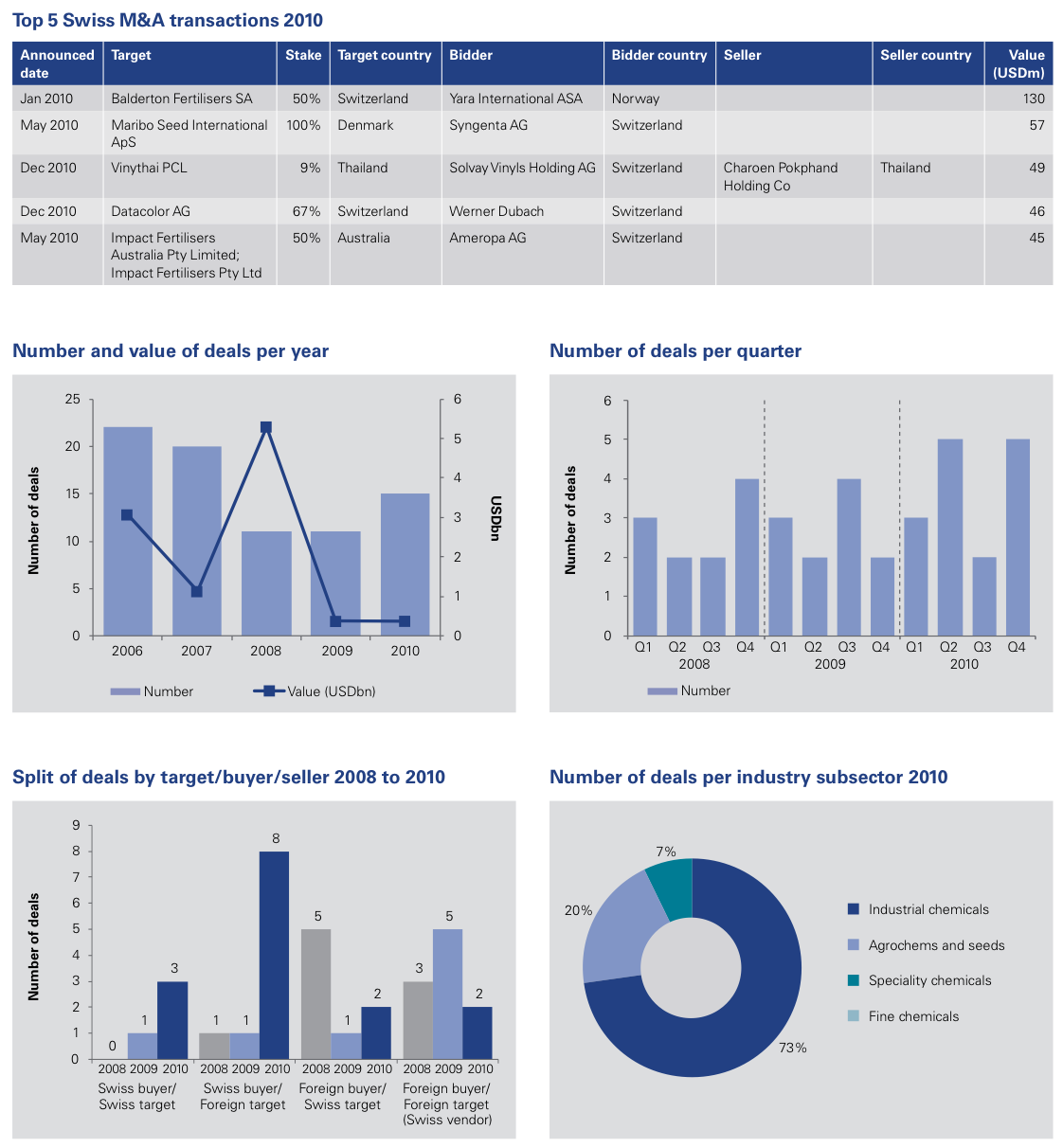

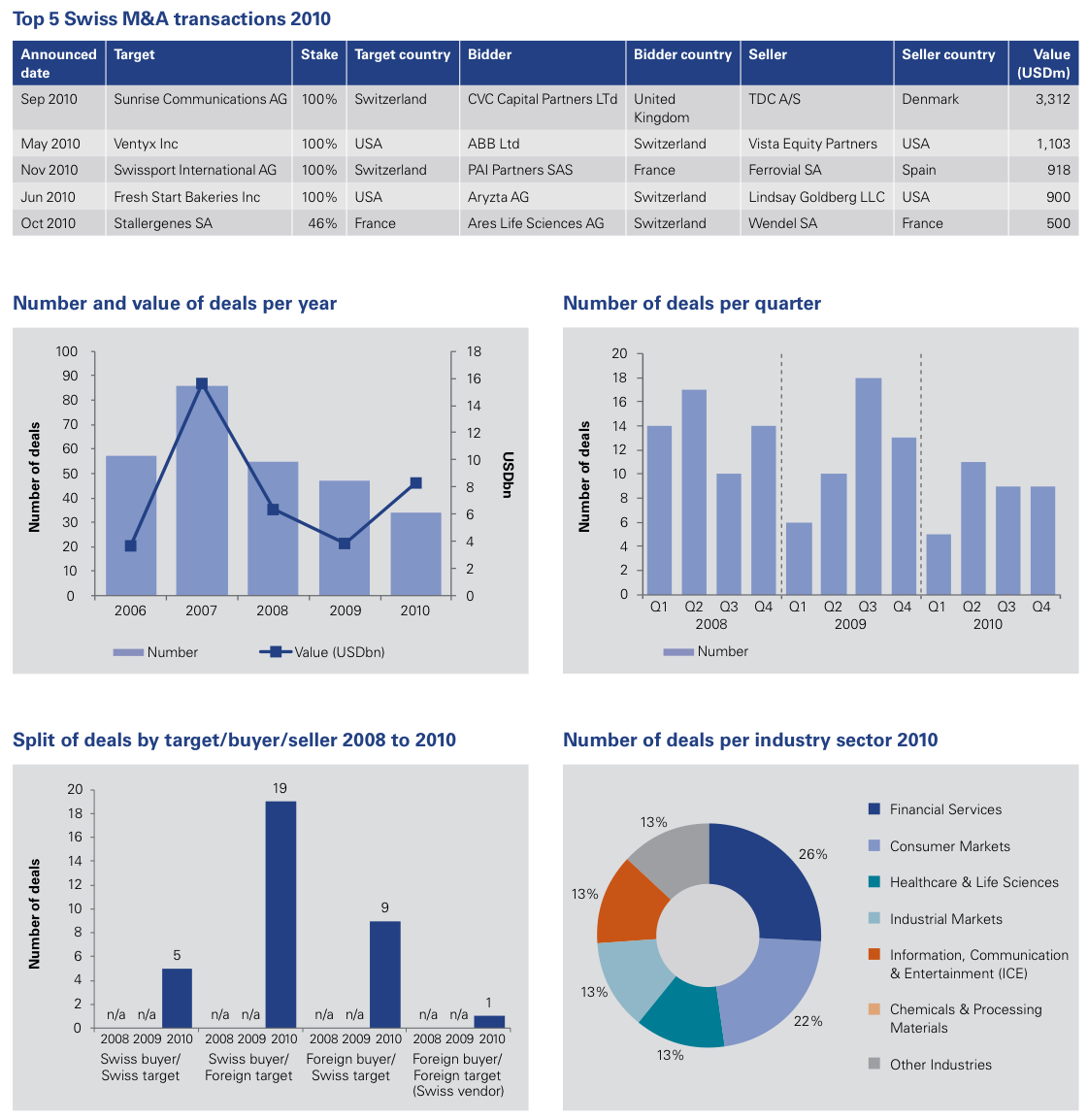

Following particularly difficult years in 2008 and 2009, Swiss businesses appear to be in an increasingly positive mood. Encouraged by healthier balance sheets and rising confidence in market prospects, and with some significant restructuring and rationalisation programmes behind them, boardroom agendas are again becoming dominated by growth. deal volumes stabilised in 2010, representing an improvement over the steady decline witnessed since 2007. Reinvigorated buy-side interest was observed in late 2010, which should combine with progressively easier access to financing to translate into more announced deals in the first part of 2011 and a general upturn in the number of transactions over the coming year.

Finger on the trigger

No matter how ready they might be for the growth race, however, many potential acquirers are frustrated by a lack of available targets. The starter pistol is being controlled to a great extent by prospective vendors, many of whom are struggling to determine the right time to put their assets up for sale. Many are awaiting full year 2010 financial information prior to initiating a sale process on the basis that these figures should demonstrate enhanced performance since the economic downturn, providing a more attractive foundation for the business plan and purchase price. Indeed, a major challenge to date has been dealing with the hockey stick effect, with even credible business plans running the risk of looking over-ambitious given the historical dip out of which they are growing.

Private Equity: a strong contender?

The Private Equity community may help fuel an M&A recovery on both the supply and demand sides. Many Private Equity houses are sitting on significant funds that they were unable to invest during the downturn due to a lack of attractive opportunities.They are now coming under pressure to demonstrate activity in order to raise future funds, although on the whole new funding is not scarce.

On the supply side, many funds delayed exits due to the economic uncertainty and a generally unfavourable iPo environment. 2011 may see managers looking to realise these investments and show positive returns to investors. This will help bring assets to market which may be of particular interest to corporate bidders or as secondary buyouts if there appears to be potential for further operational improvements.

Looking abroad

This year is likely to present swiss players with a number of interesting opportunities abroad as prices in some regions remain depressed and many foreign groups continue to struggle. such groups may divest business units in order to raise capital and/or to focus on core activities, representing potential for relatively healthy swiss investors. This may be the case particularly in neighbouring countries such as Germany and France, where sizeable mid-markets may be looking at succession issues. in addition to industrial and Consumer manufacturing, sectors such as Chemicals and real Estate may be the ones to watch.

The strong swiss Franc may help swiss-based companies in this regard, though at the same time it continues to hinder sales from the export-led swiss industries. similarly, the currency’s strength is likely to curtail foreign interest in swiss acquisition targets despite the attractiveness of switzerland’s stability, production technology and generally high labour and product qualities.

Return of the mega-deal?

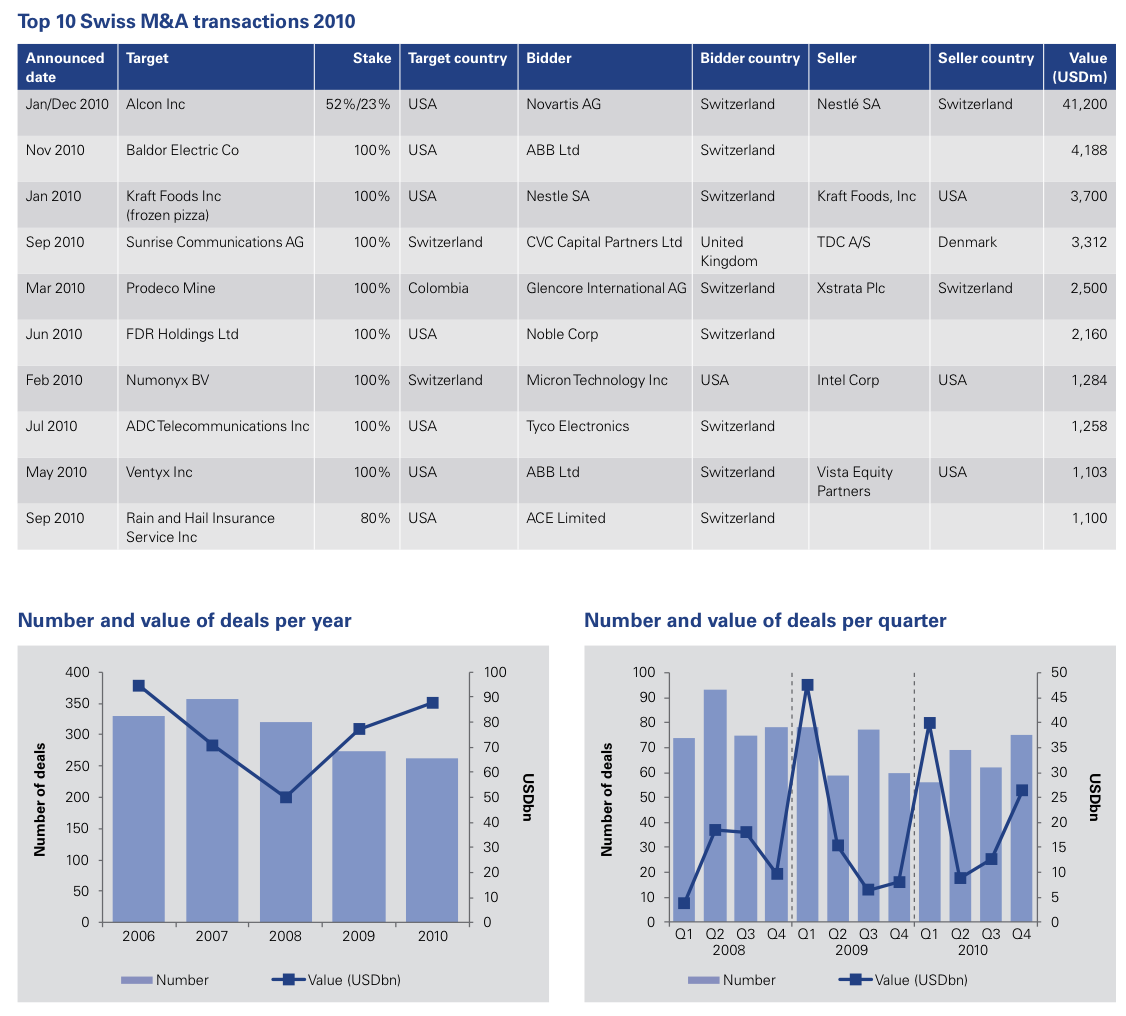

Mega-deals were few and far between in 2010 but there are some significant deals out there to be done. The largest transaction in the year was Novartis completing its acquisition of the remaining 75% of Alcon shares from Nestlé for USD 41.2 billion. This represents a significant lead over the second largest deal, being ABB’s acquisition of the USA’s Baldor Electric Company for USD 4.2 billion.

The upper end of the market may see further non-core divestments, for instance in Financial services. However, across the board supply is likely to be dominated by small and medium-sized deals, partly fuelled by family-owned businesses looking at succession planning, having been deterred from selling until there are clear signs of an economic recovery.

Healthy prospects

Some caution over global macro-economic conditions persists, with a particular eye on what happens to troubled economies within the Eurozone such as Ireland, Spain, Portugal and Greece, which have the potential to knock business confidence. This may result in M&a activity growing at a more modest pace than otherwise might be expected, at least in the first half of 2011. Some export-led industries may continue to suffer due to the strong swiss Franc, which is also deterring inbound acquisition activity into Switzerland.

Despite such concerns, swiss businesses are generally keen to take to the field and resume M&Ф activity and are well positioned to do so.The race is on to acquire the best assets, with plenty of competitors ready to chase deals in 2011.The question appears to be not ‘will the race begin?’ but ‘who will be the strongest contenders?’ and ‘which player will get off to the best start?’ If favourable conditions persist, there may be more than one winner. (Patrik Kerler, Partner, Head of Mergers & Acquisitions)

Industry snapshots for 2011

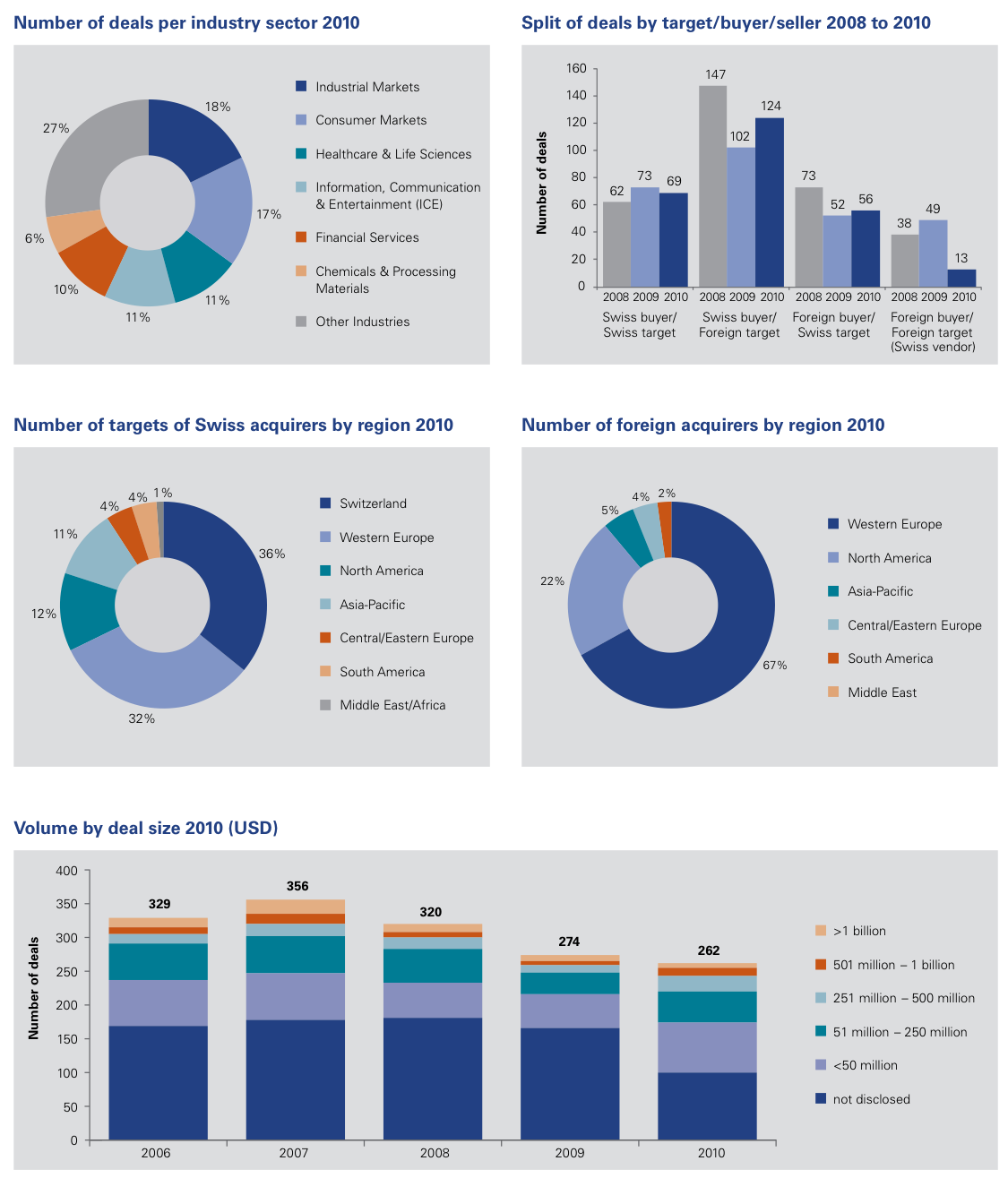

Financially robust Pharmaceutical players are expected to lead M&Ф activity in the Healthcare & Life Sciences sector in 2011. some smaller deals are likely in Medical Technology and Healthcare service provision, both of which are attracting much interest from investors.

Swiss Chemicals groups appear to be in particularly confident mood following a period of reorganisation, and there could be some interesting opportunities for swiss groups abroad. Activity is likely to concentrate on building a presence in key regional markets such as Фsia and in enhancing product portfolios.

One of the sectors hit hardest by the economic downturn, Financial Services is likely to see significant consolidation in Private Banking, where new regulations are prompting fundamental revisions of business and operating models, including on-shore presence. Elsewhere in Financial services more clarity over regulation such as Basel iii should encourage activity.

Export-led Industrial Markets are especially suffering from the strong Swiss Franc but cautious optimism prevails as late 2010 saw a significant upturn in order book levels. M&A in 2011 may be modest compared to some other sectors, but global competitive pressures may combine to encourage transformational deals and/or acquisitions along the supply chain.

2011-2012 may see further consolidation within the Consumer Markets sector and some major non-core disposals by the Food & Drink giants, which are likely also to remain in highly acquisitive mode. Luxury Goods manufacturers may seek to steal the Consumer Markets M&A crown as they search for potentially large deals outside Switzerland.

Technology deals are expected to continue to dominate Information, Communication and Entertainment as many players across industries seek to enhance their capabilities in IT and software solutions, which are increasingly critical to their businesses. A shuffling of Media portfolios is likely to occur as well as a strengthening of the swiss presence in Eastern Europe, but no groundbreaking deals are expected.

The focus on high-grade Real Estate around Geneva, Lausanne, Zurich and Central Switzerland is almost certain to continue for the foreseeable future, with prices remaining accordingly high. 2011 may see key players investigating further opportunities in development projects while the residential market continues to boom.

Not to be under-estimated, other industries such as Energy (primarily renewables) and Commodities are likely to see significant M&A activity in 2011 as interest in the swiss scene may continue to grow, with 2010 having seen some major energy traders relocate sizeable teams to Geneva.

Healthcare & Life Sciences

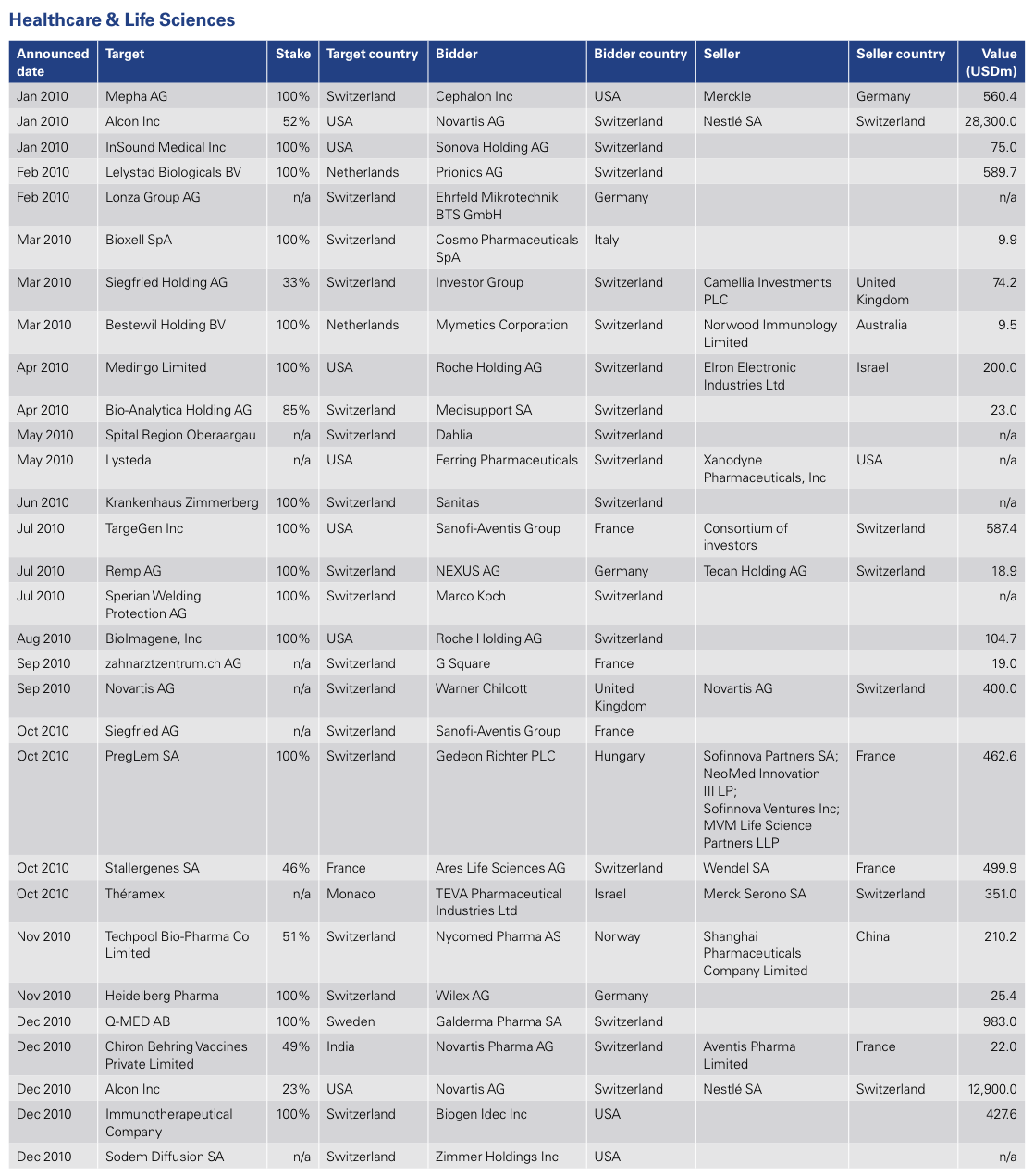

2010 yielded only a handful of major Healthcare & Life sciences transactions. However, the drivers towards further industry consolidation remain strong and 2011 may well see some larger deals in this relatively unconsolidated sector, particularly among the Pharmaceutical players. Medical technology, generic drug manufacturers and healthcare providers may all represent interesting, albeit smaller, acquisition opportunities.

The Healthcare industry is approaching a major crossroads. Ever-increasing demand for its products and services is arising from inter alia ageing populations, a rise in obesity and growing purchasing power in less developed nations. However, a large question mark exists over who pays for care – a particularly pertinent issue in the current environment of shrinking government expenditure. In the short term, expiring patents on some blockbuster drugs also pose a threat to future revenues and margins, particularly for those companies with weaker development pipelines or a less diversified revenue base.

Despite being dominated by smaller deals, 2010 was punctuated by a couple of major transactions such as Novartis’s USD 41.2 billion acquisition of the remaining 75% stake in Alcon, and Galderma’s USD 983 million acquisition of Q-MED. There had been some expectation that 2010 would see a surge of mega-deals. While this did not occur, the relatively unconsolidated state of the sector points towards the possibility of a wave of major transactions in the short to medium-term.The only question appears to be when this will take place, and the extent to which it will gather pace in 2011.

With steady cash flows, the Pharmaceutical sector has been one of the more financially robust sectors through the downturn and has continued to pursue transactions.There appears to be a steady supply of potential acquisition targets, however there is concern around the multiples being commanded and the extent to which it is possible to deliver positive long-term returns on investment.

Biotech has fallen out of favour as a result of the financial crisis, with investors deterred by the scale of investment, high failure rate and lead times in bringing products to market. although classic M&A may remain important in the Biotech field, it is expected that other forms of tie-ups such as partnerships or alliances with larger Pharmaceutical businesses will become more commonplace. such strategies create a potentially powerful proposition between the greater resources and financial firepower of the Pharmaceutical industry and the higher levels of innovation (particularly in more niche specialist drugs) typical of smaller Biotech firms. From the Pharmaceutical perspective this can also represent a more cost-effective and less risky investment than undertaking an acquisition. Many investors are also expressing a preference for Medical Technology investments, which by contrast tend to have lower investment requirements and shorter lead times than Biotech.

Outlook for 2011

2011 is likely to see continued investment in the providers of Healthcare services within Switzerland, although the same question of who pays for the increasing need for care applies. specific to switzerland, the impact of the introduction of the swiss diagnosis related Groups (DRG) legislation in 2012 (the national standardisation of hospital tariffs) is still uncertain and may impact the margins Healthcare providers enjoy. (Joshua Martin, director, Transaction services)

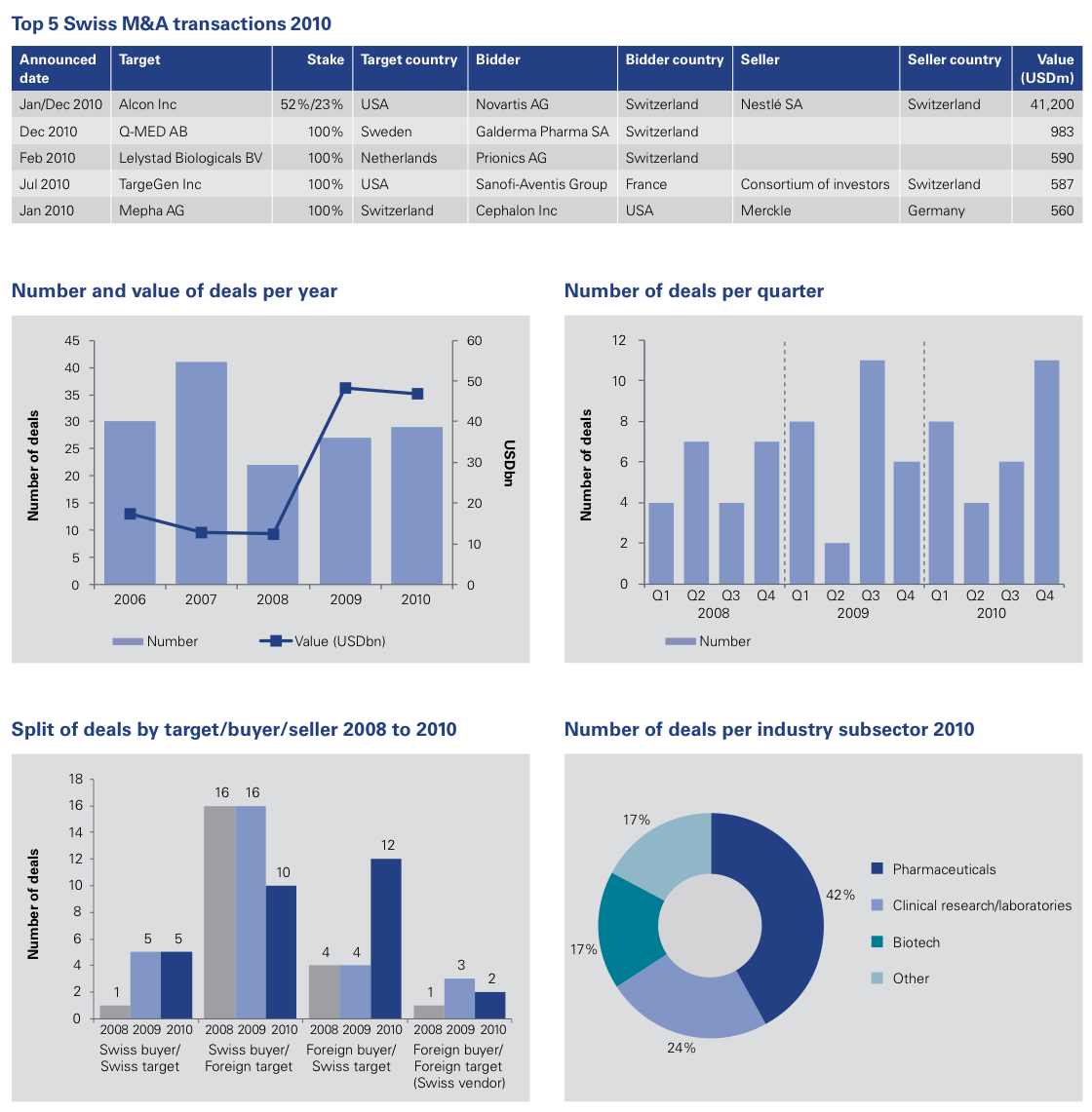

Chemicals & Processing Materials

Having weathered the economic storm, Swiss Chemicals groups are in confident mood. With restructuring largely having taken place and balance sheets regaining strength, 2011 may herald a new growth period for the sector. strategic acquisitions look set to top the agenda with a continued focus on key geographies and product portfolio enhancement.

The Swiss Chemicals industry is facing increasing competition from the Middle East and Asia and an increase in regional demand is driving the growth of domestic Chemicals companies.

The larger Swiss Chemicals groups such as Clariant have invested much effort and resource in positioning themselves for the post-economic crisis period, with initial indications being that these efforts have paid off. improved earnings, enhanced working capital management and an evidently successful reorganisation of production facilities worldwide are placing them in a much stronger position than one year ago.

This focus on realignment and stabilising the core business may explain the relative lack of acquisition activity in this sector over the course of 2010. However, boardroom agendas are now turning back to the subject of growth as a number of market participants are performing well.

While deal values in 2010 were relatively modest, the year is notable for having seen particular activity in the fertiliser business.The largest and fifth largest deals of the year were an inbound and an outbound deal respectively, the first being the acquisition of a stake in Balderton Fertilisers by Norway’s Yara International, and the other being Ameropa’s purchase of a stake in the Australian Impact Fertilisers.

Many major players such as Syngenta and Sika have fixed an eye on bolt-on acquisitions that will place them in prime position to generate future growth. Both have done deals which focused on penetrating key territories and enhancing product portfolios.

Outlook for 2011

While it is unlikely that 2011 will see any mega-deals involving swiss businesses, general deal activity is expected to increase over the course of the year.

More generally across the Chemicals sector, bolt-on acquisitions are likely to continue with a focus on key geographies such as India – interest being driven by a desire to establish a regional hub for East and South East Asia, leveraging a low-cost base as well as helping to secure raw material supplies. desire may not necessarily translate into success, however, as experience shows significant difficulty in finding acquisition targets in Asia that are attractive and available at a reasonable price.

An option for expansion closer to home may be to acquire business units being divested by groups keen to raise funds. Opportunities might exist in certain European countries where the sector was hit harder than its swiss counterpart, and where there are a number of groups that may need to make non-core or forced disposals. (Pablo Ljaskowsky, Partner, Transaction Services, and Patrick Schaub, Senior Manager, Transaction Services)

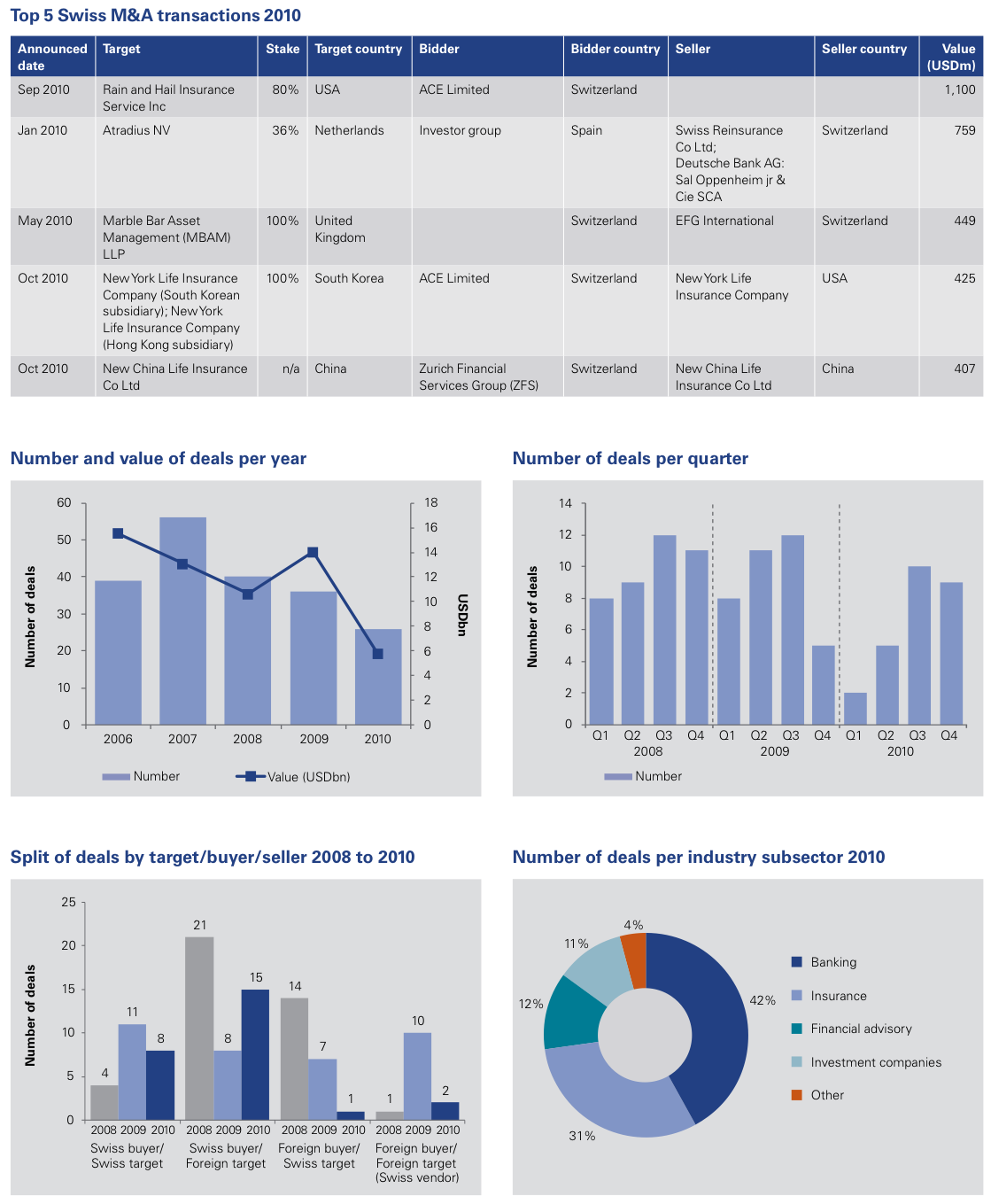

Financial Services

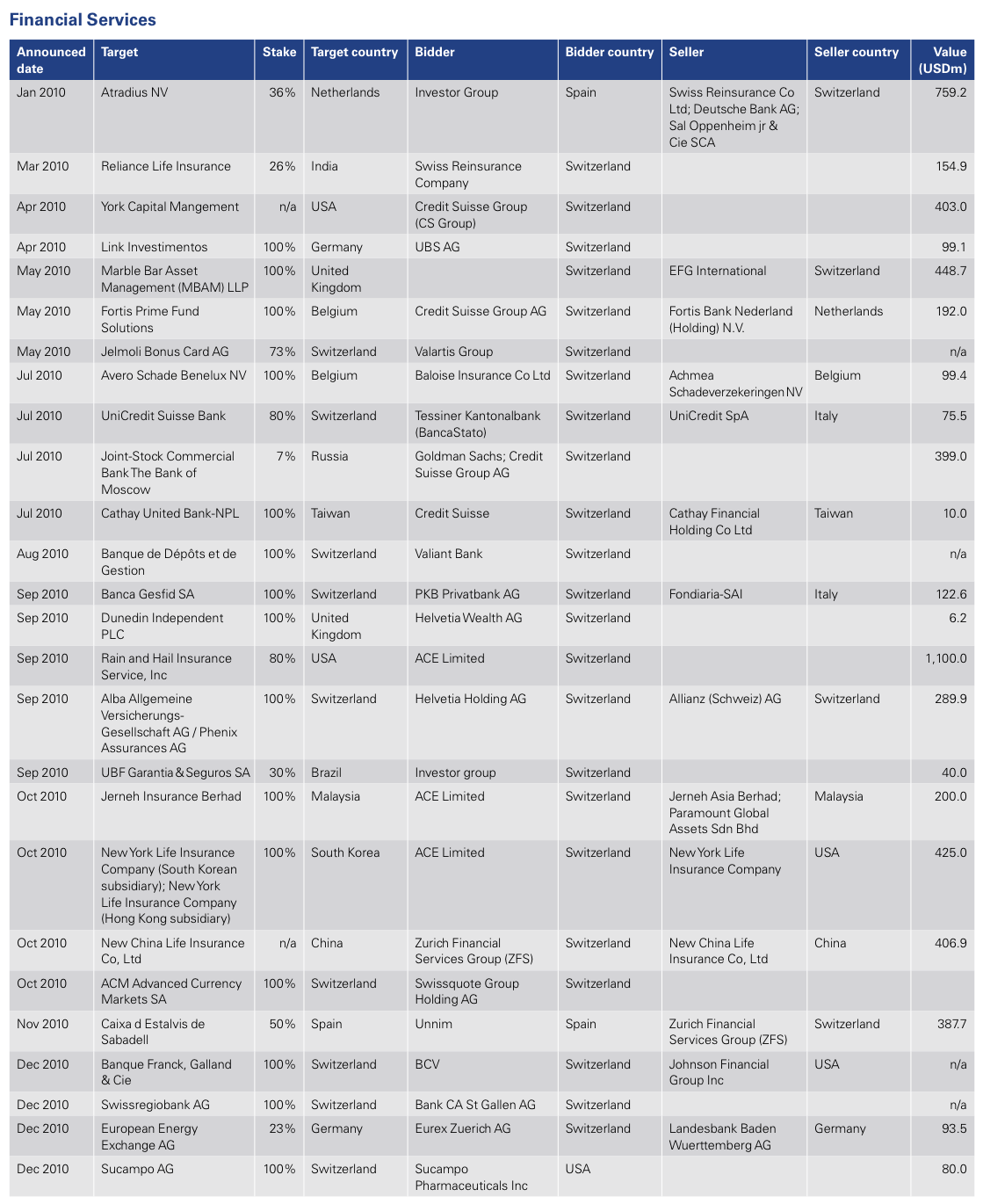

Although 2010 experienced the lowest level of Financial services M&A activity since 2005, swiss institutions are getting back into shape following a tough couple of years, with a particular rebound in the number of Swiss acquisitions abroad. The insurance sector saw the largest deal of the year, and indeed the only deal to exceed USD 1 billion. 2011 is likely to experience stronger activity in Private Banking as regulatory challenges and business model considerations encourage long-awaited consolidation.

The low level of M&A activity in 2010 was driven in part by attention being focused on anticipating and adapting to new and upcoming regulation. Whether capital requirements for Banks and insurance companies or legislation fundamentally impacting the Private Banking business model, the evolving regulatory landscape posed serious challenges and uncertainties across the industry.

While outbound deal activity by swiss institutions almost doubled over 2009 from 8 to 15 deals, foreign players seemed to be deterred from making acquisitions in Switzerland, with only one such deal in the year.

Banking transactions were primarily sales-driven with a number of crisis-induced deals. Not strictly distressed sales, they were largely born of a need to focus on core activities and / or reinforce the vendor’s capital position.

The Insurance sector was relatively active, particularly towards the end of the year with ACE completing three transactions including the largest deal in the sector being an acquisition in the USA valued at USD 1.1 billion. a number of key players have been actively pursuing opportunities. Swiss Re appears to be positioning itself for growth in the emerging markets, having undertaken acquisitions in both India and Brazil during the course of the year. its sale of a minority stake in Atradius may be seen to bolster its financial position to implement further expansion plans.

Tough market conditions, changing client needs and an increasing regulatory burden are eroding margins in the Private Banking sector. a swathe of new regulation and compliance obligations from the Swiss Financial Market Supervisory Authority (FiNMA) and from non-Swiss authorities poses significant additional requirements and raises questions over the sustainability of current service propositions and operating models. Indeed, regulatory developments may prompt a degree of consolidation in the industry as some players struggle to adapt.

Outlook for 2011

This year’s market may be characterised by strategic realignment and the continued disposal of non-core assets. Banks that do have surplus cash reserves may seek opportunities from among those that continue to struggle. Finalisation of Basel III in December 2010 may however remove some regulatory uncertainty, positively impacting M&A activity in 2011.

Private Banking is likely to be the hottest sector over the year. significant consolidation may combine with some less profitable players seeking to exit the market, to help drive activity. Larger Private Banks are well positioned to make foreign acquisitions as they seek to build on-shore presences and concentrate on expansion in certain key markets. Western Europe remains the highest priority followed by Latin America and East & South East Asia. (Christian Hintermann, Partner, Transactions & Restructuring Financial Services)

Industrial Markets

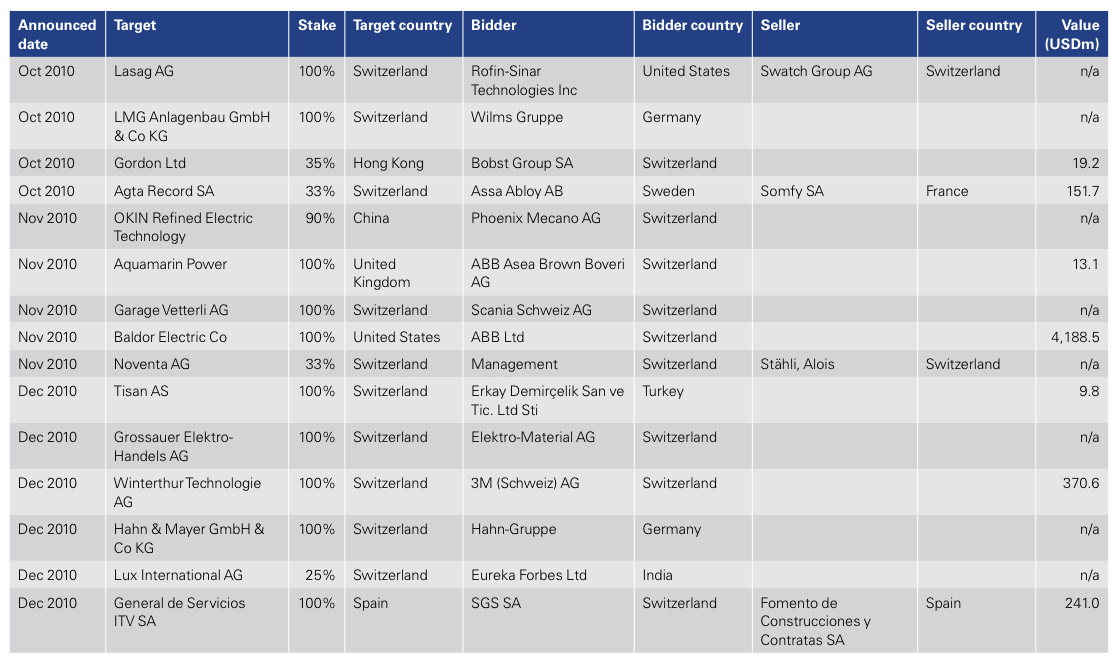

Cautious optimism prevails as swiss industrial businesses transition into a period of recovery, fuelled by healthier order books. Many cyclical industries grew in 2010, putting M&A appetite back on the agenda for 2011, though perhaps with a focus on less risky transactions such as horizontal consolidation to add scale to core businesses or to add new customers or distribution channels. However, rising global competition may force established players to seriously consider both transformational transactions and acquisitions of key suppliers and/or new technologies.

The Swiss industrial sector is seeing a gradual return of confidence after a couple of tough years, with talk around many boardroom tables moving from restructuring to sustainable growth. after a period in which both manufacturers and distributors actively managed down their inventories, the second half of 2010 saw a sales-led restocking as order book levels began to rise. some major businesses have already resumed growth plans in earnest. With a substantial cost-control programme behind it, ABB announced it will spend more than USD 5 billion combined on two acquisitions alone, bolstering its presence in industrial motors and software solutions respectively through the anticipated purchase of US-based Baldor Electric Company and the closed acquisition of Ventyx.

Many though are cautious about putting into effect significant expansion plans while economic uncertainty remains and there are questions over how the industrial market will develop after the end of stimulus programmes. The continued strengthening of the swiss Franc is a particular issue for the export-led industrial market, challenging its price competitiveness abroad as well as possibly deterring inbound M&a activity. it is also prompting discussions around hedging alternatives and outsourcing production to lower labour cost economies. A further driver negatively impacting M&A activity last year was valuation expectations. although the gap between seller and buyer has narrowed, it is still hindering deal activity.

Outlook for 2011

Mounting pressure for businesses to expand abroad in order to remain internationally competitive is likely to help drive M&A activity.This combines with an incentive for larger players to secure strategic assets and supplies, expanding their operations along the value chain. Succession planning issues in family-owned businesses may also encourage mid-market disposals. Many owners are presently resisting the temptation to sell until they have (better) full year results for 2010.The consequence is that 2011 could see many more assets coming to market.

In addition to European and North american bidders, expressions of interest are likely to continue from Chinese and indian firms looking for high quality assets and access to production technology. Whether or not this results in M&a is questionable due to the difficulty of concluding deals between such distinct cultures. in terms of outbound deals from Switzerland, ABB shows little sign of slowing down and is likely to remain in a highly acquisitive mood in 2011. While few if any mega-deals may be on the menu, a number of bolt-on acquisitions are likely to be in its sights. other groups may also continue screening for assets in strategically important regions.

Corporates should be able to fund acquisitions mainly with internal reserves, operating cash flows and/or divestiture proceeds. However, lower volatility and contracting debt spreads will make debt and equity issues more attractive in the next year. Meanwhile, corporates may wish to look for potential opportunities from the disposal of Private Equity portfolios. industrial Markets has long been popular with Private Equity as it is comparatively straight-forward to drive operational efficiencies. Funds have not generally exited long-term portfolio investments in the last two years and many now feel pressure from investors to do so.They may use the improved market and profitability of disposal assets to start preparing structured disposal processes to take place in 2011. (Sean Peyer, Partner, Transaction Services, and Andreas Poellen, Senior Manager, Mergers & Acquisitions)

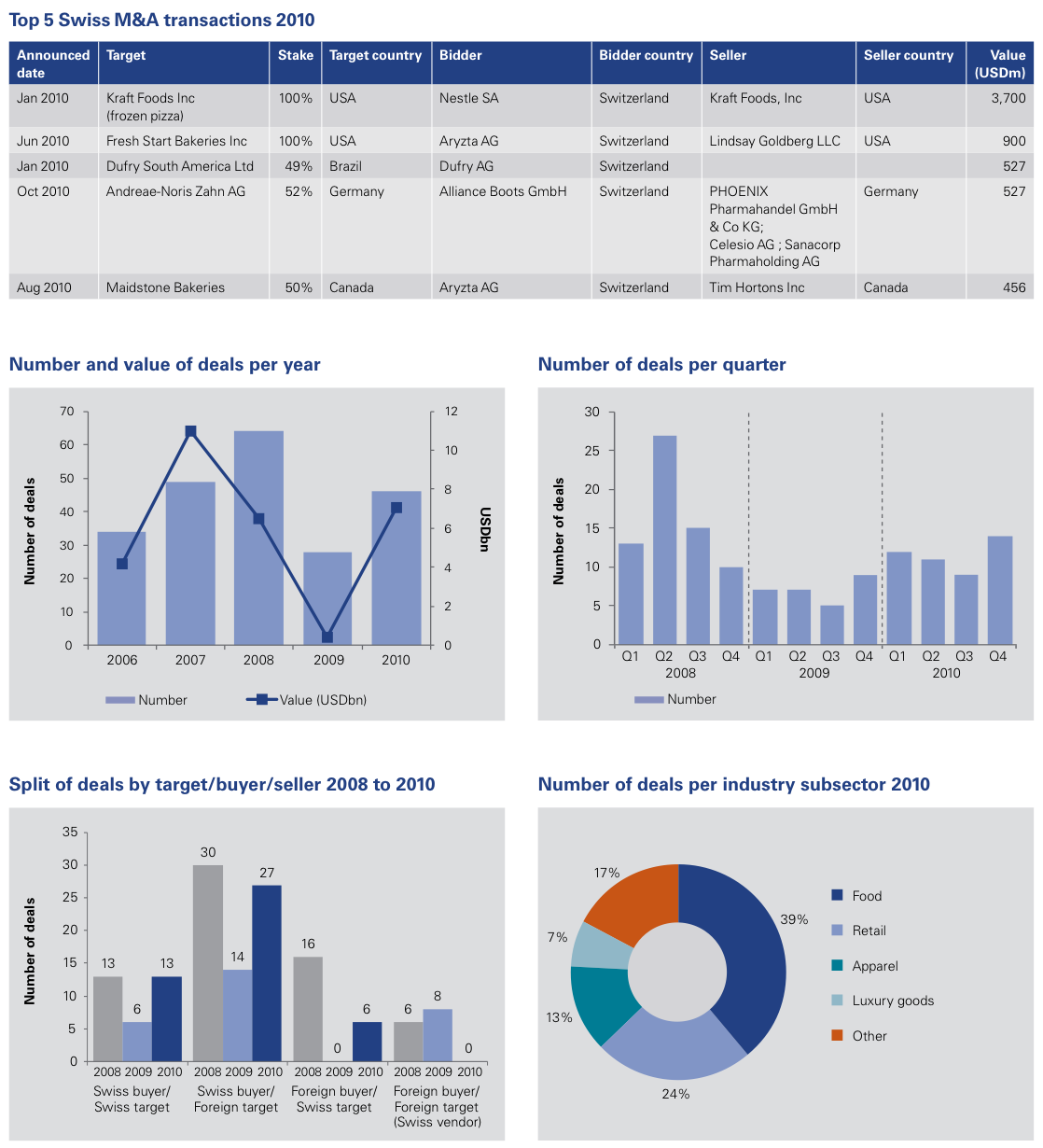

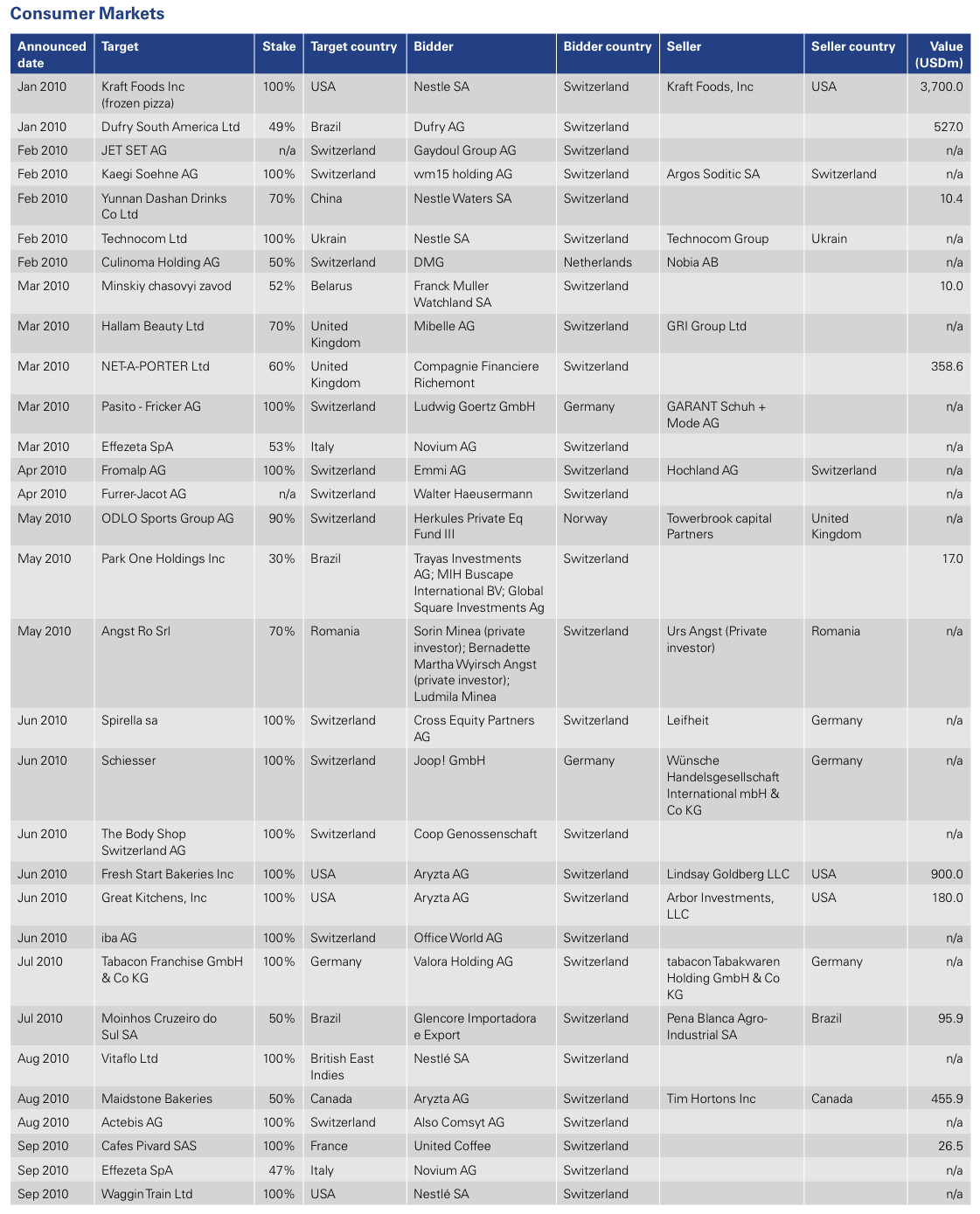

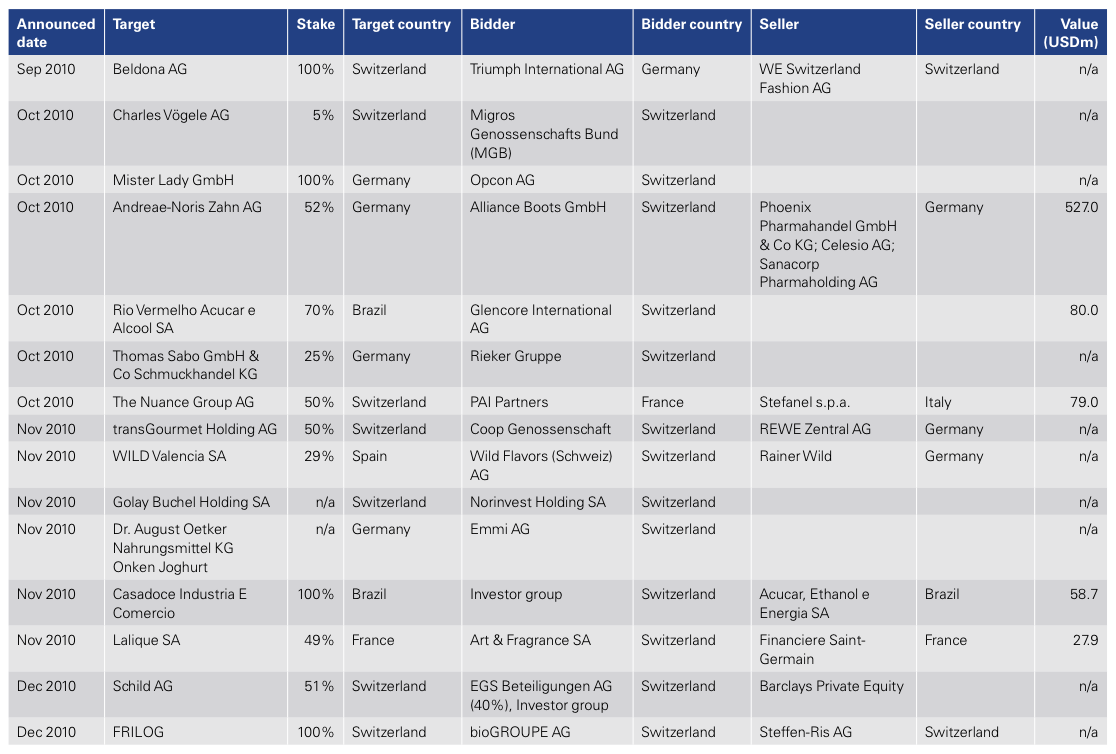

Consumer Markets

Financially healthy and well positioned to pursue a growth agenda, Switzerland’s Consumer Markets has survived recent economic troubles better than most other sectors. activity may continue to be dominated by the mighty Food & Drink players, though manufacturers of Luxury Goods are ready to make interesting acquisitions if opportunities materialise.

In 2010, M&A started with a bang in Switzerland’s Consumer industry with a major transaction. While many businesses took stock of their positions and sought to prepare themselves for a period of renewed market confidence, 2010 saw a healthy level of M&A activity under the lead of Nestlé. Still, due to the uncertain economic outlook and attractive acquisition targets remaining scarce the strong start to the year was not sustained.The above factors contributed to a fair degree of caution among prospective dealmakers, though overall a greater disposition towards considering deals was noted, boding well for activity in 2011.

Less impacted by the economic downturn than many other sectors, the Food & Drink giants have been able to remain focused on growth. They are by and large financially stable, well focused on their core segments and possess the necessary war chests to make opportunistic acquisitions as and when such arise. Major deals such as Nestlé’s acquisition of Kraft Foods’ Frozen Pizza business or Aryzta’s purchase of the USA’s Fresh Start Bakeries are testimony to the fact that they retain significant financial muscle. also to be noted is the acquisition of the Alcon business by Novartis from Nestlé. This transaction impressively demonstrates the closing gap between Consumer and Healthcare, a trend that may further affect both industries and their M&A activity.

Economically stable, the Swiss Retail sector is notable for the strong position of its traditional peers Migros and Coop. The foothold recently obtained by German competitors such as Aldi and Lidl has undoubtedly brought a new dynamic to the industry, though the dominance of Migros and Coop in the short- and mid-term cannot yet truly be challenged. Coop was the active player on the 2010 retail M&A stage, having bought the remaining stake in TransGourmet from Rewe, reinforcing its presence in the Swiss food services market while at the same time providing new channels and opportunities for future international growth.

The dip in 2009 was righted during the course of 2010, seeing Luxury Goods manufacturers return to form. Businesses such as Richemont and Swatch remain in fine shape and appear to be in acquisitive mood, looking primarily for smaller, bolt-on acquisitions to enhance or complement their brands and existing portfolios. However, they are struggling in light of a scarcity of attractive targets, which might also drive them to do bigger, more transformational transactions.

Outlook for 2011

The outlook for the Consumer industry appears promising. More transactions should be expected of the Food & Drink giants. Once Nestlé has digested the recent acquisition of Kraft Foods’ Frozen Pizza, it may once again be hungry. some of the larger international groups may seek to dispose of non-core business units over the next years, which will further shape the industry.

While Food & Drink is likely to spearhead Swiss Consumer Markets interest abroad, the Luxury Goods players under the lead of Richemont and Swatch are well positioned to follow or even overtake in 2011 by making large international moves. at the same time the strong interest in smaller Swiss luxury brands and companies might trigger certain inbound acquisitions by foreign investors. (Patrik Kerler, Head of Mergers & Acquisitions)

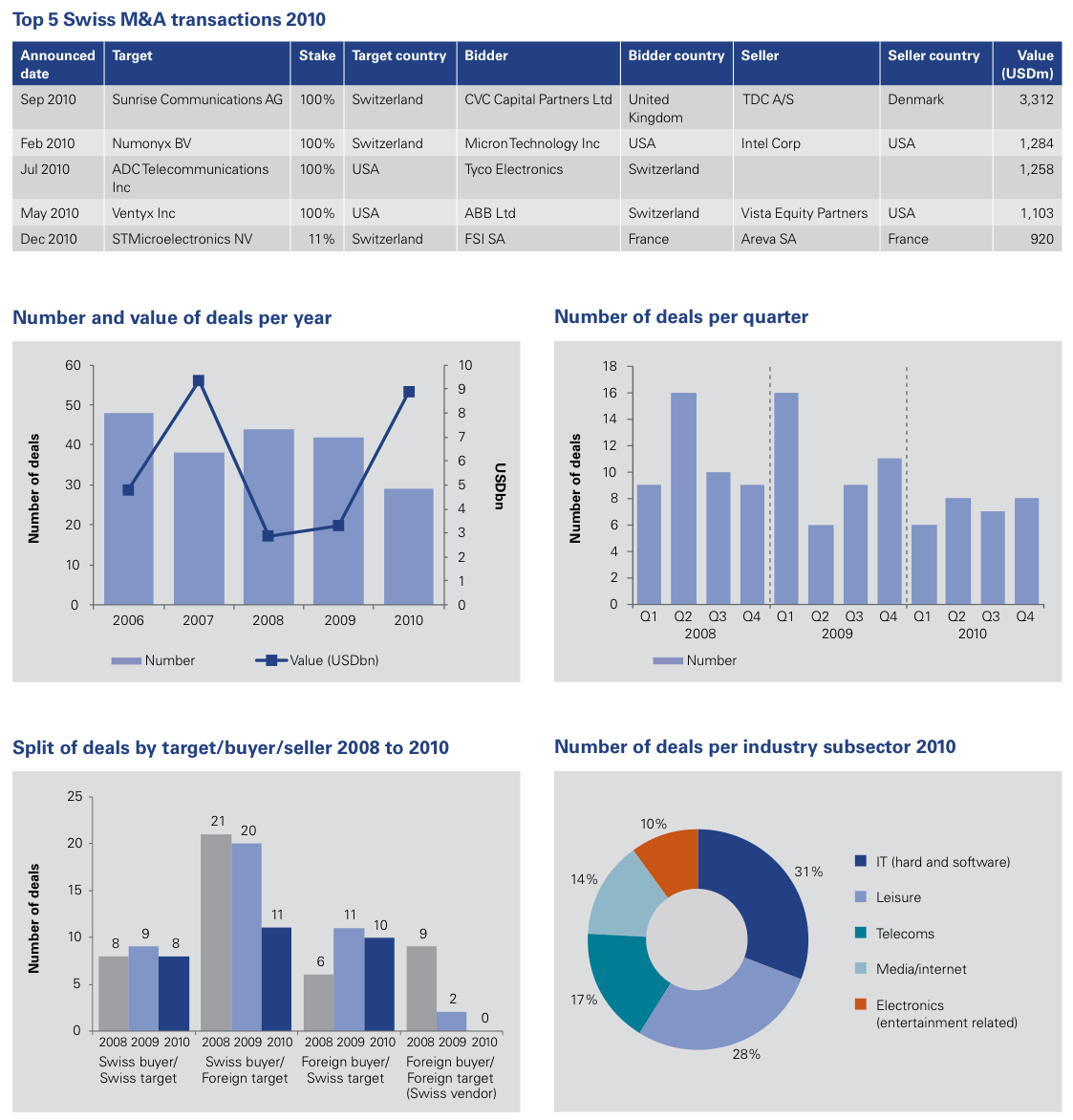

Information, Communication & Entertainment

Dominated byTechnology and Telecoms deals, the sector may see pockets of M&A activity around banking software, semiconductors and energy-related businesses. Media and Travel may continue to focus on portfolio review and consolidation without giving rise to major transformational moves.

In Technology, the banking software industry in particular has benefited from the economic crisis due to the focus on enhancing risk and reporting systems in Financial Services. Many players are actively seeking acquisition opportunities, including Temenos, which continues to scout for targets in key foreign markets.

The largest Telecoms transaction in 2010 was CVC Partners’ acquisition of Sunrise following the cancelled merger with Orange Suisse. Meanwhile, Swisscom built on its specialist portfolio in 2010 with acquisitions in network business services, IT solutions, and hospitality (hotel WiFi solutions), but no major deals. In 2011, the focus may be on strengthening its Italian subsidiary, Fastweb.

Hard hit by the economic downturn as advertising spend fell, Media appears to be getting back on its feet. of the major players, Tamedia carried out little M&A in 2010 as it progressed with the ongoing merger of swiss media activities with Edipresse.

The traditional Travel business remains in flux, especially due to the internet’s increasing capacity to enable travellers to bypass tour operators and travel agents. Some major tour operators are reacting by acquiring destination and specialist travel companies. Kuoni maintained its usual M&A pace through five acquisitions in 2010. Under pressure due to poor financial results, Hotelplan reorganised its structure in 2010, then strengthened its position in the UK ski travel market by buying Enigma Travel.

Outlook for 2011

As IT and software solutions become ever more critical across a range of sectors, including Energy and related industries, 2011 may see the start of a wave of M&A or alliances and partnerships. ABB is likely to seek an expansion of its capabilities, especially in the USA and with a particular interest in managed IT solutions for smart grids. Meanwhile, SGS could also include software-driven solutions in its M&A strategy, where it has been focusing on expansion in developing markets.

The semiconductor industry may see ST Microelectronics return to the M&A scene in 2011 as it develops its portfolio and builds the strength of its intellectual property, while either exiting non-core businesses or merging them with strong partners. Targets are likely to be intellectual property-rich companies in the USA and Northern Europe, as well as possible partnership opportunities in Asia. u-blox may show interest in undertaking acquisitions or may be a target itself.

Logitech will most likely be open to acquiring targets with innovative device solutions in 2011 irrespective of their geographic location. An example could be increasing the depth of its internet TV product offer on the back of its alliance with Google.

2011 may witness Media companies continuing to try to optimise their portfolios. Goldbach Media and Ringier may seek targets to bolster their expansion into Eastern Europe (as Ringier did in teaming up with Axel Springer in 2010), and to bolster their digital services offering, but in 2011 the emphasis is likely to be on portfolio improvement rather than committing to major acquisitions. (James Carter, Director, Transaction Services)

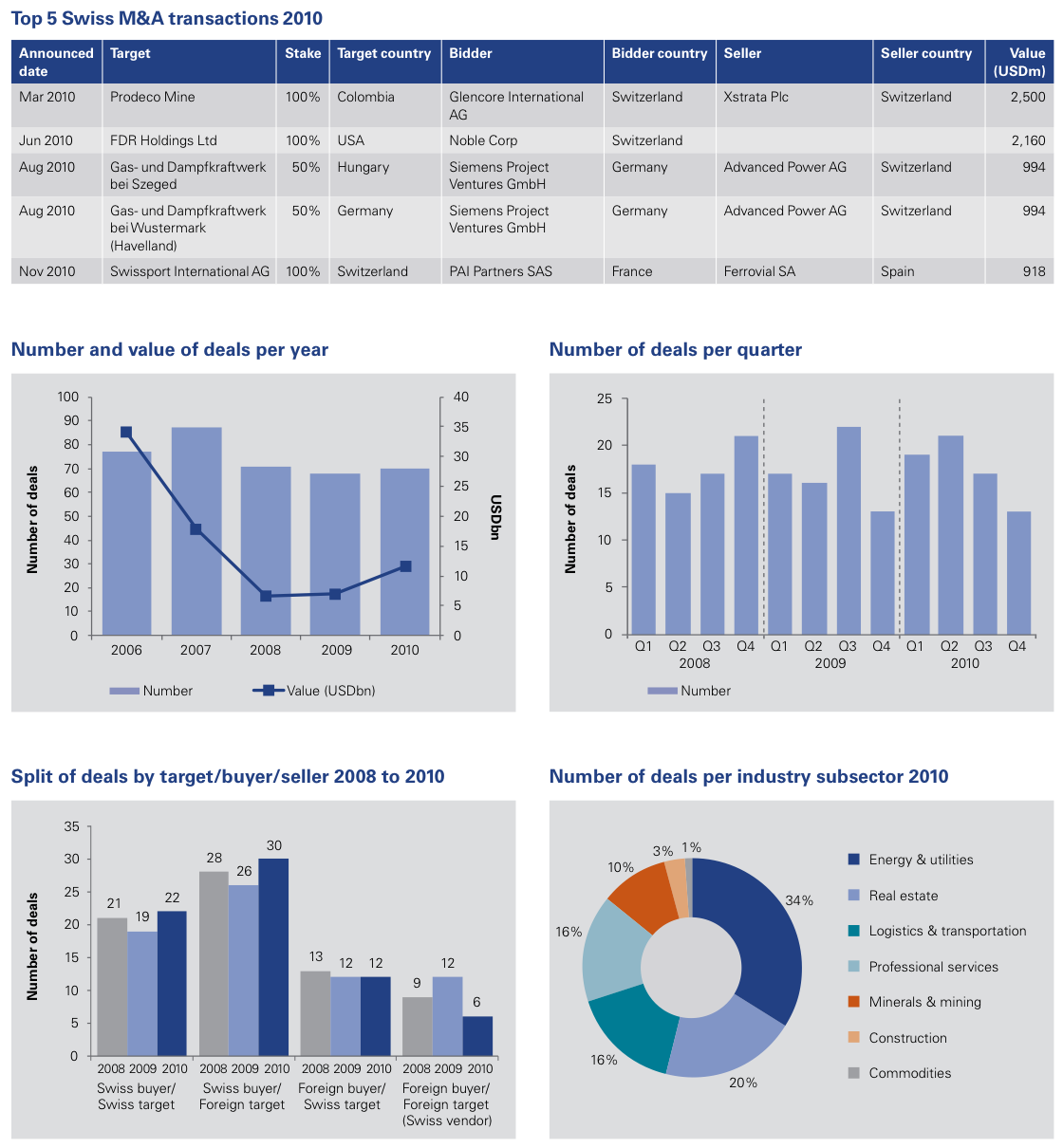

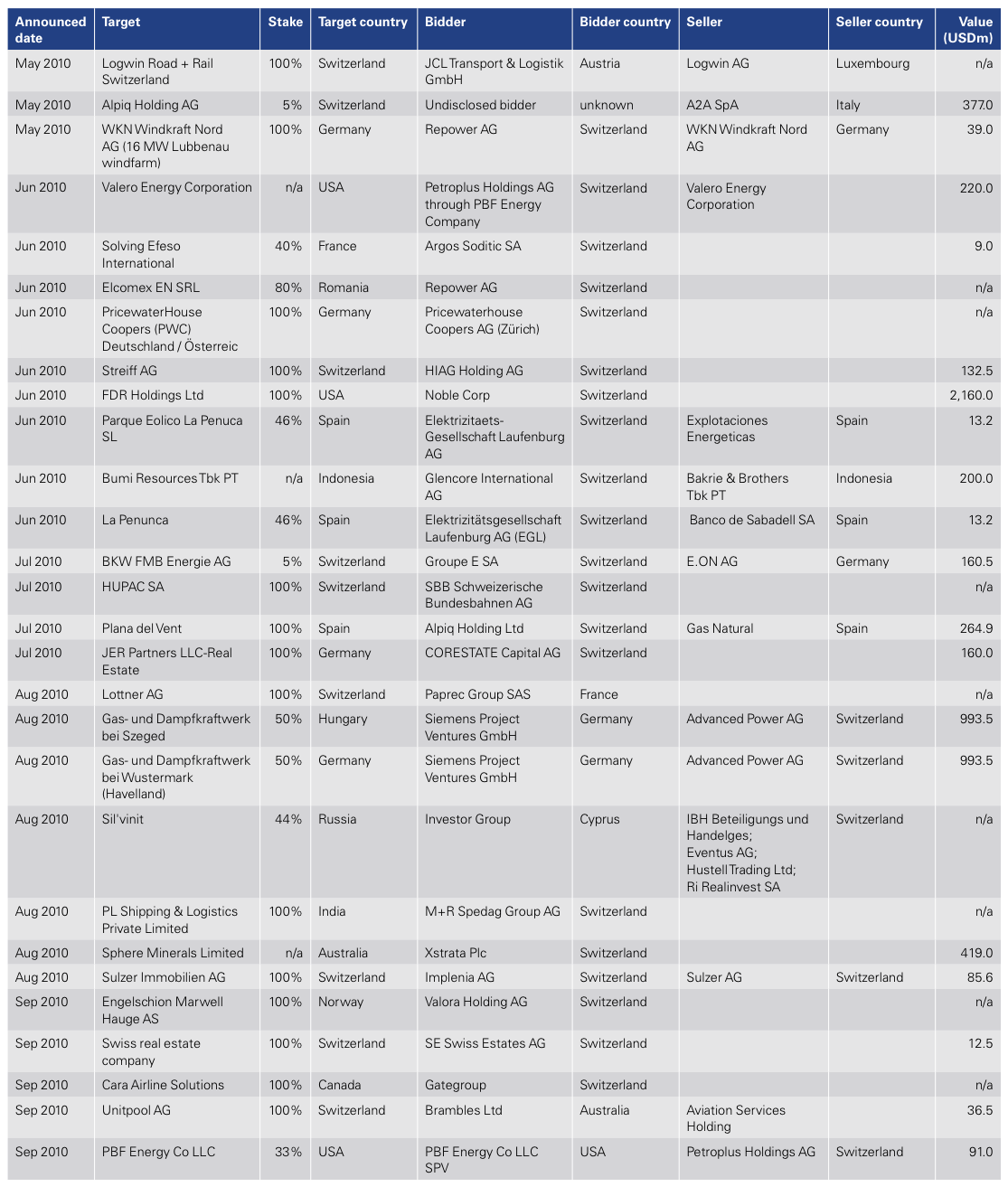

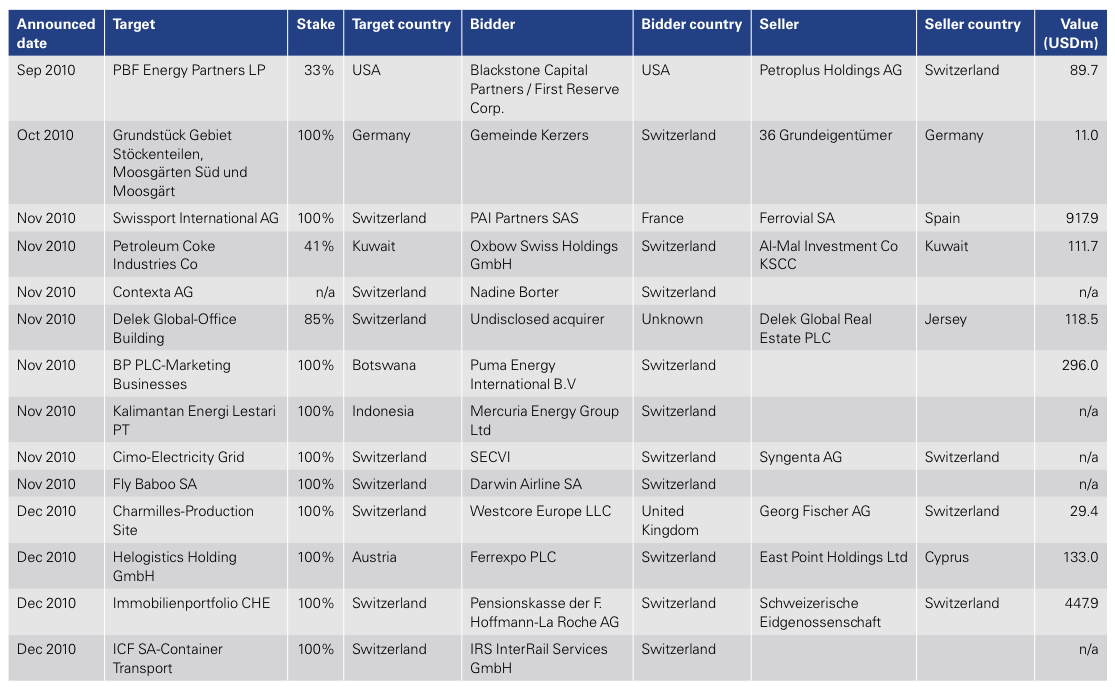

Other Industries

Energy and Commodities top the agenda, with swiss companies being in acquisitive mood following a period of restructuring and cost control. disposals are possible with the aim of building shareholder value, representing potential opportunities for Private Equity and corporate investors alike.

‘Other industries’ captures those sectors not specifically covered elsewhere in this publication. For 2010 the most interesting sectors were arguably Energy, Mining and Commodities. This looks set to remain the case in 2011.

2010 showed a notable desire by Swiss businesses – particularly utility companies such as those in Zurich and Bern – to invest in Renewable Energy. Primarily in the areas of wind and solar power, there is a feeling that a certain level of ‘catch up’ is required.

The other main focus has been on Mining and Commodities. It is known that Chinese companies are looking globally to acquire land in order to secure access to food and / or raw materials. The battle for such commodities may well intensify over the coming years and will be spearheaded on Switzerland’s behalf by groups such as Xstrata and Glencore. Due to the nature of the commodities business, acquisitions tend to be few and far between, but when they do take place they tend to be sizeable. It is difficult to predict where and when acquisition targets will become available, and so to an extent a successful growth agenda must be a combination of strategy and opportunism.

A particular development in 2010 was the relocation of a number of oil traders to Geneva, particularly from London. Switzerland is noted by some commentators as being about to overtake London as the world’s main trading centre for physical energy commodities. Vitol, the world’s largest energy trader, is transferring its European natural gas and power team to Geneva, while the world’s third largest oil trader, Trafigura, is moving one-quarter of its workforce to the city. Such moves clearly help to bolster Switzerland’s role in global commodity trading and may lead to diverse opportunities.

Outlook for 2011

The notable shift into acquisition mode is set to continue in 2011. Many Swiss businesses are leaner and more efficient following considerable restructuring or cost control measures and are in excellent positions to actively pursue a growth agenda. on the sale side, many large groups may consider disposing of non-core or problematic businesses they have held on to for a while, in order to enhance shareholder value. These are in the main not distressed sales but rather an opportunity to raise funds to either distribute to shareholders or to spend on acquisitions to reinforce their core businesses.

Energy will remain strongly on the agenda. There is the prospect of the start of a consolidation phase among utility companies, but this is unlikely to be achieved fully until there is greater market liberalisation in Switzerland. in the meantime, players may begin laying the groundwork and scouting for attractive assets. acquisitions will chiefly be strategic rather than opportunistic, focused on building a portfolio and / or making bolt-on acquisitions. (Rolf Langenegger, Director, Valuation Services)

Private Equity

2010 saw a reawakening of the Swiss Private Equity industry, with deal activity increasing as the year progressed. Fierce competition from resurgent corporates, however, combines with a shortage of available quality assets to present severe challenges to the Private Equity dealmaker, who is pursuing various strategic alternatives such as wider geographic focus and sourcing proprietary deals.

The Private Equity model so successfully applied prior to the financial crisis faces a number of threats. a decline in cheap financing has eroded a key competitive advantage while a general lack of acquisition targets pushes up prices, making it harder to generate the required returns on investment. some investor classes – notably wealthy individuals and family offices – are also observed to be bypassing funds by making direct investments through shareholdings. Exacerbating the problem is the fact that corporate balance sheets are relatively healthy and boards are becoming more confident to refocus on the growth agenda, giving rise to more intense competition for available assets. on the sale-side, many prospective vendors prefer to wait until a sustained return of confidence and rising prices makes it more conducive to bring assets to market. as switzerland suffered less from the economic crisis than the majority of its European counterparts, there has been a comparative absence of distressed or forced sales. Many Private Equity houses are therefore seeking homes for the often significant funds they hold. This can present a dilemma: invest funds in sub-optimal assets or retain the funds but possibly struggle to demonstrate performance and raise further finance.

Various strategies are being pursued to deal with these challenges, notably by investing even more time and patience in sourcing proprietary deals, but also looking outside Switzerland. Capvis, for instance, has focused more on the greater number of available targets in the German market, acquiring Kaffee Partner in 2010. On the sell-side, Capvis sold its investment in Ticketcorner to German group CTS Eventim and IPO’d Orior, the Swiss convenience food group.

Geneva-based Argos Soditic continues to successfully raise funds with the announcement in December 2010 that it has closed its EuroKnights VI fund of EUR 400 million with the aim of focusing on small and mid-market companies based in Europe, predominantly in France, Italy and Switzerland.

The most notable new Private Equity investment in Switzerland was CVC’s acquisition of Sunrise Communications, Switzerland’s third largest Telecom provider. Further key exits included Barclays Private Equity’s sale of its 51% stake in Schild to the management team, and EGS Beteiligungen and Towerbrook’s sale of Odlo, the Swiss outdoor apparel company, to Herkules Private Equity.

Outlook for 2011

The hottest sector for Private Equity in 2011 is likely to be diversified industrials, where it has typically been easier to drive operational improvements.There may also be interest in small and medium-sized Food businesses. For both, activity may depend on whether sufficient targets come to market and at what price.

Despite the challenges, Private Equity continues to be attractive to many vendors, who see benefits over corporate bidders, including: likely longer-term retention of the brand and identity of the acquired business; a willingness to keep the owner and/or management involved; and more flexible and responsive decision-making processes resulting in a potentially more efficient, speedier sale process. The light at the end of the tunnel may thus also be family-owned businesses facing succession issues. Many would-be vendors have held on to their assets during the economic crisis and may be tempted to sell if confidence in business plans grows and prices remain firm or increase. Meanwhile, successful exits may be helped by the presence of well-funded corporates on the look-out for high quality assets to buy or by recovering stock markets encouraging IPO activity. (Tobias Valk, Partner, Head of Transaction Services)

Real Estate

Regional hotspots and premium pricing continued to define the real Estate sector in 2010. As institutional players tighten their hold on assets, investors are looking to move up the value chain into development projects.

Direct Real Estate continues to be in demand due to predictable income flows and comparatively high yields (annualised one year total return of 6.67%1), representing enviable returns over other forms of investment. Fund-raising has been active in what was a difficult year for most other sectors. Credit Suisse successfully launched a hospitality fund, with raised capital of USD 1.2 billion, oversubscribed by 33%. These funds will for example flow into the Swiss Holiday Park, a hotel and seminar destination acquired by Credit Suisse in December 2010.

A hot sector was the privately-owned residential market. demand was so great that the Swiss National Bank warned against entering a price bubble, though market players and observers largely discounted this fear. However, the investment residential market recorded a relatively modest price increase of 2.4%1 in 2010.

Regional hotspots are a challenge as most investors seek high grade real Estate primarily in Geneva, Lausanne, Zurich and the greater Zurich area.This sustains premium prices and leads to tender processes. Prices are beginning to peak in central Switzerland, including Zug, and in holiday destinations such as St Moritz.

Investors are responding by moving up the value chain, undertaking development projects with a contractor rather than waiting for completed assets. This reflects in deal activity in the construction and development industry. Implenia, the largest Swiss-based construction firm, acquired Sulzer Immobilien, a real estate development company. HIAG Immobilien Schweiz acquired Streiff, a company with a vast land portfolio in Zurich and Basel. Hindustan Construction Company Limited, the listed Indian infrastructure company, bought a 66% stake in the construction company Karl Steiner for USD 33 million. Despite this latter deal the sector remained overwhelmingly domestic. Foreign investors showed a preference for areas with more depressed market conditions and prices. Swiss players showed little appetite for foreign acquisitions. Although some pension funds considered investing abroad, plans were revised in light of the impacts of the economic crisis. Insurance companies may begin to look at centres such as Paris, Frankfurt or Munich, but activity is likely to be limited.

Asset deals tend to dominate over share deals. The largest portfolio transaction in 2010 comprised a residential portfolio, which was sold by the Swiss Confederation to the pension fund of F. Hoffmann-La Roche. Structured as three regional sub-portfolios, it received broad interest among Swiss institutional investors and was closed in January 2011. The most prominent single asset transaction was the sale to Swiss Life of UBS’s commercial building at Bellevueplatz 5 in Zurich. Recently renovated for USD 52 million, it is a trophy building in a prime location.

Outlook for 2011

As interest rates remain low, funds are likely to continue to flow into the sector. regional concentration is set to remain one of the largest challenges. Prices are likely to remain very high compared to other European markets. investors could try to target ‘B’-grade locations, though there is little sign of any of the major players being willing to do so.The medium-term pipeline contains some potential major projects. SBB’s sizeable, centrally located sites are ripe for development and could create interesting opportunities for Swiss and foreign investors. (Ulrich Prien, Partner, Real Estate)

Legislative & Regulatory Aspects

Despite being highly stable and predictable, Swiss merger control retains the capacity to Surprise and to catch dealmakers off-guard, as seen in the denied Sunrise / Orange merger. However, such surprises are the exception rather than the rule. Meanwhile, a review of the Swiss Competition act is underway, which might improve life for many businesses that are active also in the EU.

Merger control: Generally of concern only to the largest organisations, merger control in Switzerland typically presents few surprises to dealmakers, chiefly due to the high notification thresholds involved. Indeed, thresholds in Switzerland are much higher than in some of its larger European counterparts, particularly Germany. With the exception of mega-deals, notification requirements would generally be triggered only where one of the parties was characterised as being a market dominant enterprise in a previous legally binding order from the Swiss competition authority (in which case it must notify all prospective concentrations). in rare instances the process can derail a merger entirely, such as in 2010 when the authorities denied permission for the proposed merger between Sunrise and Orange on the grounds that it would create a collective market dominant position.

The possibility of triggering merger control should be considered at an early stage of the transaction planning as it can take up to four to six months to complete, depending on the countries where a notification needs to be filed. Particular attention should be paid when undertaking transactions in Eastern Europe or the CIS, where foreign-to-foreign transactions are also caught by national merger control law. It is not unknown in a deal likely to trigger such notification requirements to split off the relevant part of the transaction in order not to hamper or even block the entire project.

Assessing antitrust risks of targets: Particular attention is drawn to the importance of assessing antitrust risks of targets during a deal process. Antitrust risks are often sleeping risks that are extremely difficult, if at all possible, to detect pre-deal. It is highly improbable that a prospective acquirer would be in a position to identify informal, unwritten arrangements between the target management and third parties unless such are specifically disclosed. They can represent major risks if illegal practices remain uncovered by the acquirer or come to light only post-acquisition.

It is important to consider effective means of determining the existence of such risks. Most notably, one may stress-test a target’s compliance programmes: does a formal policy and programme exist? Is there a culture of compliance? Is the programme enforced, and how? Are staff sufficiently aware of it? Is regular, formal training provided? Do internal sanctions for breaches exist and are they imposed on deviators? Often, the target’s corporate culture can be key in assessing hidden risks and it is important that the acquirer gains a sense of it.

Competition Act: The Swiss Cartel Act is presently undergoing revision. While current notification thresholds are expected to remain the same for the foreseeable future it is possible that the material assessment criteria will shift from the current ‘dominant market position’ test to the ‘significant impediment of effective competition’ (SIEC) test. As the SIEC test is applied in the EU, such a move in Switzerland would bring Swiss merger control more in line with existing EU standards. Harmonising the two sets of rules, or at least moving them closer together, may yield benefits to the international firm doing business in Switzerland in the form of simpler processes.The public consultation as part of the legislative process ended in November 2010. (Daniel Lengauer, Partner, Attorney-at-law and Samuel Indermühle, Manager, Attorney-at-law)

List of 2010 Swiss M&A Transactions

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter