Publications Power Transactions And Trends, Q1 2016

- Publications

Power Transactions And Trends, Q1 2016

- Christopher Kummer

SHARE:

Overview

Diversification and disruption shape transactional agenda

This Q1 2016 edition of Power transactions and trends reviews quarterly deal activity within the power and utilities (P&U) sector and forecasts the trends that will shape future mergers and acquisitions (M&A).

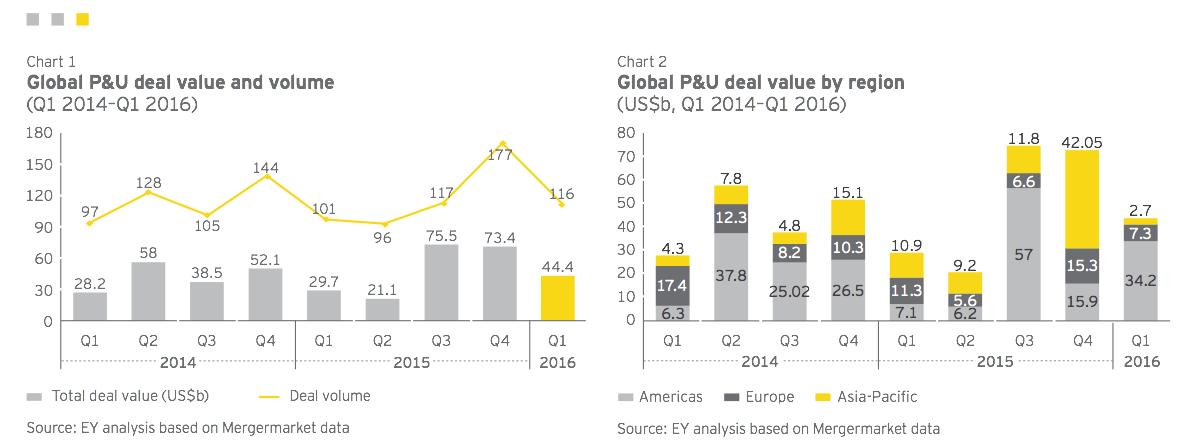

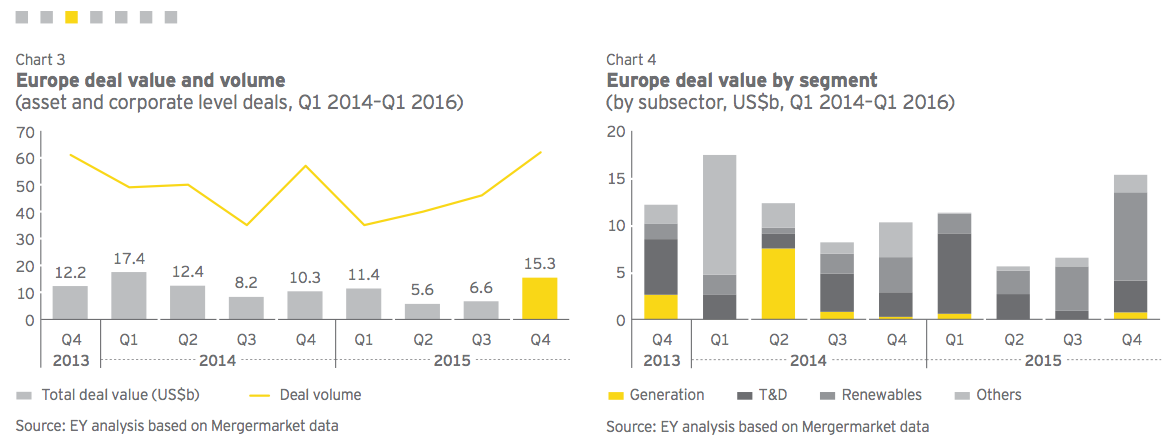

After hitting historic levels in 2015, M&A momentum continued in Q1 2016, with deal value reaching a five-year Q1 high of US$44.4b, 50% more than that of Q1 2015. The Americas sector contributed 77% of global deal value, led by US megadeals. As hybrid utilities and financial institutions sought stable earnings in the low interest rate environment by adding regulated assets to their portfolios, transactional activity in the regulated transmission and distribution (T&D) segment increased significantly. Canadian investors made their presence felt, with notable deals including the acquisitions of ITC Holdings and Empire District Electric Company for a cumulative US$13.7b.

In the Asia-Pacific, the temporary absence of large deals in China and Australia resulted in a slower quarter, with deal value reaching just US$2.8b. We see this as a short-term dip, as the region hosted significant cross-border greenfield and financing activity, mostly in India’s renewable energy sector, along with new thermal capacity in Vietnam and Indonesia. The planned sale of distribution assets in the Australian state of New South Wales also remains on track, providing a guarantee of high annual deal value outcomes this year.

In Europe, continued weak wholesale prices and regulatory uncertainty around renewables meant that financial buyers dominated strategic investor roles in European transactions. Pension funds and private equity buyers did deals worth more than US$4.5b in the region, primarily in wind generation assets.

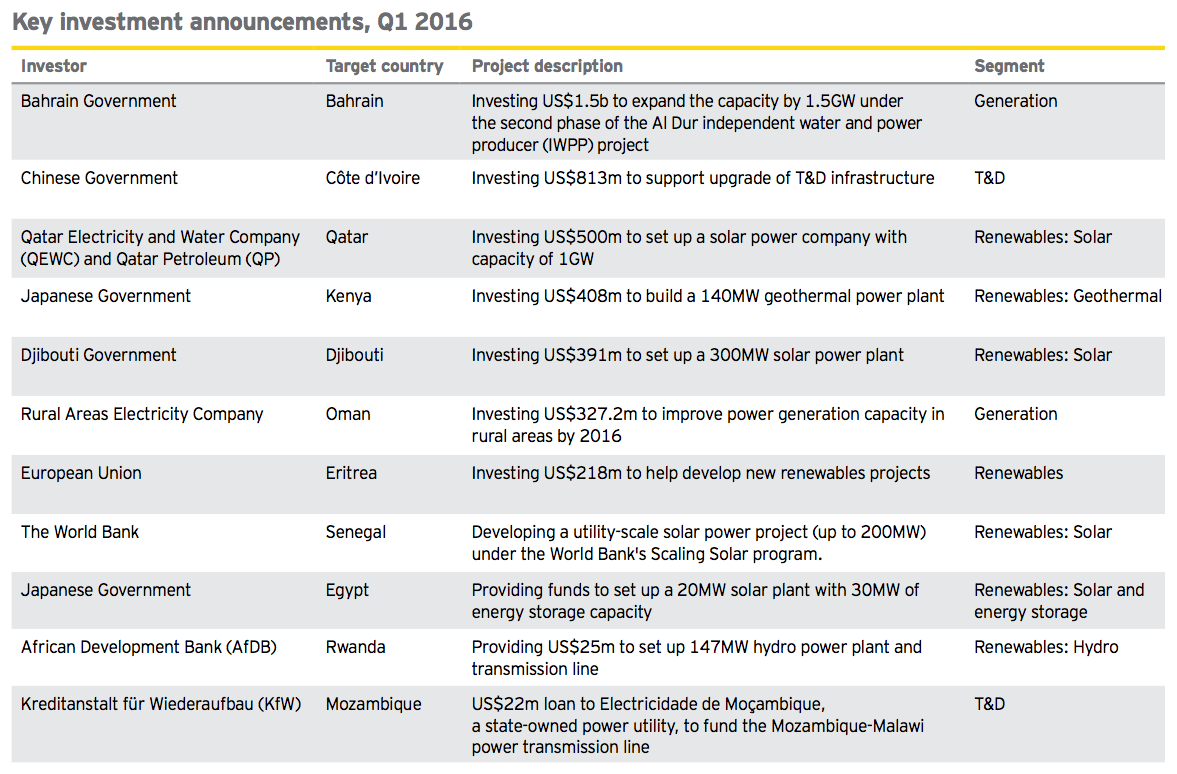

P&U investment in Africa and the Middle East shifted to a new phase this quarter, with investors moving from due diligence to acquisition, reflecting increased confidence in long-term growth. In Africa, the representation of European and Chinese investors keen to diversify investment into emerging markets remained high. In the Middle East, the focus continues to be on outbound transactions into Eastern Europe and neighboring Gulf countries. (Matt Rennie, EY Global Transaction Advisory Services (TAS) Power & Utilities Leader)

Investors target regulated and renewable energy assets

The quarter saw two themes becoming more present in P&U M&A outcomes:

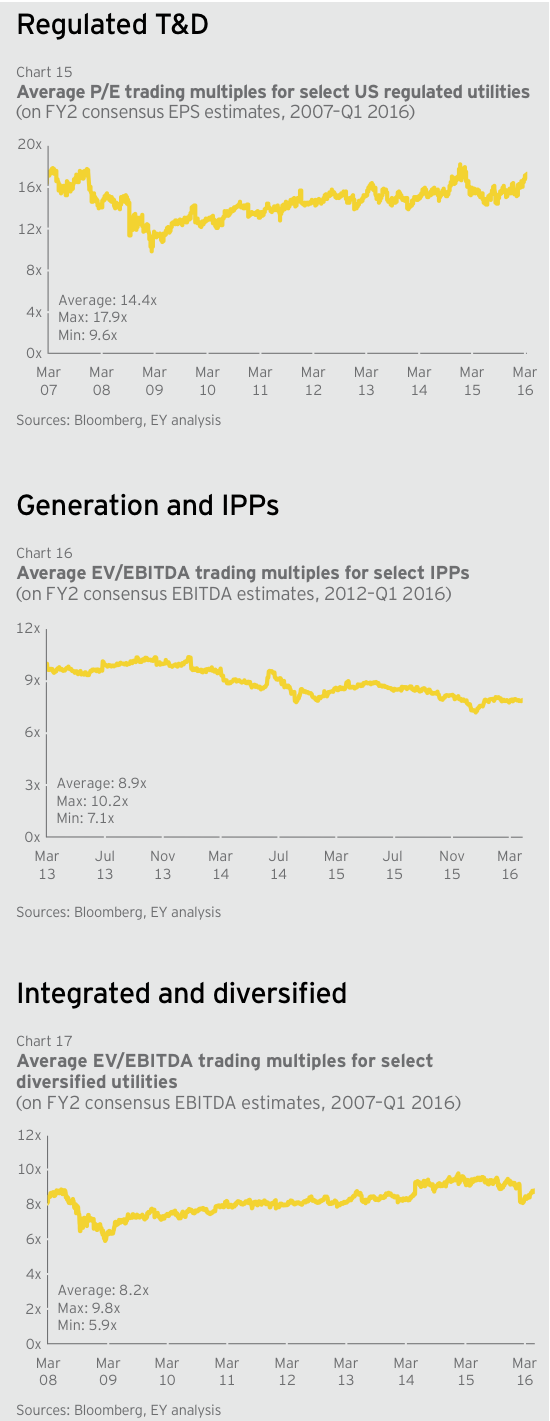

1. Deal imbalance driving funds towards renewable and regulated assets: Low interest rates and wholesale energy prices, combined with oversupply of conventional generation in most developed markets is putting pressure on utilities to diversify operations. Regulated network assets, stable retailing operations and long term (preferably sovereign) PPA backed renewables deals are hotly contested between both P&U companies and those funds specializing in infrastructure investment. Valuations for gas and electric transmission and distribution (T&D) assets remain high – in the Americas investors are willing to pay as much as 40% over target stock price premiums to secure stable cashflows. Renewables are also attracting competitive valuations. The April auctions of Mexico’s wind and solar contracts achieved an average contract price of US$50.7/MWh while in May 2016, a new record lowest bid was set in Dubai, when 800 MW of large scale solar received bids as low as US$30/MWh (without subsidies).

2. Investment in energy services and disruptive technology assets: Declining revenue from electricity sales is also driving utilities to explore cross-sector investment at an increased rate, particularly as a way to acquire new energy technology and offer the different products and services customers are demanding. We are seeing power and utilities companies either buying, partnering or acquiring stakes in the energy services, connected homes, distributed energy and battery storage space, in a trend that is driving increased M&A activity.

We expect these factors and ongoing deal momentum to lead to robust M&A activity within the world’s P&U sector through 2016.

US$44.4b total deal value for Q1 2016, a five-year Q1 high

77% contribution by Americas deal activity during the quarter

US$9.2b total Americas deal value, a seven-year high

30% average discount on historical valuations for independent power producers in the Americas

Europe

Utilities explore disruptive technologies to drive growth

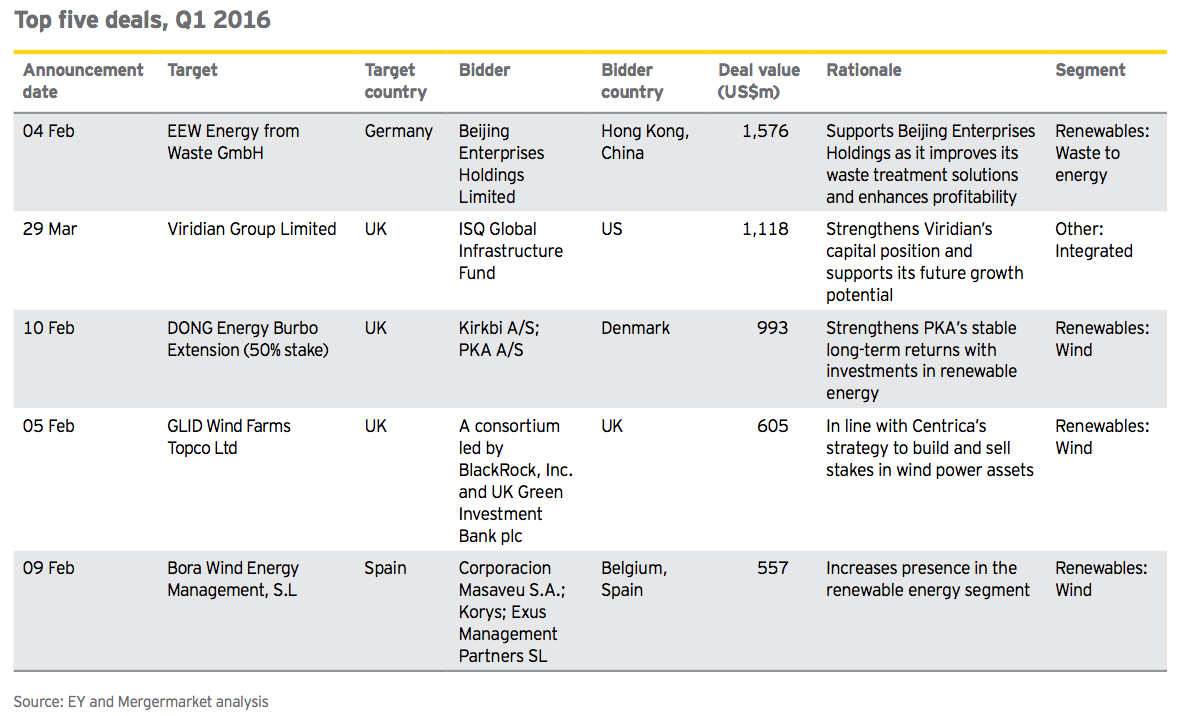

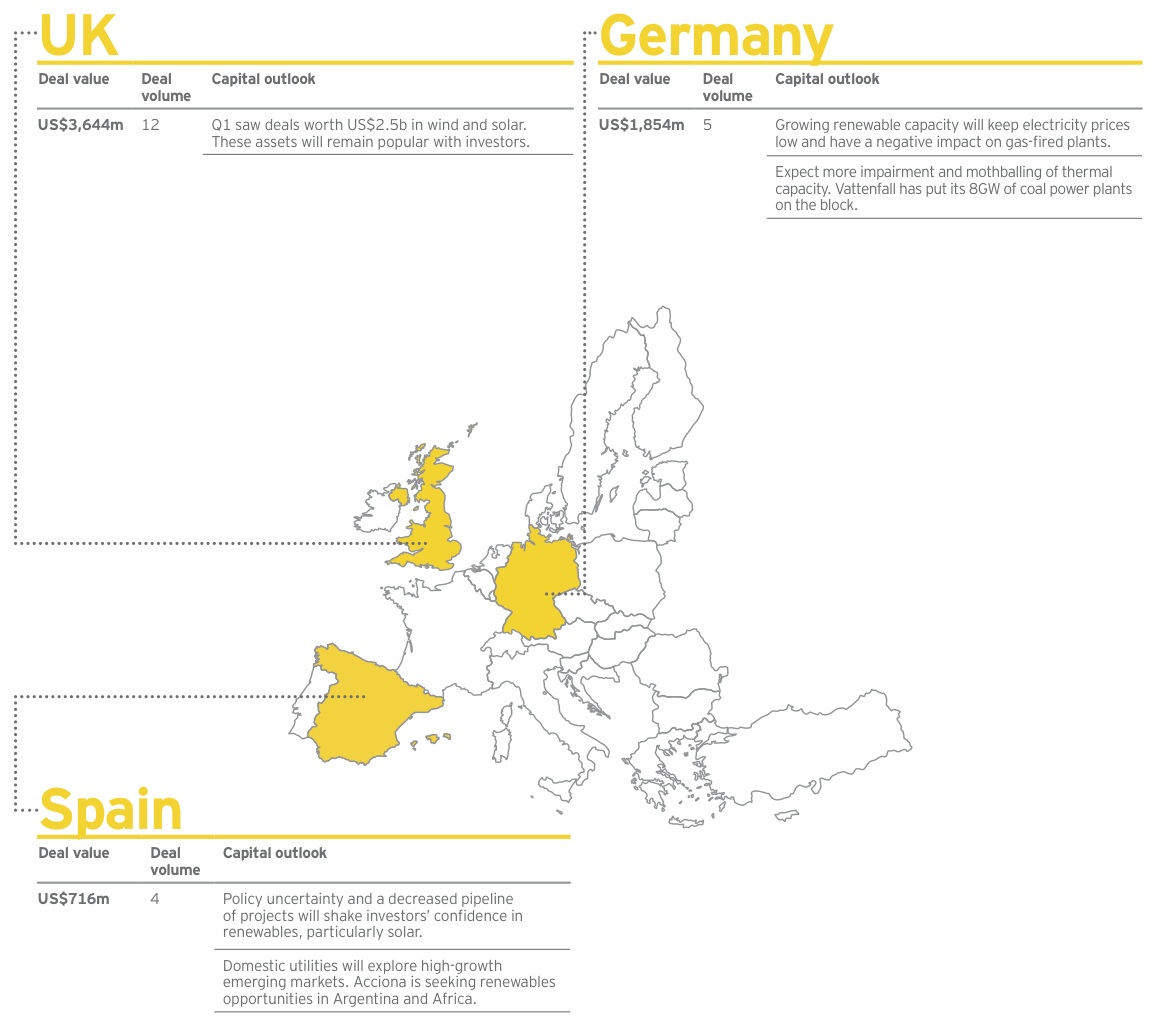

Deals within Europe’s power and utilities (P&U) sector reached just US$7.4b in Q1 2016, compared with US$11.4b in Q1 2015. Regulatory and commodity uncertainty and weak wholesale power prices are prompting utilities to focus on small to mid bolt-on deals. The quarter saw more than three times as many deals worth less than US$500m than mega billion-dollar acquisitions.

Many deals and initiatives announced in Q1 highlight how utilities are using transactions to seek growth through disruptive technology, renewables and energy services:

- E.ON will partner with SOLARWATT GmbH to develop an electricity storage system in an example, according to E.ON, of its focus on a “new energy world, characterized by renewables, distributed generation, energy efficiency [and] microgrids.”

- Statkraft has launched operations of its first multi-megawatt-battery in TenneT’s German grid area.

- Fortum Oyj announced a new vision focused on clean energy, customers and shareholder value creation, including the establishment of two new business units relating to M&A and renewables development, and technology and new ventures.

There were no generation asset deals in Q1, suggesting investors are wary of continued sluggish energy demand. Estimates indicate earnings growth for European utilities is unlikely to exceed 1% through 2016. Utilities with high exposure to volatile generation assets and upstream oil and gas exploration and production (E&P) are likely to be hardest hit, leading to the possibility of further asset write-downs.

Q1 2016 highlights:

• Utilities sell equity stakes in wind assets to raise capital: There was continued strong activity in the wind energy markets, with utilities selling stakes in wind energy generation assets to predominantly financial investors. In February 2016, Denmark-based PKA A/S and Kirkbi A/S acquired a 25% stake each in a 258MW UK offshore wind farm project from DONG Energy for US$993m, with 7%+ stable returns cited as the biggest driver. In March 2016, Greencoat UK Wind Plc and GMPF and LPFA Infrastructure LLP acquired a 49.9% stake in Clyde Windfarm Limited from SSE Plc.

• Upstream oil companies invest in clean technologies: Oil and gas companies also appear keen to diversify revenue streams through the addition of renewable energy into their portfolios. Statoil’s new US$200m venture capital fund will invest in growth companies in the renewable energy segment, while French oil giant Total bought stakes in two solar power start-ups via its US$150m Total Energy Ventures capital fund.

• Coal weighs on balance sheets: We continued to see mothballing of coal-fired assets over the quarter, as evidenced by SSE and Drax in February. E.ON and RWE posted significant losses following their respective US$9.8b and US$3.4b coal and gas plant write-downs in 2015.

• Divestments fund expansion into new markets: Utilities are continuing to divest non-core assets to fund expansions into overseas and adjacent markets. Italian gas company Snam announced plans to spin off domestic distribution operations to fund expansion of its core transmission business across Europe. Spain-based integrated oil and gas company Repsol sold its piped gas business to EDP as part of its divestment strategy.

US$7.4b total deal value for Q1, down from US$11.4b in Q1 2015

US$5.4b Q1 2016 deal value powered by renewable energy transactions

US$4.6b deal value undertaken by financial investors

74% deal value contributed by cross-border deals

Transaction snapshot

Renewables dominate deals as utilities partner with financial investors

As forecast in our Q4 2015 edition, this quarter’s European M&A was focused on renewables, which accounted for 74% of total transactional value. Many of these deals involved wind generation, with utilities across the UK, Spain and Norway selling around 1GW of these assets to capitalize on strong investor interest. We also saw deals involving around 1GW of solar energy assets.

Many of these assets were bought by financial investors, who did 16 deals worth a total of US$4.6b in Q1 — their highest contribution in four quarters. Wind energy, particularly UK offshore wind, was the favored segment (69% of financial deal value) due to stable long-term cash flows.

Investors this quarter were also attracted to integrated, and water and wastewater management, utilities. Cross-border buyers dominated, accounting for two-thirds of these deals, worth more than US$1.4b. The highlight was US-based ISQ Global Infrastructure Fund’s US$1.1b acquisition of Viridian Group Limited, an Irish integrated company with 1.8GW of gas and wind assets.

As merchant thermal energy continues to struggle, we expect increased transactional activity in segments that were previously not high on investors’ agenda. In particular, we anticipate more European deals in energy efficiency and energy services, water and wastewater and integrated utilities.

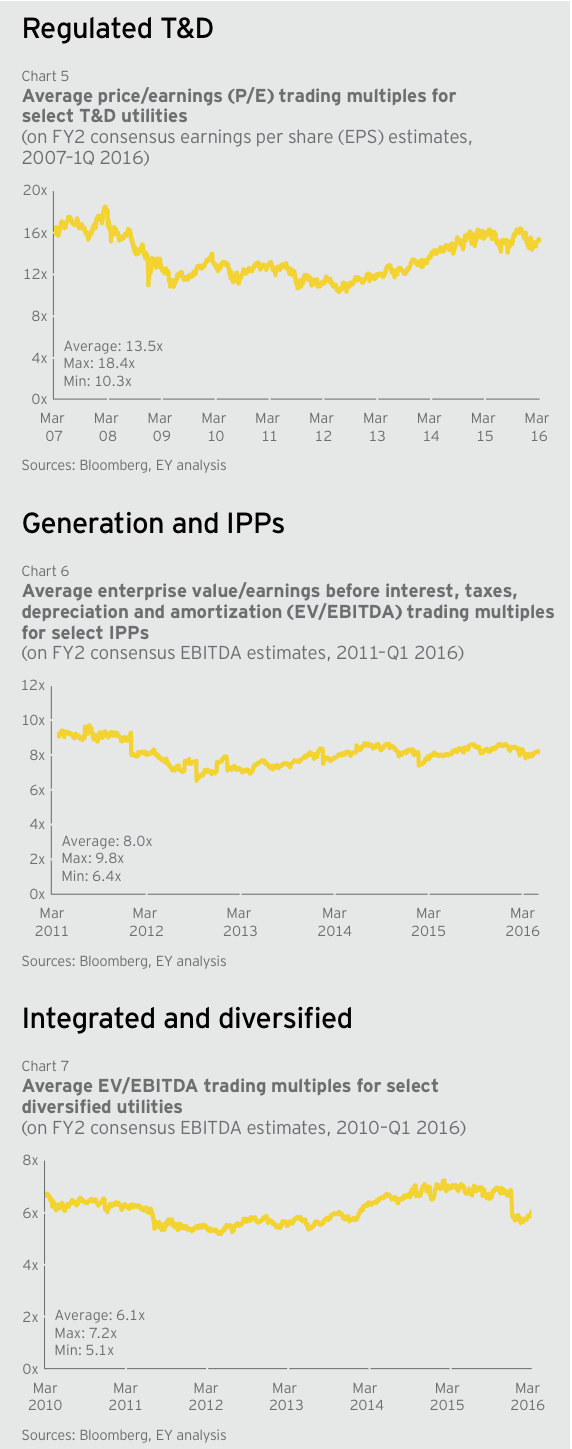

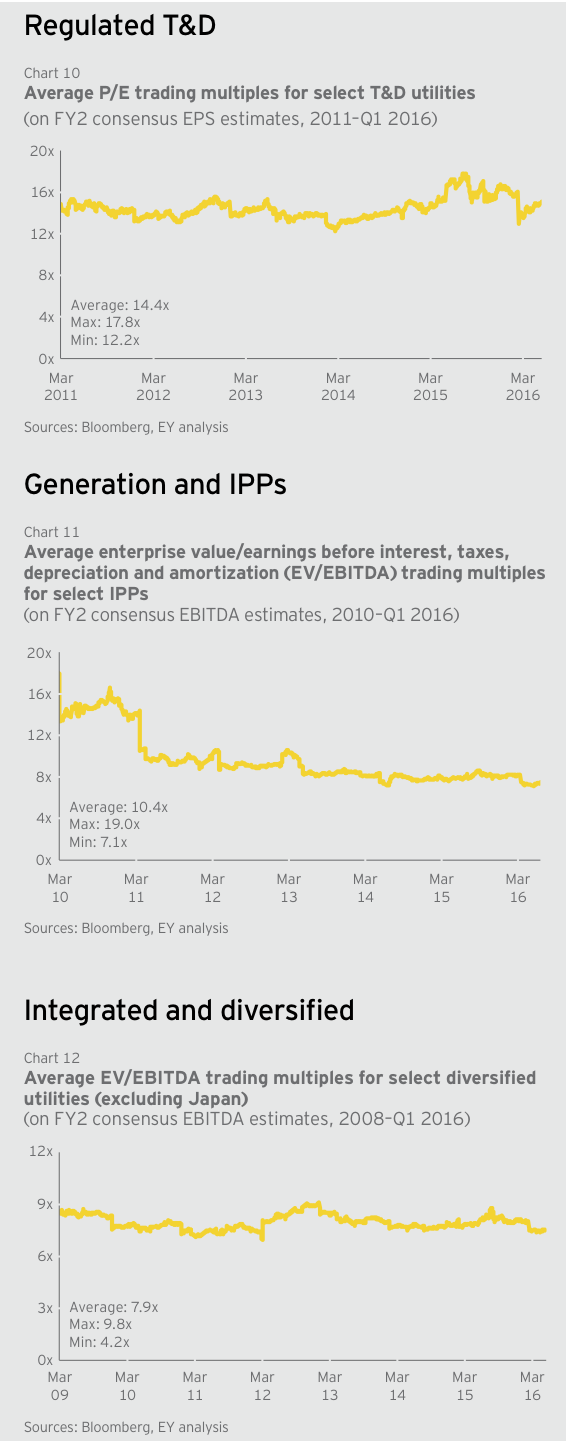

Valuations snapshot

Weak prices and declining energy demand weigh on valuations

As utilities exposed to thermal generation assets are challenged by tighter margins, we see more impairments in the segment — in 2015, E.ON wrote off US$9.8b while RWE wrote off US$3.4b. Revenues from these assets are continuing to decline, with Drax reporting a 26% fall in 2015 full-year core earnings to US$239m.

Coal-fired generation did recover briefly in several European countries as cheaper coal supply displaced gas, but this trend was short-lived. Increasing emission standards, rising taxes and mandatory capacity closure continued to make commercial operations difficult for coal-fired generation. SSE recently announced the closure of three plants at its 1.9GW coal facility in Chesire in the UK.

It is worth noting that Europe’s interconnected energy market may see utilities with clean hydro and nuclear assets face headwinds due to the surge in renewables across the region. As renewable energy technologies become cheaper, power generated from hydro and nuclear is comparatively expensive and unprofitable in cross-border trade. Swiss companies Alpiq and Axpo, which sell much of their power in Europe’s cross-border energy trading system, have posted cumulative losses of about US$1.9b since 2014.

Valuations of transmission and distribution (T&D) assets remain high, trading at a premium of 13% based on FY2 EPS (forecast year 2 earnings per share) multiple. As more utilities invest in this segment to achieve stable, regulated revenues, we expect even further increases in these valuations.

Over time, we expect the growing focus on interconnectors to accommodate renewable energy into the grid to drive investments in T&D infrastructure. Danish transmission grid company Energinet.dk will invest US$1.6b to build two new electricity connections from Denmark to the UK and Germany, in partnership with National Grid and TenneT Holding. Gas network utilities are also trading close to five-year highs on EV/EBITDA (enterprise value/earnings before income, taxes, depreciation and amortization) multiples, as investors are attracted to their long-term, regulated revenues.

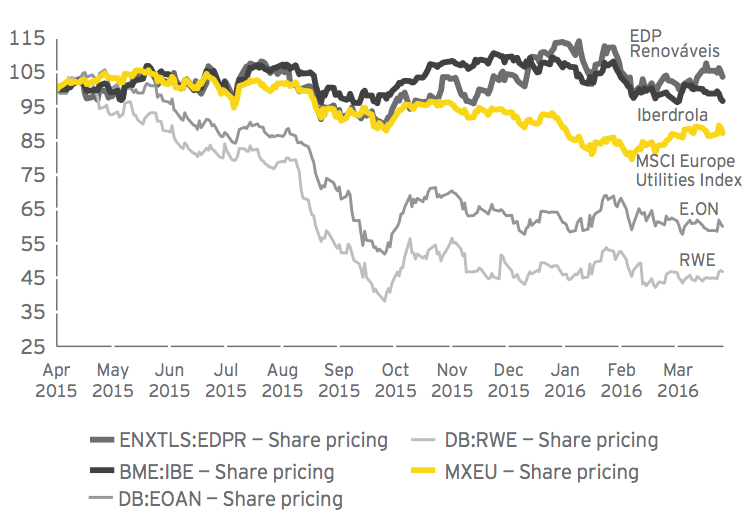

Investors reward utilities transforming their businesses

Structural shifts in the European P&U sector are challenging utilities’ traditional way of operating. Thermal power, once central to the energy portfolio, is being divested or closed. The balance sheets of utilities with exposure to these assets are under stress. German utilities RWE and E.ON posted losses in 2015 on account of high impairment charges, which have impacted share prices — E.ON’s share price dipped 39% last year.

But some utilities have been quick to identify the need to transform by restructuring portfolios and have been rewarded by investors. Iberdrola’s strategy to invest in regulated assets and renewable energy in high-growth markets has seen it outperform other European utilities. EDP Renováveis has invested solely in renewable assets and has consistently outperformed the market. EDP’s earnings are expected to grow by 25% in 2016 — while RWE’s may shrink by 38%.

2016 M&A hot spots and capital outlook

Reforms, changing technology landscape and renewables to drive activity

We expect deals in Europe’s P&U sector to increase as utilities use M&A as a strategic tool to restructure business models and optimize portfolios. Four key drivers are likely to dominate the agenda across 2016:

1. Investment in new technologies and energy services: We expect utilities to further optimize their asset portfolios toward technologies and energy services with growth potential. In the UK, British Gas has acquired Internet of Things (IoT) start-up AlertMe for £44m (about US$62.3m) to expand its Hive service. RWE and E.ON have invested in energy storage firms to diversify revenue streams.

2. UK offshore wind market to grow: Investment in European offshore wind, which doubled to €13.3b (about US$15b) in 2015, should continue to grow, with UK and Germany emerging as hot spots. Financial investors are increasingly attracted to these assets as they bolster regulated portfolios.

3. Focus on non traditional segments of the value chain: Utilities are restructuring to focus on different parts of the value chain, with a notable example being the Uniper and E.ON separation. This will see Uniper deal in conventional power generation and global energy trading while E.ON focuses on renewables, energy networks and customer service. Centrica has identified five businesses — energy retail supply; home and business energy services; distributed energy; the connected home; and energy marketing and trading — that will drive future growth.

4. Reforms in Eastern Europe present opportunities: Serbia, Bulgaria, Latvia, Macedonia and Ukraine are among the Eastern European countries undergoing energy reforms. In January, infrastructure investment fund Marguerite bought a 28.97% stake in Latvija Gaze from Uniper for an undisclosed sum. Pressure from the European Union’s third energy package is expected to bring more assets to market.

Asia-Pacific

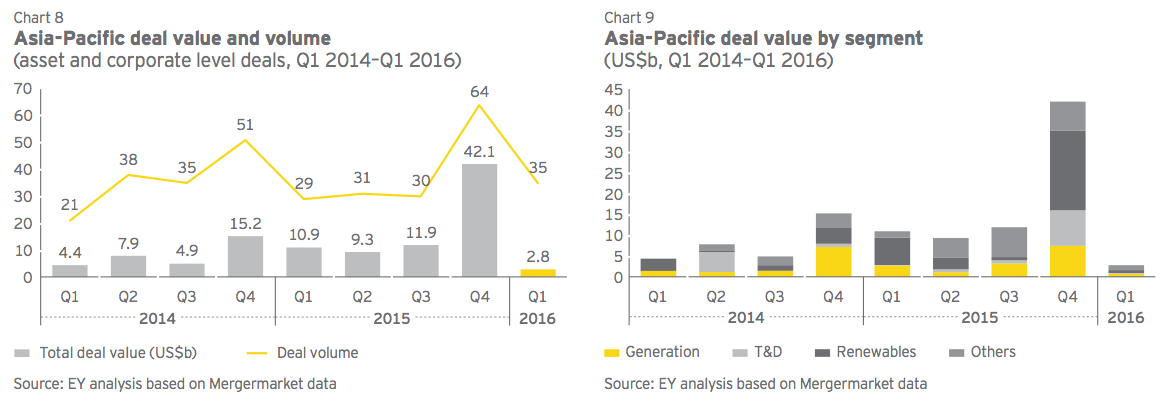

Deals hit five-year low but reforms expected to lift activity

After a six-year high in 2015, deal activity in the Asia-Pacific’s power and utilities (P&U) sector hit a historic low in Q1 2016, as many of last year’s buyers take time to digest transactions and integrate acquisitions. As well as a drop in value, deal volume halved, compared with Q4 2015, with an absence of large deals in 2015’s hot spots, Australia and China. In China, domestic consolidation continues, but a slowing economy has delayed some investment.

Despite the slow start, we expect the region’s P&U deal activity to pick up in coming quarters as energy reforms and privatization programs progress. In Australia, the New South Wales government is keen to follow up its successful privatization of Transgrid with sales in stakes of power distribution company Ausgrid. The Western Australian government is also considering privatizations.

Within India, reforms of the electricity distribution sector should drive more M&A, with 15 states already signed up to the UDAY (Ujwal DISCOM Assurance Yojana) scheme. As energy demand grows in Indonesia, plans are underway to allow foreign investors to fully own geothermal power plants with a capacity of more than 10MW, and take stakes of up to 67% in smaller power plants.

With Japan’s electricity retail business open to competition from 1 April, the country’s power monopolies are adjusting operations to a post-reform environment. Already, 266 companies from sectors including gas and oil, telecommunications and railways, have entered the Japanese electricity retail market. We expect consolidation to follow, as players use M&A to gain market share.

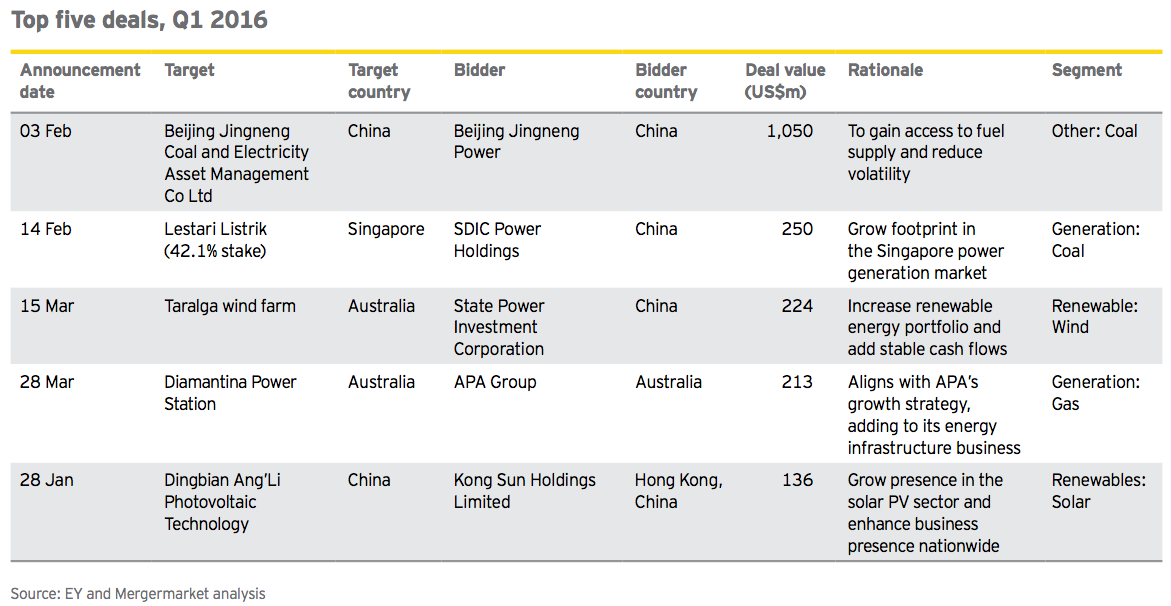

Q1 2016 highlights:

• New generation capacity requirements lure foreign investors: Increasing energy demand is driving foreign investment in new generation capacity in Southeast Asia, particularly in Vietnam and Indonesia. In January 2016, a consortium of Saudi Arabia’s ACWA Power and South Korea’s Taekwang Power Holdings signed an agreement to build a US$2.2b thermal power plant in Vietnam. In February, Qatar’s Nebras Power Q.S.C. acquired a 40.5% stake in an Indonesian 2GW thermal power plant from Engie for an undisclosed sum.

• Chinese outbound activity continues to rise: Amid a slow domestic market, Chinese investors are seeking foreign assets. Q1 saw eight outbound Chinese deals worth US$2.6b, primarily in European wind and solar energy assets. SDIC Power Holdings announced it would acquire the UK offshore wind business of Repsol for US$262m, primarily to capture attractive investment returns.

• Increased focus on new technologies: China’s 13th Five-Year Plan, which calls for greater investment in renewables, innovation and technology, particularly battery storage and clean coal, is expected to drive activity in this space. In India, focus on solar and storage is increasing, with the state-run Solar Energy Corporation of India (SECI) seeking bids for a 750MW solar park in Andhra Pradesh. SECI is also looking to procure 100MW of storage capacity. Within Australia, we see some utilities partnering with battery storage, solar PV and energy services players to retain customers.

• Valuations of power generators take a hit: Generation assets are trading at 7.3x EV/EBITDA FY2 estimates, compared with 8.1x last quarter. This slump reflects tepid investor sentiment as government support for coal-fired generation declines in big markets such as India and China, although we do see rising thermal generation capacity demand in some Southeast Asian countries.

US$2.8b total Q1 2016 deal value, a five-year low

US$1.2b deals in water and wastewater, energy services and coal segments

28% discount to historic valuations for generation and IPPs

40% of total deal volume in solar and wind segment

Transaction snapshot

Renewables make up almost half of Q1 deals

Renewables accounted for 46% of total Q1 deal volume, with wind and solar the most active segments. China-based State Power Investment Corporation’s US$224m acquisition of Australia’s Taralga wind farm from Inversiones Capital Global SA was the region’s biggest renewable deal of the quarter. Another notable transaction was SkyPower’s signing of four power purchase agreements (PPAs) with the Indian state of Telangana to build and operate a total of 200MW of solar energy projects. We expect continued investor interest in renewables, although competitively low tariff bids in India and shorter PPA terms offered in Australia could impact funding and investor returns for projects under development across the region.

Q1’s historically low regional deal value — reaching just 7% of last quarter’s total — was mostly contributed by Chinese deals (59% at US$1.6b). The acquisition of Beijing Jingneng Coal and Electricity Asset Management by Beijing Energy Investment Holding for US$1.1b was the quarter’s biggest deal.

We saw a buyer community made up largely of corporate investors who acquired assets worth US$2.6b, or 94% of total deal value. As well as investing in renewables, these buyers remain bullish on the coal and water and wastewater management segments, acquiring US$1.2b worth of assets. Financial buyers remained subdued, contributing only four deals worth US$153m.

Valuations snapshot

Mixed signals amid Chinese slowdown and growing role of energy efficiency

The region’s valuations remain volatile because of slow growth in electricity demand in China, low commodity prices and energy efficiency. China’s power consumption growth is likely to remain flat across 2016, dragging down the country’s valuations.

Growing penetration of renewable energy and modest demand growth supports earnings growth in the regulated transmission and distribution (T&D) sector. As highlighted in our 2015 year-end report, the global electric power transmission network is forecast to grow 3% between 2014 and 2020. Mainland China will account for 48% of this growth, followed by India at 21.6%. Australian T&D companies and those in Hong Kong and Singapore will continue to benefit from stable, transparent and consistent tariff-setting mechanisms. Vector Ltd in New Zealand and AusNet Services in Australia, in particular, are experiencing strong valuations, trading at 22x FY2 EPS multiples, significantly above the regional group average.

Generation companies and independent power producers (IPPs) are trading at a 28% discount to their historic FY2 EV/EBITDA. In China, the government has announced it will halt the construction of new coal-fired power plants in 13 provinces where capacity is in surplus. This decision is expected to see a dip in the valuations of conventional generation companies. We expect consolidation to drive M&A in coming quarters as small to midsize companies seek economies of scale.

While India’s reforms have boosted investment, Moody’s negative outlook for the country’s power sector (citing fuel supply risk and the weak financial condition of distribution utilities) has reduced valuations. Meanwhile, the growing adoption of LED lighting and rising electricity tariffs are curtailing demand in several key cities. While coal will continue to play an important role in the country’s generation mix, we may see distressed assets come to market this year. In January 2016, reports emerged that Larson and Toubro (L&T) is in talks to sell its 1.4GW coal-fired capacity after its stock price fell 35% in six months.

Renewable energy players are receiving strong regulatory support across the region. As part of its emissions reductions strategy, China aims to achieve 150GW of solar PV capacity by 2020, which would cement its position as the world’s largest renewable hot spot. In India, reforms are driving interest from foreign investors to both acquire and set up new solar and wind energy plants. The government plans more initiatives to attract investment, including the Renewable Power Obligation (RPO), which will require that 8% of India’s electricity consumption is sourced from solar energy by March 2022.

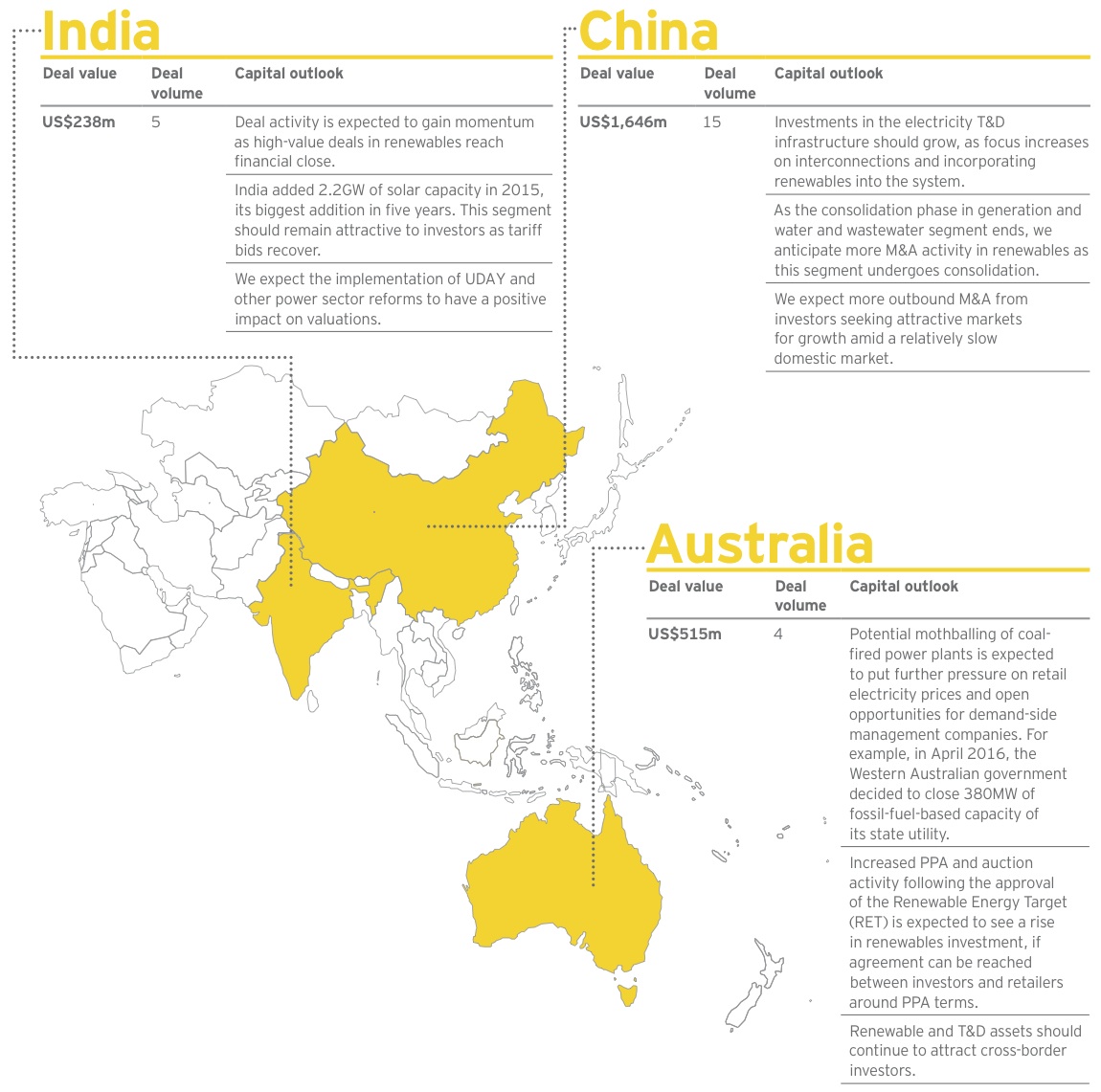

2016 M&A hot spots and capital outlook

India, Australia and China remain at the forefront of transactional activity

Despite a quiet quarter, the Asia-Pacific P&U region is primed for increased deal activity. As many utilities are currently trading at discounted values, there is a huge opportunity for long-term investors to acquire distressed assets at attractive valuations. We see four key drivers of regional M&A:

1. Chinese buyers’ exploration of new investments: With consolidation among China’s generation sector largely complete, Chinese investors with huge appetites are looking to renewables and overseas markets.

2. Boosted activity in India: India will emerge as a bright spot for the region’s deals as reforms gather pace. Renewable energy companies are selling stakes in operational assets to free up capital for further investments. In one example, Welspun is in talks to sell 700MW of renewable assets to IDFC Alternatives Ltd, in a deal expected to fetch US$1.5b. SunEdison, which entered India with plans to set up 15GW of solar and wind capacity by 2022, is now seeking equity partners for its current capacity (online and under development) of 1.7GW. (Although SunEdison has recently filed for bankruptcy protection in the US, it has been reported that this will not impact its Indian operations and developments.)

3. Demand to drive investment in generation capacity: Energy demand will drive investment in new coal-fired generation in many South or Southeast Asian countries. In particular, Vietnam, Pakistan, Indonesia and South Korea each have more than 9GW of coal-fired capacity in the pipeline.

4. Innovative partnerships to explore different routes to growth: We expect more utilities to secure partnerships with start-ups, innovative technological companies, analytics firms and energy aggregators to further penetrate into new areas of growth in energy services and distributed energy resources.

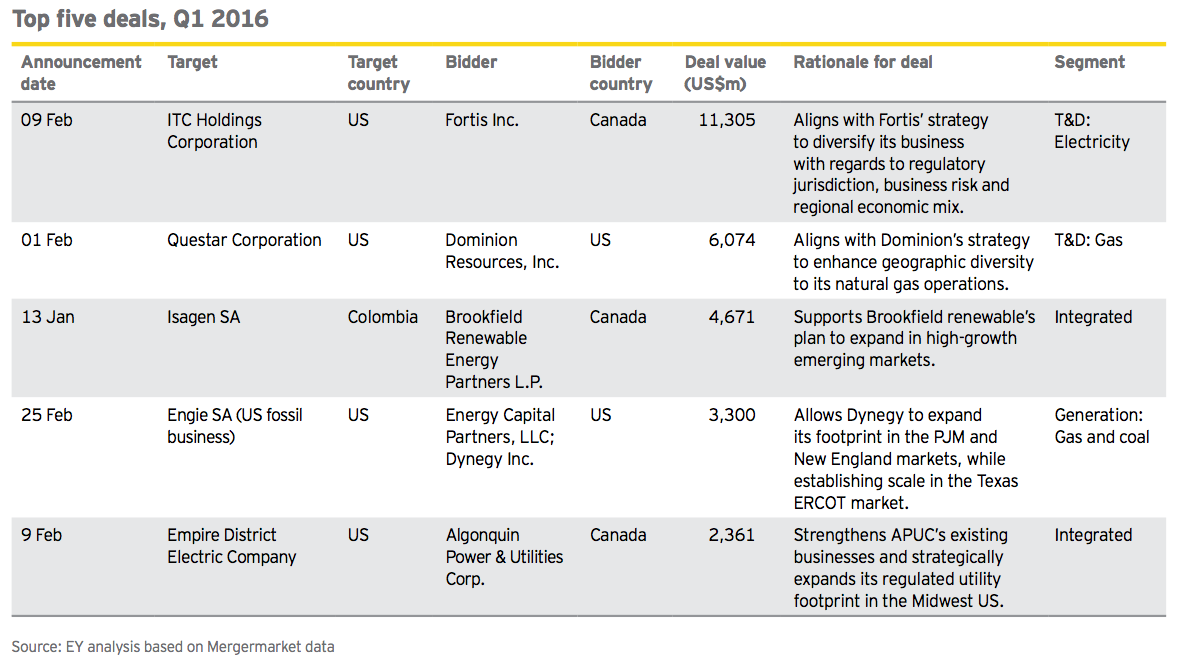

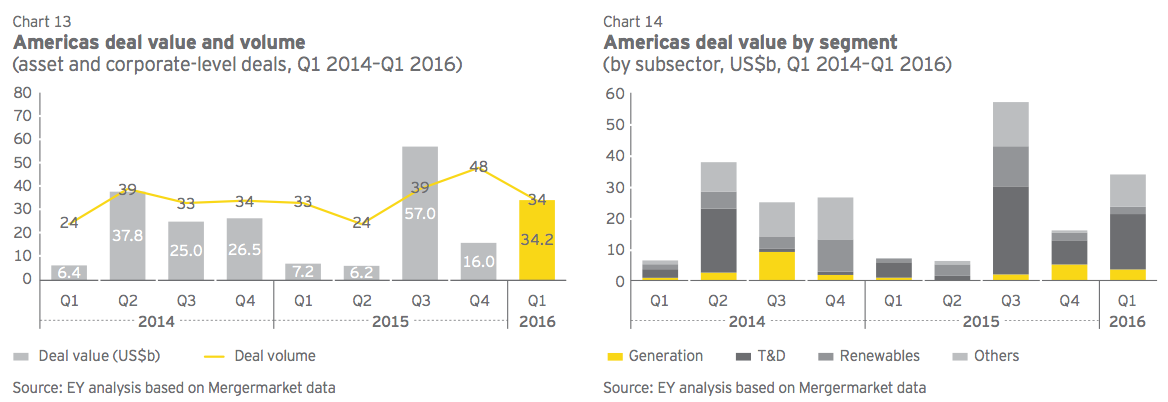

Americas

Deal intentions remain strong as utilities seek growth

2016 began well for the Americas power and utilities (P&U) sector, with deal value reaching US$34b — five times that of Q1 2015. Consolidation drove most activity due to strong market interest in regulated assets with the potential to accelerate growth and generate stable earnings.

These assets are attractive as growth remains sluggish — total US electricity sales fell 1.1% in 2015, the fifth drop in eight years. Meanwhile, historic low interest rates make access to debt cheaper.

We saw gas assets in demand, as evidenced by Dominion Resources’ announcement to acquire Questar Corporation for US$6.1b. The deal diversifies Dominion’s business and should benefit master limited partnership (MLP) affiliate Dominion Midstream Partners. Amid challenging conditions, more small and midsize utilities may consider merging with larger utilities to achieve economies of scale.

While large integrated utilities continue to dominate buyers, financial investors are returning after a quiet 2015. Infrastructure and pension funds from the US, Brazil and Colombia contributed deals worth more than US$9b, primarily in traditional generation and renewables. We also see a continued move toward investment in disruptive technologies and energy services firms as utilities seek to drive new growth in an increasingly competitive market.

Q1 2016 trends:

• Canadian investors seek regulated assets: A shortage of targets in Canada’s highly regulated sector drives Canadian investors to diversify through outbound M&A. Examples this quarter included Fortis’ US$11.2b acquisition of ITC Holdings and Algonquin Power and Utilities Corp’s deal to buy Empire District Electric Company for US$2.3b.

• Utilities increase debt levels to finance deals: Some recent acquisitions have seen debt to capitalization ratios rise to around 75%, triggering a negative rating for some utilities, including The Southern Company, which is anticipated to significantly increase debt levels to acquire AGL. These developments fuel concern that debt premiums may be overstretched.

• Valuations remain unchanged: Premiums on regulated gas and electricity T&D assets remain high. Despite a delay to the US Clean Power Plan, utilities are investing heavily in renewables with investment in gas anticipated to grow in tandem. Expect boosted spending in T&D infrastructure to drive up returns and valuations. Low natural gas prices and increased reserve margins will restrain power prices and returns for merchant generators.

• Energy reforms in Colombia: The Colombian Government has announced it will sell a 57.6% stake in Isagen SA to Canada-based Brookfield Renewable Energy Partner for US$4.7b. The consortium is paying a premium of over 25% on Isagen’s closing share price of one-day prior to the date of announcement.

US$34b Q1 2016 Americas deal value, five times the Q1 2015 total

US$9.2b total Americas deal value, a seven-year high

US$1.4b average deal value for the Americas region, a seven-year high

18% premium on historical average of T&D valuations

Transaction snapshot

Financial investors return to US sector

US megadeals dominated activity, with the country hosting five of the region’s eight US$1b-plus transactions in Q1 2016, contributing 76%, or US$26b to the total regional deal value. Regulated electric and gas T&D assets captured the most investment (US$17.5b), because of their attractive returns. Premiums remain high as utilities use low interest rates to raise debt.

Renewables, particularly hydro assets in Colombia and Brazil, also gained traction with investors. Apart from the high-profile Isagen deal, we also saw Canada’s Public Sector Pension Investment Board buy Engie SA’s US-based portfolio of hydroelectric assets for US$1.2b.

As predicted in our 2015 year-end report, financial investors are returning to the US sector. As yieldcos move out of the buyer community because of falling valuations and independent power producers (IPPs) continue to suffer from volatile power prices, pension and infrastructure funds, and private equity houses now see opportunities to buy generation assets at attractive prices.

In fact, generation assets amounting to 2,000MW of capacity exchanged hands with financial investors in Q1 2016. The Carlyle Group acquired 1,767MW of gas and hydro generation assets from Essential Power LLC, while Dynegy and Energy Capital Partners agreed to buy the US fossil-fuel business of Engie SA, worth US$3.3b, primarily to increase their footprint in the PJM and New England energy markets. UK-based Cubico Sustainable Investments was also seen shopping for renewable and regulated assets in Canada and the US.

Valuations snapshot

Investors favor gas distribution companies, while IPPs trend down

Last year’s interest rate hikes, the US Clean Power Plan delay and depressed oil prices significantly affected utilities valuations. While 2016 began on a more positive note, uncertainty remains, with investors wary of acquiring assets exposed to volatile commodity and power prices.

Several large deals, including the Fortis and Dominion acquisitions, suggest both foreign and domestic players are seeing tremendous opportunity in the regulated electric and gas T&D segment. Premiums remain high for these assets.

Gas utility stock prices spiraled in 2015, driven by high gas demand, stable cash flows and rising M&A activity. Competition for these assets remains strong among electric utilities seeking growth, diversification and stable cash flows. High premiums are likely to continue in 2016, though this will depend on the ability to drive synergies through deals. Many of the deals with high premiums involved overlapping territories.

After declining valuations and a retreat from the market in 2015, yieldcos are beginning to invest again, particularly those with access to capital markets and strong sponsor support. In January, 8point3 and Pattern Energy declared their first-quarter dividend, which was about 2%-3% higher than the previous result. Similarly, NextEra Energy Partners expect 2016 distributions to increase by up to 15%.

IPPs continue downward, trading at an average 30% discount on EV/EBITDA two-year forward estimates. Falling electricity demand is pushing several utilities to cut their exposure to unregulated markets where prices are volatile. In February 2015, Dynegy and private equity firm Energy Capital Partners acquired French utility Engie’s US power plants in a US$3.3b deal aimed at expanding into the regulated Texas market. The transaction’s $/KW multiple of 373 was much lower than 2015’s median multiple of 688$/KW. In contrast, a deal by AIA Energy North America LLC to acquire a 49.9% share in Black Hills Colorado IPP traded at a multiple of 2,154$/KW, significantly higher than the average premium offered. Although rising coal-fired retirements will support the supply-demand dynamic, we do not expect generation companies’ valuations to rise in the near term.

This bodes well for renewables, as utilities replace lost capacity with solar and wind to meet renewable targets. A record 7.3GW of solar was commissioned in the US in 2015, and we expect the extension of investment tax credits (ITC) to see solar installation continue at high levels in 2016. In March, PSEG Solar Source acquired a 37.8MW solar energy facility from Juwi Solar, primarily to boost its portfolio of cost-effective, community-based solar solutions.

2016 M&A hot spots and capital outlook

Utilities seek growth in energy services and form partnerships with financial investors We expect future M&A in the Americas P&U sector to be driven by four key themes:

1. Regulated gas and midstream investments: Large integrated utilities, primarily in North America, are keen to explore opportunities to grow their earnings and diversify geographically, amid weak wholesale prices and stagnant energy demand. Gas local distribution companies will remain attractive because of their higher potential for profits and rate base growth through infrastructure investment and upgrades. Midstream investments by utilities may increase, with companies including Xcel Energy, NextEra Energy and Entergy Corp hinting that they will invest in their gas businesses to grow returns.

Electric utilities will also seek to expand their gas-fired generation fleets to gain control over local gas supplies and infrastructure. However, they will face competition from financial investors willing to hold onto these assets until natural gas prices increase.

2. Investment in technology and energy services companies: Large utilities and IPPs will partner with, and acquire, technology and energy services companies to add new revenue streams. In a recent example, The Southern Company has agreed to acquire energy technology company PowerSecure International in a US$415m deal. EY’s 14th P&U Capital Confidence Barometer survey revealed that 46% of the respondents are planning to focus on making better use of technology, digital and analytics to drive growth in the next 12 months.

3. Consolidation in generation: As conditions remain tough for merchant generators, expect more consolidation aimed at realizing the benefits of synergies. With low natural gas prices negatively affecting the sector’s short-term outlook, we see longer-term opportunities in the supply/demand balance for those US power markets, such as the PJM Interconnection and ERCOT, where coal-fired generation retirements will tighten up supply and support prices.

4. Utility–financial investor partnerships: Expect more partnerships between utilities and financial investors. The partnership between Dynegy and Energy Capital Partners, for example, shared risk and minimized the need to issue equity associated with the US Engie SA deal.

Africa and the Middle East

Renewables, energy efficiency and reforms hold the key to growth

As in previous quarters, most recent deals in the Africa and Middle East power and utilities (P&U) sector involved greenfield investment, although we witnessed increasing M&A in Q1, particularly in renewables. Chinese investors remain a force across Africa, although European utilities are also making their presence felt as they diversify into this high-growth market.

Much of the interest comes as low oil prices and a growing gap between energy demand and supply drive governments across the region to consider energy reforms, tariff cuts and initiatives to encourage private investment. These drivers are also behind growing investment in energy management services in the Middle East. GE recently launched a new company, Current, to offer energy efficiency services in the region. In March, Schneider Electric posted 12% revenue growth over the past three years across the Gulf countries, due largely to investment in innovative energy management technologies.

Q1 2016 trends:

• Chinese investment continues: In January, the Chinese government agreed to invest US$813m to upgrade Côte d’Ivoire’s transmission and distribution (T&D) network. The Shanghai Electric Power Company (SEP) will invest US$25.5m in a Mozambique coal-fired thermal power plant, while China Sunergy and Z-One Holding are forming a joint venture to market and sell China Sunergy’s solar products and solutions in the region.

• Domestic utilities bet big on solar investments: Investment in solar energy within MENA doubled in 2015 (to US$7.1b), and this segment remained attractive to investors in Q1. Qatar Electricity and Water Company (QEWC) and Qatar Petroleum (QP) agreed to set up a 1GW solar power company with an initial investment of US$500m. The Development Corporation of Zambia (IDC) launched the second round tender for 100MW of solar power projects.

• Gulf governments see merit in energy reforms: As well as Egypt’s decision to remove electricity subsidies, Oman is considering reducing commercial electricity subsidies by 7%–8%.

• European utilities expand presence: European utilities are pursuing growth in emerging markets through local partnerships. Turkey’s Hakan Mining and Electricity Generation Industry and Trade will invest US$400m in an 80MW coal-fired power project in Rwanda. French solar firm Générale du Solaire and investment fund Arborescence Capital have partnered to build a 300MW solar PV plant in Cameroon, while German solar company Industrial Nova Solar Power will construct a 125MW solar power plant in Nigeria.

US$900b total planned investments in MENA energy sector through 2020

US$986m worth of transactions by Gulf utilities

2GW solar project to be built in Aswan, Egypt

Transaction snapshot

Substantial deal activity fueled by drive for renewables

Q1’s increased transaction activity highlights utilities’ confidence to strike deals after what could be described as a very long period of due diligence. We see increased interest from European utilities seeking new markets for growth and taking advantage of low valuations across Africa. Italian renewable energy firm Enertronica SpA, acquired a 70% stake in Namibian solar company Sertum Energy Namibia Pty Ltd for US$8m. The investment arm of French petroleum giant Total acquired Off-Grid Electric, a Tanzania-based solar company for US$25m. These deals are low in value but indicate a growing trend toward M&A.

Morocco, Egypt and Kenya emerged as investment hot spots in Q1, attracting domestic private investors, European utilities and Middle East companies. Morocco awarded wind tenders for 850MW of capacity to a consortium composed of Enel Green Power (EGP), Nareva and Siemens in an investment worth around US$1b. Kenya also agreed to build a 140MW geothermal power plant with US$408m of funding from Japan.

Utilities used acquisitions in the high-growth markets of MENA (Middle East and North Africa region) and Latin America to add new value and diversify their energy mix. Most transactions involved clean energy:

- ACWA Power International acquired a 70% stake (US$200m) in Sunrise Solar Energy, which is building a 50MW solar plant in Jordan.

- The Africa Finance Corporation (AFC) acquired InfraCo’s minority stake in the 25.5MW Cabeólica wind farm in Cape Verde for an undisclosed sum.

- In March, Qatar Solar Technologies (QSTec) agreed to support Turkey to grow its solar capacity by 3GW.

During the quarter, we also saw interest from Masdar Capital, a clean-energy investment arm of the Abu Dhabi Government’s investment vehicle Mubadala Development, in investing in Australia’s renewable sector.

2016 Investment hot spots and capital outlook

Private sector remains bullish about investment in the region

In our 2015 year-end edition, we identified markets that should be on the radar for investors in 2016. These included Kenya, Nigeria, South Africa, Morocco and Egypt. We have already seen investment here and expect this to increase as emphasis on clean energy and reforms grow. Key themes around investment include:

• Public-private partnerships (PPPs) still important as M&A increases: In Q1, PPPs remained the main investment method for utilities in the region. In one example, China International Water and Electric Corporation (CWE) agreed to build a US$1.3b 450MW hydro power project in Guinea. But as investors gain confidence, M&A will increase. Recently Abraaj Group acquired African-focused power finance advisory firm Themis Energy to expand into renewable and energy efficiency projects.

• Deal activity boosted by renewables investment: The world’s increased emphasis on renewables is even more critical in power-starved Africa. As indicated in our year-end report’s country attractiveness model, we expect activity in this segment to see Kenya, Morocco and South Africa emerge as hotspots as hurdles to doing business are removed. Oman, too, has plans to launch a 200MW solar tender while working to promote small-scale solar development.

• Gulf region utilities driven by energy services: The Middle East offers opportunities to invest in the rising need for demand-side energy management and diversification of energy mix. As energy consumption is still very much coupled with the economic development of the region, new capacity and demand-side management of energy will remain the two most active segments for investment.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter