Publications Taxation Of Cross-Border Mergers And Acquisitions: India 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: India 2014

- Christopher Kummer

SHARE:

By KPMG

Introduction

The legal framework for business consolidations in India consists of numerous statutory tax concessions and tax-neutrality for certain kinds of reorganizations and consolidations. This chapter describes the main provisions for corporate entities. Tax rates cited are for the financial year ending 31 March 2013, and are inclusive of an applicable surcharge (10 percent for domestic companies and 5 percent for foreign companies having income over 100 million Indian rupees (INR) (approximately US dollars (USD) 16,666,667) and an education cess (tax) of 3 percent.

Recent developments

The following recent changes to the Indian tax and regulatory framework may affect transaction structuring.

General anti-avoidance rule

Under the Finance Act, 2013, a general anti-avoidance rule (GAAR) will come into force in India with effect from 1 April 2015 (financial year 2015-16). Investments made before 30 August 2010 will be grandfathered. GAAR provisions shall apply only if tax benefit arising to all parties to the arrangement exceeds INR 30 million in relevant financial year. GAAR empowers the Tax Authority to declare an ‘arrangement’ entered into by an assessee to be an ‘impermissible avoidance agreement’ (IAA), resulting in denial of the tax benefit under the provisions of the Act or tax treaty. An IAA is an arrangement the main purpose of which is to obtain a tax benefit and which:

- creates rights and obligations that are not ordinarily created between persons dealing at arm’s length

- results in the misuse or abuse of tax provisions

- lacks commercial substance, or

- is not for a bona fide purpose.

Taxability of indirect share transfers

Where a foreign company transfers shares of a foreign company to another company and the value of the shares is derived substantially from the assets situated in India, then capital gains derived on the transfer are subject to income tax in India. Further, payment for such shares is subject to Indian withholding tax (WHT).

Limited liability partnerships

The Limited Liability Partnerships Act was passed in 2009. Previously, Indian law only permitted partnerships with unlimited liability. The introduction of this law paved the way for setting up limited liability partnerships (LLP) in India. Under this law, an LLP operates as a separate legal entity, able to enter into binding contracts. LLPs are taxed as normal partnerships; that is, the profits earned by an LLP are taxed in its hands and shares of profit are exempt in the hands of the partners. The law is at a nascent stage and progressively evolving. The Reserve Bank of India is expected to publish rules governing foreign investment into LLPs (as of January 2014, these rules had not been published).

Direct Taxes Code Bill

A new Direct Taxes Code Bill was introduced in the Parliament in 2010. After reviewing various representations, the government has prepared a revised draft of the Direct Taxes Code, but it is unclear when it will be introduced in the Parliament. This Code is proposed to replace the existing Income Tax Act and Wealth Tax Act, and it aims to simplify existing provisions and procedures.

Real Estate Investment Trust proposals

The Securities and Exchange Board of India (SEBI) has proposed to introduce a new vehicle for investment in the real estate sector in the form of a real estate investment trust (REIT). This proposal is still under discussion. On one hand, REITs would provide investors a vehicle to invest primarily in completed, revenue-generating real estate assets, which is less riskier than investing in under-construction properties and provides a regular income stream from rental income. On the other hand, REITs would provide sponsors (usually a developer or a private equity fund) with avenues of exit since the units issued by REITs will be listed, thus providing liquidity and enabling sponsors to invest in other projects.

The REIT would be setup as a trust under the Indian Trusts Act, 1882, and would have parties such as trustee (registered with SEBI), sponsor, manager and principal valuer. However, foreign direct investment (FDI) in trusts is not allowed under the current Foreign Exchange Management Act (FEMA) Regulations. Hence, once SEBI launches the investment structure, the infusion of foreign funds in REITs would be subject to regulations to be framed by the Reserve Bank of India (RBI).

Competition Commission of India regulations

Under Competition Commission of India (CCI) regulations, a business combination that causes or is likely to cause an appreciable adverse effect on competition within the relevant market in India shall be void. Any acquisition of control, shares, voting rights or assets, acquisition of control over an enterprise, or merger or amalgamation is regarded as a combination if it meets certain threshold requirements and accordingly requires approval.

Impact of Companies Act, 2013

The Companies Act, 2013, partially repeals the Companies Act, 1956. Restructuring provisions under the new law have yet not been made effective. However, these provisions, once effective, will permit, among other things, the merger of an Indian company with a foreign company, which was not previously allowed. The extant FEMA Regulations do not contemplate a situation in which shareholders of an Indian company may be allotted shares of a foreign company unless the Indian company has obtained the RBI’s prior approval.

Asset purchase or share purchase?

The acquisition of the business of an Indian company can be accomplished by the purchase of shares or the purchase of all or some of the assets. From a tax perspective, long-term capital gains arising on a sale of equity shares through the recognized stock exchanges in India are exempt from tax, provided securities transaction tax (STT) is paid. All other gains on sales of assets are taxable. In some cases (in addition to capital gains taxes), other transfer taxes, such as stamp duty, may also be levied. A detailed comparison of the various types of purchases is provided at the end of this chapter.

Purchase of assets

A purchase of assets can be achieved through either a purchase of a business on going concern basis or a purchase of individual assets. The acquisition of business could be one of two types: a ‘slump-sale’ or ‘itemized sale’ basis. The sale of a business undertaking is on a slump-sale basis when the entire business is transferred as a going concern for a lump-sum consideration – cherry-picking of assets is not possible. An itemized sale occurs either where a business is purchased as a going concern and the consideration is specified for each asset or where only specific assets or liabilities are transferred – cherry-picking of assets by the buyer is an option. The implications of each type of transaction are described later in this chapter.

Asset purchase or share purchase?

The acquisition of the business of an Indian company can be accomplished by the purchase of shares or the purchase of all or some of the assets. From a tax perspective, long-term capital gains arising on a sale of equity shares through the recognized stock exchanges in India are exempt from tax, provided securities transaction tax (STT) is paid. All other gains on sales of assets are taxable. In some cases (in addition to capital gains taxes), other transfer taxes, such as stamp duty, may also be levied. A detailed comparison of the various types of purchases is provided at the end of this chapter.

Purchase of assets

A purchase of assets can be achieved through either a purchase of a business on going concern basis or a purchase of individual assets. The acquisition of business could be one of two types: a ‘slump-sale’ or ‘itemized sale’ basis. The sale of a business undertaking is on a slump-sale basis when the entire business is transferred as a going concern for a lump-sum consideration – cherry-picking of assets is not possible. An itemized sale occurs either where a business is purchased as a going concern and the consideration is specified for each asset or where only specific assets or liabilities are transferred – cherry-picking of assets by the buyer is an option. The implications of each type of transaction are described later in this chapter.

Purchase price

The actual cost of the asset is regarded as its cost for tax purposes. However, this general rule may be subject to some modifications depending on the nature of asset and the transaction. Allocation of the purchase price by the buyer in case of acquisition through a slump-sale is critical from a tax perspective because the entire business undertaking is transferred as a going concern for a lump-sum consideration. The tax authorities normally accept allocation of the purchase price on a fair value or other reasonable commercial basis. Reports from independent valuations providers are also acceptable.

For itemized sale transactions, the cost paid by the acquirer as agreed upfront may be accepted as the acquisition cost, subject to certain conditions. Therefore, under both slump-sales and itemized sales, a step-up in the cost base of the assets may be obtained.

Goodwill

Goodwill arises when the consideration paid is higher than the total fair value/cost of the assets acquired. This arises only in situations of a slump-sale. Under the tax law, only depreciation/amortization of intangible assets, such as know-how, patents, copyrights, trademarks, licenses and franchises or any similar business or commercial rights, is permissible. Therefore, when the excess of consideration over the value of the assets arises because of these intangible assets, a depreciation allowance may be available. Recent judicial precedents have allowed depreciation on goodwill arising out of amalgamation by treating it as a depreciable asset.

Depreciation

Depreciation charged in the accounts is ignored for tax purposes. The tax laws provide for specific depreciation rates for the tangible assets (buildings, machinery, plant or furniture), depending on the nature of asset used in the business. Additional depreciation of 20 percent is available for new plant and machinery used in manufacturing or production, subject to certain conditions. Depreciation on eligible intangible assets (described above) is allowed a flat rate of 25 percent. Certain assets, such as computer software, enjoy higher tax depreciation at 60 percent.

Depreciation is allowed on a ‘block of assets’ basis. All assets of a similar nature are classified under a single block – and any additions/deletions are made directly in the block. The depreciation rates apply on a reducing-balance basis on the entire block. However, companies engaged in the generation and/or distribution of power have the option to claim depreciation on a straight-line basis. In the first year, if the assets are used in the business for less than 180 days, only half of the entire eligible depreciation for that year is deductible. When the assets are used for more than 180 days in the first year, the entire eligible depreciation for that year is allowed. Capital allowances are available for certain types of asset, such as assets used in scientific research or other specified businesses, subject to certain conditions.

Tax attributes

Tax losses are normally not transferred irrespective of the method of asset acquisition. The seller retains them.

However, certain tax benefits/deductions that are available to an undertaking may be available to the acquirer when the undertaking as a whole is transferred as a going concern as a result of a slump-sale.

In case of a pending proceedings against the transferor, the tax authorities have the power to claim any tax on account of completion of proceeding from the transferee where the transfer is made for inadequate consideration.

Value added tax

Based on judicial precedent, state-level value added tax (VAT) should not apply to the sale of a business as a whole on a going concern basis with all its assets and liabilities comprising movable and immovable property, including stock-in-trade and other goods, for a lump-sum consideration (i.e. a separate price is not assigned to each asset or liability). VAT is a state levy, so the provisions of the laws of the state or states concerned should be examined before completing the transaction.

Unlike a slump-sale, in an itemized sale, individual assets are transferred at a specified price for each asset transferred. Since the intention is clearly to sell goods as goods, a VAT liability may apply to the consideration paid for the goods.

There are mainly two rates of VAT: 12.5 percent and 4 percent, although rates vary from state to state. Depending on the nature of the item sold, the transferee may be able to recover VAT paid by the transferor through input credit.

Transfer taxes

The transfer of assets by way of a slump-sale attracts stamp duty. Stamp duty implications differ from state-to-state. Rates generally range from 5 percent to 10 percent for immovable property and from 3 percent to 5 percent for movable property, usually based on the amount of consideration received for the transfer or the market value of the property transferred (whichever is higher). Depending on the nature of the assets transferred, appropriate structuring of the transfer mechanism may reduce the overall stamp duty cost.

Purchase of shares

Businesses can be acquired through purchase of shares. No step-up in the cost of the underlying business is possible in a share purchase, in the absence of a specific provision in the Act. No deduction is allowed for a difference between the underlying net asset values and the consideration paid. Further, the sale of shares is taxed as capital gains to the seller (see the section on concerns of the seller later in this chapter).

Tax indemnities and warranties

In a share acquisition, the purchaser takes over the target company together with all its related liabilities, including contingent liabilities. Hence, the purchaser normally requires more extensive indemnities and warranties than in the case of an asset acquisition.

An alternative approach is for the seller’s business to be transferred into a newly formed entity so the purchaser can take on a ‘clean’ business and leave its liabilities behind. Such a transfer may have tax implications. When significant sums are involved, it is customary for the purchaser to initiate a due diligence exercise. Normally, this would incorporate a review of the target’s tax affairs.

Tax losses

Tax losses consist of normal business losses and unabsorbed depreciation (where there is insufficient income to absorb the current-year depreciation). Both types of losses are eligible for carry forward and available for the purchaser. Business tax losses can be carried forward for a period of 8 years and offset against future profits. Unabsorbed depreciation can be carried forward indefinitely. However, one essential condition for setting off business losses is the shareholding continuity test. Under this test, the beneficial ownership of shares carrying at least 51 percent of the voting power must be the same at the end of both the year during which the loss was incurred and the year during which the loss is proposed to be offset. This test only applies to business losses (not unabsorbed depreciation) and to unlisted companies (in which the public are not substantially interested).

Transfer taxes

STT may be payable if the sale of shares is through a recognized stock exchange in India. STT is imposed on purchases and sales of equity shares listed on a recognized stock exchange in India at 0.1 percent based purchase or sale. STT is payable both by the buyer and the seller on the turnover (which is a product of number of shares bought/sold and price per share).

Transfers of shares (other than those in de-materialized form, which are normally traded outside the stock exchanges) are subject to stamp duty at the rate of 0.25 percent of the market value of the shares transferred.

Tax clearances

In the case of a pending proceeding against the transferor, the tax authorities have the power to claim any tax on account of completion of proceeding from the transferee where the transfer is made for inadequate consideration. Income tax law provides mechanism for obtaining tax clearance certificate for transfer of assets/business subject to certain conditions.

Choice of acquisition vehicle

Several possible acquisition vehicles are available in India to a foreign purchaser. Tax and regulatory factors often influence the choice of vehicle.

Local holding company

Acquisitions through an Indian holding company are governed by the downstream investment guidelines issued in 2009 under FDI policy. At a broad level, any indirect foreign investments (through Indian companies) are not construed as foreign investments where the intermediate Indian holding company is owned and/or controlled by resident Indians.

The criteria for deciding the ownership and control of an Indian company are ownership of more than 50 percent of the shares along with control of the governing board. Downstream investments made by Indian entities are not considered in determining whether these criteria are met.

Dividends in India are subject to a dividend distribution tax (DDT) of 16.995 percent. A parent company may be able to obtain credit for the DDT paid by its subsidiaries against its DDT liability on dividends declared.

Foreign parent company

The foreign investors may invest directly through the foreign parent company, subject to the prescribed foreign investment guidelines.

Non-resident intermediate holding company

An intermediate holding company resident in another territory could be used for investment into India, to minimize the tax leakage in India through, for example, source withholdings and capital gains taxes on exit. This may allow the purchaser to take advantage of a more favorable tax treaty with India. However, evidence of substance in the intermediate holding company’s jurisdiction is required.

WHT on sale by non-resident

WHT applies at the applicable rates to any payment made to a non-resident seller for the purchase of any capital asset on account of any capital gains that accrue to the seller.

Local branch

The RBI regulates the establishment of branches in India. The prescribed guidelines do not permit a foreign company to use the branch as a vehicle for acquiring Indian assets.

Joint venture

Joint ventures are normally used where specific sectoral caps are applicable under the foreign investment guidelines. In such scenarios, a joint venture with an Indian partner is set up that will later acquire the Indian target. In planning a joint venture, the current guidelines for calculating the indirect foreign investments should be considered.

Choice of acquisition funding

A purchaser using an Indian acquisition vehicle to carry out an acquisition for cash needs to decide whether to fund the vehicle with debt, equity or a hybrid instrument that combines the characteristics of both. The principles underlying these approaches are discussed below.

Debt

Tax-deductibility of interest makes debt funding an attractive method of funding. Debt borrowed in foreign currency is governed by the RBI’s external commercial borrowing (ECB) guidelines. These impose restrictions on ECB in terms of the amount, term, cost, end use and remittance into India, which prohibit an eligible borrower of ECBs to use the proceeds for certain purposes, including to fund any acquisition of shares or assets.

Borrowing funds from an Indian financial institution is worth considering as interest on such loans can be deducted from the operating profits of the business to arrive at the taxable profit. This option is likely to have the following advantages:

- no regulatory approvals required

- flexibility in repayment of funds

- no ceiling on rate of interest

- no hedging arrangements required

- no WHT on interest.

However, bank loans may have end-use restrictions.

Deductibility of interest

Normally, the interest accounted for in the company’s books of accounts is allowed for tax purposes. Interest on loans from financial institutions and banks is normally only allowed when actually paid. Other interest (to residents and non-residents) is normally deductible from business profits, provided appropriate taxes have been withheld thereon and paid to the government treasury.

No thin capitalization rules are prescribed in India.

Under GAAR, however, if an arrangement is declared to be an IAA, then any equity may be treated as debt and vice versa.

Withholding tax on debt and methods to reduce or eliminate it

Interest paid by Indian company to a non-resident is normally subject to WHT of 21.63 percent. However, the rate may be reduced under a tax treaty, subject to the conditions mentioned therein.

Foreign institutional investors (FFI) and qualified financial institutions (QFI) are now subject to 5.4075 percent WHT on an INR-denominated bond of an Indian company or a government security on which interest is payable after 1 June 2013 and before 1 June 2015. Similarly, where an Indian company borrows funds in a foreign currency from a source outside India, either under a loan agreement or by way of issue of long-term infrastructure bonds, as approved by the Central Government, then the interest payment to a non- resident person also is subject to the concessionary WHT rate of 5.4075 percent.

Withholding tax on debt and methods to reduce or eliminate it

Interest paid by Indian company to a non-resident is normally subject to WHT of 21.63 percent. However, the rate may be reduced under a tax treaty, subject to the conditions mentioned therein.

Foreign institutional investors (FFI) and qualified financial institutions (QFI) are now subject to 5.4075 percent WHT on an INR-denominated bond of an Indian company or a government security on which interest is payable after 1 June 2013 and before 1 June 2015. Similarly, where an Indian company borrows funds in a foreign currency from a source outside India, either under a loan agreement or by way of issue of long-term infrastructure bonds, as approved by the Central Government, then the interest payment to a non- resident person also is subject to the concessionary WHT rate of 5.4075 percent.

Checklist for debt funding

- Foreign currency-denominated debt must conform to ECB guidelines.

- Consider the WHT on the interest expenses for domestic and foreign debt.

- Assess whether the profits in the Indian target entity are sufficient to make the interest deduction effective.

- All external borrowings (foreign debt) from associated enterprises should comply with the transfer pricing rules.

Equity

Most sectors in India have been opened up for foreign investment, so no approvals from the government of India should be necessary for the issue of new shares with respect to these sectors. Certain sectors are subject to restrictions or prohibitions of foreign investment that require the foreign investor to apply to the government of India for a specific approval. Pricing of the shares must comply with guidelines issued by the RBI. Further, any acquisition of equity through a share swap must be pre-approved by the Foreign Investment Promotion Board (FIPB).

Dividends can be freely repatriated under the current exchange control regulations. Dividends can be declared only out of profits (current and accumulated), subject to certain conditions.

Under current Indian tax laws, dividends paid by domestic companies are not taxable to the shareholders. No WHT applies at the time of the distribution of dividends to the shareholders. However, the domestic company must pay dividend distribution tax (DDT) at the rate of 16.995 percent on the amount of dividends actually paid to the shareholders. Dividends are not tax-deductible. However, an Indian parent company can take credit for DDT paid by its subsidiary, subject to certain conditions.

In the case of outbound investments, gross dividends received by an Indian company from a specified foreign company (in which it has shareholding of 26 percent or more) are taxable at the rate of 16.995 percent, up to 31 March 2014, subject to certain conditions. This treatment aims to encourage the repatriation of income earned by residents from their foreign investments.

Under current company law, equity capital cannot be withdrawn during the lifespan of the company, except through a buy-back of shares. Under company law, 10 percent of the capital can be bought back with the approval from the board of directors and up to 25 percent can be bought back with approval of shareholders, subject to other prescribed conditions.

A recent amendment to the Indian Income Tax Law imposes tax at the rate of 22.66 percent on the buy-back of shares by a closely held unlisted company to the extent of the amount distributed over the amount received by the company from the shareholders on issuing the shares. Tax shall be paid by Indian unlisted Company and buyback proceeds shall be exempt in hands of the shareholder.

Business Reorganization

Merger/amalgamation

In India, mergers (amalgmations) are infrequently used for acquisition of business, but they are used extensively to achieve a tax-neutral consolidation of legal entities in the course of corporate reorganizations. Amalgamations enjoy favorable treatment under income tax and other laws, subject to the fulfillment of certain conditions.The important provisions under Indian laws relating to amalgamation are discussed below.

Tax neutrality

Indian tax law defines amalgamation as a merger of one or more companies into another company or a merger of two or more companies to form a new company such that:

- all the properties and liabilities of the merging companies immediately before the amalgamation become the properties and liabilities of the amalgamated company

- shareholders holding at least three-quarters of the shares in the amalgamating companies become shareholders of the amalgamated company (any shares already held by the amalgamated company or its nominees are excluded for purposes of this calculation).

From 1 April 2005, the transfer of a capital asset by a banking company to a banking institution in the course of amalgamating the two banking entities as directed and approved by the RBI is not regarded as a transfer for capital gains purposes. The cost of acquiring the capital asset is deemed to be the cost at which the amalgamating banking company acquired it.

Generally, the transfer of any capital asset is subject to capital gains tax in India. However, amalgamation enjoys tax-neutrality with respect to transfer taxes under Indian tax law – both the amalgamating company transferring the assets and the shareholders transferring their shares in the amalgamating company are exempt from tax. To achieve tax-neutrality for the amalgamating company(ies) transferring the assets, the amalgamated company should be an Indian company. In addition, to achieve tax-neutrality for the shareholders of the amalgamating company(ies), the entire consideration should comprise shares in the amalgamated company.

Carry forward and offset of accumulated losses and unabsorbed depreciation

Unabsorbed business losses, including depreciation of capital assets, of the amalgamating company(ies) are deemed to be those of the amalgamated company in the year of amalgamation. In effect, the business losses get a new lease of life as they may be carried forward for up to 8 years.

However, such carry forward is available only where:

- the amalgamating company owns a ship or hotel or is an industrial undertaking (manufacturing or processing of goods, manufacturing of computer software, electricity generation and distribution, telecommunications, mining or construction of ships, aircraft or rail systems)

- the amalgamating companies are banking companies.

The carry forward of losses on amalgamation is subject to additional conditions under the income tax law.

Other implications

Other implications of amalgamation include the following.

- Where a business unit/undertaking develops/operates an infrastructure facility, telecommunication service, or is in the business of power generation, transmission or distribution, and the business unit/undertaking is merged, then the tax benefits it enjoys cannot be claimed by the amalgamated company, where specifically restricted under the tax law. Various tax incentives still may be available as long no specific restriction applies under the law.

- The basis for claiming tax depreciation on assets of amalgamating company(ies) acquired on amalgamation remains the same for the amalgamated company. No step-up in the value of assets acquired on amalgamation is possible for tax purposes.

- The total depreciation on assets transferred to the amalgamated company in that financial year is apportioned between the amalgamating and amalgamated company in the ratio of the number of days for which the assets were used by each entity during the year. Thus, depreciation up to the effective date of transfer is available to the amalgamating company and depreciation after that date is available to the amalgamated company.

- Amalgamation expenses can be amortized in five equal annual installments, starting in the year of amalgamation.

- Unamortized installments of certain deductions eligible to the amalgamating company(ies) are allowable for the amalgamated company.

Corporate law

Corporate reorganizations involving amalgamations of two or more companies require the approval of the Jurisdictional High Court. Following a recent amendment, the function of granting approval under the Companies Act, 2013 on being notified for corporate mergers will be transferred to the National Company Law Tribunal, upon notification. Obtaining High Court approval normally takes 6 to 8 months.

Transfer taxes

The transfer of assets, particularly immovable properties, requires registration with the state authorities for purposes of authenticating transfer of title. Such registration requires payment of stamp duty. Stamp duty implications differ from state to state. Generally, rates of stamp duty range from 5 percent to 10 percent for immovable properties and from 3 percent to 5 percent for movable properties, usually calculated on the amount of consideration received for the transfer or the market value of the property transferred (whichever is higher). Some state stamp duty laws contain special beneficial provisions for stamp duty on a court-approved merger.

The VAT implications on court-approved mergers vary from state to state. The VAT provisions of most states stipulate that the transfer of properties, etc., by way of a court-approved merger between the merging entities generally attracts VAT until the date of the High Court order.

In the absence of such a provision, various courts have held the effective date of the merger to be the day the merger scheme becomes operative and not the date of the order of the court. In such cases, VAT has been held not to apply on the transfer of properties between the merging entities during the period from the effective date of merger to the date of the High Court order.

Exchange control regulations

In India, capital account transactions are still not fully liberalized. Certain foreign investments require the approval of the government of India. A court-approved merger is specifically exempt from obtaining any such approvals where, post-merger, the stake of the foreign company does not exceed the prescribed sectoral cap.

Takeover code regulations

The acquisition of shares in a listed company beyond a specific percentage triggers implications under the regulations of SEBI, India’s stock market regulator. However, a court-approved merger directly involving the target company is specifically excluded from the application of these regulations. A court-approved merger that indirectly involves the target is also excluded where prescribed conditions are met.

Therefore, a court-approved merger is the most tax-efficient means of corporate consolidation or acquisition, apart from these disadvantages:

- more procedural formalities and a longer timeframe of 6 to 8 months

- both parties must be corporate entities and the transferee company must be an Indian company.

Competition Commission of India regulations

Any merger or amalgamation is regarded as a combination if it meets certain threshold requirements; if so, CCI approval is required. Exemptions are available for an amalgamation of group companies in which more than 50 percent of the shares are held by enterprises within the same group.

Demerger

The separation of two or more existing business undertakings operated by a single corporate entity can be achieved in a tax-neutral manner under a ‘demerger’. The key provisions under Indian law relating to demerger are discussed below.

Income tax law

Indian tax law defines ‘demerger’ as the transfer of one or more undertakings to any resulting company, pursuant to a scheme of arrangement under sections 391 to 394 of the Indian Companies Act, such that as a result of the demerger:

- All the property and liabilities relating to the undertaking being transferred by the demerger company immediately before the demerger becomes the property and liabilities of the resulting company.

- Such property and liabilities is transferred at values appearing in the books of account of the demerged company (for determining the value of the property, any revaluation is ignored).

- In consideration of a demerger, the resultant company issues its shares to the shareholders of the demerged company on a pro rata basis.

- Shareholders holding three-quarters of the shares in the demerged company become shareholders of the resultant company (any shares already held by the resultant company or its nominees are excluded for the purposes of this calculation).

- The transfer of the undertaking is on a going-concern basis.

‘Undertaking’ is defined to include any part of an undertaking or a unit or division of an undertaking or a business activity taken as a whole. It does not include individual assets or liabilities or any combination thereof not constituting a business activity.

In a demerger, the shareholders of the demerged company receive shares in the resultant company. The cost of acquisition of the original shares in the demerged company is split between the shares in the resultant company and the demerged company in the same proportion as the net book value of the assets transferred in a demerger bears to the net worth of the demerged company before demerger. (‘Net worth’ refers to the aggregate of the paid-up share capital and general reserves appearing in the books of account of the demerged company immediately before the demerger.)

Generally, the transfer of any capital asset is subject to transfer tax (capital gains tax) in India. However, a demerger enjoys a dual tax-neutrality with respect to transfer taxes under Indian tax law: both the demerged company transferring the undertaking and the shareholders transferring their part of the value of shares in the demerged company are tax-exempt. To achieve tax-neutrality for the demerged company transferring the undertaking, the resultant company should be an Indian company.

Other provisions of the income tax law are as follows:

- The unabsorbed business losses, including depreciation (i.e. amortization of capital assets) of the demerged company directly related to the undertaking transferred to the resultant company are treated as unabsorbed business losses or depreciation of the resultant company. If such losses, including depreciation, are not directly related to the undertaking being transferred, the losses should be apportioned between the demerged company and the resulting company in the proportion in which the assets of the undertaking have been retained by the demerged company and transferred to the resulting company.

- The unabsorbed business losses of the demerged company may be carried forward and set off in the hands of the resultant company for that part of total permissible period of 8 years that has not yet expired.

- Where a business unit/undertaking develops/operates an infrastructure facility, telecommunication service, or is in the business of power generation, transmission or distribution, etc., is demerged, then the tax benefits it enjoys cannot be claimed by the resultant company where the Act specifically disallows such a claim.

- If any undertaking of the demerged company enjoys any tax incentive, the resulting company generally can claim the incentive for the unexpired period, even after the demerger.

- The total depreciation on assets transferred to the resulting company in a financial year is apportioned between the demerged company and the resulting company based on the ratio of the number of days for which the assets were used by each during the year. Depreciation up to the effective date of transfer is available to the demerged company and thereafter to the resulting company.

- The expenses of a demerger can be amortized in five equal annual installments, starting in the year of the demerger.

- A step-up in the value of the assets is not permissible either in the books or for tax purposes.

Any corporate reorganization involving the demerger of one or more undertakings of a company requires the approval of the Jurisdictional High Court. As noted earlier, the function of granting approval under the Companies Act, 2013 on being notified for corporate mergers will be transferred to the National Company Law Tribunal. Obtaining High Court approval normally takes 6 to 8 months.

The transfer of assets, particularly immovable property, requires registration with the state authorities to authenticate transfers of title. Such registration requires payment of stamp duty, which differs from state to state. The rates range from 5 percent to 10 percent for immovable property and from 3 percent to 5 percent for movable property. Rates are generally calculated based on the consideration received or the market value of the property transferred, whichever is higher. Some state stamp duty laws contain special stamp duty privilege for court-approved demergers.

The VAT implications of a court-approved demerger vary from state to state. Some states are silent on this issue, while others stipulate that when a company is to be demerged by the order of the Court or the Central Government, it is presumed that companies brought into existence by the operation of the said order have not sold or purchased any goods to each other from the effective date of the scheme to the date of the High Court order.

Exchange control regulations

A court-approved demerger is specifically exempt from obtaining government approval where, following the demerger, the investment of the foreign company does not exceed the sectoral cap.

A court-approved demerger is the most tax-efficient way to effect a divisive reorganization, apart from these disadvantages:

- more procedural formalities and longer time frame of 6 to 8 months

- for tax neutrality, mode of consideration shall only be issue of shares of resultant company to shareholders of demerged company.

Hybrids

Preference capital is used in some transaction structuring models. Preference capital has preference over equity shares for dividends and repayment of capital, although it does not carry voting rights. An Indian company cannot issue perpetual (non-redeemable) preference shares. The maximum redemption period for preference shares is 20 years. Preference dividends can be only declared out of profits. Dividends on preference shares are not a tax-deductible cost. Preference dividends on fully convertible preference shares can be freely repatriated under the current exchange control regulations. The maximum rate of dividend (coupon) that can be paid on such preference shares should be in accordance with the norms prescribed by the Ministry of Finance (generally, 300 basis points above the prevailing prime lending rate of the State Bank of India).

The redemption/conversion (into equity) feature of preference shares makes them an attractive instrument. Preference capital can only be redeemed out of the profits of the company or the proceeds of a new issue of shares made for the purpose. The preference shares may be converted into equity shares, subject to the terms of the issue of the preference shares. On the regulatory front, a foreign investment made through fully compulsorily convertible preference shares is treated the same as equity share capital. Accordingly, all regulatory norms applicable for equity apply for such securities. Other types of preference shares (non-convertible, optionally convertible or partially convertible) are considered as debt and must be issued in conformity with the ECB guidelines discussed above in all aspects. Because of the ECB restrictions, such non-convertible and optionally convertible instruments are not often used for funding acquisitions.

Call/put options

Until recently, options (call/put) in investment agreements contravened Indian securities law. However, SEBI now permits contracts consisting of pre-emption rights, such as options, right of first refusal (ROFR), and tag-along/drag-along rights contained in shareholder or incorporation agreements.

Further, to align this amendment, RBI has notified that the use of options is subject to certain pricing guidelines that principally do not provide the investor an assured exit price and conditions as to the lock-in period. The RBI has recently amended the FDI Regulations to permit issue of non-convertible/redeemable bonus preference shares or debentures (bonus instrument) to non-resident shareholders under the automatic route.

Another possibility is the issuance of convertible debt instruments. Interest on convertible debentures normally is allowed as a deduction for tax purposes. However, like preference shares, all compulsorily convertible debentures are treated the same as equity. Other non-convertible, optionally convertible or partly convertible debentures must comply with ECB guidelines.

Other considerations

Concerns of the seller

Asset purchase

Both slump-sales and itemized sales are subject to capital gains tax in the hands of the sellers. In the case of a slump-sale, consideration in excess of the net worth of the business is taxed as capital gains. Net worth is calculated under the provisions of the Income Tax Act, 1961. Where the business of the undertaking of the transferor company is held for more than 36 months, such an undertaking is treated as a long-term capital asset and the gains from its transfer are taxed at a rate of 22.66 percent for a domestic company. Otherwise, the gains are taxed at 33.99 percent for a domestic company.

Capital gains taxes arising on an itemized sale depend on the nature of assets, which can be divided into three categories:

- tangible capital assets

- stock-in-trade

- intangibles (e.g. goodwill, brand).

The tax implications of a transfer of capital assets (including net current assets other than stock-in-trade) depend on whether the assets are eligible for depreciation under the Income Tax Act.

For assets on which no depreciation is allowed, consideration in excess of the cost of acquisition and improvement is taxable as a capital gain. If the assets of the business are held for more than 36 months, the assets are classified as long-term capital assets. For shares in a company, other listed securities, units of mutual funds and zero coupon bonds, the eligible period for classifying them it as long-term assets is reduced to 12 months. The gains arising from transfers of long-term capital assets are taxed at a 22.66 percent rate for a domestic company and 21.63 percent for a foreign company. For the purposes of calculating the inflation adjustment, the asset’s acquisition cost can be the original purchase cost. Inflation adjustment is calculated on basis of inflation indices prescribed by the government of India. (Where the capital asset was acquired on or before 1 April 1981, the taxpayer has the option to use the asset’s fair market value as of 1 April 1981 for this calculation).

Where the assets of the business are held for less than 36 months (12 months for shares), capital gains on the sale of such short-term capital assets are taxable at the rates of 33.99 percent for a domestic company and 43.26 percent for a foreign company.

For assets on which depreciation has been allowed, the consideration is deducted from the tax written-down value of the block of assets (explained below), resulting in a lower claim for tax depreciation going forward.

If the unamortized amount of the block of assets is less than the consideration received or the block of assets ceases to exist (i.e. there are no assets in the category), the difference is treated as a short-term capital gain and subject to tax at 33.99 percent for a domestic company and at 43.26 percent for a foreign company. If all the assets in a block of assets are transferred and the consideration is less than the unamortized amount of the block of assets, the difference is treated as a short-term capital loss and could be offset against capital gains arising in up to 8 succeeding years.

Any gains or losses on the transfer of stock-in-trade are treated as business income or loss. The business income is subject to tax at the rates of 33.99 percent for a domestic company and 43.26 percent for a foreign company. Business losses can be offset against income under any category of income arising in that year. If the current year’s income is inadequate, business losses can be carried forward to offset against business profits for 8 succeeding years.

The tax treatment for intangible capital assets is identical to that of tangible capital assets, as discussed earlier in this chapter. The Supreme Court recently held that goodwill arising on amalgamation amounts to an intangible asset that is eligible for depreciation. However, the issue of claiming depreciation on goodwill acquired has yet to be practically tested considering certain provisions of the Income Tax Act.

Share purchase

When the shares are held for 12 months or less, the gains are characterized as short-term capital gains and subject to tax at the following rates.

If the transaction is not subject to STT:

- 33.99 percent for a domestic company

- 43.26 percent for a foreign company

- 33.99 percent (flat rate) for an FFI.

If the transaction is subject to STT, short-term capital gains arising on transfers of equity shares are taxed at the following rates:

- 16.995 percent for a domestic company

- 16.2225 percent for a foreign company or FFI.

Where the shares have been held for more than 12 months, the gains are characterized as long-term capital gains and subject to tax as follows:

If the transaction is not subject to STT:

- The gains are subject to tax at a 22.66 percent rate for case of a domestic company and 21.63 percent for a foreign company. Resident investors are entitled to the benefit of an inflation adjustment when calculating long-term capital gains; the inflation adjustment is calculated based on the inflation indices prescribed by the government of India. Non-resident investors are entitled to benefit from currency fluctuation adjustments when calculating long-term capital gains on a sale of shares of an Indian company purchased in foreign currency.

- Income tax on long-term capital gains arising from the transfer of listed securities (off the stock market), which otherwise are taxable at 22.66 percent or 21.63 percent, is restricted to a concessionary rate of 11.33 percent rate for a domestic company. The concessionary rate must be applied to capital gains without applying the inflation adjustment.

- A concessionary rate of 10.82 percent applies on the transfer of capital assets being unlisted securities in the hands of non-residents (including foreign companies). The concessionary rate must be applied to capital gains without the benefit of exchange fluctuation and indexation.

If the transaction is subject to STT, long-term capital gains arising on transfers of equity shares are exempt from tax.

Company law and accounting

The Companies Act, 1956, governs companies in India. The Act incorporates the detailed regulations for corporate restructuring, including corporate amalgamation or demerger. The Jurisdictional High Court, under the powers vested in it by the Act, must approve all such schemes. The provisions allowing corporate amalgamations or restructuring provide a lot of flexibility. Detailed guidelines are prescribed for other forms of restructuring, such as capital reduction and buy-back.

Accounting norms for companies are governed by the Accounting Standards issued under the Companies Act. Normally, for amalgamations, demergers and restructurings, the Accounting Standards specify the accounting treatment to be adopted for the transaction.

The accounting treatments are broadly aligned with the provisions of the Accounting Standard covering accounting for amalgamations and acquisitions. The standard prescribes two methods of accounting: merger accounting and acquisition accounting. In merger accounting, all the assets and liabilities of the transferor are consolidated at their existing book values. Under acquisition accounting, the consideration is allocated among the assets and liabilities acquired (on a fair value basis). Therefore, acquisition accounting may give rise to goodwill, which is normally amortized over 5 years.

Transfer pricing

After an acquisition, all intercompany transactions, including interest on loans, are subject to transfer pricing regulations.

Outbound Investments

Foreign investments by a local company

Foreign Investments by an Indian company are regulated by the guidelines issued by the RBI. Broadly, an Indian entity can invest up to 100 percent of its net worth (as per audited accounts) in joint ventures or wholly owned subsidiaries overseas, although investments exceeding USD5 million may be subject to certain pricing guidelines. Currently there are no controlled foreign companies (CFC) regulations in India.

Comparison of asset and share purchases

Advantages of asset purchases

- Faster execution process, because no court approval is required (court approval is required for an acquisition of a business through a demerger).

- Assets and liabilities can be selectively acquired and assumed.

- Possible to restate the values of the assets by the acquirer for accounting and tax purposes, subject to appropriate valuation in a slump-sale and subject to carrying out the transaction at a specified price in an itemized sale of assets.

- Possible to capture the value of brand(s) and intangibles and claim depreciation thereon, subject to appropriate valuation in a slump-sale and subject to carrying out the transaction at a specified price in an itemized sale of assets.

- No requirement to make an open offer, unlike in a share acquisition.

Disadvantages of asset purchases

- The transaction may not be tax-neutral, unlike amalgamations and demergers, among others.

- Approvals may be required from the financial institutions (among others) to transfer assets or undertakings, which may delay the process.

- Continuity of incentives, concessions and unabsorbed losses under direct or indirect tax laws or the Export and Import Policy of India (also known as EXIM or Foreign Trade Policy of India) must be considered.

- Stamp duty may be higher.

- VAT implications need to be considered in an itemized sale of assets.

Advantages of share purchases

- Faster execution process, because no court approval is required (except where the open offer code is triggered or government approval is required).

- Typically, STT is levied on a sale of equity shares through a recognized stock exchange in India at the rate of 0.1 percent for each such purchase and sale.

- Gains arising on the sale of assets subject to STT held for more than 12 months are exempt from tax.

- On a sale of shares (other than listed shares) held for more than 12 months, rate of tax of 22.66 percent for a domestic company after considering a cost inflation adjustment for gains on transfer of such shares and a concessionary rate of 10.82 percent for non-residents (including foreign companies) without benefit of exchange fluctuation and indexation.

- No VAT applies.

Disadvantages of share purchases

- The transaction may not be tax-neutral, and capital gains taxes may arise for the sellers.

- Stamp duty cost at 0.25 percent of total consideration payable on shares held in physical form.

- Not possible to capture value of intangibles.

- Not possible to step-up the value of assets acquired.

- Consideration paid for acquisition of shares is locked-in until the shares are sold, and embedded goodwill cannot be amortized.

- May require regulatory approval from the government and from regulators such as SEBI and FIPB.

- Valuation of shares may be subject to the pricing guidelines of the RBI.

- On an acquisition of shares of listed companies, acquiring more than 25 percent would trigger the SEBI Takeover Code, which obliges the acquirer to acquire at least 26 percent of the shares from the open market at a price determined under a prescribed SEBI formula. This may substantially increase the transaction cost and the time needed to complete the transaction because the shares would only vest in the acquirer after the open offer is complete.

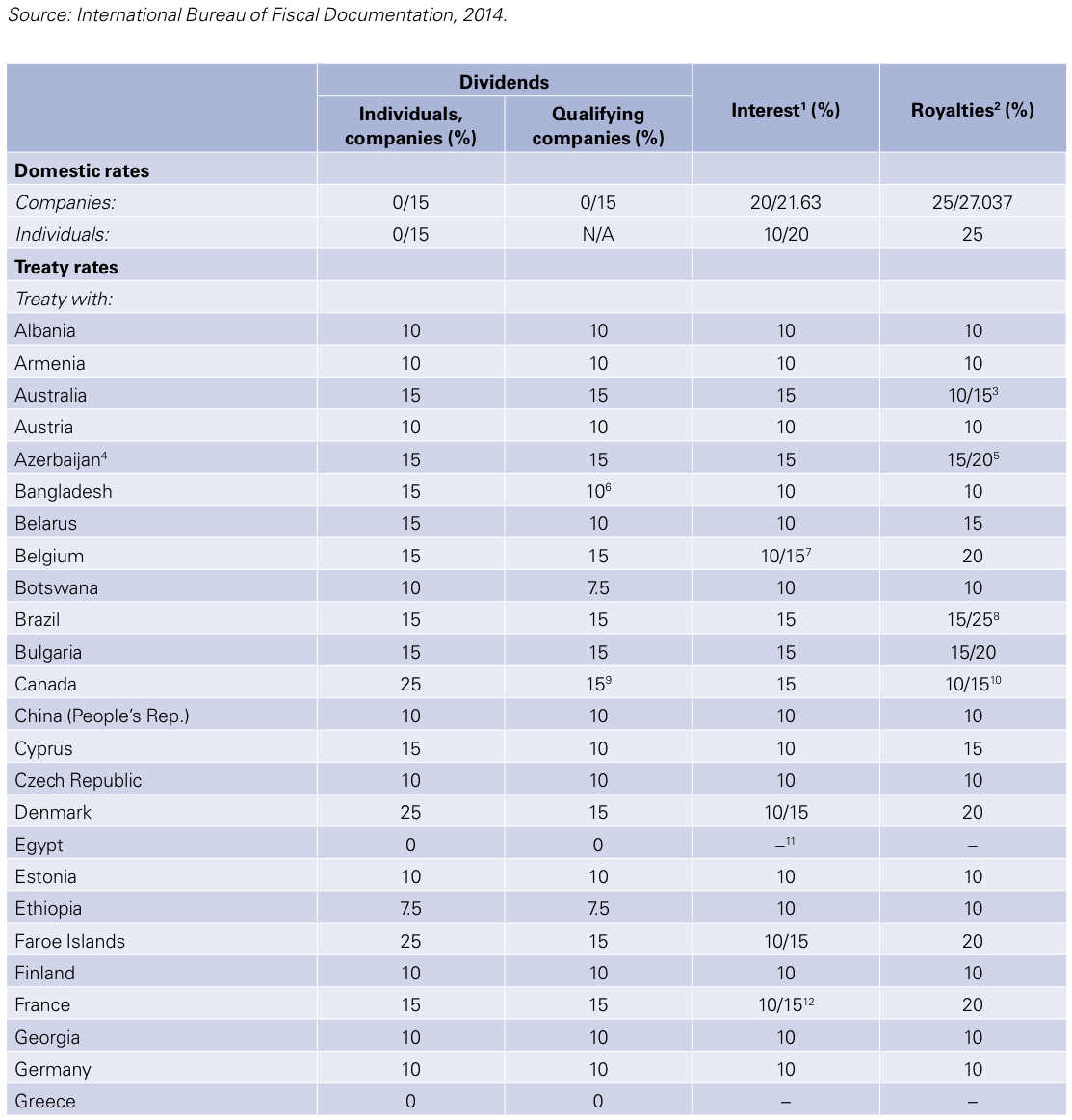

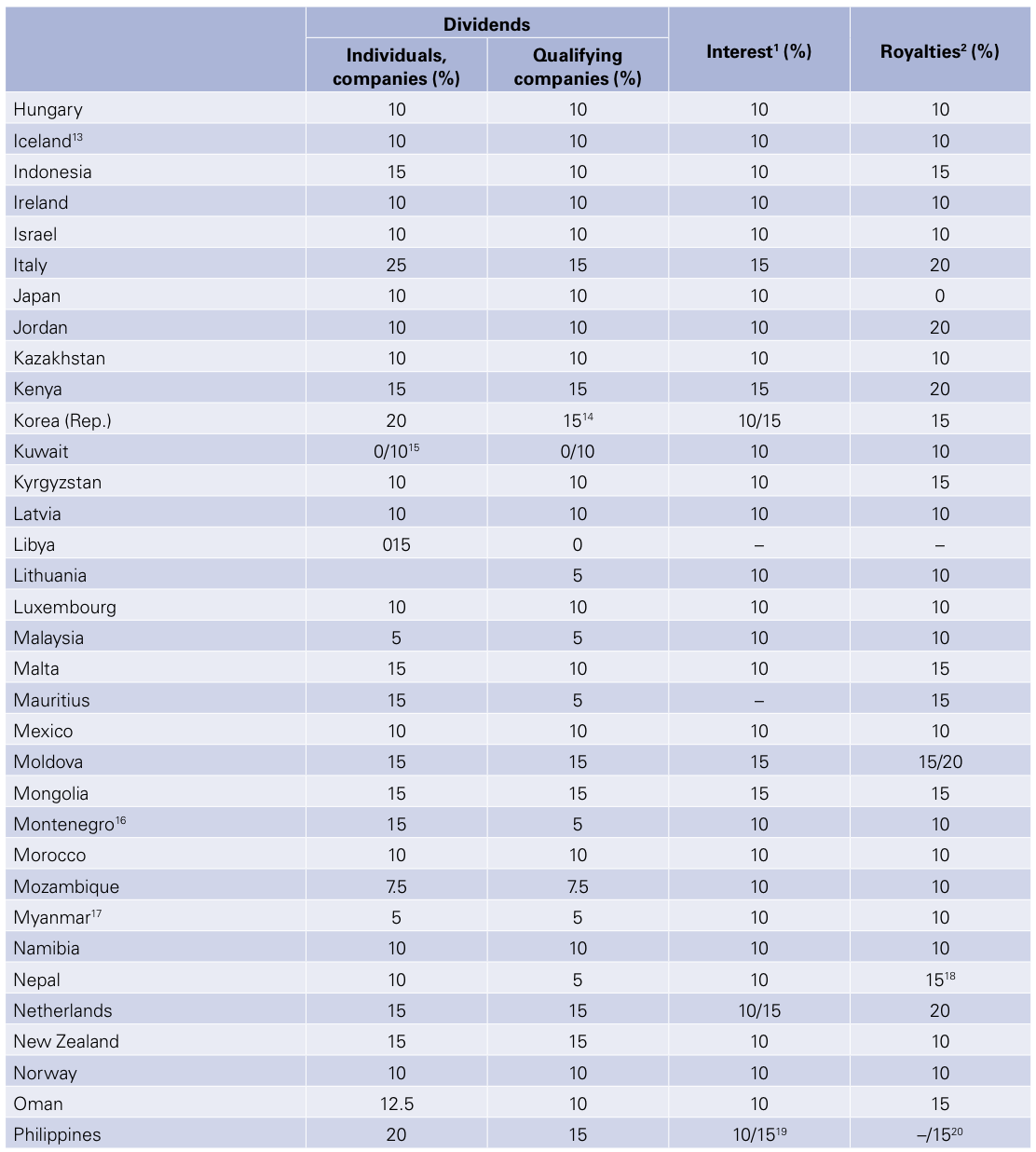

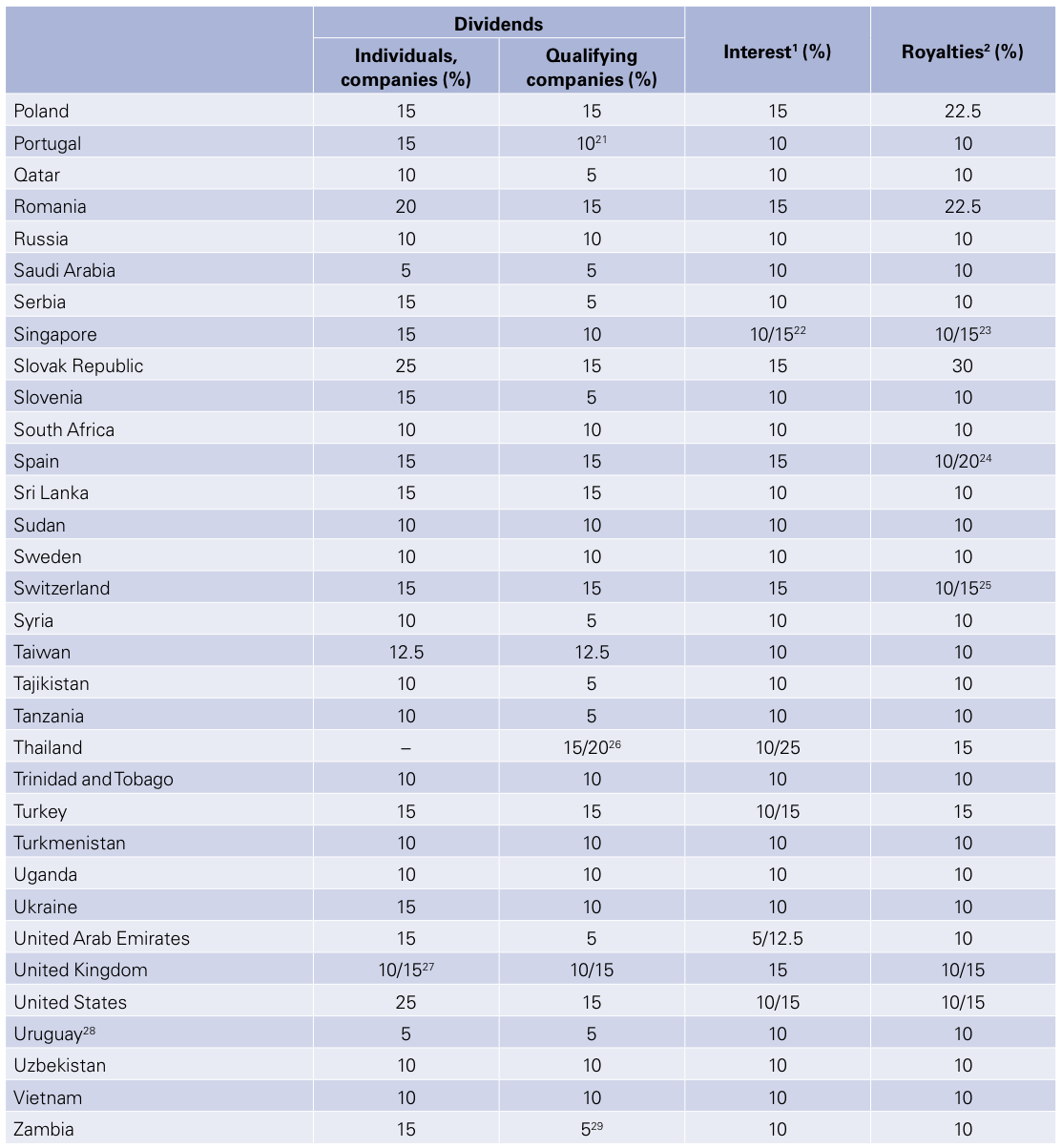

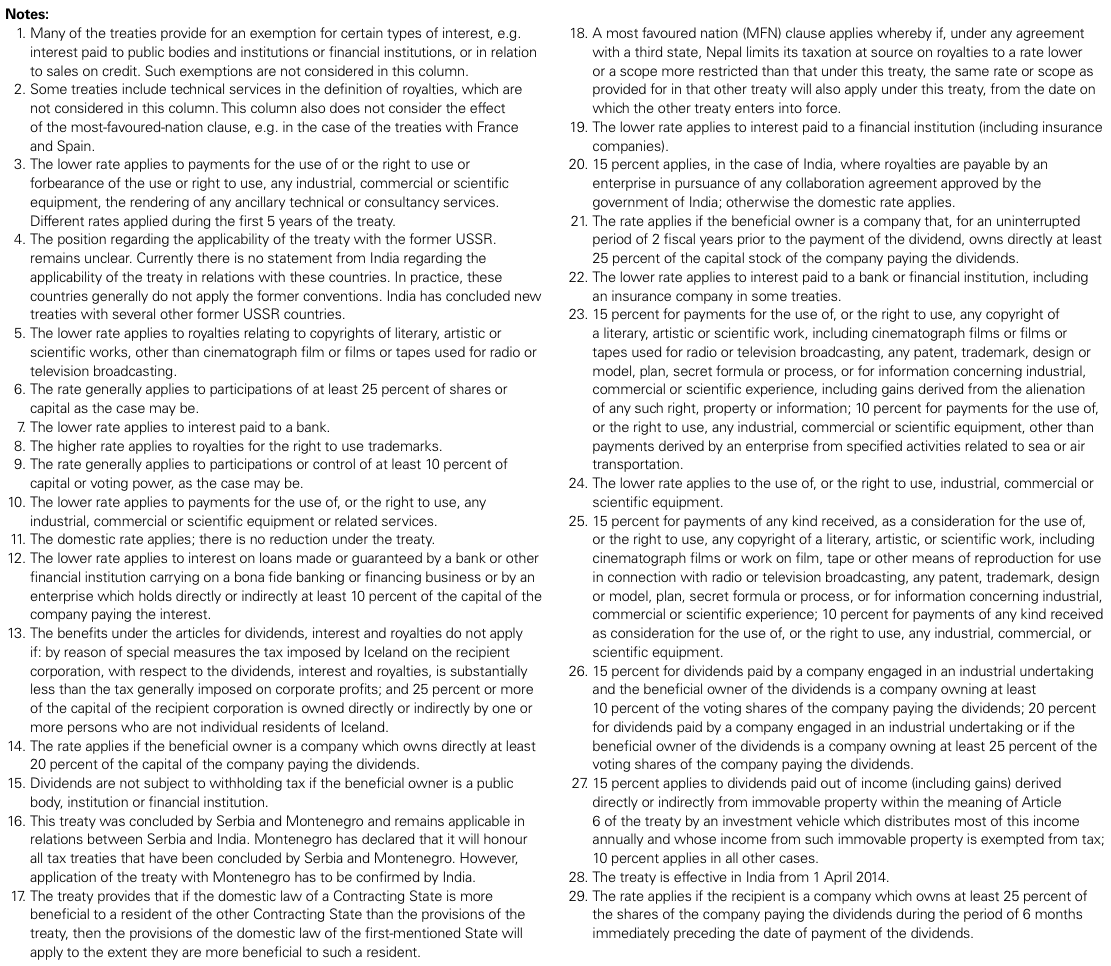

India – Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under India’s tax treaties. This table is based on information available up to 1 January 2014.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter