Publications When Do Acquirers Invest In The R&D Assets Of Acquired Science-Based Firms In Cross-Border Acquisitions?

- Publications

When Do Acquirers Invest In The R&D Assets Of Acquired Science-Based Firms In Cross-Border Acquisitions?

- Christopher Kummer

SHARE:

The Role of Technology and Capabilities Similarity and Complementarity

By Marcela Miozzo, Lori DiVito, Panos Desyllas

Drawing on a multiple case study of acquisitions of UK biopharmaceutical firms, we develop an analytical framework that elucidates how key determinants of the knowledge base of science-based firms and their combinations through M&As interact and affect post-acquisition investment in the target’s R&D projects. We show that two factors — the complementarity/similarity of the technology, and the complementarity/similarity of the discovery and development capabilities of the target and acquiring firm — interact to produce different outcomes in terms of investment in the acquired firm’s R&D assets and for the local science and technology system.

Introduction

The increase in cross-border mergers and acquisitions (M&As) (Hitt et al., 2001), especially in high-tech and science-based sectors, has raised concerns for policymakers that the innovative activity of target firms could be reduced and shifted abroad (Bertrand, 2009 and UNCTAD, 2005). Cross-border mergers and acquisitions accounted for 28% of the total volume of mergers and acquisitions in 2013 (Dealogic, 2014). Not only is this a significant percentage, but the issue is not merely quantitative, it is also qualitative, as it reflects growing interdependence between economies and has important implications for spillovers for regions and countries. An example is the strong reaction from stakeholders to the (U.S.) Pfizer’s takeover bid for the (UK-Swedish) AstraZeneca. Expressing concerns to the UK government, the chairman of the Wellcome Trust (the largest UK medical research foundation) was quoted as saying: “Pfizer’s past acquisitions of major pharmaceutical companies have led to substantial reduction in R&D activity, which we are concerned could be replicated in this instance (Financial Times, 8 May 2014).

There is much evidence that multinationals tend to concentrate their more strategic activities, such as the higher value-added R&D, at home, due to their embeddedness in their national systems of innovation and need for internal cohesion (Blanc, Sierra, 1999, Patel, Pavitt, 1997 and Zanfei, 2000). Nevertheless, there is also evidence of a shift in the role of R&D abroad, from just supporting local business units and adapting products or processes to foreign markets, to improving home country technological assets or acquiring new technological assets (Dunning, 1994, Kuemmerle, 1999 and Pearce, 1999). Foreign locations can provide access to complementary location-specific advantages from, for example, centers of excellence in research or suppliers, offering the potential for technological developments (Cantwell, 1995). For firms, access to tacit knowledge from other locations, and the combination of this knowledge — much of which is firm-specific and affected by path dependent conditions in the host country or region — with its own knowledge is important to facilitate the exploration of new technologies and development of their capabilities.

The refocusing of the international business literature on spatial aspects of foreign direct investment (Cantwell, 2009) has brought attention to the complex organizational strategies in internationally-integrated multinationals (Bartlett, Ghoshal, 1989 and Doz, 1986), the evolution of subsidiary roles (Birkinshaw, Hood, 1998, Frost et al, 2002 and Miozzo, Yamin, 2012), and the growing importance of asset-seeking strategies by multinationals (Dunning, 1995). This literature underlines the significance of location as a source of competitive advantage for the multinational (Cantwell, Mudambi, 2005 and Nachum, Zaheer, 2005), and of the qualitative and quantitative differences in types of R&D conducted in different types of subsidiaries (Kuemmerle, 1999, Pearce, 1999 and Phene, Almeida, 2008). Nevertheless, it neglects the R&D reorganization process following cross-border M&As. Cross-border M&As constitute a large share of foreign direct investment, and are an important strategy for companies to expand abroad (Andersen, 1997, Brouthers, Brouthers, 2000, Child et al, 2001, Inkpen et al, 2000, Seth et al, 2002 and Vermeulen, Barkema, 2001). Research, however, lags behind the pace of growth of such international diversification strategy (Shimizu et al., 2004).

In this paper, we focus on what happens with the technological resources of target firms when they are acquired by foreign firms. We explore under what conditions foreign acquirers offer funding and complementary assets to develop the R&D projects of the target firms. Using a knowledge-based approach to the analysis of M&As (Grant, Baden-Fuller, 2004 and Paruchuri, Eisenman, 2012), we explore how knowledge relatedness influences the reduction and relocation of the target firms’ technological assets in the acquirers’ home country, or the further investment in these assets in the host country. We draw on an in-depth case study of six acquisitions of UK biopharmaceutical firms.

We develop an analytical framework that elucidates how key determinants of the knowledge base of science-based firms, and their combinations through M&As, interact and affect post-acquisition investment in the target’s R&D projects. Earlier studies have explored the role of knowledge relatedness between acquiring and target firm as an important determinant of innovation outcomes (Ahuja, Katila, 2001 and Makri et al, 2010). Our research draws on, but also extends, these studies. In particular, our work builds on the insight that similarity and complementarity of technology have an effect on innovation outcomes following acquisition, but goes beyond this by incorporating into the framework the important role played by similarity and complementarity of capabilities between firms in affecting innovation outcomes. We argue that these two constructs — the complementarity/similarity of technology, and the complementarity/similarity of discovery and development capabilities of the target and acquiring firm — interact to produce different outcomes in terms of investment in the acquired firm’s R&D projects and for the local science and technology system. This framework can encompass the different motives, processes and outcomes in technology-motivated M&As, and is therefore able to cast light on mechanisms ignored by earlier studies. We show that a knowledge-based view can potentially illuminate the rationale and effects of M&As on target innovation.

In the next section, we review the literature on M&As, knowledge relatedness and innovation. Subsequently we detail the research design and methods, present and discuss the findings, and follow with a conclusion.

Knowledge and mergers and acquisitions

The knowledge-based view of the firm regards the firm as a collection of difficult-to-imitate knowledge assets, and argues that through experience firms develop a knowledge base that leads to a set of firm-specific capabilities that enhance firm performance. Knowledge assets include explicit knowledge (comprising systematized knowledge in, for example, manuals, patents, or databases) or tacit knowledge (in shared, common experience embedded in idiosyncratic “routines” such as behavioral regularities and operating procedures, or in symbolic language such as design) (Cyert, March, 1963, Nonaka, 1994 and Winter, 1964). Innovation is seen as the result of firms’ combinative or dynamic capabilities to generate new applications from existing knowledge ( Fleming, Sorenson, 2001, Kogut, Zander, 1992, Nelson, Winter, 1982 and Teece et al, 1997). Firms can only accumulate these capabilities by engaging in knowledge creation or search activities, which are uncertain activities. Knowledge search processes tend to be localized, and knowledge development is often firm-specific and industry-specific, tacit and cumulative, appropriable by specific firms, and tied to local institutions ( Arthur, 1989, Atkinson, Stiglitz, 1969, David, 1985, Dosi, 1982, Gertler, 2003, Nelson, Winter, 1977 and Polanyi, 1966). For firms, access to tacit knowledge from outside their geographic environments ( Jaffe et al, 1993 and Mansfield, 1995) and the combination of this knowledge — often sticky, embodied in the employees of local firms, and in the knowledge flows between firms and other organizations ( Lundvall, 1988 and Saxenian, 1994)—is crucial for increasing the breadth of search, exploration of new technologies, and the development of new technological capabilities ( Laursen, 2012 and March, 1991).

Scholars have used knowledge-based perspectives to study strategic alliances and M&As. The rapid growth in technological knowledge, and the increasing need to integrate multiple technologies from different sources, is challenging for even the largest corporations (Granstrand and Sjölander, 1990). The integration of externally sourced technology assets with internally developed assets is increasingly important (Graebner et al, 2010, Puranam et al, 2006 and Ranft, Lord, 2002). Extant work on alliances focuses on firms’ technological knowledge as a determinant of partner selection and the future trajectory of each partner’s innovation activity (Dyer, Nobeoka, 2000, Hagedoorn et al, 2000, Inkpen, Crossan, 1995, Khanna et al, 1998 and Larsson et al, 1998). Similarly, the M&A literature acknowledges M&As as one of the main ways for firms to create value by gaining access to new knowledge and capabilities, or by a synergy of complementary productive resources (Hagedoorn, 2002, Inkpen et al, 2000, King et al, 2008, Larsson, Finkelstein, 1999, Sleuwaegen, Valenti, 2006 and Uhlenbruck et al, 2006).

Strategy and technology management studies have focused on the impact of M&As on innovation and its determinants. They argue that M&As enable scale and scope economies in R&D and shorter innovation lead times (Cassiman et al., 2005); they help firms enter new technology and markets complementing internal R&D resources (Vermeulen and Barkema, 2001); they facilitate reorganization of their R&D efforts among different research centers; they facilitate greater internal finance for R&D projects (Hall, 2002); and they increase the buyer and target firms’ absorptive capacity resulting in greater innovation output (Ahuja, Katila, 2001 and Desyllas, Hughes, 2010). Nevertheless, M&As can also lead to reduction in research due to reduced competition (Kamien and Schwartz, 1982), and to the reorganization of business units, thus disrupting R&D departments (Puranam et al, 2006 and Ranft, Lord, 2002). They restrain inventors’ abilities to seek, process and recombine research knowledge due to uncertainty (Paruchuri and Eisenman, 2012), and cause managers to postpone decisions regarding long-term R&D investments, changing the emphasis from strategic issues to financial control (Hitt et al, 1991 and Hitt et al, 1996).

In particular, researchers have focused on the role of knowledge relatedness between acquiring and target firms as an important determinant of acquisition outcomes. These studies reason that an acquisition expands a firm’s knowledge base and has positive effects on innovation, but integration of a new knowledge base also disrupts established routines (Birkinshaw et al, 2000, Haspelagh, Jemison, 1991 and Puranam et al, 2006). This is justified by the concept of absorptive capacity, which suggests that the ability to use new information and to learn is enhanced when newly acquired knowledge is related to existing knowledge; i.e., when there are common skills, shared languages and similar cognitive structures (Cohen, Levinthal, 1990, King et al, 2008, Nonaka, 1994 and Zahra, George, 2002). Smooth absorption of the related knowledge and inventive recombination (Henderson and Cockburn, 1996) enhances the capacity to recognize the value of new information and exploit it commercially. Similarly, Puranam et al. (2006) showed that the existence of “common ground” in technology knowledge between the acquiring and acquired firms facilitates the acquisition integration process. If the innovation routines of the firms are different, then the integration of knowledge is disruptive and requires greater effort to adapt and integrate, resulting in radical changes in the ways of organizing research. If the knowledge bases of the firms are similar, then there is little contribution to innovation performance, incurring cost of transfer without knowledge enrichment (Ghoshal, 1987 and Hitt et al, 1996). In sum, M&As improve innovation performance when the technological knowledge of the acquiring and acquired firms is similar enough to facilitate learning, but different enough to provide opportunities to enrich the acquiring firm’s knowledge base.

Ahuja and Katila (2001) found that relatedness of acquired and acquiring firms’ knowledge bases (as measured by overlap of cited patents) in technology-related acquisitions has a curvilinear impact on the acquiring firm’s innovation output (patent counts). Extending Ahuja and Katila’s analysis, Cloodt et al. (2006) found evidence confirming the curvilinear relationship between relatedness and innovation output for technology-related acquisitions. Cassiman et al. (2005) found that M&As involving firms with complementary technologies result in greater R&D efficiency post acquisition. When acquiring and acquired firms are technological substitutes, they decrease their R&D level post-acquisition, and R&D reduction is more prominent than when there are complementary technologies.

Makri et al. (2010) built on these insights, and examined not only the effect of the relatedness of the technological knowledge but also that of the science base. Using a sample of 95 high-technology acquisitions in the drug, chemical and electronics industries, they differentiated between similarity and complementarity in both science (scientific disciplines and research communities) and technology (patents). Firms acquiring other firms with complementary science and technology knowledge produced higher quality and more novel inventions. This study suggests that when a firm acquires a target with similar technologies (and based in similar areas of science), integration is easier but the amount of novel inventions are lower. When acquisitions involve similarity in technology and complementarity in science, they lead to more novel inventions only.

Although these studies have improved our understanding of technology-driven M&As, there are two particular areas that have attracted less attention. First, few studies have focused on the effects of M&As on the target firms’ innovation activity. Ernst and Vitt (2000) found that among acquired German R&D-performing firms, about 30% of key inventors left the company, or those who stayed were less inventive. Calderini et al. (2003) focused on the acquisition of U.S. high-tech firms, and investigated the effects of acquisitions on inventive performance. They found that the patent activity of the acquired firms contracted compared to a control sample of non-acquired firms. Graebner (2004) studied the post-acquisition integration of eight technology firms, and found that post-acquisition outcomes and synergies depended on whether managers of the acquired firms remained involved in their units’ projects and were entrusted with cross-organizational responsibilities. From another study on the acquisitions of U.S. firms in the semiconductor industry, Kapoor and Lim (2007) concluded that there is a curvilinear relationship between the innovation productivity of the acquired firm’s inventors and the overlap of technical skills in the acquiring and acquired firms. These studies suggest that some complementarity in technological knowledge is beneficial for the combined post-acquisition innovation performance.

Second, we know little about what happens with cross-border M&As and innovation. An expectation is that the positive and negative effects of domestic M&As may be enhanced. Cross-border M&As enable access to a wider set of resources residing in different country boundaries (Inkpen et al, 2000 and Larsson, Finkelstein, 1999). Vaara et al. (2012) found evidence among Finnish firms that national cultural differences between the acquiring and acquired firms were positively associated with learning from knowledge transfer. They argued that national cultural differences allowed access to diverse knowledge and capability repositories, and that most managers appeared to be knowledgeable in managing national differences. However, there is a danger that acquiring firms may centralize R&D in the home country, to enable economies of scale in research and avoid the costs of coordinating dispersed R&D centers (Kumar, 2001). As a result, the innovative activity of the target firm could be reduced or shifted away, thereby reducing the potential of R&D as a source of innovation and economic growth. The contribution by Bertrand (2009), based on accounting data on French innovative manufacturing firms, found that acquisitions of French firms by foreign firms increased external and internal R&D expenditure of the acquired French firms. There was more contracting out to local public laboratories and universities. The growth of the R&D budget was financed by not only internal resources, but also by the acquiring firm. Thus, results are inconclusive as to how foreign acquisitions affect innovation in the acquired firm and the local science and technology system.

Our study addresses this gap in the literature by exploring what happens with the technological resources of science-based firms when they are acquired by foreign firms. We focus on a set of resources — the R&D projects of the acquired firms — and ask under what conditions their development is continued in the host country. We ask how and why foreign acquirers offer long-term funding and complementary assets to develop the distinctive technologies of the acquired firms. Given the important role of tacit knowledge in science-based firms and the high degree of embeddedness, cross-border acquisitions and their impact on the target’s innovation are likely to depend on and affect the local science and technology system.

Research design and methods

The purpose of this study is to build theory inductively. We use a multiple case study design to improve the richness and accuracy of the conceptual insights (Yin, 2003). Adopting a detailed, in-depth approach is appropriate given the relative lack of theoretical and empirical attention to the relation between cross-border M&As and investment in the acquired firm’s technology. In this way, we study not only the impact of cross-border M&As on investment in the target firm’s technology but also how the target firm’s technology is developed post-acquisition.

Research setting

We focus on the acquisitions of six biopharmaceutical firms in the Cambridge, Oxford, and Manchester areas in the UK. The biopharmaceutical industry is an ideal setting for our study for two reasons. First, our research question focuses on the effect of cross-border acquisitions on the continued investment and development of acquired technological assets of science-based firms. Biopharmaceutical firms operate upstream in the value chain or product-development trajectory, generate product- and firm-specific knowledge and represent the complexity of R&D in science-based businesses. Science-based firms confront specific challenges, including an unusually high-risk profile and longer-term horizons compared to firms in medium-tech and other high-tech sectors. Every R&D project is an experiment. R&D in science-based firms is about successively reducing uncertainty by acquiring, selecting and screening information: a highly iterative and inductive process. This is unlike other high-tech industries where products evolve through design-test iterations (Pisano, 2006). As argued by Pisano (2006, 151): “Biotechnology is quite different from semiconductors and software. The pieces of the drug discovery puzzle are often not modular, but constitute a set of interdependent problems. Subtle interactions between a target, a molecule’s structure and its physical properties, dosage form, the manufacturing process, the dose, and the patient population can profoundly influence the performance of a drug.” Science-based firms require appropriate mechanisms to integrate cross-disciplinary skills and capabilities to identify targets, develop molecules, develop formulations, design clinical trials, choose the target population and select the manufacturing process. Each technological/scientific choice has implications on other choices. This makes integration of R&D and technology knowledge and processes across firm boundaries (and across country boundaries) very difficult (Schweizer, 2005).

Secondly, since the early 1990s, there is evidence of a high degree of organizational experimentation, including M&As and strategic alliances, in biopharmaceuticals (Arora, Gambardella, 1990 and Pisano, 1991). It has become increasingly apparent that technology-motivated acquisition of biopharmaceutical companies is not simply limited to acquisition by large pharmaceutical firms, but that acquisitions are increasingly important for the growth of medium-sized and large biopharmaceutical companies, as they are acquiring (generally smaller) biotech companies with complementary technologies, capabilities and markets. Biopharmaceutical firms need extensive amounts of funding to develop their drug products, and they generally raise funding from venture capitalists and public equity. However, the R&D cost of bringing a new drug product to market often exceeds the amount these funding sources can supply. Biopharmaceutical firms therefore seek to partner, merge, or be acquired by other firms (including foreign firms) that can support their drug development, both with financial and complementary resources.

Case selection

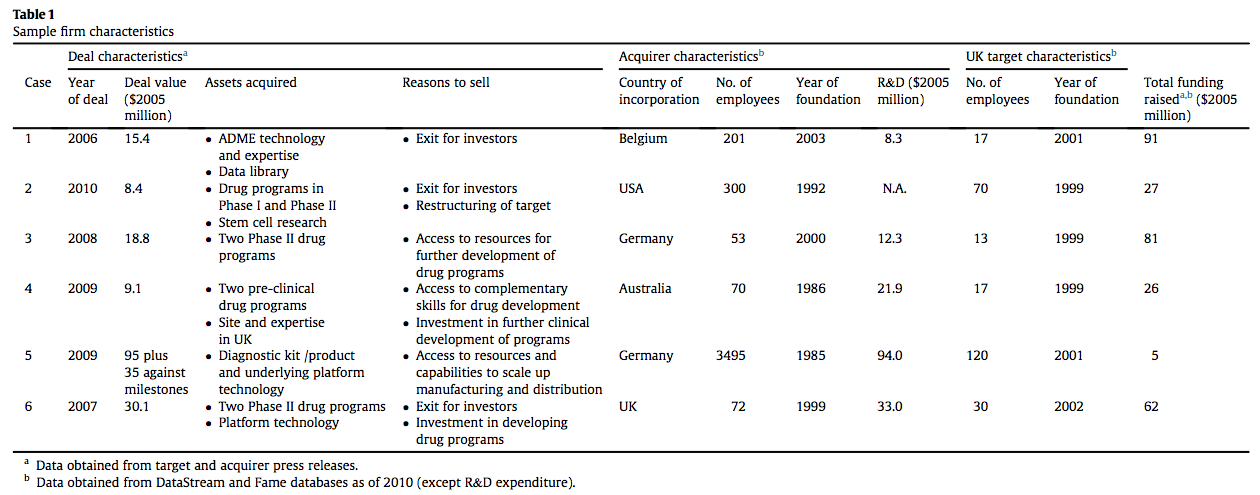

To yield more generalizable and robust insights (Eisenhardt and Graebner, 2007), we selected our sample from a large group of acquisitions we identified by scanning the trade press from 2006 to 2010, for foreign acquisitions of British biopharmaceutical firms. Following recommendations to ground the insights of inductive studies on a diverse sample (Sigglekow, 2007), we built a sample that was balanced and varied in terms of the types of technological assets acquired (drug development programs, diagnostics and services), the size of acquirer and target firms, and the value of the acquisition deal (Table 1). We applied the logic of theoretical sampling, as opposed to a sampling logic for statistical generalization (Flick, 2007 and Strauss, Corbin, 1990). We selected six acquisition cases. In the first five cases, the acquirers were large and small firms from a range of countries, including Australia, Belgium, Germany and the U.S. The sixth case involved a domestic acquisition, added to our sample for theoretical replication (Yin, 2003) to compare and contrast the findings with the cross-border acquisition. In all of the cases, the acquisitions were technologically motivated. The general aims among the target firms varied. Four out of the six target firms were motivated by sustaining their growth and gaining access to resources. The other two target firms had later-stage products with disappointing trials and faced difficulties raising finance. Table 1 provides an overview of the characteristics of the selected cases.

Data collection

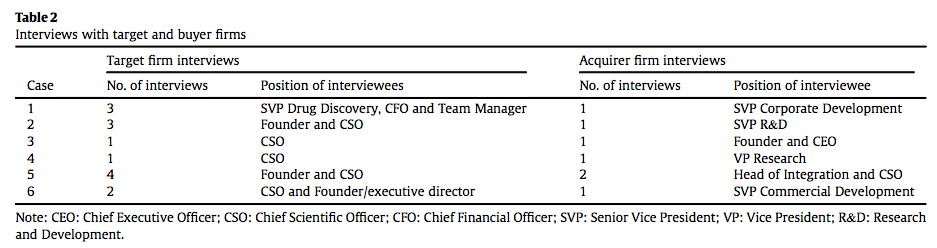

We collected all the data between 2006 and 2013, using a window of two years before and after the acquisition date. The time window of two years prior and post acquisition allowed us to make accurate judgments about the target firm’s pre- and post-acquisition state. The combined use of three data collection mechanisms (semi-structured interviews, archival data, and patent data) created a rich understanding of the subject matter. We held in-depth interviews with the founders and/or main scientists on the premises of the target and acquirer firms. Interviews with senior management of both the target and the buyer were conducted, providing dyad relationships in the sample. In each case, we identified the informants that had been actively involved in the deal, and in the knowledge transfer process post-acquisition. Table 2 lists the interviews held with target firms and buyer firms. The interviews lasted between two and three hours, allowing the authors to see how knowledge-base combinations emerged as important determinants in science-based M&As, and to explain what happens to the technological assets of science-based target firms.

In the initial interview protocol, we asked questions about 1) the nature of the business, products and technology and collaborations pre-acquisition; 2) the events leading to the acquisition; 3) knowledge transfer between target and buyers; and 4) changes in the nature of the business, products and technology and collaborations post-acquisition. Following the constant comparative method (Strauss and Corbin, 1990), over time we adjusted the interview protocol to refine the theoretical perspective, by asking questions on the technology of the target and acquirer, and on the discovery and development capabilities of the dyad firms.

All interviews were recorded, transcribed and organized into a digital database. When salient issues emerged around some of the emergent concepts, such as particular contradictory information between interviewee and patent data, we questioned the respondents about these issues in follow-up interviews.

We also consulted archival data in order to triangulate and verify information gathered from informants. We used the firms’ web sites and press releases to gather factual information about the M&A transaction, as well as other pertinent information — e.g., on partnerships, licensing or products, preceding and succeeding the M&A. We also used publicly available databases, such as Datastream and Fame, to gather and verify facts about various firm characteristics — e.g., number of employees, R&D budget.

Finally, in order to construct proxies for the technological knowledge of the acquiring and acquired firms, we collected data on patented inventions, technology classes and categories, assignee names and inventor identity for the target and acquirer firms from Thomson’s Delphion database. Because our sample of acquirers originates from different countries, and because the biopharmaceutical industry is a global industry, we use data on international patent applications to the World Intellectual Property Office (WIPO). In this way, we try to deal with the well-documented differences across countries in economic costs and benefits of patents because of judicial, geographical and cultural factors (e.g., De Rassenfosse et al, 2013, Desrochers, 1998 and Pavitt, 1988). Indeed, it has been suggested that there is a growing number of patent applications via the Patent Cooperation Treaty (PCT) route (for evidence from Canada during the period 1990-2008, see Nikzad, 2011). When international patent protection is sought, making a single initial patent application to WIPO under the PCT — which allows applying for patent protection in a maximum of 145 nations — is advantageous compared with filing multiple national applications simultaneously under the Paris Convention (see World Intellectual Property Office (WIPO), 2012). In particular, filing a PCT application is a simpler process. By having to deal with a single office, it requires the applicant to comply with a single set of formal requirements, and it reduces costs related to international patent protection (e.g., legal and translation costs and national patent office fees). Using WIPO patent data for our sample firms allows us to control for the “home bias”, which arises because applicants tend to file more patents in their home country patent office than in foreign patent offices (De Rassenfosse et al, 2013, OECD, 2004 and Picci, 2010). There is also evidence that the PCT route is associated with higher value patents (Van Zeebroeck and Van Pottelsberghe de la Potterie, 2011). Not surprisingly, given the prominence of the U.S. market in biopharmaceuticals, all 259 international patent applications made by our sample target and acquiring firms identified the U.S.A. as one of the many designated nations for patent protection. Moreover, in order to account for the long time period between the time of an invention and the granting of a patent, we consider WIPO patent applications by the original priority date.

We refined our preliminary findings through discussions with practitioners at three workshops, organized jointly with the University of Manchester Incubator Company, Babraham Bioscience Technologies and One Nucleus (East England biotechnology industry association), and Oxford Biotechnology Network. We also discussed findings with policymakers, including representatives of the Department for Business, Innovation and Skills (UK), and UK Trade & Investment.

Data analysis

In inductive research, close adherence to the empirical data and their analysis by means of prior and emerging theoretical constructs guides a disciplined reasoning toward the development of conceptual insights (Eisenhardt and Graebner, 2007). From analyzing the field data, we identified the interrelated concepts that unfolded during the acquisitions of science-based firms. Our inductive work went hand-in-hand with our data coding in a manner that let us identify the main determinants. However, in order to ground the “intellectual leap” in the data, we considered in turn alternative explanations (Rerup and Feldman, 2011). These alternative explanations included the importance of local research collaborations of the acquired firms, the previous collaborations between the target and acquirer, and the efforts of knowledge exchange and organizational integration between the target and acquirer. We constantly compared data and analysis, identifying emergent concepts and comparing them with the relevant literature (Suddaby, 2006). We used cross-case comparative tabular displays to unscramble our empirical findings, and cluster and process our data (Miles and Huberman, 1994).

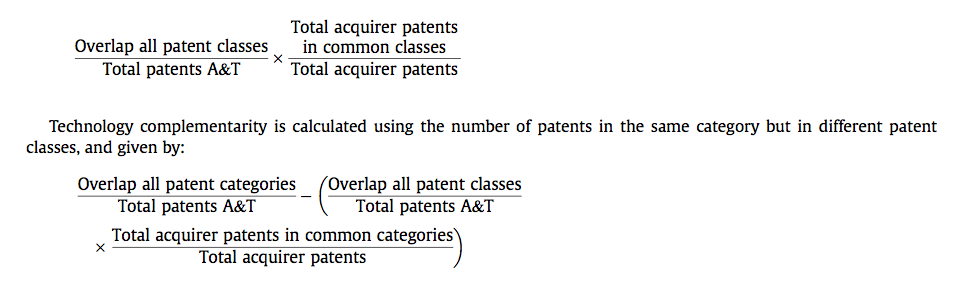

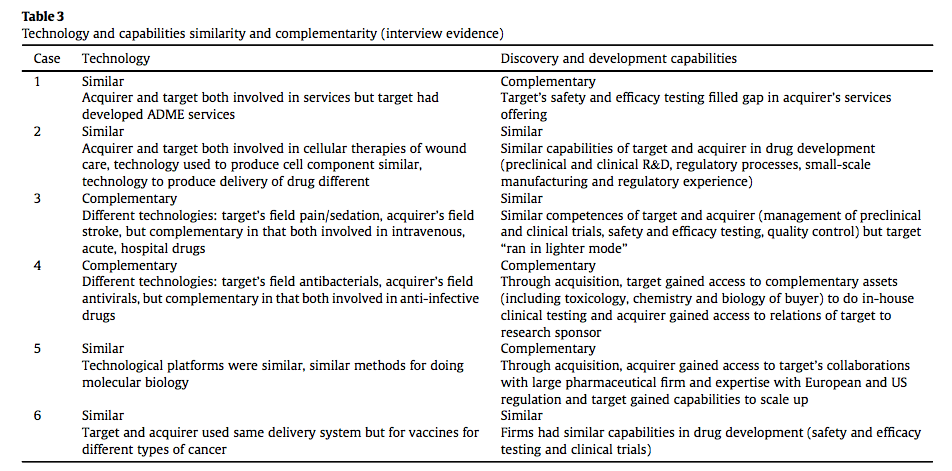

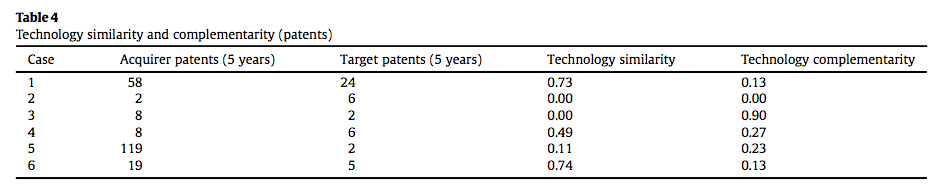

As we iterated between data and emerging logic, we gradually built a more refined characterization of the constructs for analysis. It became clear that we needed to examine the similarity/complementarity of the technology, as well as the similarity/complementarity of discovery and development capabilities, which in the case of science-based firms strongly reflects their knowledge base. Science-based firms are continuously integrating a variety of activities rooted in many technology and scientific domains along an emergent technological trajectory (Dosi, 1982). Thus, we developed the construct of technology similarity/complementarity to express whether the technological problem-solving of target and acquirer firms focused on the same or different narrowly defined areas of knowledge within a broader area of knowledge that they shared. This first construct was developed through examining case study data. All cases were technology-motivated mergers, and we asked senior managers to explain the technology of the acquirer and target, and how and why technological problem-solving was similar or complementary between acquirer and target. We also followed Makri et al. (2010) to construct measures of technology similarity/complementarity based on patent data of the acquirer and target firm. Technology similarity is calculated as the number of patents applied for by the acquirer (A) and the target (T) that are in the same patent class, multiplied by the total number of patents the acquirer has in all common classes divided by total acquirer patents. Hence, technology similarity is given by:

The measures of technology similarity and complementarity are weighted by the importance of each patent class for the acquirer, in order to account for the fact that large firms tend to patent in various patent classes. Similar to previous work (e.g., Ahuja, Katila, 2001 and Cloodt et al, 2006), we assess the similarity/complementarity of the technology of the acquirer and target firms over the five-year period prior to the deal date. However, the well-documented general and biotechnology-specific weaknesses in the use of patents as proxies for technological knowledge lead us to question the extent to which patent data can accurately reflect biopharmaceutical firms’ knowledge bases.4 The indices developed from patent data were compared with a careful case-by-case examination of data from the in-depth interviews. A follow-up interview was made to clarify any discrepancy between patent and interview data regarding similarity and complementarity of the technology.

A second construct that emerged inductively from our study is the similarity/complementarity of the discovery and development capabilities between the firms. From the interviews, the nature of firms’ capabilities emerged as key features of acquisition and reorganization decisions. Evolutionary theories of the firm (Nelson, 1991, Nelson, Winter, 1982 and Winter, 1990), of which the capabilities perspective of the firm is one manifestation (Richardson, 1972 and Teece et al, 1997), argue that firms are repositories of organizational knowledge. The competitive advantage of firms rests on the development and advancement of organizational capabilities and routines that are tacit, unique and difficult to imitate. Routines, which depend on individual skills, are the “building blocks” of organizational capabilities (Dosi et al, 2000, Nelson, Winter, 1982 and Zollo, Winter, 2002), and apply to most operational and strategic activities; they store important coordinating information and organizational experience in a form that firms can transfer to new situations (Cohen, Bacdayan, 1994 and Pentland, Feldman, 2005). Organizational capabilities are collections of routines characterized by firm-level outcomes, and they are identified with the knowledge that a firm possesses, so that it performs its activities reliably or “solves” its problems and extends its actions (Dosi et al., 2000). These capabilities enable the firm to provide the existing products or services, or develop new products or services. Within a science-based firm, the firm’s “problem” is the purposeful search activity for new scientific products (such as drugs), and the identification and linking of technological options and market opportunities. In science-based environments, firms’ capabilities depend heavily on their R&D resources. Coordination between R&D and other functions, and often with suppliers or partners, is needed to identify and link options and opportunities. Several of these capabilities are hard-to-imitate because they are embedded in firms’ processes and historically bounded. Each R&D project is unique and demands an iterative process of activity integration for drug development; e.g., pre-clinical and clinical trials, regulatory approval and the final market launch, all of which are highly interdependent. Despite the growing use of bioinformatics and computer-aided discovery, this process still has a strong tacit dimension (Pisano, 2006) and, unlike many high-tech sectors, proximity to universities and industry clusters matters for access to this cognitive tacit knowledge embedded in individuals (Balconi et al, 2007 and Liebeskind et al, 1996).

From our data, we derived a list of the relevant discovery and development capabilities in the firms under study. These included organizational and managerial capabilities (including but not exclusively related to R&D) that support and complement new product and process technologies emerging from R&D (Teece et al., 1997). There are many challenges in conceptualizing routines or capabilities because of their distributed nature. The performance and interpretation of these routines or capabilities occur at different levels of the organization, with different participants performing different activities and having different understandings of them. Recognizing these limitations, we asked the interviewees to describe the organizational and managerial capabilities of the target and acquirer firms in these areas prior to the acquisition. The key firm capabilities that emerged were: ability to do clinical trials; safety and efficacy testing; management of regulatory authorities; ability to provide services to clients; to manage ties to customers or partners; and capacity for manufacturing.

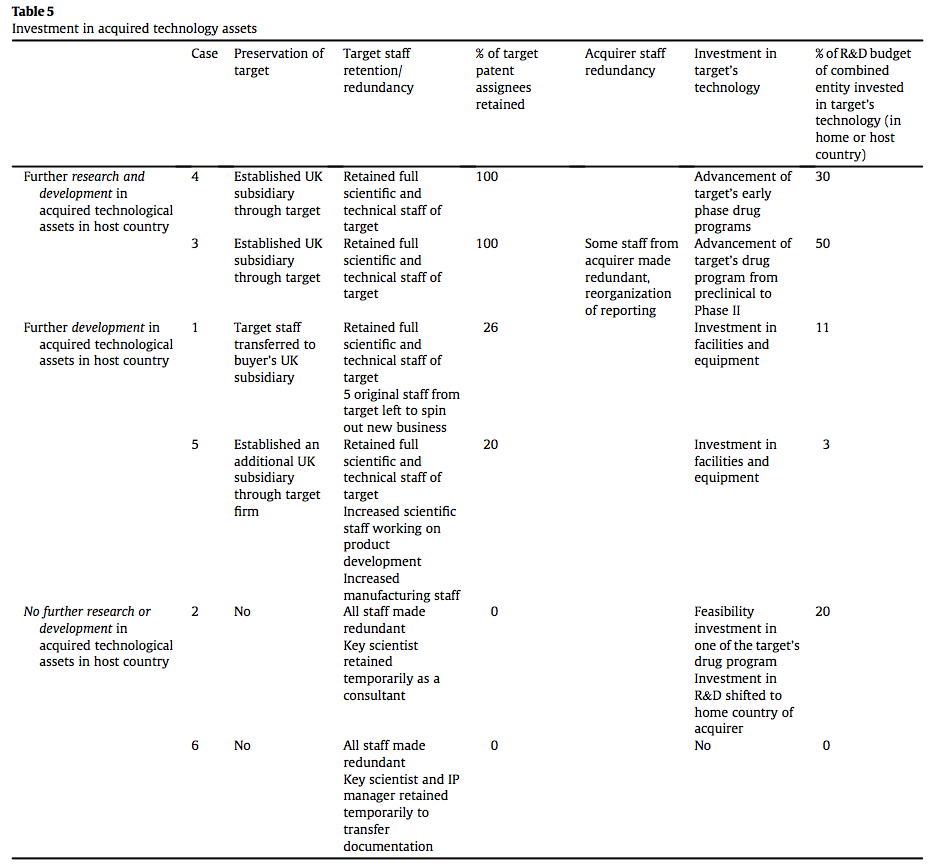

We explored how and why these constructs led to further research and/or development investment in the technological assets of the acquired firm in the host country after acquisition, and focused on three aspects of this investment: preservation of the target business unit; retention or redundancy of scientists and other technical staff; and investment in development of acquired drug programs or in facilities or capital equipment of the target firm. We combined data from open-ended and closed questions in interviews on the extent to which the target firms’ patent assignees (whose names have been identified from patent data) were retained post-acquisition, and on the percentage of the R&D budget of the combined entity invested in the target’s projects. We focused on innovation inputs rather than intermediate (e.g., patents) or final (e.g., new drugs) outputs, given the length of time and the uncertainty involved in product development.

Findings

Here we present the case study data on the three main constructs that we develop: i) technology similarity/complementarity; ii) similarity/complementarity of the discovery and development capabilities; and iii) investment in the acquired firms’ technological assets post-acquisition.

Technology similarity/complementarity

From our analysis of the data, it emerged that Cases 1, 2, 5 and 6 involved technology similarity between target and acquirer. In Case 1, the target firm expanded from platform services to drug product discovery and development, and ADME (absorption, distribution, metabolism and excretion) testing of molecules. Following funding difficulties, the target firm rationalized its focus to services only, and was thereafter acquired by the buyer, a larger international biopharmaceutical firm offering a comprehensive suite of discovery products and services. We concentrated on the target firm’s ADME services which were similar to the buyer’s technological knowledge but filled a gap in the services offered by the acquirer, which had a full-service subsidiary based in the UK (the other part of the target was rationalized and divested). The patent analysis supported our conclusion and showed a technological similarity index of 0.73, much higher than the complementarity index of 0.13. (Table 3 and Table 4 summarize the results from the interviews and the patent analysis respectively).

At its founding in 1999, the target firm in Case 2 licensed technology (compounds) from UK universities, and spent ten years developing drug programs in skin repair and regeneration, including wound care and hair regeneration, their lead program completing Phase II clinical trials. After disappointing results from Phase III clinical trials of their lead program, the board of directors decided to sell the firm. The target was unsuccessful in selling the firm as a whole, and sold the different technological assets to various biotechnology and large pharmaceutical firms for a fraction of their value. Three of the lead programs were sold to two separate biotechnology firms (acquirers were avoiding “misfits”: see Anokhin et al., 2011). A subsidiary business of the target focused on stem cell research was sold to a large pharmaceutical firm, and the last drug development program in early stage was taken over by the target’s founder. We focused on the acquisition of the two lead drug programs in wound care sold to a biotechnology firm. From the interview data, we saw a high level of technological similarity between the acquirer and the target firm. The chief scientific officer and founder of the target firm explained that the acquirer was “already experienced in cellular therapies and there aren’t many companies in the world that are in cellular therapies of wound care so they were one of maybe four or five companies that could have possibly purchased this and pursued it.” Patent data showed no similarity or complementarity in this case. This finding reflects not only the very few patents of the buyer, but also the concentration of the two firms in different technology classes — at least in regards to the knowledge included in patent application records.

In Case 5, the target firm developed a diagnostic kit by collaborating with a large pharmaceutical firm. The diagnostic kit was used to determine the effectiveness of drug therapies for cancer, and the target firm had first-mover advantage because its product became a regulated diagnostic. The target firm, however, could not expand rapidly enough to keep up with the demand for their product, and entered into a distribution and marketing collaboration with another large pharmaceutical firm. At this time, the target firm was approached and acquired by another medium-sized diagnostic firm producing molecular biology tools, with a diagnostic division (excelling at HPV testing) with similar methods for doing molecular biology. It had developed a product that competed in the same market as the target’s, but was considered to be harder to use and less sensitive than the target’s product. In this instance, the patent indices of similarity and complementarity were rather close to each other and did not square well with the interview evidence. We brought this to the attention of our interviewee. When asked about this discrepancy, the representative of the acquirer argued that, although the two patents of the target were potentially valuable, they referred to the target’s technology platform and not the diagnostic product, which was not patented. Furthermore, the patents reflected technology that had not been researched further, and were a somewhat poor representation of the overall knowledge base of the target firm. The technology object of our analysis was hard to patent but also hard to copy. In the words of the target firm’s chief scientific officer, the technology implied “experience running through processes, being familiar with the technology, having the expertise of how to document, perform the work, put everything down so that the FDA [U.S. Food and Administration] can be happy with how everything has been documented”.

In Case 6, at the time of the acquisition, the target firm was developing three vaccines: one for use in melanoma, one for hepatitis B, and one for HIV. The first two programs had passed through Phase I and Phase II clinical trials, but there was limited interest in these potential drug products from large pharmaceutical firms, and, faced with increasing development costs, the target firm decided to enter a trade sale. The acquiring firm was developing a cancer vaccine based on a protein called 5T4 and found primarily on cancer cells, all except melanoma. By acquiring the target’s melanoma vaccine, the acquirer broadened its pipeline in a wider variety of cancer vaccines. Representatives of both the target and the acquirer explained that the products were based on very similar underlying technology. The target firm explained that the viral vector in both technologies underlying the products was MVA, and that “[the technology] was not exactly the same thing but it is the same material. They knew how to make MVA.” A further indication of the technological similarity of target and buyer was that, prior to the acquisition, there was a patent dispute regarding the target’s platform technology. When the target filed for the patent, the acquirer, along with five other firms, opposed the patent, claiming it was invalid due to prior art. The patent was upheld but those five firms appealed, and between the opposition hearing and the appeal, the acquiring firm acquired the target. The acquiring firm was able to maintain the patent claims. Patent analysis supported this classification and showed a technological similarity index of 0.74, much higher than the complementarity index of 0.13.

Cases 3 and 4 were cases of technological complementarity. In Case 3, at the time of the acquisition, the target firm had three clinical development programs in the central nervous system field and focused on sedatives; e.g., post-operative pain and chronic pain. The acquiring firm had a lead program on stroke that had just failed Phase III clinical trials, and, as a public company, attracted negative press and reduced the firm’s market value. The acquirer was therefore interested in acquiring drug programs “for example in central nervous system or thromboses” that could be further developed without a lot of risk. The technology complementarity was acknowledged by both the target and acquirer firms. The former chief scientific officer of the target firm explained the complementarity in these terms: “There is some similarity, they are hospital products, intravenous and acute … [and] they were central nervous system. [But] stroke [therapeutic area of the acquirer] and pain and sedation [therapeutic areas of the target] are quite different areas.” Thus, technology problem-solving was focused on different but complementary therapeutic fields, as the eventual drug products would be developed and then marketed, and administered, similarly (through hospitals, and intravenously). Patent analysis supported this classification and showed a technological complementarity index of 0.90, much higher than the zero similarity index.

In Case 4, at the time of the acquisition, the target firm had two early stage drug programs in antibacterials. The acquiring firm was specialized in antivirals. As in Case 3, where the common factor was the central nervous system, the common factor in Case 4 was anti-infective drugs. Again, as in Case 3, the specific therapeutic focus within the common field was quite different. The target firm characterized the complementarity as: “We haven’t really explored too much about their anti-viral discovery in the same way that most of our virologists haven’t had much experience in anti-bacterials.” By acquiring the target firm, the acquirer broadened their pipeline in anti-infective drugs. However, the patent analysis did not correspond with the evidence from the interview data. The patent analysis showed a higher index of technology similarity compared with the complementarity index. When asked about the discrepancy with the patent analysis, the chief scientific officer of the target firm justified the technological complementarity: “the compounds that are patented may be the same but they are put together differently for different uses”.

Discovery and development capabilities similarity/complementarity

From our case study evidence, it emerged that, in Cases 2, 3 and 6, there was a similarity of capabilities between target and acquirer (see Table 3). In Case 2, the firms were developing drug products and were specialized in the field of regenerative medicine in wound care and had similar capabilities in drug development. Both the target firm, having developed drug candidates from preclinical to Phase III clinical trials, and the acquiring firm, having developed and launched drug products on the market, had drug development capabilities in preclinical R&D, clinical R&D, small-scale manufacturing for clinical trials, and experience with regulatory procedures. Additionally, since the acquirer had already marketed products, it had developed substantial sales and marketing capabilities.

In Case 3, the target and acquirer firms were developing drugs in the central nervous system area. Both firms prior to the acquisition were carrying out activities related to producing drug products, namely the management of preclinical and clinical trials, safety and efficacy testing, and quality control. However, the acquirer was operating on a larger scale than the target: “what they had is something similar to what we had but we ran in an extremely light fashion, an under-resourced fashion.” Furthermore, the target firm explained the similarity of their activities: “The [acquirer’s] clinical development expertise is very good … but it is not bad here. There isn’t any particular thing that they do that we couldn’t get somewhere else or that we didn’t do beforehand. There is a lot of commonality in the type of work we do.” However, some of the capabilities of the target firm were superior, such as preclinical R&D and quality management, which became the company standard post-acquisition. Also, personnel in the target firm had more experience collaborating with large pharmaceutical firms than those of the acquirer. The acquirer had superior capabilities in clinical development, and experience with regulatory procedures.

Also, in Case 6, both firms had capabilities in drug development, e.g., safety and efficacy testing and clinical trials. The founder of the target firm explained that, “how it works is in the public domain. We can make the stuff … anyone can do that” but he further explained that owning the intellectual property and being able to defend it was the “real value”. The acquiring firm substantiated this claim by saying they had all the in-house expertise and skills because they were developing a very similar product, and that they “already knew what to do with it”, as proof of having the required (and similar) capabilities.

In contrast, Cases 1, 4 and 5 showed evidence of complementarity of capabilities between target and acquirer. In Case 1, the target firm offered services based on two different technologies: one based on proprietary technology (computer-based drug discovery), the other based on generic technology to determine proper dosing (safety and efficacy testing). The acquiring firm acquired both technologies, but was primarily interested in the safety and efficacy testing in order to extend its service offering to its customers, and has since divested the computer-based drug discovery service. The acquisition extended the scope of their services, as the service that was acquired required specialist knowledge the acquirer did not have. The target firm described their safety and efficacy testing service as having “specialists in knowing when something is going to get into the bloodstream and then when it’s in the bloodstream how quickly it’s removed.” This type of testing is generally required for FDA approval of drugs, and the acquirer was “relatively weak” in this service area. And, although the customers of this safety and efficacy testing service tend to be regional (80% of the target’s customers), the acquirer had successfully gained new service sales from its existing customer base that had begun to use the safety and efficacy testing service.

In Case 4, both firms were developing drug products (one in antivirals, the other in antibacterials), and both firms had been carrying out activities related to drug development. However, the target firm had less experience with larger-scale clinical trials, as its products were still in the preclinical development stage. The acquirer had drug products in Phase II clinical trials and had a much larger organization with in-house chemists. The target firm described the acquirer and target as having “quite a high degree of common language and processes.” He explained further that this was “partially due to a fairly large proportion of their scientists coming from the UK and having a shared approach.” The two firms made an effort to integrate their businesses without disturbing their capabilities: “They [the acquirer] are quite different in the therapeutic areas in processes and assays … making sure that we use similar platforms for ourselves so, for instance, if we have the same assay, we should call it the same name.” The acquirer contributed with project management systems, and there was an important effort to harmonize assays and other processes including occupational health and safety systems. With the acquisition, the target acquired access to internal toxicology, chemistry, biology, clinical development, and business development. The target contributed with both technology and market knowledge in developing products in a new therapeutic area with significant funding from the Wellcome Trust: “I think there is an added value to having people focused on the area, like I’ve been doing in this area for about fifteen years and so you have to understand the market, you’ve seen results, you’ve seen people make mistakes so you don’t need to make them again in this area. It is that kind of developed experience I think that is harder to put down.”

Lastly, in Case 5, the target and acquirer firms produced diagnostic products, and the acquirer bought the target firm in order to expand into a new market of companion diagnostics (diagnostic products used in conjunction with prescribing new drugs). The acquirer contributed with more standardized processes related to harmonization of product development, regulatory approval and quality control, and more supporting functions, such as marketing and sales, and general human resource management. The increasing market demand for the target’s diagnostic product required rapid expansion to meet U.S. FDA requirements that was very difficult for the target firm to manage prior to the acquisition. The target firm acknowledged that there were gaps: “nobody grows at that rate without leaving some holes.” The expertise and knowledge from the acquirer firm — in regards to first the European regulation, and later the FDA processes — were crucial to scale up the target’s manufacturing operations. The acquirer realized it had been less successful than the target in this market, and intended to keep the target’s local facility as a “center of excellence”. The acquirer also realized that a large portion of the value of the acquired technological assets resided in the relationships the target’s top management had with large pharmaceutical firms, and their ability to enter funded R&D collaborations with these firms. The acquirer acknowledged this by stating that they (the acquirer) were very good at relationships at the lower level in a customer’s organization, the bench or scientist level, but did not have staff with large pharmaceutical experience to build relationships at the higher levels, the vice-president level. The top management from the target firm had experience in working with large pharmaceutical firms, and knowledge and expertise related to acquiring and building large pharmaceutical R&D partnerships.

Investment in targets’ technology assets post-acquisition

In Cases 3 and 4, there was an expansion of R&D in the UK. In Case 3, our evidence showed retention of the full technical and scientific staff of the target and substantial investment in the development of the acquired drug programs:

“We decided right from the start that we would focus our investment on one [target’s] asset- … a preclinical asset … We have been able to move it forward very rapidly. We have done three clinical trials; the fourth clinical trial is on the verge of being launched. Due to our overall financial situation, we were not able to invest into [the other programs]. There were three more assets … [For] one we did some regulatory, very broad re-analysis and want to partner this. [Another] had nearly completed an ongoing Phase II trial but … this would probably not be very partnerable without us taking very high development risks — we decided to stop [investing] … There was a very early program … which we stopped right from the start because running one program is requiring all the focus of the team”.

Post-acquisition, the target and acquirer firms integrated these activities across country borders. According to the acquirer, the decisions of who was responsible for which activities were based on the “background and experience level of people” across the target and acquirer. This resulted in some staff redundancies in the acquirer’s location. Given the high level of similarity in capabilities (with the target even having some superior capabilities than the acquirer), the combined entity was reorganized to allow cross-country, cross-location reporting structure, with the heads in the target firm responsible for some activities.

Initially, the acquirer invested in all of the acquired assets in order to determine which program would provide the best return on investment. In the end, they invested primarily in one drug program, which they progressed, post-acquisition, from preclinical to Phase II. This level of product development required substantial investment. The combined entity invested 50% of its R&D budget in the target’s projects. They retained most of the target’s staff post-acquisition, although there were some redundancies in the acquirer’s firm. The retention of patent-assignees was 100%. The target location became a UK subsidiary for the acquiring firm (see Table 5).

In Case 4, the acquirer maintained and further invested in the programs and associated capabilities of the target firm, which were highly valued by the acquirer: “The [specialized] function is exclusively performed in the UK, adopted without change. It is fit for purpose and it is world class.” In this case, there was further research and development of the two target firm’s drug programs (both in pre-clinical stages). Since acquisition, the combined entity invested 30% of its R&D budget in the target’s projects in the target’s research programs. All staff was retained, including 100% of the patent-assignees, and the target firm’s location became a subsidiary for the acquirer firm.

In Cases 1 and 5, there was continuation of development operations, but no further investment in research in the UK. In Case 1, in which a services business was acquired, the acquirer firm invested primarily in staff and facilities. All of the staff related to performing the activities for the service were retained, about fifteen people in total, and were moved to the acquirer firm’s subsidiary in the UK. Nevertheless, the target firm informed us that five of the retained staff had left and spun out a new business. The acquirer made no further investment in developing the acquired technology. The target’s revenues were re-invested mainly to continue and expand the provision of services through facilities, staff recruitment and equipment maintenance, but not to carry out further research. The combined entity retained 26% of the target’s patent assignees.

In Case 5, which involves the diagnostic product firms, all staff was retained. The acquirer invested about 3% of the R&D budget of the combined entity for product development, primarily in staff and facilities for this purpose. It did not invest in further research. The combined entity lost 80% (4 out of 5) of the target’s patent assignees in the acquisition process. The target firm relocated to new facilities in the UK, forming a new UK subsidiary. There was also considerable investment in increasing the headcount at the UK location, from approximately 70 staff at the time of acquisition to 140 (the amount of staff doing product development has risen from 20 to 53, which was necessary to meet FDA requirements).

Finally, in Cases 2 and 6, the target R&D projects were either shifted away to the home country of the acquirer or completely terminated. In Case 2, in which two drug programs were acquired, there was evidence of investment in product development but in the acquirer’s home country. There was a high level of staff redundancy (the target firm originally had grown to 70 employees, but had already contracted to approximately 25 by the time of acquisition). The acquirer firm did not retain any scientists from the target firm, except for the temporary hire of the key scientist of the target firm to act as a consultant. The technology transferred included documentation and physical products, such as cell banks and specialized equipment, but also know-how, as scientists from the acquirer went to the target’s location to work with other key scientists to transfer knowledge about procedures and processes. Although there was no retention of staff or patent assignees from the target firm, nor investment in facilities or equipment, the acquirer indicated that they were investing approximately 20% of their R&D resources in early pre-clinical development for one of the drug programs of the target firm in the home country. The other drug program was in late-stage development and had completed Phase III, but with negative results. The acquirer was re-evaluating the program and was uncertain if there would be further development.

In Case 6, there was no further investment in technological development, staff or facilities of the target post-acquisition. The target’s staff was made redundant, retaining none of the patent assignees, although a key scientist and IP manager were retained for a year to transfer the documentation. In this case, the acquirer experienced some financial difficulty following disappointing results in Phase III studies of their main cancer vaccine, which occurred shortly after the acquisition of the target firm. Facing financial constraints, the acquirer was not in a position to invest in further development of the target’s R&D projects. We concluded at the time of the interview that the acquirer was not using the acquired technology assets, but was looking for partners to out-license those technology assets.

Discussion

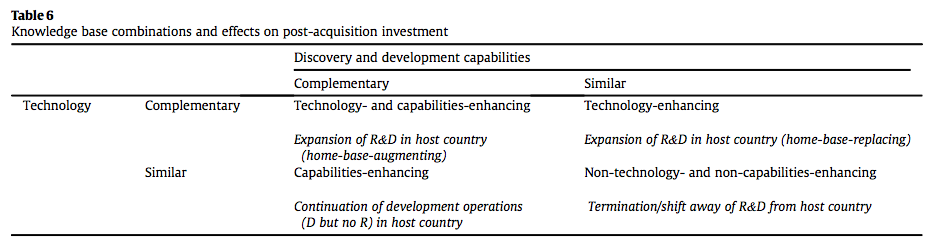

We asked the question: What happens to the technological resources and assets of science-based firms when they are acquired by foreign firms? We investigated this by drawing on evidence from six case studies of acquisitions of UK biopharmaceutical firms. Table 6 plots the similarity/complementarity of the technology against that of the discovery and development capabilities in each pair of acquiring and target firms. In a rather speculative fashion, the basic picture that emerges is of four ideal types of knowledge base combinations: i) technology- and capabilities-enhancing (consistent with Case 4); ii) technology-enhancing (consistent with Case 3); iii) capabilities-enhancing (consistent with Cases 1 and 5); and iv) non-technology- and non-capabilities-enhancing (consistent with Cases 2 and 6). Our findings contribute to advancing the discussion at a conceptual level, by showing that different combinations of firms’ technology and discovery and development capabilities have different outcomes regarding further investment in, or shift of, the target’s R&D. Next, we discuss the four ideal types.

In what we call technology-enhancing combinations — involving complementary technology but similar discovery and development capabilities — acquisitions reflect a strategic intent to explore new technological knowledge domains. We argue that these combinations create a potential for R&D “exploration” through experimentation with new alternatives ( Grant, 1996, March, 1991 and Vermeulen, Barkema, 2001), and for inventions emerging from the integration and redeployment of the components from the amalgamated knowledge base (Fleming and Sorenson, 2004). The combinations require the buyer to invest further in the target R&D projects in order to absorb the tacit, complex and embedded complementary knowledge. These acquisitions provide the target with opportunities to access complementary skills and resources for clinical development, and the buyer with opportunities to renew its knowledge base and diversify its product pipeline by developing projects in complementary technology areas. These acquisitions may be designed to “replace” some knowledge of the acquirer, especially when they experience a setback, such as a failed clinical trial. The similarity of the discovery and development capabilities between the buyer and target firm may facilitate the integration of processes, methods, and systems related to clinical development. The acquisition of a firm with similar capabilities, however, may lead to reorganization and rationalization of the combined entity, and some redundancy of staff in either the buyer or target firm.

In capabilities-enhancing knowledge base combinations — involving similar technology but complementary discovery and development capabilities — acquisitions reflect a strategic intent to explore new product market domains ( Bower, 2001). These combinations can be explained as an acquisition strategy aimed at further “exploitation” of the extant knowledge bases (March, 1991) through the adoption of complementary discovery and development capabilities. In these cases, we see the continuation of development operations, but not further investment in basic research in the target’s R&D projects. These acquisitions may be designed to take advantage of scale and scope economies and efficiency improvements, through scaling up operations and acquiring complementary manufacturing or service capabilities. The motivation to maintain the target firms’ operations stems primarily from the embedded tacit knowledge of the staff in the acquired firms, such as in Case 5, where the valuable collaborative relationships with large pharmaceutical firms constituted a large part of the acquired value. As such, the target firm’s development activities may be continued, but there is little inventive output.

In technology- and capabilities-enhancing combinations — involving complementary technology and complementary discovery and development capabilities — the acquisition emphasizes both “exploration” and “exploitation”. Further investment in the R&D projects of the target is necessary for the further development of promising target projects. Such acquisitions may be part of a platform or buy-and-build strategy, where an initial acquisition provides the acquirer with a foothold in a new domain and the option to build on that platform with further internal investment or a series of follow-on acquisitions ( Haspelagh, Jemison, 1991 and Smit, 2001). As such, these acquisitions are knowledge-seeking, and designed to “augment” the technology and capability base of the acquirer (Kuemmerle, 1999).

Finally, in non-technology- and non-capabilities-enhancing combinations, the potential for “exploration” or “exploitation” may be limited. Here, effort is done to “transfer” or “translate” the intellectual property documentation to the buyer, but the retention of technical and scientific staff is not seen as necessary to continue the exploitation of these capabilities. These acquisitions represent attempts to deal with the escalating drug development costs and risks (e.g., DiMasi et al., 2003), or to increase market power and reduce competitive rivalry. In these cases, we see either the shifting away of the target R&D activity to the home country of the acquirer, or the outright termination of the target R&D projects. Thus, the opportunities for recombination of knowledge-base assets/resources are limited, and there is little contribution to the innovation output post-acquisition. Our findings showed that, although similar knowledge bases (both in terms of technology and discovery and development capabilities) may be easily integrated and require minimal resources to do so, the increase in innovative output was also minimal.

Our research draws on and also questions some of the findings of existing research on the effect of knowledge relatedness on innovation in M&As (Makri et al., 2010). In particular, it builds on the insight that similarity and complementarity of technology have an effect on innovation outcomes following acquisition, but goes beyond this by incorporating into the framework the important role played by similarity and complementarity of capabilities between firms in innovation outcomes. This added focus contributes to the development of an analytical framework that elucidates how key determinants of science-based firms interact and affect investment in the target firm’s R&D post-acquisition. This framework can encompass the different motives, processes and outcomes in technology-motivated M&As, and is therefore able to cast light on mechanisms ignored by earlier studies. For example, it casts light on the difference in motives and processes between what we call technology- and capabilities-enhancing knowledge-base combinations (in which acquirers seek to “augment” their knowledge) and technology-enhancing knowledge-base combinations (in which acquirers seek to “renew” or “replace” their knowledge), with implications for the nature of the R&D reorganization process. Our framework also explains the reasons for the continuation of only the development operations (as opposed to further research) of target firms in the host country in the case of capabilities-enhancing knowledge base combinations, in contrast to the cases with complementary technology. Finally, it explains the motives for and processes of termination or shift of R&D from the host country in the case of similarity of technology and of discovery and development capabilities. These issues have not been explored by earlier studies of knowledge-relatedness in M&As.

Our conceptual framework has important management implications. Promising target R&D projects (which could have led to much-needed drugs) may be discontinued due to similarity in technology and capabilities, to the dismay of scientists in target firms. These outcomes are not necessarily foreseen by the acquirer and target senior managers, and do not necessarily reflect their initial strategic intent, but instead emerge from the process of post-acquisition rationalization and reorganization of R&D. The theoretical predictions and practical implications of this framework resonate with the literature emphasizing the decisive role the acquired firms’ senior managers can play by championing opportunities for resource reconfiguration and synergy (Graebner, 2004 and Graebner et al, 2010). Our conceptual framework highlights the importance for the acquired firms’ senior managers to be able to evaluate, select and promote actively their most valuable R&D projects, in order to maximize the chance of survival and follow-on investment.

Implications for the local science and technology system

Our analytical framework allows us to distinguish between the different outcomes in terms of implications for the local science and technology system, and therefore also has significant policy implications. Technology- and capabilities-enhancing and technology-enhancing knowledge base combinations have positive effects on the local science and technology system as buyers are keen to access the product- and firm-specific assets, and further investment is directed towards R&D of the acquired firms’ technology in the host country. The tacit nature of knowledge in science-based firms requires the buyer to retain this knowledge, which is embedded and location-bound in scientists and their personal relationships, and constrains buyers from shifting R&D activities away from the host country of the target firm or centralizing it in the buyer’s home country ( Carayannopoulos, Auster, 2010, Kogut, Zander, 1992 and Pisano, 1991). Proximity to qualified universities or other research organizations that deliver this kind of tacit, cognitive knowledge, and to clusters of firms operating in the same and in complementary sectors (including the availability of experts in intellectual property or regulatory issues), is crucial to accessing this knowledge ( Balconi et al, 2007, Casper, 2007, Liebeskind et al, 1996 and Owen-Smith, Powell, 2004). Therefore, for acquisitions involving access to complementary technology, the combined entity will have the imperative to remain and continue R&D activities in the host country.

The picture is different for capabilities-enhancing knowledge base combinations. In these acquisitions, although the target’s technological knowledge base is kept intact and local operations tend to be continued by forming a subsidiary in the host country, the buyer firm invests little in further research regarding the acquired technology. The target firm’s ties to the client or supplier base, for example, provide a strong rationale to maintain operations in the host country, but, in this combination, the combined entity does not seek to explore, create and absorb new knowledge from R&D projects of the target firm, or allocate new resources to these research activities.

For the final, non-technology- and non-capabilities-enhancing type, the R&D activities of the target are eliminated or shifted away from the host country. This avoids redundancies and duplications in the combined entity, resulting in the loss of skilled employment and the suppression of the target’s technological assets (unless target assets are readily re-deployable for alternative uses).

Our findings highlight the importance for policy to encourage and support regional innovative capabilities embedded in virtual laboratories in the form of broad and deep networks of operational, technological and scientific researchers that cut across firms and universities, encouraging technological diversity and new firm creation (Almeida, Kogut, 1999, Audretsch, Feldman, 1996, Best, 2001, Casper, 2007 and Saxenian, 1994). Encouraging development of these regional specializations and capabilities is especially necessary in countries that invest heavily in sustaining a strong and healthy science base, but face challenges in the ability to commercialize and benefit from the economic impact of science and innovation. Regions that invest in policies that support and develop these capabilities and networks may strengthen the ability to appropriate value, even when their firms are acquired by foreign firms.

Limitations and implications for future research

Our study offers new conceptual insights on the different knowledge base combinations that can affect further investment, continuation or suppression of target firms’ R&D projects. We acknowledge the challenges to test empirically and extend the analytical framework developed in this study. A major challenge for a large-scale empirical testing is the operationalization of similarity/complementarity of technology and of discovery and development capabilities. The findings from our study, which rely on both interview and patent data, suggest that caution must be applied to the adoption of widely used objective measures of acquirer and target firm innovation characteristics. While previous studies have relied on patents to analyze the effect of technology relatedness on post-acquisition innovation outcomes (e.g., Ahuja and Katila, 2001), we find that the innovation-related proxies based on patents and case study evidence did not always lead to identical findings when studying smaller biopharmaceutical firms. To some extent, these discrepancies can be attributed to the general criticism of the reliability of patent data as a measure of economic value and their corresponding result in practical applications. In particular, the evidence shows that smaller firms — as is the case for most of the target firms in our study — have a lower propensity to apply for patents, perhaps reflecting the costs of the patenting process and the availability of internal legal capacity (Kleinknecht et al., 2002). Our findings suggest that patent-based proxies for technological knowledge capture a small part of a firm’s knowledge base and sometimes not the core technology of the firm. Furthermore, patent-based indicators can be obscured by strategic behavior; firms may seek patent protection to prevent a competitor from using a particular technology. Biopharmaceutical firms rely on extensive and detailed documentation and “standard operating procedures” related to each step of the drug discovery and development process. As a result, much knowledge integration and transfer occurs through an interpretation of the documentation trail of clinical testing between the buyer and target firms. Our study illustrates that, even in acquisitions involving similarity in both technology and capabilities, the transfer of patents was not enough to ensure the exclusive use of the technology, and the retention of key scientists or intellectual property specialists was necessary in order to “transfer” or “translate” the intellectual property. These key scientists were retained temporarily, despite the fact that all other staff was made redundant.

An even greater challenge is the operationalization of the discovery and development capabilities. As argued above, capabilities and routines are distributed in organizations and involve different participants performing different activities and who have different understandings of those capabilities. These constructs cannot be derived from existing large-scale data sources, and inevitably demand close scrutiny regarding the types of firm skills, history and experience. Nevertheless, we have provided a starting point for articulating into the analysis the particular capabilities for discovery and development that reflect biopharmaceutical firms’ ability to perform their activities. It is possible to collect information on firms’ clinical trials, products and services from specialized databases, firms’ websites, or articles in trade journals, which can give some indication on the ability of firms to conduct clinical trials, safety and efficacy testing, the experience of firms in the management of regulatory authorities (if they have regulated products), provision of services or engagement in manufacturing. Nevertheless, it is difficult to derive from these data sources reliable information on firm capabilities. To gather this kind of information, case-by-case analysis is required (e.g., through the implementation of a dedicated survey). Databases on clinical trials can also be used to explore outcomes, as it may be possible to trace whether target projects have proceeded through clinical trials after acquisition. Another alternative to explore outcomes is to trace the careers of scientists through business-oriented social networking services, in order to investigate whether scientists from the target firm continue to work in the acquirer.