Publications Winning Big Deals — Profitably

- Publications

Winning Big Deals — Profitably

- Bea

SHARE:

By Thomas Kratzert – A.T. Kearney

Today’s aggressive, sophisticated buyers make detailed comparisons of prices and specifications. Often there’s little room for loyalty, relationships and even trust. But when it comes to crafting multimillion-dollar contracts, sellers that combine strategic selling and pricing approaches can win more business and bolster their margins.

It has been said that a business grows its top line one customer at a time. But when a sale is worth hundreds of millions, or even billions of dollars, the growth potential takes on new dimensions. Think of recent examples such as Dell, which will provide hardware and managed desktop services to Dutch electronics giant Philips Electronics in a US$700 million deal involving 60 countries and 75,000 employees. Even (relatively) smaller multimillion-dollar deals involve multiple moving parts and hard-to-quantify benefits.

How do companies win deals of that size and complexity? And how do they price them?

Organizations that can answer these critical questions are well positioned to accelerate top-line growth. Our experience in helping clients close deals valued as high as US$1.3 billion reveals that strategic, or consultative, selling together with advanced pricing approaches can help the seller significantly improve conversion ratios and win rates of large contracts, while earning on average 5 percent additional gross margin.

Regardless of sector, high-value solutions and services involve large sums of money and significant technical performance and timing risks. Because they affect the buyer’s business performance, they require cross-functional involvement and multiple decision influencers. And the business benefits and risks are ambiguous.

As a result, while large deals remain highly data driven, the focus changes. Benefits aren’t measured in near-term cost savings but in longer term, broader measures that span 10 or more years. Business cases that look far into the future are difficult for the seller to create — and equally difficult for the buyer to evaluate. Trust, experience and a strong strategic capability must move to the forefront of the selling process, since the buyers must have confidence in the seller’s projections and want to collaborate to refine the business case.

Strategic selling and pricing approaches aren’t just for large deals. By packaging elements of these approaches, companies can train their sales professionals to adapt these concepts to smaller deals as well.

Consultative Selling

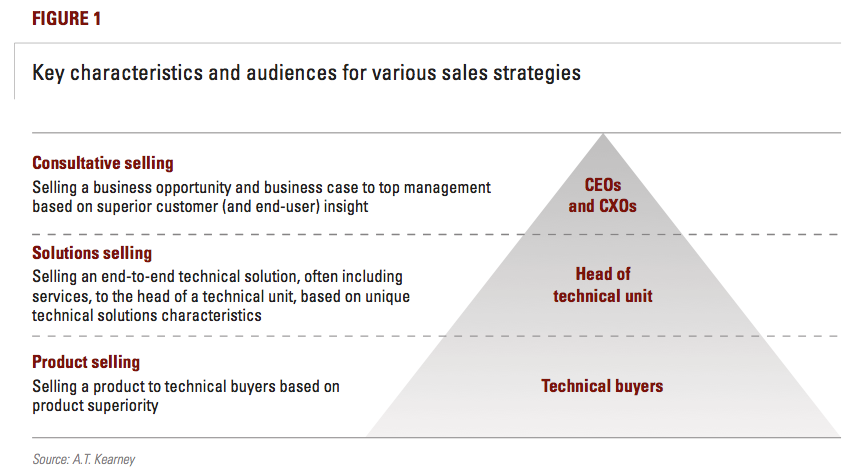

The most successful sellers don’t focus on specific product attributes or even solution superiority. Rather, they present a solid business case and compelling opportunity (see figure 1).

Because the focus is on solving significant business issues, the consultative seller wins favor by presenting a convincing business case and truly differentiating its offering from the competition’s. The value proposition typically includes a significant amount of partnering, and for equipment suppliers, a large services component.

The process runs through three major phases:

Create a shadow strategy for the buyer. The seller assesses the buyer’s strategic objectives, obstacles to achieving them and potential solutions. The seller also assesses developments in the buyer’s industry and markets as well as the opportunities and threats the buyer is facing. For example, one supplier thoroughly researched its potential customer’s situation and showed the buyer it could never achieve its overall revenue objective without addressing the small- to medium-sized enterprise (SME) market. The seller gained the buyer’s trust and offered to assist in executing the SME strategy.

Propose highly targeted, customer-driven value propositions. A successful seller will help the buyer capitalize on opportunities or mitigate specific, quantified threats. Propositions typically cover both the seller’s solutions and services and those of external partners. One seller crafted its value proposition to address the buyer’s key issue: redundancy payments to surplus personnel. The seller suggested forming an enterprise utility to deliver a broad set of services and recommended a partner to assist with the implementation. This solution could significantly reduce redundancy payments, and thus help fund the buyer’s technology investment and maximize the benefits gained.

Secure buy-in for an attractive business case. Starting with specific, common assumptions, the seller begins a series of inter- actions with the buyer to lay out the business case. One organization, for example, provided comprehensive 10-year financial models on how the buyer’s revenue, operational costs and investments would develop under two scenarios. The first scenario modeled the seller’s recommended technology migration strategy, while the second mapped out a realistic competitive migration scenario. The seller’s recommended scenario offered about US$4 billion more in net present value — and beat out its rival. The two- to three-month consultative selling process makes it difficult for competitors that arrive late to the table to match carefully tailored value propositions. Additionally, it usually uncovers key opportunities to obtain new contracts and bring in additional revenue.

THE MOST SUCCESSFUL SELLERS don’t focus on specific product attributes or even solution superiority — they present A SOLID BUSINESS CASE AND COMPELLING OPPORTUNITY to the buyer.

Calculating Costs and Benefits

A consultative approach arms the seller with the facts that make it possible to clearly articulate the total benefit of ownership for the buyer. The seller can then seek a reasonable stake, typically about 10 to 30 percent of the value created compared with the next-best competitor’s offer. Clearly, detailed competitive intelligence is highly beneficial.

Companies that take this approach don’t look at the situation from the inside out, but focus on the customer’s business and work backwards. What does the customer need to achieve long-term advantage? The answer typically reaches beyond what any single supplier can offer, making the ability to build in partner propositions essential. This knowledge enables the supplier to focus on what matters to the sophisticated buyer: total cost of ownership (TCO) and total benefit of ownership (TBO).

Pricing Right: Value Is Key

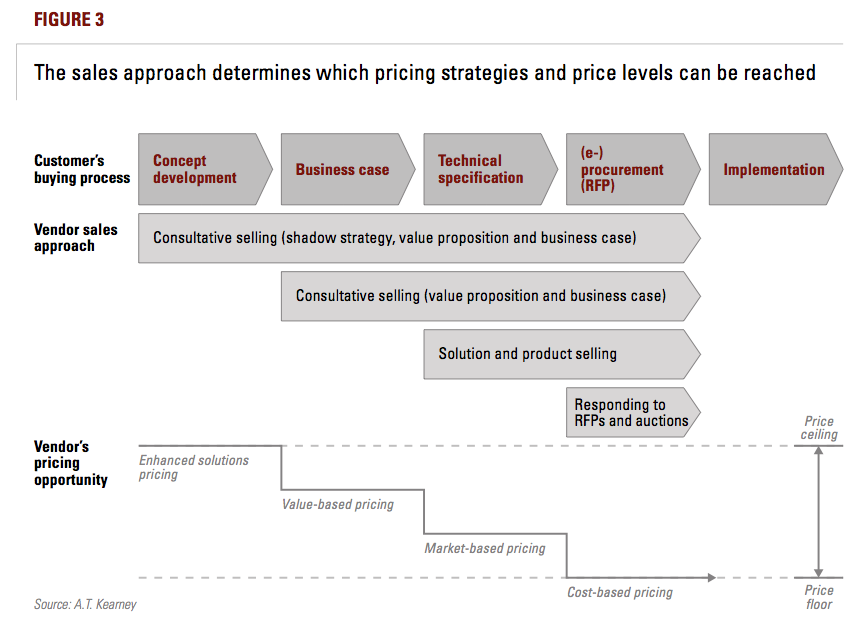

The dialogue established during the consultative selling process not only improves win rates, but also reveals what the buyer truly needs, enabling the use of advanced pricing models based on value. Sellers can begin with more advanced pricing approaches and work to simpler ones if necessary. The most advanced pricing, based on a detailed business case for total benefit of ownership, requires new competencies and systems support.

If the seller has a strong TCO/TBO advantage, it might suggest that the buyer specify TCO/TBO criteria in its requests for proposal (RFP). A solution might offer a range of benefits, such as increased productivity or the opportunity to move into a global market. What are the total operating expenditures the solution would require? In one case, we found that our client could ask for a price premium of 50 to 100 percent, depending on its competitor’s proposal, while still being cost neutral for the total investment in the network and operations expenses over the first five years.

Another possibility for the seller is to suggest gain-sharing models in the RFP process, which will complicate product-to-product comparisons, but help bridge the gap between buyer and seller if expectations are asymmetric. A seller can also try to focus on providing services rather than equipment via models such as “power by the hour” or outsourcing. Selling “power by the hour” allows the seller to capture and keep the TCO advantage if the price is set in line with competitors’ (rational) prices. In addition, the total sales value can increase dramatically; in one case, we found the revenue was five times greater.

Companies that take A CONSULTATIVE SELLING APPROACH don’t look at the situation from the inside out, BUT FOCUS ON THE CUSTOMER’S BUSINESS AND WORK BACKWARDS.

The most appropriate pricing and deal structuring models vary by industry. We created a “ladder” structure for a set of industrial sellers (see figure 2). Under this structure, the models with the least margin opportunity are to the left; those with the most margin opportunity are to the right. The seller can begin the process with an enhanced pricing solution and value-based pricing, and if necessary, move to the less attractive models. The earlier the seller engages with the buyer in a consultative selling dialogue, the greater the chance that it can influence the process and use of pricing models in its favor (see figure 3).

Enhanced solution pricing can be up to 20 to 30 percent higher than cost-plus pricing for a seller with significant TCO advantages. But since it’s likely that deals will be distributed across the pricing ladder, total gross margin improvements are typically closer to 5 percent.

From Principles to Practice

Companies that really know their customers — down to their strategies for thriving in the future — are well positioned to enhance share of wallet even in tough times. Consider, for instance, the plight of a major equipment supplier to a European national telecommunications operator. Facing shareholder demands to increase profitability without jeopardizing long-term service levels and viability, the buyer decided to reduce capital expenditures by 40 percent. The supplier, with about 30 percent share of wallet, was told its sales to the operator would drop by 40 percent immediately.

The supplier sought ways to deflect the impact of the new requirements onto other suppliers while retaining or increasing its sales levels. The supplier and A.T. Kearney analyzed the shareholder demands and estimated more specifically what the shareholders likely wanted in terms of revenue increases and cost reductions, uncovering specific obstacles preventing the operator from getting there. The accuracy of the initial analysis helped build the operator’s trust that the project would yield sufficient value to justify involving senior managers, and to some extent confidential information, with the team.

The supplier suggested alternative ways for the operator to reduce operating expenditures and raise revenues, offering sufficient specifics to gain backing from sales and marketing. With each stage, new senior managers were coaxed on board, attracted by suggestions as to how they could significantly contribute to the objective. The project covered areas ranging from shared services and insourcing to new services and revenue assurance. It resulted in revenue-enhancement and cost-reduction plans substantially beyond reducing capital expenditures — and beyond the operator’s original aspirations.

The team also formulated several value propositions to help the operator overcome the barriers to its goal, and it included partners to provide the operator with a full solution.

The project ultimately enabled the operator to beat its revenue and cost targets while preventing deterioration of its network and even to begin preparing for its inevitable move to an end-to-end next-generation network. The supplier doubled its share of wallet to approximately 60 percent and enjoys a strong relationship with this operator.

Ensuring a Mutual Win

Closing large contracts profitably has never been easy, and with the increasing focus on upgrading procurement capabilities among buyers over the world, it will likely remain a challenge. But given the key role top-line growth plays in building shareholder value, closing contracts effectively is crucial. If executives make investing in the development of these key sales capabilities a top priority, they will be favorably positioned as selling becomes more strategic. When the seller moves substantially closer to the highest attainable price, while still providing the best proposition for the buyer, both sides win. Now that’s a big deal.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter