Publications Mergers & Acquisitions Quarterly Switzerland – Second Quarter 2010

- Publications

Mergers & Acquisitions Quarterly Switzerland – Second Quarter 2010

- Bea

SHARE:

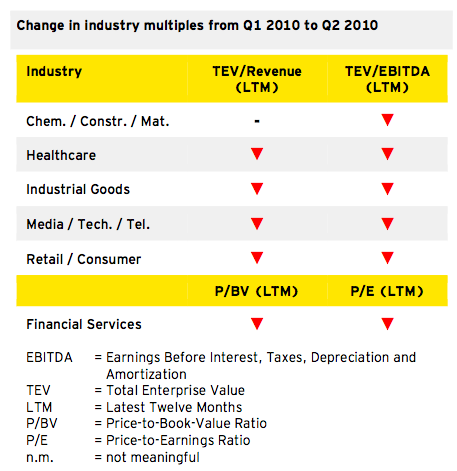

In the second quarter of 2010, the Swiss M&A market remained stable in terms of number of transactions. However, transaction volume decreased significantly compared to Q1 2010. In addition, overall stock performance in Q2 2010 was negative as the economic outlook and the European sovereign debt crisis weighed on the stock market. As a result of the weakened stock market, valuation multiples decreased throughout all industry sectors in the second quarter of 2010.

Swiss M&A Market Q2 2010 and Outlook for 2010

M&A Market Q2 2010

The Swiss M&A market has remained stable in terms of number of transactions during the second quarter of 2010 compared to the same quarter in 2009. However, deal volume dropped significantly by over 50% year-over-year in the second quarter of 2010. Strategic transactions remained the main source of Swiss M&A activity.

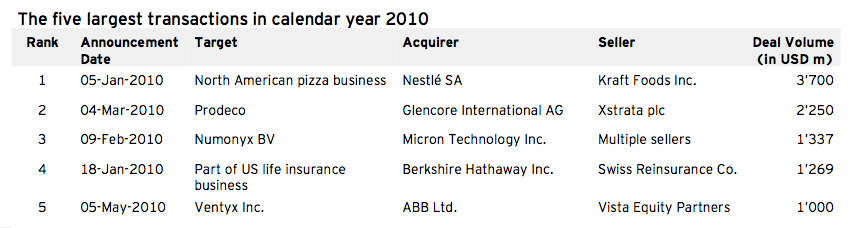

In terms of deal size, only one transaction was valued at USD 1bn or higher in the second quarter of 2010. ABB Ltd. acquired Ventyx Inc. for USD 1bn in early May 2010. With this acquisition, ABB became the globally leading provider of software solutions for managing energy networks.

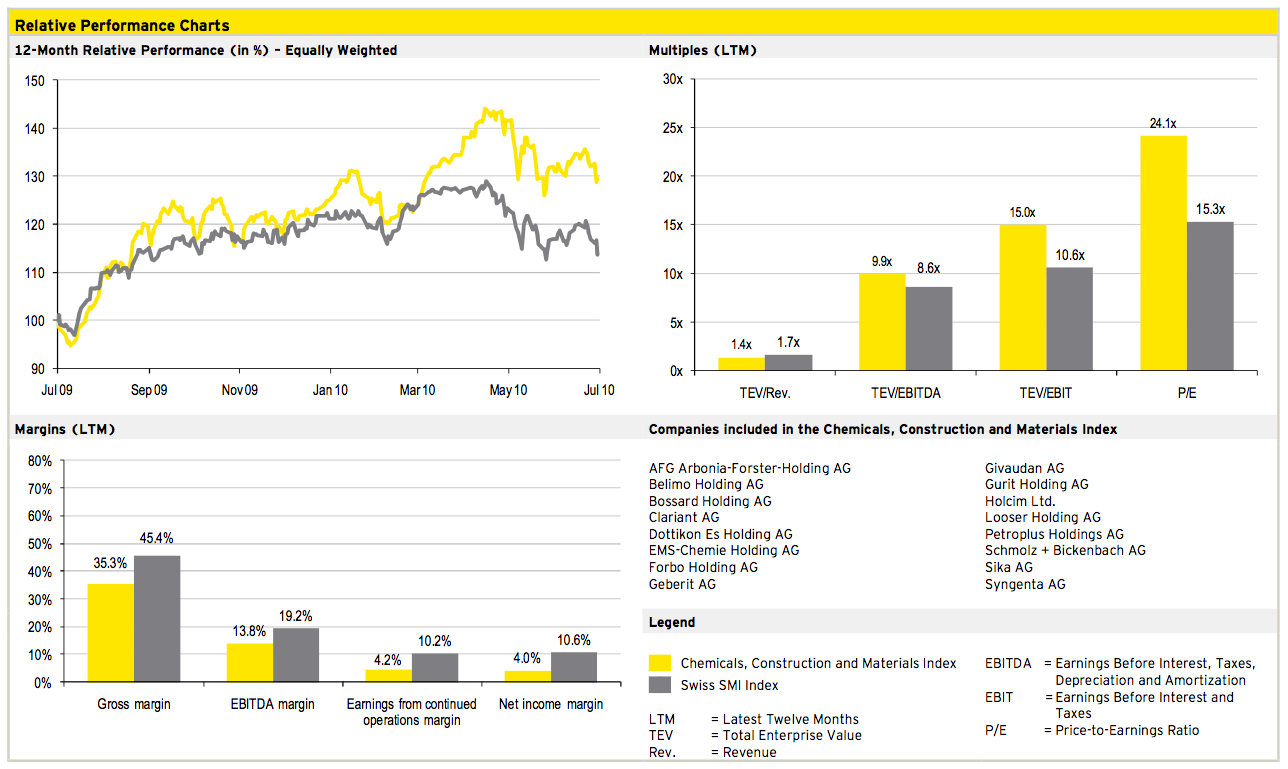

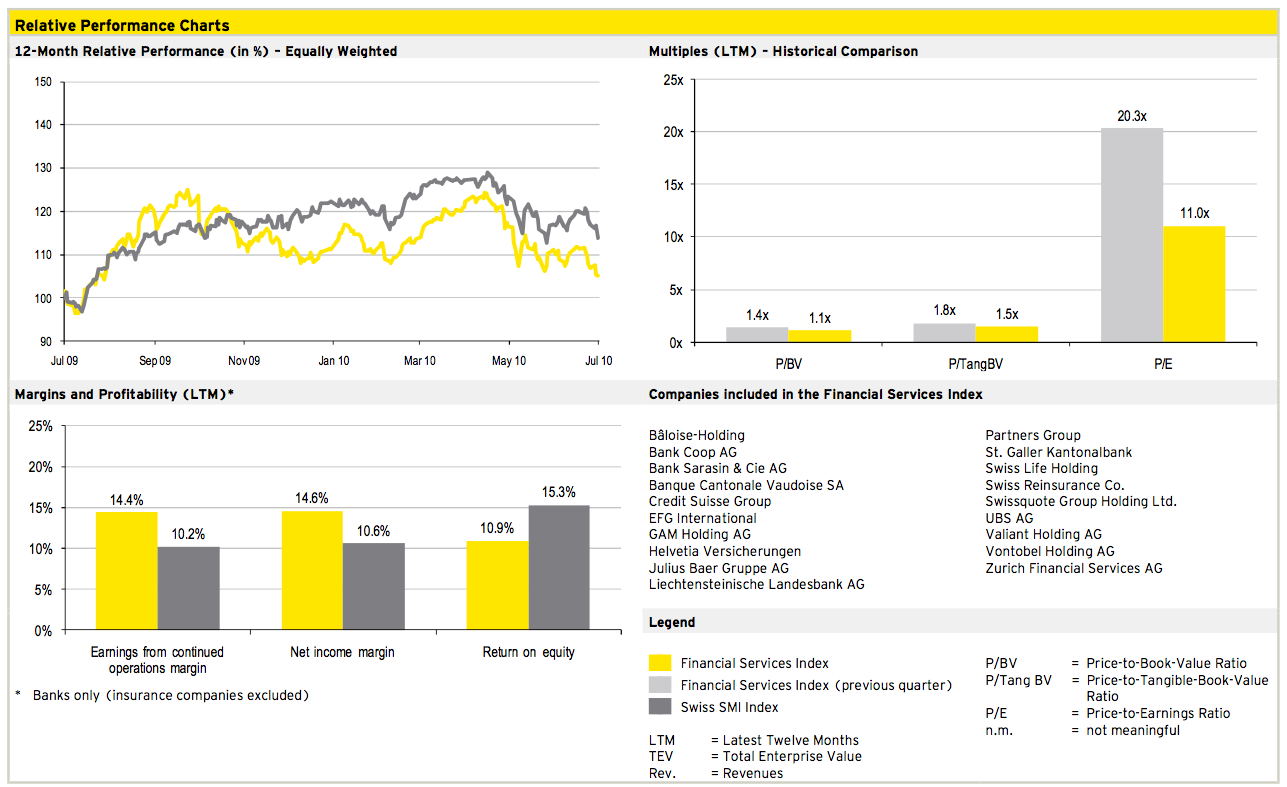

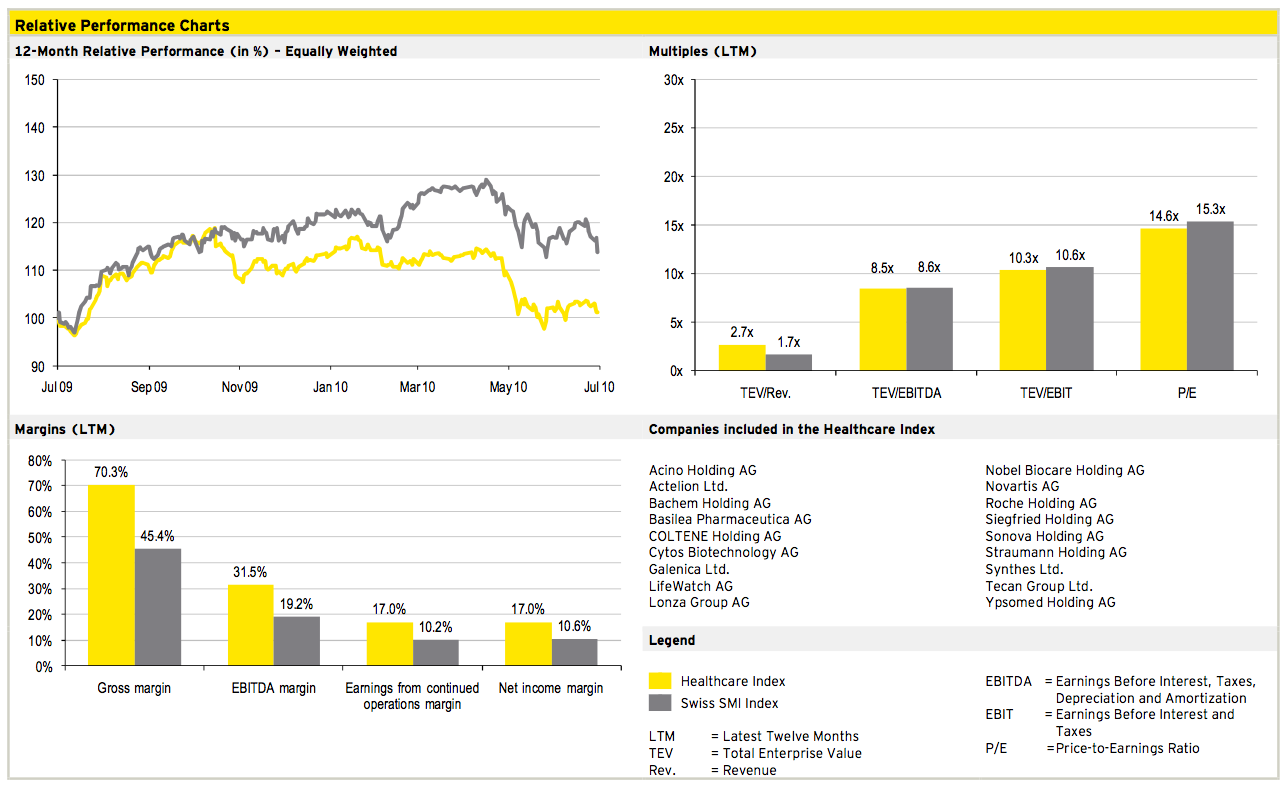

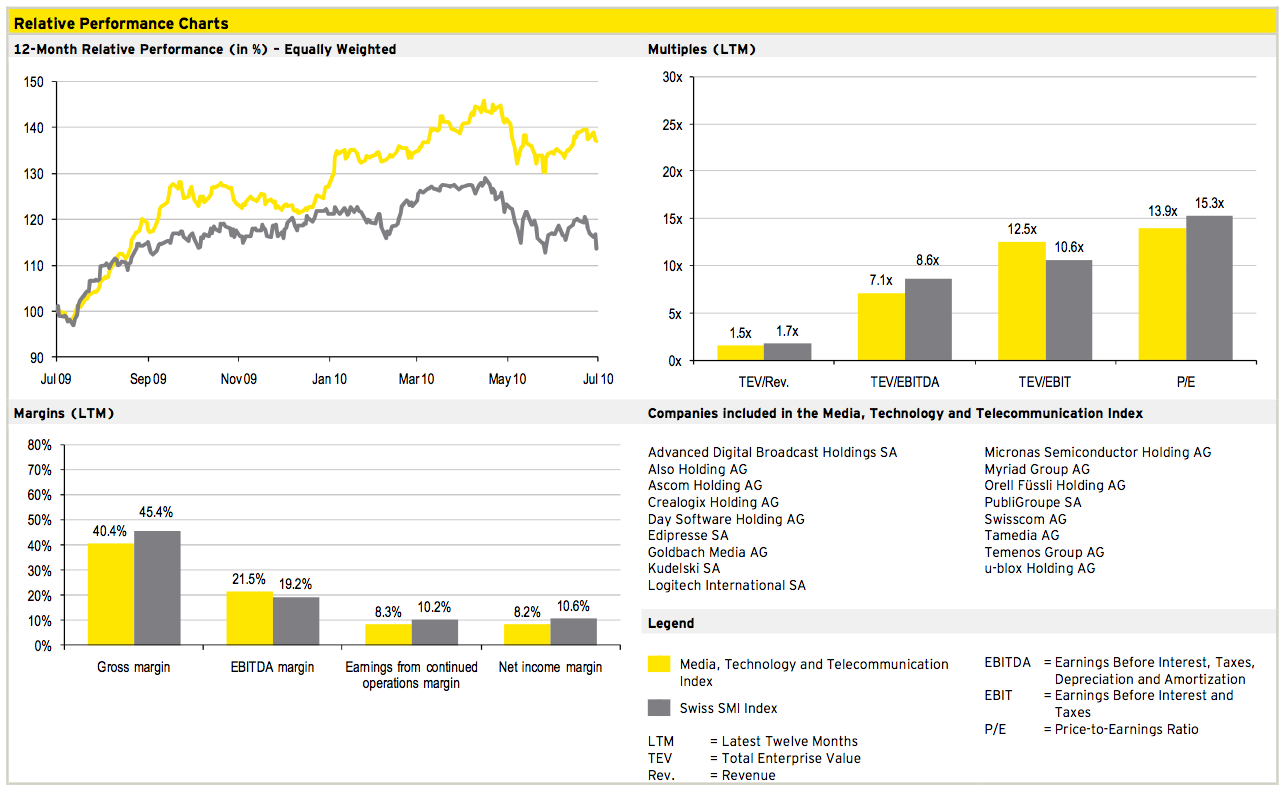

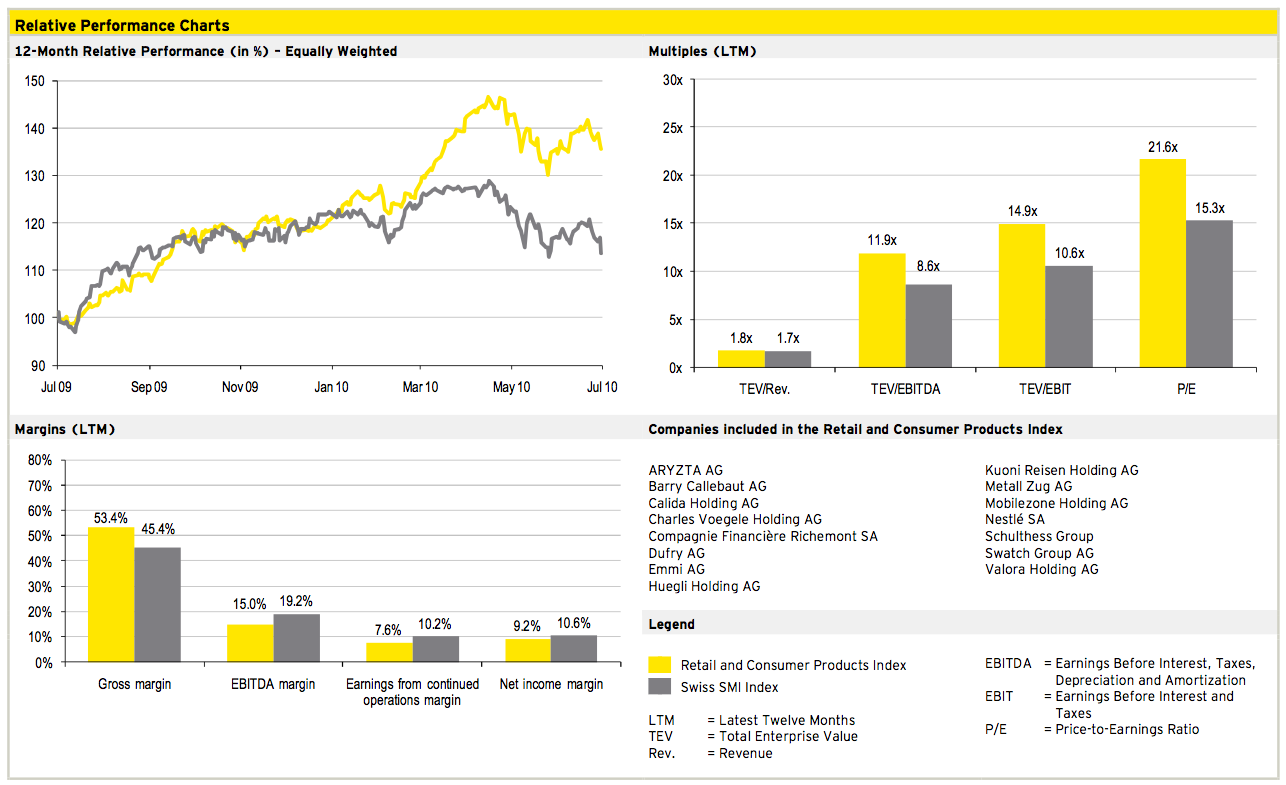

In Q2 2010, share prices declined as economic headwinds and the sovereign debt crisis in the European Union weighed on investor sentiment. Nevertheless, since 30 June 2009, overall stock performance remained positive with the SMI index up by almost 15%. The strongest industry performance was achieved by media, technology and telecommunication, closely followed by industrial goods and services as well as retail and consumer products, all increasing by more than 35% over the past four quarters. Healthcare and financial services companies underperformed the overall stock market during this period.

Transactions by industry and size

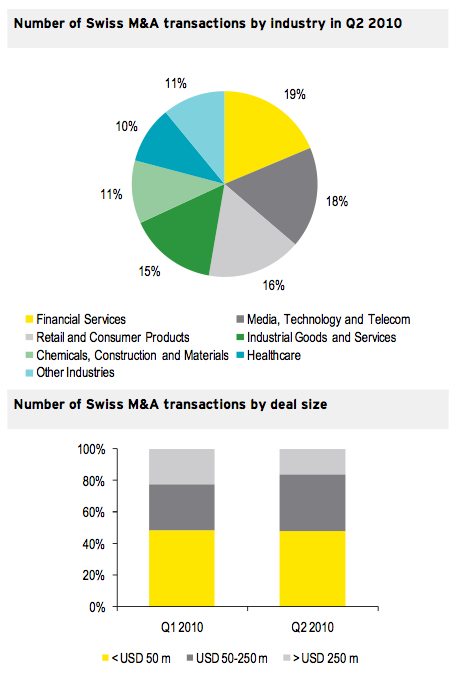

In terms of number of transactions, the most active industries during the second quarter of 2010 were financial services as well as media, technology and telecommunication accounting for 19% and 18% of all Swiss M&A transactions, respectively.

The media sector experienced significant M&A activity in April as Tamedia AG acquired Zürichsee Presse AG, the publisher of Zurich’s leading regional newspaper Zürichsee-Zeitung, from majority owner Zürichsee Medien AG advised by Ernst & Young. In addition, Tamedia also acquired the minority stake in Zürichsee Presse AG as well as a 100% stake in Zürcher Unterland Medien AG and a 38% in Zürcher Oberland Medien AG from NZZ Group. In turn, Tamedia sold Huber & Co. AG, publisher of Thurgauer Zeitung, to NZZ.

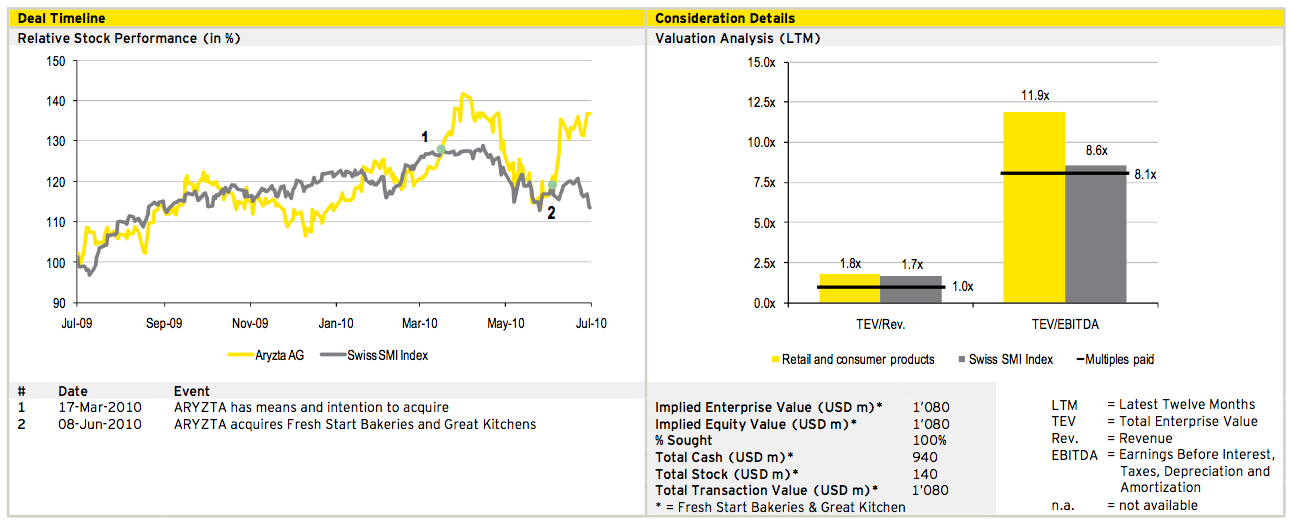

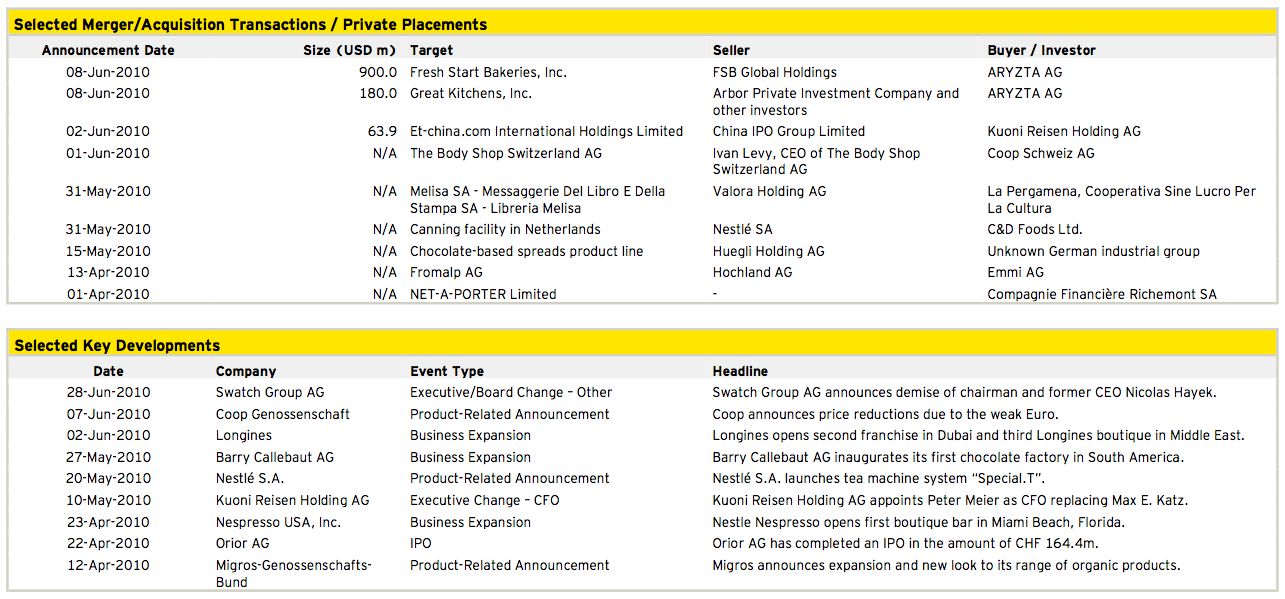

In the consumer products sector, ARYZTA AG announced two separate transactions in early June 2010, acquiring Fresh Start Bakeries and Great Kitchens. As of May 2010, these two businesses had combined revenues for the trailing twelve months of USD 1bn. Further information on these acquisitions including the transaction rationale is available in the Deal of the Quarter section.

Large M&A deals valued above USD 250m decreased from 7 to 4 transactions during the second quarter of 2010 compared to the previous quarter. Out of these four deals, two acquisitions were announced by ABB. The lack of larger deals was a sign that companies were relatively hesitant in executing larger transactions as stock market volatility increased.

Outlook 2010

In June 2010, the latest GDP growth outlook of the Swiss State Secretariat for Economic Affairs (SECO) was raised from 1.4% to 1.8% for 2010. However, SECO expects GDP growth to decline in 2011 due to increased economic risks in foreign countries which could negatively affect the Swiss economy. As the economic outlook is not expected to improve significantly over the upcoming quarters, overall Swiss M&A activity is anticipated to improve only moderately in the mid-term.

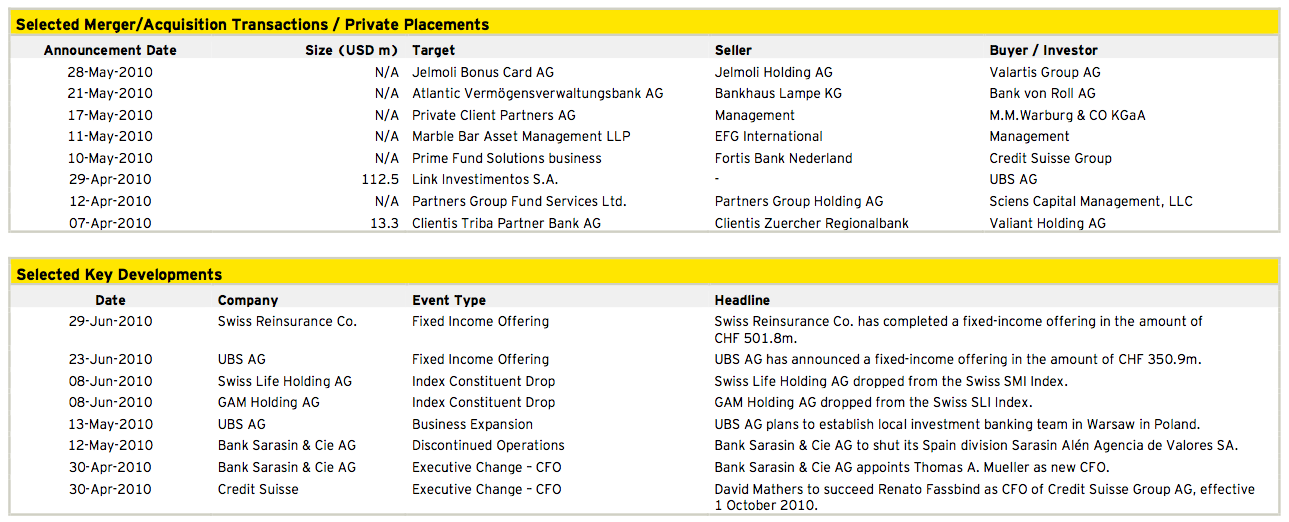

It is also expected that the financial services industry is to remain among the most active industries in the Swiss M&A market. In particular foreign financial institutions which are partially state-owned are reevaluating their Swiss operations as they are continuing their post-financial crisis restructuring process.

In the near term, Swiss M&A activity is anticipated to remain driven mainly by strategic transactions. However, as equity markets have become more volatile in the wake of economic turmoil (e.g. Euro crisis), boards and shareholders are expected to remain cautious to authorize larger deals until volatility subsides and the global economic outlook becomes clearer.

A positive effect on Swiss M&A activity could be the recently strong performance of the Swiss Franc especially against the Euro. In 2007, the Euro exchange rate was approximately at CHF 1.65. In June 2010, the Euro exchange rate dropped to historic record lows below CHF 1.35. In addition, Swiss market valuations and global stock markets have decreased in the second quarter of 2010 compared to the previous quarter. These developments might stimulate cross-border transactions with Swiss companies taking advantage of the historically low exchange rate to the Euro and more attractive company valuations.

Worldwide, private equity firms are estimated to have USD 500bn in cash available for investments. As most of these funds have been committed by investors between 2004 and 2007, private equity firms are expected to increasingly become pressured to invest these funds. This pressure may lead to increased deal activity from financial investors in forthcoming quarters.

Deal of the quarter

Deal Summary

Our Deal of the Quarter features the separate acquisitions of Fresh Start Bakeries Inc. and Great Kitchen Inc. by ARYZTA AG for a combined value of USD 1.1bn announced on 8 June 2010. The acquisition of Fresh Start Bakeries was valued at USD 900m and was financed by debt of USD 760m as well as ARYZTA shares worth USD 140m. The purchase of Great Kitchen was valued at USD 180m and was fully financed with debt.

Zurich-based ARYZTA is primarily focused on specialty bakery, i.e. freshly prepared bakery offerings. It is expected that these acquisitions are going to be accretive to ARYZTA’s earnings per share over the next 12 months by approx. 20%.

Deal Rationale

► With these acquisitions, ARYZTA was able to double its manufacturing volumes and gain greater access to a broader customer base within the quick service restaurant segment.

► ARYZTA will have a more balanced exposure to its core markets in Europe and North America, while also extending its geographical footprint in other regions.

► In addition, the transactions are expected to enhance the company’s defensive characteristics through greater diversification in terms of customer mix.

Industry overview

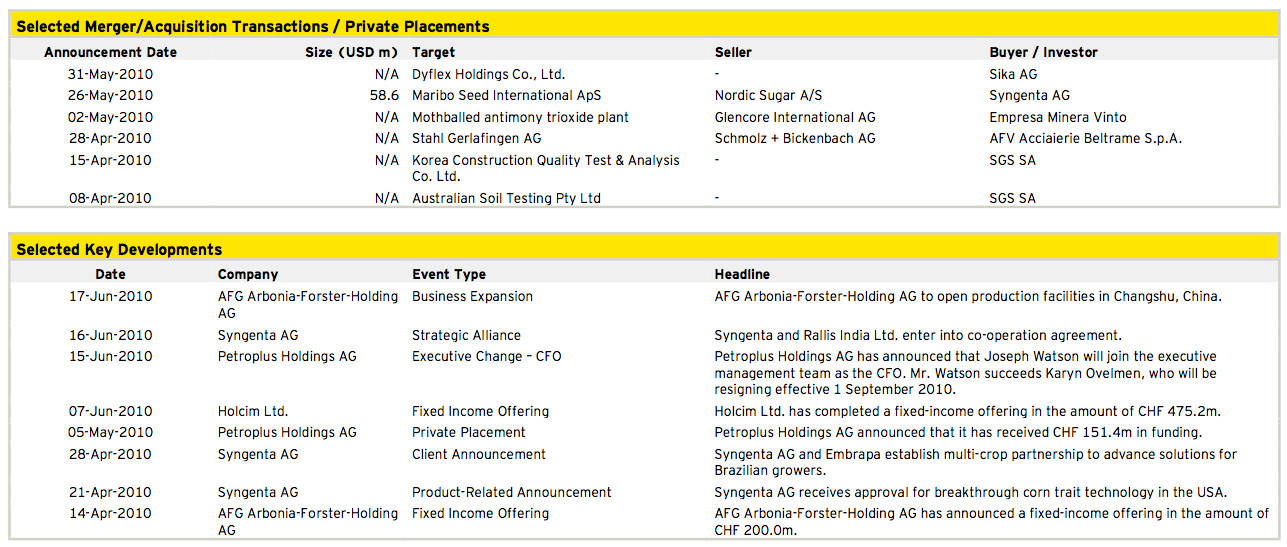

Chemicals, Construction and Materials

Financial Services

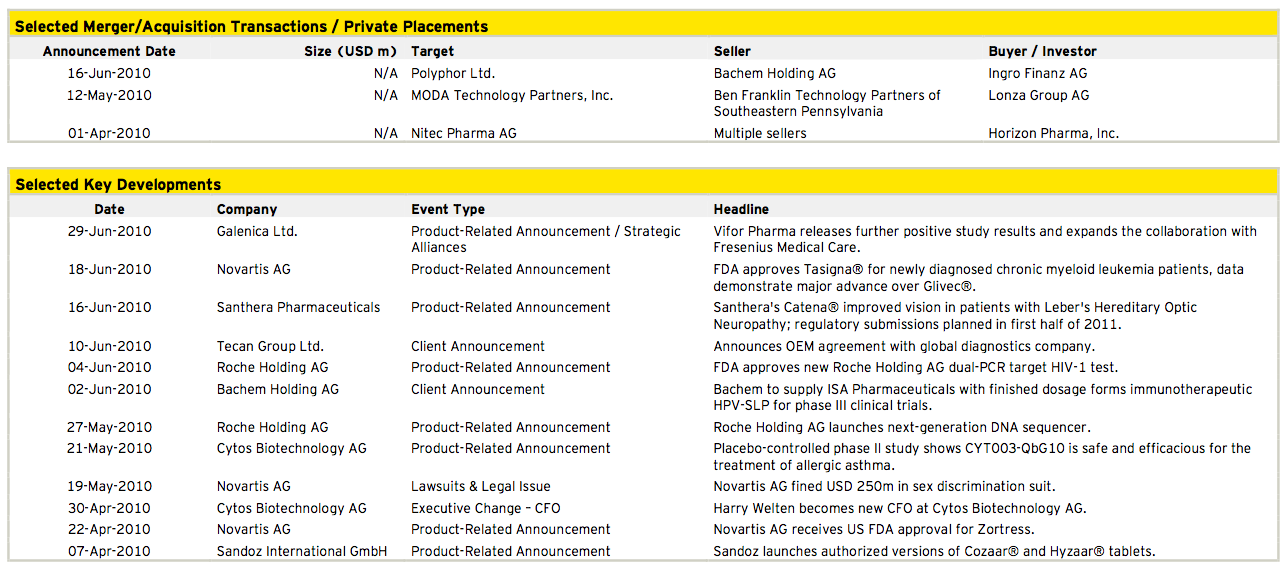

Healthcare

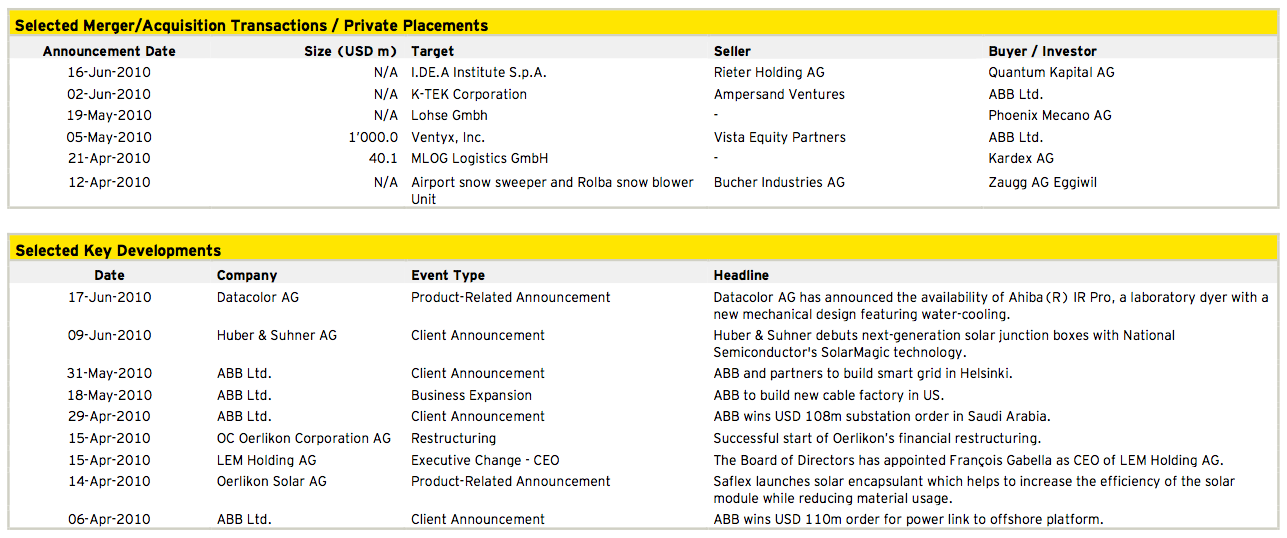

Industrial Goods and Services

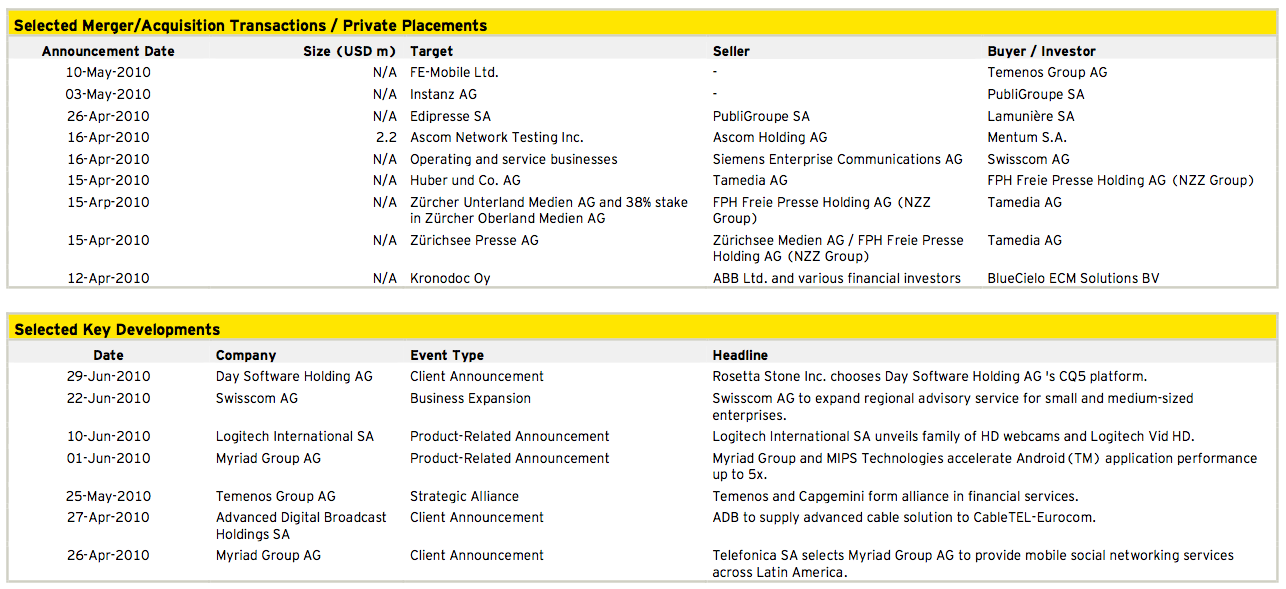

Media, Technology and Telecommunications

Retail and Consumer Products

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter