Publications The Right Combination: Managing Integration For Deal Success

- Publications

The Right Combination: Managing Integration For Deal Success

- Christopher Kummer

SHARE:

By Max Habeck – Ernst & Young

About the research

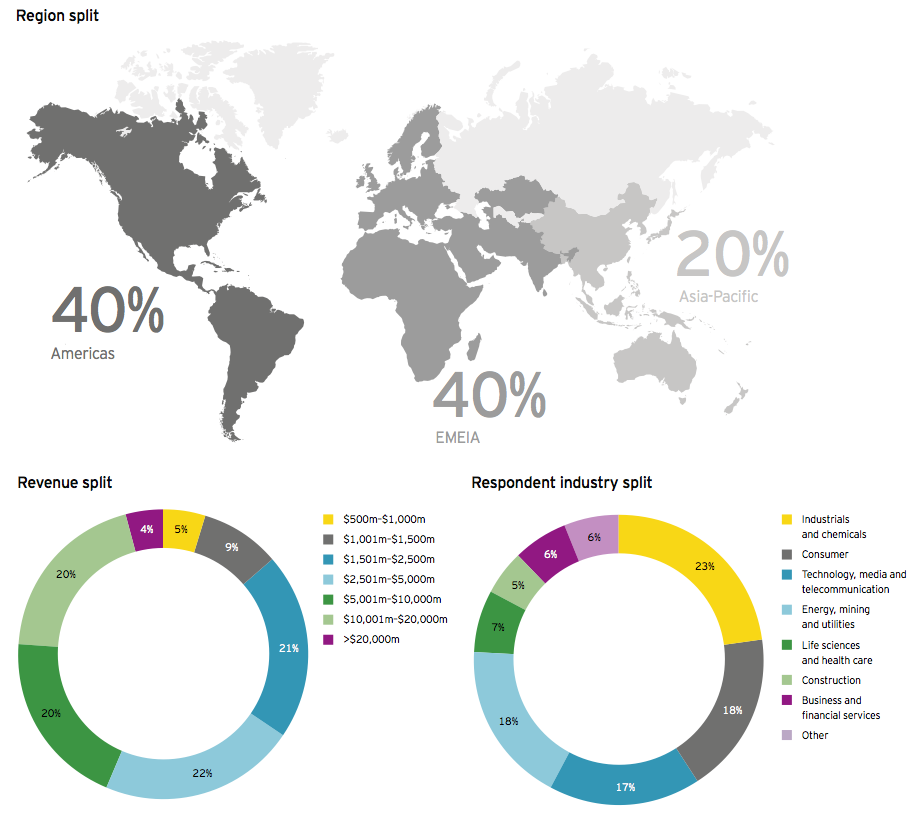

In H2 2013, Remark, the market research division of the Mergermarket Group, interviewed 200 senior corporate executives involved in the deal integration process. During the interviews, these executives offered insight into how the strategic rationale of their company’s last significant transaction shaped their integration strategy.

Using the Mergermarket database, Remark identified all those companies involved in an M&A transaction over the past two years that had an enterprise value in excess of US$450m. The company list was then filtered to include only firms with annual revenues of US$800m or above.

Executive respondents were drawn from the Americas, Asia-Pacific and Europe, Middle East, India and Africa (EMEIA) regions, representing a range of industries. All interviews were conducted by telephone. The results are reported anonymously and presented in aggregate.

Foreword

Post-deal integration is an incredibly challenging process and research shows that one in every two deals fails to achieve its strategic aims. We hope this study can help readers understand the common mistakes that companies make when integrating new acquisitions and how best to avoid these pitfalls.

We interviewed 200 senior corporate executives operating across a range of sectors and geographies, and involved in the deal integration process. Their responses provide a comprehensive overview of the relationship between deal rationale and integration strateqy, and a detailed analysis of the five key practices companies need to follow in order to deliver on their strategic goals when it comes to integration.

The results provide vital insights into what is driving M&A in the current market and how companies are aligning their integration strategies with deal rationales. Our headline result is that the integration of sales and marketing, and operations have become the focus areas for corporates post merger. The survey shows that these functions are regarded as the most important for increasing growth and scale.

With four-fifths of respondents indicatinq that qrowth is the main reason for undertakinq M&A, the priority given to integrating sales and marketing, and operations suggests that companies recognize the importance of linking deal and integration strategies.

The study also reveals how these priorities for integrations change according to geography and sector. The siqnificant differences in inteqration strateqies in different reqions is a key findinq qiven the focus on usinq M&A as a tool to expand into new qeoqraphies.

Integrating new acquisitions effectively post transaction is crucial if corporates are to realize the strategic ambitions for their deals. But companies are still making mistakes. More than a fifth of respondents say that they underbudqeted for inteqration costs. There is also evidence to suggest that acquirers are underestimatinq staffinq requirements and undervaluing the importance of IT in the integration process.

Many companies are not extracting the full potential value from mergers that they should. We hope that the information in this report can help to change that.

Key findings

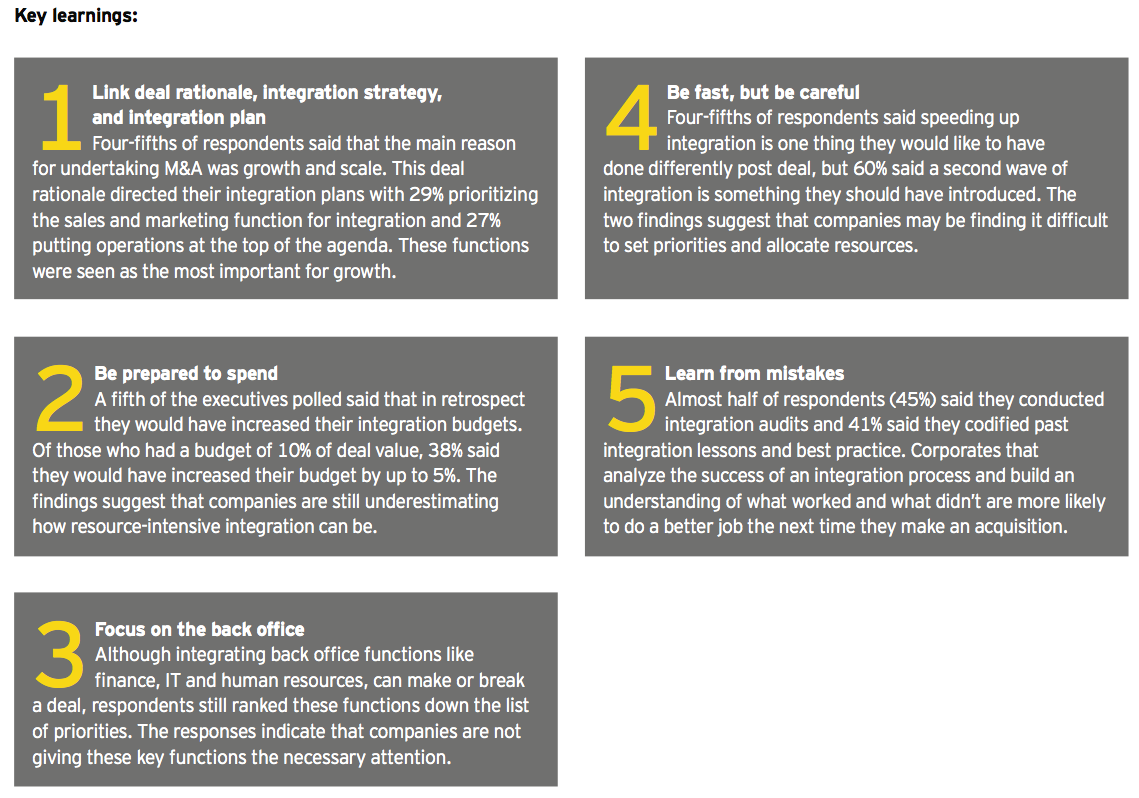

Companies that pursue M&A focus on growth and expansion. So, targeting the right functions for integration, spending resources accordingly and strong leadership are the keys to a successful integration.

84% cited building market share and scale as a key strategic driver for undertaking deals.

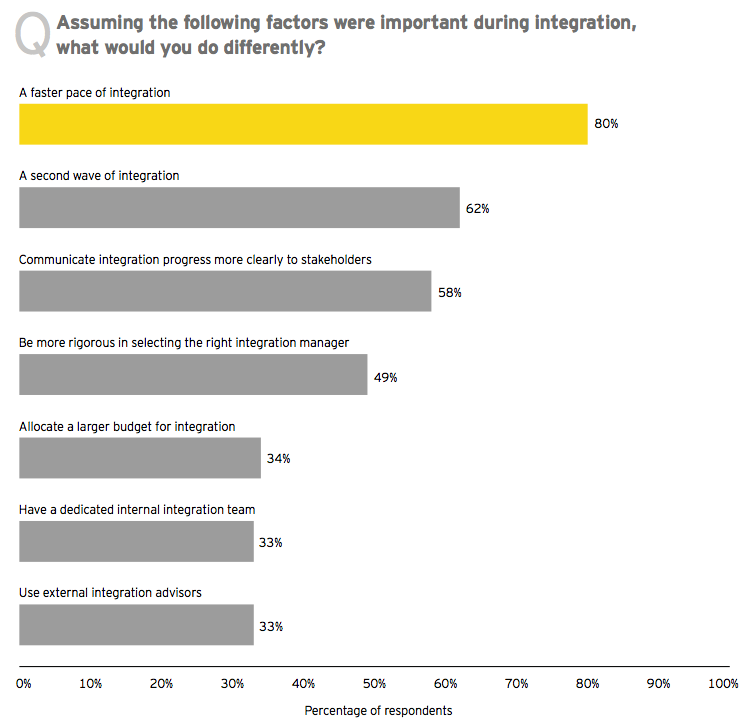

80% said they would speed up the pace of integration for their next deal.

29% stated that sales and marketing was the most important priority area during the integration phase. This was the highest of all functional areas.

With the global economy showing signs of recovery, corporate confidence is rising and executives are focusing on deals that can grow revenues and market share.

Our survey found that growth is back on the agenda for acquirers, with 84% of respondents citing building market share and scale as a key driver for doing deals in the last 12 to 24 months. Over a third cited growth as the main reason for pursuing an acquisition.

While the integration phase of a deal may not grab the headlines, the successful integration of a company into another is, in many ways, the only way to evaluate the outcome of a deal properly.

Our survey reveals five key practices that companies need to follow in order to deliver on their strategic goals when it comes to integration.

1. Concentrate on the core

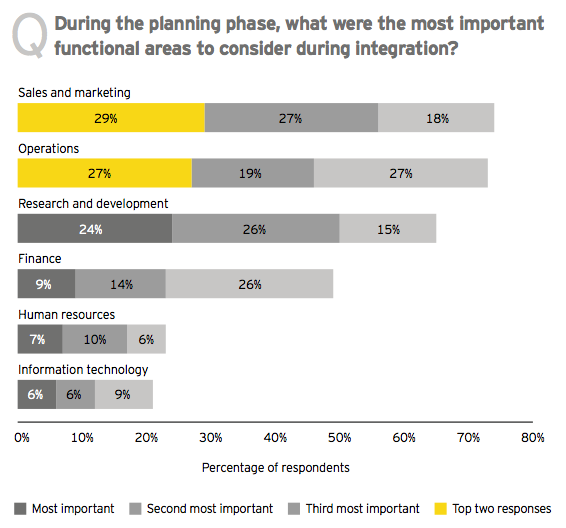

With growing scale and geographical expansion the main reasons for undertaking M&A, during the integration phase, the majority of respondents focus on integrating front office and key operational functions.

Sales and marketing (chosen by 29% of respondents) and operations (27%) were the functions given the most important priority. Back-office functions, such as finance and IT, where reduced costs were the main benefit, ranked lower. These results indicate that companies are recognizing the importance of integration as a key part of their strategy. Respondents also noted that the best integration processes involved defining a clear rationale from the outset and ensuring the rationale directed the integration strategy.

2. Balance the fundamentals

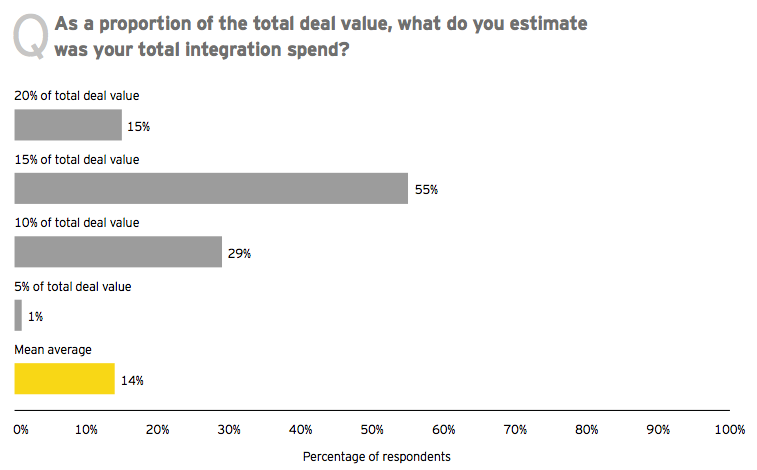

We found that companies, on average, spent 14% of deal value on integration. Mergermarket figures show the average deal size for disclosed value transactions over the past 12 months was €256m (US$366m). This suggests that the integration costs per deal are averaging out at €36m (US$50m).

There is evidence to suggest companies are not spending enough on their integration budget. Over a fifth of those surveyed stated that, in retrospect, they would have increased the size of their integration budget. Meanwhile, only 4% used 16 or more staff on their integration team. In addition, corporates seem to be undervaluing the importance of IT in the integration process.

3. Speed up, speak up and start a second wave

Speed of execution and communication were two areas identified by those polled as most in need of improvement. Tour-fifths of respondents said speeding up the integration process was one of the things they would have done differently. In addition, 58% said they could have communicated more clearly the progress of the integration process to all stakeholders. Although a large proportion of executives said speed was the area most in need of improvement, 60% also said that, in retrospect, they would have introduced a second wave of integration.

4. Never stop learning

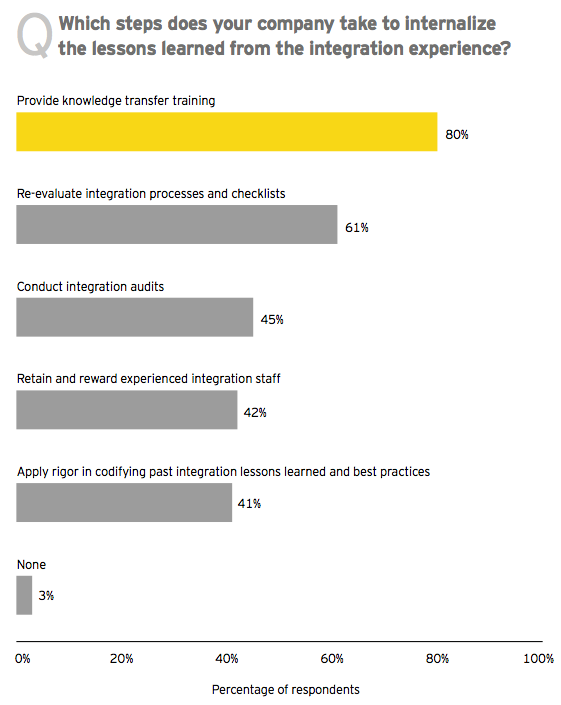

The executives surveyed agreed overwhelmingly that evaluating the success of a deal after integration was crucial, with only 3% saying that they took no steps to learn lessons from the process.

High-level financial synergy targets were cited as a key evaluation metric by the majority of respondents (77%), with changes in capital productivity (75%) and meeting integration targets (65%) also featuring prominently in responses. In terms of learning lessons from integration, the provision of knowledge transfer training was the tool of choice, cited by 80% of executives.

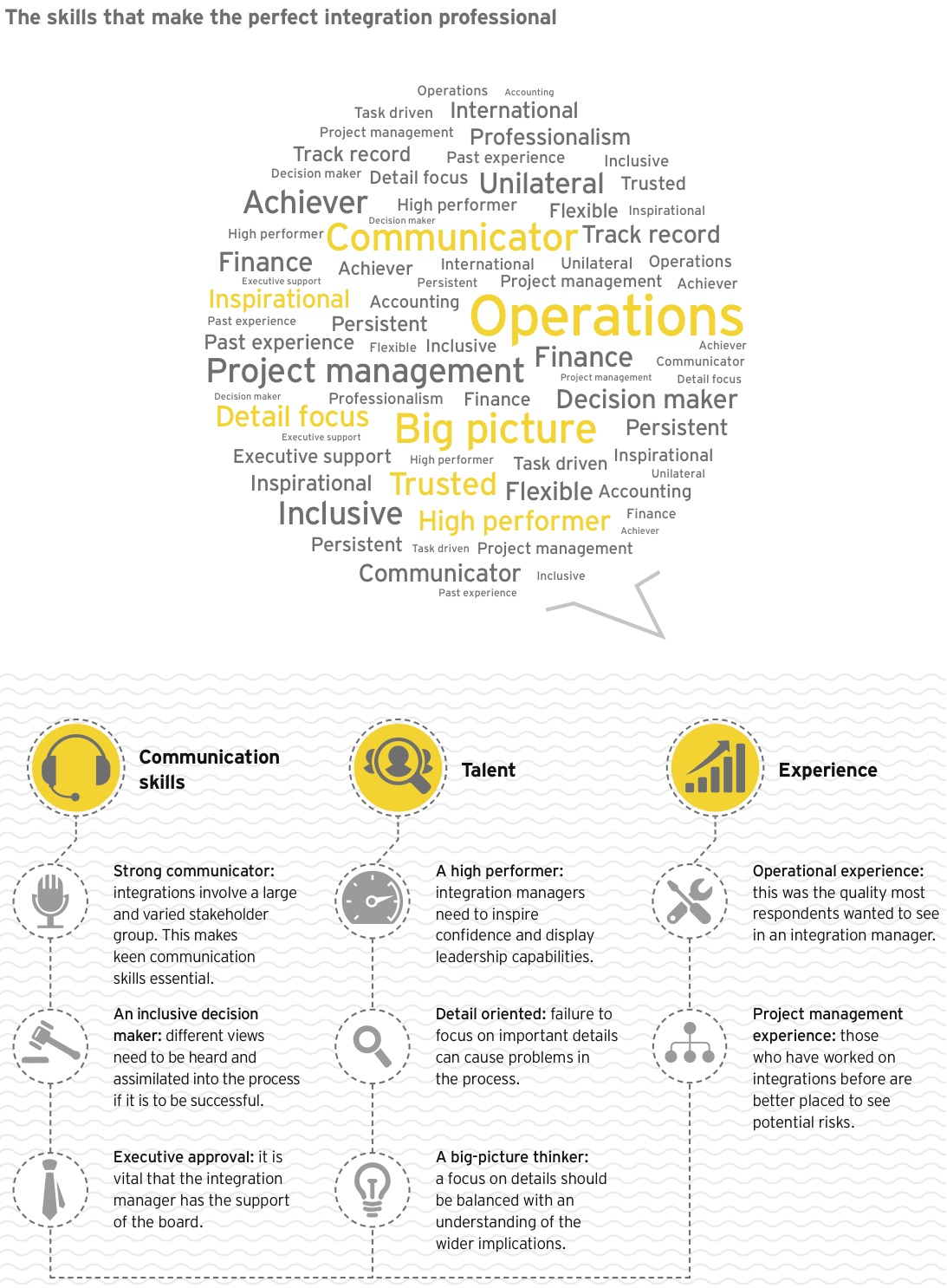

5. Get the right manager for the job

The survey also revealed the high value that integration managers brought to their companies. The findings showed that executives expect their integration managers to display a wide range of skills. Operational experience was the key factor, according to 86% of those surveyed. Respondents were eager to recognize integration managers who performed well, with the role offering career progression opportunities and financial incentives.

Merge for growth

Scale and expansion emerge as the key strategic drivers for M&A activity as corporates put growth back on the agenda

84% said building market share and scale was one of the strategic drivers behind their last deal.

This included 35% of respondents that ranked it as the most important reason for doing their last deal.

As the world economy emerges from the economic downturn, growth is picking up once again. The International Monetary Fund (IMT) forecasts global growth to average 3.7% in 2014, up from 3% in 2013. And confidence levels among corporates are also on the rise — for example, according to the latest Economist / FT Business Barometer, published in February 2014, 36% of executives surveyed planned to increase capital investment this year – with only 8.4% looking to decrease spending.

One respondent, the Director of Finance for a Mexican beverages group, confirms this view. “Economies around the globe have been stabilizing over the past 12 to 24 months, which has given rise to more M&A deal volume in emerging markets,” he said.

Growth and expansion drive M&A

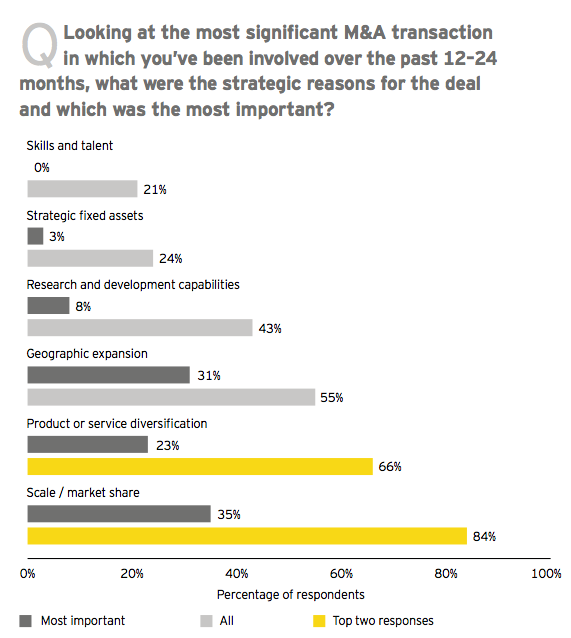

This optimism is borne out by the results of the survey. For most respondents, driving scale and geographic expansion, rather than finding synergies and cutting costs, underpinned the M&A rationale.

More than four-fifths of respondents (84%) said building market share and scale was the strategic rationale for doing their most significant deal in the last 12 to 24 months, with 35% ranking it as the most important reason for doing a deal.

“Economies around the globe have been stabilizing over the past 12 to 24 months, which has given rise to more M&A deal volume in emerging markets.” – Director of Finance, Mexican beverages group

In contrast, doing a deal to acquire strategic fixed assets was only cited by 24% of executives as a reason for doing a deal, with only 3% saying it was the most important strategic rationale for a transaction.

Although product and service diversification was identified by a higher proportion of respondents (66%) than geographic expansion (55%) overall, when it came to selecting the most important driver of a deal, a higher proportion choose geographic expansion (31%) over product or service diversification (23%).

Japanese drinks company Suntory’s US$16b acquisition of Beam Inc, the business behind the Jim Beam bourbon brand, demonstrates that corporates are making acquisitions to break into new geographies and expand scale. The Beam Inc deal, announced in January 2014, will strengthen Suntory’s position in the US market and make the group the third-largest distiller in the world.

The Jim Beam deal followed a similar move from Suntory in September 2013 when it acquired the Lucozade and Ribena drinks brands from GlaxoSmithKline in a US$2.1b deal. This transaction gave Suntory market platforms in Malaysia and Nigeria.

“Geographic expansion has been the core strategy behind our acquisitions in the last few years. Markets like Canada and Africa have always been on our radar. We targeted Canada with an aim to expand our reach and acquire new resources with better technology to improve our operations and services.” – CFO, Brazilian energy and resources group

Regional variations

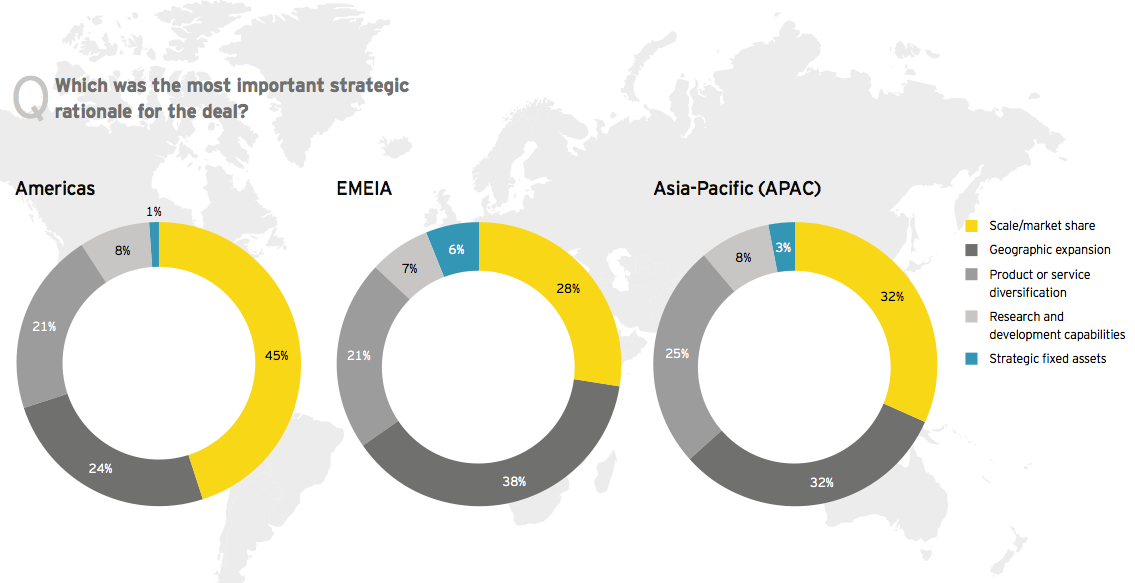

Increasing scale and market share was especially important for executives in the Americas. Of those polled in this region, 45% identified it as the primary strategic deal driver for their last significant transaction, 10 percentage points higher than the overall survey poll.

“The acquisition we did was strategically very important for us. The transaction not only extended our global footprint but also gave us access to a low-cost platform and improved our services to customers with redefined production and distribution processes,” said the Director of Strategy of a Mexican consumer goods company.

For companies in EMEIA, expanding their geographic footprint emerged as the key driver of deals. Of the respondents polled in EMEIA, 38% ranked geographic expansion as the most important deal driver. No strategic driver in the region ranked higher.

“The deal further strengthened our strong foothold in the already competitive and concentrated European market and also meets our strategy to penetrate new countries in Europe,” said the Director of Finance at a Belgian business services provider.

For APAC-based companies, geographic expansion shared the top spot with achieving scale and market share, as the key motivation for deal-making, with both selected by 32% of respondents.

“Achieving geographic expansion in today’s climate is vital to business growth and success. We tapped the right market at the right time and we forecasted significant growth in the APAC market,” said the Director of Strategy at a Chinese manufacturing company.

Talent: the phony war

While companies are focusing on getting bigger and expanding geographically, the survey indicates that corporates are not using deals as an opportunity to bring new skill sets into the business. But could this be a mistake, particularly when entering new territories?

The survey demonstrates that building scale and breaking into new markets are the main reasons for undertaking M&A. However, making an acquisition can also bring new talent into a business.

The survey found that companies could be overlooking this opportunity when doing deals. Just 21% of executives identified acquiring skills and talent as a factor for undertaking their last major transaction. None of the respondents ranked it as the most important reason for a deal.

The low priority placed on bringing in key people through M&A stands in contrast to the notion that in order to remain competitive and successful businesses need to win the “war for talent.” Survey responses from executives indicate that companies see bringing in new, talented staff as an added bonus of a deal.

“To grow market share in an environment where organic growth is hard to come by, we pursued acquisitions. This not only helped in growing market share but also provided us with new skills and talent,” the Chief Strategy Officer of a US-based manufacturer said.

The need to “keep the keepers”

The Finance Director of a Belgian business services company added that the skills brought in following a deal had helped to service clients better, even though the primary reason for the transaction was to break into other European markets.

“The deal strengthened our foothold in the competitive and concentrated European market and meets our strategy to penetrate new countries in Europe. With new skills and talent on board, we are able to provide expert solution to clients,” the Finance Director said.

This comment highlights that the importance of talent within a target company can be underestimated.

Operating in a new market may require skills and local knowledge that the acquiring company lacks. Companies may need to place more emphasis on the talent that they are acquiring, and, in particular, put in place the resources to secure the commitment of individuals that are essential to the organization’s future success.

Concentrate on the core

The emphasis on growth makes sales and marketing and operations the key departments targeted for integration

29% of respondents said sales and marketing integration was the top area of consideration for their last major deal.

27% identified operations as the most important area, but it was nonetheless targeted for a higher level of integration than sales and marketing.

Front office and operations are the focus of integration

It is unsurprising that, with the focus on growth and expansion, companies are prioritizing sales and marketing and operations for integration in the post-deal period.

Sales and marketing integration was the function identified by most executives as the key consideration for their last major deal, with 29% saying it was their integration priority.

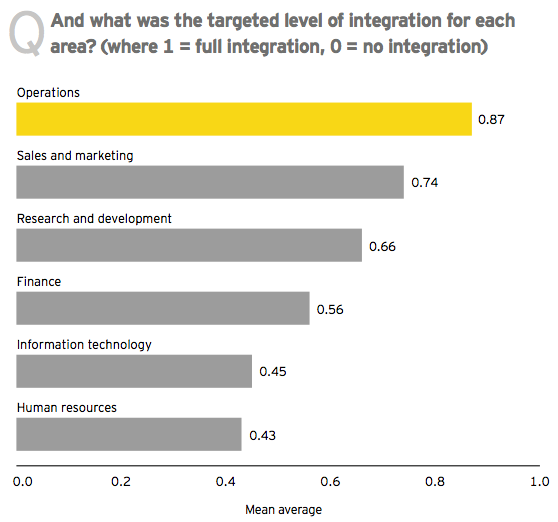

Sales and marketing also ranked highly when it came to the degree of post-acquisition integration, achieving an average integration score of 0.74, where 1 equals full integration and 0 represents no integration.

Close operational integration is a priority

Although operations was chosen as the most important function for amalgamation by slightly fewer executives (27%), it was targeted for a higher level of integration, recording an average integration score of 0.87. “Aligning the strategies and operations, and integrating operations completely is critical to determining the long-term deal objectives,” said the Executive Vice President of Strategy & Integration at a Finnish industrial products group.

R&D also ranked highly, with 24% putting it at the top of their integration agenda. “New product development is critical to the competitive positioning of our company and to better leverage design and engineering expertise,” said the Director of M&A at a Netherlands-based technology, media and telecommunications (TMT) company. “Collaboration in new product development and design was the long-term synergy we aimed for. To realize it, we pushed for a quick and coordinated integration of R&D.”

Back office on the backburner

Back-office functions such as finance (9%), human resources (HR) (7%) and information technology (IT) (6%) were ranked in the bottom three positions by respondents in the survey.

The findings suggest executives are more interested in growth, less so in cutting costs and synergies. It is important, however, to recognize that organizations typically expect finance, HR and IT to be integrated as a matter of course. The successful integration of sales and marketing, which is linked to upside growth, is less certain and therefore more likely to be at the forefront of an executive’s mind. Yet a failure to integrate back-office functions can make it impossible to achieve other integration goals.

“When transacting in emerging markets, companies should pay as much attention to risk mitigation as growth synergy realization,” said Yew-Poh Mak, EY Greater China Operational Transaction Services Leader. “For example, compliance risks like FCPA (Foreign Corrupt Practices Act), fraudulent accounting and local labor law adherence should not derail the strategic intent of the merger.”

Integration in support ofstrategy

Whether the reasons for a deal were geographic growth, diversification or market share, respondents highlighted the close links that exist between deal rationale and integration strategy.

The best integration processes involved defining a clear rationale for the deal from the outset and ensuring that rationale sets the agenda for the integration strategy accordingly.

“The deal rationale helped us in creating KPIs to measure the performance of the integration,” said the Head of Strategy at a UK-based aerospace company.

The Managing Director of a Colombian industrial company said: “As the main motive was geographic expansion, we had to understand the potential challenges and issues that could affect the deal internationally. We had to align our strategy accordingly, which helped us progress smoothly during implementation and the integration process.”

“Whether the reasons for a deal were geographic growth, diversification or market share, companies need to strike the right balance between budget, time and team size. This is even more important, as the right sequence of a transaction process is a mystery to many companies.” – Max Habeck, Global Operational Transaction Services Leader, EY

Balancing act

The survey shows that companies need to strike the right balance between budget, time and team size

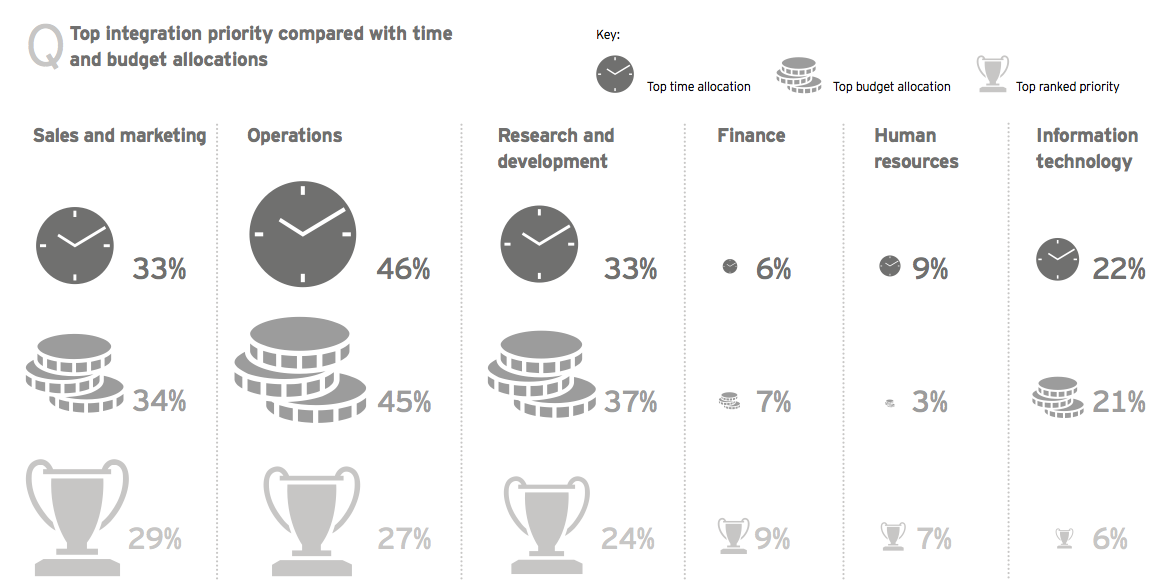

46% allocated the most time to operations in the integration process.

45% of acquirers allocated the largest budget to operations in the integration process.

21% of respondents said, in retrospect, they would have increased their integration budget.

Minimum spend

Any executive undertaking a transaction will, of course, incur additional integration costs.

The survey found that, on average, integration budgets ran at 14% of the deal value.

Figures from Mergermarket show that the average deal size for disclosed value transactions over the past 12 months was €256m (US$342m), suggesting that integration costs per deal are averaging out at €36m (US$50m).

This equates to total expenditure of €234.4b on integration during 2013, with €102.7b of this in North America, €74.6b in EMEIA and €47.9b in the APAC region.

Budgeting challenges

According to the Cass Business School, around 70% of mergers fail to create value. The strategic reasons for doing a deal may work in theory, but the practicalities of integration mean companies often miss these value creation opportunities. Attention and resource needs to be invested in the integration process to ensure that the strategic reasons for a deal are fulfilled. Some 66% of respondents said that they were happy with their integration budget for their last acquisition. However, just over a fifth of the executives polled said that, in retrospect, they would have increased their integration budgets, while only 14% said they would have cut the integration budget.

Of the respondents who had a budget of 10% of deal value, 38% said they would have increased their budget by up to 5% in hindsight.

In these cases, the findings suggest that executives are underestimating the cost involved in integrating.

Acquirers primarily motivated by R&D were the most likely to want to increase the budget (29%), whereas those driven by the acquisition of strategic fixed assets were the most likely to decrease the budget (18%).

Larger teams

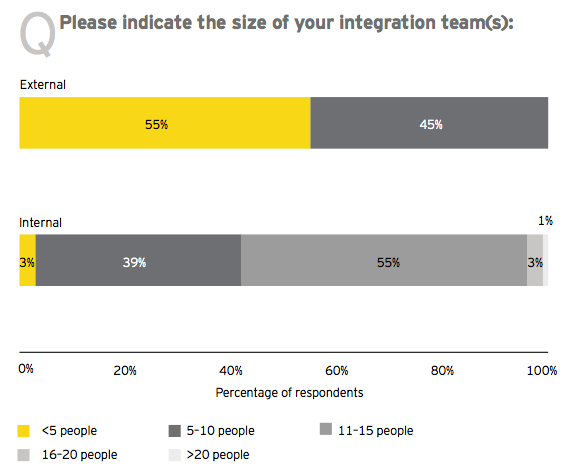

It would also appear that corporates are underestimating team sizes when it comes to integration. Only 4% of corporates use teams with more than 16 people, while 96% use 15 people or fewer (including 42% that use fewer than 10).

Spending time and money where it’s needed

Although the survey suggests that integration budgets are running at well over a 10th of deal value, the findings indicate that companies are deploying those resources in line with the strategic rationales for their deals.

Operations received the greatest allocation of time and money among half of respondents. Sales and marketing and R&D receive the top time and budget allocation in roughly a third of responses. IT received the most time and cash in a fifth of responses, with human resources and finance doing so in less than 1 in 10.

These figures suggest that, on the whole, companies are doing a good job of allocating the bulk of their integration resources to support the strategic aims of their transactions. This contrasts with the significant underestimating of the manpower required to drive through integration.

“I think companies come to the realization that they under- prioritized IT too late, when all of a sudden product shipments cannot be guaranteed anymore, or stockkeeping unit rationalization cannot happen, or vendor prices remain a mystery and a deal’s rationale is at risk of falling off the agenda.” – Jeffery S. Perry, US Operational Transaction Services Leader, EY

Set a place for IT at the top table

While allocation of time and resources is broadly in line with the top priorities, the position of IT in the integration process needs to be reviewed.

Despite its operational importance, IT ranks as the top integration priority for just a handful of executives.

Only 6% of the respondents to the survey say IT is the top integration priority. Interestingly, however, although few executives say they focus on IT as a top priority, more than a fifth end up allocating the top proportion of time and money resources to IT integration.

This suggests that IT is underprioritized in the integration process and that, because of this, executives end up spending more on it than anticipated.

A separate EY report, IT as a driver of M&A success, echoes these findings. This report revealed that 47% of companies felt, in retrospect, that more detailed IT due diligence could have prevented value erosion. A fifth of the participants in this study recognized IT as one of the most pressing post-transaction challenges, despite the significant potential for lost value.

With most respondents focused on expansion and breaking into new markets, back office functions such as IT have fallen down the priority list.

This can make it harder to find a place for IT at the M&A table. The EY IT as a driver of M&A success report found that only 50% of respondents involve IT in the transaction process compared with almost 80% for finance.

Many respondents reported inaccurate cost estimates and timelines as a result of not bringing IT to the table early enough. The mismatch between prioritization and resource allocation, which this survey reveals, echoes this observation.

Lessons learned: speed up, speak up and start a second wave

If given the chance to do their last deal again, executives would integrate faster, improve communications and introduce a second wave of integration

80% of respondents said, in retrospect, they would have quickened the pace of integration.

62% of respondents would have introduced a second wave of integration.

58% of acquirers would have communicated integration progress to their stakeholders.

Speed versus thoroughness

It is unsurprising that four-fifths of respondents said speeding up the integration process was one of the things they would have done differently. After all, the sooner you integrate, the sooner you can get back to focusing on your core business and increasing earnings.

“Completing the deal before time is always a plus point because the business can then focus on increasing revenues by focusing more on core operations and performance,” said the Director of Finance at a Canadian TMT company.

Increased speed is identified as one of the key benefits of using external advisors by the Director of M&A at a Finnish TMT company. “External integration advisors save us a lot of time and extra effort, resulting in a faster integration process. The external advisor should have the skill and expertise of carrying out the integration and be able to keep in mind the business objectives and scope.”

Executives who targeted deals in order to acquire strategic assets were the ones who placed the greatest emphasis on speed of integration. Among these respondents, 41% said it was the main thing they would do differently.

“Completing the deal before time is always a plus point because the business can then focus on increasing revenues by focusing more on core operations and performance.” – Director of Finance, Canadian TMT company

Yet despite the clear desire to accelerate the integration process, almost two-thirds of respondents (62%) also said a second wave of integration is something they would have introduced into the process. A fifth of those polled cited second-wave integration as the single most important thing they would change if they could do a deal again.

“A second wave helps identify the ignored issues that can affect the deal performance in the future. Double checking and measuring the performance continuously is essential,” the CFO of a diversified industrials company in the Philippines said.

Second-wave integration was most important to investors making acquisitions for R&D or to build market share, with 21% and 22% of the respondents in each group respectively saying this would be their priority. However, for both these strategic rationales, R&D investors (29%) and acquirers of market share (34%) ranked integration speed as the primary factor they would do differently.

These two findings suggest that companies may be finding it difficult to set their integration priorities and allocate resources accordingly.

Listen carefully, act decisively

External advisors could help clients strike the right balance between speed and thoroughness. A third of respondents saw value in bringing in third-party advisors. Expertise in the integration process itself was the area in which external advisors were most useful, according to the survey.

An increased focus in the initial phases of an integration process on back-office functions, such as HR, finance and IT (areas that ranked down the list of priorities in the survey), could reduce the need for a second wave of integration, thereby speeding up the process.

Communication is key

After speed of execution and second-wave integration, communication was the third most important item respondents said they would approach differently, with 58% saying they could have improved their communication of the progress of integration to stakeholders.

One in five of the executives polled said communication would be the area they would look to improve the most if they were to conduct the transaction again.

It is unsurprising that communication is an area respondents recognize as one that can be improved. An integration process affects a wide variety of stakeholders with different interests. Tailoring individual messages to each audience can be complex and difficult to execute.

Employees can lose motivation if it is unclear how a merger will affect their responsibilities and reporting lines. Shareholders need information on the progress of an integration and its financial benefits to set valuations. Suppliers, distributors and customers require guidance on how a merger will impact their relationship with a company.

A well-planned and detailed communication strategy can reduce these risks.

“In the end, integration, despite all the planning and thinking it through, remains an art and less a science. While a business may move into it scientifically, on-the-ground management judgment based on experience and sound advice is one of the key differentiators.” – Jeffery S. Perry, US Operational Transaction Services Leader, EY

Dealing with difference

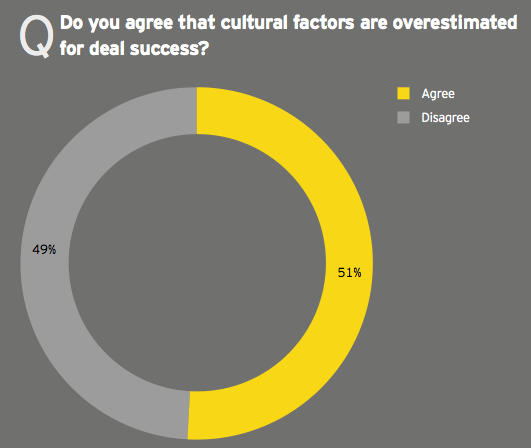

The issue of cultural factors in the integration process splits respondents right down the middle. Yet cultural differences can be a key factor in successful integration, particularly in cross-border deals.

It is not easy bringing two distinct corporate cultures together following a transaction. The process has been described as like a new marriage or the first day of school.

Some survey respondents are well aware of the difficulties involved in bringing different business cultures together.

“We do face cultural difficulties and it is challenging to deliver synergies where the work cultures are different,” said the Chief Integration Officer of a US-based energy company. “Cultural differences can have a big effect on a deal’s success and could even lead to huge monetary losses. Focusing on forming one culture was our priority and the managing team did their duty well.”

Split over cultural differences

Yet despite the risks posed to integration by cultural differences, just over half the executives polled believe the influence of cultural factors is overestimated.

When this response is analyzed alongside other findings regarding HR, communication, bringing in talent and evaluating integration success, there is evidence to suggest that companies could benefit from giving HR and cultural issues higher priority.

Human resources ranks low on the list of priorities for integration with just 7% saying it is the main post-deal focus area. Executives also pay limited attention to the acquisition of people and skills. Just 21% of respondents say it is a factor in a deal and none rank it as the most important factor.

When evaluating integration, respondents see financial synergy targets and capital productivity measures as the best way to gauge success. In contrast, improved employee satisfaction surveys rank third from bottom on the list of options.

Building a cultural dialogue

Companies do recognize the need to improve the way they communicate, with 58% of executives saying that this is an area that they could have improved upon in their last deal.

Recognizing how risky clashing business cultures can be may help facilitate better dialogue. If communication is improved, cultural differences can be picked up earlier and be better addressed.

Integration teams should be aware that cultural factors go beyond language and geography. Integrating companies of different sizes presents risks too.

Smaller companies may have shorter reporting lines, faster decision-making processes and a more familiar business culture. If an acquirer is a large multinational, employees and management teams, on both sides, can find it difficult to adjust post deal.

“ When transacting in emerging markets, companies should pay as much attention to risk mitigation as growth synergy realization. For example, compliance risks like Foreign Corrupt Practices Act, fraudulent accounting and local labor law adherence, should not derail the strategic intent of the merger.

It may be difficult to define how cultural integration actually works. Two companies with different DNAs when merged together will naturally have conflicts. This is a certainty.

The key success factor, rather then trying to impose one’s culture onto the other, or vice vera, no matter who’s business is bigger or more profitable, is to create a shared vision of the way forward.

Take what works from each other’s culture, aim to achieve the best of both worlds!“ – Yew-Poh Mak, Greater China Operational Transaction Services Leader, EY

Cultural clashes can be costly

The Director of M&A at an Indian automotive company observes that failure to address differing corporate cultures can prove costly.

“Working with two different cultural environments is frustrating for the employees as there are no structured processes to be followed,” the M&A Director said. “There are differences created between the two companies, which lead to diminishing synergies and productivity. Hence cultural differences need to be resolved and a single work culture should be adopted.”

Improving integration

Financial synergy targets, improvements to capital productivity and integration milestones are the key metrics companies use to judge the success of integration

77% of respondents look to high-level financial synergy targets such as EBIT and EBITDA when evaluating integration success.

75% look to changes in capital productivity when evaluating integration success.

65% look at integration milestones when evaluating integration success.

Evaluating the success of a deal and the subsequent integration of the target is a crucial part of the process. It is a necessary step if a company is to improve its integration processes in the future.

“Re-evaluation is a must,” said the Vice-President of Strategy and M&A at a construction company based in Trance. “It is necessary to check the progress on a timely basis in order to avoid any issues in the middle of the integration process. Proper re-evaluation will help identify the hidden challenges and decision-makers can take appropriate actions to overcome them.”

Measuring performance

There are a variety of measurements that can be used to evaluate the progress of integration. High-level financial synergy targets were cited as the most valuable, with 77% of participants saying this was the metric they used.

“Improving financial synergies is the main factor because it determines the deal success. It is essential to pay close attention and revolve actions around the areas that need most attention,” said the Senior Vice-President of Finance at a Canadian mining company.

A positive change in capital productivity followed a close second.

This measurement was selected by 75% of the executives surveyed.

“Monitoring the performance of each and every step we take during integration is necessary because it detects the challenges — and these challenges can then be addressed immediately,” said the Head of Finance at a Philippines-based conglomerate.

Meeting integration milestones ranked as the third most popular evaluation tool, with support from 65% of respondents.

“Monitoring the performance of each and every step we take during integration is necessary because it detects the challenges — and these challenges can then be addressed immediately.” – Head of Finance, Philippines-based conglomerate

Driving improvement

Once the integration process has been evaluated, undertaking formal steps to learn lessons from the process can be beneficial. The value of building a pool of integration experience should not be underestimated.

“To have experienced integration staff on board is a plus point because they can handle the processes more effectively through their experience,” said the Vice-President of Corporate Development at a Canadian oil and gas company. “They are the most important at these times. They can do the implementation a lot faster and can save on the time needed to get all the processes aligned.”

The provision of knowledge transfer training to help learn the lessons from integration was the most common practice among survey respondents (80%). Re-evaluating integration processes and checklists was the next most popular option, chosen by 61% of the executives polled.

Almost half of executives (45%) said they conducted integration audits. Codifying past integration lessons and best practices was listed by 41% of respondents.

With experience recognized as a valuable asset in a integration process, 42% of respondents said retaining and rewarding key staff was important.

“Recognition and rewards are what key people involved in the integration process expect. They look for motivation and rewards either in monetary terms or appreciations from the senior officials,” said a Japanese energy company’s Director of Finance.

Only 3% of respondents said they took no steps to internalize lessons from an integration process.

Integration superhero: the powers required

Individuals can add huge value to an integration process. The role of the integration manager is a demanding one, but there are rewards on offer for those who can do the job well.

86% of respondents stated operational experience as the most important professional attribute for an integration manager.

71% of respondents stated excellent communication skills as the most important professional attribute for an integration manager.

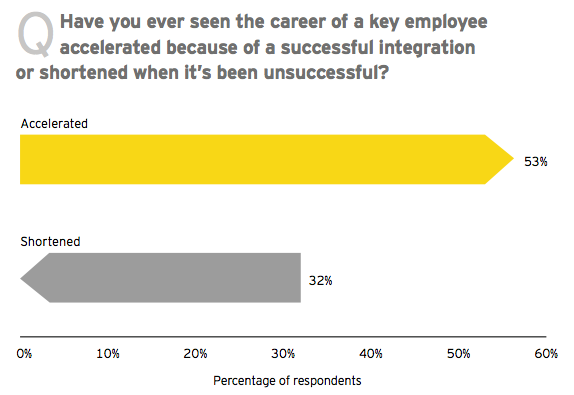

53% of respondents have seen the career of a key employee accelerated by a successful integration.

The failure of an integration process can cost companies significant value. Businesses are eager to reward and retain staff who have a track record of working successfully on integration processes. But they have high expectations of people tasked with the job.

Best of the best

Given the importance of the integration manager role, the demands that come with it are wide ranging. Operational experience was identified as the key attribute for an integration manager by 86% of respondents.

An eye for detail and excellent communication were the next most important skills (71% each). Big-picture thinking (69%), being task driven (66%) and being a high performer (65%) also ranked highly.

Inclusive decision-making skills, project management experience, executive management acceptance and a track record of achievement were also identified as important attributes.

A career opportunity

Only the very best candidates are trusted with running an integration process. So it is unsurprising that the role can aid career progression.

“Certainly, we do reward the good performers who have helped in the integration. They add value to the business — and people who add value are always an asset. So, with the extended experience and their success ratio, their careers are accelerated or shortened based on their performance,” said the Director of Finance at a Swiss consumer foods company.

The survey found that 53% of respondents had seen the career of a key employee accelerated after successfully executing a deal integration.

Equally, those who were not seen to pull their weight were moved on. Close to a third (32%) of respondents said they had seen a career shortened when an integration process had been unsuccessful. The success or failure of an integration can have huge repercussions for a company’s long-term strategic plans and growth prospects. Managers who can integrate key acquisitions successfully are highly valued and rewarded accordingly.

“We see some acquirers bring in an integration manager to take care of the process and leave the target’s management in charge of the business. Otherwise there is a risk of one individual trying to stay on top of the integration process while getting involved in the day-to-day operations. This would likely result in losing sight of what’s really important.” – Max Habeck, Global Operational Transaction Services Leader, EY

“A client, who was head of M&A at a life sciences company, recently told me they have not determined an integration manager and are still not sure who it should be. The two people they have in mind are both too important for the business. But can it really be a person from elsewhere?“ – Samy Walleyo, Operational Transaction Services, Partner, EY, Germany

“My view is that prior integration process experience is a must to succeed. If you have it in-house, great. If not, you better get it.“ – Max Habeck, Global Operational Transaction Services Leader, EY

The mind of a manager

Conclusions

The integration process is complex and challenging. If it’s done well, it can help businesses grow and succeed. However, if it’s done badly, it can result in significant loss of value. We hope that the key learnings below can help companies and their integration managers navigate the demands of the process, identify where obstacles lie and how best to deal with them.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter