Publications Insights on M&A deals in the Financial Services Industry

- Publications

Insights on M&A deals in the Financial Services Industry

- Nima Noghrehkar

SHARE:

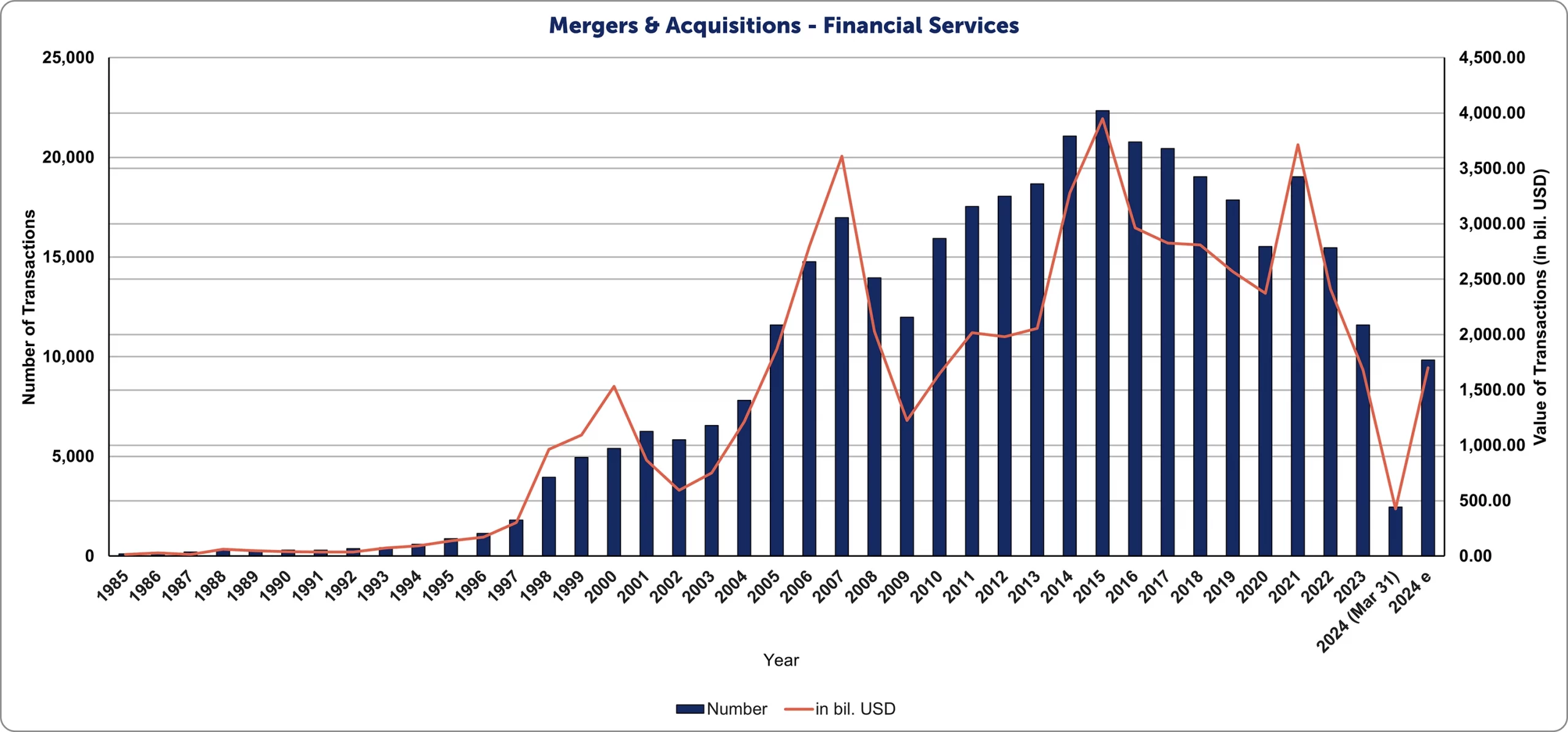

The flurry of M&A activities has been constant throughout the last decades in the Financial Services sector. From 1985 to Q1 2024, more than 372 thousand deals have been announced with a total value of over USD 56 trillion. The M&A activity reflects the industry’s growth and constant adaptation to shifting economic cycles.

This extensive dataset, researched by the Institute for Mergers, Acquisitions, and Alliances (IMAA), tracks M&A activities within the Financial Services Industry. It covers trends in transaction volume and value and critical financial metrics such as Enterprise Value to EBITDA and Enterprise Value to Revenue. Such detailed analysis reflects the industry’s evolution over nearly four decades.

Historical M&A data in the financial services industry is valuable for analysts, investors, and policymakers. It provides deep insights into market trends, which can help make strategic decisions on market timing. This information is crucial in crafting informed investment and operational strategies for navigating market dynamics.

At a Glance: M&A Activity in the Financial Services Industry from 2021 – 2023

2021 M&A Activity

Overall Transactions | Overall Value |

19,030 Deals | USD 3.7 Trillion |

The lively deal activities in financial services resumed in 2021 following a slump during the start of the pandemic. A total of 19,030 deals were announced, coming from 15,522 in 2020. The year also saw larger deals announced, with the total value reaching USD 3.7 trillion, more than USD 1.4 trillion higher than in 2020.

2022 M&A Activity

Overall Transactions | Overall Value |

15,473 Deals | USD 2.4 Trillion |

M&A activities in the financial services sector slowed down again in 2022, with an almost 19% drop in the volume of deals. The deal size decreased, resulting in a total transaction value decline of 35% in 2022.

2023 M&A Activity

Overall Transactions | Overall Value |

11,598 Deals | USD 1.7 Trillion |

As banks and financial institutions continued their transformation and reacted to economic conditions in 2023, M&A activities in the sector continued their downtrend, with deal volumes declining by 25% and value down by as much as 30%.

January to March 2024 M&A Activity

Overall Transactions | Overall Value |

2,460 | USD 425 Billion |

In the first quarter of 2024, a total of 2,460 deals were announced in the Financial Services sector, lower by 22% vs same period last year. The value of Q1 deals is slightly up at 1%.

Download the IMAA Dataset on M&A Activity in the Financial Services Industry.

IMAA’s dataset on M&A activity within the Financial Services Industry tells the story of the sector’s evolution and transformation over time. Investors, analysts, and entrepreneurs can use this information to make informed strategic recommendations and decisions. Policymakers can also leverage this data to identify gaps or opportunities that could be addressed through new policies. The data provides historical trends and financial evaluations, which aid in making informed decisions, contributing to the sector’s continuous growth and transformation.

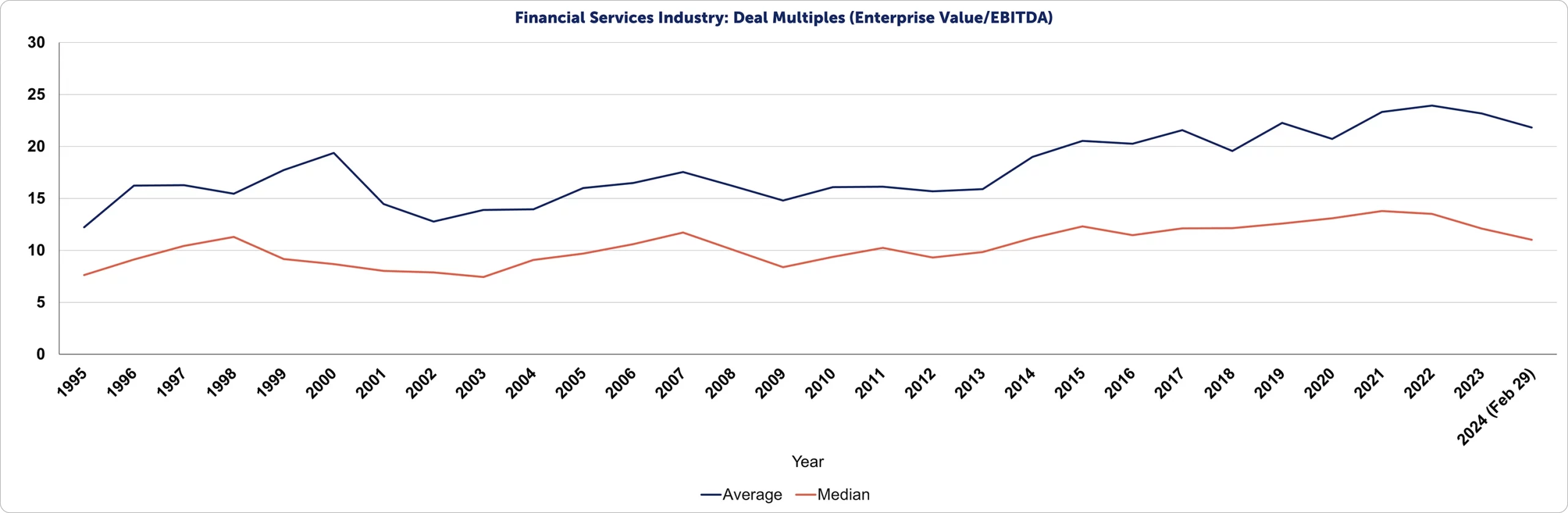

Deal Multiples (Enterprise Value/ EBITDA)

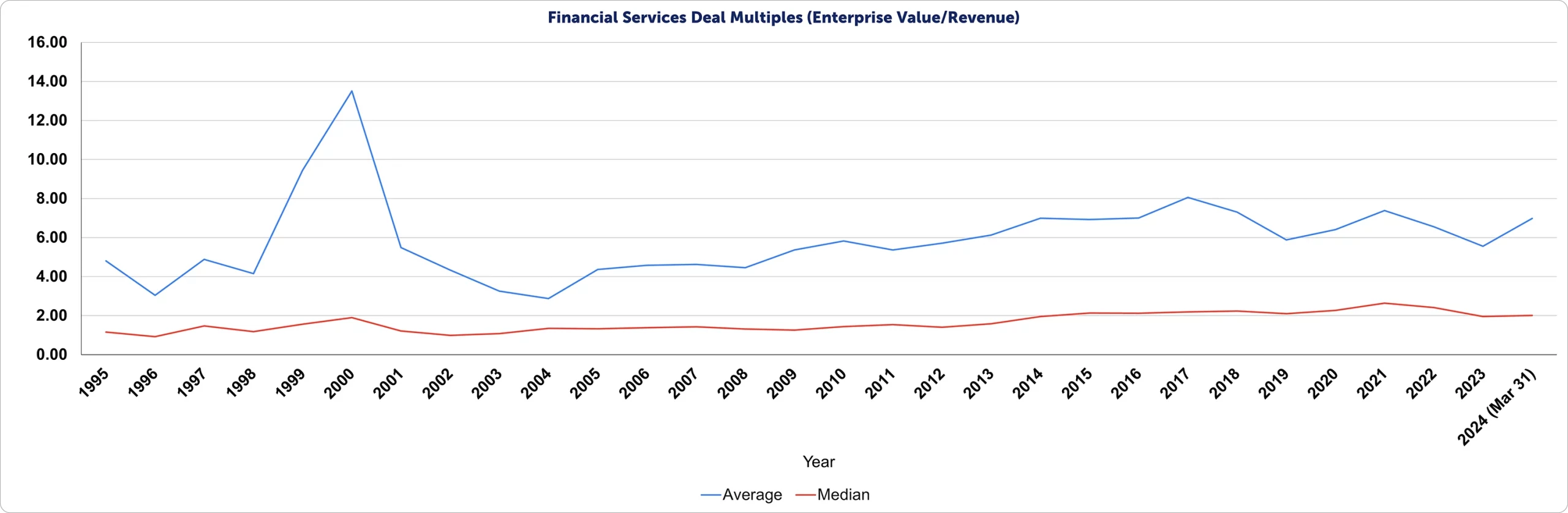

Deal Multiples (Enterprise Value/ Revenue)

Explore further with our M&A Activity in Construction and Engineering Industry dataset.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter