Publications Mergers & Acquisitions Quarterly Switzerland – Second Quarter 2013

- Publications

Mergers & Acquisitions Quarterly Switzerland – Second Quarter 2013

- Christopher Kummer

SHARE:

The Swiss M&A market was characterized by a record low disclosed deal value since 2008 and a corresponding low average deal size in the second quarter of 2013. Nevertheless, with respect to the number of announced transactions, a recovery was observed with slightly more transactions in Q2 2013, compared to the previous quarter.

Looking forward, stronger economic fundamentals in connection with the availability of more acquisition opportunities and significant cash reserves might influence the M&A market positively for the remainder of 2013. However, with uncertainty remaining high due to the persisting Euro crisis, M&A activity might still remain subdued.

Swiss M&A market Q2 2013 and outlook 2013

M&A Market Q2 2013

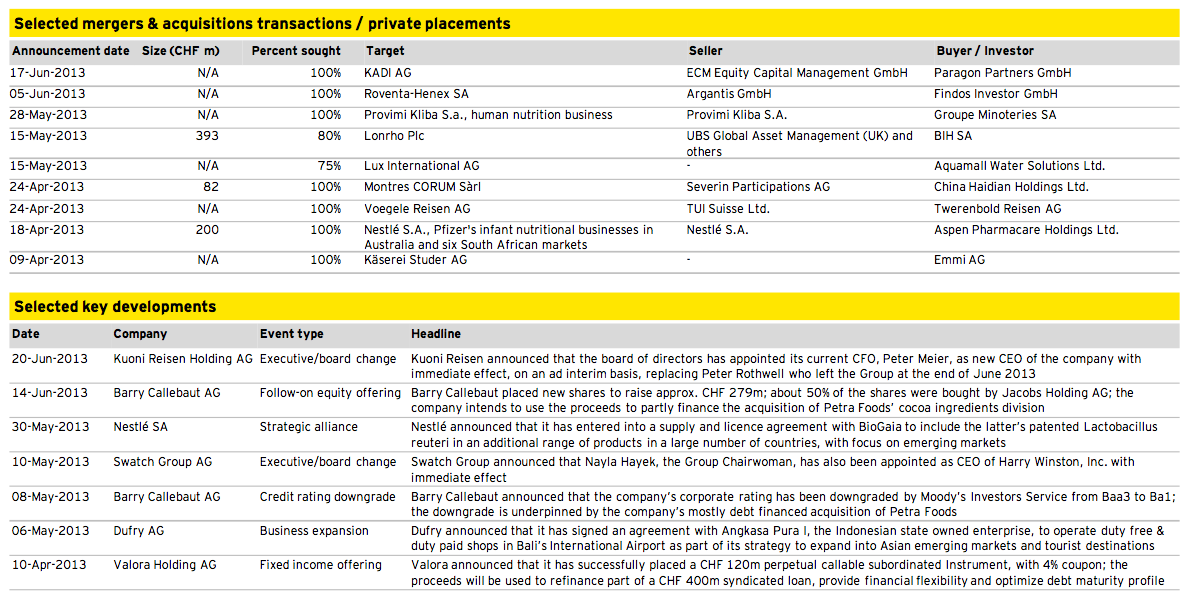

► Total disclosed deal volume for the Swiss M&A market amounted to CHF 4.1b in Q2 2013; this is the lowest value since the launch of this brochure in 2008 and reflects a decline of 83% and 14% compared to Q2 2012 and Q1 2013, respectively.

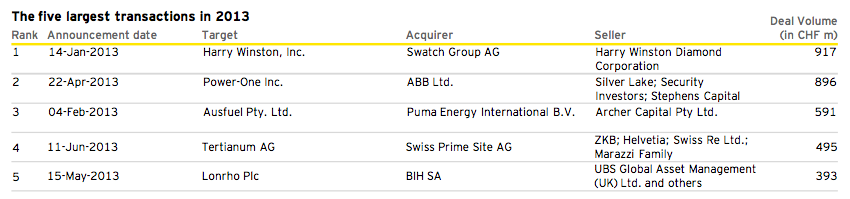

► This development is mainly caused by a lack of large deals; with only 15% of the announced transactions in Q2 2013 above CHF 250m, compared to 22% on average over the last twelve months. The largest transaction in Q2 2013 was the acquisition of US-based Power-One Inc. by Swiss-based ABB Ltd. with a deal size of ca. CHF 0.9b.

► In total, 139 deals were announced in Q2 2013, representing a slight increase of seven deals to the previous quarter and a year-on-year drop of two deals. This is in-line with the overall trend over the last five quarters, where the number of deals hovered around 150 deals per quarter.

► After two consecutive quarters of positive performance, the Swiss Market Index (SMI) decreased by approx. 2% in Q2 2013.

► Among others, decreasing stock prices were attributable to announcements of US FED president Ben Bernanke in May and June, that the current expansionary monetary policy might come to an end.

► Despite the slight loss in the current period, the SMI gained 28% over the last twelve months, thus gaining 3 percentage points in comparison to its twelve-months performance at the end of Q1 2013.

► Unlike the previous quarter, all equally-weighted sector indices performed positively over the last twelve months.

Transactions by industry

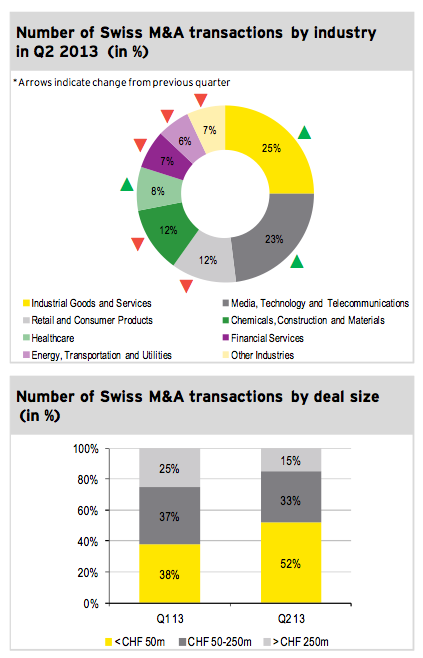

► In Q2 2013, Industrial Goods and Services accounted for 25 % of all announced deals and thus, was the most active industry sector, followed by Media, Technology and Telecommunications with a stake of 23%.

► The largest disclosed deal within Industrial Goods and Services was ABB’s acquisition of Power-One Inc.

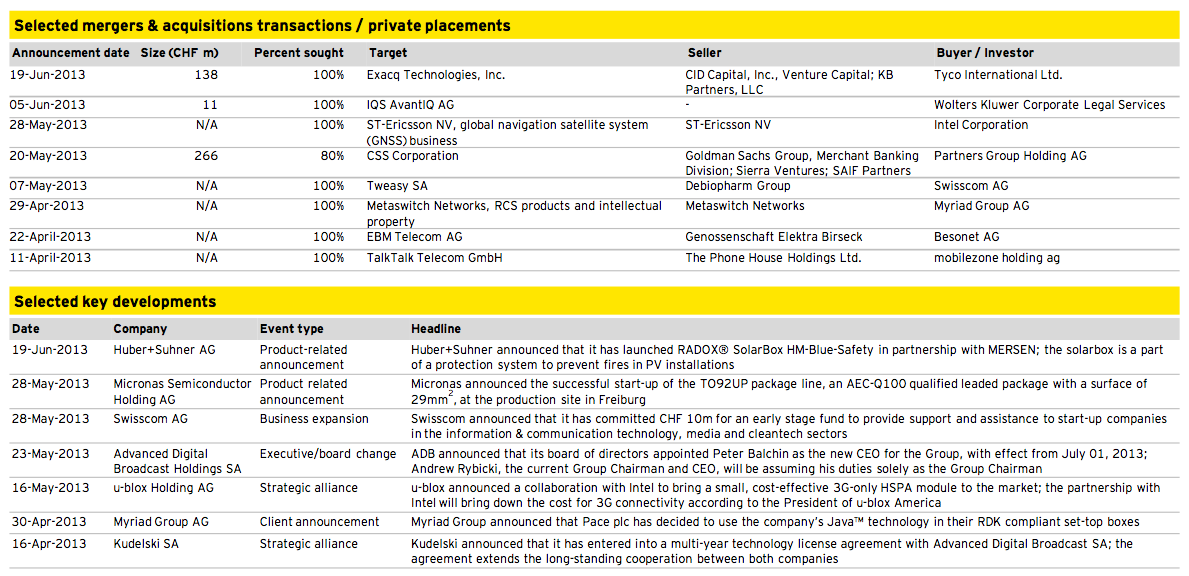

► The largest transaction in Media, Technology and Telecommunication features the acquisition of CSS Corporation by private equity firm Partners Group Holding AG as part of a management buyout for CHF 266m.

► Industrial Goods and Services and Media, Technology and Telecommunication experienced the most significant increase in deal activity, compared to the previous quarter, with a gain of nine percentage points.

► The biggest decline of eight percentage points was recorded in Energy, Transportation and Utilities.

Transactions by size

► The share of mid and large transactions in overall deal count decreased significantly in the second quarter of 2013.

► Disclosed mid-market transactions, ranging from CHF 50-250m, slightly decreased in comparison to Q1 2013, whereas large-cap transactions experienced a significant share reduction from 25% to 15%. As a result, small transactions with a deal size below CHF 50m accounted for more than half of the transactions in the second quarter of 2013.

► Deal size was disclosed in 24% of all transactions announced in the second quarter of 2013.

Outlook 2013

► In June 2013, the Swiss State Secretariat for Economic Affairs (SECO) updated its annual GDP-growth forecast for 2013 to 1.4%, an increase of 0.1 percentage points from its previous projection. The outlook is underpinned by relatively robust domestic demand on one hand and subdued exports on the other hand.

► SECO’s projection of 2.1% growth for 2014 indicates a brighter outlook compared to 2013. This is mainly attributable to an increase in exports, subject to global economic activity recovering as expected. Although market tension in Europe eased recently, the debt crisis in the Eurozone is still projected as the largest economic risk for the Swiss market going forward.

► The latest Global IPO update published by EY in June 2013 indicates an optimistic outlook on global IPO and M&A activity. Stronger investor confidence due to improved economic fundamentals is expected to stimulate deal activity in the second half of 2013. More mid-cap transactions are projected to be announced in Europe, according to the study.

► In summary, macroeconomic uncertainty with respect to the European economic crisis are expected to dampen Swiss M&A activity for the remainder of 2013. However, selected studies suggest that the German M&A market is expected to trend upward, which might also lead to increased deal activity in Switzerland. Another source of upward potential for the domestic M&A market is the availability of selected acquisition opportunities across Southern Europe. Coupled with Swiss companies on the lookout and significant cash reserves, deal activity with Swiss participation may outperform expectations.

Private equity statistics: Germany, Switzerland and Austria

Private equity Q2 2013

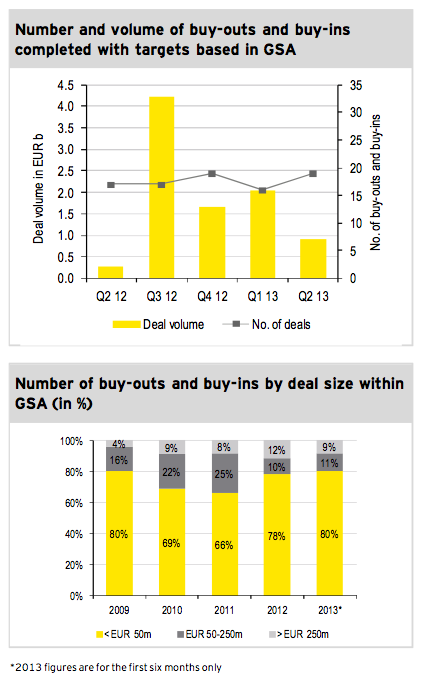

► 19 private equity (PE) transactions were registered in Germany, Switzerland and Austria (GSA) in Q2 2013; this corresponds to an increase of three deals compared to the previous quarter and two more deals in comparison to Q2 2012.

► In Q2 2013, total PE deal volume in GSA of about EUR 0.9b was low, resulting in a decrease of 55% with respect to Q1 2013. However, deal volume was almost 2.5-times larger than in the second quarter of last year.

► Decreasing volume in Q2 2013 compared to Q1 2013 was largely attributable to a lack of large transactions. The completed acquisition of Intertrust Group Holding S.A. by Blackstone Group L.P. from Waterland Private Equity Investments BV with a deal size of EUR 675m was the largest transaction in GSA. All other deals in GSA had a deal value of below EUR 100m.

► Hence, small transactions of less than EUR 50m accounted for the large majority in GSA during the first six months of 2013. This remained virtually unchanged in comparison to the first three-month figure.

► The number of buy-outs and buy-ins in GSA accounted for ca. 16% of the deals in Europe in the current quarter, representing an increase of three percentage points compared to Q1 2013.

► In terms of disclosed deal value, the GSA PE market constituted about 11% of total PE deal volume in Europe, compared to 17% in the previous quarter.

Industry overview

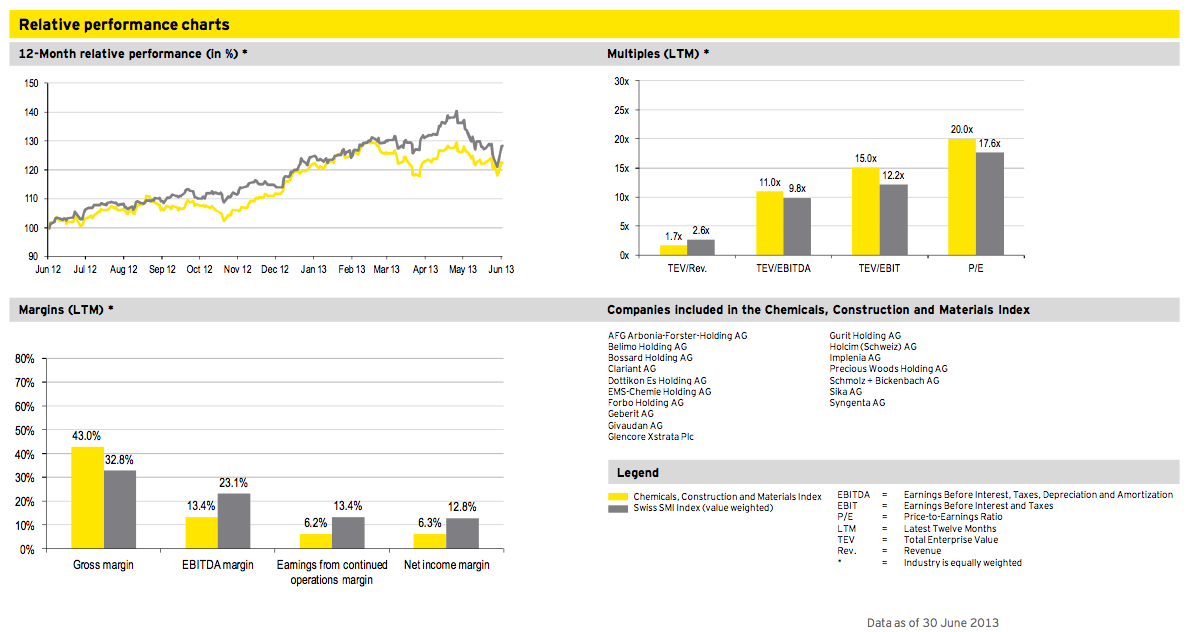

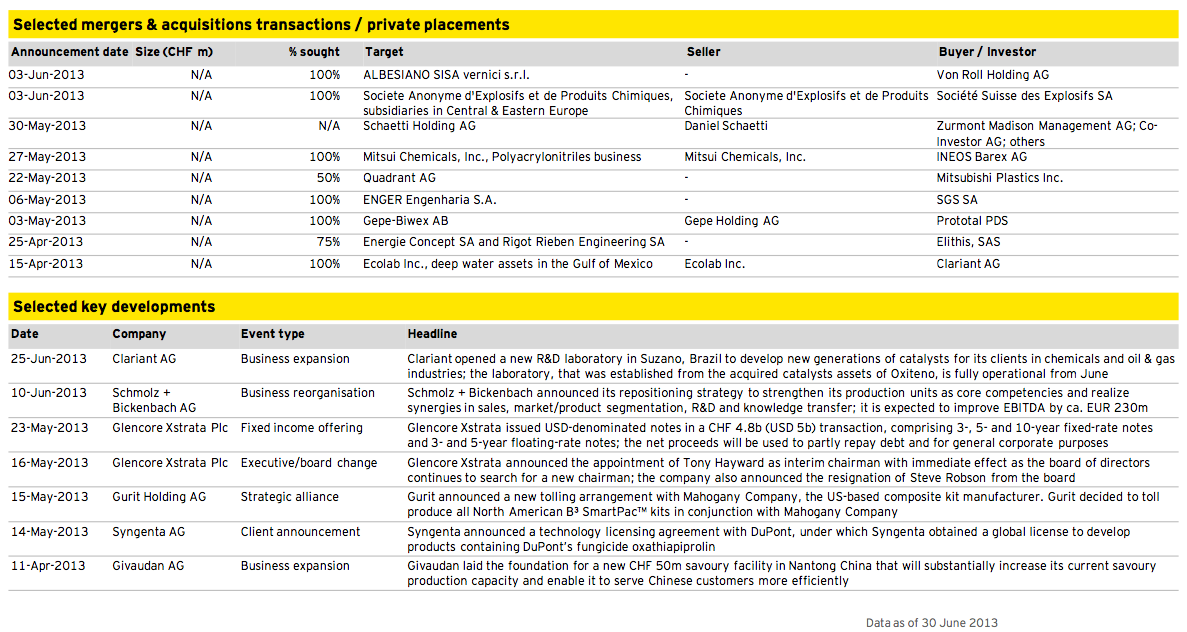

Chemicals, Construction and Materials

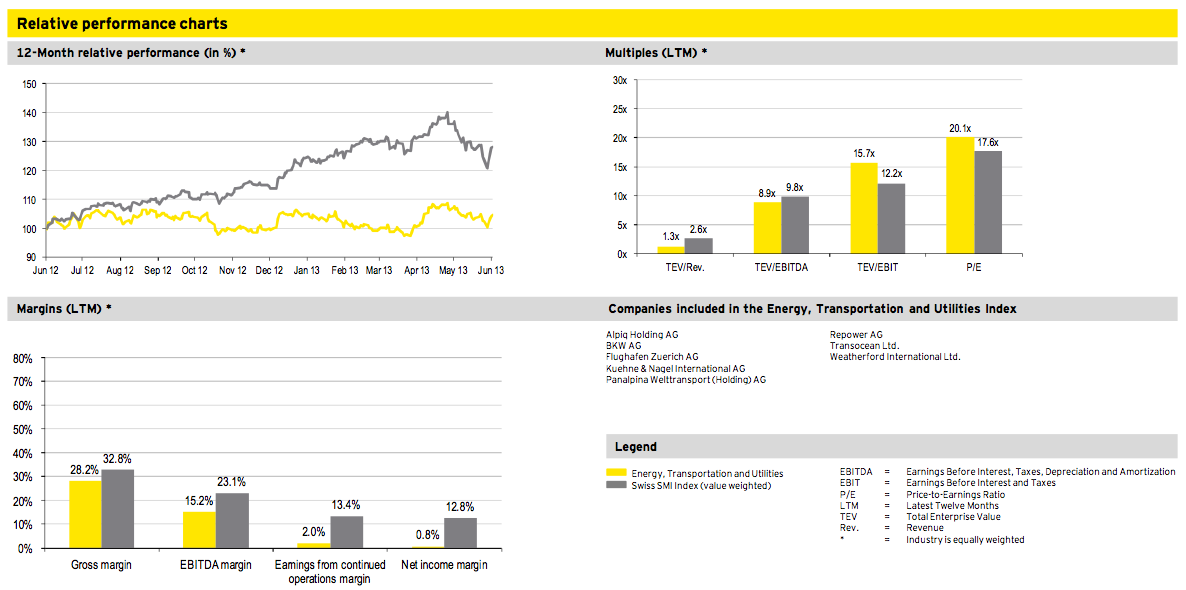

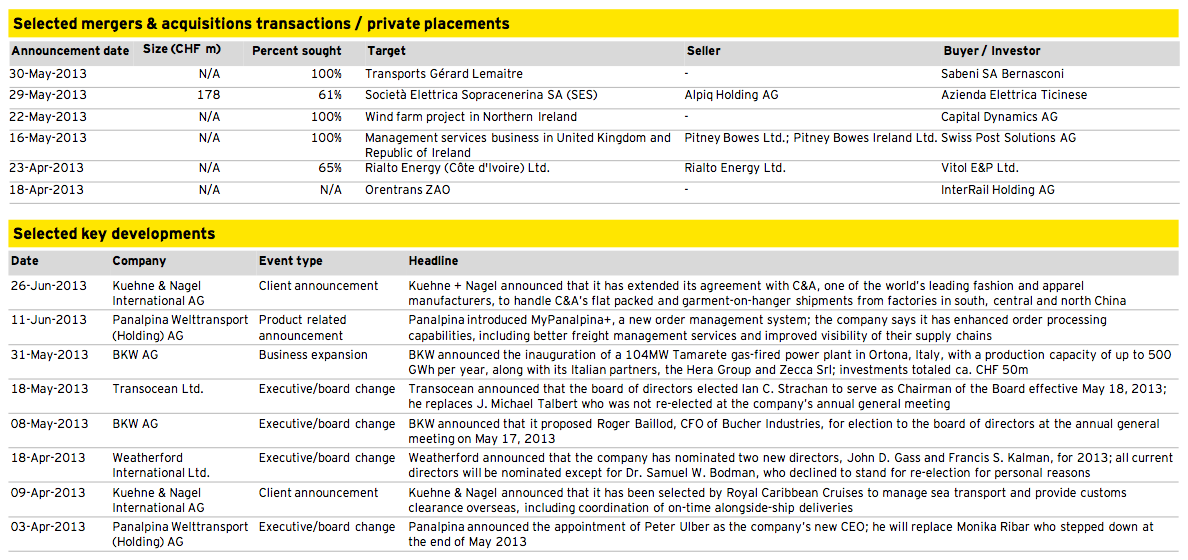

Energy, Transportation and Utilities

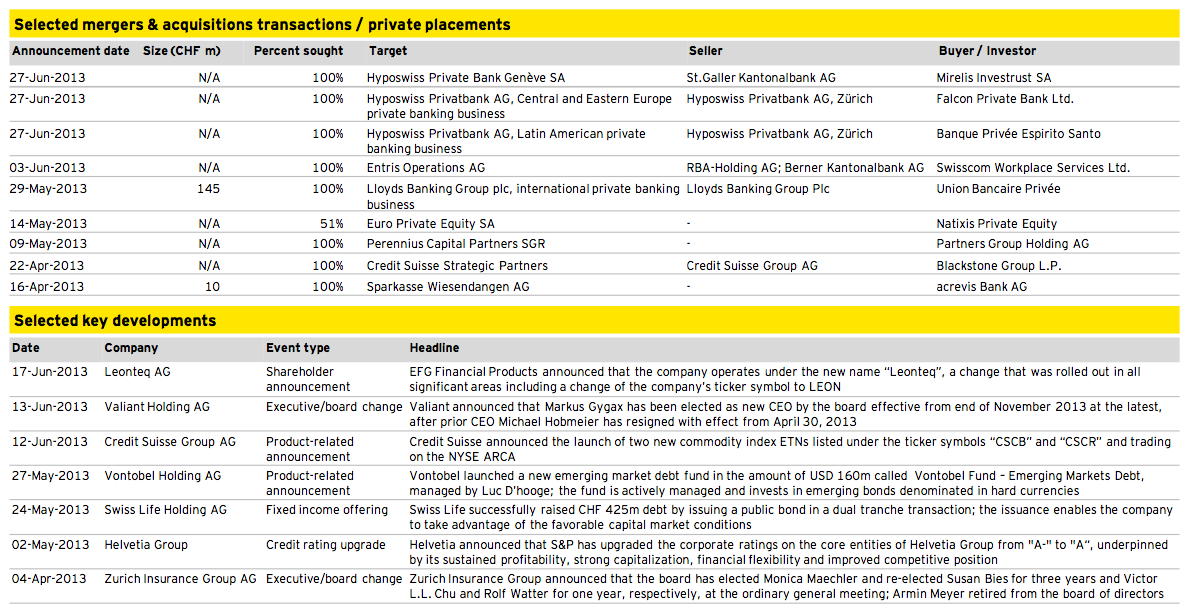

Financial Services

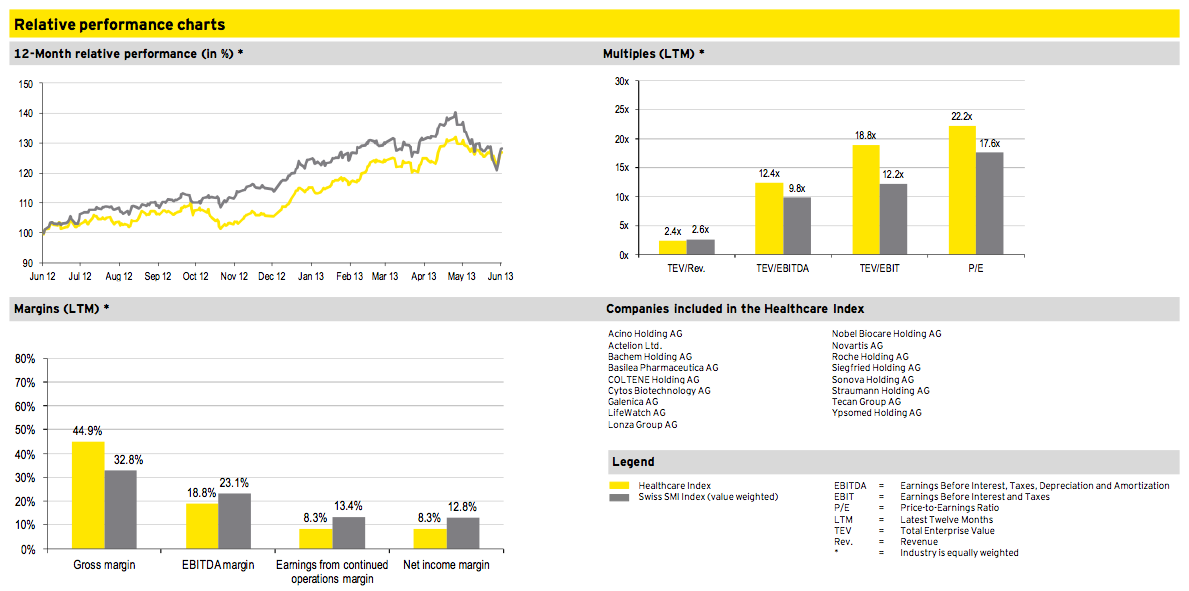

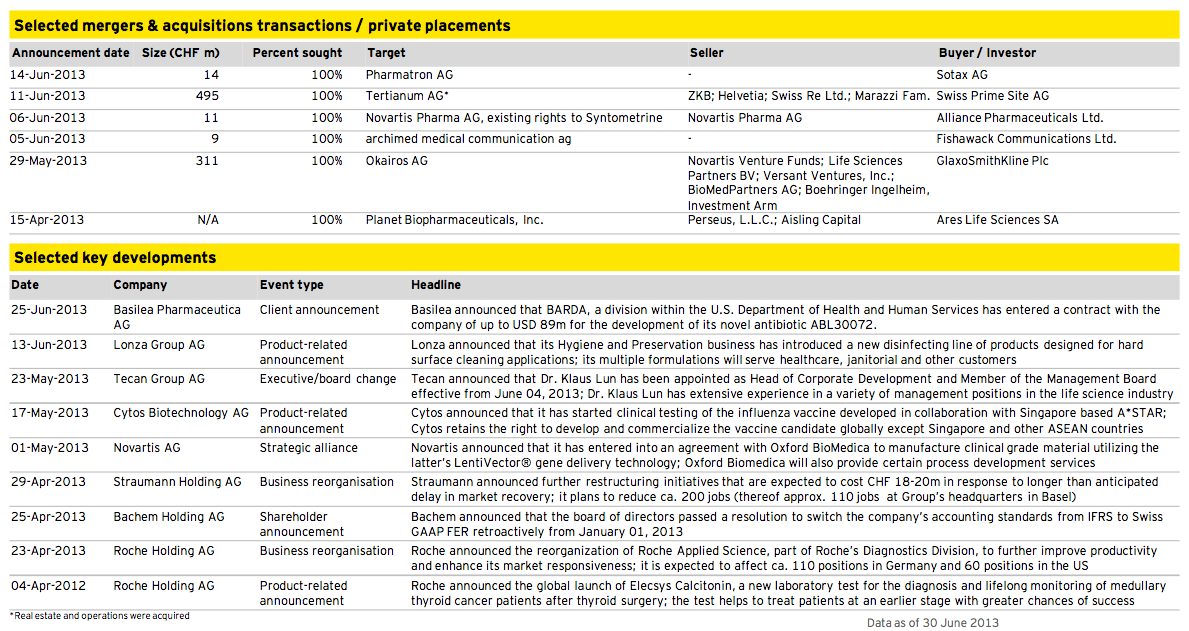

Healthcare

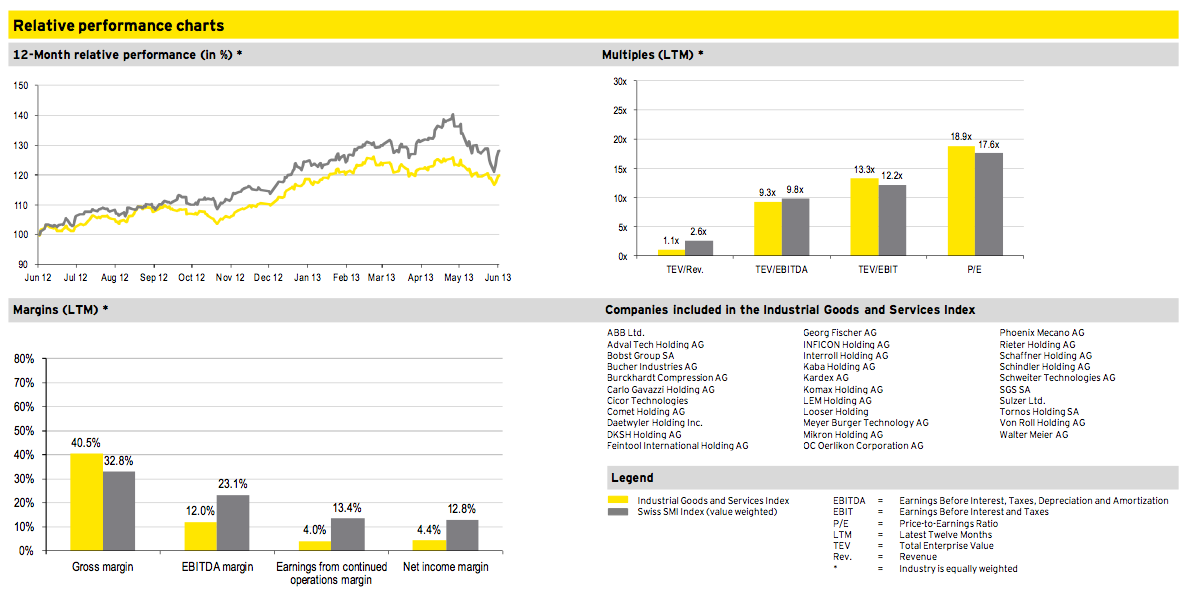

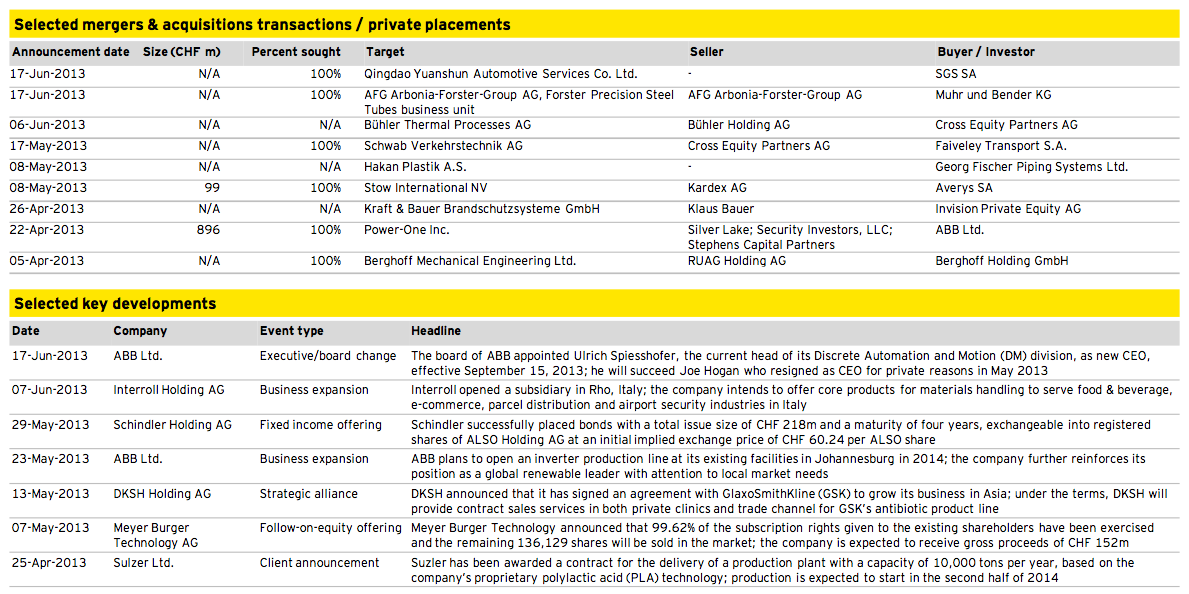

Industrial Goods and Services

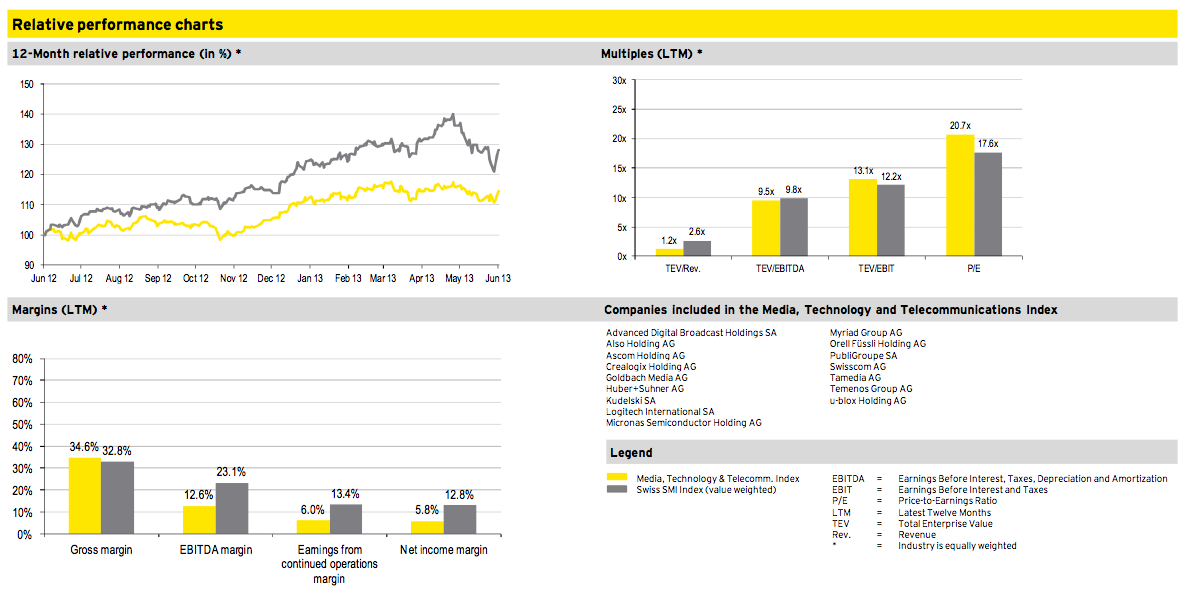

Media, Technology and Telecommunications

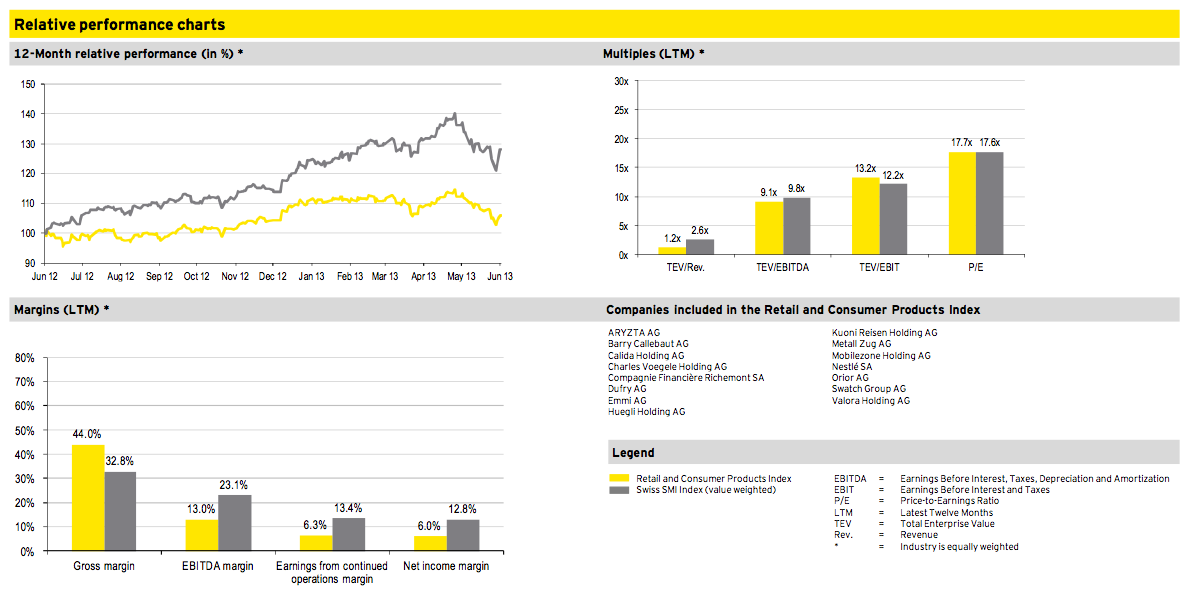

Retail and Consumer Products

Deal of the quarter

Transaction overview

Deal summary

In the second quarter 2013, our deal of the quarter features the acquisition of Power-One Inc. by ABB Ltd. The world’s biggest electricity-network builder announced it would acquire the leading provider of renewable energy, energy-efficient power conversion and power management solutions for USD 946m (CHF 896m) which includes net cash of USD 266m. The company is to be integrated into ABB’s Discrete Automation and Motion unit which produces robots, motors and drives. The transaction is expected to close in the second half of 2013.

California (USA) based Power-One is the second largest producer of inverters that allow solar power to be fed into grids and offers products ranging from residential to utility applications with a broad global manufacturing footprint. The company employs 3,300 people and operates in Asia, Europe and the Americas.

Deal rationale

► For ABB, the acquisition is aimed to broaden its overall solar power product portfolio and complement its inverter business.

► With Power-One being highly regarded as a technology innovator, the transaction is expected to increase ABB’s technological know-how.

► Power-One is expected to benefit from ABB’s substantial R&D as well as global service and sales capabilities.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter