Publications Post Merger Integration Study 2009 – Zielgerade oder Achterbahn?

- Publications

Post Merger Integration Study 2009 – Zielgerade oder Achterbahn?

- Bea

SHARE:

By Christian Knechtel , Thomas Menzler , Hatto Schick and Margarethe von Spee. – PwC Germany

Summary

As already mentioned, the results of the survey reflect the economic climate of the past three years. Most company acquisitions were essentially aimed at generating growth – be it regionally, through new customers or new products.

Accordingly, costs and synergies were less of a focus during integration. This is also evident in the relatively high proportion of cost overruns and delays in integration projects.

The different phases of the transaction (initiation, due diligence and integration) usually fall into separate areas of responsibility, which can sometimes lead to a loss of information at the interfaces. For example, the results of due diligence are rarely used as a basis for integration planning.

Although they have already been frequently analyzed and published, topics such as communication, change management and dealing with (management) personnel still pose a major challenge during integration. If such “soft issues” are ignored, this can quickly be reflected in “hard numbers”.

The declining overall economic demand was not without impact on companies’ M&A activity. First of all, it should be noted that the number of mergers and acquisitions has decreased significantly. Furthermore, in company mergers the focus shifts from the growth side to the cost side. Many future mergers will be carried out out of insolvency or in areas close to insolvency. As a result, future integration projects will take place to a greater extent in a consolidation and restructuring context.

In our view, such projects will rely even more heavily on the following elements in the coming years:

- The objective is “additional value” instead of pure growth in size

- Detailed analysis of the purchased property through integrated due diligence (analysis of the areas of finance, operational business and market environment as well as their dependencies) and transfer of the results to the post-merger phase

- rapid implementation of measures with particular attention to change management issues and efficient communication

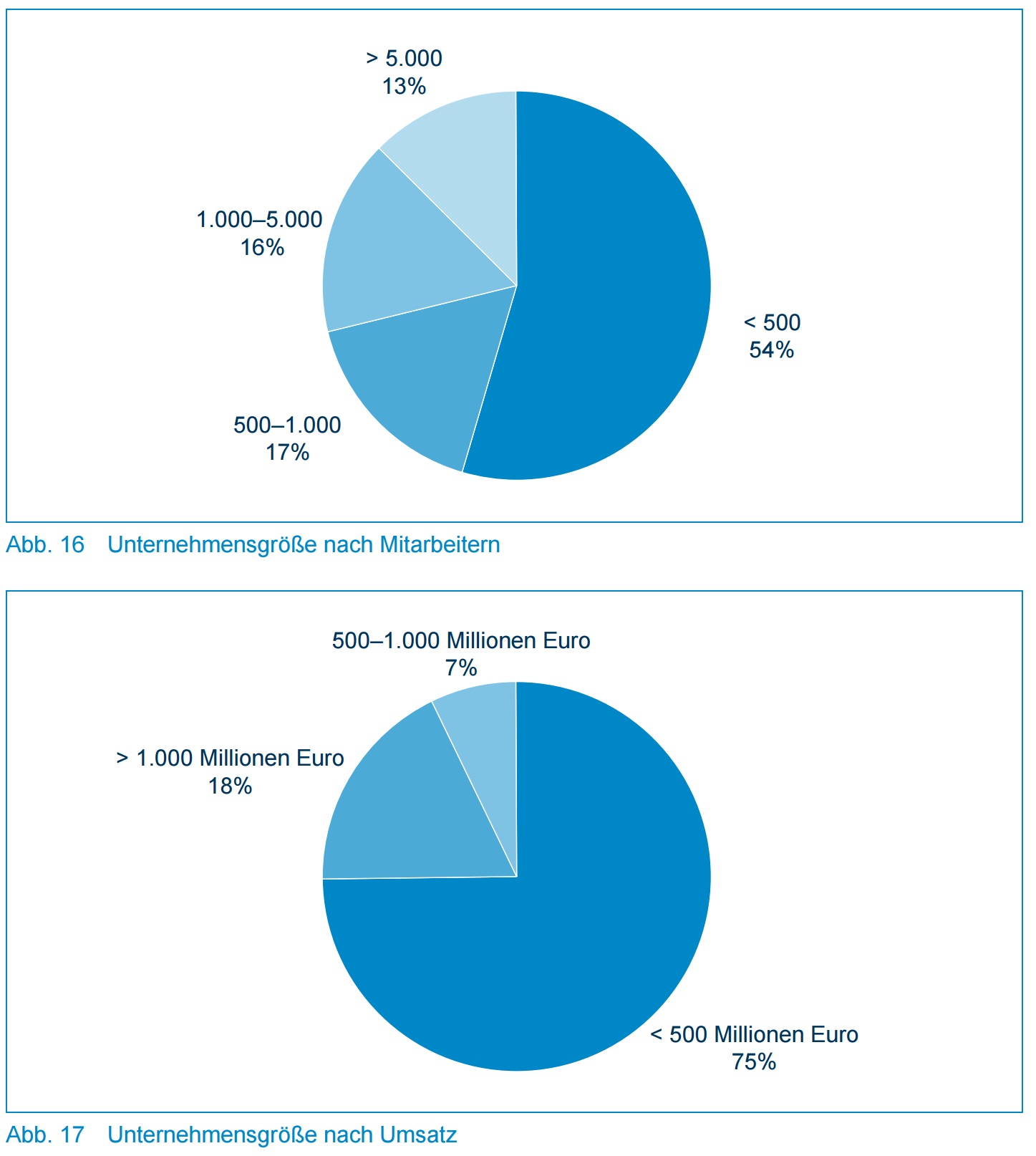

This study consists of statistical analyzes of the survey of over 50 top managers who have taken part in a corporate transaction in the past three years. Managers of both the acquiring and the acquired companies were interviewed. The survey took place in January and February 2009. Detailed information about the participating companies can be found in the appendix.

A. Key messages

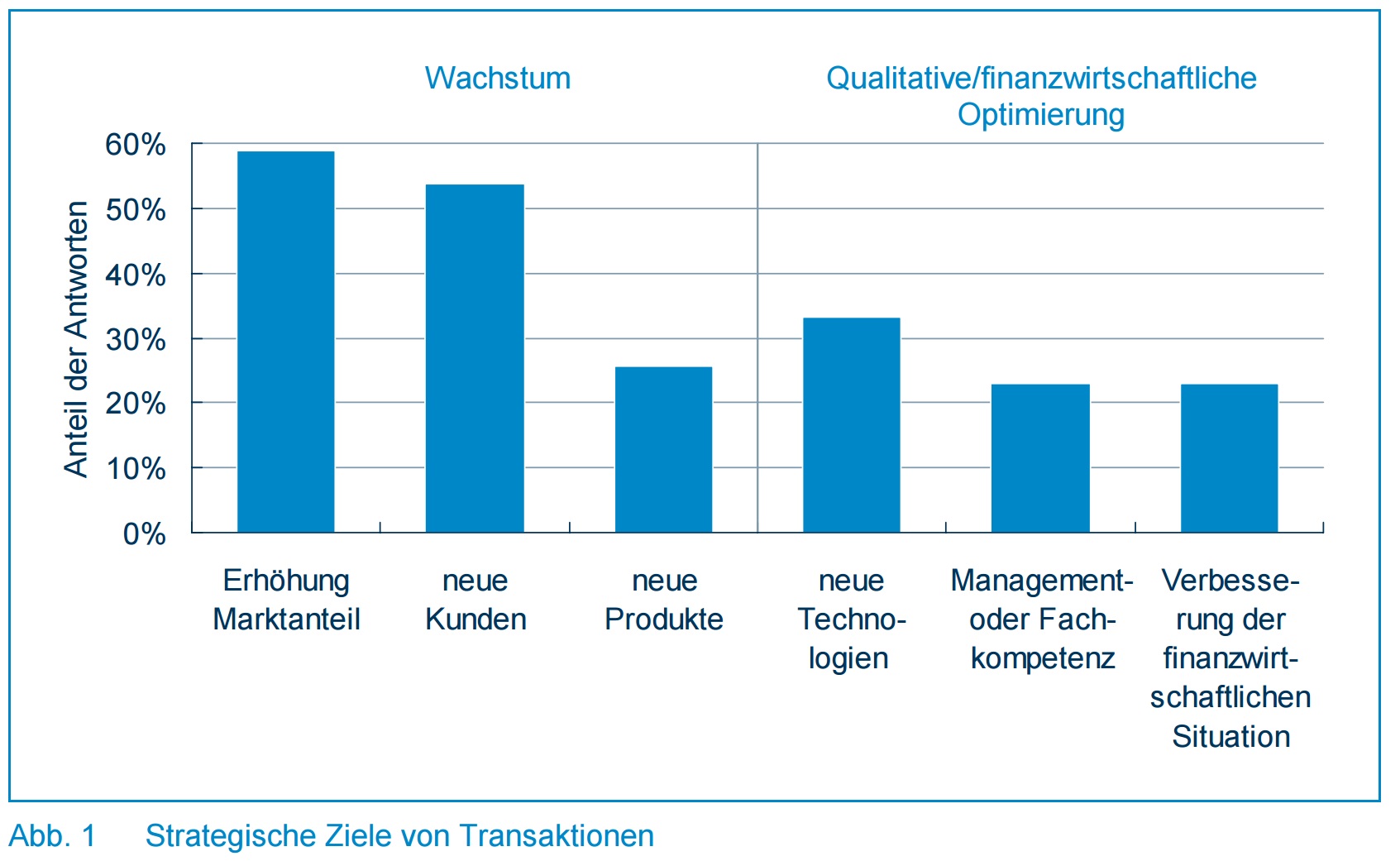

The vast majority of respondents cite sales growth and gaining market share as the most important goal. Improving profitability or expanding skills were mentioned much less often (page 9).

Most transactions were rated as successful or very successful by the managers surveyed, even if synergy expectations were not or only partially fulfilled (page 11).

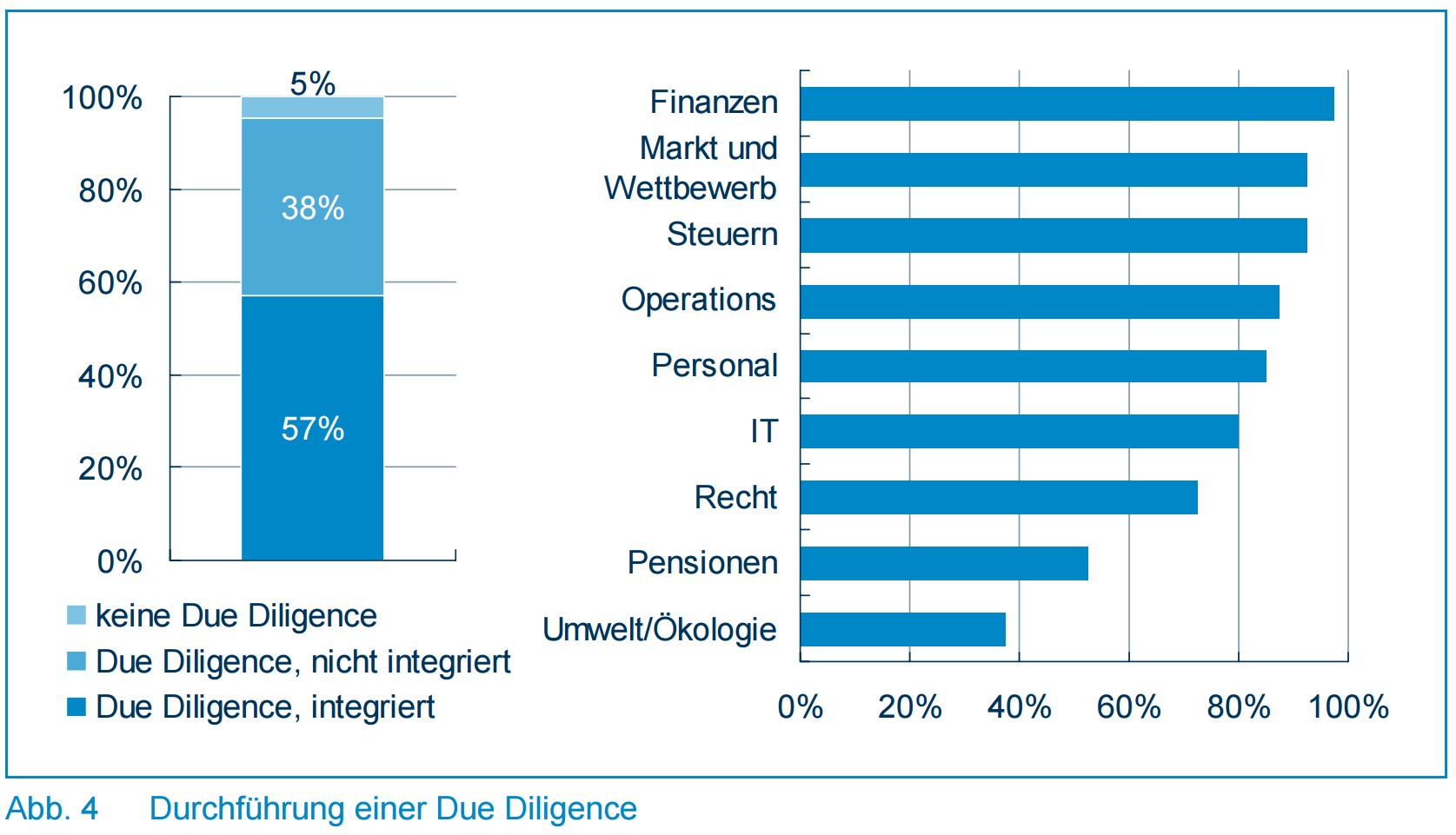

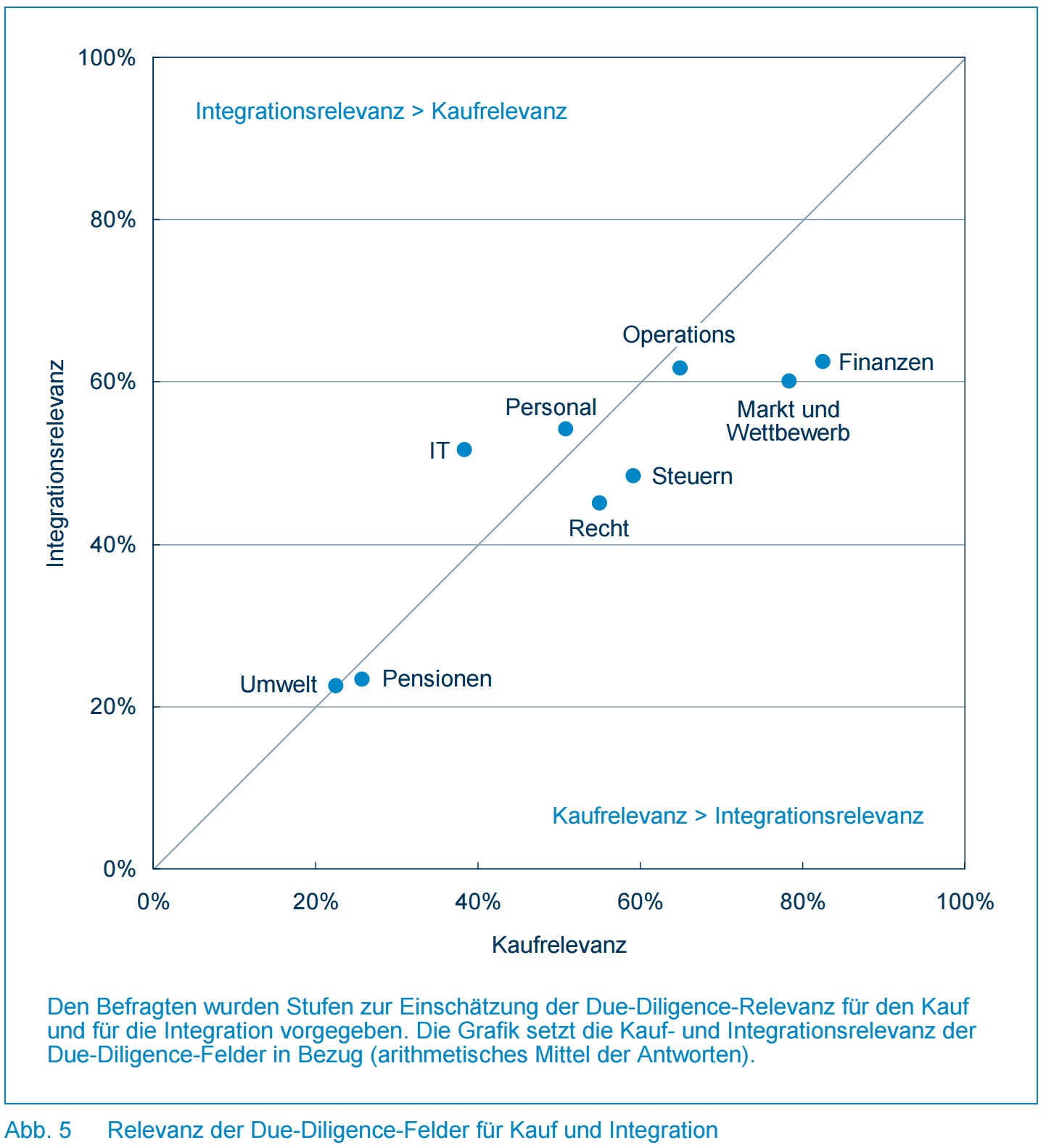

In 95% of all cases, extensive due diligence was carried out before the purchase. However, the use of the knowledge gained in this way varies significantly. The topics of finance, market and competition are primarily used to make purchasing decisions and price determination. The results from IT and personnel only become significantly more important in the integration phase. Only the “Operations” area remains consistently important for purchasing and integration (page 12).

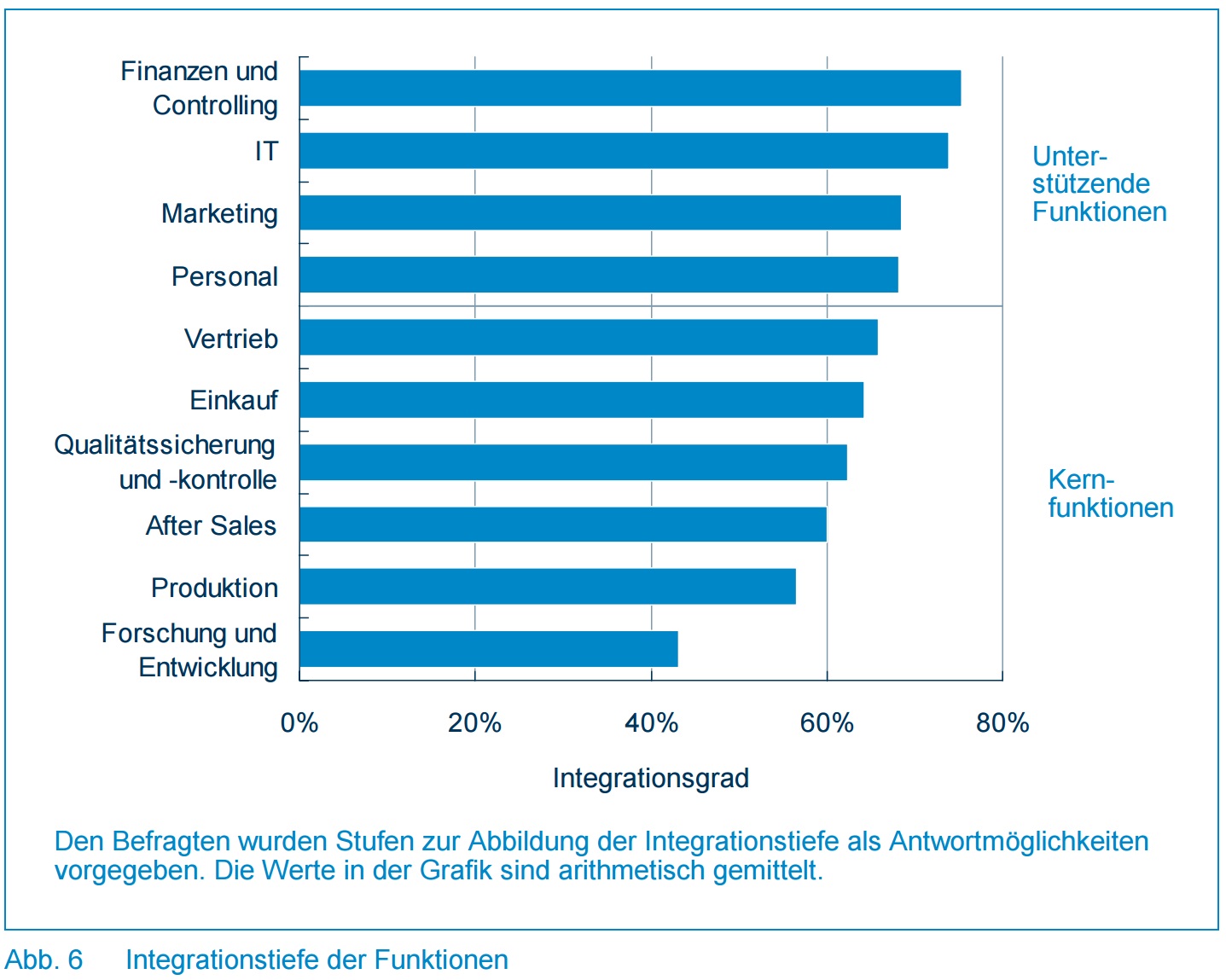

Classic supporting functions (e.g. finance, human resources, IT) are integrated much more closely than operational, value-adding areas such as production and R&D (page 14).

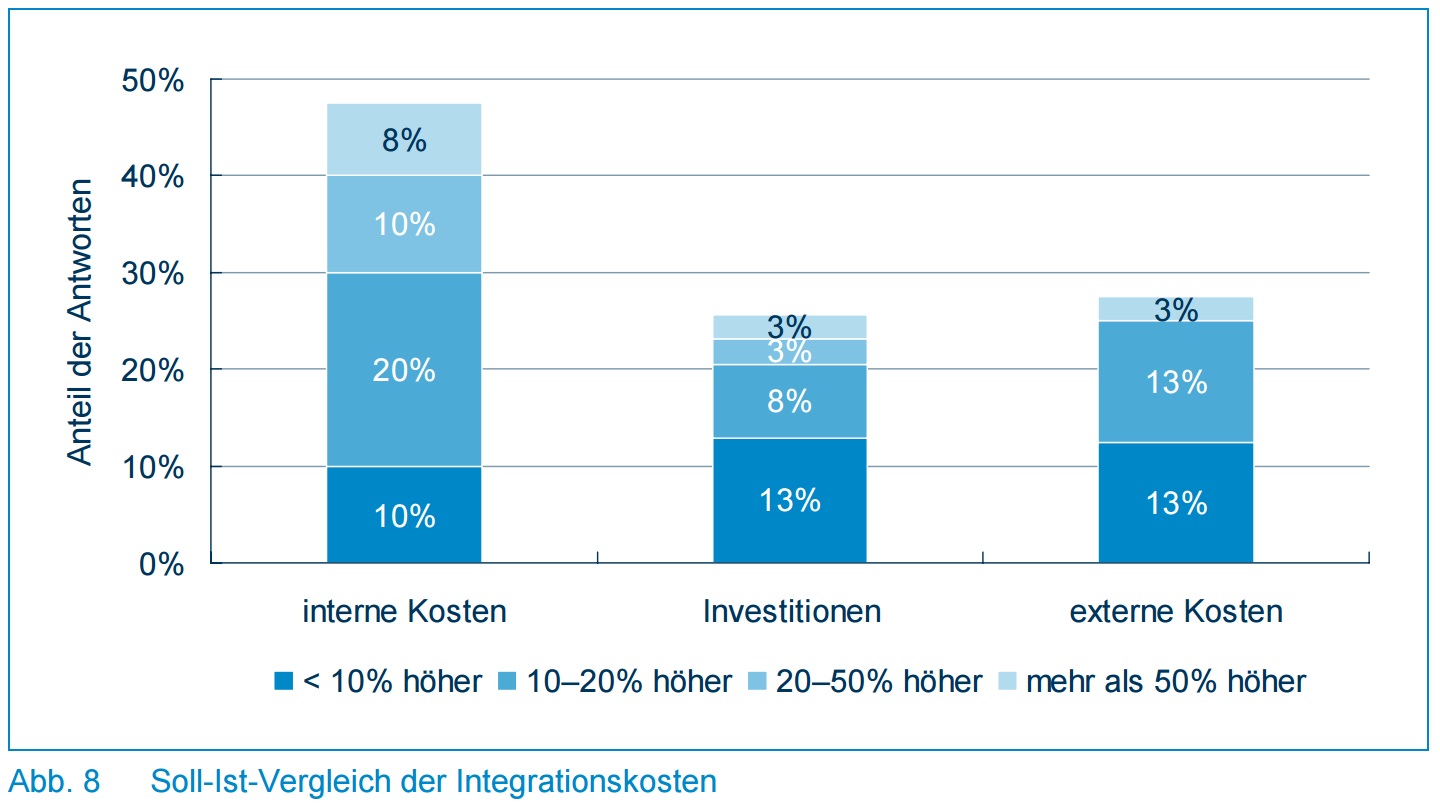

The integration budget and schedule are often significantly exceeded. This applies to internal costs to a much greater extent than to external costs or investments (page 15).

When asked in hindsight, almost 80% of executives believe that a faster integration would have been beneficial. Both cost arguments and the uncertainty associated with an integration process are cited here (page 17).

Over 70% of companies systematically measure integration success. The methods used for this include measure controlling, KPI reporting, as well as regular tracking of the financial effects of the integration measures (page 18).

This includes, for example: B. adapting the organization and company cultures as well as retaining key people in the joint company and ensuring the motivation of the workforce (page 19).

Most companies regularly informed their employees about the integration. The effect is also generally assessed as positive. However, systematic feedback is obtained in less than 25% of all cases (page 21).

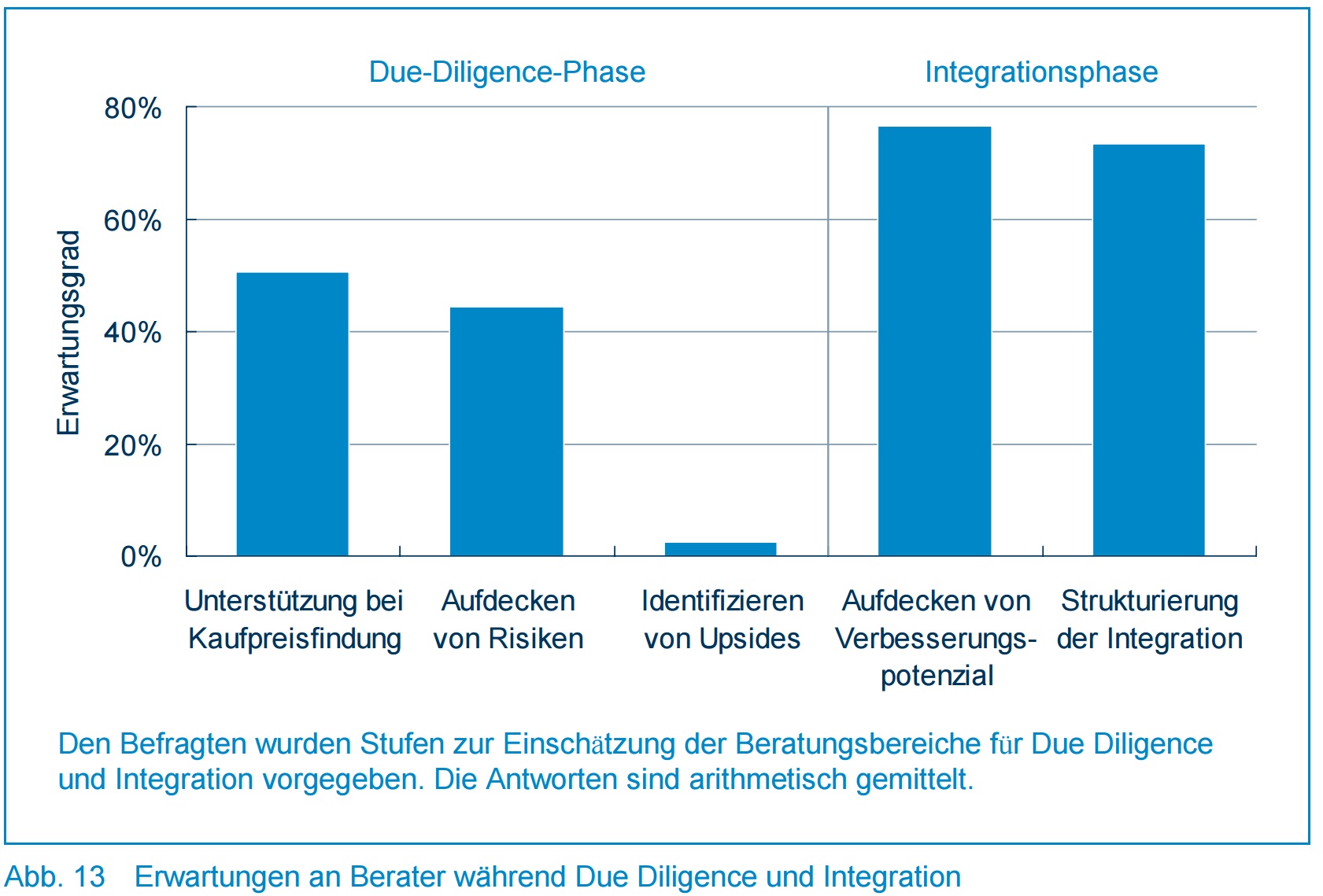

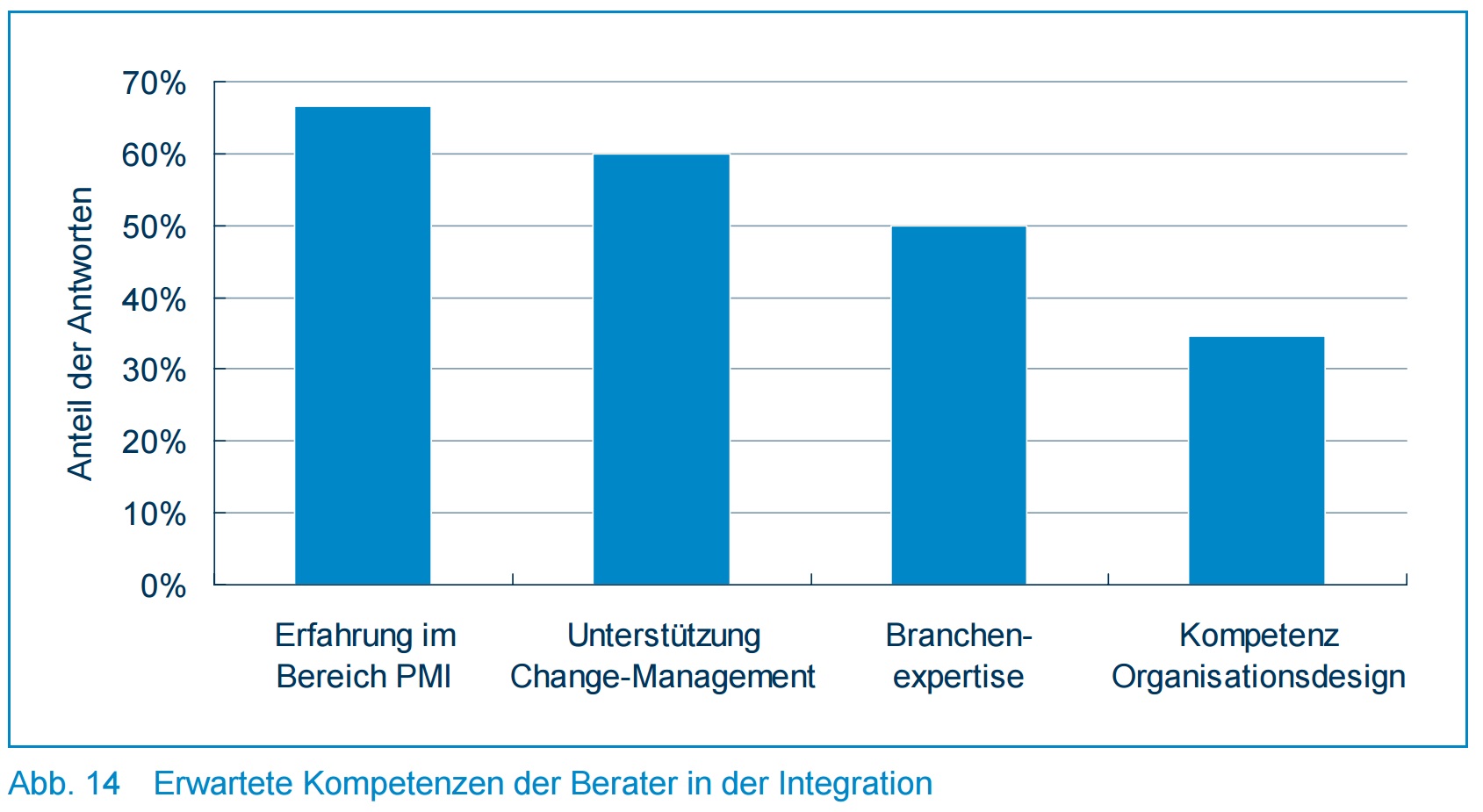

The most important requirements for advisors in the due diligence phase are support in determining the purchase price and identifying risks. In the integration phase, on the other hand, the focus is on structuring the integration project and uncovering potential for improvement.

For this purpose, companies primarily expect competencies in the areas of PMI and change management (page 22).

B. Detailed discussion of results

The most important transaction goal is growth – improving margins and expanding competence are of secondary importance

Over half of the companies surveyed see increasing market share and acquiring new customers as top strategic goals. The expansion of competencies (e.g. purchasing new technologies) is usually not the motivation for transactions (Fig. 1).

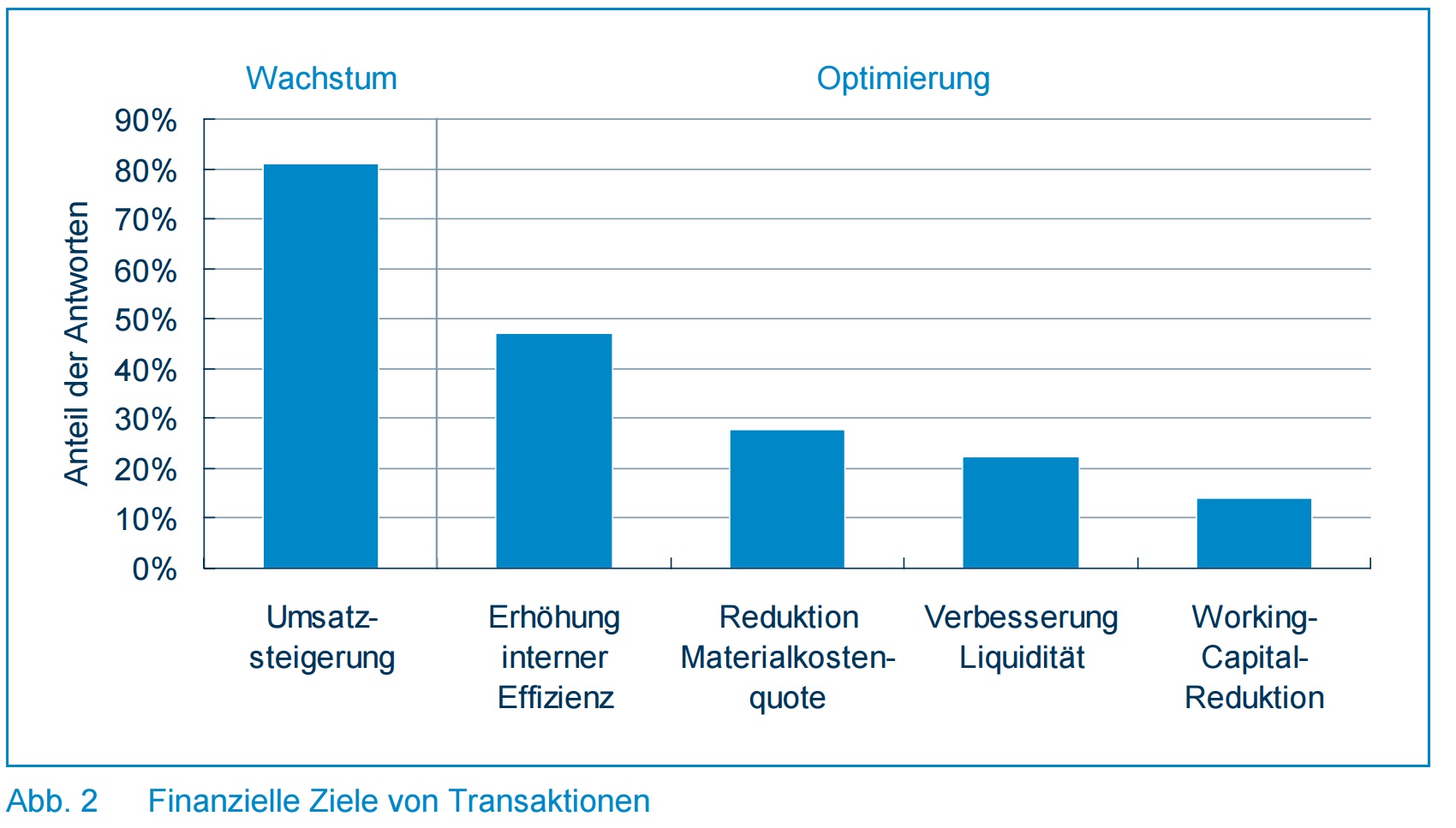

When it comes to the question of the most important financial goals for company acquisitions, the pursuit of size is also in the foreground. 80% of the companies surveyed see increasing sales as the most important financial goal of the transaction. Improving profitability was significantly less important to those surveyed (Fig. 2)

The stated transaction targets reflect the positive economic climate of recent years. When markets are constantly growing and (of course) positive results, companies typically focus more on their sales growth than on profitability.

Due to the economic slowdown, the pressure to act is currently shifting from the sales side to the cost side. As a result, the goals of transactions will also shift – towards greater use of operational improvement opportunities.

“The purchase price was not the decisive criterion for the purchase. We would have bought the company anyway because otherwise the competitor would have taken over.” Survey participant

Transaction success is largely viewed positively – significantly better than synergy realization

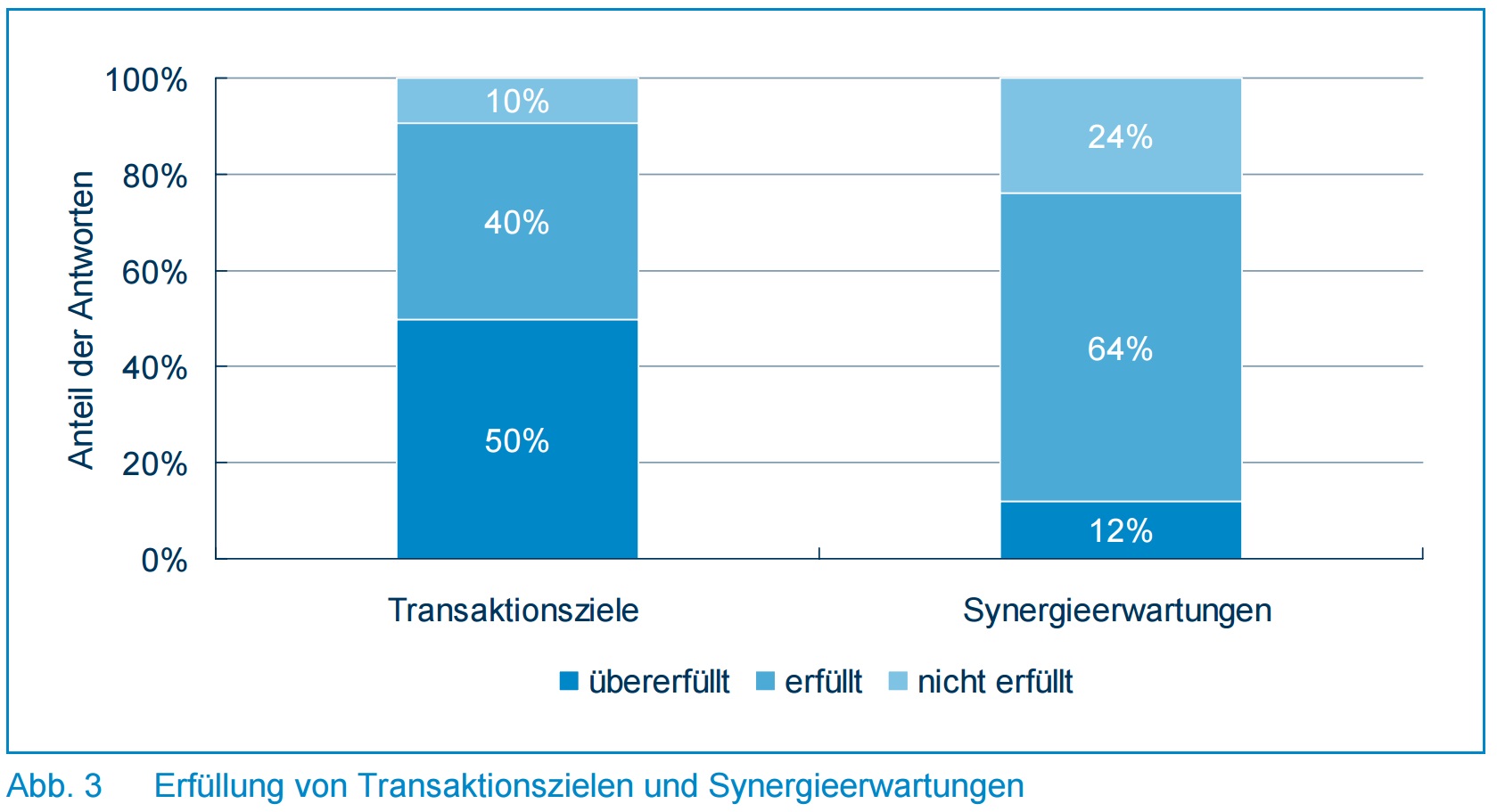

Approximately 90% of transactions are classified as successful ex post. In almost half of the cases, the success of the transaction even exceeds the expectations of those involved. What is surprising is that, taken in context, far fewer transactions meet the expected synergies.

Almost a quarter of those surveyed are not satisfied with the realization of synergy potential in connection with the transaction (Fig. 3). The fulfillment of synergy expectations is apparently not a prerequisite for a transaction to be considered successful.

In the context of the transaction goals presented above, this response pattern only seems logical. However, by neglecting synergies, value creation potential remains unused.

Due to the changed economic conditions, synergies and the resulting increases in efficiency in transactions will become more important. With consistent analysis, planning and implementation of integration activities with regard to defined synergy potential, costs can be reduced and the company’s value can be increased.

“The operational merger was the main focus – synergies were not that important.” Survey participants

Due diligence has prevailed – results play an essential role in purchasing and integration

In almost all transactions, in-depth due diligence is carried out prior to the purchase. However, the individual fields of due diligence are usually examined individually and not as part of an integrated due diligence. Dependencies and connections often cannot be discovered (Fig. 4).

Almost all of the due diligence fields examined are included in the purchase decision, but the most important are the results of the classic “financial” due diligence, as well as the analysis of the market and competitive environment. “Operational” due diligence plays an important role for both the purchase and the integration.

The fields of human resources and IT are of secondary importance for the purchase decision, but are even more important for the integration. Investigating pension provisions and environmental requirements is less important to those surveyed (Fig. 5).

The respondents only partially use due diligence as a source of information for planning integration activities.

The understanding of a transaction as an entire process from the M&A phase to the completed integration has not yet been established. A certain degree of staff continuity is desirable. In particular, the identification and realization of synergies should fall within the same area of responsibility.

“The due diligence results were hardly incorporated into the integration at all.” Survey participants

“You should start planning for topics such as HR and organization even earlier – it would make sense to think about this before the signing.” Survey participants

Depth of integration is greater in supporting functions than in value-adding areas

The companies surveyed are integrating administrative areas more closely. For core functions, the degree of integration is less deep, although the transactions usually take place horizontally (increasing market share as the goal) and therefore offer synergy potential through similar structures and processes (Fig. 6).

The merger of administrative areas can be seen as the basis for successful integration. The integration of core functions is usually more complex and time-consuming, but offers far greater opportunities for generating value and should therefore not be neglected. A company purchase that only realizes synergies in the administrative area will not be able to generate long-term competitive advantages.

“The operational integration should be optimized even more. For example, cross-selling potential could be used by training your own employees about the skills of the new company.” Survey participants

The duration and costs of integration are underestimated

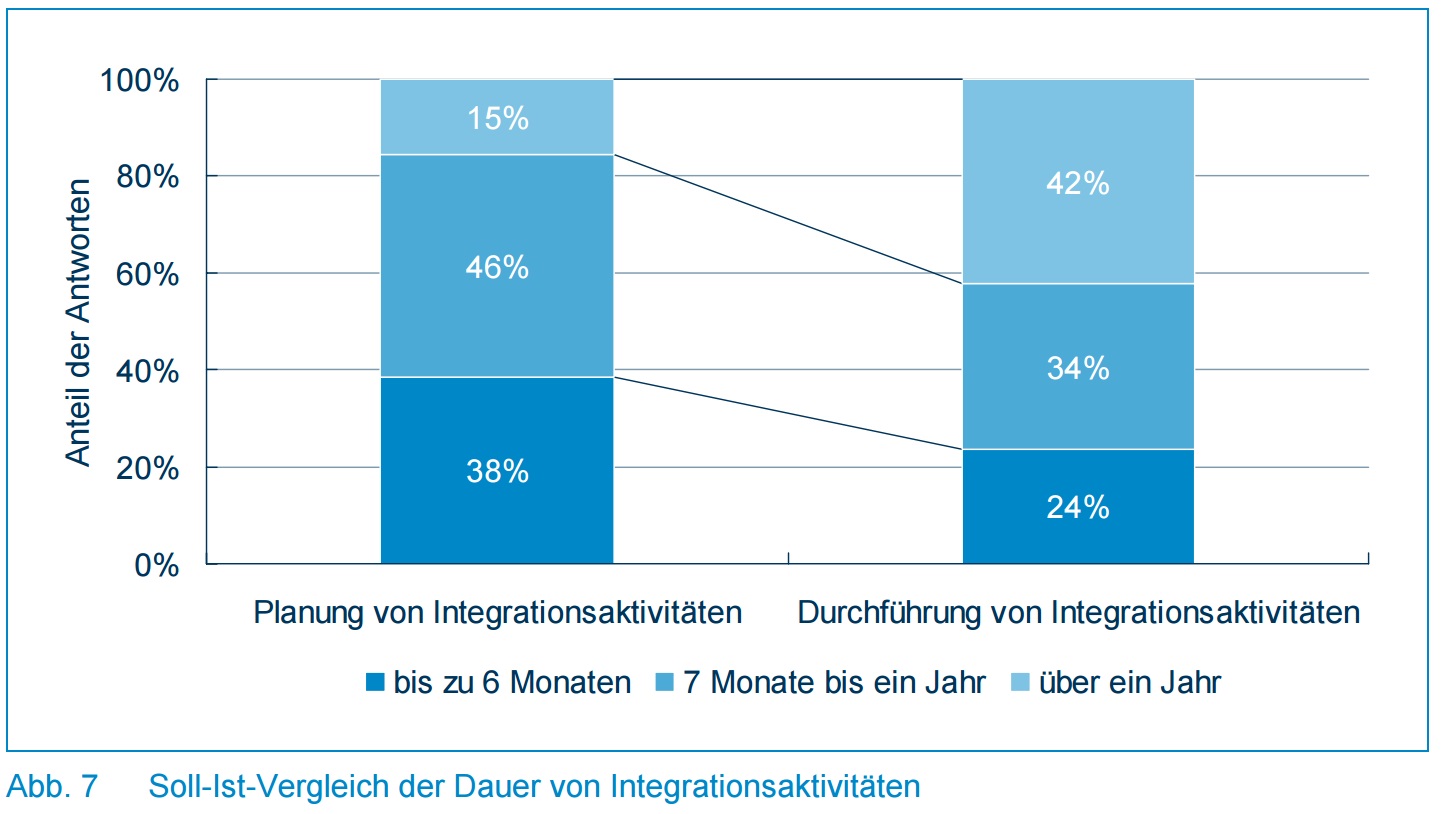

Integrationen dauern meist länger als geplant. Planen circa 85 % der Befragten eine Integrationsdauer unter einem Jahr, so benötigen circa 40 % der Befragten mehr als ein Jahr für die Durchführung der Aktivitäten (Abb. 7).

Auch die Kosten liegen vielfach über den vorhergegangenen Planungen. Insbesondere die tatsächlichen internen Kosten liegen über den Vorgaben. Externe Kosten und Investitionen scheinen transparenter und deshalb besser kontrollierbar zu sein. Sie übersteigen seltener die Vorgaben (Abb. 8).

Bei der Integrationsplanung werden die internen Kosten meist vernachlässigt, da diese als nicht beeinflussbar betrachtet werden. Externe Kosten sind vertraglich fixiert und Investitionen werden meist detailliert geplant.

Dieser Ansatz birgt jedoch Risiken: Werden interne Kosten (insbesondere der Verbrauch von Arbeitszeit) ungenügend geplant oder gar nicht verfolgt, kann dies zum unkontrollierten Ressourcenverbrauch führen. Dies bedeutet fast zwangsläufig, dass die Mitarbeiter und Führungskräfte überlastet sind oder das Tagesgeschäft vernachlässigt wird. Beides wird sich mittelfristig negativ bemerkbar machen. Die sorgfältige Planung interner Kosten ist somit wesentlicher Teil einer guten Integrationsplanung.

„Bei einer schnelleren Durchführung der Integration liegt der Fokus bereits nach kurzer Zeit wieder auf dem Kerngeschäft – dies bedeutet Kostensenkung und Ergebnis- verbesserung.“ Umfrageteilnehmer

„Man sollte die Planung vor der Integration verstärken, da man dann die Ressourcen besser planen kann.“ Umfrageteilnehmer

Geschwindigkeit ist entscheidend

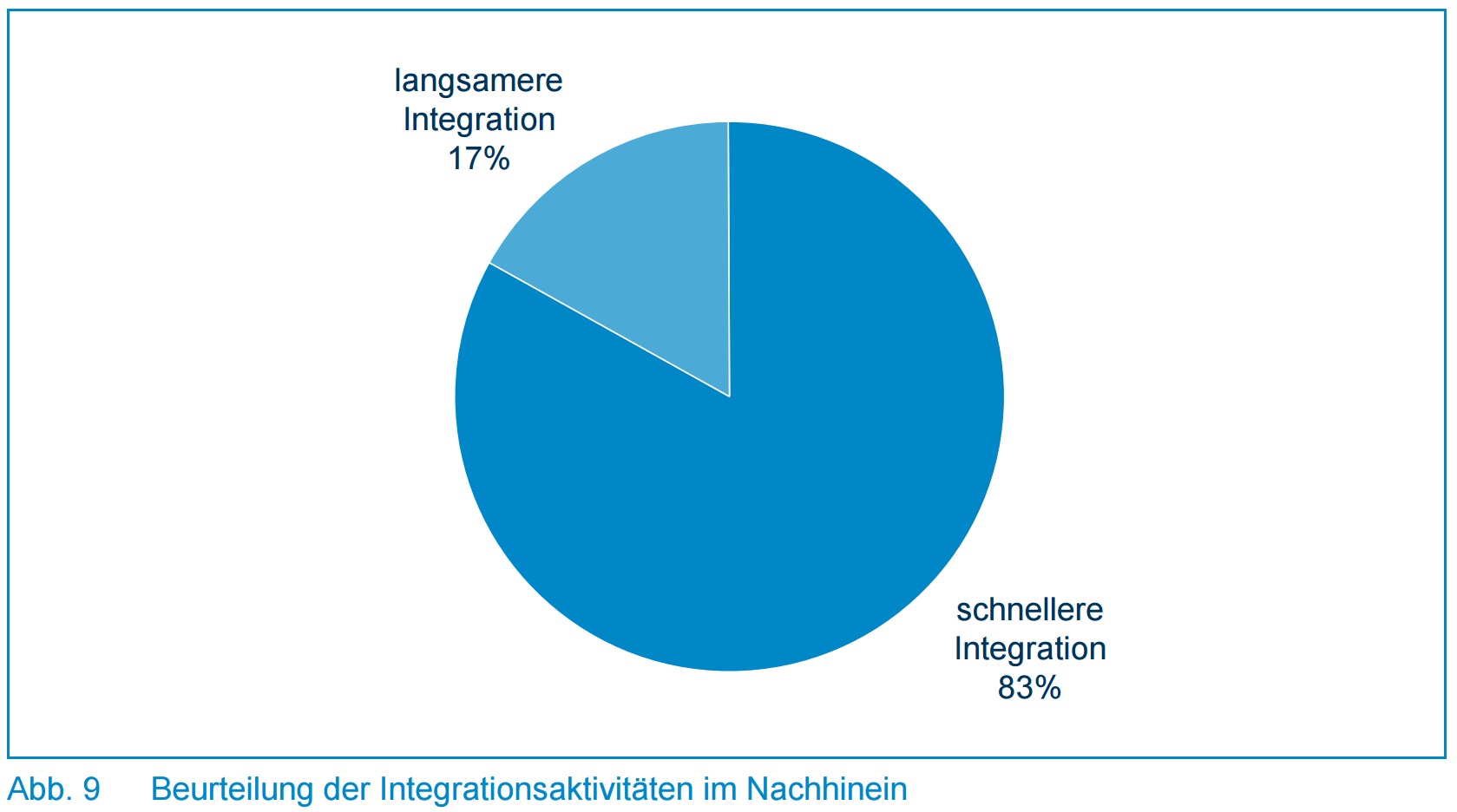

Über 80 % der Befragten geben an, dass der Integrationsprozess zu lange gedauert hat (Abb. 9). Gründe für eine schnellere Integration sind vor allem Kostensenkung und Minimierung der Unsicherheit von Mitarbeitern.

Wenn die Befragten sich für eine langsamere Integration aussprechen, so begründen sie dies ausschließlich mit der Komplexität der IT-Integration.

Der Prozess der Unternehmenszusammenführung, die damit einhergehenden Veränderungen sowie die zusätzlichen Aufgaben werden von den Beteiligten meist als Belastung empfunden. Eine schnelle und transparente Umsetzung vermindert bei allen Beteiligten die Bedenken, sichert die Identifikation der Mitarbeiter mit dem Unternehmen und ermöglicht eine schnellere Rückkehr zum Tagesgeschäft.

„Wenn wir schneller integriert hätten, hätten wir weniger Reibungsverluste gehabt und Wirkungen wären schneller eingetreten.“

Umfrageteilnehmer

„Man muss möglichst schnell klare Verhältnisse schaffen.“

Umfrageteilnehmer

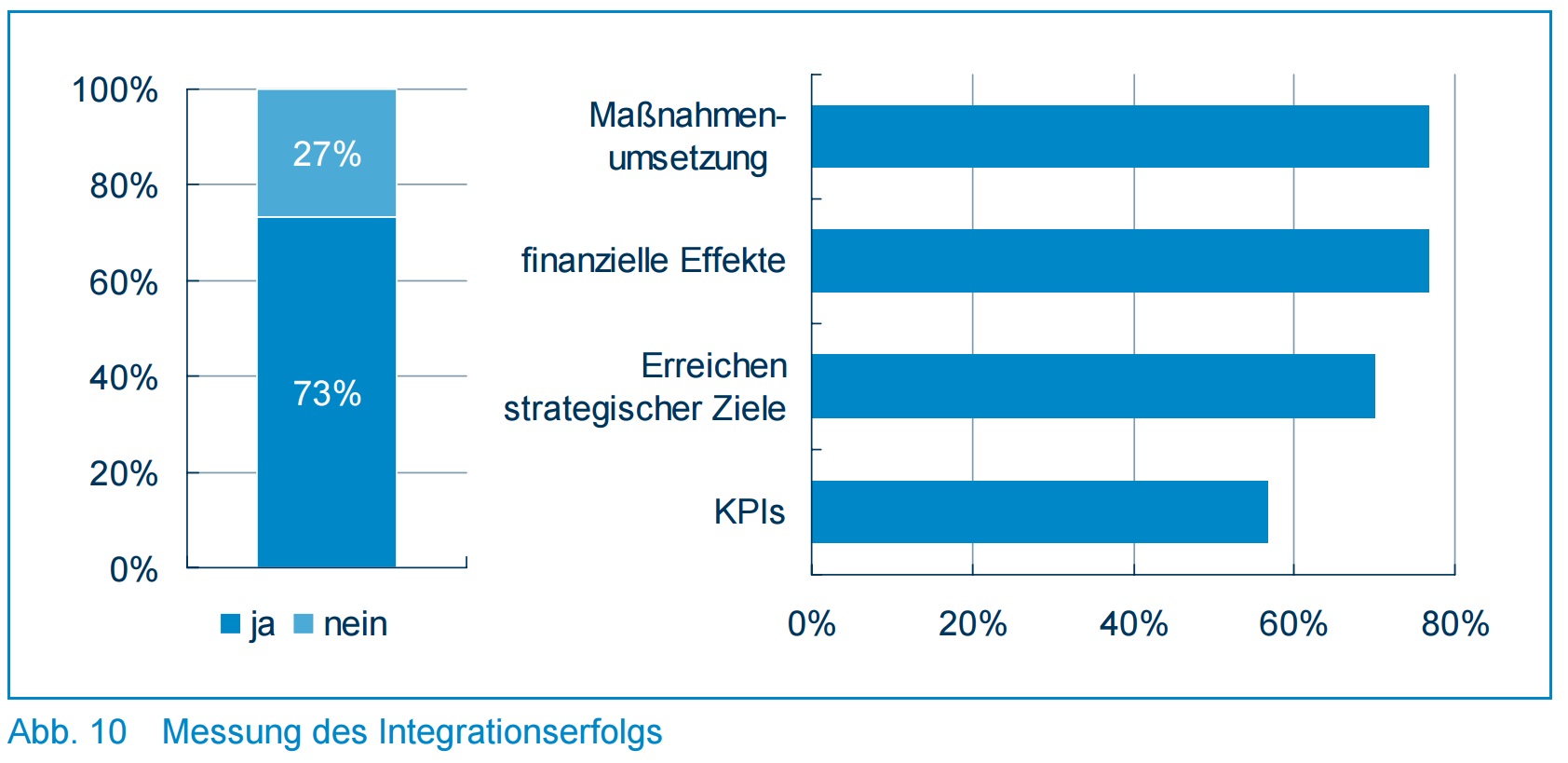

Die meisten Unternehmen verfolgen die Integration über Maßnahmenumsetzung und finanzielle Effekte

70 % der befragten Unternehmen messen den Integrationserfolg. Hierzu werden vor allem Maßnahmenumsetzung und finanzielle Effekte betrachtet, aber auch das Erreichen strategischer Ziele. Key-Performance-Indikatoren (KPIs) spielen eine geringere Rolle (Abb. 10).

Die Wichtigkeit der Messung des Integrationserfolgs wurde von den meisten Unternehmen erkannt und umgesetzt. Je größer ein Projekt ist, desto wichtiger werden formalisierte Prozesse. Bei zunehmender Projektgröße wird es für Führungskräfte insbesondere schwieriger, den Gesamtprozess ohne standardisiertes Reporting und Controlling zu überblicken und zu steuern.

Durch ein kontinuierliches Reporting des Projektfortschritts und der Aktivitätenplanung war der Projektfortschritt für die Entscheidungsträger stets ersichtlich.“ Umfrageteilnehmer

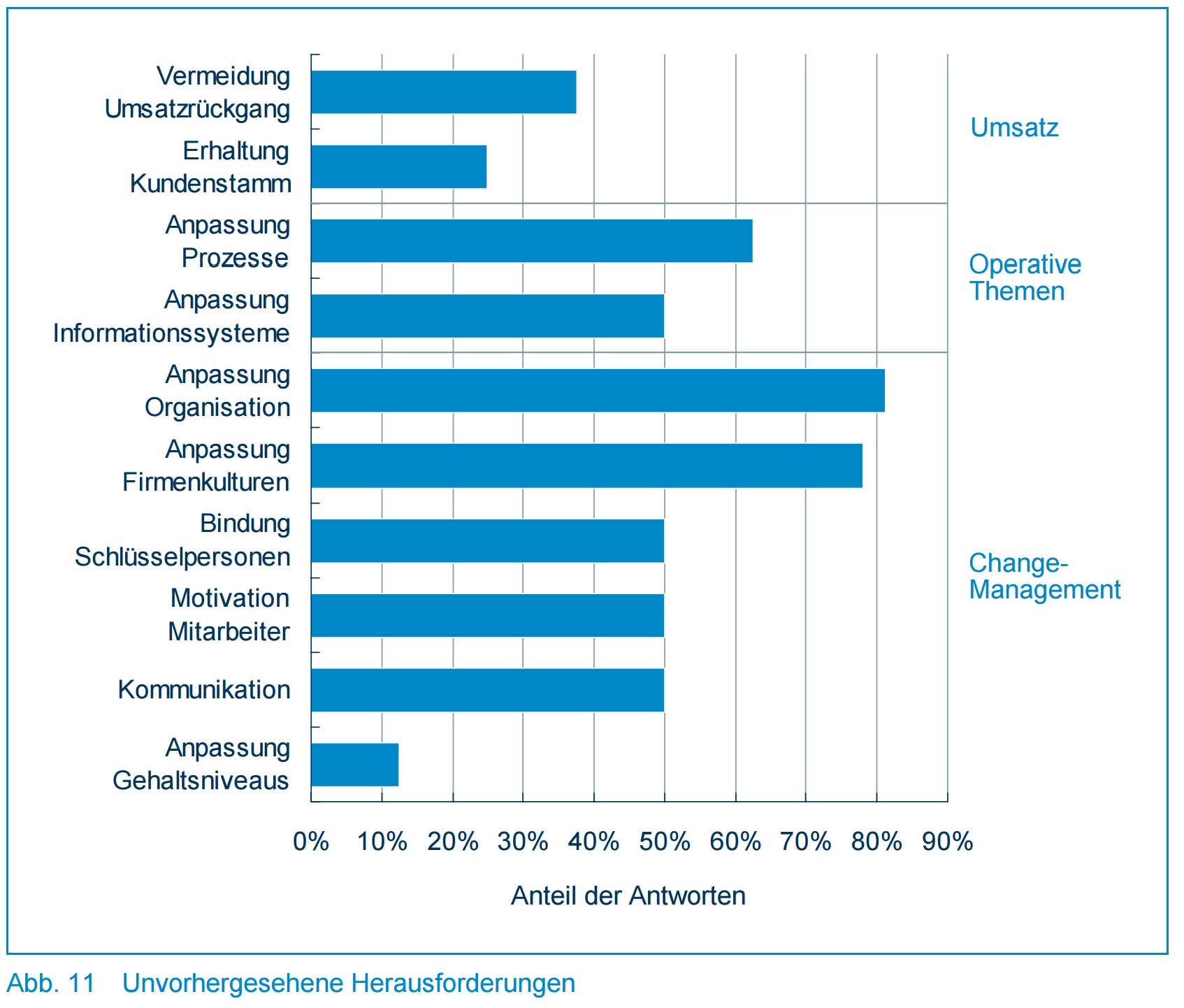

Große Herausforderungen liegen nach wie vor im Change-Management

Die meistgenannten unvorhergesehenen Probleme liegen im Bereich Change- Management. Insbesondere der Umgang mit verschiedenen Firmenkulturen hat für die erfolgreiche Zusammenführung zweier Unternehmen eine größere Bedeutung als vielfach angenommen. Auch die Anpassung der Organisation gestaltet sich in über 80 % der Fälle schwieriger als vorher angenommen. Darüber hinaus spielen die Bindung von Schlüsselpersonen sowie die Kommunikation mit und die Motivation von Mitarbeitern eine wesentliche Rolle (Abb. 11).

Die operativen Integrationsthemen, die Vermeidung von Unzufriedenheit bei den Kunden sowie Umsatzverluste scheinen besser planbar und vorhersehbar und spielen deshalb eine sehr viel geringere Rolle als die Führungsthemen.

Die Änderung gewachsener Strukturen wird bei vielen Zusammenschlüssen vernachlässigt. Sie ist kompliziert und hängt stark von der Wandlungsfähigkeit und -bereitschaft der Betroffenen ab. Vom Management sind hier eine klare Kommunikation sowie eine faire Feedback-Kultur gefordert, um unnötige Frustration zu vermeiden. Sieht die Belegschaft den Veränderungsprozess als Chance und nicht nur als Bürde, so ist eine erfolgreiche Integration sehr viel leichter durchführbar.

Beim nächsten Mal sollte man neue Führungskräfte systematisch aufbauen, da die alten teilweise zu ,verhaftet’ sind in alten Strukturen.“ Umfrageteilnehmer

„Man sollte das nächste Mal noch konsequenter ohne Rücksicht auf Mitarbeiter (vor allem Führungspersonal) die Möglichkeit nutzen, eine neue Organisation nach dem Idealbild einzuführen.“ Umfrageteilnehmer

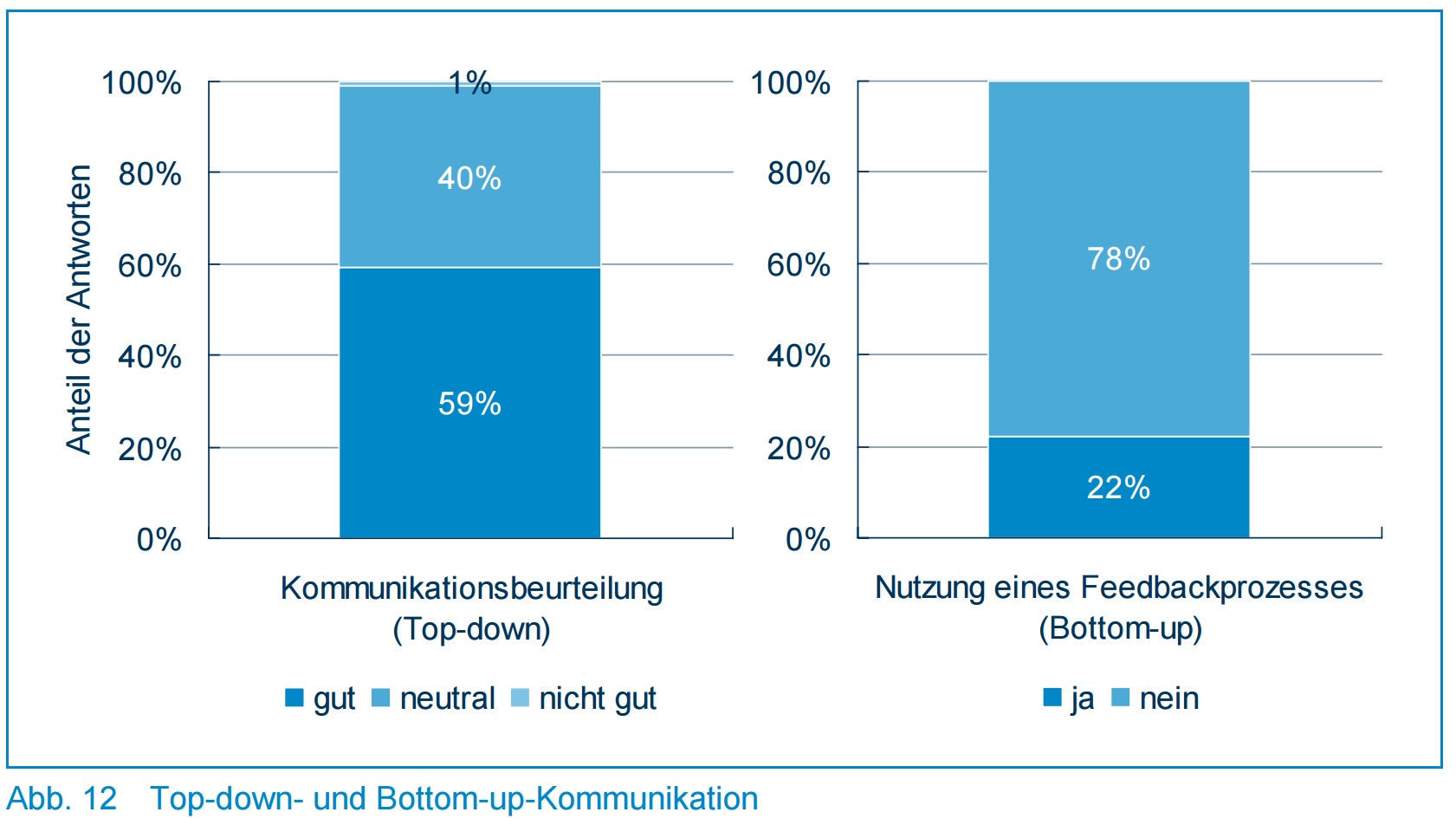

Bedeutung des Themas Kommunikation ist erkannt – Prozess findet häufig nur in eine Richtung statt

Der Erfolg der Kommunikationsmaßnahmen wird sehr positiv beurteilt. Nur knapp 1 % der Befragten geben an, dass die Kommunikation an einzelne Interessengruppen nicht zufriedenstellend war (Abb. 12).

In vielen Fällen gab es allerdings keine Feedbackprozesse. Dies lässt auf eine einseitige Kommunikation Top-down schließen. Außerdem sehen viele Befragte im Rückblick die Kommunikation als eine unvorhergesehene Herausforderung an.

If communication is only done top-down, employees’ knowledge of the operational effects of the integration remains unused and problems are not identified. A systematic feedback process without consequences for the feedback provider can uncover problems and give the workforce the opportunity to participate in the change process.

It can be assumed that decisions and goals are communicated in companies, but it remains unclear what reaches the recipients. The positive assessment of communication success therefore only refers to the “sending” of information.

“Unfortunately, we didn’t have a feedback process.”

Survey participants

“There was no systematic feedback process; employees were able to contact their superiors unofficially or comment during periodic employee reviews.”

Survey participants

“There was a portal to ask questions to HR.”

Survey participants

Requirements for advisors before and after the deal differ significantly

During the due diligence phase, the consultants involved are almost exclusively expected to uncover risks and provide support in determining the purchase price. Recognizing opportunities, on the other hand, hardly plays a role. In contrast, the main task of the consultants in the integration phase is primarily to uncover potential for improvement and to structure the integration project (Fig. 13).

As a prerequisite, it is assumed that integration consultants have both industry expertise and experience in the post-merger area. Pure process competence does not meet expectations. The respondents also rely on the experiences of their consultants in the area of change management (Fig. 14).

The unequal treatment of opportunities and risks enables the purchase decision to be secured, but is not necessarily sufficient for a long-term successful transaction. By looking for potential for improvement, an attempt is only made ex post to optimize the transaction in terms of internal efficiency.

Due to the change in economic conditions, efforts to increase value will increase significantly even before the transaction.

“More care should be taken in the selection of consultants in order to achieve better quality. In the integration phase, the consultant’s focus should go beyond process expertise.”

Survey participants

“You should use external consultants with industry knowledge and post-merger experience.”

Survey participants

C. Successful company acquisitions: lessons from practice s

- Buy a company that fits your strategy and your organization. Don’t buy a company just because it’s on sale.

- Before signing a contract, have a clear idea of how you want to integrate the company you are buying and include these considerations in your purchasing decision.

- Involve your key managers in the purchasing decision. Do not plan for synergies that are not supported by those responsible for implementation.

- Start with the conceptual planning of the integration in the due diligence phase and immediately start the detailed planning after signing.

- Ask yourself about the right managers at the beginning of the integration. Make necessary personnel decisions quickly.

- Keep your employees informed about developments during the integration and actively collect feedback. Prevent a “two-tier society” between “old” and “new” employees.

- Relieve your managers, who are under double strain during integration, with professional support.

- Deal intensively with the synergy potential in value-adding areas that is harder to exploit; Don’t just settle for quick wins in the back office functions.

- Act quickly during the integration so that you can get back to day-to-day business just as quickly.

- Plan the end of the integration project and the consultant assignment. Ensure that outstanding activities are transferred from the project team to the line organization in a timely manner.

D. Participant profiles

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter