Publications Making A “Poison Pill” Easier To Swallow: How To Manage M&A-Related Software Licensing Costs And Compliance Risks

- Publications

Making A “Poison Pill” Easier To Swallow: How To Manage M&A-Related Software Licensing Costs And Compliance Risks

- Christopher Kummer

SHARE:

By Deloitte

CIOs who use a centralized, streamlined approach to M&A-related software license re-contracting may reduce costs, aid compliance, and enhance the value of the entity in play.

With M&A activity on an upward trajectory, CIOs of companies undertaking mergers, acquisitions, divestitures, and joint ventures may be facing millions of dollars of unanticipated software expenses—temporary and long-term licenses, transition services, and other third-party agreements—that often are unaccounted for in deal terms.

CIOs can make this “poison pill” easier to swallow by using a centralized, streamlined approach to M&A-related software license re-contracting. Doing so may help to reduce costs, aid compliance, enhance the value of the entity in play, and raise awareness of the IT organization’s value at the highest levels within the company.

During a recent divestiture of a Fortune 200 diversified energy company, centralizing and streamlining IT contract separation resulted in cost avoidance of approximately $50 million through license transfers and negotiated savings.

The need for IT re-contracting

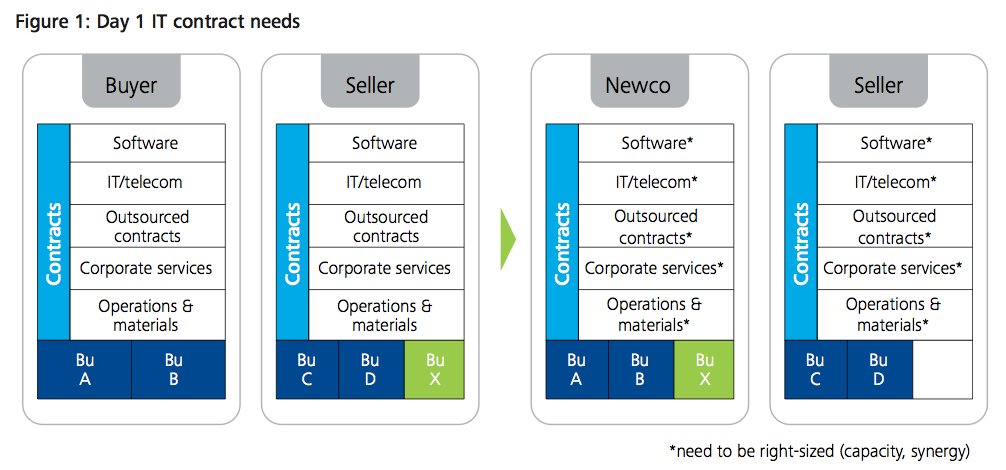

A number of factors differentiate the rights associated with software and, to some extent, hardware purchases from other assets a company buys. Software license agreements contain legal protections for intellectual property (IP) that restrict how and by whom the software can be used. Additionally, software licenses are bought but never “owned” and this distinction can be a costly challenge to conducting business as usual on the day a company sells or acquires another entity (“Day 1”) (see figure 1).

Key takeaways

- Buyer plus the newly acquired business unit (NewCo) will need additional capacity

- The acquired Business Unit (BU) will require its current licenses, at least temporarily

- The seller will have surplus capacity and stranded costs

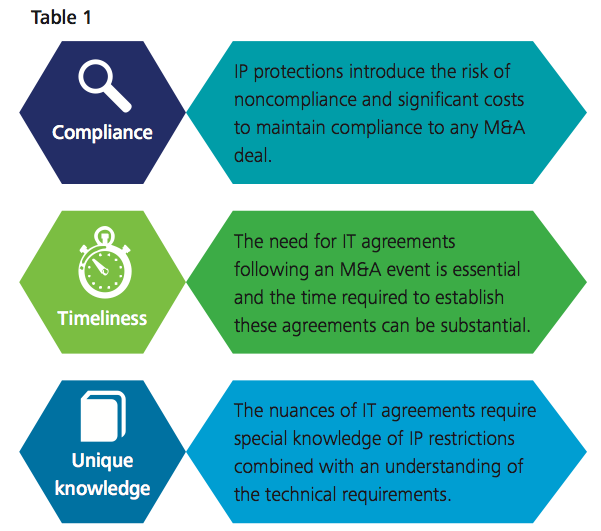

A typical business relies upon hundreds, if not thousands, of IT contracts to support systems and applications used across the company. These contracts lock in millions of dollars of assets and restrict their use to only the licensee and their affiliates. As a company evolves and restructures through M&A, the portability of licenses to move with users should not be assumed; license restrictions can make what many thought were assets of the organization worthless in certain situations. Therefore, effective on Day 1, a company that sells or acquires another entity needs to obtain rights to the licenses that support day-to-day operations. Table 1 describes the challenges of following a traditional path to renegotiating these contracts in order to support the M&A event.

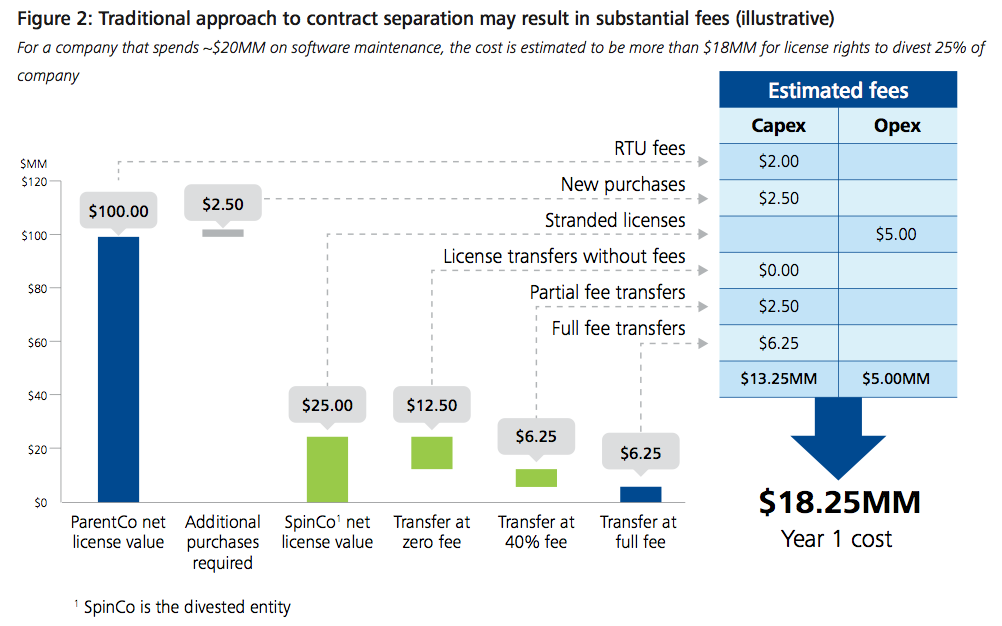

While IT integration as a whole is nearly always a key focus area leading up to and continuing for a year or more following a deal’s close, re-contracting software agreements is often an afterthought and can result in substantial, unexpected expenses—sometimes totaling in the tens of millions of dollars—in the form of legal fees, right-to-use fees, software repurchases and, in the worst cases, fees and penalties for noncompliance, as indicated in figure 2.

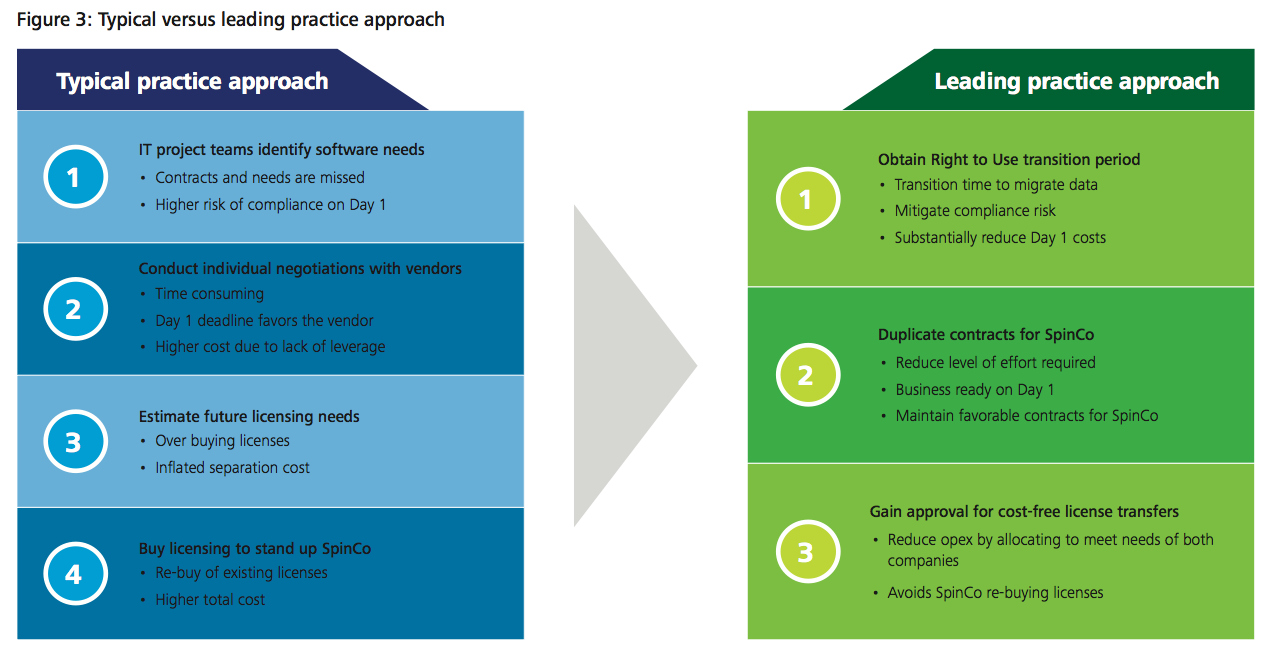

The traditional approach to software re-contracting (see figure 3) relies heavily upon the involvement of corporate or outside legal staff, the corporate procurement department (which may not understand the nuances of IT agreements), or individual users (who likely lack an enterprise-level perspective). When a deal is announced, the buyer’s legal representatives typically process on a piecemeal basis what can be a flood of re-contract requests in an effort to stem compliance concerns. Meanwhile, the purchasing department or individual users contact vendors to obtain additional licensing to support the divested or acquired entity on Day 1. This one-off-based approach often produces a host of unexpected, noncompliant situations due to the backlog of agreements still waiting for legal approval on Day 1. It also results in the divested entity incurring higher-than-forecasted license costs. The seller, in turn, may find that it retains responsibility for maintenance payments for licenses stranded in the department that previously supported the divested entity but did not go with the sale. Ultimately, the seller faces a stranded cost implication.

In contrast, CIOs who use a leading practice approach centralize all deal-related license re-contracting issues to better control costs and reasonably make certain that on Day 1, all parties have access to the software they need while reducing stranded costs across the ecosystem. These CIOs enhance their value to the organization by reducing licensing fees, shortening costly and cumbersome Transition Services Agreement (TSA) periods, and using the visibility afforded by an M&A event to improve licensing costs across the entire organization. Importantly, CIOs understand that this approach requires total alignment of the executive leadership team, highly governed project management to meet Day 1 requirements (e.g., establishing governance, gathering data and reviewing contracts, defining strategies, and negotiating mutually beneficial agreements), and partnering with vendors to make the separation process beneficial for both parties while maintaining the useful value contained within existing licenses.

Using the leading practice approach, a Fortune 200 diversified energy company divesting a significant portion of its organization saved nearly 90 percent in estimated separation license costs.

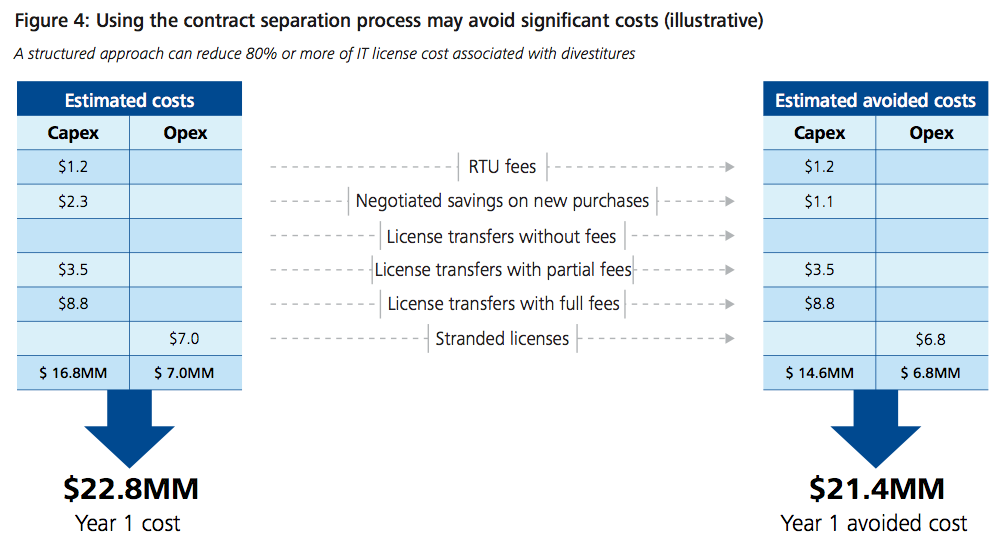

To begin contract separation, the seller and/or buyer should dedicate resources to a centralized contracts management office that is completely focused on contract separation activities, controlling outward communication, and reducing the need for legal involvement by using a standard amendment to leverage existing contracts for the new entity wherever possible. This approach shifts the re-contracting effort from legal staff, allowing them to focus on myriad other deal-related requests. In addition, leveraging the agreements currently in place for a divested entity (particularly if they were for a larger enterprise) reduces the quantity of new software and other IT agreements required prior to Day 1. This lessens the procurement burden, bolsters the buying power of the combined organization, and quickly positions the new entity for success. Following the divestiture or acquisition, a full assessment of the IT portfolio, preferably via an automated process utilizing scripts, allows the contracts team to identify potential software for transfer and other areas where licensing support costs could be reduced, as well as to renegotiate or source new agreements where business needs have increased. Using these techniques, companies have realized significant reductions in software costs, as illustrated in figure 4.

Strengthening the vendor-client relationship

Although a centralized contracts team is likely to work more efficiently using a “war room” approach—requesting a standard set of terms from vendors—it is important to work directly with vendors that have high-value agreements or particularly impactful relationships with the organization. Because of its annual maintenance payment structure, key IT vendor-customer relationships should be viewed as a partnership: In return for consistent revenue, the vendor provides support and services for all contracted products. Offering a customer flexible solutions during a time of transition adds value to this relationship, thereby enhancing the vendor in the customer’s eyes, earning it a place in the IT portfolio for both the divesting and divested entity and strengthening the vendor-client relationship in the near and long term.

Benefits of a centralized approach

The effort, time, and cost required to maintain software continuity through a merger, acquisition, or divestiture can be substantial; however, the impacts of mismanaging the re-contracting effort may be much worse—risks of noncompliance, penalties, transfer fees, and duplicate licensing, among others. Although the re-contracting period prior to Day 1 is not ideal for making wholesale changes to the goods or services under contract, it is an opportune time to leverage existing volumes and contracts for the new entity and determine those that are no longer needed in the post-deal world. Taking a centralized approach to software re-contracting may generate considerable benefits (see table 2).

By managing M&A-related software licensing costs and compliance risks more effectively, CIOs and the IT organizations they lead can exit a deal with an improved cost structure, a better understanding and command of the assets they control, strengthened vendor relationships, and the ability to better satisfy the needs of their internal and external constituents.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter