Publications Mitigating Risks in Mergers and Acquisitions: Undertaking Due Diligence in China

- Publications

Mitigating Risks in Mergers and Acquisitions: Undertaking Due Diligence in China

- Bea

SHARE:

Robert Stegmann, a director in BearingPoint’s Merger Services practice, has worked extensively with companies in China, Korea, Japan and throughout the United States, helping them improve their strategies when it comes to due diligence and merger integration. In this Perspectives piece, Robert shares vital information for companies actively interested in entering or expanding in the Chinese market.

China has been described as a “factory to the world” because of its comparatively low labor cost, which has fueled a rapid rise in direct investment from abroad. China now accounts for a significant percentage of world production of several products, including cameras (50 percent), air conditioners (30 percent), televisions (30 percent) and washing machines (25 percent). With 25-year average gross domestic product growth of 9.7 percent, China’s spectacular economic performance has also fueled demand for commodities imports and transportation services in addition to the myriad service requirements needed to support expansion, including tech- nology transfer, legal services and education in modern manufacturing techniques.

For many businesses, the question is not whether to engage in business with China but rather how to select the most appropriate entry vehicle. Depending on the degree of control needed and the complexity of your product or service, the required structure may range from purchase agreements and product licensing to joint ventures and equity acquisition of an existing business. Other drivers in this impor- tant initial decision include the amount of risk you are willing to assume, the extent of your commitment, and the markets you intend to serve.

Mergers and acquisitions in China have been occurring at a record pace in recent years as investors have acted decisively to capitalize on the abundant opportunities available in virtually every major sector of the economy. In 2003, China overtook the United States as recipient of the largest foreign direct investment (FDI) in the world, attracting record investments of $53 billion.1 In 2004, the FDI exceeded $60 billion and, for the first quarter 2005, has been recorded as $13.4 billion, an increase of 10 percent over the same period last year.

China’s Foreign Trade Law was revised in April 2004, liberalizing treatment of foreign direct investments as part of China’s agreement to gain admission to the World Trade Organization. Under China’s Measures for Administration for Foreign Investment in the Commercial Sector, foreign investors are now allowed (as of December 2004) to establish wholly owned trading companies in retailing (from fixed location, telephone, Internet, mail order, vending machine or television), wholesaling, franchise operations or import/export business by existing manufacturing operations.

DUE DILIGENCE —

THE CRITICAL SUCCESS FACTOR FOR YOUR M&A ACTIVITIES

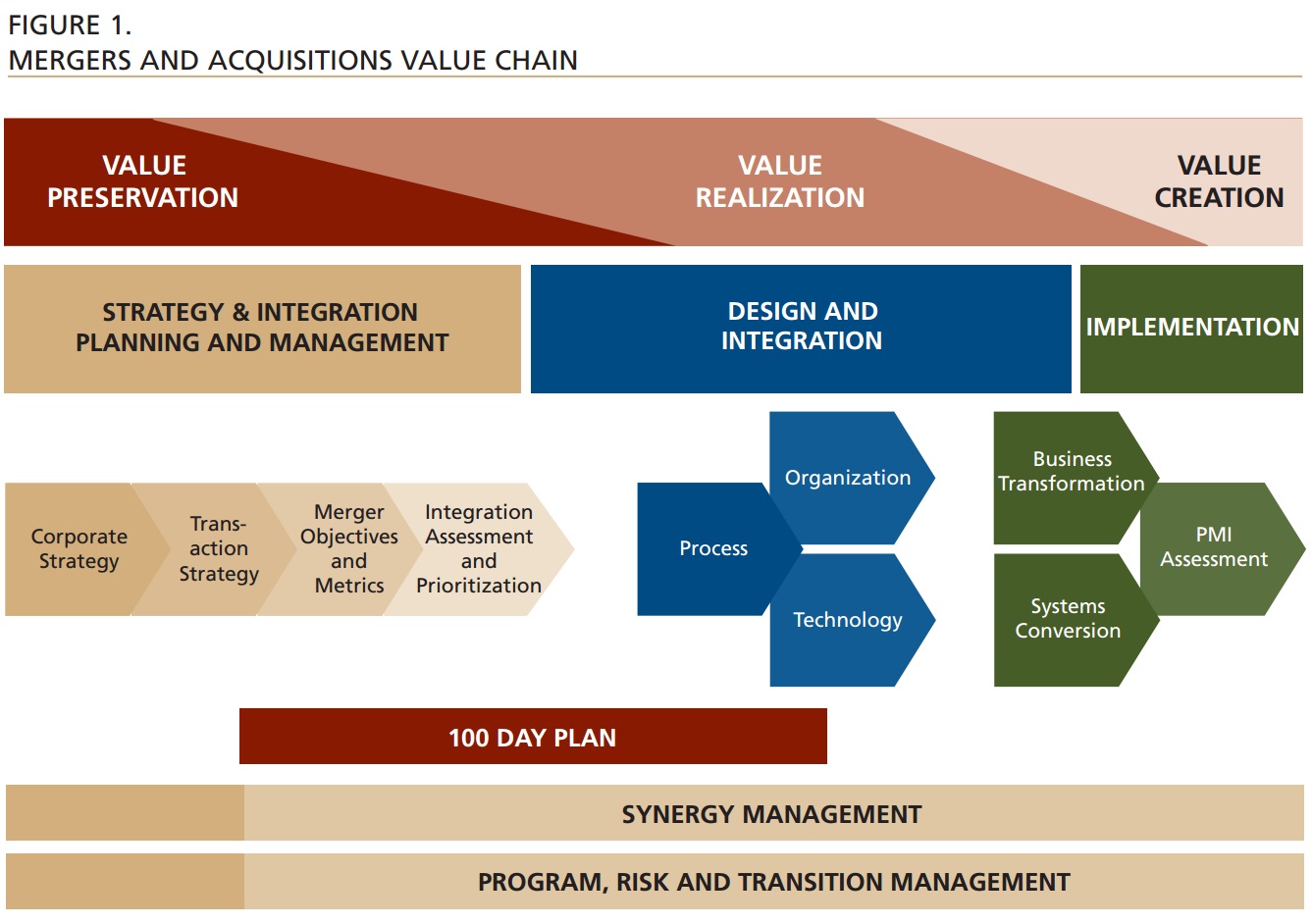

Because mergers and acquisitions rarely occur as initially envisioned, the mergers and acquisition (M&A) process requires participants to be extremely flexible. At BearingPoint, we’ve identified the key interrelated steps for a highly successful merger as:

- Value preservation

- Value realization

- Value creation

Value preservation incorporates pre- close steps that begin with your company’s articulation of its market strategy and identification of an appro- priate acquisition target or joint ven- ture partner. Due diligence should precede negotiation of structure and related deal terms, which would include formulating an offering price.

Value realization is the product of successful due diligence that antici- pates merger integration by identify- ing potential issues and enables the acquirer to appropriately plan for an effective business operating model, organizational alignment and required change management.

These steps in turn lead to value creation, which harvests the goal of undertaking an investment whether motivated by customer acquisition, new products, strengthening one’s supply chain, accessing new technology or entering new markets.

Due diligence should be undertaken prior to investing in China irrespective of the organizational form you may have in mind (see Figure 1).

THE BENEFITS OF OUR EXPERIENCE

At BearingPoint, we’ve helped leading companies execute successful mergers and acquisitions in a productive, effi- cient manner based on this three- phased approach. For instance, we recently worked with a global trans- portation services company that wanted to pursue domestic expansion of its services throughout mainland China to enhance its service levels in an increasingly competitive global trade environment.

The company looked to BearingPoint for help with performing compre- hensive due diligence on the financial, operational, human resource and in- formation technology (IT) aspects of a target firm. We also helped the com- pany assess the risks and opportunities associated with this expansionary investment.

Value Preservation

At the outset of project initiation, BearingPoint professionals worked closely with the company to define the scope of the investigation in order to fully under- stand operational aspects of the target critical to deal analysis and define the required timeline prior to initiating due diligence.

We helped the company identify and outline major discoveries, including potential problem areas, and made recommendations for integration steps and estimated additional required investment should the investment proceed. In this case, our due diligence process is normally divided into the following work streams:

- Operations

- Systems and culture

- Finance

- Legal and tax

An extensive data request was prepared prior to initiating the review that served as the basis for populating a dedicated data room to be used throughout the process for logging and tracking all requested and received documentation. For any company in this situation it is very important to retain experienced legal counsel to similarly review all key aspects of due diligence.

Multinational firms may be well advised to seek specific tax repre- sentation, which may be handled by either one’s legal counsel or an external accountant.

The objective of the due diligence process is to gain as much insight and understanding into the conduct of the target company as is practical to support an informed decision to invest (or decline), as well as provide insight into transaction structure, terms and steps to pursue in integration.

Another important aspect of the diligence process is that the target company designate key contacts to source all requested information, arrange interviews and pursue answers to open items. Insiders responsible for facilitating the process must have the authority to approve release of information and source responses to all related inquiries.

In closely held businesses, the owner typically plays a central role in the due diligence process because employees may be reluctant to overstep their bounds of authority or may not even be aware of the transaction.

At BearingPoint, we have worked extensively with companies in coaching them how to best approach both internal and external communications to help maintain confidentiality and manage potential anxieties that can arise when employees sense change may be forthcoming.

One must not rush to judgment in assessing the manner in which responses to information requests are handled because the detailed level of investigation pursued by foreign firms may be deemed overly aggressive in accordance with Chinese norms, or quite possibly the information simply may not be available.

It was equally important throughout the diligence process to avoid being critical of efforts to gather information, as this could undermine the foundation of trust that is being formulated throughout the process. Advisors retained to conduct due diligence are representatives of the potential investor and must conduct themselves professionally and politely in interactions with the target at all times. Gaining cooperation of the target firm is an important aspect of information gathering and may also impact the success of future integration efforts. This is true in potential acquisitions in any country, though we have found it to be particularly important in China.

It has been our experience that incon- sistent bookkeeping practices and lack of adherence to acceptable accounting practices plague many companies in China. Some key differences between accounting systems for business enterprises (ASBE) and international financial reporting standards (IFRS) accounting standards that warrant caution are the manner in which inventories are valued, the treatment of stale accounts receivable, the selected applications of depreciation and amortization, and the manner and use of tax deferrals.

Fair value has not been adopted as the standard of value under ASBE. Coupled with the lack of transparency in many financial statements in China, one must proceed very cautiously when evaluating true profitability of a target company. For the deep-dive review recommended when contemplating a wholly foreign owned enterprise (WFOE), the due diligence process should begin with a matching of source documents that roll up into reported financials. Reconciling financial statements in China can be quite challenging when multiple subsidiaries are involved. Authentication of reported results is, in fact, a major undertaking of successful due diligence.

Value Realization

The due diligence process by its very nature incorporates a significant amount of cash flow verification and other quantitative analysis to generate the modeling inputs required in formulating an offering price. Qualitative analysis is aimed at assessing the depth of personnel, culture compatibility issues, operational efficiency, and prod- uct and client diversification, as well as whether the target carries any “unwanted baggage” (e.g., underutilized assets, contingent liabilities, unwanted product lines, reputational issues, etc.).

One of the keys to conducting insightful due diligence in China is the identification of potential business and financial issues that need to be resolved through effective merger integration. During this phase, we try to answer questions such as:

- How compatible are the respective IT platforms and what level of expense and effort will be required to integrate management reporting with effective processing and reporting controls?

- What efforts are required to improve operational efficiency and effectiveness?

- Are significant capital expenditures required to replace worn or incompatible equipment?

- Should the human resources function be realigned, including compensation and benefits?

- Is the real estate function maximized?

- How well are the production and supply chain functions currently managed?

In the case of the global transportation services company, our due diligence timeline spanned a period of four months, with the follow-up investigation requiring an additional 60 days. The timeline for undertaking due diligence will vary in accordance with the complexity and preparedness of the target. We provided valuable insights that enabled the company to craft a more accurate offering price for use in negotiations. The acquisition was viewed as the most expedient means with which the company could quickly expand its domestic presence in China.

The company is currently undergoing the final negotiations of this investment. During the course of the due diligence, we identified a number of weaknesses in the target’s IT platform and internal accounting systems that will need to be upgraded post-merger. The associated costs of these enhancements have been factored into the proposed purchase price.

Our team now has the ability to further support this company’s need for IT and accounting system integration work, thus building on the knowledge gained through due diligence. The required post-merger integration investments will thus be handled more efficiently than if the company had to turn to another service provider for this post-acquisition work.

Value Creation

The final stage of the value chain, value creation, is the byproduct of effective merger integration and should be tracked and measured over time. Acquirers should effectively plan to capitalize on cross-selling, melding of acquired R&D with existing products, entering new markets based on acquired capabilities, or whatever specific motivation precipitated the initial decision to acquire. Revenue upside may take time to cultivate but results in value being created often- times through future growth.

We recommend that clients identify, quantify and prioritize synergy oppor- tunities and continually monitor synergy realization. Realizing these benefits may involve transforming the organization to bring the combined company to new levels.

LESSONS REGARDING CHINA MARKET ENTRY

It has been our experience that numerous differences exist between Chinese company practices and their foreign counterparts in the operations, account- ing and financing of a business. In China, it is not uncommon for successful entrepreneurs to be the sole driving force behind a company with little depth of middle management talent, ineffective research and development, questionable accounting practices or other areas of common concern.

Contingent liabilities may arise from underpayment of taxes, failure to fund employee social welfare obligations or cross-guarantees of undisclosed indebtedness. Irrespective of the form of business selected for entering China, it is advisable for investors to undertake some form of due diligence, while those contemplating a WFOE are well advised in taking a deep dive into the background, reputation, relationships and accounting of the identified target firm.

In China, business practices as well as enforcement of government regulations may vary from province to province. Adherence to licensing requirements may be subject to closer scrutiny upon change of control. Local taxing authorities may intervene in the sale process out of concern for protecting their tax base. It also is important to clarify that due diligence may not completely insulate an investor from fraud, nor provide assurance of cooperation from local government officials. As in all business dealings, investors in China should pursue a level of detail in due diligence commensurate with their potential risk exposure and gain a thorough understanding of regulatory requirements and potential pitfalls.

In the simplest form of business transaction— sourcing product supply, for example— the buyer is still entering into a dependent relationship and should seek some assurance as to the integrity of the supplier. Character assessment is an important component of the foun- dation to building trust, particularly where product quality and continuity of supply are at issue. Should the investor contemplate a joint venture arrangement, the stakes become higher and additional investigation is warranted. In the case of an acquisition, one must assess the merits of acquiring equity, which is accompanied by assumption of all liabilities, both known and contingent. Alternatively, an asset acquisition can limit assumed risks but may also convey fewer rights, such as licenses and access to valuable land rights. Particularly in China, venturing into an M&A transaction is a risky proposition that may involve avoidable risks if adequate precautions are exercised.

Robert Stegmann, BearingPoint, 2006

BUSINESS AND SYSTEMS ALIGNED. BUSINESS EMPOWERED

BearingPoint is a leading global business advisor, systems integrator and managed services provider. Our experienced professionals help organizations around the world set direction to reach their goals and create enterprise value. By aligning their business processes and information systems, we empower our clients with the right business solutions to gain competitive leadership advantage— delivering results in an accelerated time frame. To learn more, visit our Web site at www.bearingpoint.com.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter