Publications Taxation Of Cross-Border Mergers And Acquisitions: Japan 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: Japan 2014

- Christopher Kummer

SHARE:

By KPMG

Introduction

This chapter provides insight into tax issues that need to be considered when mergers and acquisitions (M&A) are contemplated in Japan.

Recent developments

Under the 2011 tax reform, the national corporation tax rate was reduced from 30 percent to 25.5 percent for fiscal years beginning on or after 1 April 2012. Accordingly, taking all the national and local taxes into account, the effective statutory tax rate for large companies in Tokyo was reduced from 40.69 percent to 35.64 percent.

After the 11 March 2011 earthquake, a special reconstruction tax was introduced, which is levied on corporation tax liability from 2012 to 2015 and on income tax liability from 2013 to 2037. As part of the economic stimulus package intended to mitigate backlash from the increased consumption tax rate, the special reconstruction tax on corporate tax liability is expected to be abolished in April 2014, one year earlier than planned.

The consumption tax rate is scheduled to increase in two steps: to 8 percent on 1 April 2014 and to 10 percent on 1 October 2015. Whether the rate will be raised to 10 percent as scheduled will be reconsidered before implementation.

Asset purchase or share purchase

The following sections discuss issues that need to be considered from a Japanese tax perspective when a purchase of either assets or shares is contemplated. A summary of the advantages and disadvantages of each alternative is provided at the end of this chapter.

Purchase of assets

In an asset deal, the selling entity realizes a gain or loss in the amount of the difference between the sale price and the tax book value of the assets sold, and the assets have a new base cost in the purchaser’s hands.

Purchase price

For tax purposes, in an asset deal, the purchase price should be allocated among individual assets based on their respective market values. In the case of a purchase of a business, the excess of the purchase price over the total of the values allocated to each individual asset is treated as goodwill for tax purposes. Any excess of the total of values of the individual assets over the purchase price constitutes negative goodwill for tax purposes.

Goodwill

For tax purposes, goodwill recognized in a purchase of business should be amortized over 5 years (20 percent of the base cost annually). The amortization should be treated as deductible. Negative goodwill also should be amortized over 5 years (20 percent of the base cost annually), and the amortization should be treated as taxable. Unlike the depreciation of tangible assets or the amortization of intangible assets explained later in this chapter, the amortization of goodwill or negative goodwill recognized in a purchase of business for tax purposes is not affected by the accounting treatment.

Depreciation

Generally, a company may select either the straight-line method or the declining-balance method to compute the depreciation of each class of tangible assets. The default depreciation method for most assets is the declining-balance method. For buildings and certain leased assets, the straight-line method must be used. Intangible assets also must be amortized using the straight-line method.

The depreciation and amortization allowable for tax purposes is computed in accordance with the statutory useful lives of the assets provided in the Ministry of Finance ordinance. For secondhand assets, shorter useful lives could be applied.

The depreciation or amortization must be recorded in the statutory books of account to claim a tax deduction. The amount of depreciation or amortization in excess of the allowable limit for tax purposes must be added back to the profits in calculating taxable income. If the book depreciation or amortization amount is less than the allowable amount for tax purposes, no adjustment is required, and the asset effectively gains an extension of its useful life for tax purposes.

Tax attributes

Tax losses and other tax attributes are not transferred to the purchaser in an asset deal.

Value added tax

Japanese consumption tax, similar to valued added tax (VAT), is levied on a sale or lease of an asset in Japan and a supply of service in Japan. The current rate of consumption tax is 5 percent, but a number of transactions are specifically excluded, such as the sale of land or securities. A sale of business in Japan is treated as a sale of individual assets for consumption tax purposes and should be subject to consumption tax, depending on the type of asset transferred. A sale of goodwill in Japan is a taxable transaction for consumption tax purposes.

The consumption tax rate is scheduled to increase in two steps: to 8 percent on 1 April 2014 and to 10 percent on 1 October 2015. Whether the rate will be raised to 10 percent as scheduled will be reconsidered before implementation.

Transfer taxes

Stamp duty is levied on a business transfer agreement. The amount of stamp duty is determined according to the value stated in the agreement. The maximum amount of stamp duty is 600,000 Japanese yen (JPY).

If real estate is transferred in a business transfer, registration tax and real estate acquisition tax are levied. These taxes are subject to a number of temporary reductions and reliefs, and the tax rates differ depending on the type of acquiring entity (e.g. trust, special-purpose vehicle). When the acquiring entity is an ordinary corporation, registration tax is levied in principle at 2 percent of the appraised value of the property. For land, the tax rate is reduced to 1.5 percent until 31 March 2015.

Real estate acquisition tax is levied at 4 percent of the appraised value of the property. This rate has been reduced to 3 percent until 31 March 2015 for land and residential buildings. Further, when land is acquired by 31 March 2015, the tax base of such land will be reduced by 50 percent.

Purchase of shares

In a share purchase, the purchaser does not achieve a step-up of the base cost of the target company’s underlying assets.

Tax indemnities and warranties

In a share purchase, the purchaser takes over the target company’s liabilities, including contingent liabilities. In the case of negotiated acquisitions, it is usual for the purchaser to request, and the seller to provide, indemnities or warranties as to any undisclosed tax liabilities of the company to be acquired. The extent of the indemnities or warranties is a matter for negotiation. When an acquisition is made by way of a hostile takeover, the nature of the acquisition makes it impossible to seek warranties or indemnities.

Tax losses

Tax losses may be carried forward for 9 years (7 years for tax losses incurred in fiscal years ending before 1 April 2008).

The deductible amount of tax losses is limited to 80 percent of taxable income for the fiscal year, except for small and medium-sized companies and tax-qualifying Tokutei Mokuteki Kaisha (TMK) and Toushi Hojin (TH), etc., for which the deductible amount of tax losses is up to the total amount of taxable income for the year.

For Japanese corporate tax purposes, there is no distinction between revenue income and capital income.

Restrictions could apply on the carry forward of losses where more than 50 percent of the ownership of a company with unused tax losses changes hands. These restrictions only apply where, within 5 years after the change of ownership, one of several specified events occurs, such as the acquired company ceases its previous business and starts a new business on a significant scale compared to the previous business scale.

Japanese tax law also provides for a tax loss to be carried back for one year at the option of the taxpaying company. This provision has been suspended since 1 April 1992, except in certain limited situations, such as dissolution and for small and medium-sized companies.

Crystallization of tax charges

If the target company belonged to a 100 percent group, gains and losses that the target company has incurred and deferred relating to transfers of assets to other entities within the 100 percent group crystallize in the target company when the target company leaves the 100 percent group as a consequence of the acquisition.

Pre-sale dividend

Where the seller is a Japanese corporation, the seller may prefer to receive part of the value of its investment as a pre-sale dividend rather than sale proceeds. Capital gains from the sale of shares are subject to corporate tax at approximately 35.64 percent.

However, dividend income less interest expenses deemed incurred in relation to holding the shares (net dividend income) is exempt from corporate tax, provided the Japanese seller corporation has held 25 percent or more of the target company for 6 months or more before the dividend is declared. If these conditions are not satisfied, 50 percent of net dividend income is exempt from corporate tax. Dividend income received within a 100 percent group is entirely excluded from taxable income without deducting interest expenses attributable to such dividend.

Transfer taxes

No stamp duty is levied on the transfer of shares. However, if the target issues share certificates for the purpose of the transfer, the issuance of the certificates is subject to stamp duty. The amount of stamp duty varies based on the stated value of the certificate. The maximum liability per share certificate is JPY20,000.

Tax clearances

It is not necessary to obtain advance clearance from the tax authorities for acquisitions or disposals of shares. For complex or unusual transactions, the parties may decide to seek a ruling from the tax authorities (generally, a verbal ruling) to confirm the proposed tax treatment.

Choice of acquisition vehicle

The following vehicles may be used for an acquisition by a foreign purchaser. When establishing an ordinary domestic company (Kabushiki Kaisha or Godo Kaisha), registration tax is charged at 0.7 percent of share capital (not including capital surplus), while establishing a branch of a foreign company is generally subject to registration tax of JPY90,000.

Local holding company

If the purchaser wishes to offset financing costs for the acquisition against the Japanese target company’s taxable income, a Japanese holding company may be set up as an acquisition vehicle. The offsetting would be achieved either through a tax consolidation, which allows an offset of losses of one company against profits of other companies in the same group, or through a merger, which makes two entities one. The tax consolidation system in Japan is explained in the section on other considerations later in this chapter. For tax implications of a merger, see the equity section.

Foreign parent company

If the foreign purchaser wishes to offset the financing costs for the acquisition against its own taxable profits, the foreign purchaser may choose to acquire the Japanese target company directly. In this case, Japanese tax implications should be considered for dividends from the target company to the foreign parent company and for capital gains to be realized when the foreign parent company disposes of the target company in the future.

Japanese withholding tax (WHT) is imposed on dividends paid by a Japanese non-listed company to its foreign shareholders at the rate of 20 percent under Japanese domestic law. Reduced tax rates are available under Japan’s tax treaties.

A special reconstruction income tax is imposed on WHT at 2.1 percent from 2013 to 2037.

Capital gains from the sale of shares in a Japanese company by a foreign corporate shareholder without a permanent establishment in Japan are subject to Japanese national corporation tax at 25.5 percent, where:

- the foreign shareholder and its related parties owned 25 percent or more of the outstanding shares at any time during the previous 3 years including the year of sale and sold 5 percent or more of the outstanding shares of the Japanese company in a specific accounting period

- more than 50 percent of the Japanese company’s total property consists of real estate located in Japan on a fair market value basis.

Some of Japan’s tax treaties exempt foreign shareholders from taxation on capital gains in Japan.

Non-resident intermediate holding company

If the foreign parent company could be subject to significant tax in Japan and/or its home country if it directly holds the Japanese target company, an intermediate holding company in another country could be used to take advantage of benefits of tax treaties. However, interposing an intermediate holding company for the sole purpose of enjoying tax treaty benefits could be regarded as treaty shopping and application of the treaty could be disallowed. The Japanese government has recently been updating its tax treaties, and many now contain limitation on benefits (LOB) clauses.

Local branch

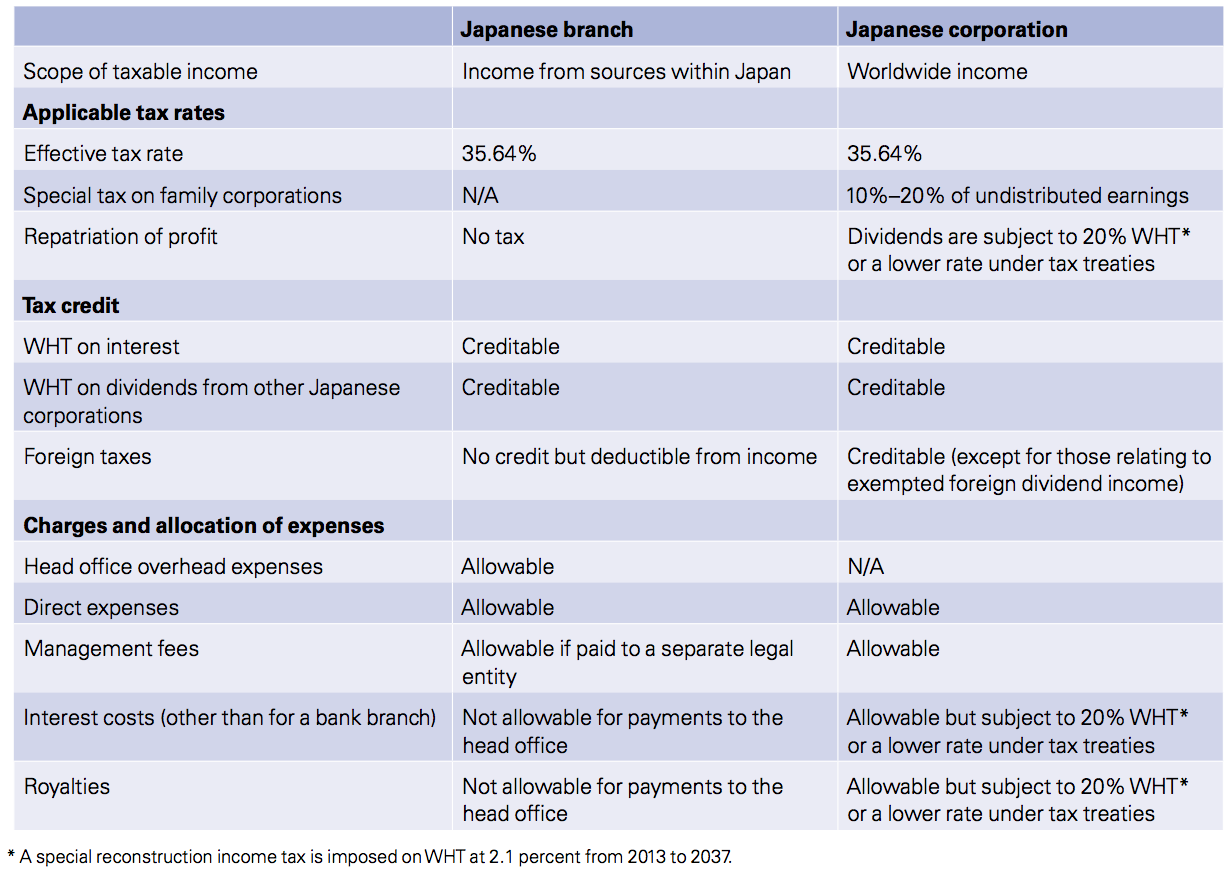

Generally, there is no material difference in the tax treatment of a branch of a foreign corporation and a corporation organized under Japanese law. The methods for computing taxable income, tax-deductible provisions and reserves, limitations on allowable expenses (e.g. entertainment expenses and donations) and corporate income tax rates are the same for both a branch and a corporation.

However, due to the difference in corporate structure between a branch and a corporation, certain areas are treated differently, as follows:

Japan’s government has proposed to change the international taxation principle applied to foreign companies under domestic tax law from the entire income principle to the attributable income principle. This proposed treatment is in line with Article 7 (Business Profits) of the Organisation for Economic Co-operation and Development (OECD) Model Tax Convention amended in 2010. The new rule is expected to apply for fiscal years beginning on or after 1 April 2016 for corporation tax purposes.

Joint venture

A joint venture generally is either a Japanese corporation with joint venture partners holding shares in the Japanese corporation or a Nin-i Kumiai (NK, similar to a partnership) with joint venture partners holding interests in the NK. In Japan, an NK is not recognized as a separate taxable entity and the partners are liable for Japanese tax on the basis of their share of profits under an NK agreement and in accordance with their own Japanese tax status.

Choice of acquisition funding

Debt

Interest paid or accrued on debt, including an intercompany loan, generally is allowed as a deduction for the paying corporation, but there are exceptions, particularly in the case of an intercompany loan from a foreign shareholder or affiliate.

Deductibility of interest

The thin capitalization rule restricts the deductibility of interest payable by a Japanese subsidiary to its overseas controlling shareholders or affiliates. The safe harbor is the debt-to-equity ratio of 3:1. Where loans from the overseas controlling shareholders or affiliates cause the ratio to be exceeded, interest expenses calculated on the excess debt are treated as non-deductible expenses for Japanese corporation tax purposes.

Third-party debts, including the following, may also be subject to the thin capitalization rule:

- back-to-back loans from overseas controlling shareholders through third parties

- debts from a third party with a guarantee by overseas controlling shareholders

- debts from a third party provided through bonds borrowed from overseas controlling shareholders as collateral for the debts.

In lieu of the 3:1 ratio, a company may use the debt-to-equity ratio of a comparable Japanese company where a higher ratio is available. A foreign company engaged in trade or business in Japan through its branch is also subject to the thin capitalization rule.

In addition to the thin capitalization rule, an earnings stripping rule was introduced in 2012 with the aim of preventing tax avoidance by limiting the deductibility of interest paid to related persons where it is disproportionate to income. Under the rule, where ‘net interest payments to related persons’ exceed 50 percent of ‘adjusted taxable income’, the excess portion is disallowed.

Interest paid to overseas shareholders or affiliates should also be reviewed from a transfer pricing perspective.

Withholding tax on debt and methods to reduce or eliminate it

Under Japanese tax law, the WHT rate on interest payable to a non-resident is 20 percent. A special reconstruction income tax is imposed on WHT at 2.1 percent from 2013 to 2037.

Reduced WHT rates are applicable under tax treaties. To obtain the reduction of Japanese WHT under a tax treaty, the recipient or their agent should submit an application form for relief from Japanese income tax to the competent authority’s tax office through the payer corporation before the date of payment.

Checklist for debt funding

- Consider whether interest should be treated as fully deductible from a thin capitalization perspective.

- Consider whether interest should be treated as fully deductible from a transfer pricing perspective.

- The use of bank debt may avoid thin capitalization and transfer pricing problems unless there are back-to-back arrangements.

- Consider whether the level of profits would enable tax relief for interest payments to be effective.

- WHT of 20 percent (and the special reconstruction income tax is imposed on WHT at 2.1 percent from 2013 to 2037) applies on interest payments to foreign entities unless a lower rate applies under the relevant tax treaty. For the application of a treaty rate, submitting an application form to the tax office is necessary before the payment.

Equity

Dividends paid by an ordinary Japanese company are not deductible. Under domestic law, WHT is imposed on dividends paid by a Japanese company to its foreign shareholders at 20 percent. WHT on dividends from certain listed companies is reduced to 15 percent. Reduced tax rates are available under Japan’s tax treaties.

Bear in mind the special reconstruction income tax imposed on WHT at 2.1 percent from 2013 to 2037.

Japanese corporate tax law provides for a specific regime for corporate reorganizations, summarized in the next section.

Tax-qualified versus non-tax-qualified reorganizations

The corporate reorganization regime provides for definitions of tax-qualified reorganizations and non-tax-qualified reorganizations for the following transactions:

- corporate division (spin-off and split-off)

- merger

- contribution in kind

- share-for-share-exchange (kabushiki-kokan) or share transfer (kabushiki-iten)

- dividend in kind.

Under a tax-qualified reorganization, assets and liabilities are transferred at tax book value (i.e. recognition of gains/losses is deferred) for tax purposes, while under a non-tax-qualified reorganization, assets and liabilities are transferred at fair market value (i.e. capital gains/losses are realized) unless the merged and surviving companies have a 100 percent control relationship. Where a share-for-share-exchange or a share transfer is carried out as a non-tax-qualified reorganization, built-in gains/losses in assets held by the subsidiaries are crystallized, although assets and liabilities are not transferred and remain in the subsidiary unless the parent company and the subsidiaries (the subsidiaries for a share transfer) have a 100 percent control relationship.

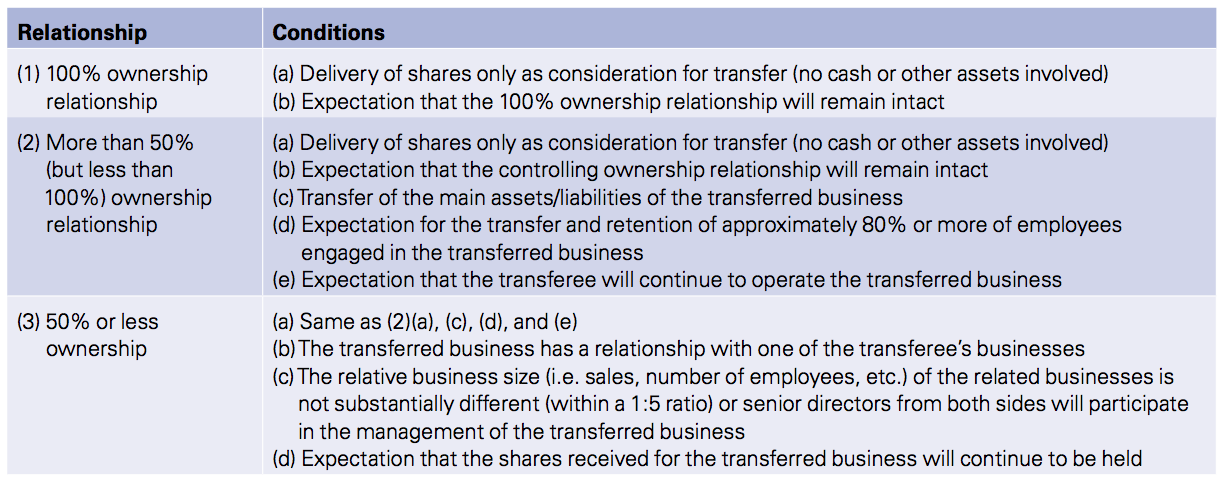

The table below outlines the general conditions required for a tax-qualified reorganization with respect to mergers, corporate divisions and contribution in kind:

The conditions for a tax-qualified share-for-share exchange or share-transfer are similar but slightly different since no business is transferred. For example, the condition in (2)(c) is not relevant; (2)(d) should be replaced by the expectation that approximate 80 percent or more of the employees in the subsidiary will continue working for the subsidiary; and (2)(e) should be replaced by the expectation that the subsidiary will continue to operate its own main business.

With respect to a dividend in kind distributed by a Japanese company, where all the shareholders are Japanese companies that have a 100 percent control relationship with the dividend-paying company at the time of the payment, the dividend in kind is treated as tax-qualified dividend in kind.

A triangular reorganization (a triangular merger, spin-off or share-for-share exchange) is available in Japan, whereby the shares of the parent company of the transferee company (including the company becoming the parent company of the transferred company in a share-for-share exchange) are transferred to shareholders of the transferor company (including the transferred company becoming a subsidiary in a share-for-share exchange) instead of shares in the transferee company. Under Japanese company law, although both the transferee company and the transferor company must be Japanese companies, the parent company of the transferee company in a triangular reorganization could be a foreign company. In connection with condition (a), where the shareholders of the transferor company receive only shares in the parent company of the transferee company in a triangular reorganization, condition (a) is satisfied, provided the parent company directly holds 100 percent of the shares of the transferee company.

Pre-reorganization losses

Under a tax-qualified merger, where certain conditions are met, pre-merger losses are transferred from the merged company to the surviving company. Otherwise (i.e. under a non-tax-qualified merger or other tax-qualified merger that does not satisfy certain conditions), such losses cannot be transferred.

As for pre-merger losses incurred in the surviving company, where the merger is tax-qualified, certain requirements must be met to use such losses against future profits after the reorganization. There are no such requirements for non-tax-qualified mergers. This rule also applies to pre-reorganization losses incurred in the transferee company in the cases of a corporate division and a contribution in kind.

There are a number of rules that restrict the use of built-in losses after a reorganization under certain circumstances.

Taxation of shareholders

When the shareholders receive shares in the transferee company only, or shares in the parent company of the transferee company (in triangular reorganizations) only, capital gains/losses from the transfer of the shares are deferred in principle. In the case of a merger or split-off, where the reorganization is non-tax-qualified, the shareholders of the transferor company recognize a deemed receipt of dividends.

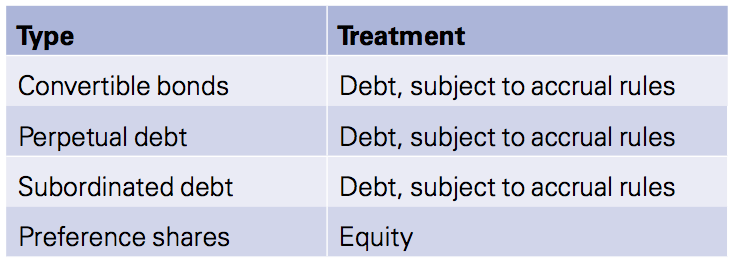

Hybrids

Hybrid instruments are deemed to be either shares, which are treated as equity, or debt, which is subject to the accrual rules. The following is a list of the major types of instruments and their treatment for tax purposes:

Discounted securities

Generally, the issuer of discounted securities obtains a tax deduction for the discount accruing over the life of the securities, while the lender recognizes taxable income accruing over the life of the securities. However, tax treatments of discounted securities could be different, and each case should be analyzed on its facts.

Deferred settlement

Earn-out arrangements that defer part of the consideration and link its payment to the performance of the acquired business are not uncommon in acquisitions. Generally, the seller recognizes gains as they are realized, but the tax treatment of such a deferred settlement varies case-by-case, and each case should be analyzed on its facts.

Other considerations

Concerns of the seller

The seller’s concerns or preferences in terms of the form of the deal structuring are affected by various factors, including the seller’s tax position and whether it is an individual or corporation. For example, where the seller is a Japanese resident individual, capital gains from the sale of shares of a Japanese non-listed company are taxed at 20 percent (15 percent income tax and 5 percent inhabitant tax; in addition, 2.1 percent of special reconstruction income tax is imposed on the income tax liability from 2013-37).

Where the Japanese non-listed company in which the Japanese individual holds shares sells assets and distributes the sale proceeds as a dividend to the shareholder, generally, the company is subject to corporate tax at approximately 35.64 percent on the gains from the sale of assets. The shareholder then is subject to income tax on dividend income distributed out of the company’s after-tax profits at a maximum of approximately 50 percent. In this case, a Japanese individual seller may prefer a share deal to an asset deal.The position is not straightforward, and professional advice should be sought.

Company law and accounting

In June 2009, the Financial Services Agency of Japan released a roadmap for the adoption of International Financial Reporting Standards (IFRS). According to the roadmap, the mandatory adoption of IFRS was supposed to start from 2015 at the earliest. However, since the minister in charge of the Financial Services Agency commented in mid-2011 that the mandatory adoption of IFRS would not happen in 2015 and that a preparation period of 5 to 7 years would be necessary once the decision for mandatory adoption is made, the timing of mandatory IFRS adoption in Japan is uncertain.

Group relief/consolidation

Consolidated tax return filing system

A group of companies may elect to file consolidated tax returns. A group is made up of a Japanese parent company and its 100 percent directly or indirectly owned Japanese subsidiaries. Non-Japanese companies are excluded from the consolidated group. To become a consolidated group, an election needs to be made to the tax office in advance. The tax consolidation system is applicable to national corporation tax only, and each company in a consolidated group is required to file local tax returns individually.

Consolidation allows for the effective offset of losses incurred by one company against profits of other companies in the same group. Consolidated tax losses can be carried forward and set off against future consolidated profits for up to 9 years. In principle, losses incurred by subsidiaries prior to joining the consolidated group expire on joining. Under the 2010 tax reform, the rule was relaxed. For example, prior losses incurred by a certain subsidiary (e.g. subsidiary that has been held by the parent for over 5 years) may be utilized by the consolidated group up to the amount of post-consolidation income generated by the subsidiary.

At the time of joining a consolidated group, a subsidiary is required to revalue its assets to fair market value and recognize taxable gains or losses from the revaluation for tax purposes except in certain cases, including where the subsidiary has been held by the parent company for over 5 years.

Group taxation regime

Under the 2010 tax reform, the group taxation regime was introduced. The group taxation regime automatically applies to certain transactions carried out by Japanese companies belonging to a 100 percent group (i.e. a group of companies that have a direct or indirect 100 percent shareholding relationship), including a tax consolidated group. In principle, the group taxation regime applies only to transactions between Japanese companies in a 100 percent group.

Capital gains/losses arising from a transfer of certain assets (e.g. fixed assets, securities, monetary receivables and deferred charges excluding those whose tax book value just before the transfer is less than JPY10 million) within a 100 percent group are deferred. The deferred capital gains/losses are realized by the transferor company, for example, where the transferee company transfers the assets to another person or where the transferor or transferee company leaves the 100 percent group.

Donations between companies in a 100 percent group are not taxable income for the recipient company and are a non-deductible expense for the company paying the donation.

Domestic dividends paid between companies in a 100 percent group are fully excluded from taxable income without deduction of associated interest expenses. In the case of dividends in kind paid in a 100 percent group, no capital gains/losses from the transfer of assets are recognized (tax-qualified dividend in kind).

In certain cases, including where a company repurchases its own shares from another company in a 100 percent group or where a company liquidates and distributes its assets to another company in a 100 percent group, the shareholder company does not recognize capital gains/losses on surrendering the shares. Tax losses of the liquidated company may be transferred to its shareholder company on liquidation.

Transfer pricing

Japan’s domestic transfer pricing legislation aims to prevent tax avoidance by companies through transactions with their foreign related companies. Generally, the tax authorities require all intragroup transactions to be carried out in accordance with the arm’s length principle. Two companies are related where one controls the other or they are under common control. A company has control over another company where the former company:

- directly or indirectly owns 50 percent or more of the total share capital of the other company

- has the power to ensure that the affairs of the other company are conducted in accordance with its wishes.

The standard methods for transfer pricing are the comparable uncontrolled price method, resale price method, cost-plus method or a reasonable alternative method, including the profit-split method or transactional net margin method.

A company is required to declare in its tax returns the transfer pricing methodology used for its related-party transactions and the volume and characteristics of the transactions.

Foreign investments of a local target company

Japan operates an anti-tax haven system whereby a Japanese company holding 10 percent or more of a specified foreign subsidiary can be subject to tax on a prorated portion of the income of the tax haven subsidiary. For this purpose, a specified foreign subsidiary is a foreign company owned more than 50 percent by Japanese-resident companies/individuals and paying tax at an effective rate of 20 percent or less: a tax haven subsidiary.

The tax haven taxation does not apply where the tax haven subsidiary:

(i) is not primarily engaged in holding shares or bonds, licensing industrial rights or copyrights, or leasing vessels or aircraft (business purpose test)

(ii) maintains an office, store, factory or other fixed place of business necessary to conduct its business in the country where the head office of the subsidiary is located (substance test)

(iii) functions with its own administration, control and management in the country in which the head office of the subsidiary is located (administration and control test)

(iv) conducts its business mainly with unrelated parties (unrelated party test)

(v) conducts its business mainly in the country in which the head office of the subsidiary is located (country of location test).

A company conducting wholesale, banking, trust, securities, insurance, ocean transport or air transport business is required to meet the conditions (i) through (iv). A company conducting any other business must meet the conditions (i), (ii), (iii) and (v). Special rules apply to a tax haven subsidiary with regional headquarters functions when determining whether these conditions are met.

Even where a tax haven subsidiary satisfies these conditions, its Japanese shareholder company needs to report, as its taxable income, a proportionate share of the tax haven subsidiary’s passive income (e.g. certain dividends, capital gains, royalties).

Comparison of asset and share purchases

Advantages of asset purchases

- Goodwill may be recognized and amortized for tax purposes.

- Fixed assets may be stepped-up and depreciated or amortized for tax purposes (except for land).

- No previous liabilities of the target company are inherited.

- Possible to acquire only part of a business.

Disadvantages of asset purchases

- Capital gains, including those arising from goodwill, are taxable for the seller, so the price could be higher.

- Real estate acquisition tax and registration tax are imposed.

- Consumption tax (VAT) arises on certain asset transfers.

- Benefit of any losses incurred by the target company remains with the seller.

Advantages of share purchases

- Legal procedures and administration may be simpler, making this more attractive to the seller and thus reducing the price.

- Purchaser may benefit from tax losses of the target company.

- No consumption tax (VAT) is imposed.

- Where the seller is non-Japanese, Japanese tax on capital gains from the sale of shares in the Japanese target company could be exempt, depending on Japan’s tax treaty with the country in which the seller is located.

- Purchaser may gain the benefit of existing supply and technology contracts and licenses or permissions.

Disadvantages of share purchases

- Liable for any claims or previous liabilities of the target company.

- No deduction is available for the purchase price.

- Step-up of the target company’s underlying assets is not possible. Amortizable goodwill is not recognized.

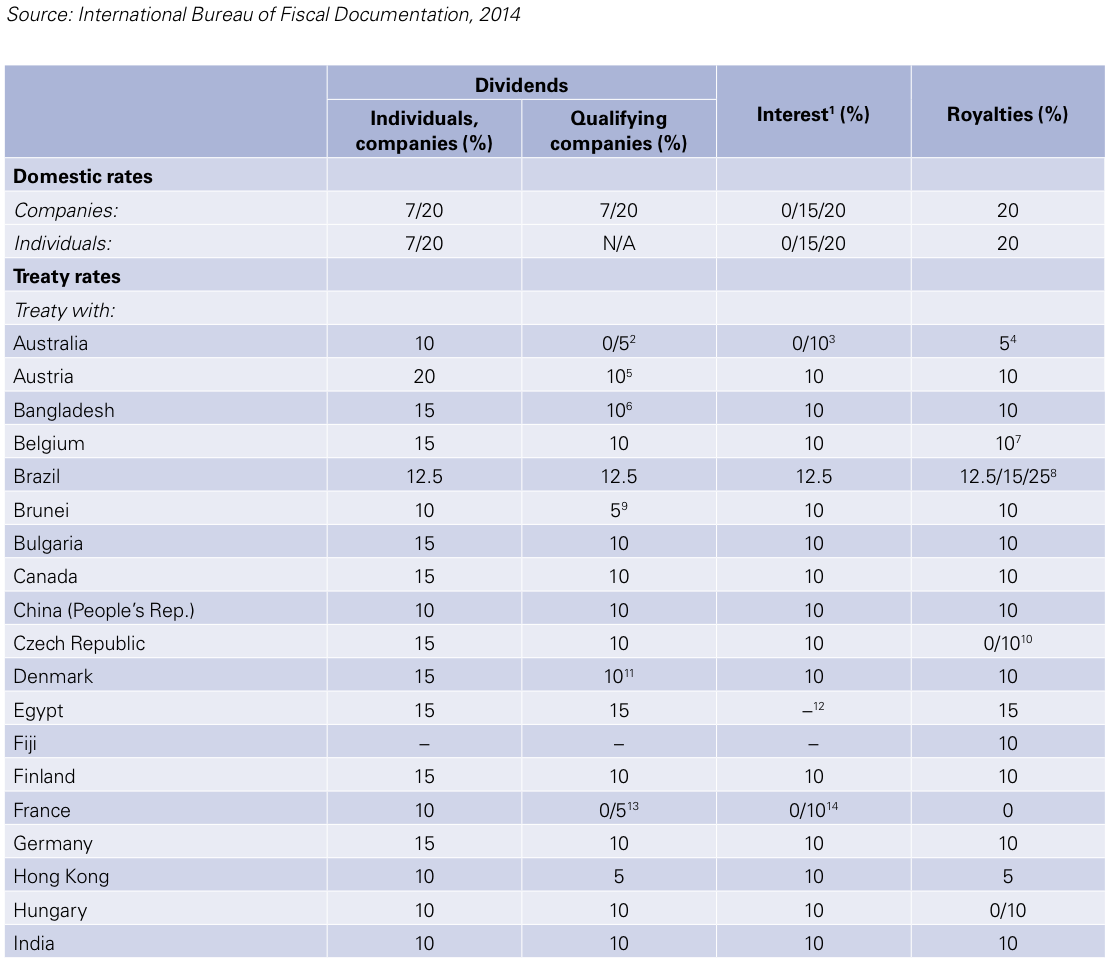

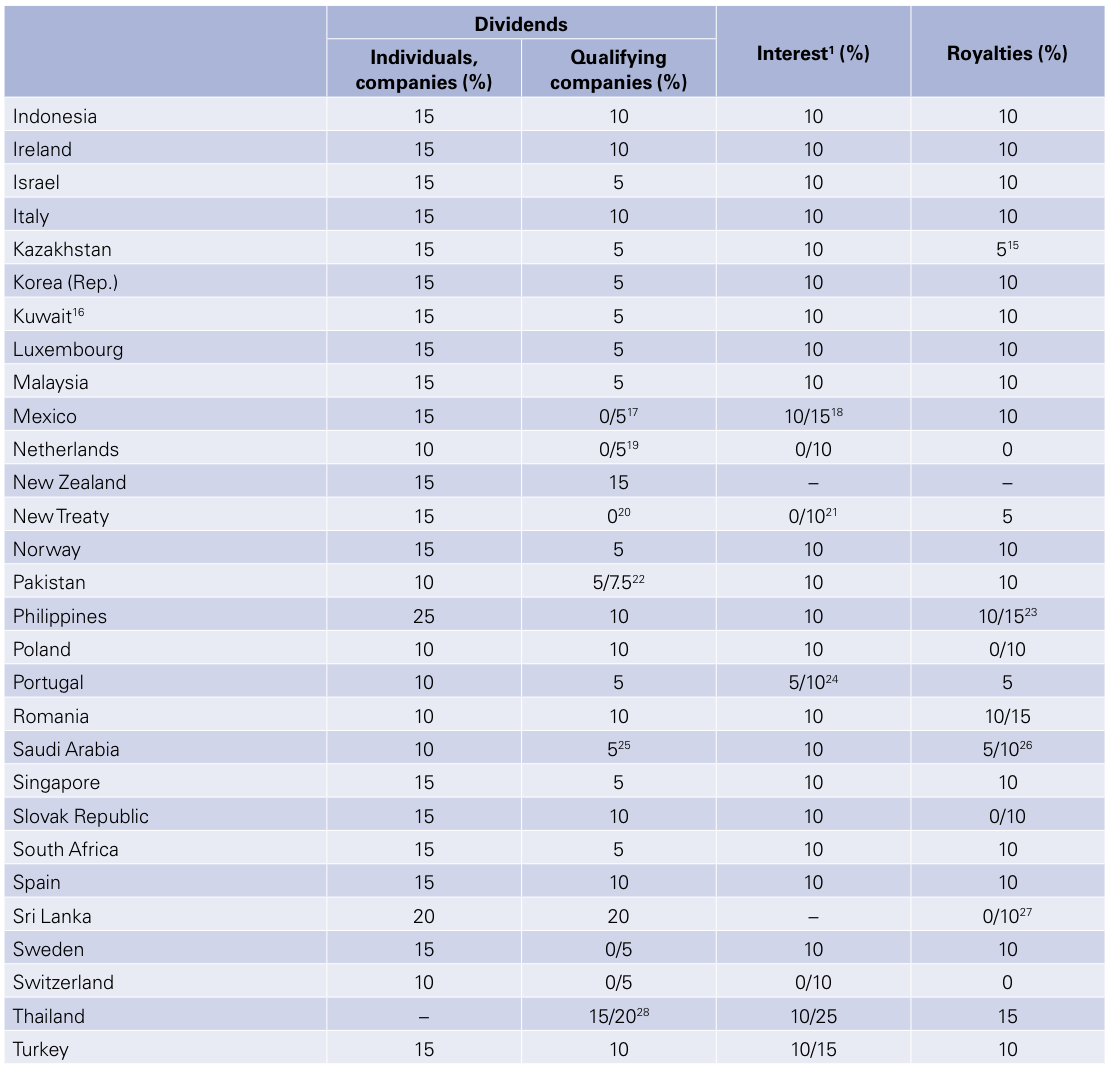

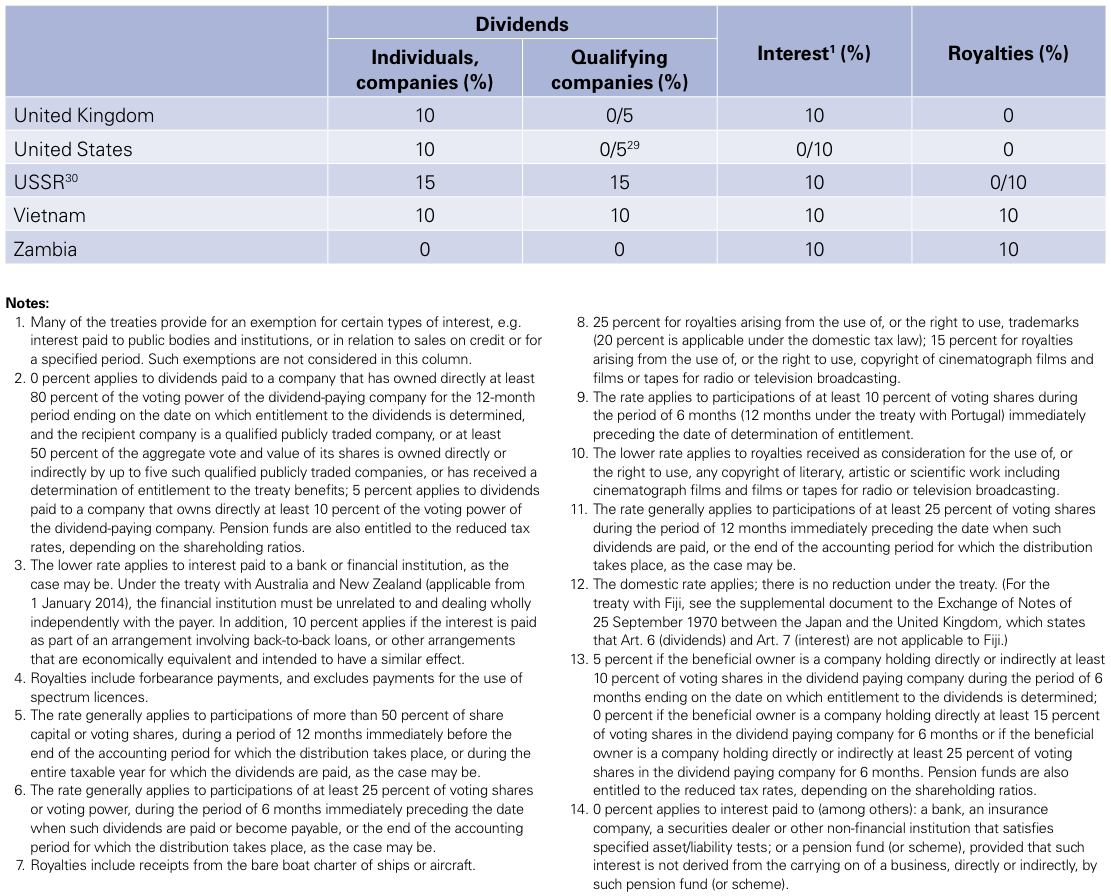

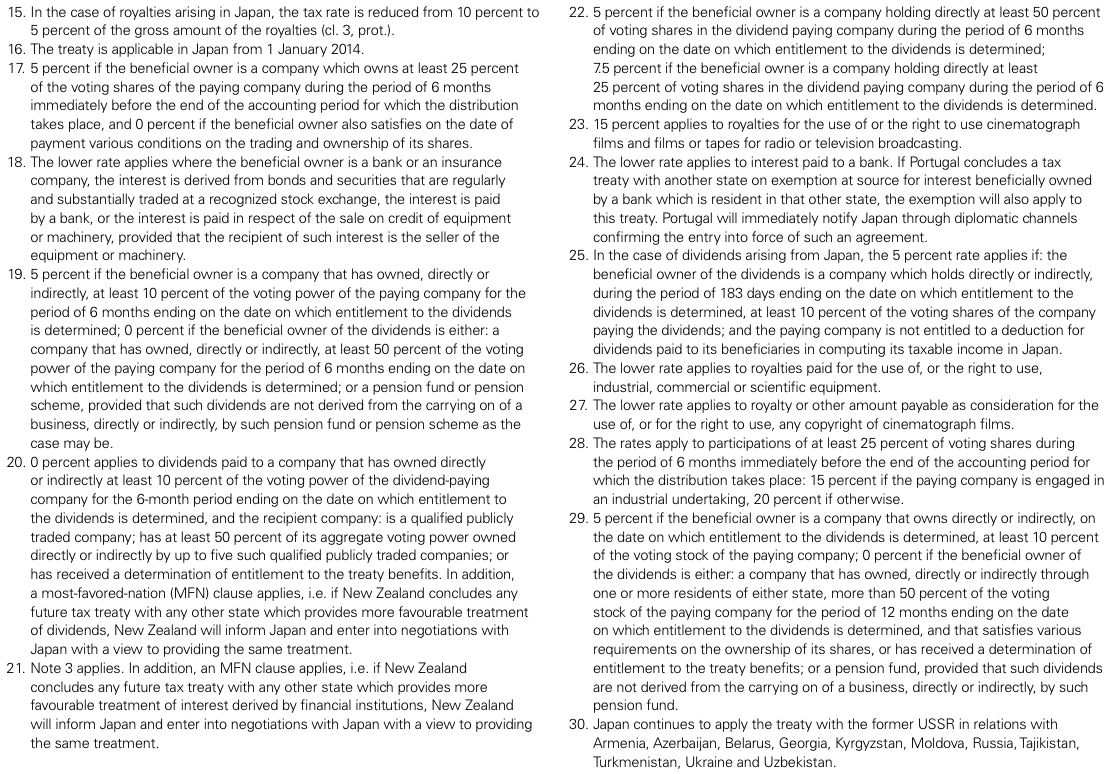

Japan – Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Japan’s tax treaties. This table is based on information available up to 1 February 2014.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter