Publications Mergers & Acquisitions Quarterly Switzerland – First Quarter 2015

- Publications

Mergers & Acquisitions Quarterly Switzerland – First Quarter 2015

- Christopher Kummer

SHARE:

On 15 January 2015, the Swiss market was taken by surprise by the Swiss National Bank’s announcement to abandon the CHF/EUR exchange rate floor, which was followed by an immediate and strong appreciation of the Swiss Franc. Since then, the Swiss Franc has remained close to parity with the Euro, a development that has occupied management teams across all sectors, especially in regards to export-oriented companies.

Based on M&A activity in Q1 2015, the SNB’s decision had a negative effect on the Swiss M&A market, as the number of transactions and total deal volume decreased significantly compared to previous quarters.

Although several studies had forecast an exceptional M&A performance for 2015, the SNB’s decision to abandon the exchange rate floor against the Euro caused the outlook on M&A activity to become more cautious. This is underpinned by this quarter’s rather weak development. However, as several factors come into play, the long-term effects of the SNB decision remain to be seen.

Swiss M&A market Q1 2015 and outlook 2015

M&A market Q1 2015

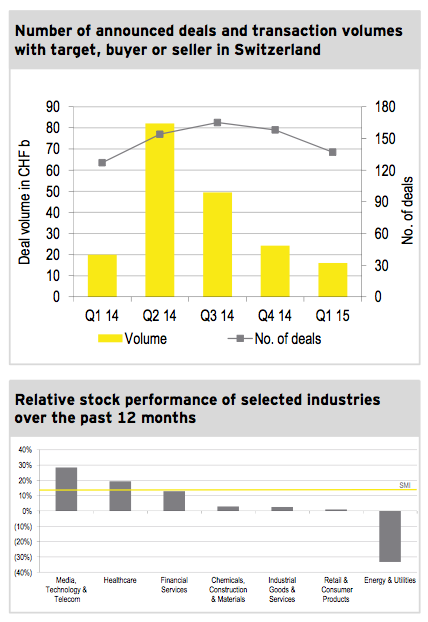

► In the first quarter of 2015, the number of announced transactions decreased to 137 deals compared to 158 deals in the previous quarter, representing a decline of 13%.

► In terms of volume, the Swiss M&A market also recorded a decrease with disclosed deal volume totaling CHF 16.1b, which is significantly lower than the CHF 24.3b achieved in the last quarter. From a historical perspective as well, this quarter’s deal volume is below the average quarterly value of 21.3b since 2007.

► Total disclosed deal volume for the first quarter can largely be attributed to the transaction announced between Holcim, Lafarge and CRH, which totaled CHF 6.8b. Despite recent uncertainty as to whether the Holcim-Lafarge mega-deal would go ahead, divestments due to regulatory restrictions are still being announced. The CRH deal along with the other top five transactions of the quarter contributed 76% of the total disclosed transaction value.

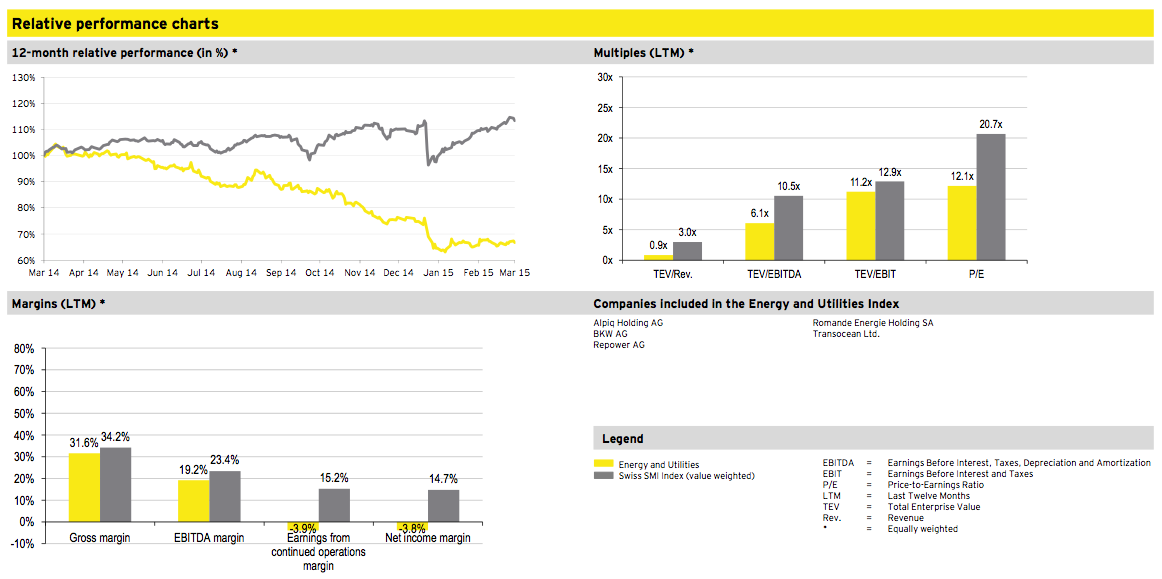

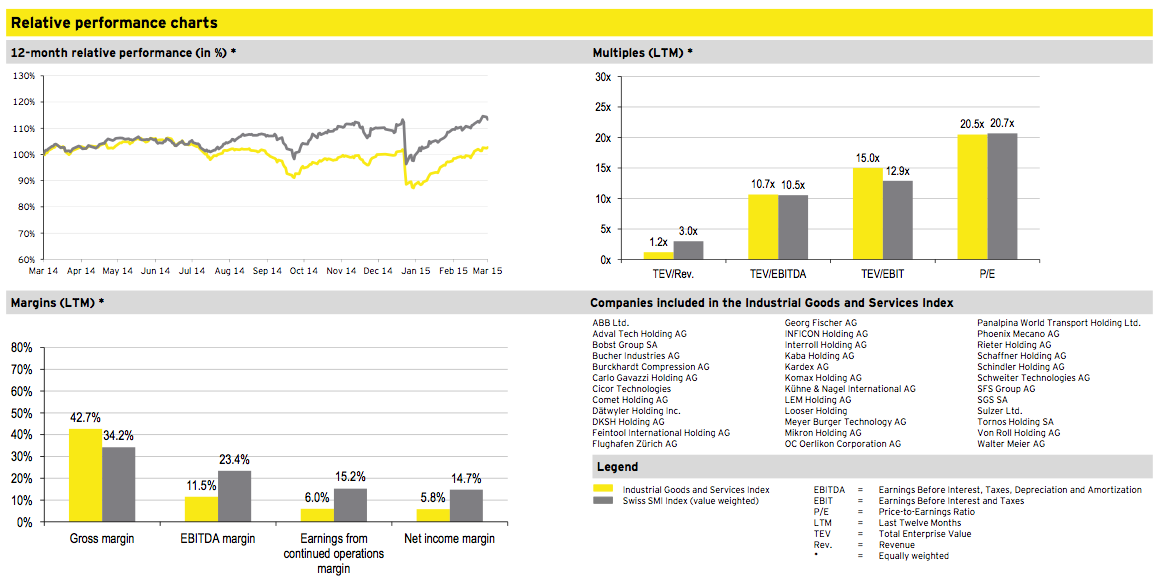

► The SMI gained 13.4% over the last twelve months, showing a positive performance across all sectors, except Energy and Utilities, which continued to decline. Compared to the twelve-month period ended last quarter, i.e. 31 December 2014, the SMI witnessed a slight improvement in performance with an increase of 2.1 percentage points.

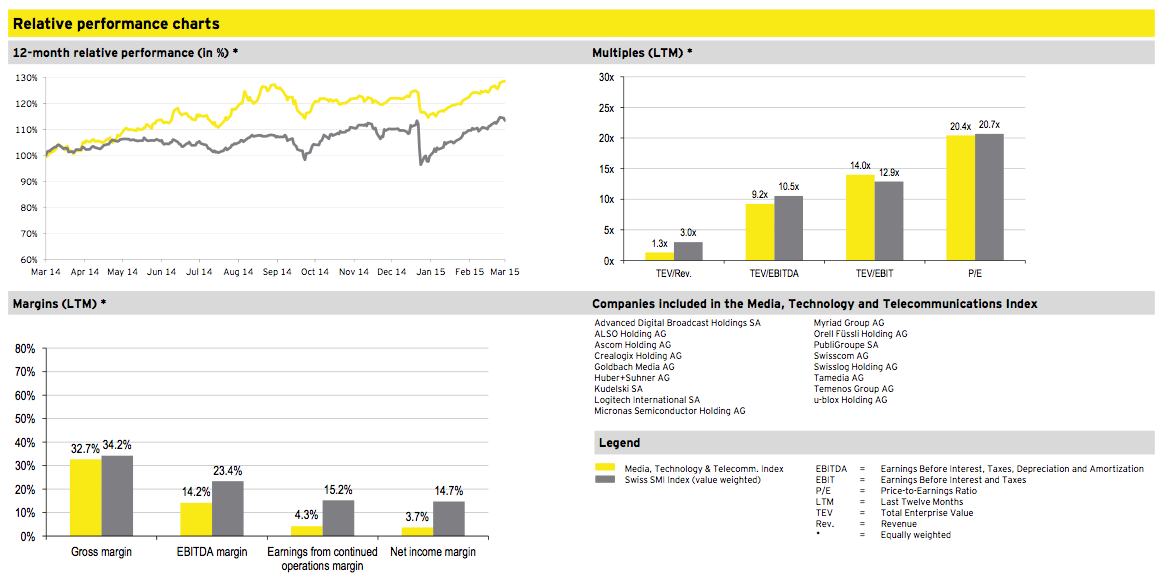

► Media, Technology and Telecommunication displayed the strongest industry performance with an improvement of 28.5% over the last twelve months. This represents approximately 2.1 times the SMI performance.

Transactions by industry

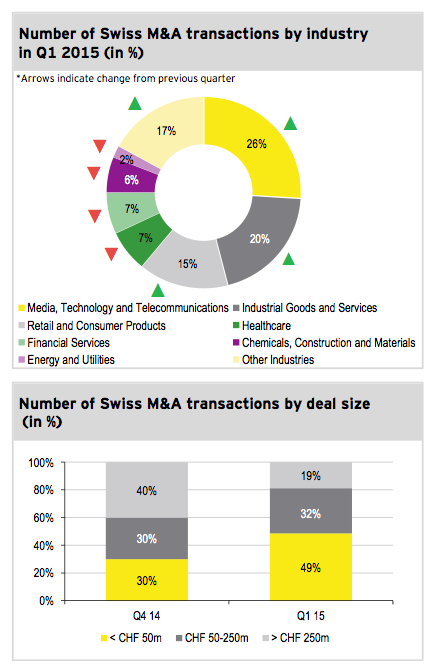

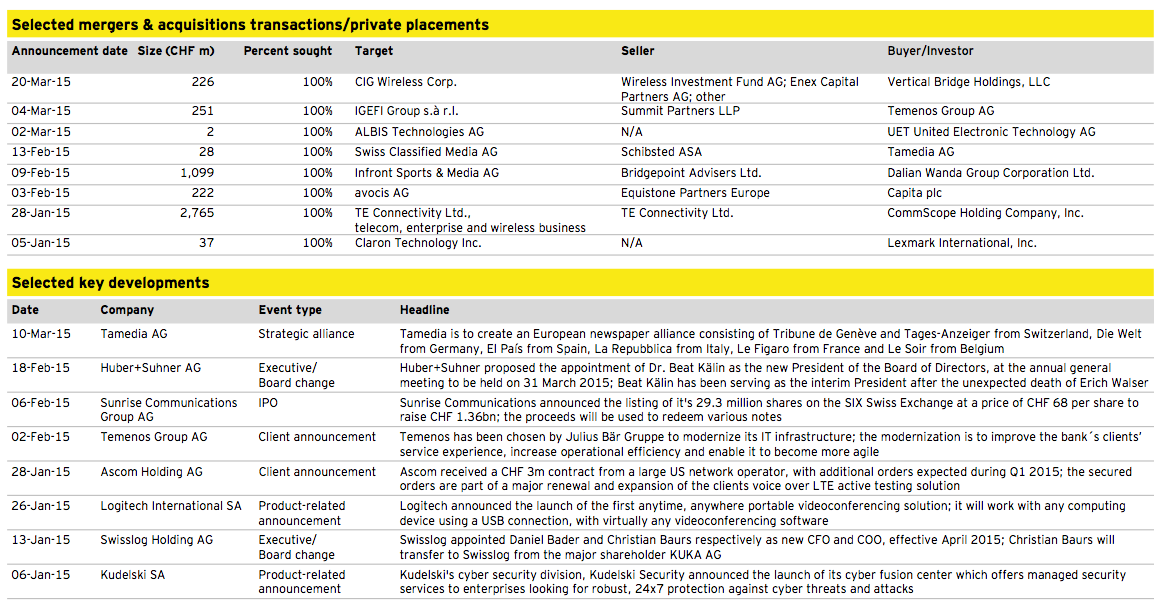

► In the first quarter of 2015, Media, Technology and Telecommunications was the most active sector in Switzerland, contributing 35 transactions or 26% of the total 137 deals announced. This is an increase of seven percentage points compared to last quarter.

► Furthermore, Media, Technology and Telecommunications accounted for two of the top five transactions measured by deal value, namely the acquisition of TE Connectivity’s telecom, enterprise and wireless business by CommScope for CHF 2.8b and the acquisition of Infront Sports & Media by the Dalian Wanda Group for CHF 1.1b.

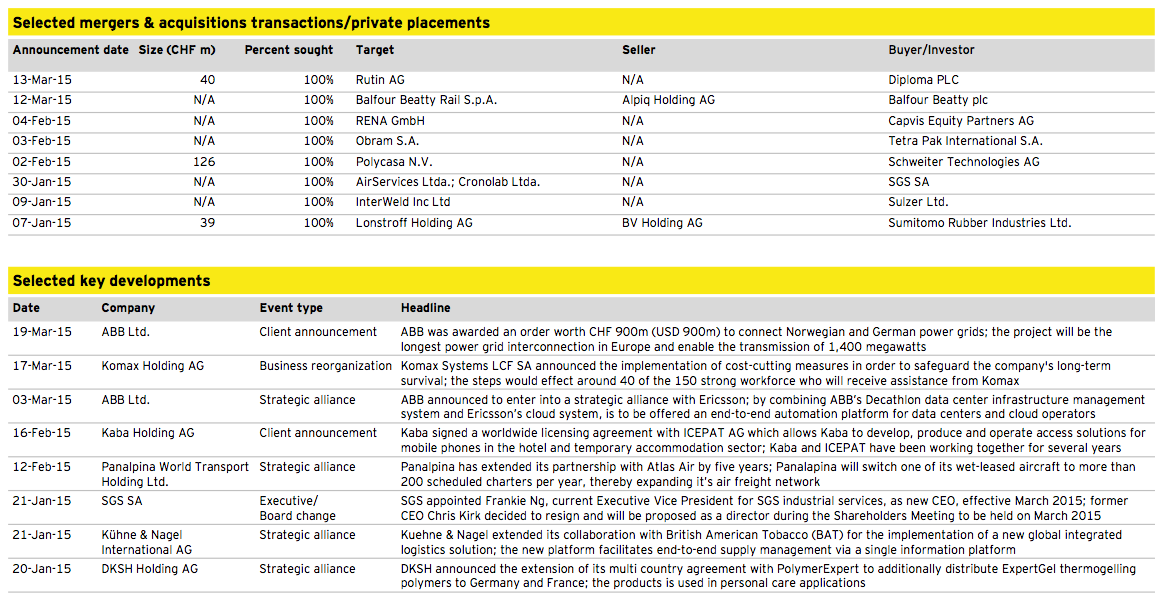

► After closing 2014 as the most active sector in Switzerland, Industrial Goods and Services ranked number two with 20% of transactions in Q1 2015. However, this represents an increase of five percentage points compared to the previous quarter.

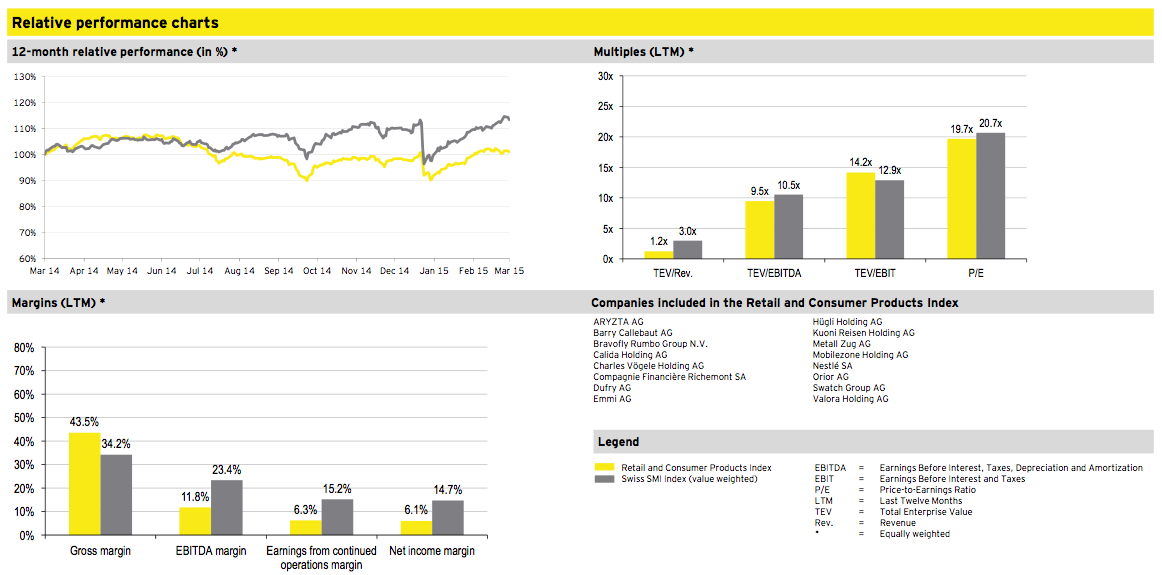

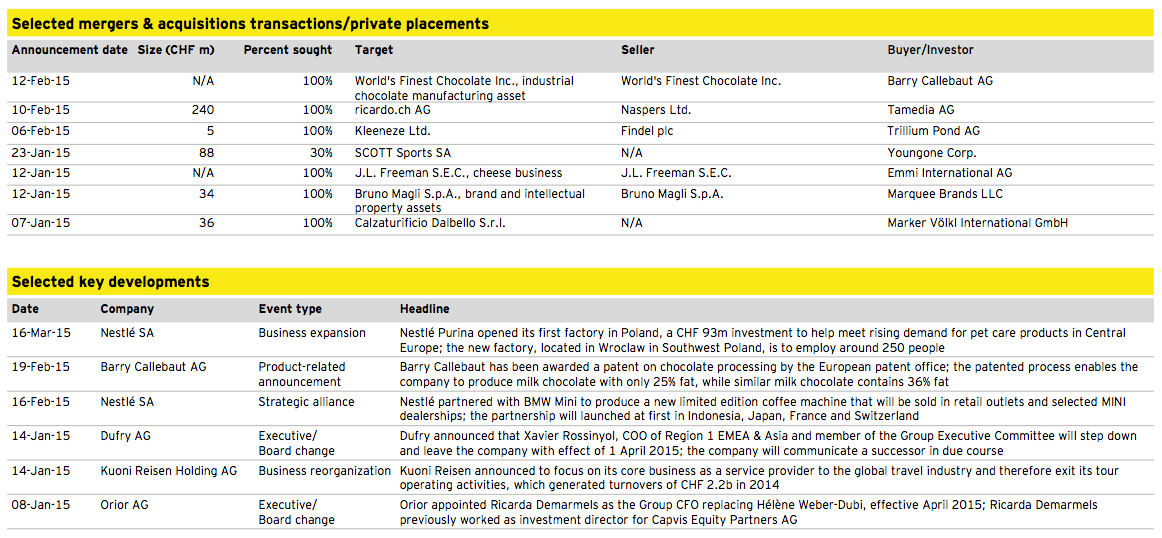

► The Retail and Consumer Products sector recorded the third-largest number of transactions, with an increase in the percentage of deals from 11% in the previous quarter to 15% in the first quarter of 2015.

Transactions by size

► In the first quarter of 2015, the number of deals in the mid-market remained largely constant, while the small market with deal size less than CHF 50m showed a significant increase from 30% to 49%.

► With a share of 19%, the large transaction segment was below its historical performance.

► Media, Technology and Telecommunications had a dominant position in Switzerland’s large transactions market representing approximately 38% of all deals with deal size above CHF 250m.

► Deal size was disclosed in 31% of all announced transactions in Q1 2015.

Outlook 2015

► On 15 January 2015, the Swiss National Bank (SNB) announced its decision to abandon the CHF/EUR exchange rate floor and increased negative interest rates on deposits to a range between -1.25% and -0.5%. Following this announcement, the Swiss currency immediately appreciated by ~20% and has since then remained close to parity with the Euro.

► The Swiss National Bank made its decision public shortly before the European Central Bank (ECB) announced an extended program, including monthly purchases of assets for EUR 60b until September 2016, with the aim to stabilize the Euro and allowing inflation in the Euro zone to increase to 2%.

► Due to the “franc shock” the Swiss State Secretary for Economic Affairs (SECO) adjusted its GDP growth forecast for 2015 from 2.1% down to 0.9%, while the economic research institute KOF most recently predicted a growth of 0.2%. However both institutions stress the high uncertainty associated with forecasting the effects of the “franc shock” on the Swiss economy and the limited experience with negative interest rate environments in Switzerland.

► According to the latest EY Global Corporate Divestment Study published in March 2015, the value of global divestments has increased by 80% since 2009.

Companies more frequently utilize divestment strategies to optimize their portfolio performance and fund new growth opportunities. This trend is expected to continue as 54% of all questioned executives expect an increase in the number of willing strategic sellers and 46% expect an increase in distressed sales.

► Although several studies had forecast a record-braking year for Swiss M&A activity in 2015, board room priorities have shifted due to the unexpected decision by the SNB to abandon the EUR/CHF exchange rate floor. On the one hand, the purchasing power of Swiss companies looking for acquisitions abroad has increased as a result. On the other hand, management teams are occupied with operational improvements, especially where production cannot be shifted to foreign countries. Based on figures for Q1 2015, the SNB decision had a negative impact on Swiss M&A activity. However, the long-term effect remains to be seen.

Private equity statistics: Germany, Switzerland and Austria

Private equity Q1 2015

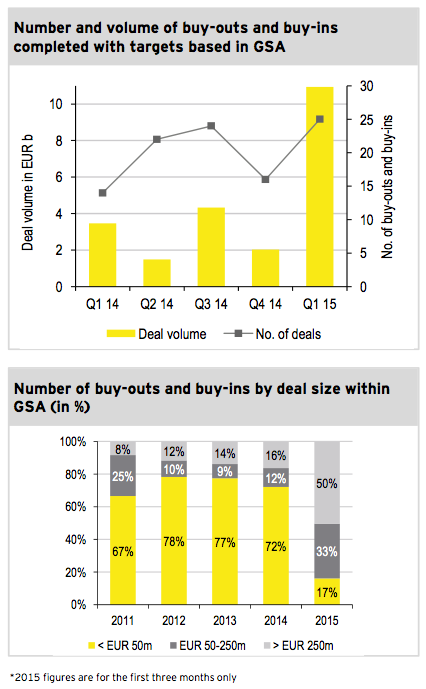

► In Q1 2015, 25 private equity (PE) deals were closed in Germany, Switzerland and Austria (GSA). This constitutes an increase of 9 transactions compared to Q4 2014. At the same time, deal volume of buy-outs and buy-ins in GSA increased significantly from EUR 2.0b in the previous quarter to EUR 10.9b in Q1 2015.

► This quarter’s deal volume of EUR 10.9b almost equals total deal volume in the entire year 2014 of EUR 11.3b and was mainly attributable to three mega deals. The acquisition of RWE Dea by LetterOne for a consideration of EUR 4.5b, the acquisition of SIG Combibloc by Onex for EUR 3.8b and the sale of Orange by Apax Partners for EUR 2.3b.

► Each one of these three PE transactions in Q1 2015 outranks the largest PE transaction closed in 2014 in EUR 2.0b.

► The last time this publication reported a comparable total deal volume in a single quarter was Q3 2013, when total deal volume of PE transactions amounted to EUR 9.0b.

► In the first quarter of 2015, the share of large PE transactions with a deal volume of more than EUR 250m increased significantly, as 50% of all PE transactions in GSA exceeded EUR 250m compared to 16% in 2014.

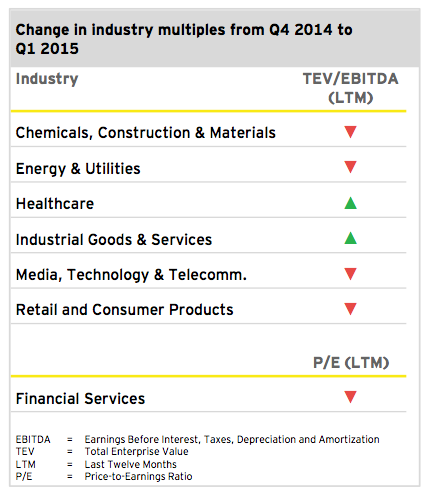

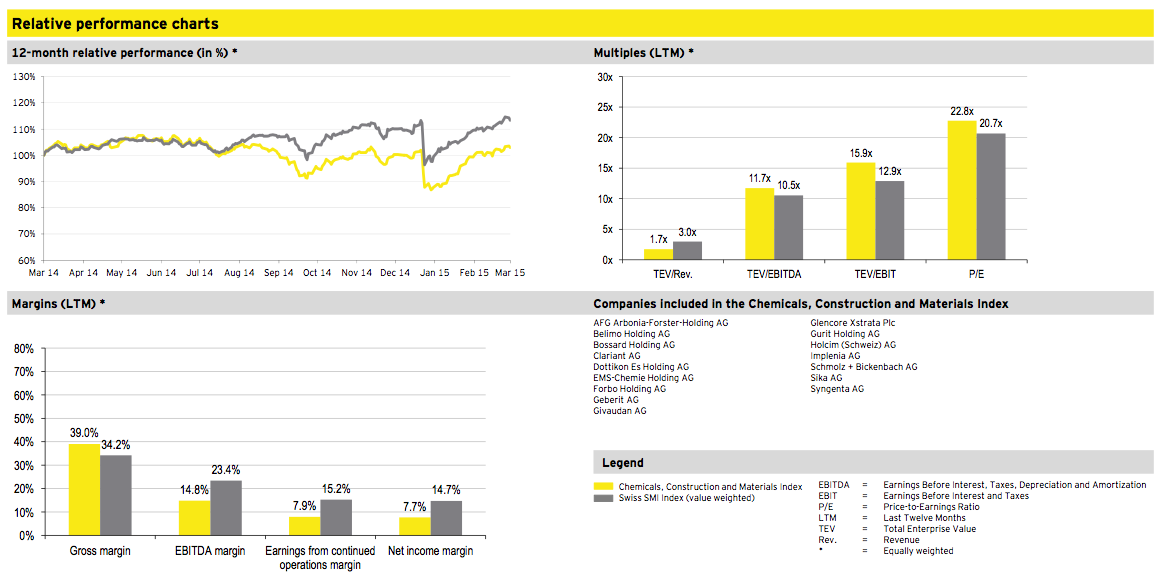

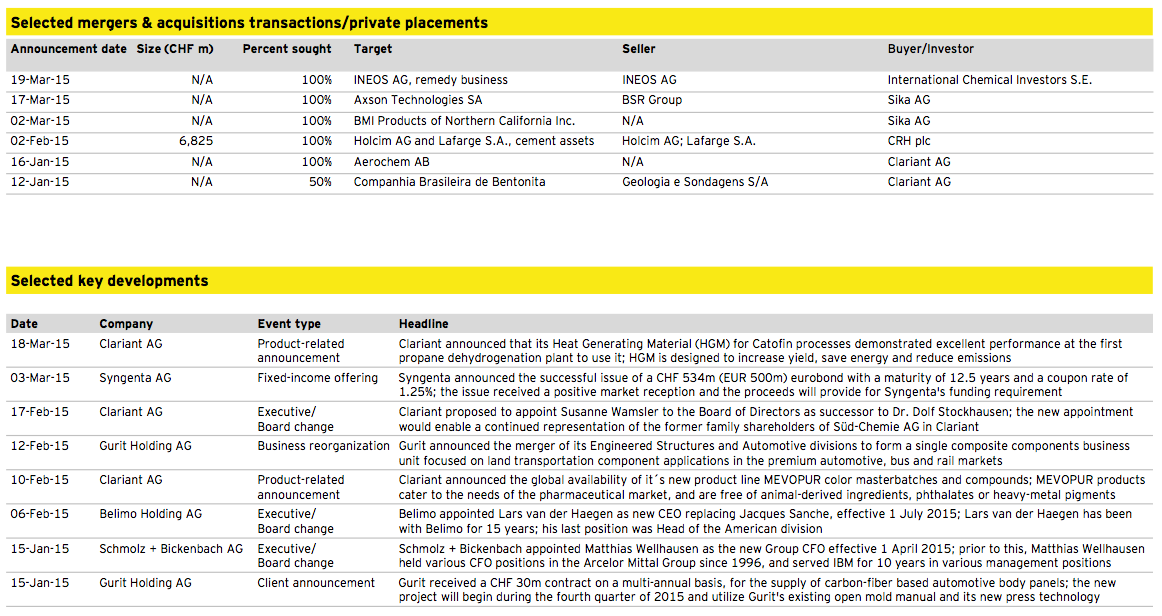

Chemicals, Construction and Materials

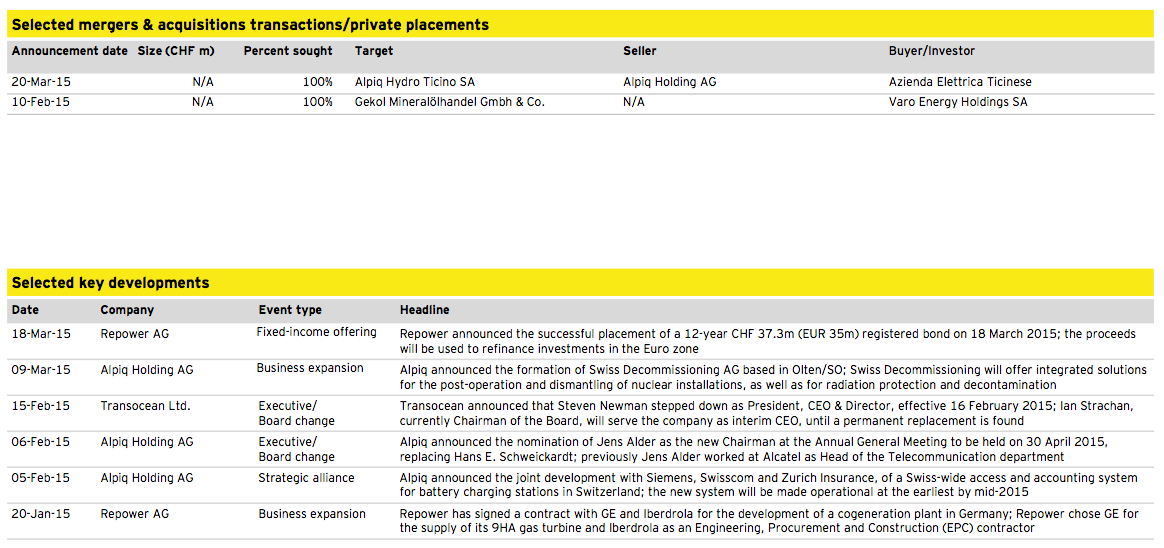

Energy and Utilities

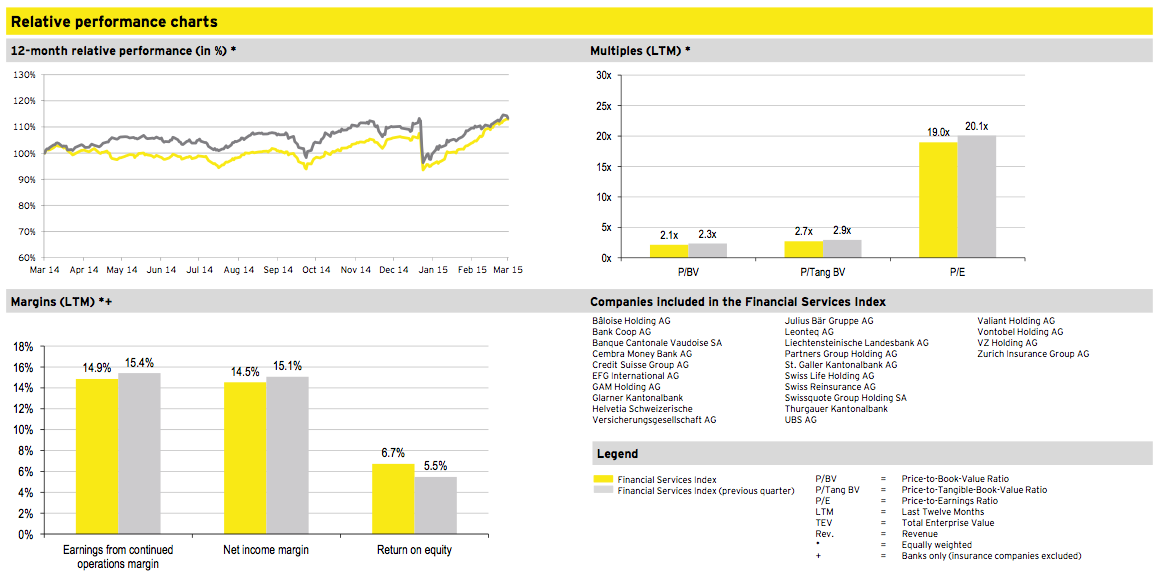

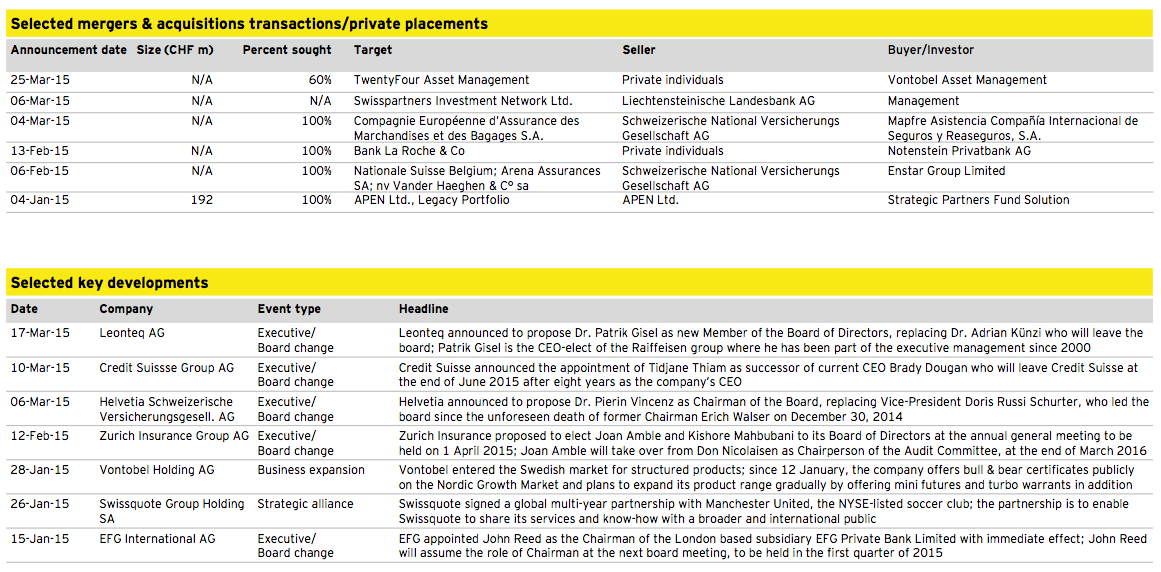

Financial Services

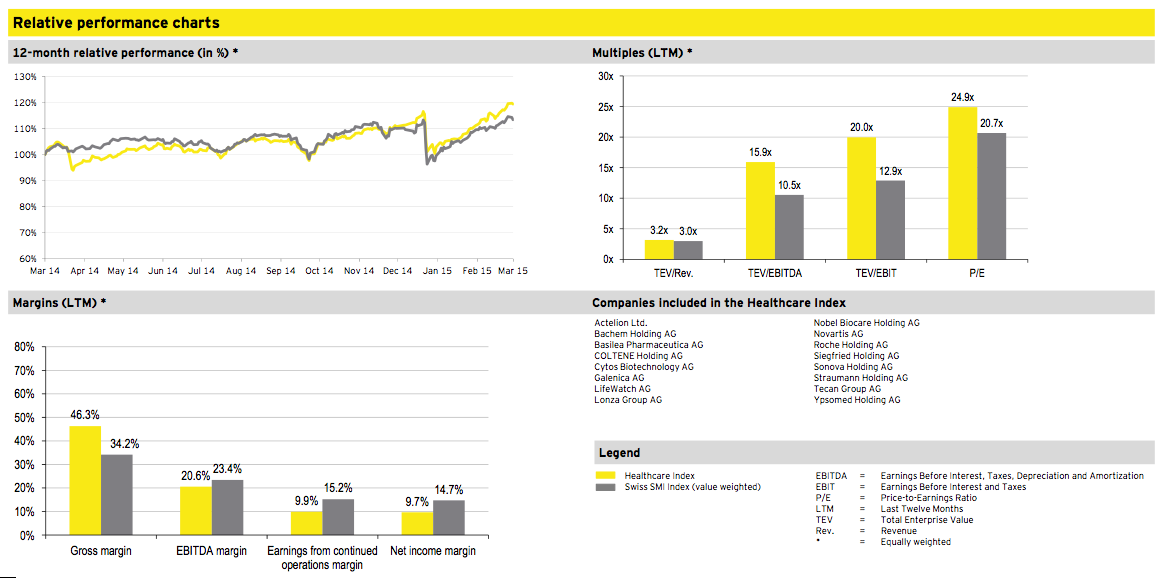

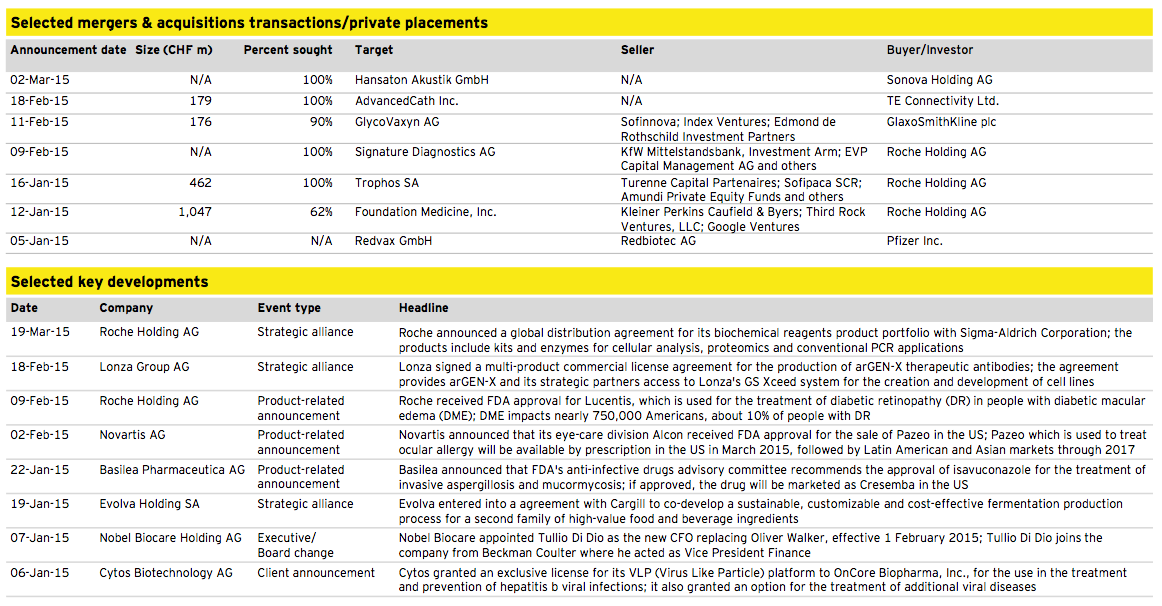

Healthcare

Industrial Goods and Services

Media, Technology and Telecommunications

Retail and Consumer Products

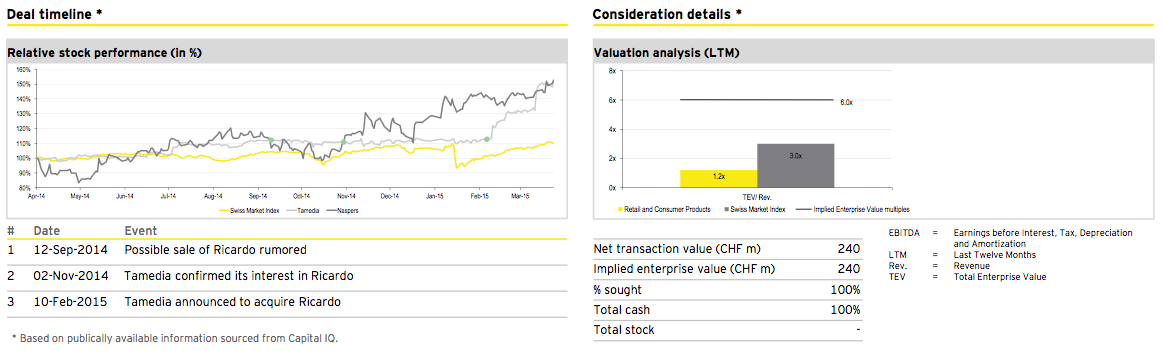

Deal of the quarter

Transaction overview

Deal summary

On 10 February 2015, Tamedia announced the acquisition of Ricardo.ch from Naspers. This is one of several transactions Tamedia has announced since 2014 aimed at strengthening its digital business segment. Additionally, Tamedia invested in several minority stakes in digital companies and entered a joint venture with Swisscom, combining local.ch and search.ch. These M&A activities reflect the company’s ambitions to further develop its digital business with a view towards future growth. The transaction is subject to regulatory approval.

Ricardo.ch operates the auction platform ricardo.ch, the vehicle platform autoricardo.ch, the classified advertisement homepage olx.ch and the online shopping center ricardoshops.ch. Ricardo.ch earned revenues of approx. CHF 40m in 2014 and employs about 220 people in Switzerland and France.

Deal rationale

► The acquisition is in line with Tamedia’s strategy to strengthen its position in the Swiss online market and expand its digital portfolio. The company plans to increase the EBITDA contribution of its digital business to 50%, compared to ~30% in 2014, by growing organically and through acquisitions over the next 2-3 years.

► Tamedia is planning to profit from synergy effects between the classified advertisement online platforms olx.ch and tutti.ch. Furthermore the combination of autoricardo.ch and car4you.ch is planned in order to create a strong player in the Swiss automotive market as an alternative to Autoscout 24.

► According to Management, Ricardo’s core business is expected to benefit from positive network effects from Tamedia’s online media, e.g., 20minuten.ch.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter