Publications Unlocking Shareholder Value: The Keys To Success

- Publications

Unlocking Shareholder Value: The Keys To Success

- Bea

SHARE:

Mergers & Acquisitions. A Global Research Report.

By John Kelly, Colin Cook, Don Spitzer – KPMG

This report presents the findings of KPMG’s most recent survey into the issues surrounding M&A integration. The survey sets out to be different.

Rather than looking predictably at the reasons for failure, it emphasises what successful companies are doing right to unlock value from their deals. We focused our sample on the largest cross-border deals completed between 1996 and 1998 so the results capture the experiences of leading blue chip companies. Our innovative approach means that for the first time we have gone beyond respondents’ subjective assessment of performance and have applied an objective measure of deal success, based on shareholder value, to arrive at the ‘keys to success’. The results highlight the importance of an integrated approach to the pre-deal period. They also stress the challenge acquirers face in addressing the ‘softer’ people and cultural aspects of the deal, and in delivering an effective communications plan. As ever, it is the delicate balance between financial drivers and people aspects which underpins success. Neither is sufficient in itself to deliver the benefits.

Finally, our high profile international sample gives us unique insight into the features of cross-border transactions. We have a new perspective on the cultural challenges faced by acquirers and can compare success rates between US, UK and European based deals.

We commend this document to all those embarking on a major merger or acquisition. Our results indicate that acquirers remain over-optimistic about their performance and many still fail to deliver enhanced shareholder value through their acquisitions. Although each deal is different, much benefit can be gained by learning from the experience of others.

Executive summary

Survey Objectives

This research report sets out to be original. Too many surveys in the past have concentrated on what is going wrong with mergers and acquisitions. We focus instead on understanding what, in their most recent deals, major international companies are getting right in the hope that their experience will provide a useful guide to companies entering into their own deals in the future and that we have the most up-to-date view on this burgeoning market. The results give us an authoritative perspective on how benefits can be delivered to shareholders.

Any merger or acquisition is an extremely complex procedure from pre-deal planning, and deal completion, through to post deal integration and the extraction of value. The inevitable pressure on time and resource mean that priorities must be allocated, and hard decisions made about which activities are undertaken, and when, how, and by whom they are done.

Our specific objectives were as follows:

■ to correlate specific actions with the success or failure of the transaction;

■ to investigate the relative importance of the different activities; and

■ to assess respondents’ approaches and attitudes to cultural and people issues.

Benchmarking Success

Shareholder value was used as the basis of the benchmark by which the success of respondents’ deals was measured. We measured equity performance pre and post-deal and set individual company performance against their own industry trends. Deals were then categorised into those that failed to create value, those that neither created nor destroyed value, and those that exceeded their industry trend.

Full details of the methodology and survey parameters are outlined in chapter 2.

How good are companies at mergers and acquisitions?

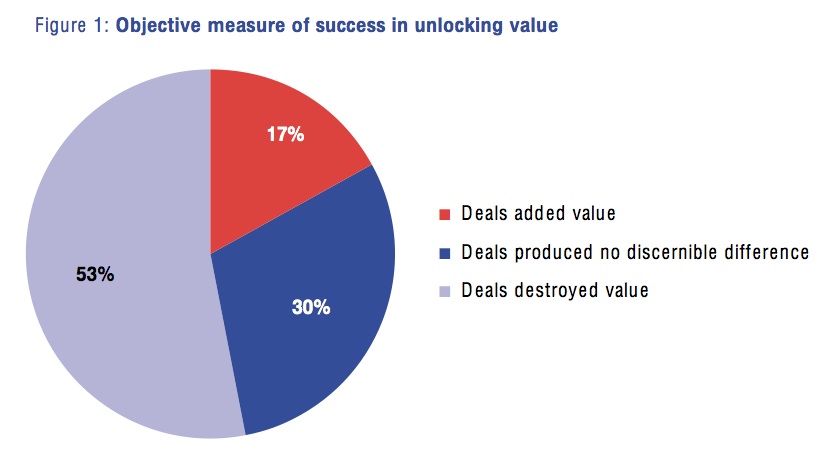

The survey found that 82% of respondents believed the major deal they had been involved in had been a success. However, this was a subjective estimation of their success in achieving the deal objectives (see figure 2, on page 8), and less than half had carried out a formal review process. When we measured each one against our independent benchmark, based on comparative share performance one year after deal completion, the result was almost a mirror opposite. We found that only 17% of deals had added value to the combined company, 30% produced no discernible difference, and as many as 53% actually destroyed value. In other words, 83% of mergers were unsuccessful in producing any business benefit as regards shareholder value.

Achieving the balance to unlock value

We have focused the survey on the ‘hard’ factors which impact on value realisation and those activities which address the ‘soft’ people and cultural issues. The results give us six ‘keys’ which successful companies use to unlock value.

The Hard Keys

As a result of our benchmark analysis, we found that successful companies achieved long-term success by prioritising three key activities in the pre-deal phase (the so called hard keys) which had a tangible impact on ability to deliver financial benefits from the deal. They are:

■ synergy evaluation;

■ integration project planning; and

■ due diligence.

Using the benchmark, a quantifiable benefit could be accorded to each one.

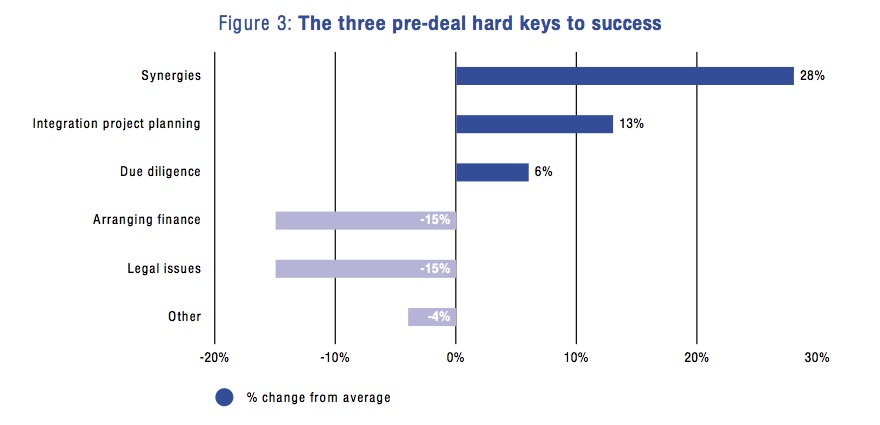

Those companies that put priority on pre-deal synergy evaluation were 28% more likely than average to have a successful deal and for integration project planning the figure was 13%.

The results were particularly surprising in relation to the mandatory pre-deal activities. Of these, due diligence emerged as the activity most critical to deal success (companies which prioritised this were 6% more likely than average to have a successful deal). On the other hand, companies focusing their attention on arranging finance or on legal issues (to the detriment of other areas) were 15% less likely than average to have a successful deal.

We have identified, then, three pre-deal activities. Each one in its own way contributes to deal success, however there is overlap between them. They can therefore have greatest impact if brought together in a single pre-deal process which gives the acquirer essential intelligence about risks, benefits and operational issues. This information will help deal negotiations and shape the post-deal integration programme to ensure shareholder value is increased.

The Soft Keys

Experience tells us that people and cultural issues are important in determining deal success, so we wanted to use this survey to drill down and understand the impact of different decisions and timescales relating to soft keys on deal outcome. The results highlight three soft keys:

■ selecting the management team;

■ resolving cultural issues; and

■ communications.

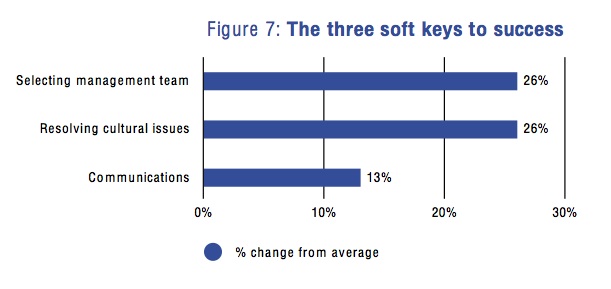

Those companies that gave top priority to the selection of the management team at the pre-deal planning stage, thereby reducing the organisational issues created by uncertainty, were 26% more likely than average to have a successful deal.

Deals were 26% more likely than average to be successful if they focused on resolving cultural issues, and those acquirers who left cultural issues until the post-deal period severely hindered their chance of deal success, compared with those who dealt with them early in the process.

Companies which gave priority to communications were 13% more likely than average to have a successful deal. When we drilled down to understand this better; poor communications with own employees appeared to pose greatest risk to deal success, more so than poor communication to shareholders, suppliers or customers.

These results highlight the importance of giving early emphasis to management team selection, cultural assessments and communications plans.

The power of the hard keys with soft keys combination

We commissioned this survey to isolate and investigate specific aspects of transactions to better understand the relative impact on success rates. However, it would be wrong of us to leave an impression that any one activity is sufficient on its own. We have highlighted the most important hard keys and stressed the benefits of an integrated approach to pre-deal investigation. Similarly, we have focused on the soft keys which have greatest impact on deal success. However, we found that the acquirers who achieved best results were those who recognised the importance of both sets of keys. In our survey just nine companies (equating to less than 10% of respondents) addressed all three soft keys and carried out integration project planning. All nine were successful.

In an environment where high premiums are being paid, stakeholders expect significant synergies from their transactions. This makes it all the more important to focus pre-deal activity on identifying the key value drivers which will have greatest impact on the realisation of shareholder value. Success, then, comes with a holistic approach where the people aspects are an integral part of the focus on financial performance and one cannot exist without the other. It is effective handling of this delicate balance which actually determines success.

Cross-border mergers and acquisitions

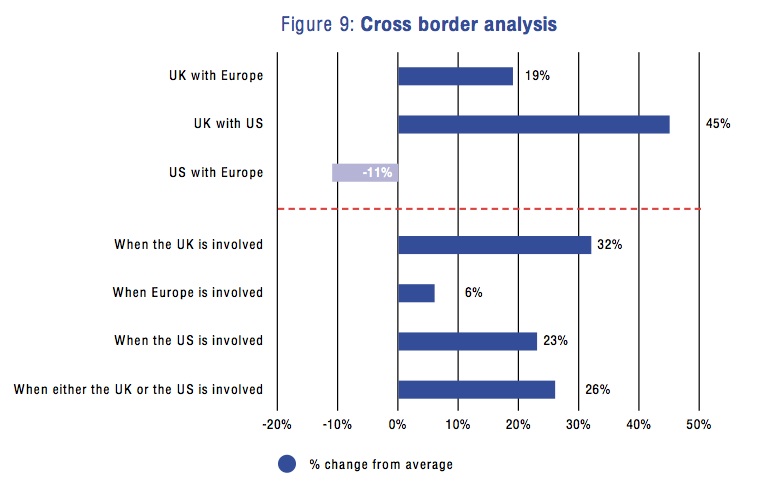

The findings appear to highlight the sophistication and experience of the UK and the US. Deals involving the UK were 32% more likely than average to be successful and 23% more likely when the US was involved. This compares with just 6% for deals involving a European company.

The results relating to different combinations of countries highlight the importance of experience, but also of cultural understanding and effective communication. While a UK/Europe combination makes the deal 19% more likely than average to be successful, the rate reaches 45% for a UK/US combination. However a US/Europe merger is 11% less likely to be successful. These findings appear to emphasise the cultural challenges the US faces in Europe as compared with the UK, itself a close neighbour of continental Europe.

Of the ten Rest of the World companies (ie not UK, Europe or North America) who had carried out cross-border deals, only one was successful. This is probably due to their relative inexperience in large mergers and acquisitions.

The results show the challenge acquirers face in undertaking cross-border deals where there is a significant cultural and linguistic disparity between participants. It is critical for acquirers to anticipate and plan for this early on in the process. The findings also indicate that experience increases the chance of success.

Approach

As outlined earlier, the research objectives were to correlate specific actions with deal success or failure, to investigate the relative importance of different activities and to drill down into the softer aspects to assess respondents’ approaches and attitudes to cultural and people issues.

The research was conducted in two parts:

Phase 1: Research amongst directors of companies participating in major M&A deals

The fieldwork was conducted by Taylor Nelson Sofres Harris in June 1999 via confidential telephone interviews. The sample frame was taken from the top 700 cross border deals by value between 1996 and 1998. The respondents were all main board members who had been very closely involved in the deal in question. In total 107 companies participated from around the world.

During the course of the interview, respondents were asked which activities they had undertaken during the deal process. They were also asked which of these they considered had contributed to the success of the deal, how successful they believed the overall deal to have been and why. All results are unweighted.

Phase 2: Analysis against an objective benchmark of M&A success

Further research was conducted using external share price data supplied by Bloomberg.

Each deal was categorised against an objective benchmark of success. This assigned each into one of three categories, determined by the change in the lead company’s shareholder value, approximately one year after the completion of the deal. The categories are:

■ Deal destroyed value

■ Deal neither created nor destroyed value

■ Deal successfully created value

In order to assess shareholder value performance accurately, for each deal, a measurement of trend in equity price was taken pre-deal – and then again approximately one year afterwards. This result was then compared with the overall trend in the relevant industry segment in order to assess which benchmark rating was most appropriate.

For standardisation purposes, we have given the benefit of the doubt to companies who had neither created nor destroyed value at the time of our research, and included those in our category of ‘success’. In our experience, once value is lost, it is seldom recovered, so those acquirers who had destroyed value were treated as failures.

Cross tabulation with the survey findings was carried out by TNS Harris, and not KPMG, in order to preserve the confidentiality and anonymity of survey respondents, in accordance with standard market research guidelines.

Unlocking shareholder value

Confidence in M&As has never been higher . . .

The value of annual global M&A transactions at the time of publication is estimated to be running at more than $2.2 trillion (*Source: Thomson Financial Securities Data 1999). Confidence in mergers and acquisitions as a means to drive growth has never been higher.

This increasing confidence is not surprising. Most blue chip companies have been involved in several major mergers or acquisitions in recent years. One in two blue chip companies are involved in a major transaction every year. This experience has led many to believe in them as a fairly certain method of delivering business growth. Our survey respondents, all of whom had been heavily involved in a major M&A deal, were no exception to this positive outlook. The results show that one year after deal completion, as many as 82% were convinced that their transaction had been a success.

However, when we investigated further, it became clear that this positive assessment was based more on a subjective ‘hunch’ than on any objective and wide-ranging measure. In fact, despite the size of the deals, less than half (45%) had carried out a formal post-deal review.

This lack of post-deal assessment is concerning. None of the respondent companies were new to the M&A process. Most, in fact, had been involved in several mergers and acquisitions before and will, no doubt, carry out more in the future. Yet, if, as our results have suggested, formal reviews are seen by most as ‘non-essential’ to the M&A process, valuable lessons are not being taken into account when developing new acquisition strategy. In this way, old and expensive mistakes can continue to prevent shareholder value being maximised.

. . . but in reality success rates are as low as ever

A subjective assessment on the part of respondents was clearly not adequate in a survey designed to investigate the key drivers behind deal success. We also decided to measure the success of the respondents’ deals using an objective benchmark based on an increase (or decrease) in shareholder value. (The shareholder value measure we used is explained in more detail in the previous chapter on our approach.)

This objective measure gave a radically different picture. It shows that, in fact, 83% of mergers failed to unlock value.

Rationale behind the deal

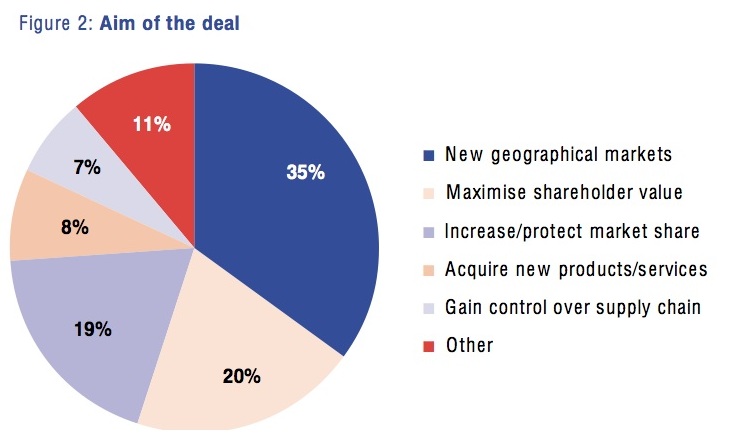

We questioned respondents on the business aims behind their merger or acquisition. Predictably, market share and access to new markets remain key motives for M&A activity; it is easy to measure success against these as deal completion itself makes these a reality. But, as the table shows, ‘maximising shareholder value’, was cited by 20% of our respondents.

This is encouraging, but it means that the remaining 80% still fail to recognise the importance of the focus on shareholder value. Is it a coincidence that these findings are very similar to the result of our objective benchmarking which tells us 83% of acquirers still fail to unlock shareholder value following their transactions?

The six keys to success

The unique approach we have taken in this survey enables us to correlate specific transaction related activities with the likelihood of delivering shareholder value from the deal. The results give us six ‘keys to success’, three focused on activities which directly impact on financial performance – the hard keys; and three issues relating to people aspects – the soft keys.

Focusing on the hard keys

The survey results suggest that successful companies were managing to achieve long-term deal success by prioritising three hard key components in the pre-deal phase. These were synergy evaluation, integration project planning, and due diligence. This planning helped them to achieve swift and substantial value extraction on completion of the deal. It also offered evidence of where less successful companies are going wrong, by concentrating on mandatory activities such as legal and financing.

Synergy evaluation – the ‘what’

Synergies are vital to the success of any merger or acquisition. Most companies now realise that without them, an M&A is unlikely to result in any significant additional growth in shareholder value.

Pre-deal synergy evaluation emerged from the survey as the prime hard key to deal success; one which can enhance chance of success to 28% above average. This is as expected. Only by gaining a clear understanding of what and where value can be obtained from a deal, can companies hope to avoid ‘bad’ deals and be in a position to work out how, during integration planning, this value extraction will be achieved.

While the concept of ‘synergies’ is now something of a cliché – and one commonly trumpeted during public merger announcements – too few companies are moving beyond these statements of intent to work out how and indeed whether they can actually be achieved. To do this requires a thorough process of synergy evaluation, beginning as soon as possible in the pre-deal phase. Such a process involves detailed work with operational managers to confirm the ‘deliverability’ of synergy assumptions and provide the reassurance during negotiations that the identified benefits are robust.

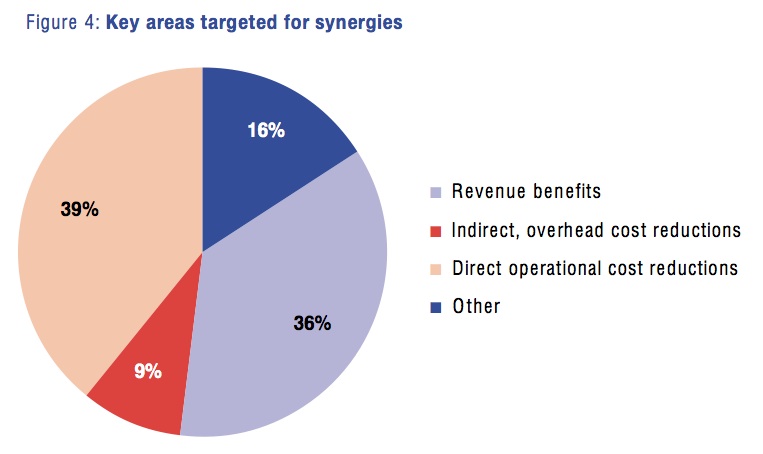

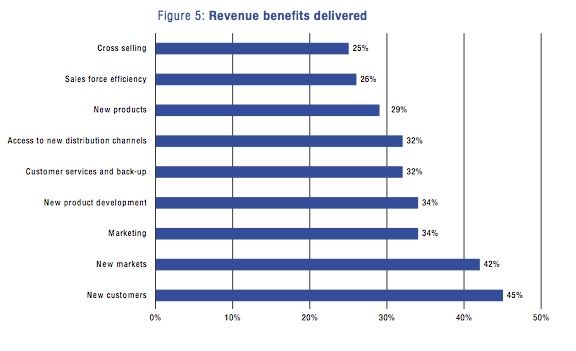

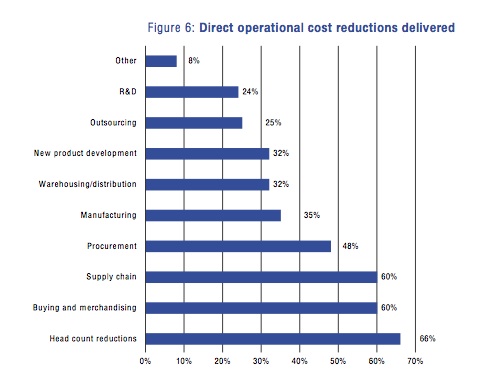

The survey confirmed that companies target synergy benefits through revenue enhancement as well as direct operational cost reductions.

Synergies were actually delivered in the following areas.

Although benefit areas such as procurement, R&D or new product development and cross-selling feature widely in synergy papers, our findings show they are actually delivered by less than half of companies. On the other hand, headcount reduction is the area where most companies have achieved benefits. Yet it is possibly the most difficult to implement effectively because of the need to be sensitive to the regulatory and cultural repercussions. Loss of staff is an inevitable result of merger or acquisition activity and will often include the very individuals the acquirer intended to keep. It is estimated that as many as 50% of managers will leave following the first year of an acquisition.

Integration project planning – the ‘how’

Integration project planning goes hand in hand with synergy evaluation as a key to merger success. It is critical to work out the mechanics of how synergies will be attained, and also how the combined business will be stabilised to preserve current value and ensure that one plus one does not make less than two.

This survey confirms, through its objective benchmark, that the chances of merger success are increased if the process of working out ‘how’ is started well before the completion of the deal. Those companies that prioritised pre- deal integration project planning were 13% more likely than average to have a successful deal.

Given recent high-profile M&A negotiation breakdowns, the temptation has never been greater for companies to hold off, or curtail, their integration project planning activities until the deal is completed. It is often felt that if negotiations fail, senior management time and resources spent on pre-deal project planning, will have been wasted.

Yet, postponing or limiting project planning is too great a risk for any company to take. There will be little time to do this properly after the completion of the deal. In our experience there is no substitute for pre-deal planning. Company management have a ‘honeymoon’ period of some 100 days after deal completion to take hold of the business and begin delivering benefits. Unless they are in a position to start implementing the hard mechanics of their M&A aims by this stage they will lose value from their acquisition. If stakeholders do not see results, and see them quickly, then their support will be lost and the project will be derailed. Companies that invest time and effort in pre-deal planning will be in a much better position to meet stakeholder expectations and unlock value from the deal.

Due diligence – a springboard to the ‘what’ and the ‘how’

Our survey shows that due diligence is the most important of the non- optional pre-deal activities. Companies which prioritised this were 6% more likely than average to have a successful deal. This contrasts with the acquirers who focused their attention instead on arranging finance or on legal issues and were therefore 15% less likely than average to have a successful deal. This evidence highlights the power of due diligence if used to full effect.

Sophisticated and forward-looking acquirers use a ‘springboard’ approach to due diligence which often encompasses a range of investigative tools designed to systematically assess all the facts impacting on value. This can include market reviews, risk assessments, and the assessment of management competencies, as well as areas to concentrate on for synergies or operational impact.

This way of working is likely to become more commonplace in the UK, with increasing focus on synergy potential as part of the due diligence procedure, particularly in the light of Takeover Panel Rules on synergy benefits. Similarly, in the US the SEC has recently put far greater emphasis and scrutiny on merger benefit numbers.

The power of an integrated approach

When viewed separately, synergy evaluation emerged as the hard key which had greatest impact on deal success. Implementation planning and due diligence also have a positive influence on success levels, though on face value appear less important than synergy evaluation.

However, it is misleading to view each area in isolation as there is inherent overlap between each of these hard keys. By bringing the three activities together within a single process, the acquirer can maximise the value of pre- deal investigation work. When handled in this way as an holistic approach, the process will provide the necessary intelligence to influence price negotiations and plan for the post-deal integration which will ultimately unlock shareholder value.

Focusing on the soft keys

People matter

We have already seen the impact of the three hard keys on deal success. What our survey also showed is that hard factors alone are not enough, and acquirers must devote effort to the ‘softer’ aspects of their transactions if they are to deliver ultimate benefit to shareholders. Three soft keys emerged which also have significant impact on deal success rates: selecting the management team, resolving cultural issues and communication.

Planning for the mechanics of M&A value extraction is worthless unless company employees are both willing and able to implement them. It is not surprising therefore, that this survey found a strong correlation between these ‘softer’ areas and overall deal success. People issues may be important, but they are historically the most difficult to resolve. Staff cannot be forced to co- operate, to drive forward merger objectives, or to change their business behaviour. They must be motivated and given incentives to do so. This requires careful planning, and resourcing. Many companies have neither the resources nor the know-how to give this area the priority it requires.

Selecting the management team

To be successful, a merger or acquisition requires exceptionally strong leadership from the board downwards, to drive forward a complex programme of value realisation.

Unfortunately management team appraisal and selection is far from straightforward. How does one amalgamate the management structure and make key appointments in a way which does not have a detrimental effect on the business?

Hasty decisions may prove to be wrong decisions and the need to move quickly must be offset by legal compliance considerations. Yet, if the selection process is too slow, uncertainty can lead to a damaging drop in morale and the exodus of key talent. This can have a devastating effect on the combined business.

Critically, if the selection process is not properly managed, it can disintegrate into a political free-for-all instead of an objective assessment of skills and competencies. The process for appointing the new management structure must be seen to be transparent, logical, rational and above all fair.

Those companies that prioritised the selection of the management team at the pre-deal planning stage were 26% more likely to have a successful deal.

We see a new trend as companies increasingly use management assessment techniques in the pre-deal period to help identify the individuals which will be critical to the future success of the business and plan a structure and incentive programme accordingly.

But what general approach should companies adopt when considering the management of a merged or acquired company? In particular, should the management of the acquired company be asked to leave? Will their continued presence be a barrier to integration or co-operation; or will it be valuable as a means to foster profitable co-operation between the legacy companies?

When we ‘drilled down’ into options for handling selection of the management team, we found strong correlations that suggest success rates vary depending on the approach taken and the degree of integration between acquirer and target. It appears that for a ‘bolt-on’ or portfolio business, success rates will be improved if the management team is replaced. On the other hand, for a fully integrated business, success rates are enhanced if managers in the acquired company are retained and incorporated into the new management structure.

These results appear to run against common practice but may be explained as follows:

■ Many acquirers pursue a policy of purchasing companies which they perceive as being basically sound, yet poorly managed. In these cases, quick value gains can be made simply by ‘importing’ a more sophisticated management team. A new management team will be more inclined than an existing one to look for the business benefits arising from the new combined entity.

■ Staff from the target bring valuable knowledge into the merged management team, but also their continued presence can give a vital sense of continuity to the new employees and help ease the process of integration.

Cultural issues

No two companies are alike, not just in what they do, but in how they operate at a corporate or functional level. Some, however, are more different than others.

The type and complexity of the cultural challenge will depend upon the nature of the merger or acquisition. If both companies are to be fully integrated, the best aspects of both legacy organisations will need to be incorporated into a single new company culture focused on achieving future business growth. Where the companies are to be run as two separate entities, cultural integration is neither wise nor necessary, yet close links to ensure mutual co-operation between two separate cultures will be essential to ensure the deal unlocks shareholder value.

In either case, cultural factors must be incorporated into all elements of the M&A process from pre-deal planning to post-deal implementation.

The survey found that deals were 26% more likely to be successful if acquirers focused on identifying and resolving cultural issues.

The survey results also suggest that a company increases its chances of success if it uses reward systems to stimulate cultural integration or co- operation, as opposed to more informal methods.

Communication

The need to ensure efficient and consistent internal and external communication during a merger process is well-known. Unless key stakeholders, from shareholders to customers, are appropriately informed during the merger process, their positive buy-in is likely to be lost and the merger process may be derailed.

The survey confirms that companies who prioritise communications are 13% more likely to be successful than average.

The ‘drill down’ to understand which target groups are the most important for the communications plan suggests, surprisingly, that poor communication to employees will have a greater detrimental effect on deal success than that to shareholders, suppliers or customers. In our experience a balanced approach to communication is essential.

Own employees are often forgotten, as acquirers concentrate on communications to staff in the target company, yet they are equally likely to feel anxious about the change to the business. Communications to customers or the public are also important but can often be safely phased in over the longer term, once value realisation programmes are underway.

Achieving the result: hard keys with soft keys

We have set out in this survey to understand better the different activities which impact on deal success. This has led us to comment on each separately. However, neither the hard nor the soft keys can be viewed in isolation. On their own they are not enough to ensure success. People and cultural aspects must be incorporated within activities focused on financial performance so that both hard and soft aspects are handled together to deliver shareholder value. In fact, we find that successful acquirers naturally incorporate the softer aspects into their pre-deal planning activity with cultural appraisals and management assessments.

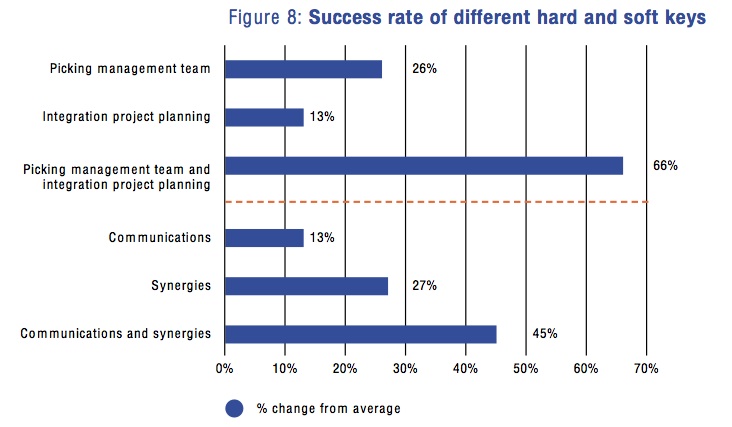

We cross-analysed soft and hard key findings to look for any correlation between the two. The results confirm that when both aspects are given priority, the success rate is increased.

For example, as the graph below shows, selection of management team with integration project planning, and communications with synergies, give significant uplift to the success figures.

However, the strongest message about the need for a holistic approach to transactions emerges when we see that although just nine companies (less than 10% of respondents) prioritised the three soft keys and integration project planning, all nine were successful. These companies have recognised that a broad based investigation in the pre-deal period will give them an assessment of the risks, benefits and operational impact of the deal. This vital intelligence will strengthen their hand during negotiations and place them in a good position to deliver shareholder value after deal completion.

The impact of cross-border deals

The international sample for our survey has provided some surprising results in relation to the issues faced by cross-border deals.

As we saw in chapter 3, cultural challenges commonly occur between legacy companies based within the same country. But the issue is accentuated when mergers occur between companies based in two or more separate countries. Language barriers, different working practices and lack of cultural understanding, are major obstacles to uniting the workforce behind a common vision and delivering benefit targets.

This difficulty is borne out by our survey. For the first time in a survey of its kind, we have been able to examine the relative success of major cross- border deals, as well as comparing the success rate of cross-border to domestic deals and distinctions between the performance of different national deals.

The results allow us to look at the impact on success:

■ of deal flows between different geographic regions;

■ when specific countries are involved in the deal, as either acquirer or target.

One interpretation for these results is that businesses in the UK and the US have historically conducted more cross-border deals, and therefore have the advantage of greater experience. Additionally, as discussed above, the UK and US have an increasingly strict regulatory code regarding merger benefits, which may be having an effect on overall success rates. Or it may simply be a question of mother tongue. If you do not talk in the same mother tongue, while you can communicate, subtle nuances may be missed or indeed misinterpreted and this can severely derail the sensitive integration process.

The graph brings out some key messages:

US/UK deals

■ benefit from many years of deal experience

■ same language and culture

■ high success rates are as expected

UK/Europe

■ the UK has extensive deal experience

■ the proximity between the UK and Europe means heightened cultural awareness, as compared with the more distant US

US/Europe

■ in spite of extensive deal experience, the US faces greater cultural differences and challenges in its deals with Europe

In a quirky result, the figure for domestic as opposed to cross-border deals gave a success rate of 11% below average. This may reflect the increasing number of domestic European deals taking place and may be due to the relative inexperience of European players compared with the UK and the US.

But the lack of deal experience by the Rest of the World (ie excluding the UK, Europe and North America) is reflected in a very poor success rate. Of the ten respondents in this category only one company was successful.

In conclusion, the survey suggests that companies entering into cross-border deals linking companies of disparate cultures or language, need to pay particular attention to the problems of cultural integration. They must focus effort on communication programmes and should look at reward systems to reinforce change management programmes. It also seems that experience pays, as the countries which have seen extensive consolidation over the past 30 years perform significantly better than the relative newcomers.

Conclusion

Balancing the keys

This survey, through its unique method of correlating deal activities against an objective measure of success, has allowed us to identify six particular components of the M&A process that have the most impact in unlocking value from a deal. Three of these relate to the hard mechanics of the transaction process, the other three to softer people matters.

The symmetry between the two areas is significant.

Too often, when planning and implementing an M&A deal, companies concentrate on the hard mechanics of value extraction. This is necessary, but by itself it will not be enough. However intensive the planning, however innovative the financing, and however watertight the contract, it is the people that will be key in implementing the mechanics of value extraction. Softer issues cannot be left to chance.

In the survey, those companies that moved beyond mere lip service and made a concerted effort to prioritise their people were rewarded with a far greater likelihood of deal success.

On the other hand, communication may well be clear, staff may well be motivated – but if the fundamental mechanics are flawed, and the framework is faulty, value extraction will prove equally elusive. We highlighted the benefits of an integrated approach to the hard keys. But we also showed the power of combining both hard and soft in an overall holistic approach to the transaction.

Put simply, during any deal, priorities must be taken – and our survey suggests where these should be. But these six areas should be a collective priority; by themselves they are not enough. A balance between the soft and the hard will be essential to successfully deliver shareholder value.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter