Publications Taxation Of Cross-Border Mergers And Acquisitions: Finland 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: Finland 2014

- Christopher Kummer

SHARE:

By KPMG

Introduction

The most common Finnish corporate entity is a limited liability company (LLC). There are two forms: the public limited company (Oyj) and the private limited company (Oy). Finnish company laws are largely based on European Union (EU) directives. The Companies Act was amended in 2006, to provide more flexibility in areas such as dividend distribution.

Other forms of legal entities are general partnerships (avoin yhtiö – Ay) and limited partnerships (kommandiittiyhtiö – Ky). The partnership must file a tax return showing the taxable profit or loss of the partnership but is not itself subject to tax. The profits of Finnish partnerships are taxed at the partner level. However, tax losses are not allocated to the partners. They are carried forward at the partnership level to offset the partnership’s taxable income. The excess income is then allocated to the partners.

Pursuant to the Income Tax Act, income earned by a corporation is taxed at the rate of 20 percent as of 1 January 2014 (previously 24.5 percent). Major tax reform in 2004 introduced a participation exemption for the sale of shares and made capital and liquidation losses and write-downs in the value of shares and loans non-deductible for tax purposes. Despite the participation exemption, liquidation losses can still be tax-deductible for corporations that have capital investment activities. Disposals of shares in real estate companies and housing companies are not covered by the capital gains exemption rules.

Recent developments

New earnings stripping rules took effect for financial years that end on or after 1 January 2014. According to the new rules, net interest costs representing a maximum of 25 percent of so-called tax earnings before interest, taxes, depreciation and amortization (tax EBITDA) are tax-deductible. Interest costs on third-party loans are still fully tax-deductible, but they limit the ability to deduct interest costs on related-party loans. Certain escape clauses to avoid the earnings stripping rules have been implemented. Non-deductible interest costs are carried forward indefinitely.

As of 1 January 2014, changes to the taxation of dividends were also implemented. In certain circumstances, repatriation of invested free equity is classified as dividend income for the shareholder.

Changes to tax consolidation to replace the current group contribution scheme and to tax loss carry forwards have also been discussed.

Merger

A merger is a tax-neutral way to combine Finnish companies. The following rules pursuant to the Business Income Tax Act apply:

- The transferring company is deemed not to be dissolved for the purposes of taxation.

- The expenses of the transferring company are deducted in the recipient company as they would have been deducted in the transferring company; the maximum depreciations (for the year of the merger) of the recipient company are reduced by the depreciation allowed in the taxation of the transferring company for that year.

- A loss resulting from a merger (i.e. the difference between the acquisition cost of shares and the value of net assets transferred) is not a deductible expense and a gain is not taxable income.

- The recipient company and the transferring company are treated as separate taxpayers until the merger is complete.

- The exchange of the shares in the transferring company for shares in the recipient company is not treated as a taxable event for shareholders of the transferring company.

- Cash may be used as consideration, but it must not exceed 10 percent of the nominal value of the new shares issued by the recipient company; the transaction is deemed to be a taxable event for shareholders to the extent that cash compensation is used.

- The deductible acquisition cost of the new shares received as a consideration by the shareholders of the transferring company is equal to the acquisition cost of the shares in the transferring company.

The recipient company or its shareholders, or the recipient company and its shareholders together, must have held more than 50 percent of the shares of the merging company at the start of the year in which the tax loss accrued in order to retain the right to carry forward its losses and use its tax surpluses.

Pursuant to the Transfer Tax Act, a merger is not subject to transfer tax. However, where cash is used, the cash consideration is subject to transfer tax of 1.6 or 2 percent (even where the cash consideration does not exceed 10 percent of the nominal value of the new shares issued as consideration by the recipient company).

Where the cash consideration does exceed 10 percent of the nominal value of the new shares issued, the merger is not considered tax-neutral. In case law, the tax effects of a taxable merger are equivalent to liquidation; the merging entity is deemed to be liquidated for tax purposes.The effects of liquidation are discussed later in this chapter.

Finland has implemented the provisions of the EU Merger Directive on mergers between companies in different Member States. Thus, Finnish tax law regulating mergers applies to mergers between companies resident in two or more Member States. Finnish company law was amended, as of 31 December 2007, to recognize cross-border mergers, so these mergers are also practical from a tax viewpoint.

Other tax-neutral transactions cover complete and partial demergers, transfers of assets and share swaps under certain preconditions that should be analyzed on a case-by-case basis. Certain clawback issues may be triggered, for example, in cross-border transactions.

Asset purchase or share purchase

An acquisition in Finland usually takes the form of a purchase of the shares of a company, rather than its business and assets, because capital gains on the sale of shares may be exempt. From a tax perspective, the capital gains consequences and possible double taxation on extracting the sales proceeds are likely to make asset acquisitions less attractive for the seller. However, the benefits of assets acquisitions for the purchaser should not be ignored, particularly given that purchased goodwill is tax-deductible. Some of the tax considerations relevant to each method are discussed below.

Purchase of assets

A purchase of assets usually results in an increase in the base cost of those assets, although this increase is likely to be taxable for the seller. In addition, historical tax liabilities generally remain with the selling company and are not transferred with the assets.

Purchase price

For tax purposes, it is necessary to apportion the total consideration among the assets acquired. It is generally advisable for the purchase agreement to specify the allocation, which is normally acceptable for tax purposes provided it is commercially justifiable.

Goodwill

The Finnish Business Income Tax Act stipulates that the purchase price must be allocated to the individual assets up to their fair market value. The excess purchase price is considered goodwill. Consequently, the buyer receives a step-up in the tax base of the assets and can deduct the goodwill for tax purposes.The goodwill must be capitalized and amortized over its economic life up to a maximum of 10 years.

Depreciation

Acquisition costs of patents, copyrights and trademarks, etc., are depreciated by the straight-line method over 10 years, or, where the taxpayer can show that the likely economic lifetime of the asset is shorter, over that period.

Expenses incurred in acquiring fixed assets are deductible through depreciation. The acquisition cost of the taxpayer’s entire stock of machinery and equipment is written off annually as a single item using the declining-balance method. Under this method, the depreciation base consists of the net book value of all such assets plus the acquisition value of assets introduced during the tax year, less any sales proceeds, insurance compensation and the like received for assets sold, damaged or lost during the tax year. The maximum annual depreciation is 25 percent of this base. Where the taxpayer can show that the current value of these assets is less than the depreciation base reduced by the full 25 percent, the taxpayer is entitled to such additional depreciation as is necessary to reduce the depreciation base to the current value.

Where the depreciation base for machinery and equipment is negative, the excess is treated as current taxable income.

As an exception to the general rule, machinery and equipment with an economic life of 3 years or less can be either written off in full in the year of acquisition or depreciated along with other machinery and equipment.

Buildings and other constructions are also depreciated by the declining-balance method. Each building must be depreciated as a separate item. Maximum rates of depreciation range from 4 percent to 20 percent, depending on the use of the building. Where a taxpayer can show that the current value of the building is less than its book value, the taxpayer is entitled to additional depreciation. Large repair costs can be either deducted as a cost immediately or included in the depreciation base of the building.

The depreciation rate for industrial buildings, power stations, workshops, warehouses, stores and similar buildings is 7 percent. The rate for homes, offices and other similar buildings is 4 percent.

Tax attributes

Tax losses are not transferred on an asset acquisition. They remain with the seller. However, tax losses can be used against any capital gain realized on the sale of the assets.

Value added tax

All goods and services, unless expressly excluded, are subject to value added tax (VAT). The standard rate of VAT is 24 percent. As an EU Member State, Finland has adopted VAT legislation in line with the Sixth EC VAT Directive.

VAT is not payable on the sale or other supply of goods and services where the sale or supply takes place in connection with the transfer of an entire business enterprise, or part of it, to a transferee carrying on the business and using the goods and services for a purpose that entitles the transferee to the deduction.Therefore, the transaction through an asset deal is not subject to tax.

Stamp duty and stamp duty land tax

A so-called transfer tax of 1.6 percent is due on the fair market value of Finnish securities, including shares of Finnish companies, and 4 percent on the real estate transferred in the asset deal. The transfer tax is 2 percent on transfers of shares in real estate companies or housing companies. The transfer tax base is not only the equity value but also other payments (e.g. shareholder loan repayments) to the seller or its affiliates. Finnish tax authorities usually accept the purchase price allocation agreed by the seller and the purchaser as an indication of the fair market value.

Purchase of shares

The purchase of a target company’s shares does not result in an increase in the base cost of that company’s underlying assets. There is no deduction for the goodwill (i.e. the difference between underlying net asset values and consideration).

Tax indemnities and warranties

In a share acquisition, the purchaser is taking over the target company together with all related liabilities, including contingent liabilities. The purchaser, therefore, normally requires more extensive indemnities and warranties than in the case of an asset acquisition.

Where significant sums are at issue, it is customary for the purchaser to initiate a due diligence exercise, which normally incorporates a review of the target’s tax affairs.

Tax losses

A tax loss may be carried forward for the subsequent 10 tax years. Where more than 50 percent of the shares of an LLC have changed ownership during the year, the loss is recorded. After that year, the right to carry forward tax losses is forfeited unless the regional tax office grants a dispensation. Indirect ownership changes are taken into consideration where there has been a change in the ownership of a shareholder that owns at least 20 percent of the shares in the company in question. There are no special provisions allowing the losses of one company in a group to be deducted from the profits of other companies in the same group, but a group contribution is tax-deductible in certain conditions.

In 2011, the Finnish Supreme Administrative Court asked the European Court of Justice (ECJ) to determine whether the Finnish exemption system concerning tax losses and changes in the ownership of companies with tax losses could constitute state aid, which is incompatible with the EU law. The ECJ gave its judgment in 2013, but did not take a clear position on whether the exemption regime constitutes state aid or not. However, the ECJ has stated that the exemption regime should be classified as existing aid where it happened to constitute state aid. Thus, the Finnish Tax Administration should adhere to the tax laws in force and the Tax Administration can continue to grant dispensations. However, the European Commission may investigate the compatibility of the dispensation regime with the EU law sometime in the future.

In the case of a merger, the acquiring company or its shareholders or both of them together must have held more than 50 percent of the shares of the merging company by the beginning of the loss-making year to retain the right to carry forward tax losses. No dispensation can be applied for in relation to tax losses forfeited in mergers.

Crystallization of tax charges

Capital gains taxation for the transferor can be deferred where preconditions for the exchange of shares are fulfilled. Where an acquisition is effected by the purchase of shares in exchange for the issue to the seller of new shares in the purchaser, the gain may be rolled over into the new shares, thus enabling the seller to defer the Finnish capital gains tax liability. Additional conditions for the tax-neutrality are that cash compensation cannot be more than 10 percent of the nominal value of the new shares issued and that the purchaser acquires more than 50 percent of the voting power of the target. It is possible to obtain clearance in advance from the Finnish tax authorities that the exchange of shares transaction will be considered tax-neutral (i.e. that the tax-free rollover is not denied).

Pre-sale dividend

In certain circumstances, the seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that the dividend may lead to lower Finnish tax but reduces the proceeds of sale and thus the gain on sale, which may be subject to a higher rate of tax. The dividend also reduces the consideration given for the shares in a Finnish company, so it could lower the amount of the transfer tax payable, which benefits the buyer, depending on timing of the dividend distribution. The position is not straightforward, and each case must be examined on its facts.

Stamp duty

A so-called transfer tax is payable at the rate of 1.6 percent or 2 percent on the value of the consideration given for shares and certain other payments that benefit the seller or its affiliates, provided either the seller or buyer is a Finnish resident individual or company. Where neither the seller nor buyer is a Finnish resident, no Finnish transfer tax is due, unless the objects of the transfer are shares in Finnish real estate or housing company. Special rules may apply to Finnish branches of certain foreign financial institutions.

Tax clearances

It is possible to obtain a clearance from the tax authorities giving assurance that a potential target company has no arrears of tax within the last 12 months preceding the date of the tax certificate. The standard certificate relies on tax return filings and payments of the target company. It does not state whether or not the target is involved in a tax dispute or whether the information on the tax returns was correct.

Choice of acquisition vehicle

Several potential acquisition vehicles are available to a foreign purchaser, and tax factors often influence the choice. There is no capital duty on the introduction of new capital to a Finnish company or branch (or to a Finnish-registered SE).

Finland holding company

There are no special rules for holding companies in Finland. The tax treatment of capital gains on the sale of shares was significantly modified by the Finnish tax reform. As of the date of issuance of the government’s bill, 19 May 2004, companies may qualify for an exemption from tax on capital gains in respect of gains realized on the disposal of shares where the seller has owned at least 10 percent of the share capital of the target company for at least 12 months prior to the disposal. Additionally, the shares must have been fixed assets of the seller.

The participation exemption does not apply where the seller is a company that carries on private equity or venture capital activities (word-for-word translation from Finnish is ‘capital investment activities’). The exemption also does not apply where the target company is a real estate company or other company, the activities of which consist of owning and managing real estate. The definition of private equity or venture capital activities has been left open in the government’s bill. Based on the statement of the Finance Committee of the Parliament, private equity or venture capital houses seek, finance and promote high-risk enterprises, which may have difficulties in obtaining financing from other sources. The purpose of the private equity/venture capital investor is to develop the activities of the company and contribute to the company’s value. The investor is not a permanent owner but intends to realize its shareholding during a stated time period. Private equity/venture capital investors typically own a minority of the company’s share capital and do not normally receive any return on their investment before the disposal of the shares.

Although the above definition of private equity or venture capital activities brings some clarity, a number of issues remain open and the application of the participation exemption to private equity or venture capital investments is unclear. According to recent Supreme Administrative Court (SAC) decisions, private equity-owned holding companies, incorporated for a transaction, may be considered to be capital investors not entitled to the capital gains exemption.

Where the participation exemption is applicable, capital losses and write-downs in the value of the subsidiary shares are not tax-deductible. Unrealized share write-downs are non-deductible also for capital investors.

Interest costs related to the acquisition of shares are tax-deductible, provided that new earnings stripping rules do not apply and the interest rate is arm’s length. It is possible to deduct the interest cost in the acquisition vehicle against the profits of the target company, provided a group contribution is allowable between the target and the acquisition vehicle (see this chapter’s section on group taxation). A Finnish branch of a foreign company can also grant or receive a group contribution.

Restrictions on interest cost deductions took effect as of 1 January 2013 and apply for financial periods that end on or after 1 January 2014. (See choice of acquisition funding below.)

Foreign parent company

The foreign purchaser may choose to make the acquisition itself, perhaps to shelter its own taxable profits with the financing costs. This does not necessarily cause any tax problems because Finland does not tax the gains of non-residents disposing of Finnish shares (unless the company’s main activity is to possess Finnish real estate). Finland levies withholding tax (WHT) of 30 percent on dividends. A reduced rate of 20 percent may be applied on dividends to certain foreign corporations. Further, the WHT is often reduced in the tax treaties concluded by Finland. There is no WHT on dividends paid to parent companies resident in the EU. Finland does not levy WHT on interest (subject to some minor exceptions).

Non-resident intermediate holding company

Finland has a comprehensive tax treaty network with more than 60 countries, including all the industrialized countries and almost all the important developing countries.

Finland branch

A non-resident company normally carries on business in Finland through a Finnish corporation (subsidiary) or registered branch. The corporate tax rate of 20 percent applies to both subsidiaries and branches.

The calculation of taxable income is basically the same for a subsidiary as for a branch. Both must base their intercompany transactions on the arm’s length principle, and each is considered to be an independent entity for tax purposes. However, a reasonable allocation of executive and general administrative expenses to the branch is allowed. A branch is not allowed to deduct interest on loans from the head office, but the profits of a branch may be remitted to the head office free of WHT.

The advantages and disadvantages of different vehicles must be considered case by case.

Joint venture

No special tax legislation applies to joint ventures.

Choice of acquisition funding

A purchaser using a Finnish acquisition vehicle to carry out an acquisition for cash needs to decide whether to fund the vehicle with debt, equity or a hybrid instrument that combines the characteristics of both. The principles underlying these approaches are discussed below.

Debt

The principal advantage of debt is the potential tax-deductibility of interest (see this chapter’s section on deductibility of interest), as the payment of a dividend does not give rise to a tax deduction. Another potential advantage of debt is the deductibility of expenses, such as guarantee fees and bank fees, in computing taxable income from business activities.

Where it is decided to use debt, a further decision must be made as to which company should borrow and how the acquisition should be structured. To minimize the cost of debt, there must be sufficient taxable profits against which interest payments can be made. The following comments assume the purchaser wishes to offset the interest payments against the Finnish target’s taxable profits. Consider also whether relief would be available at a higher rate in another jurisdiction.

Typically, a Finnish company is used as the acquisition vehicle, funding the purchase with debt either from a related party or directly from a bank. Provided that at least 90 percent of the target’s share capital is acquired, it should be possible for interest paid to be offset against Finnish taxable profits arising in the target group from the beginning of fiscal year following the acquisition.

Generally, it is safer to introduce debt financing at the time of the acquisition than after because the Finnish tax authorities have recently tried to challenge post-acquisition debt pushdowns. Further, the Finnish tax authorities have also challenged intragroup reorganizations driven by new debt allocation.

There is no specific legislation denying post-acquisition debt pushdown, however, so it should still be possible. Careful tax planning is required, and local advice should be sought.

Deductibility of interest

New interest expenses rules apply for financial years that end on or after 1 January 2014. Limitations apply to Finnish corporations and general and limited partnerships carrying on business activities; thus, the limitations do not apply to, for example, most real estate companies that are not treated for tax purposes as companies carrying on business activities.

Limitations also apply to foreign corporations in their Finnish taxation (i.e., to Finnish permanent establishments of foreign entities). Both domestic and cross-border interest expenses are subject to the limitations.

The limitations are based on the debtor taxpayer’s taxable business profits before tax EBITDA. Received and paid group contributions are taken into account in calculating the taxable business income, but tax losses carried forward are not deducted.

Interest expenses are fully deductible corresponding to the received interest income. Interest cost exceeding the received interest income is deductible insofar as it represents at maximum 25 percent of the tax EBITDA. Interest cost exceeding the 25 percent threshold is not tax-deductible; however, the non-deductible interest expense is limited to the net interest expense paid to associated companies only. Where no interest is paid to associated companies, the tax-deductibility of the interest is not limited.

The determination of ‘associated company’ corresponds to the current legislation on transfer pricing adjustments. There are two exceptions (safe harbors):

- Where the net interest expense is at maximum 500,000 Euros (EUR; including net interest expenses to both associated companies and third-party creditors), the limitations are not applied.

- Where the equity ratio (equity versus total balance) of the debtor taxpayer is higher or the same as the entire group’s consolidated equity ratio, the limitations are not applied. The comparison is made based on the financial statements; however, it is unclear how the differences between Finnish GAAP and IFRS (e.g. on hybrid instruments) are taken into account.

The limitations are not applied to finance, insurance or pension institutions.

The limitations also cover so-called back-to-back financing situations where the loan is obtained from third-party financier that has a collateral/guarantee from another associated company. However, such arrangements contaminate the third-party financing only where the guarantee is a corresponding receivable (e.g. deposit).

Publicly issued bonds and cash pooling arrangement are usually not subject to interest limitations. The limitations do not signify a reclassification of the non-deductible interest expense to, for example, dividends. Thus, corresponding interest income is regarded as fully taxable for the recipient.

The non-deductible interest expense of a certain fiscal year accumulates and is deductible from the business profits of the following fiscal years, taking into account the above limitations for each fiscal year. There is no time limit for the future deductibility, and changes of ownership do not affect the carry forward of the deductions.

The limitations have a ‘lex specialis’ status. In practice, this means that the tax deductibility of interest expenses can also be limited or denied based on the arm’s length principle and general tax avoidance clause, where applicable.

No grandfathering is available. The limitations apply to interest expenses on existing intragroup debts that were in place before the new tax provisions were introduced.

Withholding tax on debt and methods to reduce or eliminate it

There is no WHT on interest in Finland (subject to minor exceptions).

Checklist for debt funding

- The effects of the new earnings stripping rules and use of group contributions should be considered case by case.

- Consider whether and to what extent the level of profits in Finnish group companies would enable tax-deductibility of the interest.

- Analyze the timing of the group contribution, because deductibility is only possible from the beginning of the fiscal year following the acquisition.

- Analyze the arm’s length nature of the terms of loans granted by associated companies.

Equity

A purchaser may use equity to fund its acquisition, possibly by issuing shares to the seller in satisfaction of the consideration or by raising funds through a seller placing. Further, the purchaser may wish to capitalize the target post-acquisition.

There is no capital duty in Finland on contributions to equity or any stamp duty or Finnish transfer tax on new share issues.

Hybrids

According to guidelines published by the Finnish National Board of Taxes, capital/subordinated loans fulfilling the conditions set out in the Finnish Companies Act are considered as debt for Finnish tax purposes. Thus, the interest on such debt and on profit-participating loans is tax-deductible.

Deferred settlement

An acquisition often involves an element of deferred consideration, the amount of which can only be determined at a later date on the basis of the business’s post-acquisition performance. The right to receive an unknown future amount must be estimated based on the information available at the time of the acquisition and considered as part of compensation. Where it turns out later that the estimate was not correct, it must be corrected by notifying the tax authorities of the additional income or filing an appeal for a reduction of taxable income for the acquisition year.

Other considerations

Concerns of the seller

The tax position of the seller can be expected to significantly influence any transaction. In certain circumstances, the seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that the dividend may be subject to low Finnish tax but reduces the proceeds of sale and thus the gain on sale, which may be subject to a higher cash tax. The dividend also reduces the consideration given for the shares in a Finnish company and thus the amount of the transfer tax payable, which could benefit the buyer, depending, for example, on timing of the dividend distribution.The position is not straightforward, however. Each case must be examined on its facts.

Finland does not tax gains of non-residents (except on disposals of real estate and companies whose main assets are real estate and on certain disposals by non-resident companies with a permanent establishment in Finland).

Company law and accounting

The Finnish Companies Act 2006 is a modern and comprehensive law that provides plenty of scope for reorganizations. For example, from the Finnish company law perspective, cross-border mergers and triangular mergers are possible.

It is possible for a Finnish company to follow International Financial Reporting Standards (IFRS) in its single company accounts. Few companies have used this option because the accounting is the basis for tax returns of a Finnish company, and IFRS and taxation were not reconciled. However, as of 2009, certain changes were made to the Finnish tax legislation that enable a tax-neutral merger, transfer of assets or demerger even where assets need to be valued at fair market value in accounting in accordance with IFRS. Still, IFRS is not beneficial, for example, for companies that are willing to grant or receive group contributions or have accelerated depreciation for tax purposes.

Another important feature of Finnish company law concerns the ability to pay dividends. Distribution of profit may be made only out of a company’s distributable reserves.

Finally, a common issue on transaction structuring arises from the provisions concerning financial assistance. Broadly, these provisions say that it is illegal for a company to give financial assistance, directly or indirectly, for the purpose of acquiring its own shares.

Group relief/consolidation

Under the Business Income Tax Act, corporations are taxed separately and no consolidated tax returns are accepted. However, arrangements similar to group taxation are possible for tax-deductible group contributions for limited (liability) companies under certain conditions.

Group contributions (other than capital contributions, which are not deductible) can be credited between domestic companies from business income (not relating to the banking or insurance industries), where the contribution is not otherwise deductible from business income. To qualify, both companies must be resident in Finland and there must be at least 90 percent ownership, direct or indirect, from the beginning of the tax year. Group contributions can be credited in both directions, from a parent company to a subsidiary and vice versa, as well as horizontally between sister companies. The criteria for indirect ownership can be fulfilled through a foreign company on the basis of the non-discrimination clause in the tax treaty with the country involved. Where a Finnish or non-Finnish company owns at least 90 percent of its Finnish subsidiaries, a group contribution can be effected between these subsidiaries, provided the other conditions discussed above are met.

The granted group contributions may not exceed the taxable income of the contributing company in the tax year. The contributing company must formally make the decision during the tax year in which the contribution is granted, but the actual payment can be made later. The group contribution is tax-deductible only where the corresponding deduction is made in the books of the contributing company and where the receiving company books the contribution as its (taxable) income during the (tax) year in which it is deducted by the contributing company. At least a 90 percent group relationship must have prevailed during the entire fiscal year, and the financial years of the companies must end on the same day.

According to case law, a Finnish branch of a company resident in the EU may also receive and grant group contributions.

Transfer pricing

Arm’s length pricing must be followed in all intragroup transactions, including between Finnish group companies.

Dual residency

Group contributions granted by a Finnish group company to a dual resident company are not tax-deductible, so the losses of a dual resident company cannot be offset against profits of other Finnish group companies.

Foreign investments of a Finland target company

Finland’s controlled foreign company (CFC) legislation is designed to prevent Finnish companies from accumulating profits offshore in low-tax countries. Unless the offshore subsidiary is carrying on certain acceptable activities or meets other specified conditions, its profits are apportioned to its Finnish parent and subject to tax. Broadly speaking, subsidiaries situated in tax treaty countries or in the EU are not usually considered as CFCs.

Comparison of asset and share purchases

Advantages of asset purchases

- Goodwill is tax-deductible for the buyer.

- Step-up in the cost base for tax purposes is obtained.

- Possible to set off capital gain on assets against tax losses in the seller company.

- No previous liabilities of the company are inherited. After the asset deal, the seller company is still legally responsible for the company’s liabilities, such as taxes.

- Possible to acquire only part of a business.

- Profitable operations can be absorbed by loss-making companies in the acquirer’s group, thereby effectively gaining the ability to use the losses.

Disadvantages of asset purchases

- Possible need to renegotiate various types of external agreements.

- A higher capital outlay is usually involved (unless debts of the business are also assumed).

- Where the seller company does not have any tax losses, the capital gain is taxable at the 20 percent corporate tax rate. Thus, it may be unattractive to the seller, thereby increasing the price.

- Tax loss carry forwards and other tax attributes remain in the seller company (the buyer cannot take any advantage of the tax attributes).

- Transfer tax of 1.6 percent or 2 percent is due on the fair market value of the shares of the Finnish companies or real estate (4 percent) included in the assets. The buyer is liable for the tax.

Advantages of share purchases

- There is a lower capital outlay (purchase net assets only).

- Likely more attractive to the seller due to the participation exemption, so the price is likely to be lower.

- In an ownership change of more than 50 percent, the tax losses are forfeited. However, a Finnish company subject to the change of ownership may apply to the tax authorities for permission to use these tax attributes.

- Possible to benefit from existing external contracts.

Disadvantages of share purchases

- No tax deduction for the goodwill element in the purchase price.

- Buyer inherits liability for any claims or previous liabilities of the acquired entity.

- Where either the buyer or the seller is a Finnish resident, the purchase of Finnish shares is subject to transfer tax of 1.6 or 2 percent.

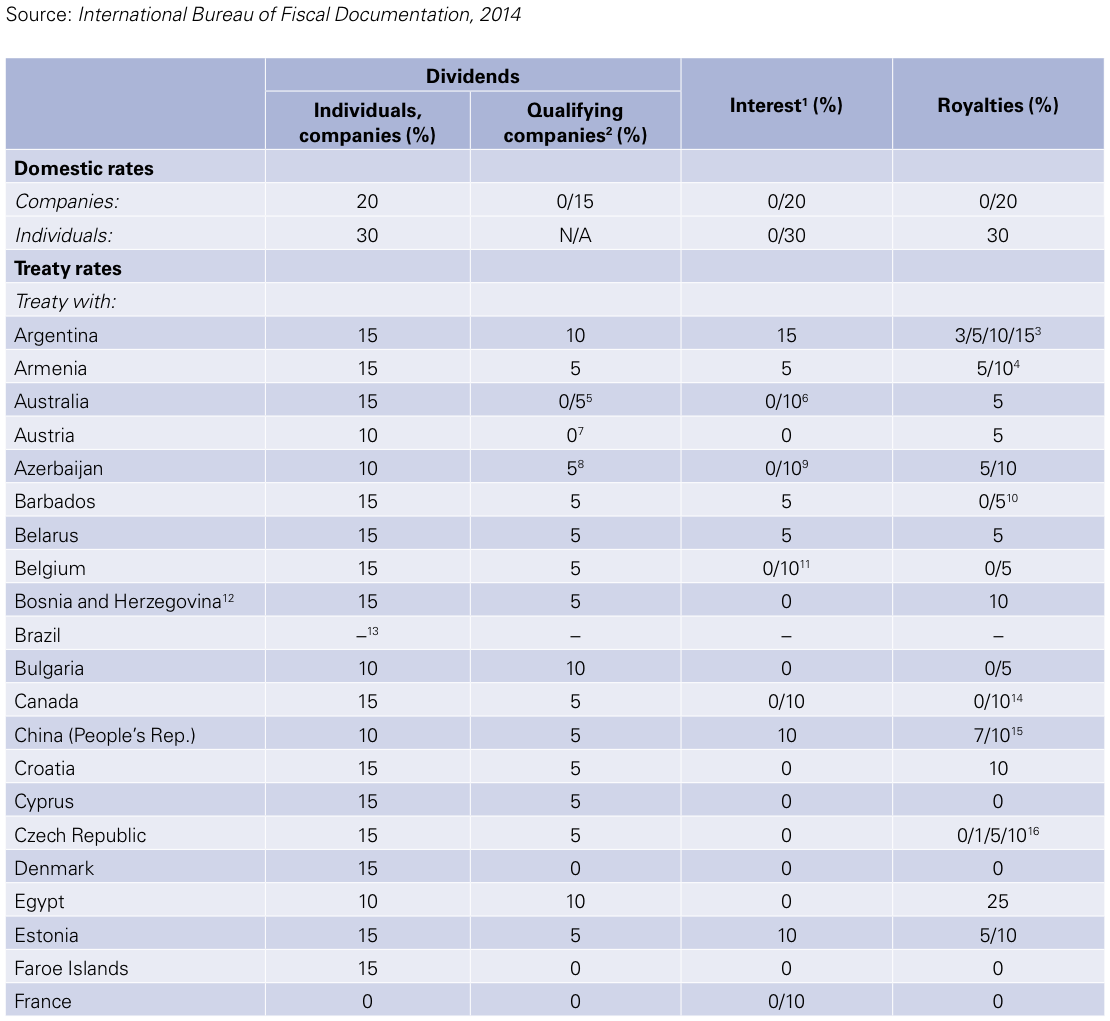

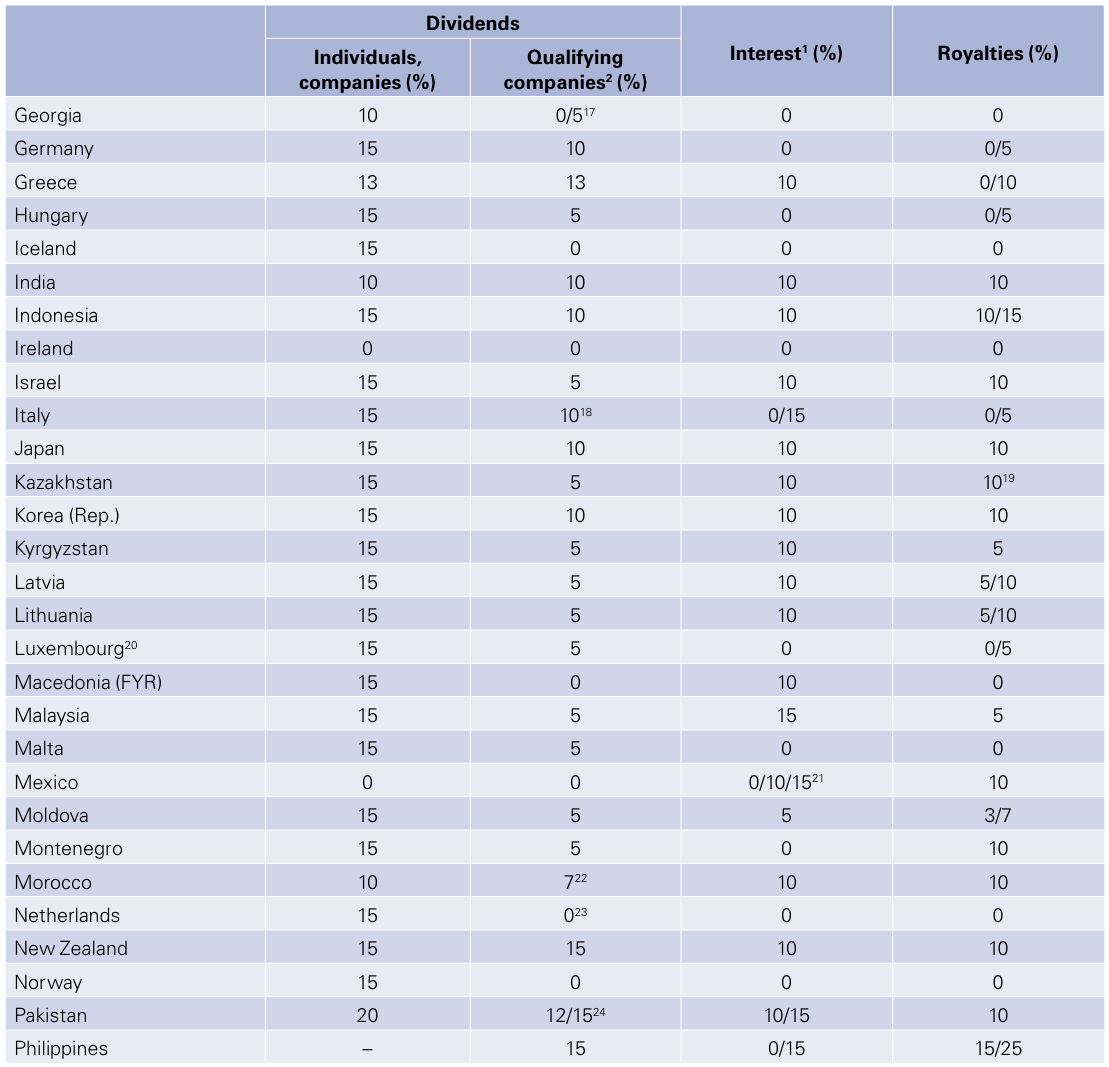

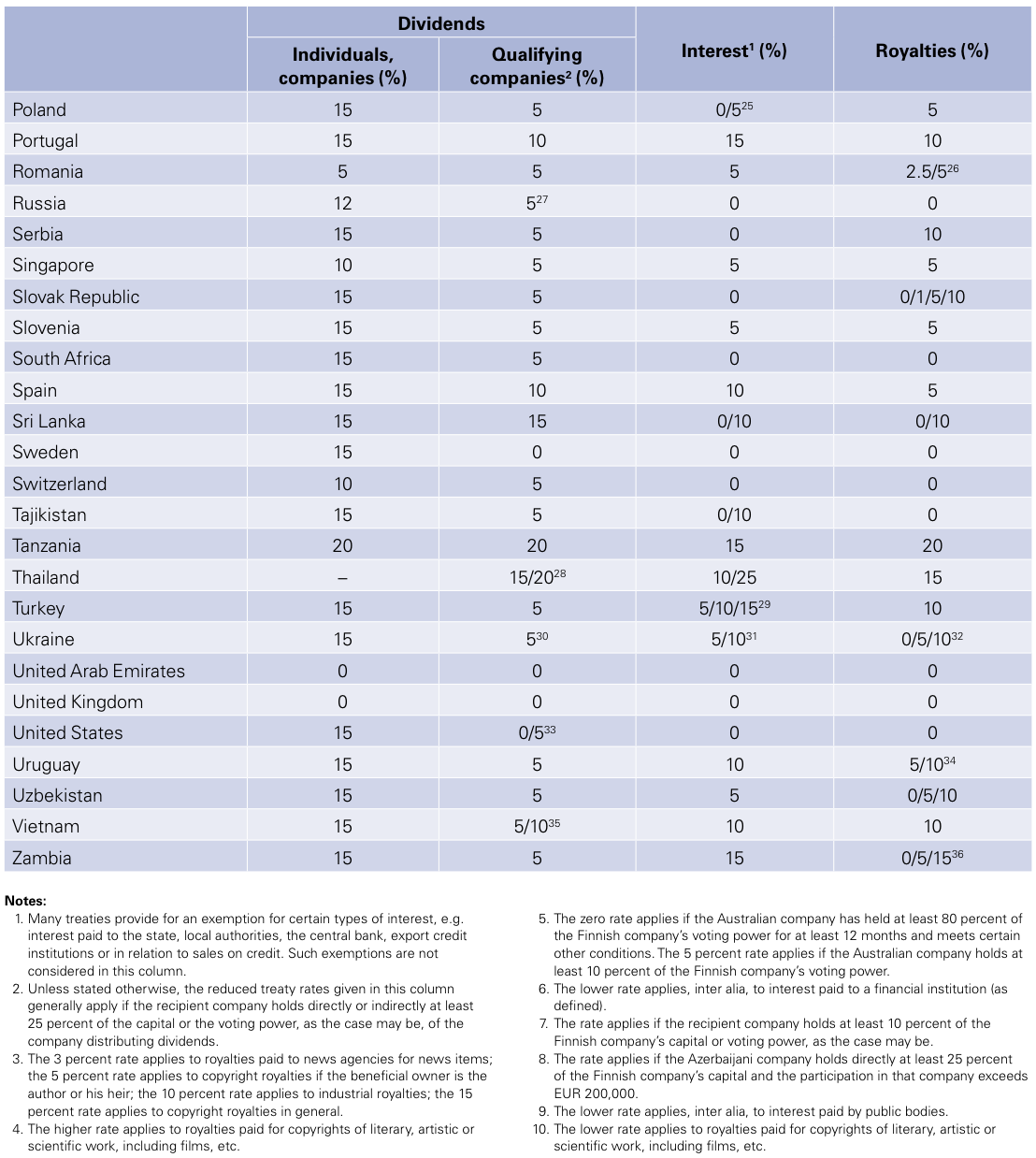

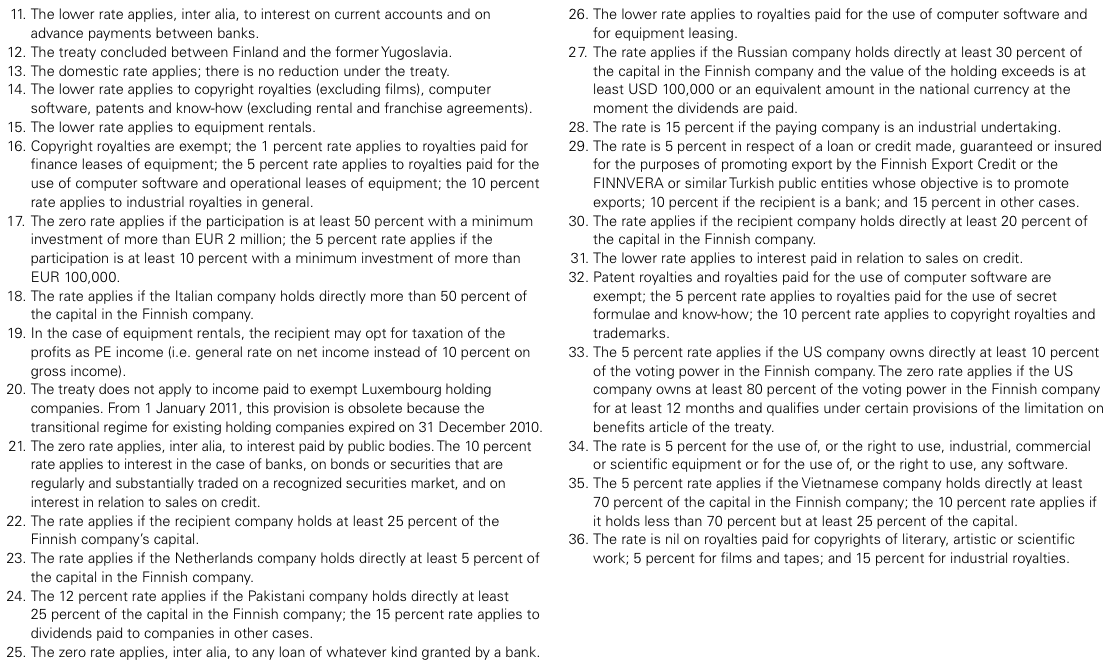

Finland – Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Finland’s tax treaties. This table is based on information available up to 11 March 2014.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter