Publications Mergers & Acquisitions Quarterly Switzerland First Quarter 2013

- Publications

Mergers & Acquisitions Quarterly Switzerland First Quarter 2013

- Christopher Kummer

SHARE:

By Beat Dolder, Marc Reinhardt, CFA – Ernst & Young

In the first three months of 2013, the Swiss M&A market was not able to maintain its upward trend and lost some momentum as disclosed deal volume as well as the number of announced transactions decreased compared to the previous quarter. Furthermore, Swiss deal activity in Q1 2013 was characterized by a lack of large-cap transactions exceeding CHF 1b. At the end of Q1 of the previous year, all of the top five transactions reported a deal volume of more than CHF 1b.

Looking forward, a brighter economic outlook and increased confidence in the international financial markets might stimulate Swiss M&A transactions throughout 2013. Nevertheless, enduring European market uncertainties are troubling Swiss and global M&A market activity.

Swiss M&A market Q1 2013 and outlook 2013

M&A Market Q1 2013

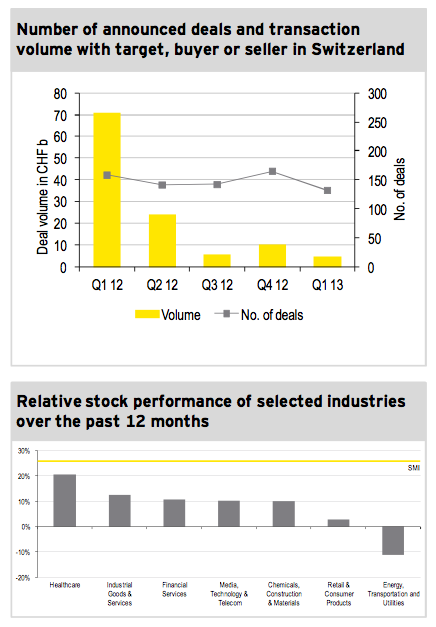

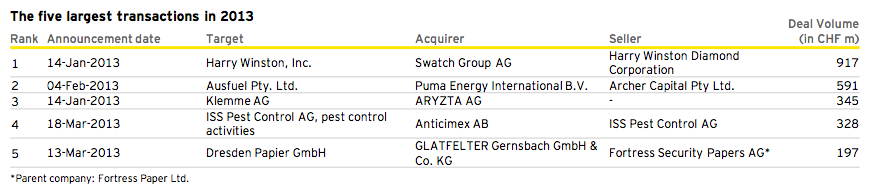

After a promising upward trend in Q4 2012, the Swiss M&A market recorded relatively weak deal activity in terms of volume as well as number of deals in the first quarter of 2013. When compared to Q4 2012 and Q1 2012, the number of 132 announced transactions in Q1 2013 represents a decrease of about 20% and 16%, respectively. With regards to disclosed deal volume, figures declined by more than half to roughly CHF 4.7b compared to the previous quarter. In comparison to the first quarter in 2012, disclosed volume dropped significantly due to the announced merger between Xstrata and Glencore. This blockbuster deal was valued at approximately CHF 48b, representing one of the largest Swiss transactions in history. By excluding this transaction, disclosed volume decreased by nearly 79% in Q1 2013. Whereas the five top transactions in Q1 2012 clearly exceeded CHF 1b, only the announced acquisition of Harry Winston Inc. by Swatch Group AG was able to reach nearly CHF 1b in deal volume in the first quarter of 2013.

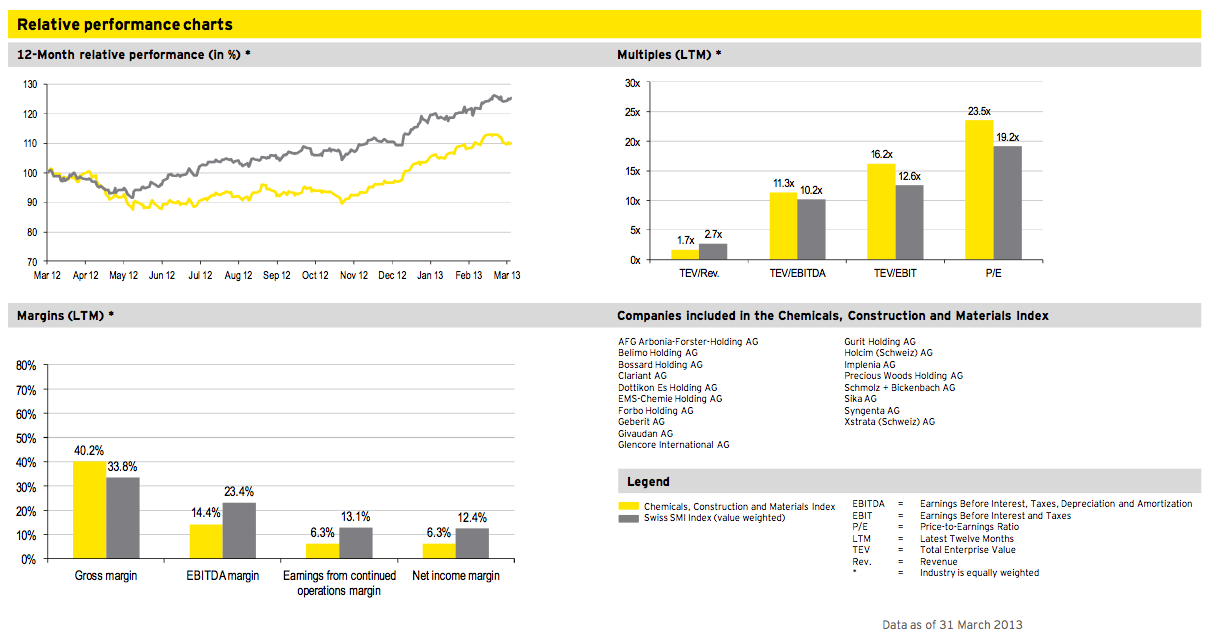

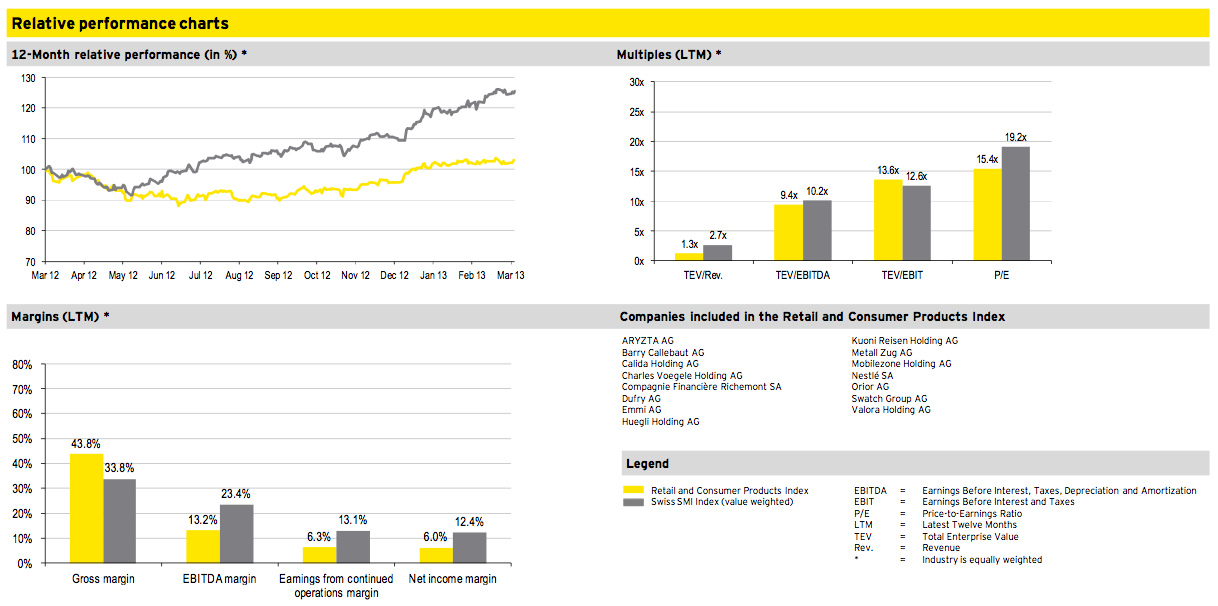

After gaining more than 3% in Q4 2012, the Swiss Market Index (SMI) continued its upward trend, ending with a positive performance of nearly 16% in the first quarter of 2013. For the last twelve-month period ended 31 March 2013, the SMI closed with a performance of more than 25%. Expansionary monetary policy through quantitative easing measures of several central banks seemed to boost the SMI and other indices; even the Standard & Poor’s 500 Index hit a new record high from its previous closing peak set in 2007.

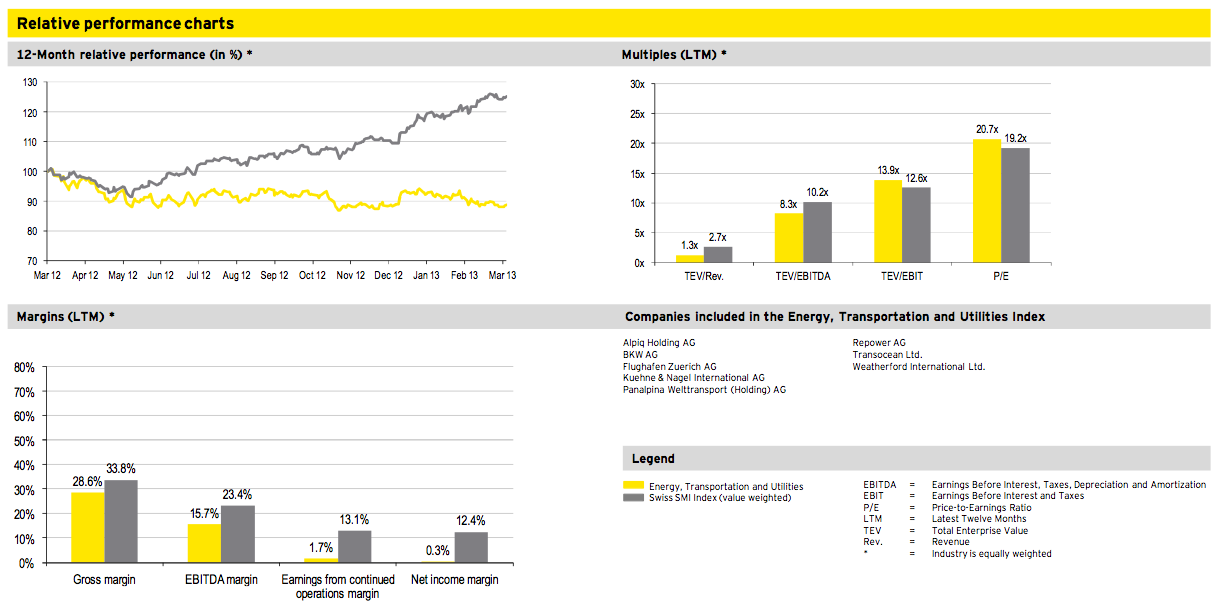

As in Q4 2012, all of the equally-weighted industry sectors were able to achieve a positive stock performance in the preceding twelve-month period, except for Energy, Transportation and Utilities. Ongoing negative performance of the Energy, Transportation and Utilities sector was mainly caused by shifts within the European industry environment and ongoing restructuring.

Transactions by industry and size

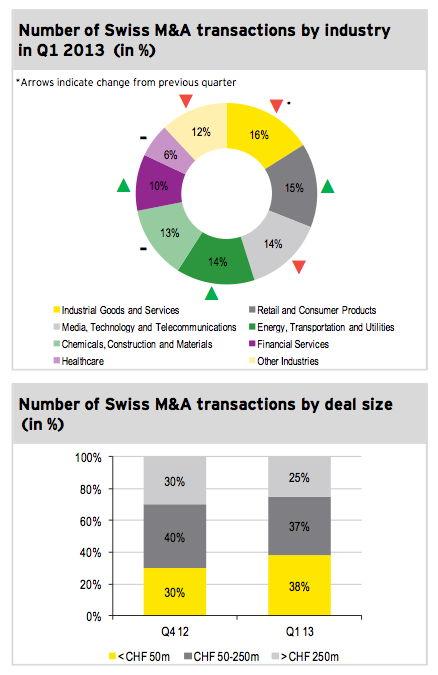

During the first quarter of 2013, Industrial Goods and Services was the most active industry regarding the number of M&A transactions accounting for about 17% of all deals; followed by Retail and Consumer Products and Media, Technology and Telecommunication. The three top sectors together represented almost half of all Swiss-based M&A transactions in Q1 2013.

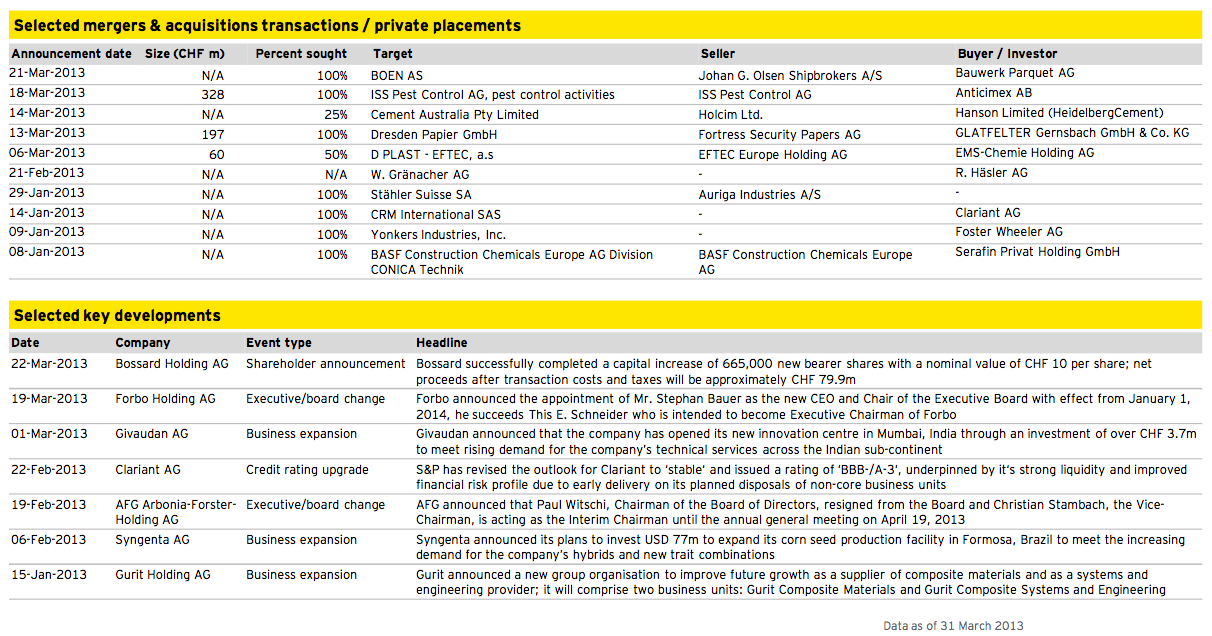

The largest announced transaction with disclosed deal volume in the Industrial Goods and Services sector was the divestment of Johnson Screens by Swiss-based Weatherford International Ltd. Focusing on its core business, Weatherford International Ltd. sold its American water technology operations to the engineering and services group Bilfinger SE, forming a global supplier of nearly all aspects of water and wastewater technology. Two of the largest transactions in Chemicals included the acquisition of ISS Pest Control AG’s pest control activities by Anticimex AB for CHF 328m and the acquisition of D PLAST – EFTEC a.s by EMS-Chemie Holding AG. EMS-Chemie Holding AG, globally active in high performance polymers and specialty chemicals, announced the acquisition of the remaining 50% stake of its joint venture to gain sole control of the automotive business operating in specialized fields of bonding, coating, sealing and damping. The Czech joint venture partner D PLAST a.s. has agreed to sell its shares for about CHF 60m.

Regarding transactions by industry, the number of deals in Energy, Transportation and Utilities went up most, growing by four percentage points compared to the previous quarter. Retail and Consumer Products as well as Financial Services also showed increasing activity, both industry sectors raised three percentage points. The largest decrease regarding the number of transaction was observed in Industrial Goods and Services and Media, Technology and Telecommunications, both declining by five and two percentage points, respectively. The Healthcare sector as well as the Chemicals, Construction and Materials industry remained stable in comparison to the last quarter of 2012.

In the first quarter of 2013, transactions with disclosed deal size below CHF 50m increased their share significantly from 30% in the last quarter of 2012 to 38% in Q1 2013; whereas mid-market transactions slightly decreased from 40% to 37%. As a consequence, large transactions with announced deal size of over CHF 250m declined from 30% to 25%. Deal size was disclosed in 18% of all transactions announced in the first quarter of 2013.

Outlook 2013

In March 2013, the Swiss State Secretariat for Economic Affairs (SECO) maintained its 2013 GDP growth expectations of 1.3%, reflecting the same forecast as in December of last year. A brighter global economic outlook and some tailwind from the international financial markets are expected to positively influence the Swiss economy, according to the federal government’s expert group. Nevertheless, economic recovery remains fragile due to unsolved international debt constraints. Ongoing debates about the fiscal cliff in the United States and significant austerity measures in many European countries, in particular in Southern Europe, are still forecast to lead to rising unemployment rates and might accelerate social tension, which may threaten global as well as Swiss economic recovery.

From a global point of view, senior executives from large companies around the world showed a clear rebound in corporate confidence, according to Ernst & Young’s most recent Global Confidence Barometer. However, these positive expectations have not yet been translated into capital investments and M&A activity.

For Switzerland, slow growth in Europe’s economy paired with a strong Swiss Franc remain the dominating factors hampering Swiss M&A activity. Despite volatile market conditions, significant cash reserves of many Swiss companies and favorable financing terms may lead to increasing deal activity throughout the remainder of 2013. Swiss companies may also increasingly pursue M&A strategies in order to participate in still buoyant emerging markets and to compensate for sluggish growth in Europe. Not only large Swiss-based multinational companies but also traditional export-oriented small and medium-sized enterprises may seek inorganic growth opportunities to reduce their dependency on Europe.

Another factor which might fuel deal activity in Switzerland is the ongoing divestment of non-core assets and portfolio rebalancing of many industrial companies to realign their business strategies. For instance, OC Oerlikon Corporation AG successfully restructured its business divisions after several years of struggling. The high-tech industrial group is now in the position to seek strategic acquisitions. AFG Arbonia-Foster-Holding AG is currently selling its non-core activities to reposition itself as a pan-European building materials supplier.

Given that the European economy further recovers and that senior executives translate their corporate confidence into M&A deals, an upward trend in Swiss M&A activity might be possible in 2013.

Private equity statistics: GSA and Europe

Private equity Q1 2013

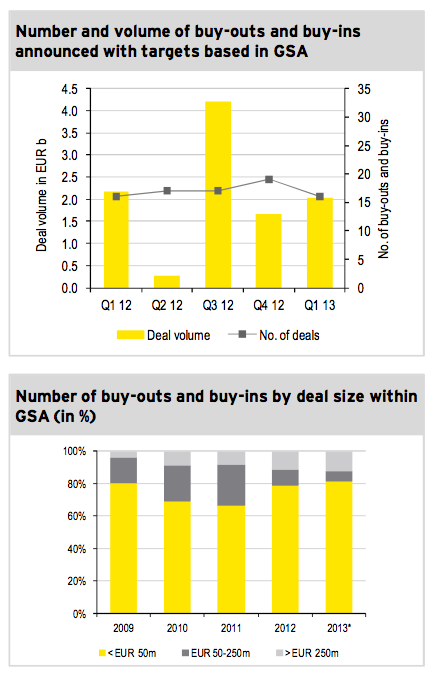

With 16 private equity transactions (PE) during the first three months in 2013, the numbers of PE deals in Germany, Switzerland and Austria (GSA) decreased by more than 15% with regards to the previous quarter. At the same time, however, disclosed deal volume increased by approximately 22% reaching roughly EUR 2b. Raising volume is mainly attributable to the voluntary public takeover offer by Beauty Holding Three AG to acquire all shares in the German retailer DOUGLAS Holding AG. The bidder belongs to the American private equity firm Advent International Corporation, focusing on international buyouts and strategic repositioning opportunities. After successfully acquiring 96.11% of all outstanding shares, Beauty Holding Three AG initiated a squeeze-out of minority shareholders to gain full control and to delist Douglas Holding AG.

Similar to the fourth quarter of 2012, buy-outs and buy-ins with a size less than EUR 50m accounted for approximately 81% of total PE deal activity in GSA. Large-cap deals accounted for approximately 13% of total PE deal activity. Beside the aforementioned public takeover of DOUGLAS Holding AG, the PE investment group Apax Partners reached an agreement to sell LR Health & Beauty Systems to a PE consortium consisting of Bregal Capital and Quadriga Capital. As both large- and small-cap transactions increased its share, mid-sized deals tumbled to roughly 7%, representing the lowest value since 2008.

The number of buy-outs and buy-ins in the GSA PE market constituted around 13% of the total number of PE deals in Europe during the first quarter of 2012. GSA PE deal volume accounted for more than 17% of European PE transaction. Similar to the previous quarter, the UK remained the most active PE market with 39 deals and a total deal volume of around EUR 4.1b, representing roughly 31% and 35% of European deal activity, respectively. With 33 transactions and EUR 1.6b, the French PE market also showed increased activity throughout the previous three-month period.

Industry overview

Chemicals, Construction and Materials

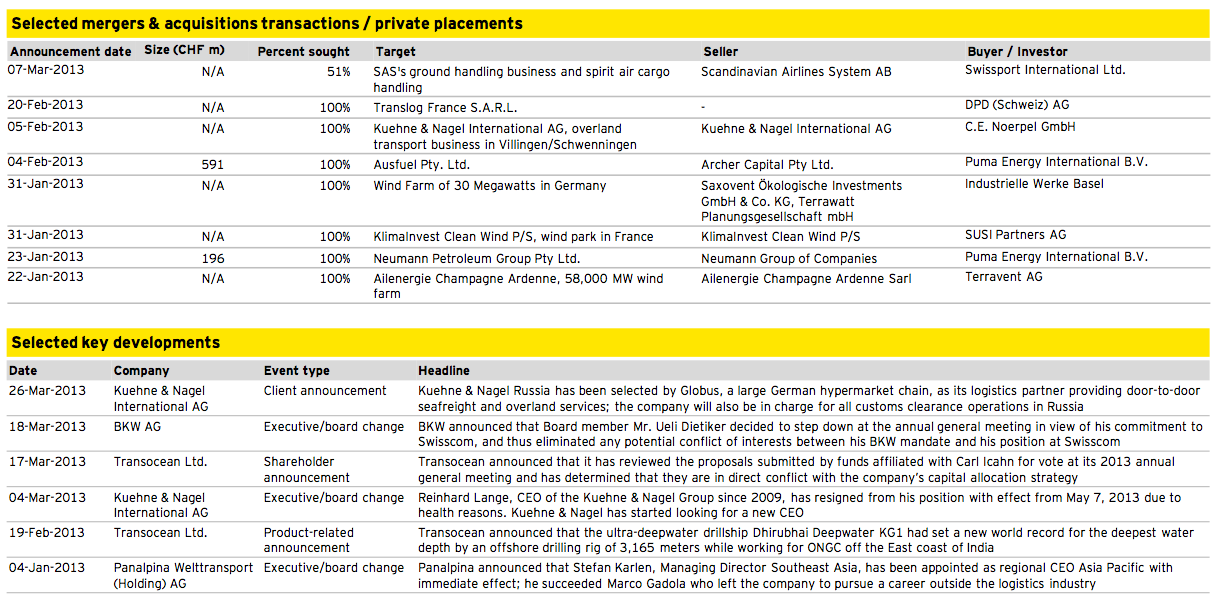

Energy, Transportation and Utilities

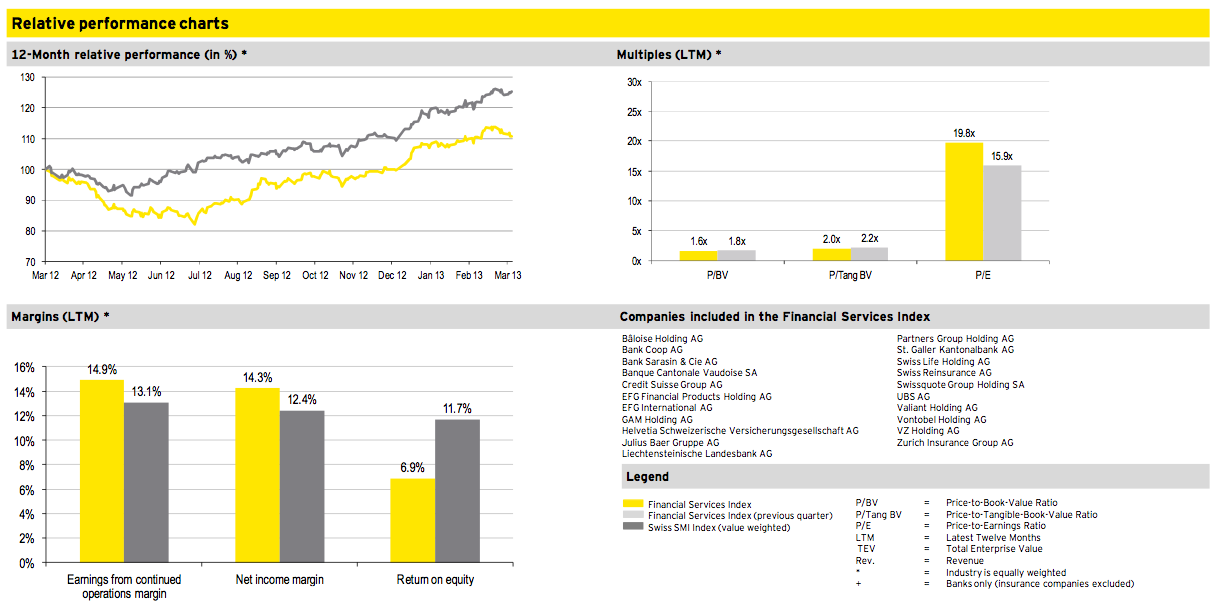

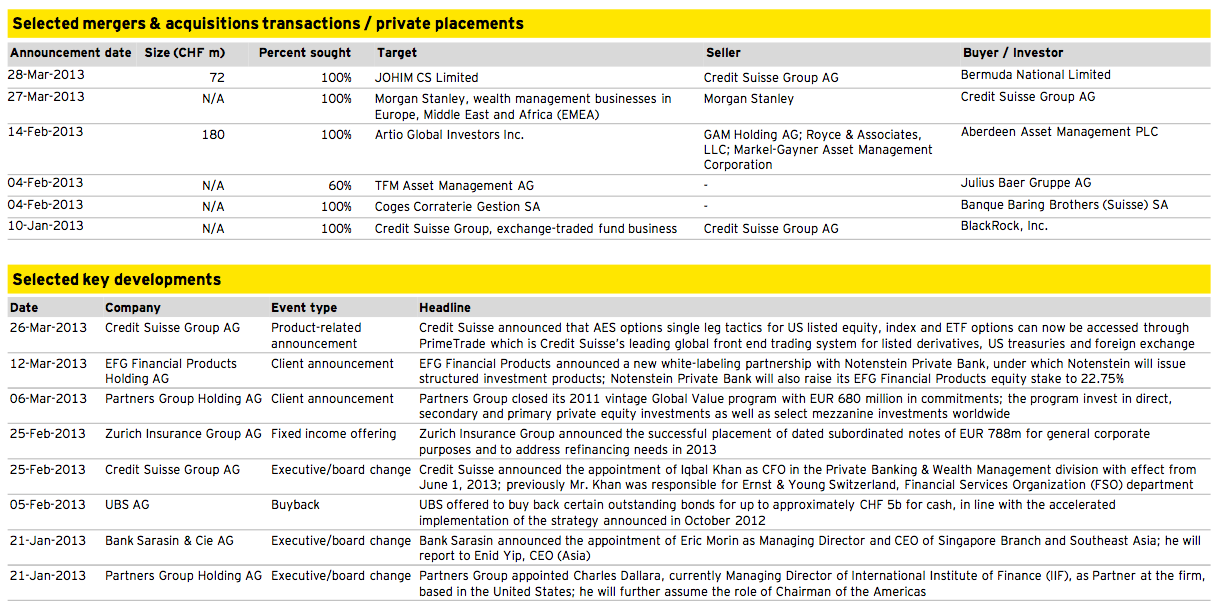

Financial Services

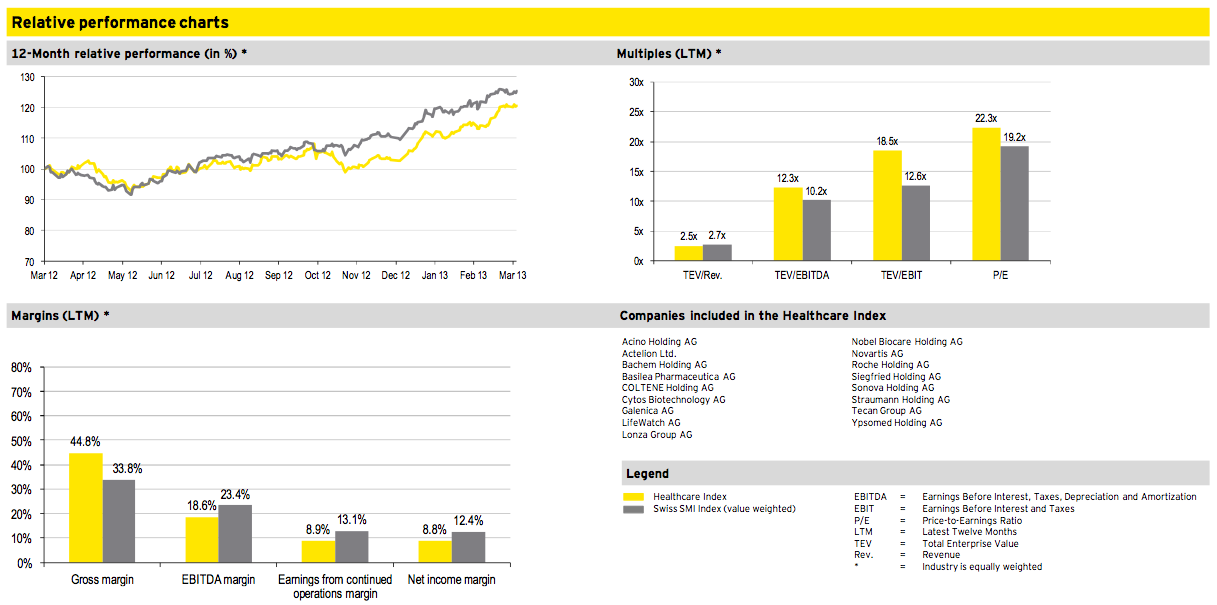

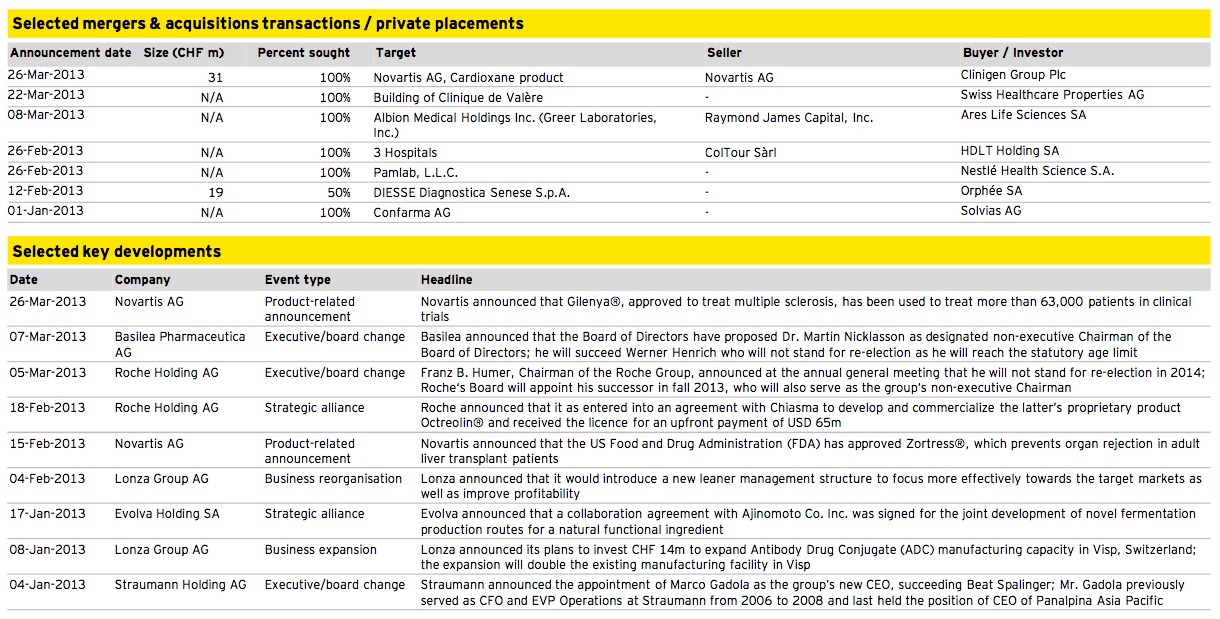

Healthcare

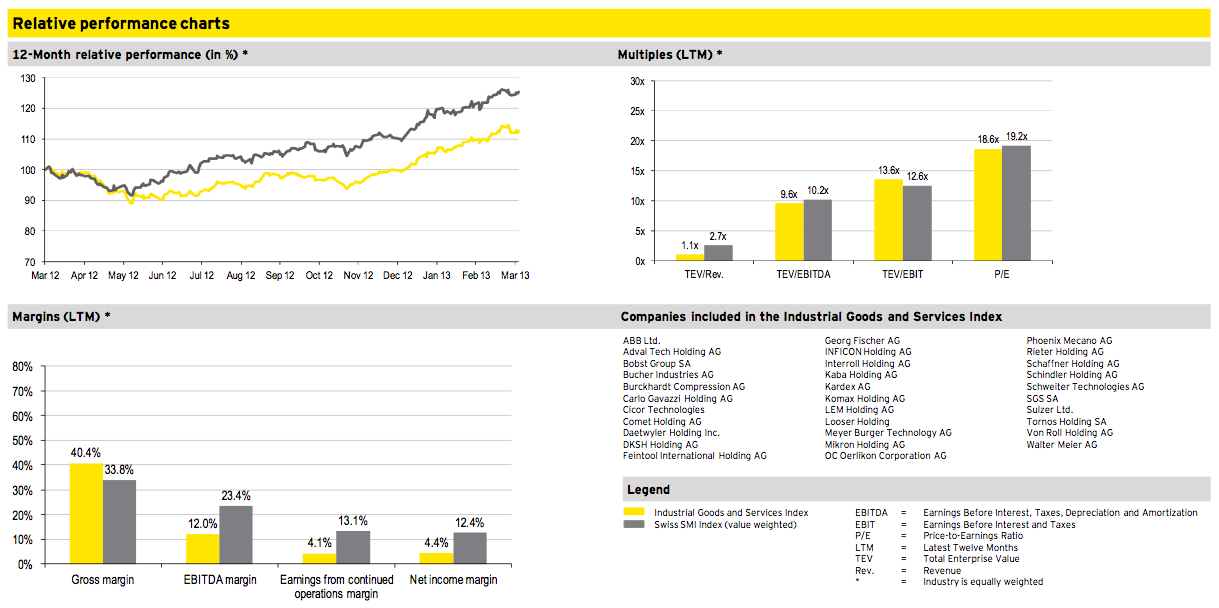

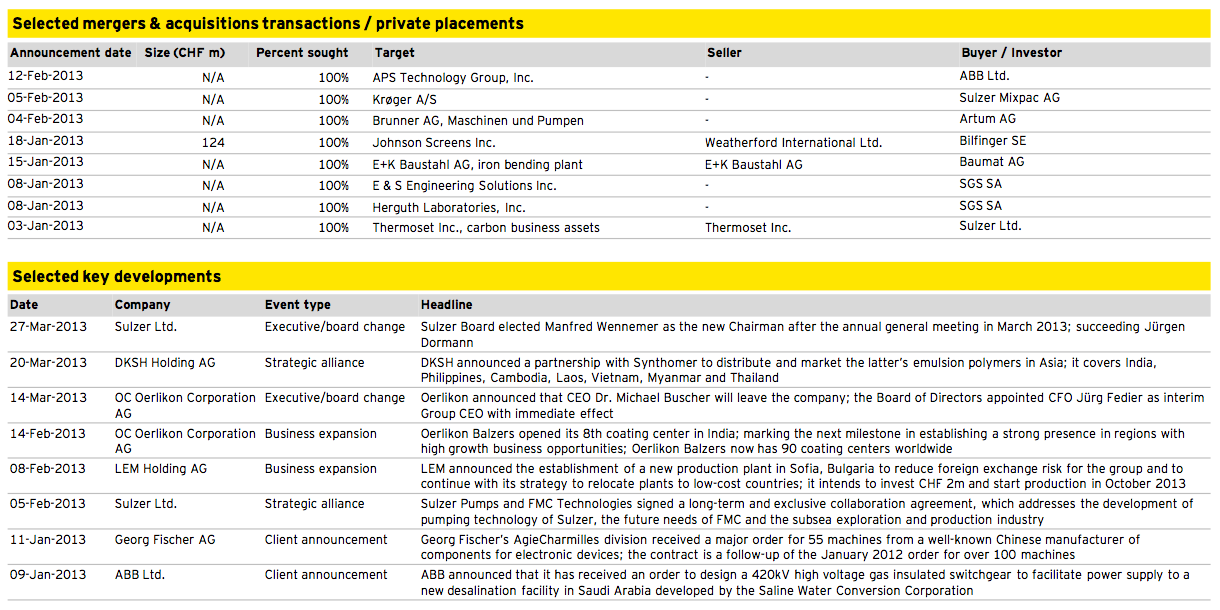

Industrial Goods and Services

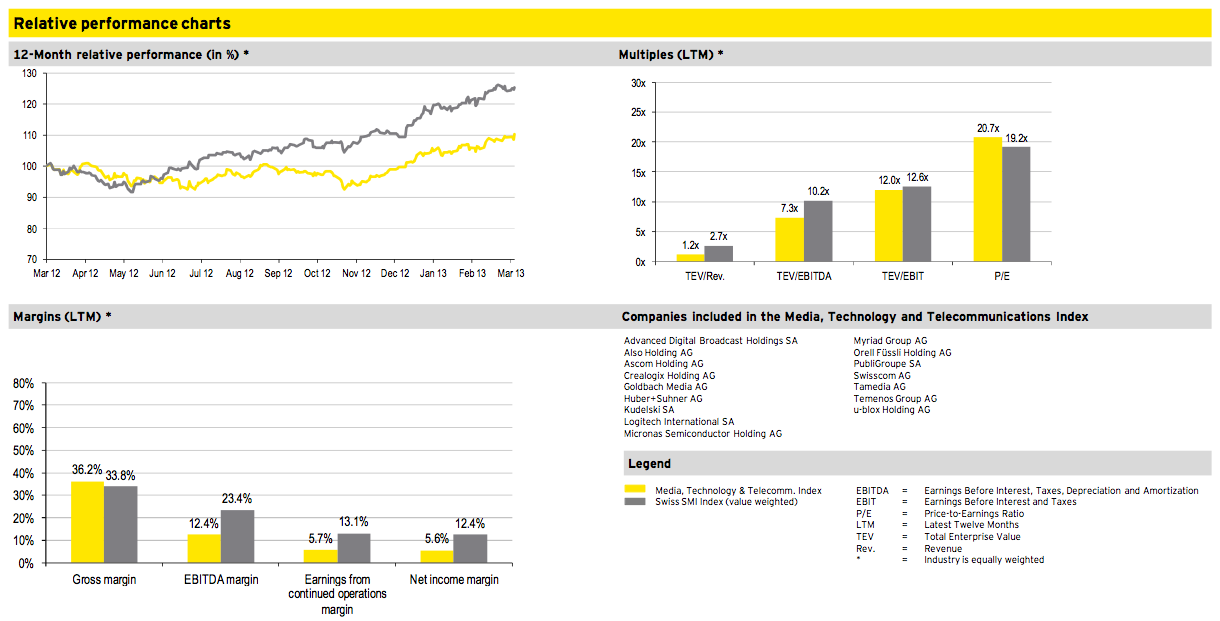

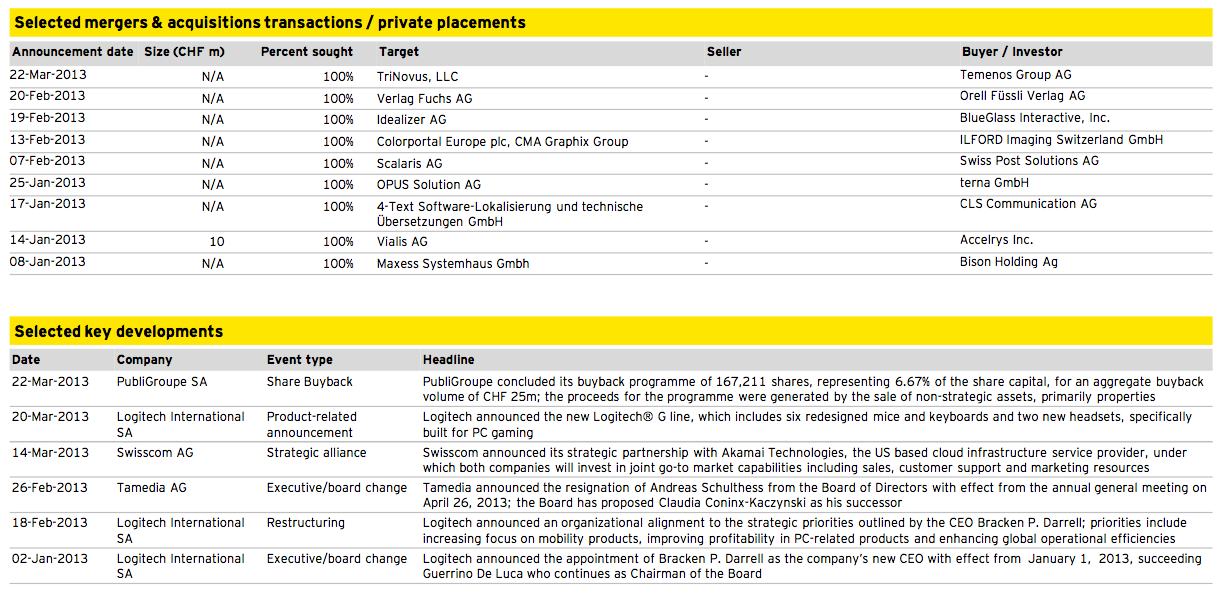

Media, Technology and Telecommunications

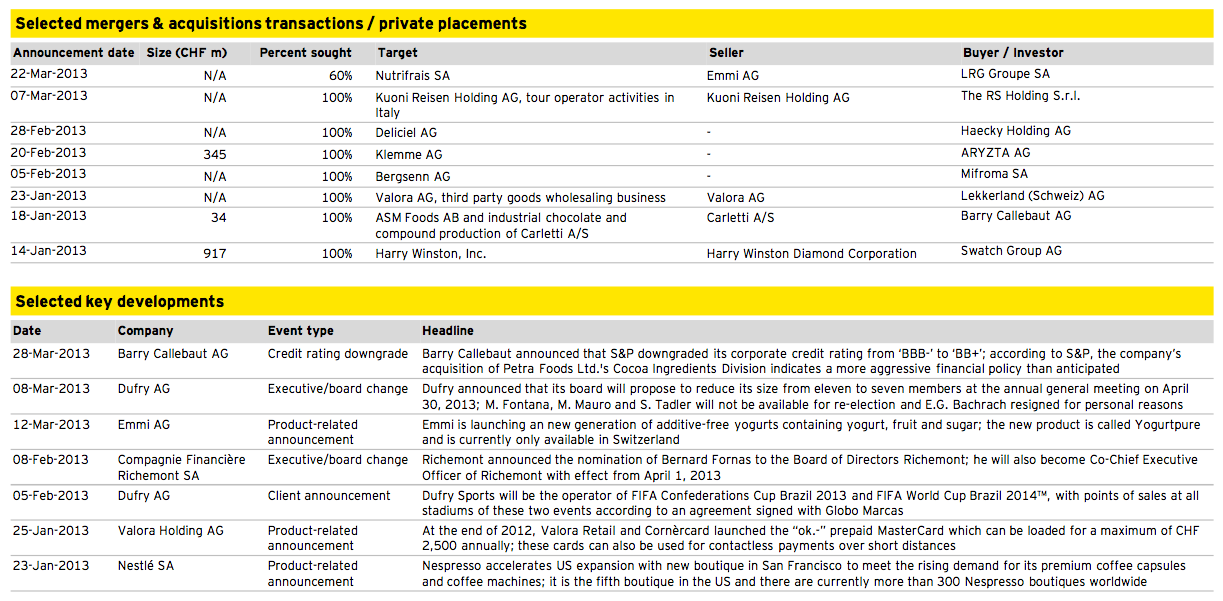

Retail and Consumer Products

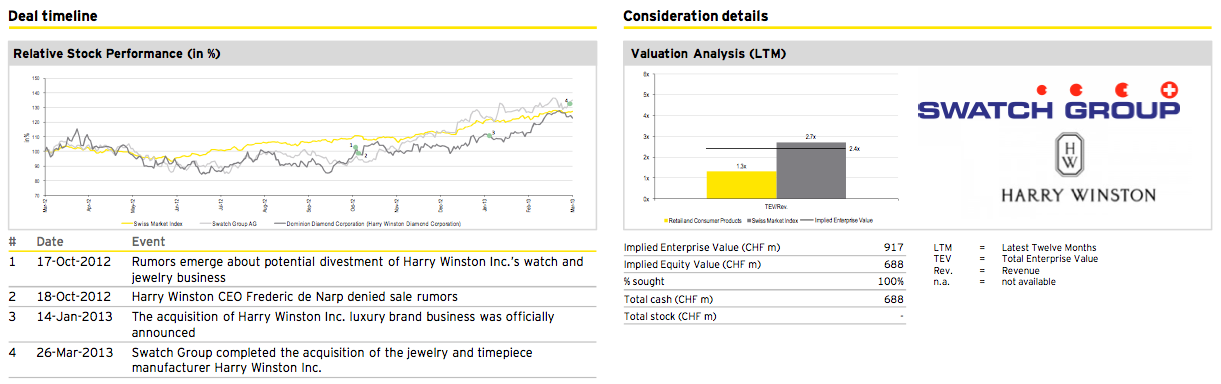

Deal of the quarter

Transaction overview

Deal summary

In the first quarter 2013, our deal of the quarter features the acquisition of Harry Winston Inc. by Swatch Group AG. The world’s largest watch manufacturer entered into an agreement to acquire the luxury brand diamond jewelry and timepiece manufacturer for USD 750m plus up to USD 250m of pro forma net debt valuing the company at about USD 1.0b. The remaining Canadian mining activities of Harry Winston Diamond Corporation are not part of the transaction and will be renamed to Dominion Diamond Corporation after closing the deal.

Founded in 1932, Harry Winston is one of the most exclusive and prestigious diamond jeweler and luxury timepiece retailer with stores in key locations around the world. Known for its outstanding craftsmanship, the company is also called “King of Diamonds” or “Jeweler to the Stars”, showing the exclusivity of the brand.

Deal rationale

► For Swatch Group, the acquisition is expected to give the company access to the market for high-end jewelry, originally dominated by firms such as Compagnie Financiere Richemont SA with its Cartier brand, Tiffany & Co. or Bulgari owned by LVMH Moët Hennessy Louis Vuitton S.A.

► Swatch Group is also forecast to enhance its product portfolio by adding a jewelry brand and is expected to realize the full potential of Harry Winston Inc.

► Harry Winston’s remaining operations are assumed to focus on mining; the company could also play a key role in consolidating the diamond mining industry through the cash inflow of its luxury brand divestment to Swatch Group.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter