Publications M&A Yearbook 2014 – KPMG’s Overview Of Mergers And Acquisitions In Switzerland In 2013 And Outlook For 2014

- Publications

M&A Yearbook 2014 – KPMG’s Overview Of Mergers And Acquisitions In Switzerland In 2013 And Outlook For 2014

- Christopher Kummer

SHARE:

By KPMG

Strategic reviews begin to yield actions

“… M&A remains at the heart of business strategy.”

Anticipating future developments is especially difficult in a constantly changing setting, such as the persistent instability and uncertainty in Switzerland’s major markets, though there are strong signs of stability returning.

Many major Swiss corporates have spent the past couple of years undertaking extensive strategic reviews, streamlining existing portfolios in line with longer-term goals. Indeed, knowing which pieces to sacrifice and when to do so can be critical to securing future prospects. The Swiss Industrials, Chemicals and Pharmaceuticals sectors in particular have seen major players shedding non-essential assets to position themselves for success in their core businesses.

Following a period in which many shifted their sights to opportunities in the world’s largest high growth market, China, even this market is experiencing a slowdown that is impacting Swiss industries such as luxury goods and watches. While the high growth economies remain a key area of focus, relatively few Swiss players are in a position to seize M&A opportunities there.

As corporates and financial investors alike plan their next moves and anticipate changes to the commercial, regulatory and macro-economic landscape, M&A remains at the heart of business strategy. Now, perhaps more than ever, thoroughly considered, well-planned actions are vital if the benefits of recent portfolio optimization and rationalization efforts are to be maintained. (Stefan Pfister, Partner, Head of Advisory)

M&A Market Press Headlines

International: IPO activities are on the rise. Private shareholders are advised to follow a few rules of conduct. – Finanz und Wirtschaft, 14 Aug 2013. Window is open for IPOs.

Some bankers are enduring it with stoicism, others are disappointed. Yet there is one thing that they all agree on: Acquisition activities – M&A in professional jargon – are not picking up momentum because executives are shying away from the risks. – Finanz und Wirtschaft, 15 Jan 2013. Leaders still too hesitant for acquisitions.

“Stock market professionals” make jokes about… inexperienced investors from time to time. Whenever they start buying stock, that is a warning sign that the boom is about to end. While this may be the case, there are also experts who only make acquisitions at peak prices – and when they do, they buy all of a company’s stocks. – NZZ, 2 Dec 2013. M&A boom: Acquisitions only at premium prices.

Hopes of an increase in acquisition activity in Switzerland are dashed on a regular basis. Meanwhile, business seems to be picking up in other Western European countries. – Finanz und Wirtschaft, 30 Mar 2013. Tenacious M&A blockade in Switzerland.

US investor Warren Buffett is convinced that the economy is picking up, particularly that of his home country. Buffett … has announced large-scale acquisitions. – Basler Zeitung, 27 Feb 2013. Buffett opens hunting season for companies.

Historically speaking, corporate merger and acquisition trends have usually developed in parallel to stock market trends, coming in waves. So far there have been six of these waves. Despite the fact that stock prices are at record highs, no seventh “M&A wave” is currently in sight. – NZZ, 1 Jun 2013. Six “M&A waves” in history – no acquisition fever despite stock boom.

Contradictory developments were seen in Switzerland’s mergers and acquisitions market from July to September: While the number of transactions conducted went up, the value of those transactions dropped considerably over the previous quarter. – Handelszeitung, 8 Oct 2013. Mergers: Lower value, more transactions.

M&A volume disappointing – Despite the announcement of three acquisitions worth billions – Heinz, Dell and Virgin Media – volumes in the mergers and acquisitions business (M&A) remained modest. According to preliminary figures from Dealogic, global M&A volumes rose 2% to USD596 billion in a year-on-year comparison. – Finanz und Wirtschaft, 30 Mar 2013. M&A volume disappointing.

Despite the fact that many companies around the world have large cash reserves and are capable of presenting healthy balance sheets, the M&A business is stagnating. This is attributed to European companies’ reluctance to conduct global transactions. – Finanz und Wirtschaft, 27 Sept 2013. The merger carousel is spinning slowly.

C. H. New York – Tension in the race for the last remaining acquisition candidates has risen another notch in America’s consolidating telecommunications market. – NZZ, 16 Apr 2013. Bidding war over mobile telecommunications provider Sprint – merger fever in America’s telecommunications market.

A string of acquisition offers has hit the headlines over the past few days. The basic conditions are right for bigger deals. Companies are investing in growth. – Finanz und Wirtschaft, 4 Oct 2013. Revival in M&A business.

Companies are currently selling like hotcakes in the US. As the political and economic environment have stabilized somewhat, many companies are venturing back into weighty acquisitions. – NZZ, 19 Feb 2013. US acquisition carousel – The company hunters are back on the prowl.

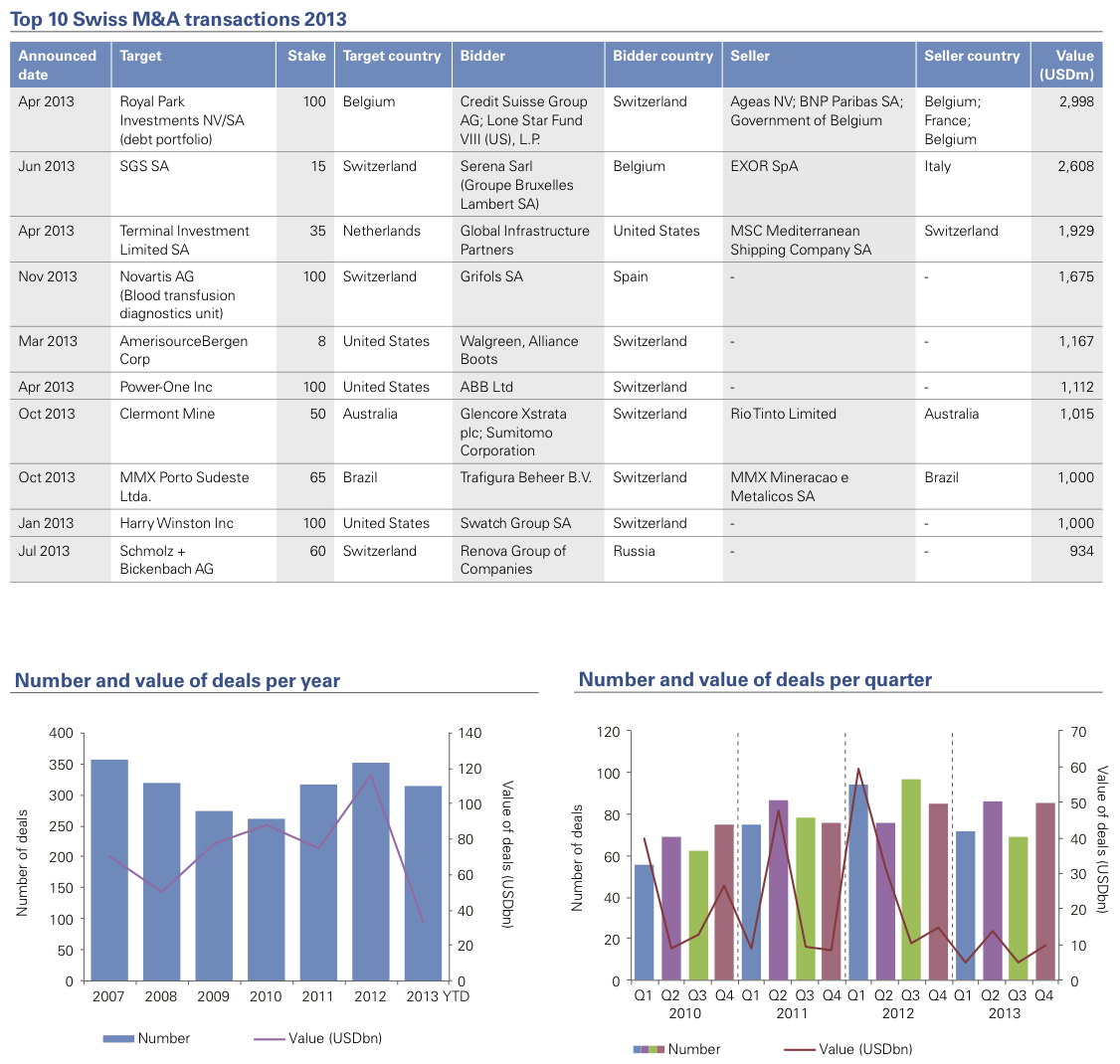

Deal Trends / Executive Summary

2013 was a tricky year for Swiss M&A. A year of falling deal volumes and generally smaller transactions in which the largest acquisition amounted to less than USD3 billion was bound to disappoint many observers.This especially following on the heels of some huge deals in prior years: Glencore / Xstrata in 2012, Johnson & Johnson / Synthes in 2011 and Novartis / Alcon in 2010. It was never going to be easy. Amid ongoing market uncertainties in the Eurozone and the US, concerns over a slowdown in Chinese growth and a stubbornly strong Swiss franc, risk aversion prevailed and many dealmakers believed 2013 was no time to take a gamble.

Reorganizing for growth

Yet, as ever, one must scratch beneath the surface to find the true story, which is one of considerable restructuring and extensive planning for future expansion. Many Swiss sectors have undergone a long period of introspection, reviewing portfolios and identifying non-core or under-performing assets to sell. This is notable in, but not confined to, Industrials, Chemicals, Pharmaceuticals and Financial Services. Observe the various divestments by Clariant over 2012 and 2013, and the sizeable disposal by Novartis this past year of its blood transfusion diagnostics business. While corporate leaders continued to scan growth opportunities, acquisitions were typically restricted to entities that fitted their core competencies and strengthened their core businesses.

Perhaps Switzerland’s newest high profile industry, Commodity trading, is similarly undergoing substantial change. Market participants are investing management time adjusting their M&A strategies to shore up thinning trading margins. The focus of many trading houses has shifted to vertical integration such as securing raw material supplies and distribution facilities and infrastructure. In this, the sector actually remains a strong source of outbound acquisition activity.

A return to easier financing

M&A plans are being helped by a growing ease of securing funding. Corporate restructuring and disposals have freed up capital while banks are becoming once again more favourable to deal financing. 2013 also saw successful fund-raising rounds by a number of Switzerland’s largest Private Equity houses, indicating positive investor sentiment. As stock markets continue to rise, in many cases to record highs, transaction multiples are also on the increase.

We may therefore view 2013 as a year of preparation in which a high proportion of M&A activity was of selected deals to strengthen core businesses and to position Swiss players to carry out their expansion plans.

Outlook for 2014

We expect the coming year to produce a moderate increase in M&A activity. Deal financing may continue to become more accessible if markets stabilize and uncertainties reduce. Many Swiss corporates and Private Equity houses are sitting on undeployed capital that they may be impatient, though not desperate, to utilize.

As valuations continue to increase, however, there is a danger of a correction in stock markets creating a negative influence on M&A activity and confidence levels.

Bank on consolidation

Watch the private banking space closely. Long-awaited consolidation in the sector is finally taking off, with the number of private banks holding Swiss banking licences falling from 171 in 2009 to 141 in 2013. Larger players continue to expand in line with their global ambitions, while mid-sized players seek to strengthen their positions by building scale. At the same time, we expect to see more private banks exiting the market by bringing forward succession plans or following Banks Frey and Wegelin into liquidation as more difficult market conditions combine with the outcomes of the USTax Program and EU taxation-related discussions to severely impact business models of smaller players in particular.

Refocusing in slowing markets

Falling demand growth in some of the major markets such as China will make life more uncertain for the Swiss luxury goods and precision engineers. The ongoing importance of key high growth markets should not be under-estimated, however. Demand for Swiss quality products and services remains high and is expected to continue so. Expectations and forecasts may be more tempered than in the past but they remain considerable. 2014 is likely to see many players continuing to take a long, hard look at their operations, adjusting their strategies to deal with this new reality and from where they expect future customer growth to come.

As Swiss businesses make ongoing efforts to move closer to their customers, we will see maintained interest in acquiring on a truly global stage. A primary hurdle will remain the scarcity of available targets in high growth economies. Secondly, what Swiss dealmakers consider to be excessive price tags on businesses for sale. Many of the larger, more established Swiss brands will most likely devote greater attention to Greenfield investments.

2014: growth amid complexity

Overall, 2014 should prove an active year characterized by complex transactions that have been long in the planning. Many sectors globally are showing a greater appetite for M&A and for IPOs, such as the US technology industry. In Switzerland, M&A remains a vital strategy instrument for large corporates.

As portfolio reviews are to a large extent concluded, 2014 may see Swiss firms undertaking mega-deals with the reserves their streamlining activities have released. (Patrik Kerler, Partner, Head of Mergers & Acquisitions)

Cross-border Deal Flows

Western Europe was the main source of M&A involving Swiss businesses in 2013, with a boom in the value of both inbound and outbound transactions. The year also saw growth in the value of Swiss acquisitions in Asia-Pacific and Latin America, with transactions in Australia and Brazil appearing in the top ten deals of 2013. North America remains a key destination for Swiss acquirers, though total deal value was lower in 2013 than the previous year due to the absence of mega-deals.

Industry Tables

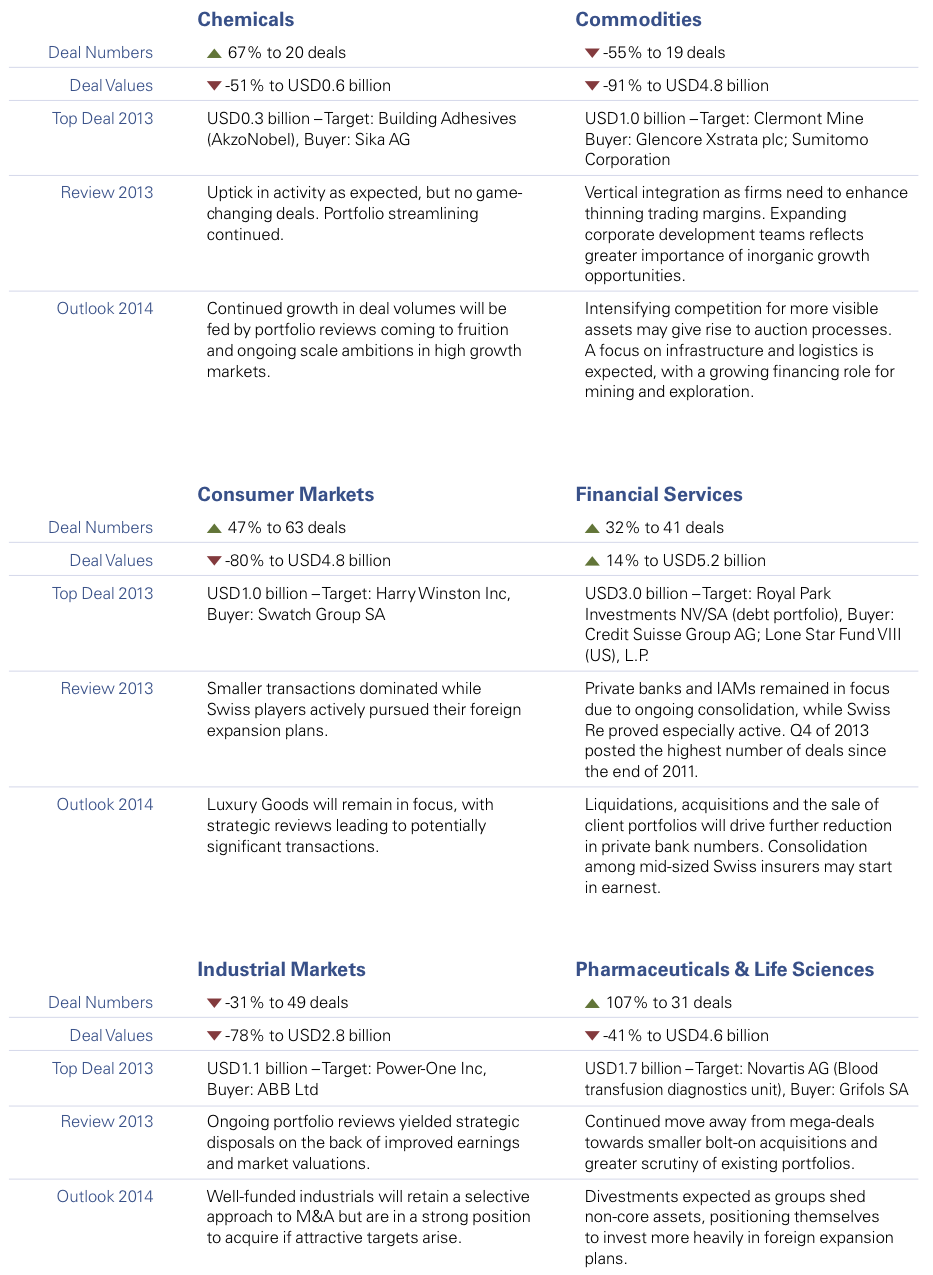

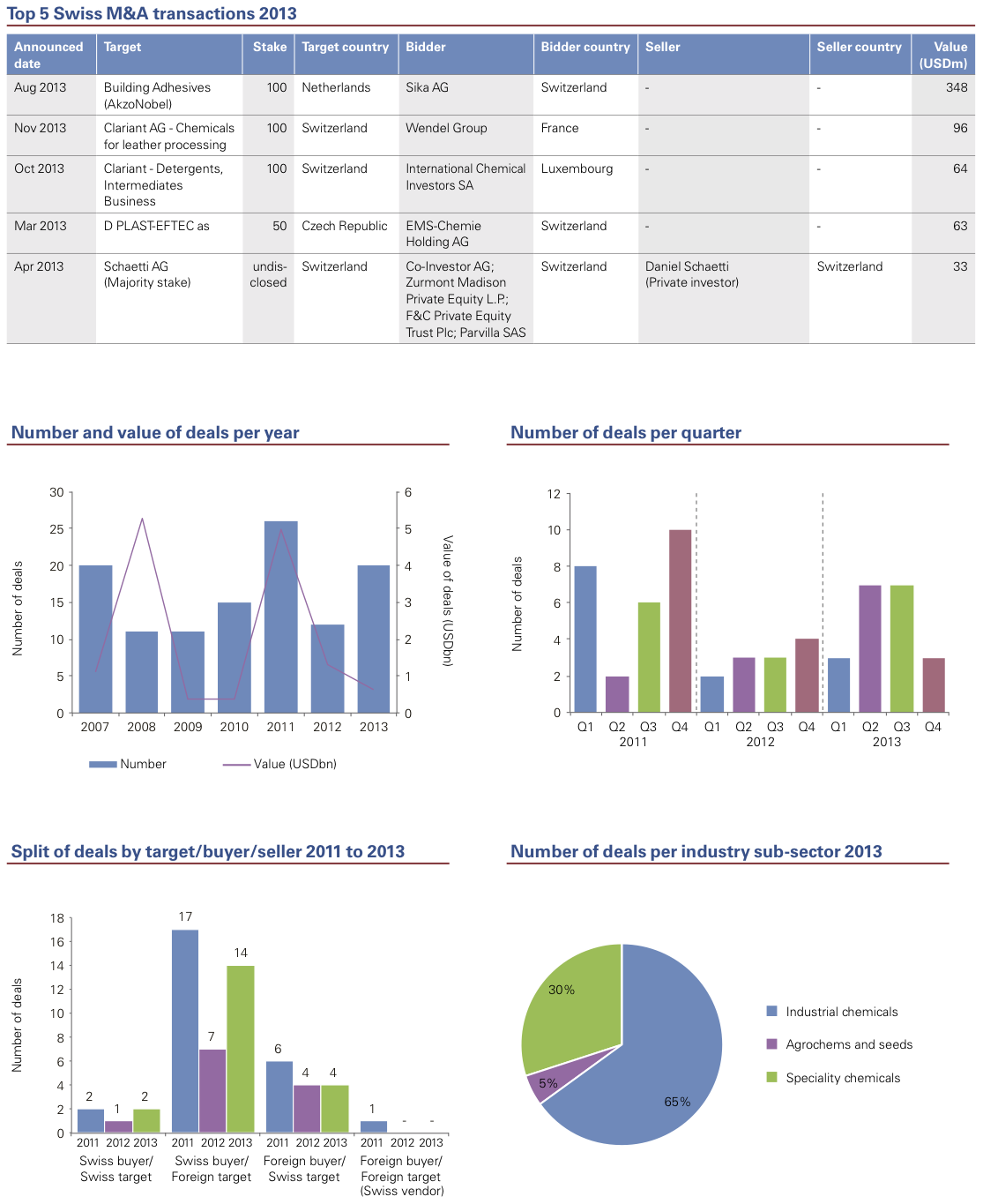

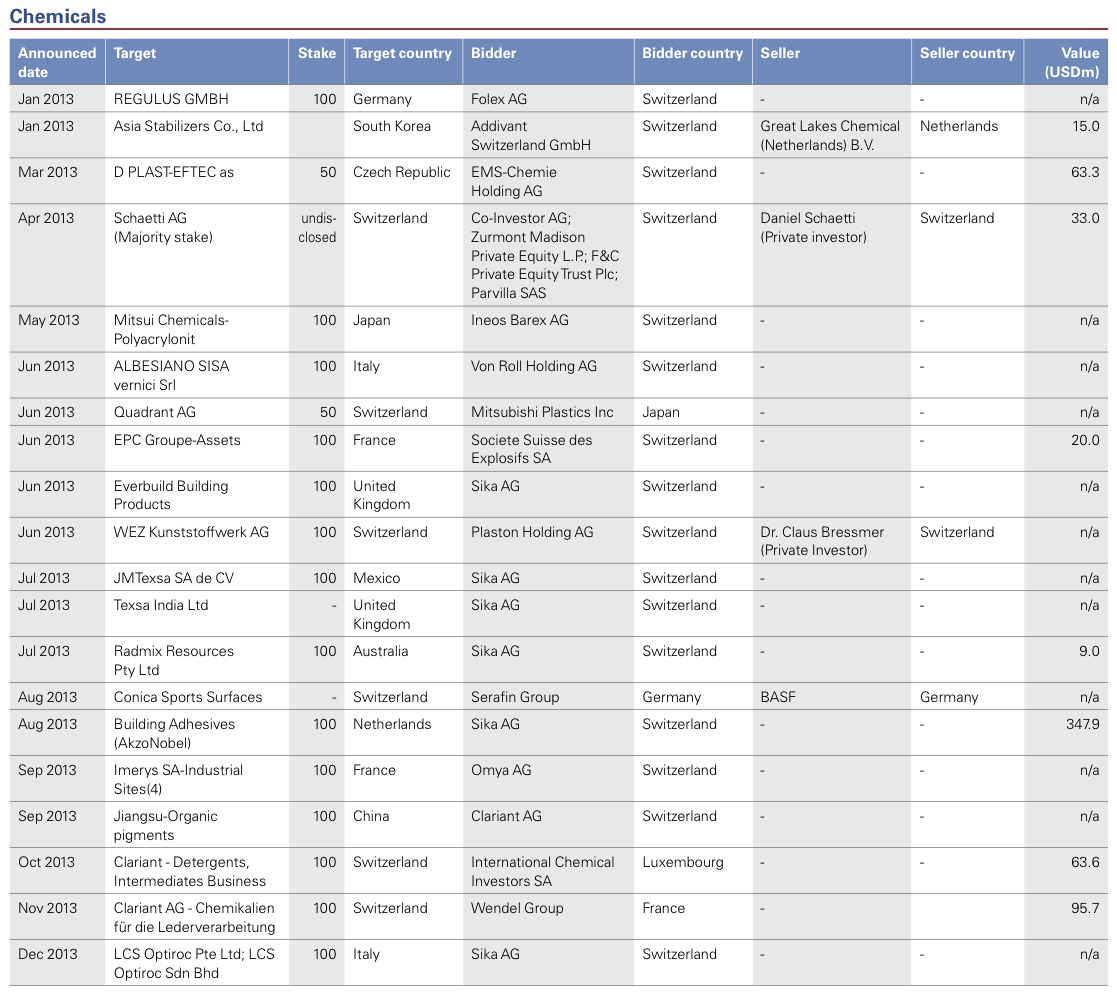

Chemicals

2013 showed a slight recovery in deal volumes. Inbound activity was driven by Clariant’s sale of further business units, while Sika actively acquired abroad. Streamlining of portfolios and the building of scale in core businesses is expected to dominate 2014 activity.

2013 saw the highest deal volumes since 2007, except for a peak in 2011. Average transaction values were down over the two prior years, with all except one deal falling below the USD100 million threshold.This illustrates the main thrust of the year’s activity – selective, smaller transactions while portfolio and core business reviews are ongoing.

Outbound deals dominated the M&A scene. Sika led the charge, with the largest transaction of the year being its acquisition of AkzoNobel’s building adhesives unit. Seen as reinforcing Sika’s position and acting on its global ambitions, this move was complemented by three smaller deals. The group acquired Australian wholesaler of steel and synthetic fibers, Radmix Resources, as well as Texsa India, which manufactures waterproofing membranes, and the UK’s Everbuild Building Products.

Clariant’s divestment program continued apace as it shed some of its non-core assets and announced plans for further disposals. The group sold its detergents and intermediates business to Luxembourg’s International Chemicals Investors and its leather services business to Stahl Holdings of the Netherlands. Together with US partner Ashland, it also put up for sale its German foundry chemicals joint venture. Meanwhile, the disposal of its textile chemicals, paper specialties and emulsions businesses to SK Capital closed on October 1. These divestments are cumulatively seen as enablers for Clariant to focus on growth in its core business, as part of which it made a smaller acquisition in 2013 and announced a planned acquisition of India’s Plastichemix Industries’ masterbatch business.

Syngenta took a significant step in its inorganic growth plans for Africa by buying MRI Seed Zambia and MRI Agro, a developer, producer and distributor of white corn seed. The deal was announced in the context of Syngenta’s USD500 million investment commitment to the region, reflecting its desire to develop and offer integrated crop solutions to African farmers.

Outlook for 2014

Major global trends including global population growth, urbanization (especially in high growth markets), and food and water scarcity join a host of other climate change-related developments that continue to impact firms across the chemicals sector. Implications arise for a range of sub-sectors from building-related products to seed technology and crop protection. Coupled with a desire by European firms to move closer to customer bases – increasingly in East and South-East Asia, Africa and Latin America, these trends all help shape deal rationales through geographical presence and technical requirements.

We expect the growth in M&A activity to continue through at least the first half of 2014. This will be helped by extensive portfolio optimization efforts coming to fruition, with past divestments putting groups in a better position to return to acquiring. An increasingly conducive financing environment will help ambitions. Overall, however, 2014 deal volumes are unlikely to significantly exceed 2013 levels.

Ongoing interest in Swiss assets will be driven by foreign firms’ desires to acquire intellectual property and technology. This is especially the case for corporates in high growth markets that are seeking to further expand their international presence and/or to acquire know-how for application in their home markets. (Patrick Schaub, Senior Manager, Transaction Services)

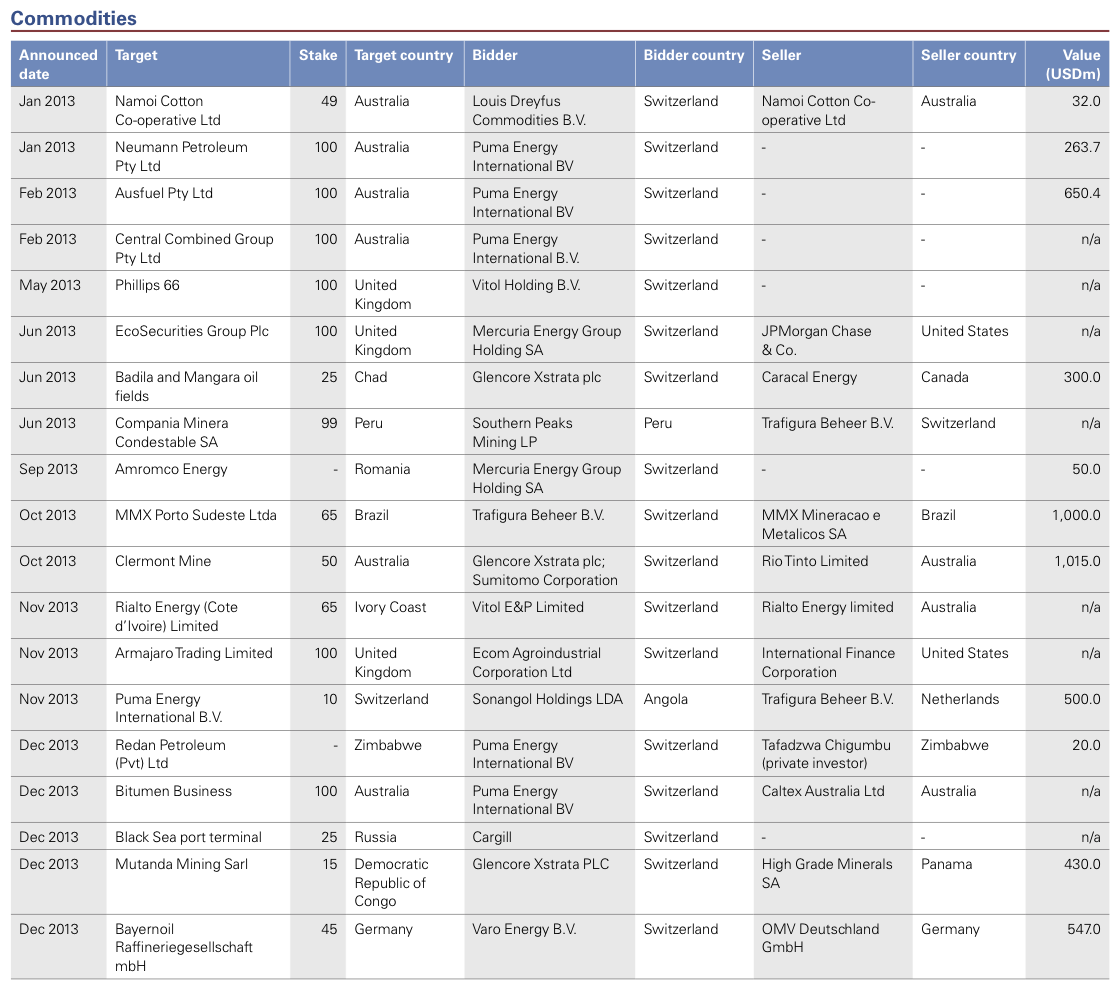

Commodities

On the hunt for margin-enhancing businesses and optionality, commodity traders are seizing vertical integration opportunities including mines, distribution facilities and infrastructure. Competition for more visible assets will grow in 2014, while trading houses will also play an increasingly important financing role in exploration and mining ventures.

While not shifting to as asset-heavy a model as Glencore XStrata, commodity traders are actively pursuing alternative strategies, focusing on taking key positions in the supply chain. This quest is driven by thinning trading margins, a slower economic recovery, lower demand in China, and generally favorable weather conditions in key crop regions. The year yielded Trafigura and the UAE’s Mubadala Development’s agreement to acquire a majority stake in MMX Porto Sudeste in Brazil, and Louis Dreyfus Commodities’ joint venture with Brooklyn Kiev to develop a multi-commodity terminal in Odessa.

Substantial activity was also observed in more “traditional” deals, in which Australia featured highly. Puma Energy concluded four deals in the country during 2013, including Ausfuel, a wholesaler and retailer of fuel and lubricants, and Neumann Petroeum, a petroleum product wholesaler. Glencore joined Sumitomo to acquire 50.1% in a heavily competed bid for Clermont Mine (Australian coal) from Rio Tinto, and 25% in Chad’s Bagila and Mandara oil fields from Canada’s Caracal Energy.

In soft commodities, Ecom Agroindustrial is set to become one of the world’s biggest cocoa and coffee traders if its agreement to buy the UK’s Aramajaro Holdings commodity trading operations comes to fruition.

Reflecting the growing importance of inorganic growth, most major trading houses have expanded their corporate development teams and budgets. From Trafigura setting up its own private equity fund, Galena, to greater deal activity and spend from Mercuria, Louis Dreyfus Commodities, Gunvor, Vitol and Puma, there is a clear shift in approach. M&A is becoming an increasingly core element of strategy.

Outlook for 2014

Swiss traders are in a strong position to play an increasingly central financing role for mines and exploration companies. In Nigeria, for instance, Glencore, Mercuria and Vitol have each teamed up with local partners to bid for onshore oil fields being divested by Royal Dutch Shell. This indicates accelerating vertical integration in the sector, which is becoming more important to success by enabling diversification, margin enhancement and a reduced dependency on existing suppliers.

Stiffer competition for more visible assets is expected. Auction processes in the sector have been rare but are likely to increase as sellers aim to maximize interest and prices.This may lead some traders to turn to Greenfield capital expenditure projects to avoid overpaying for assets. On the divestment side, surplus capacity may yield planned disposals of assets in cocoa and sugar processing in particular.

An increasing focus is likely on infrastructure and logistics, including a number of Brazilian ports potentially coming to market this year. Elsewhere, growing US shale gas production is altering some of the most established oil and gas trading routes, affecting the optimal location of refineries and other facilities. Within the US, for instance, the emphasis is shifting from coastal facilities to inland facilities convenient to shale gas sites. Gunvor is reported as expecting at least ten European oil refineries to close over the next five to seven years, mainly in southern Europe. Potential implications are huge, especially if China, reputed to have the world’s largest shale gas reserves, decides to invest heavily in shale gas. (James Carter, Director, Transaction Services and Bryan DeBlanc, Partner, Transaction Services)

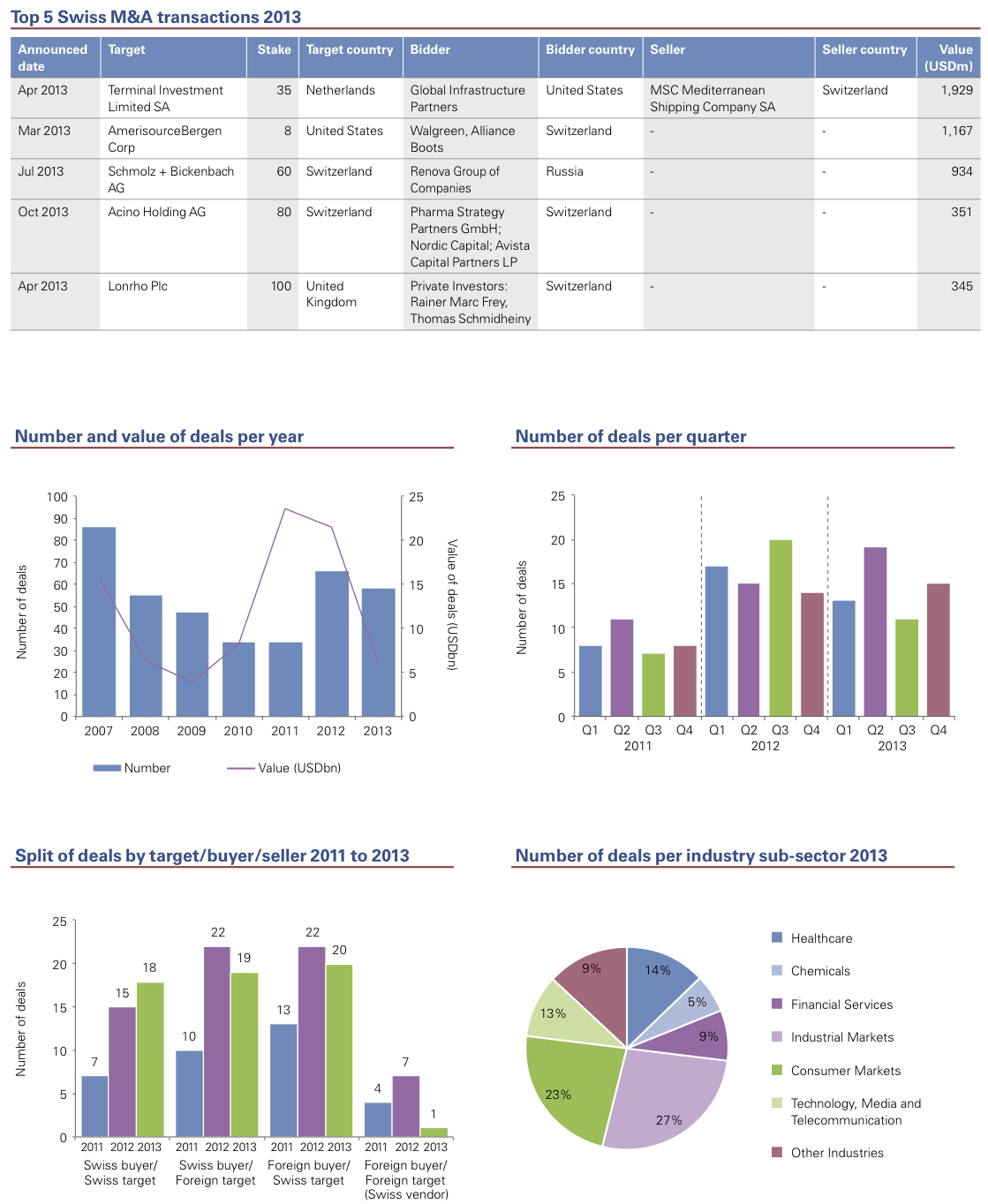

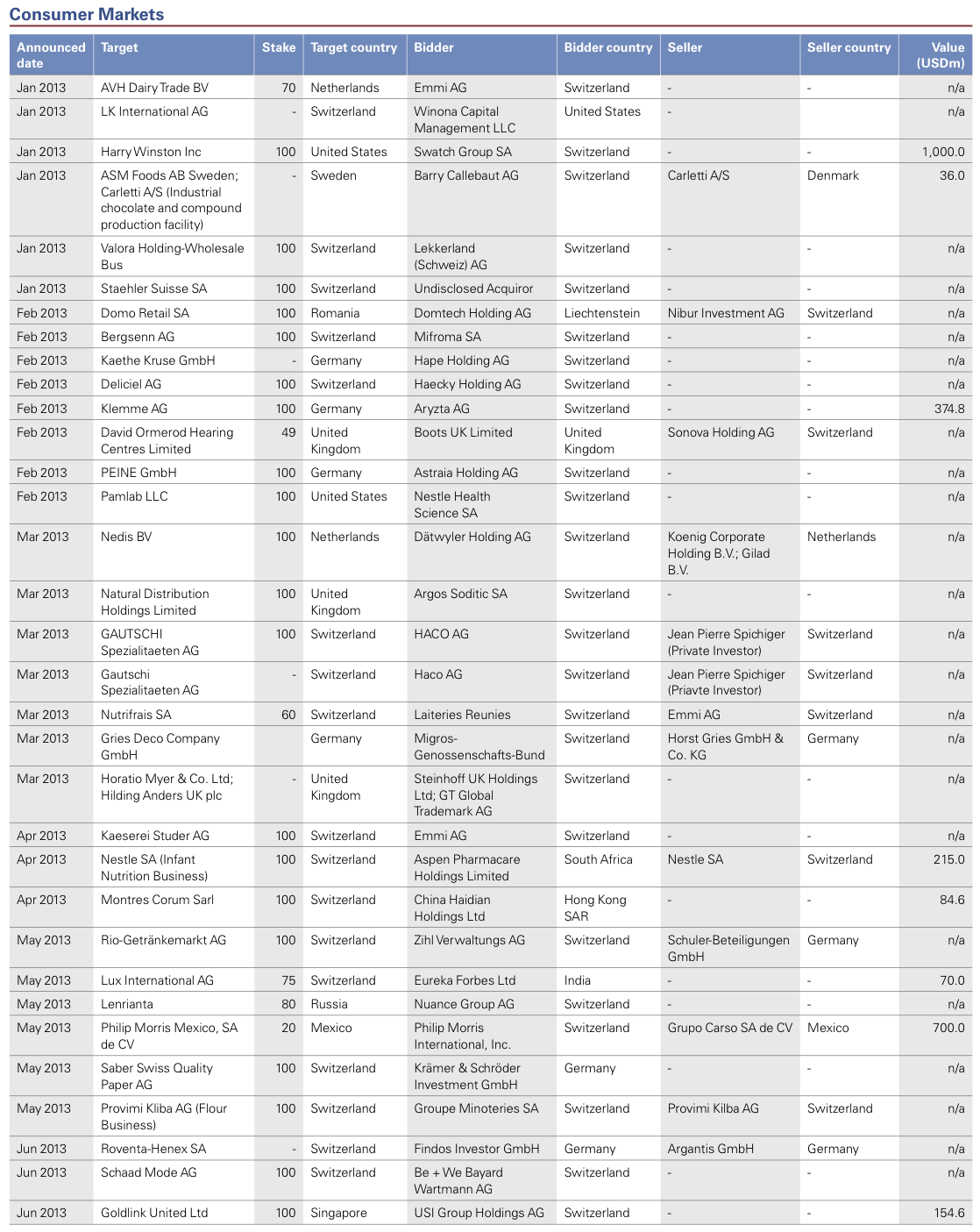

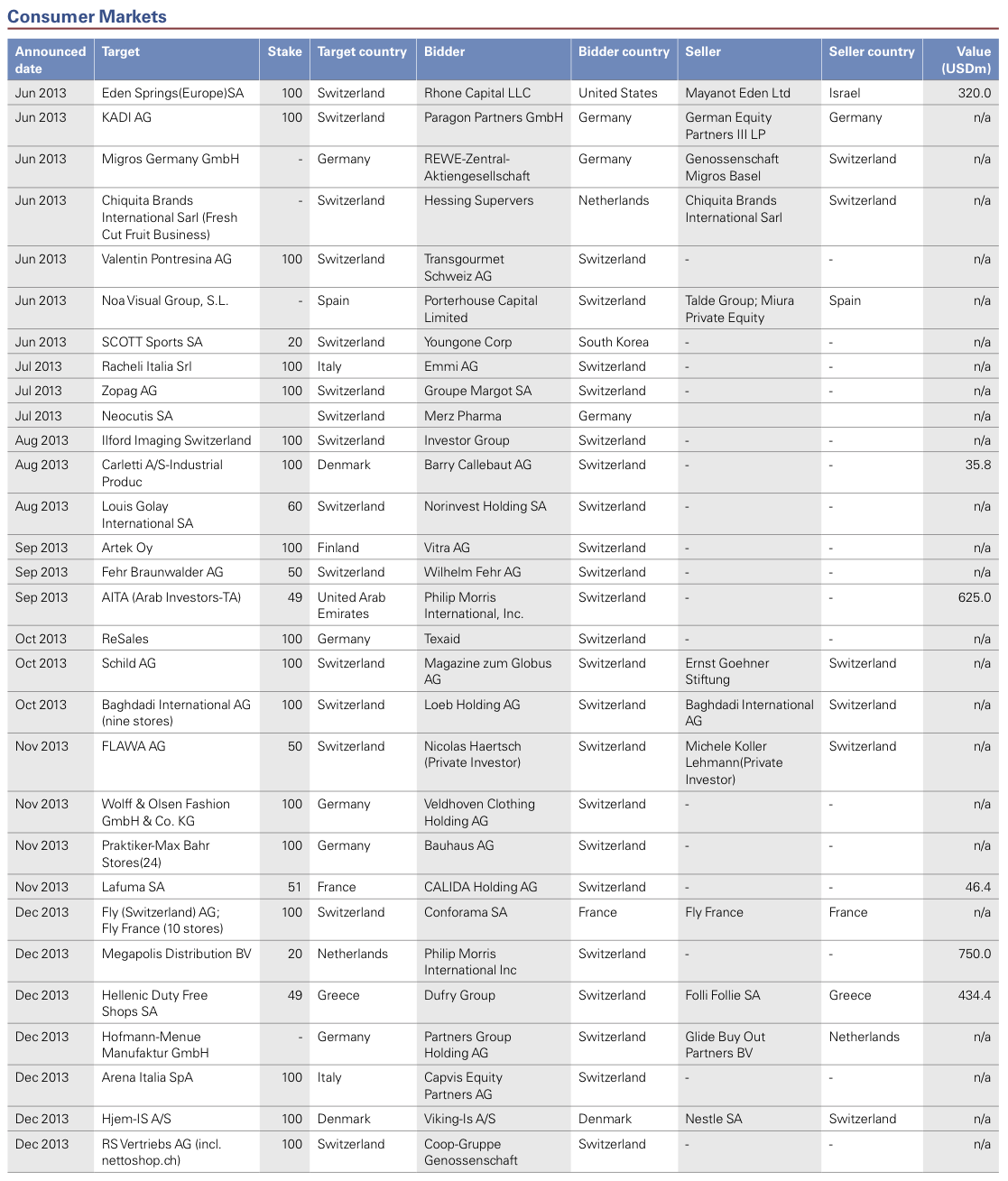

Consumer Markets

Swiss companies actively acquired assets abroad throughout 2013, most notably in Western and Northern Europe. Some larger transactions took place further afield such as Swatch’s acquisition in the US. As optimism grows, 2014 should see an increase in M&A activity.

Contrasting sharply with 2012, which featured transactions in the magnitude of USD11.9 billion and USD6.7 billion, the largest deal of 2013 amounted to only USD1 billion. Bearing out our prediction in the M&A Yearbook 2013, activity was driven by Swiss firms’ foreign expansion plans. Outbound acquisitions accounted for 42% of deals. This was in part due to a decline in inbound transactions at 19% (down from 33% in 2012) on the back of the strong Swiss franc and limited availability of attractive targets.

In Luxury Goods, the watch sector proved active in smaller deals, with Findos Investors’ acquisition of Roventa-Henex illustrating the attractiveness of Swiss precision engineering capabilities to foreign firms. Swatch undertook the largest, and potentially most significant, deal of the year by purchasing New York-based manufacturer and retailer of diamond jewellery and watches, Harry Winston. These deals bucked the trend of increasing caution in the global Luxury Goods market caused by a politically influenced slowdown in demand in China as well as ongoing issues in Europe and the US. They also demonstrate the importance of achieving scale to preserve market presence and enhance competitiveness.

While there was little change in domestic market share, Swiss Retailers remained active. Migros purchased Gries Deco of Germany while, closer to home, Migros’ subsidiary Globus acquired Lucerne-based clothing retailer Schild. The creation of the Orell Fuessli Thalia joint venture by merging retailers Thalia Buecher and Orell Fuessli Book Retailing meanwhile created Switzerland’s largest book retailer.

Food & Drink had a comparatively quiet year. Emerging from high levels of activity in 2012, many firms remain on the lookout for acquisition targets but none of the larger players concluded any transformative deals. One of the stars of 2012’s M&A scene, Barry Callebaut, was once again on the hunt for interesting assets, strengthening its position in Scandinavia by buying Danish chocolate product manufacturer and wholesaler Carletti. Swiss expansion in Europe was also furthered by Aryzta buying German frozen goods business Klemme.

Outlook for 2014

We expect 2014 to be a year of optimism, in part due to improving macro-economic developments in the US and Europe. Among the larger players, the outcomes of strategic reviews may bring non-core or underperforming business units to market, fuelling the supply of prospective deals. Vertical integration will remain a theme in the watch industry, although sizeable horizontal integration remains some time off.

Online Retail is a space to watch, as the proportion of online sales continues to grow. Greater prominence in the deal tables may be achieved as retailers look to acquire existing ecommerce businesses rather than tackling the tricky business of developing and promoting their own platforms. This is in line with deals seen previously such as the Nettoshop – Coop and Digitec – Migros transactions.

Substantial dynamism in food logistics may give rise to some interesting deals in 2014. As usual, it is the Food & Drink majors that have greatest potential firepower for acquisitions. However, as observed in 2013, their position at the top of the deal tables should not be taken for granted. (Patrik Kerler, Partner, Head of M&A)

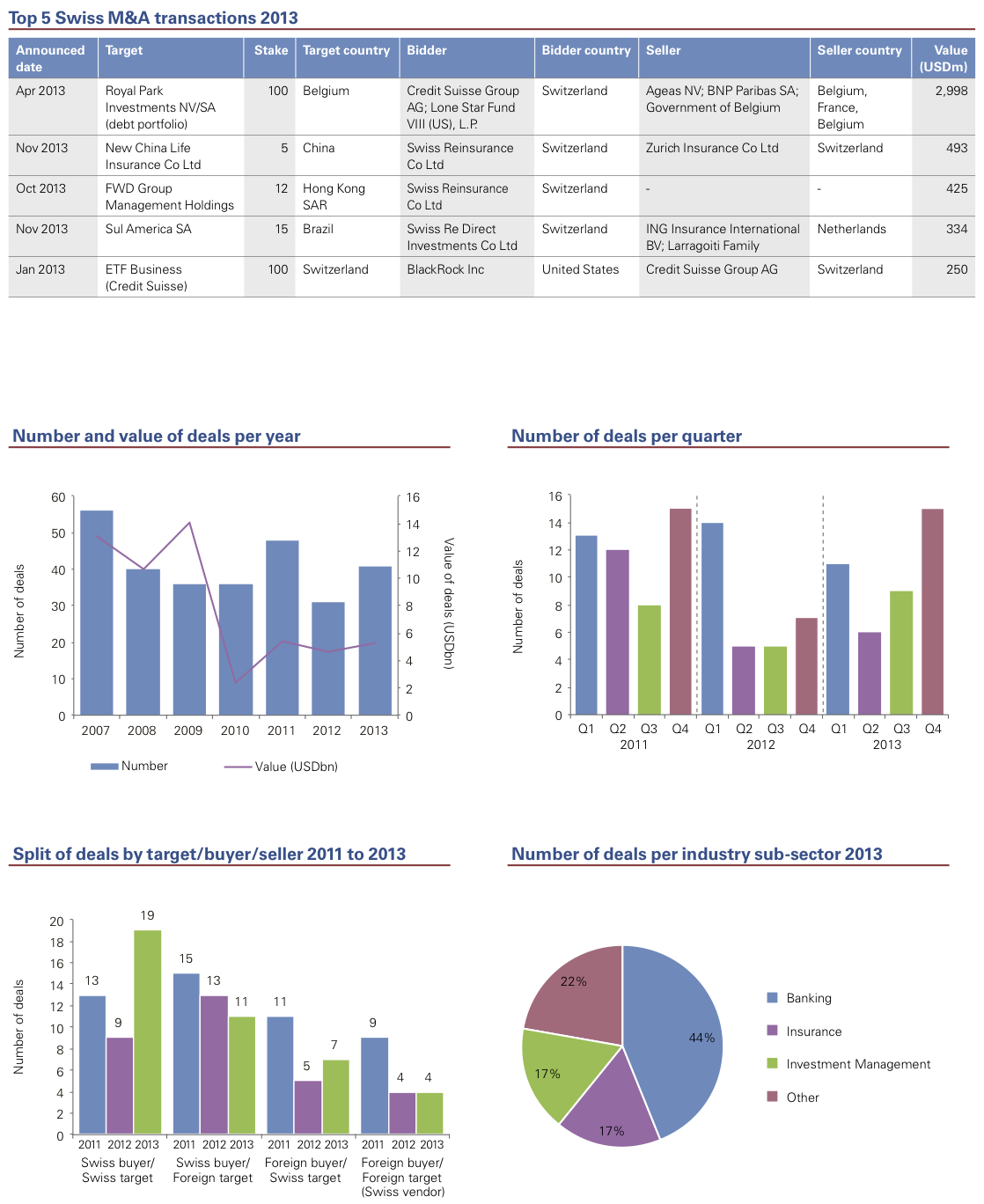

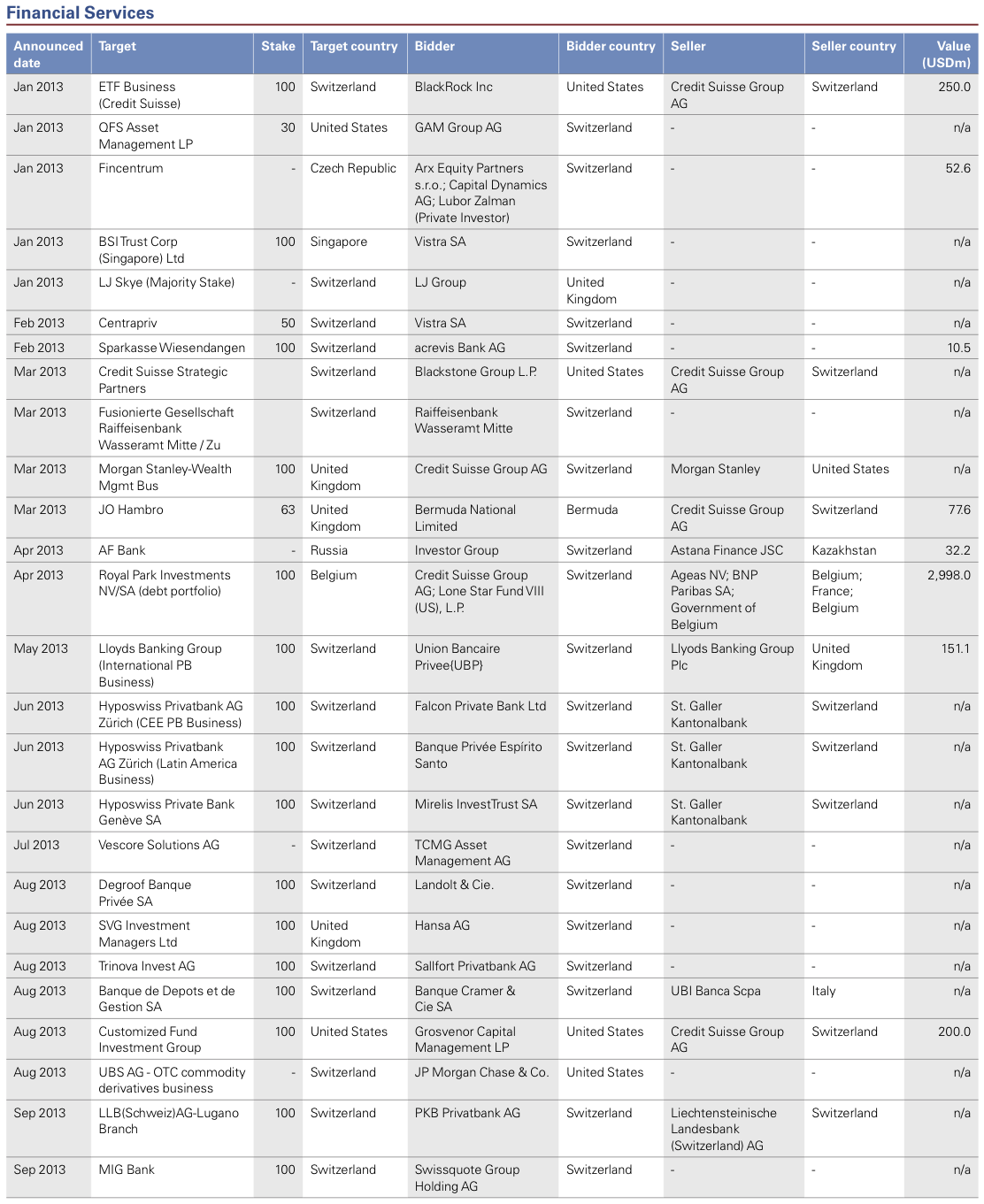

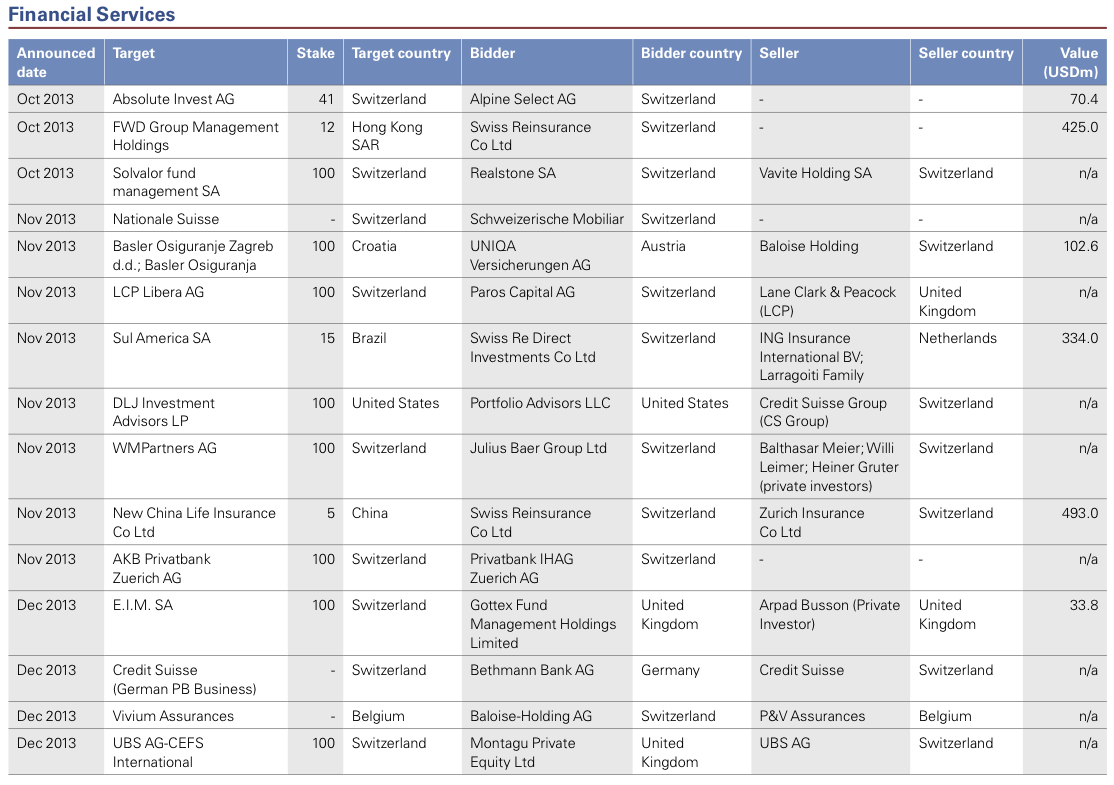

Financial Services

Consolidation of private banks and IAMs continued in 2013, with the number of Swiss private banking licenses falling to 141 from 171 in 2009. This should continue in 2014, as well as further liquidations and the sale of client portfolios. There are also signs of an impending consolidation among mid-tier insurers as the larger insurers pursue their global expansion plans.

Private Banking and Wealth Management was again the focus of activity, though at slightly lower levels than anticipated.UBP’s acquisition of Lloyds’ international private banking business illustrates how consolidation is being driven by scale ambitions among larger wealth managers and mergers and takeovers between smaller players. Margin pressures feed the pipeline of targets, exacerbated by smaller banks’ difficulties in conducting cross-border businesses and amid increasing regulation. Since 2009, the number of private banks with Swiss banking licenses has fallen by 17.5% from 171 to 141.

Increasing M&A activity was observed between IAMs, though at a relatively low level.Two notable deals were Sallfort’s acquisition of Trinova Invest, and Julius Baer agreeing to buy WMPartners Wealth Management. The latter will be merged with Julius Baer subsidiary Infidar Investment Advisory to create a new company overseeing in excess of CHF4 billion of client funds. This could be a sign of larger IAMs emerging from the ongoing consolidation.

Although Retail Banks benefited from strong demand for residential property mortgages, both UBS and Credit Suisse took the opportunity to divest non-core assets during the year. UBS sold its OTC commodities derivatives business to JP Morgan Chase and, in a bid to reduce the complexity of its operations, announced the sale of its Corporate Employee Financial Services International business to London-headquartered Montagu Private Equity. Credit Suisse meanwhile sold two units to US Private Equity houses (ETF to Blackrock and CFIG to Grosvenor Capital). This did not prevent the bank from considering acquisitions, however. Together with a Lone Star fund, it closed 2013’s largest deal, buying a portfolio of non-performing loans in the form of Royal Park Investments.

In the Insurance market, Swiss Re furthered its global ambitions, recording three of 2013’s five largest Financial Services deals. The group agreed to buy 14.9% of Brazil’s SulAmerica, 4.9% of New China Life Insurance and 12% of Hong Kong SAR-based FWD Group Management. Conversely, Baloise reaffirmed its focus on core markets by selling its Serbian and Croatian operations. In what may signal the start of consolidation among mid-sized insurers, Mobiliar increased its stake in Nationale Suisse to almost 20%.

Outlook for 2014

Private Banking consolidation should progress as larger wealth managers continue to grow and smaller ones seek to gain scale. Commercial and margin pressures will continue to bite, causing some banks to be put up for sale. Some foreign banks may decide to sell their Swiss subsidiaries, bringing interesting assets to market. The US Tax Program may help drive these trends, as banks face considerable costs in analyzing client data to identify untaxed US clients.This may trigger decisions even among players not heavily affected by the US Tax Program, as they consider their strategic direction and whether they wish to stay in the Swiss market. More are expected to follow Wegelin and Frey into liquidation.

2014 will also see more IAMs bring forward succession plans due to challenging market conditions and increasing regulatory requirements.

M&A activity by UBS and Credit Suisse is likely due to an ongoing streamlining of portfolios. Larger insurers such as Zurich Insurance Group and SwissRe may also continue to act on ambitions for greater global scale, in particular additional footholds in high growth markets. (Christian Hintermann, Partner, Head of Transactions & Restructuring Financial Services)

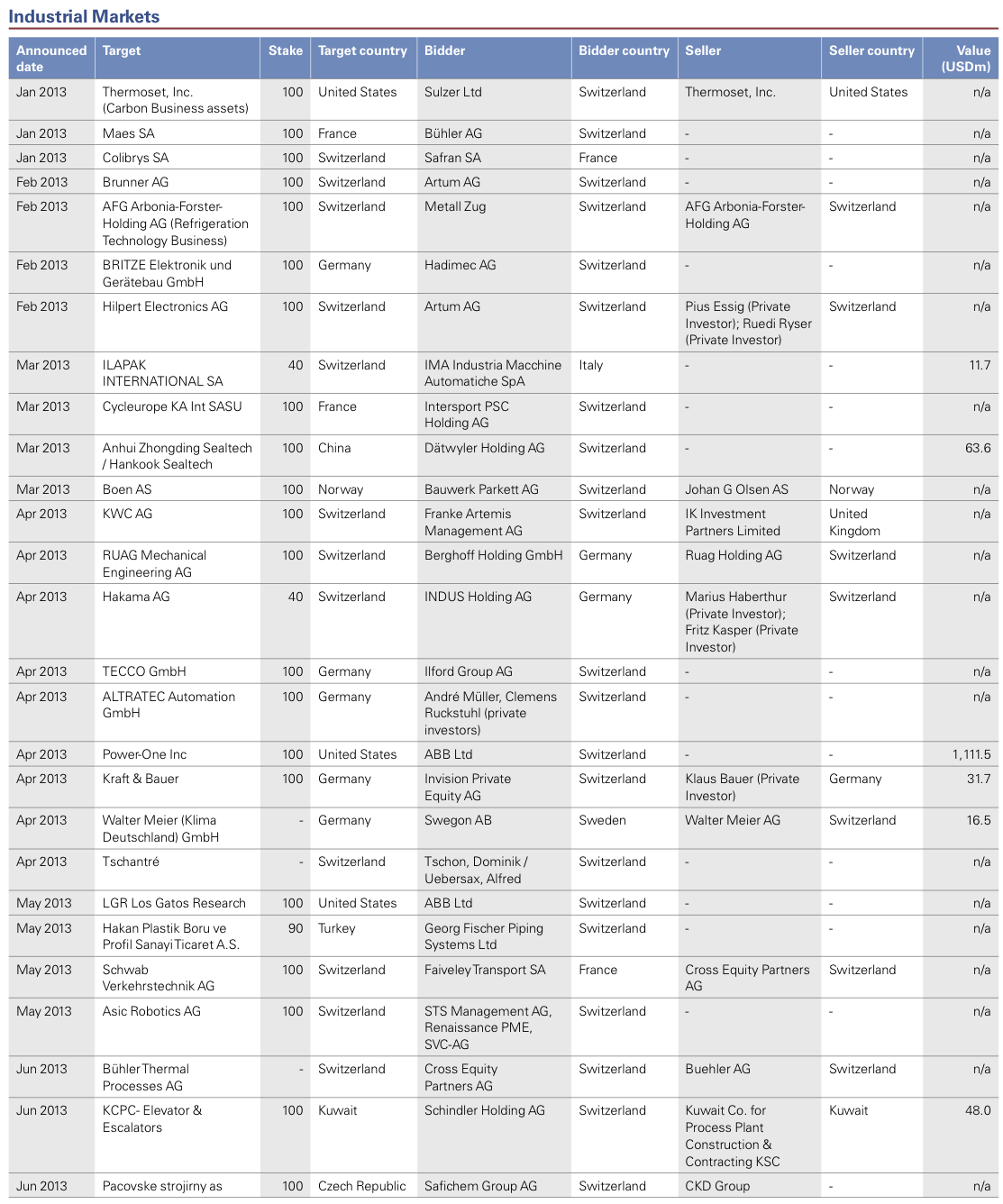

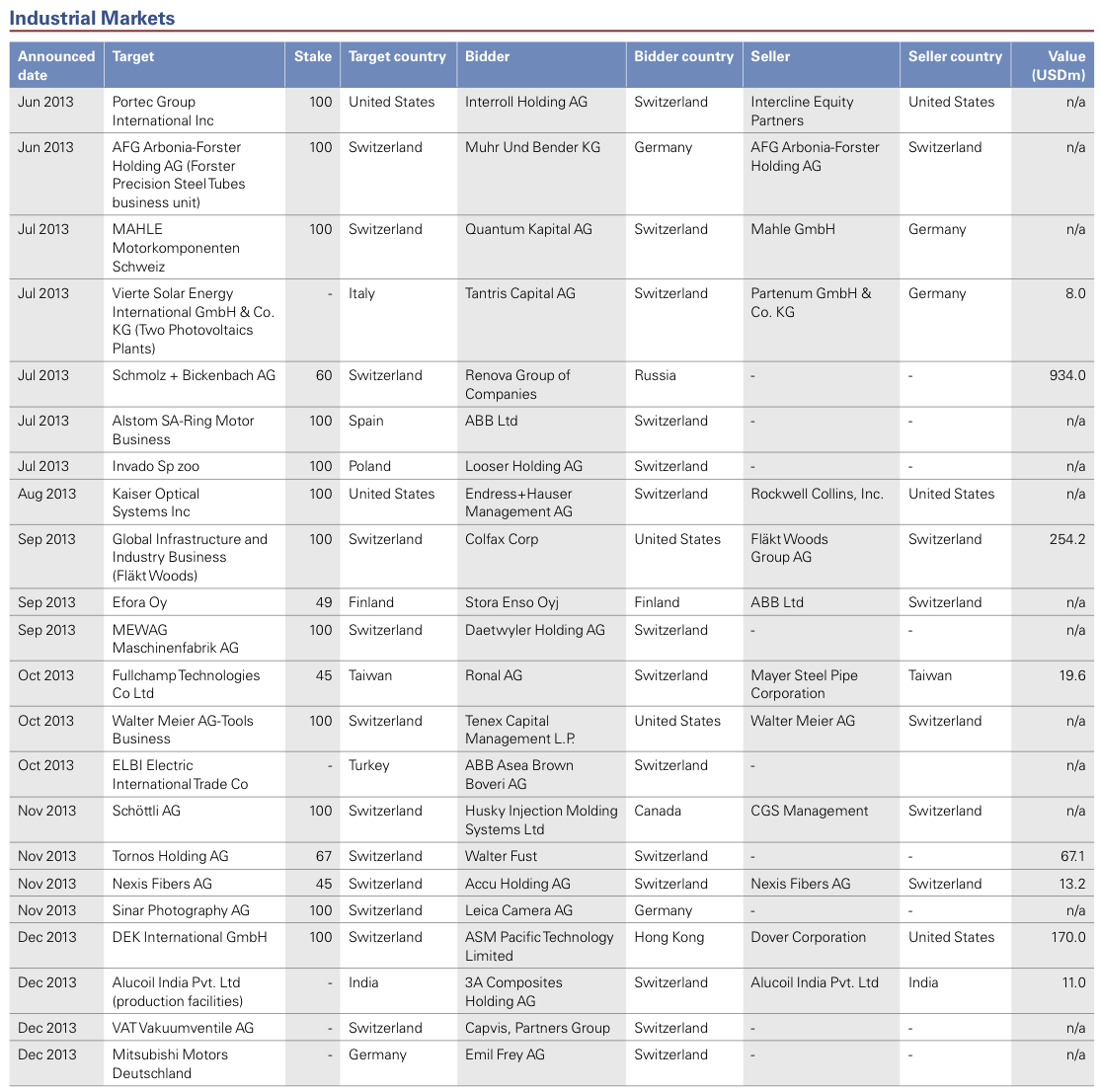

Industrial Markets

Characterized by caution among prospective buyers, 2013 saw Swiss industrial groups continue cleaning up their portfolios. This gave rise to a number of strategic divestments. Activity was otherwise limited to largely lower value transactions that represented opportunities to reinforce core businesses.

As in 2012, risk aversion, cash preservation and continued operational improvement efforts again prevailed in 2013 for most global Swiss Industrials. This led to below average deal activity both in terms of number of deals and overall deal value.

Detailed strategic reviews, which have been ongoing for some time, yielded some interesting transactions. Seeking to optimize its portfolio by divesting non-core assets, for instance, Walter Meier sold both its US tools division and its German climate products business to a US private equity firm and to Sweden’s Swegon respectively. AFG meanwhile continues its reorganization into three distinct business units.This saw it take the opportunity to dispose of its precision steel tubes and refrigerator technology businesses while announcing the planned sale of its surface technology unit. Sulzer also made public its intention to divest its surface solutions business, Sulzer Metco.

Perhaps the most notable transaction was ABB’s purchase of Power-One, making the group a global leader in the solar photovoltaic inverters market. It is worth mentioning that this was the only Industrials deal in 2013 to exceed a transaction value of USD1 billion.

Valuations are holding at generally acceptable levels, declining to overheat despite record stock market highs in many countries. This underpins the prospect of upcoming M&A activity, especially given the solid market for good quality assets. Buyers are still proving picky, however, as caution dictates that any acquisitions must be as near perfect a fit as possible into existing portfolios.

Outlook for 2014

High growth markets remain high on the agenda, but ambitions are frequently thwarted by substantial price expectation gaps. Many prospective buyers consider targets to be simply too expensive. Some Swiss Industrials are placing greater emphasis on organic growth due to this impasse, a shortage of available targets, and diverging views on optimal growth strategies. Although open to looking at reasonably priced acquisition targets, they are equally comfortable establishing their own operations in high growth economies. This is likely to restrict outbound acquisitions in 2014, particularly by stronger brands for which Greenfield investments are more feasible.

Should attractive targets arise at the right price, however, disposals over 2012 and 2013 have given many Swiss industrials comfortable cash reserves and made some impatient to put those reserves to better use. As a result, many would be in a position to move quickly to secure an interesting asset.

Cash-rich players’ hands are also strengthened by a general aversion among Swiss industrials to taking on excessive bank debt. For well-funded Industrials for which acquisitions do not come to pass, the market may see more of them initiating share buy-backs over the course of the year. (Timo Knak, Partner, M&A)

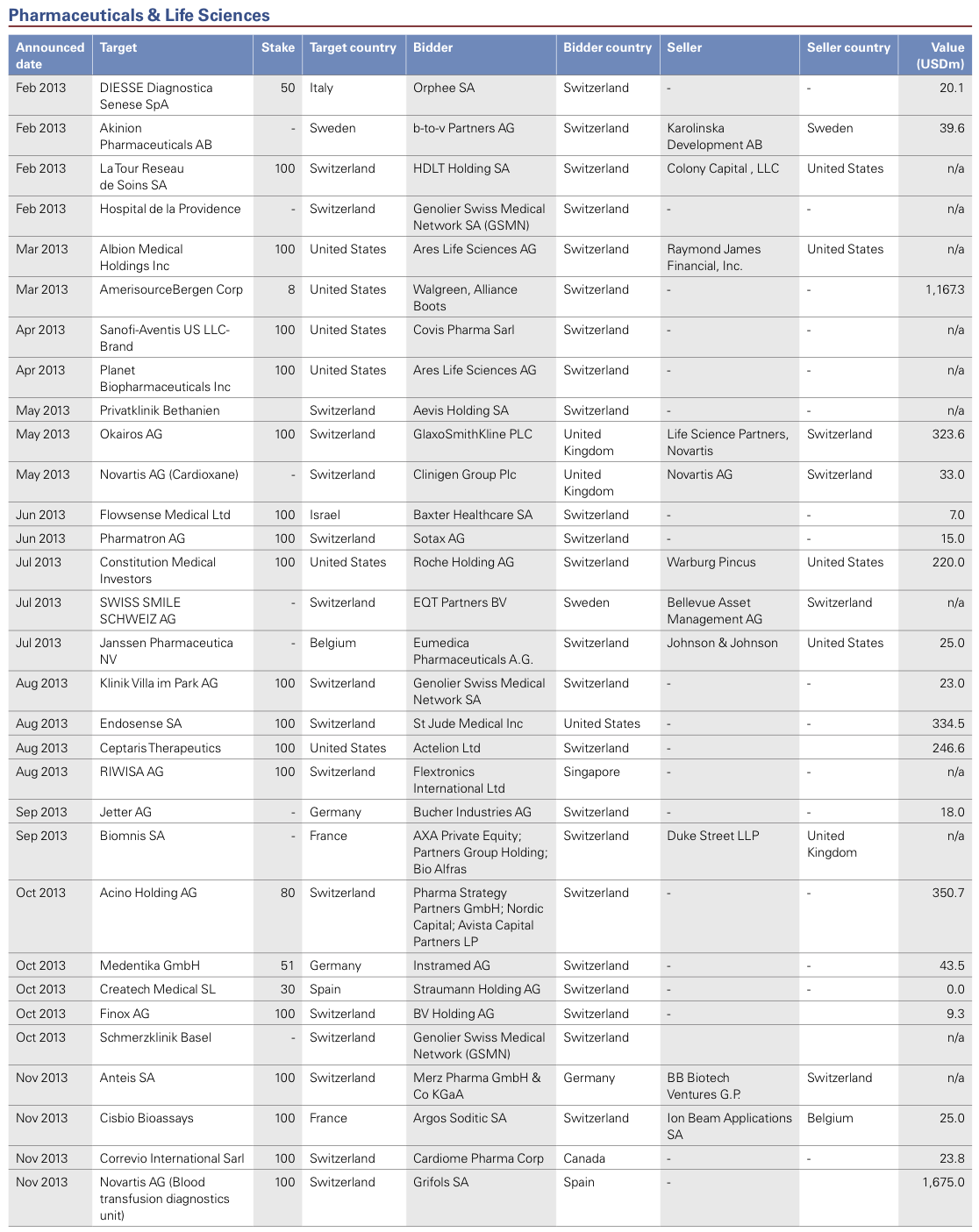

Pharmaceuticals & Life Sciences

The major players stayed away from mega-deals in favor of ongoing scrutiny of their existing portfolios, as typified by Novartis’s disposal to Grifols. Acquisitions were smaller, bolt-on transactions, such as Roche’s purchase in the US. This trend should endure through 2014, with divestments generating the most notable headlines as firms focus on areas where they have critical scale and/or technological leadership.

Deal volumes recovered from their 2012 dip to return to levels broadly in line with 2009 to 2011, although deal values in 2013 were generally lower. The continued absence of mega-deals in the Swiss market mirrored developments on a global basis. The more substantial transactions that completed arose largely from ongoing portfolio assessments, as the larger drug makers actively divested in order to focus on their core businesses.

One such divestment was 2013’s largest deal in this sector – the sale of Novartis’s blood transfusion diagnostics unit to Spain’s Grifols for USD1.7 billion. Subject to regulatory approval, this transaction is due to complete in the first half of 2014. Novartis also disposed of a small legacy Cardioxane oncology product to Clinigen. Alongside other investors through its venture capital arm, Novartis also successfully sold a genetic vaccines start-up, Okairos, to GSK for EUR250 million. There is much press speculation about the possibility of the group making further disposals in the coming year.

An acquisitive mood was not completely absent among Swiss dealmakers, however. Players remained on the lookout for bolt-on acquisitions to strengthen their market presence or deliver complementary technology. One such case was Roche’s purchase of US medical testing service firm Constitution Medical Inc, which at USD220 million bolsters Roche’s haematology offering in its diagnostics business.

No review of the Swiss Pharmaceuticals scene would be complete without looking at domestic transactions, which generated a steady deal flow over the year. A particular focus was on private clinics. Genolier reinforced its position as the largest clinic network in the Suisse Romande by acquiring La Providence hospital, and strengthened its position in the Deutschschweiz through its acquisition of Klinik Villa im Park.

Outlook for 2014

The story in 2014 is likely to closely resemble that of the past 12 months.The cleaning up of portfolios is expected to accelerate. Divestments may center on non-core brands and businesses that are beginning to require excessive investment and attention to justify relative earnings to their present owners. This should free up funds and management time to better maintain strong core units, build growth momentum and act on global scale ambitions.

Swiss players will meanwhile remain attractive to overseas players seeking to acquire specialist technologies and know-how. Further deals may be observed along the lines of 2013’s acquisition of Endosense and Acino.

There are market expectations of further divestments by Novartis, while it, Roche and others remain committed to substantial future growth outside Switzerland by both organic and inorganic means. (Joshua Martin, Director, Transaction Services and Tobias Valk, Partner, Head of Transaction Services)

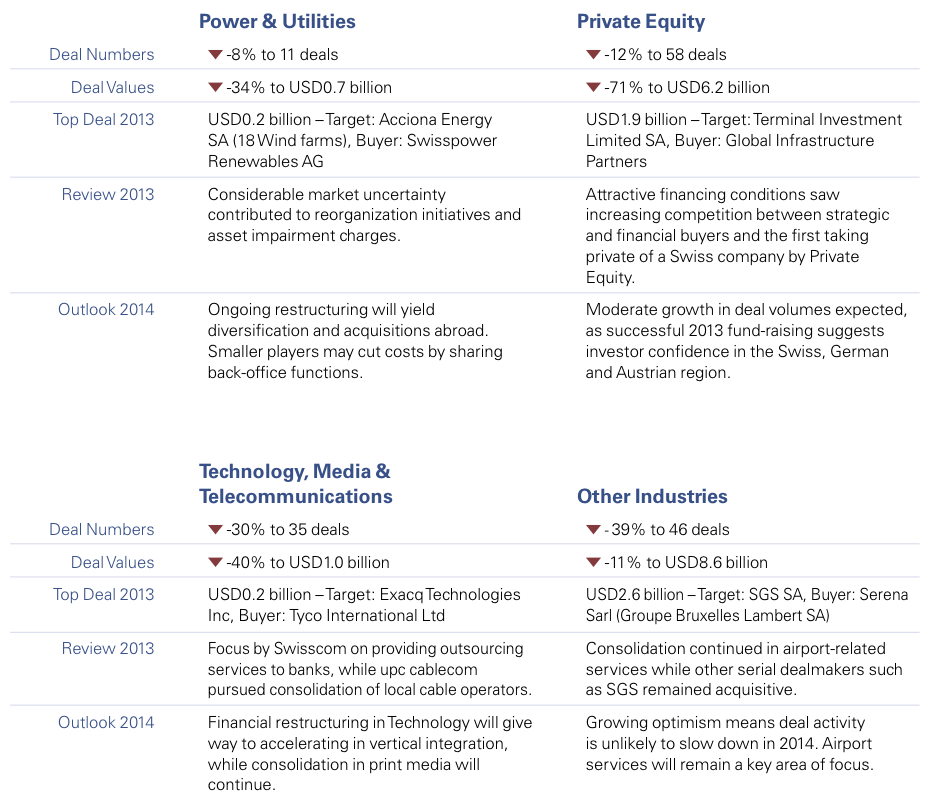

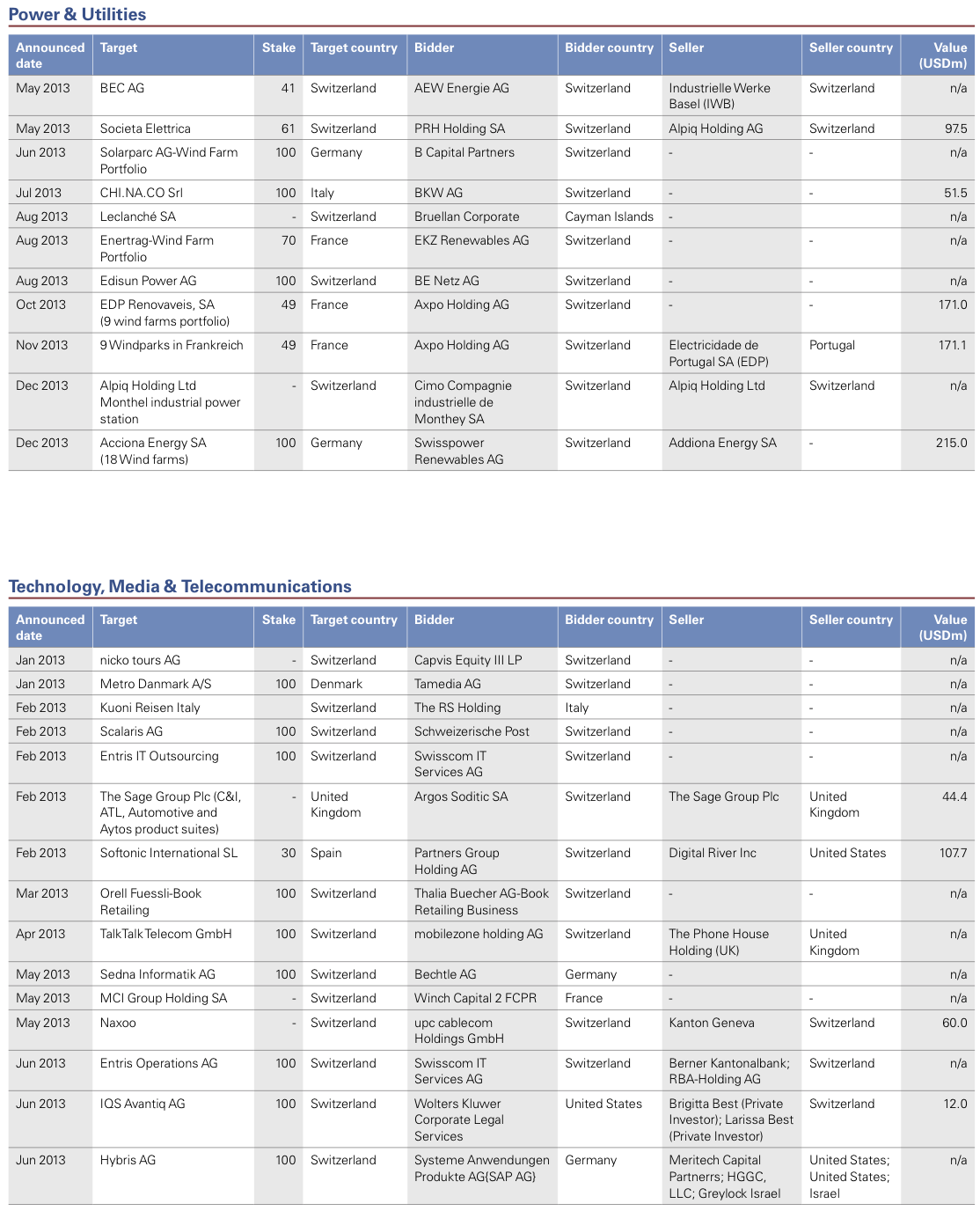

Power & Utilities

Refocusing of portfolios continued as uncertainty persists over the future of the Swiss energy market and the implementation of the Energy Strategy 2050. Limited activity abroad by Swiss players is expected to continue in the renewable space, while some local electricity operators will further consolidate back-office functions as preparation for full market deregulation.

Regulatory changes and planned energy market shifts are giving rise to significant uncertainty over the future direction of an already challenging Swiss energy environment. Questions remain over how the government’s Energy Strategy 2050 will be put into practice, including whether the planned closure of the country’s nuclear power plants will take place as scheduled, and what impact this will have on altering the energy mix further towards renewable sources.

The regulatory and commercial pressures are also impacting firms’ balance sheets. Axpo announced an impairment charge for 2013 of CHF760 million. Repower meanwhile confirmed in December 2013 that it will record a one-time impairment charge of around CHF220 million relating to a combination of ongoing power generation projects, long-term contracts and other generation assets. The group also delayed the planned 2013 start of construction on its pump storage facility at Lago Bianco in northern Italy to 2019 at the earliest. This reflects the travails facing Swiss hydro pump storage operators, demand for whose output is being significantly substituted during peak hours by subsidised surplus solar power imported from Germany.

Against this backdrop, some of Switzerland’s larger energy businesses are actively reorganizing their extensive portfolios, seeking strategic divestments while considering selected acquisitions to support longer-term objectives. Alpiq sold its stake in Repower to the two primary existing shareholders, Axpo and the canton of Grisons, while SES Holding bid for the remaining 39% of shares in Locarno-based distributor Societe Elettrica Sopracenerina after purchasing the initial 61% from Alpiq. Axpo’s sights appeared firmly set on wind power, acquiring a 49% equity shareholding and shareholder loans in a 48-turbine wind farm portfolio in France with a combined installed capacity of 100MW.

Outlook for 2014

On the back of its purchase of five small run-of-river hydropower plants in Italy from A2A, BKW has re-affirmed its ambition to diversify its portfolio by stepping up investments abroad as well as investing in energy ventures including oil and gas.

Alpiq’s ongoing efforts to optimize its portfolio come with its chairman’s commitment to reposition the group strategically. Hydropower will remain a high priority, as will further investment in European renewable energy facilities, which may well see it pursuing acquisition opportunities. At the same time, strategic considerations may give rise to the group planning the divestment of some of its power plants outside Switzerland.

Having generated some noise in recent years, Swiss interest in Spain’s solar power industry is likely to be quieter going forward. Despite remaining interested in principle, Swiss investment appetite is dampened by uncertainty in the Spanish energy market, such as that arising from retroactive tariff adjustments. An emerging trend is Swiss firms taking minority stakes in energy consortia in Spain, though we expect this to remain the exception rather than the rule given the relatively high cost compared to investment returns.

Closer to home, 2014 is likely to see smaller, local energy firms pursue the sharing of back-office functions in order to manage margins in this tricky and uncertain market. (Sean Peyer, Partner, Head of Power & Utilities)

Private Equity

With prevailing market conditions being conducive to Private Equity activity, banks are increasingly favorable to funding buy-outs. As valuation and debt multiples continue to rise, 2014 should see moderate growth in deal volumes driven by substantial undeployed capital, although tempered by ongoing caution.

Life again became more comfortable for fund managers as banks continued to become more flexible in funding buy-outs. While debt levels have not hit 2007 highs, total financing levels of 4.5 times EBITDA are now almost common, and in some instances even exceed 6.0 times EBITDA. Despite easier access to finance and the fact that many firms are sitting on substantial undeployed capital, managers remain selective regarding the acquisitions they pursue. This resulted in moderate deal activity in 2013 combined with intensive competition for attractive assets.

An interesting transaction was Capvis’ and Partners Group’s acquisition of VAT Holding, a manufacturer of vacuum valves whose exports are destined largely for Asia and North America. This deal indicates on the one hand that Private Equity is again able to successfully compete for strategically interesting assets and on the other hand that mid-cap funds are willing to consider more creative collaborations to successfully tackle larger transactions and be more innovative in financing arrangements. Partners Group’s subsequent acquisition of Hoffmann Menue from Gilde Buy Out Partners demonstrated its commitment to further strengthen its direct investment business.

In an historic first, Swiss drugmaker Acino was taken private by Avista Capital Partners and Nordic Capital. Whether this deal heralds the start of a new trend remains to be seen, although it will have raised awareness among boards and investors of this strategic option and is a reminder that the general legal hurdles to such a transaction in Switzerland are no greater than in many other countries.

Capvis, Equistone and Invision were among the Swiss Private Equity houses that successfully raised new funds in 2013. The focus of these firms on the German, Swiss and Austrian markets suggests generally positive investor sentiment towards the region. A scarcity of suitable prospects in these markets might threaten any substantial growth in deal volumes, however, and might force some houses to look further afield for potential targets.

Outlook for 2014

We expect M&A activity to grow gradually over the course of 2014, resulting in a moderate uptick in deal volumes by the end of the year. Persistent caution may be offset by attractive financing terms and funds seeking homes for their newly raised capital.

Overall insufficient deal flow, however, may result in many managers starting to look beyond their traditional borders at geographical regions in which they have previously not been active, such as Capvis’ expansion into Italy by acquiring Arena, one of the world’s leading aquatic sports brands.

Succession issues among small and mid-sized corporates in Switzerland and its neighbors should help fuel the supply side. In addition, Private Equity portfolios contain some promising assets. Exits in 2014 could result in secondary buy-outs or even IPOs given the continuing climb of stock market values. (Timo Knak, Partner, M&A and Tobias Valk, Partner, Head of Transaction Services)

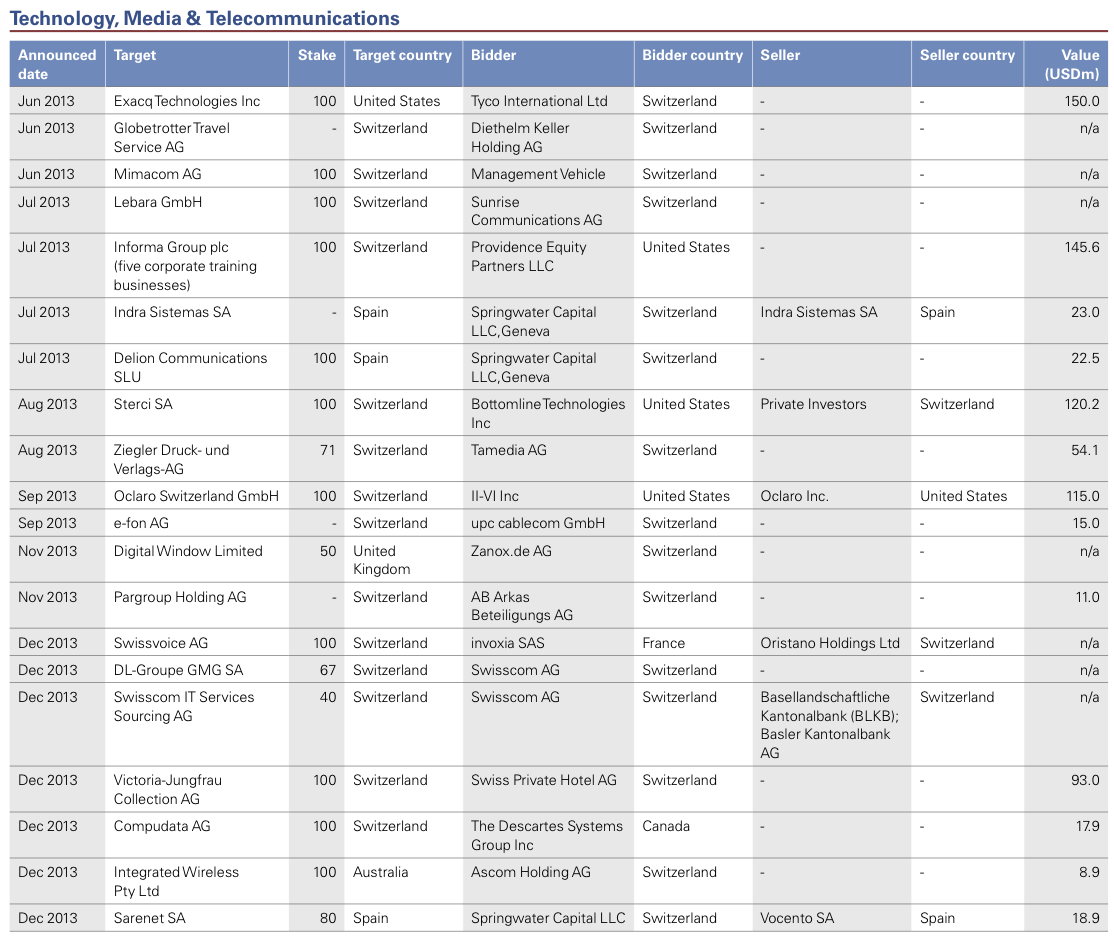

Technology, Media & Telecommunications

Consolidation advanced in media and the cable industry while Swisscom acted to strengthen its position as an outsourcing service provider to banks. Deals in the print industry reflected a continued refocusing on digital media and advertising. This looks set to continue in 2014 together with vertical integration in the Technology market.

Consolidation among Media players centered on the printing industry as firms sought to maintain scale in their core businesses while building presence in digital media and advertising.Two deals illustrate each of these trends: academic journal and newspaper publisher Informa’s divestment of five corporate training businesses to US-based Equity Partners, and Tamedia increasing its stake from 20% to 90.5% in publisher Ziegler Druck and Verlag.

With many Technology firms undergoing financial restructuring, acquisition activity was muted, although players remained open to selective deals that support their strategic objectives. Since exiting the ST-Ericsson joint venture, ST Microelectronics is investing attention in strengthening its core product offering and market position. Ascom meanwhile is looking to expand its geographical reach, as demonstrated by its acquisition of Australia-based Integrated Wireless, as well as building its presence in the healthcare sector.

UPC cablecom led the consolidation of smaller cable companies, buying a 51% stake in Telegeneve subsidiary Naxoo (subject to a referendum in February 2014) and 49% in e-fon, a leading provider of VoIP technology for businesses in Switzerland. Elsewhere in Telecoms, Swisscom bolstered its capabilities as a service provider to the banking industry, expanding its IT operations business and business process outsourcing by acquiring Entris Banking and Entris Operations. It also announced in December 2013 the buy-out of the remaining 40% stake in its processing center for banks, Swisscom IT Services Sourcing, from current minority shareholders.

Outlook for 2014

We expect print Media to throw up some interesting deals, including Tamedia and Ringier’s planned divestment of Le Temps. The wider shake-up in the print industry will sit alongside ongoing restructuring of advertising in print media, possibly resulting in the streamlining of portfolios and stimulating M&A activity in digital advertising.

Following a period of restructuring and introspection, 2014 may see Technology players re-energized to pursue growth. Ambitions persist to expand footprints in Asia, though 2014 is likely to be too soon for any significant activity in this regard. Closer to home, further consolidation is expected in IT consulting and in business process outsourcing for banks. SaaS and cloud computing remain hot topics and may generate some transactions, while in the broader software sector firms such as Ascom and Temenos may continue vertical integration efforts as well as opportunistic acquisitions. Attention should be paid to Ascom’s strategy following ZKB’s exit of its 27% stake in the company, and the impact of Blackrock and institutional investors’ influence on the business’s future direction. More generally, an interesting development to watch will be the expected uptick in early stage financing in Swiss technology firms.

In Telecoms, the consolidation of cable operators should yield a series of predominantly local transactions, such as the ongoing UPC cablecom – Naxoo transaction in Geneva. While other major players may once again actively seek bolt-on acquisitions, it remains to be seen whether 2013’s return to higher M&A activity in the global Telecoms sector (with deal values exceeding USD250 billion) will influence the Swiss market over the coming year. (James Carter, Director, Transaction Services and Adrian Bieri, Director, M&A)

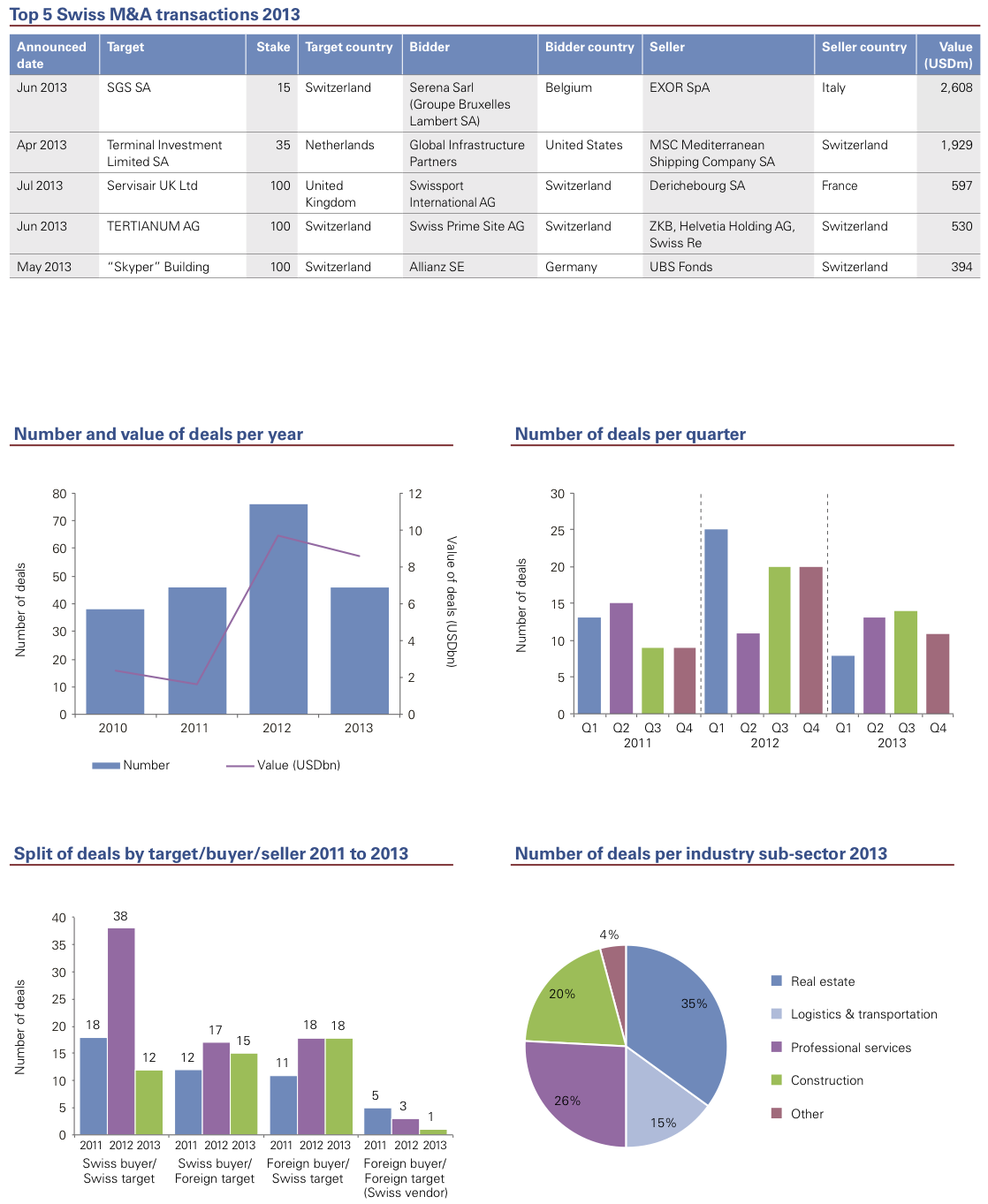

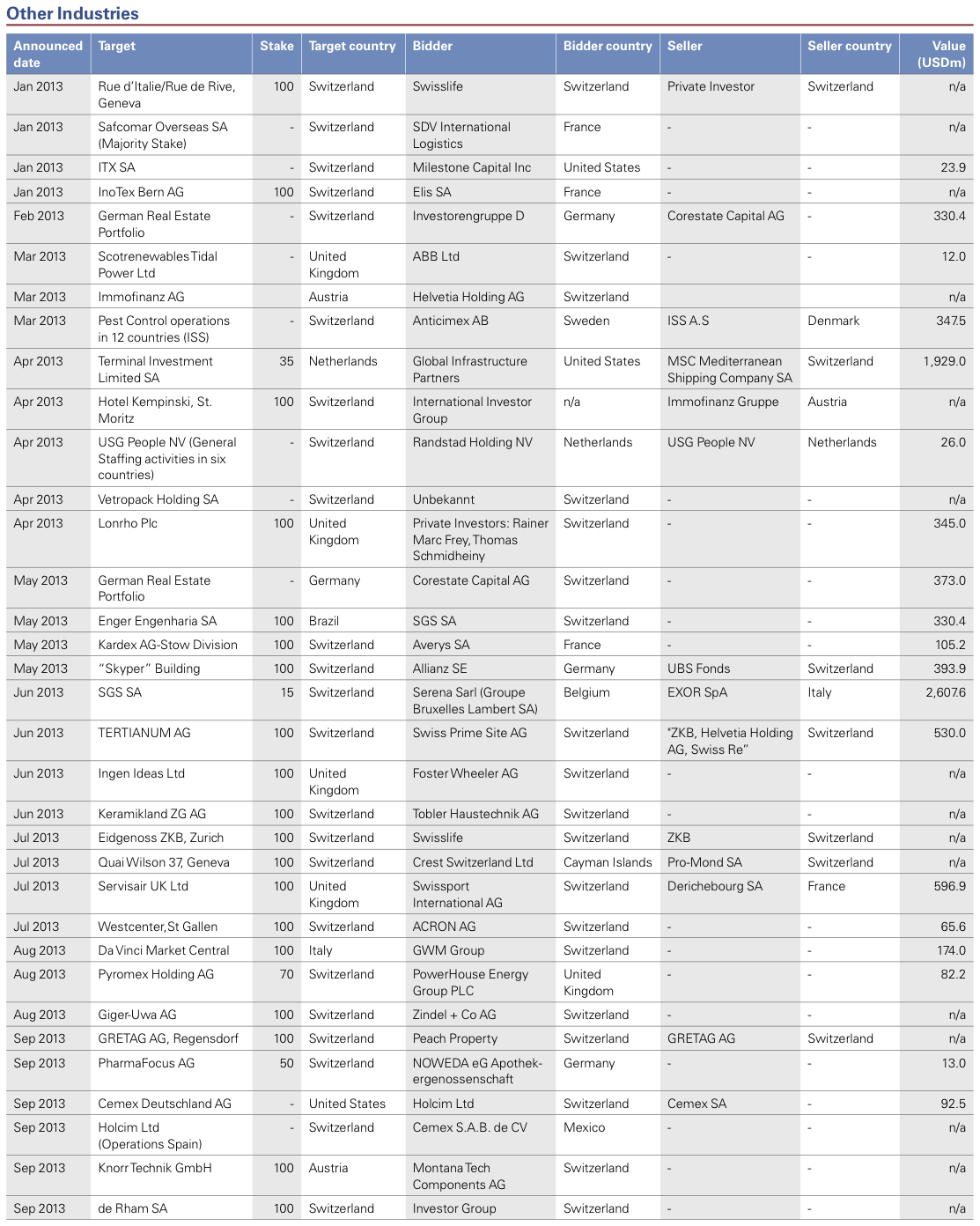

Other Industries

Ongoing globalization of airport-related services led to further consolidation during 2013. Across many industries, cross-border transactions look set to grow as foreign interest in Swiss targets remains strong and Swiss businesses hunt globally for growth opportunities. In this regard, SGS is and will remain firmly on the acquisition trail.

In Transportation and Logistics, it was airports and related services that led the M&A charge as consolidation gathers pace and many Swiss players pursue foreign assets. Airport operators showed a willingness to enter into partnerships to achieve their growth ambitions, with Flughafen Zuerich, Flughafen Muenchen and others joining forces to win the concession to extend and operate Brazil’s Confins International Airport. The consortium, in which Flughafen Zuerich owns a 24 percent stake, will hold 51 percent of the Brazilian airport company. Swissport meanwhile agreed to buy cargo handler and airport transfer service provider Servisair UK Ltd. 2013 proved to be another quiet year for road haulage and logistics, however, as both Panalpina and Kuehne & Nagel kept their distance from the deal tables.

Reinforcing its global footprint, SGS once again ranked among the serial dealmakers in Professional Services, undertaking more than ten smaller transactions around the world, including in China, Brazil, Australia, New Zealand and closer to home in Germany.

Perhaps due to the still buoyant Swiss Construction and Real Estate sector, with resultant high levels of activity across the country, the sector yielded comparatively few M&A transactions. Completed deals revolved around portfolio optimization and the building of scale. The world’s two largest cement producers effectively “swapped” assets in order to strengthen existing operations, with Holcim buying Cemex Germany while selling Holcim subsidiary Cesko to Cemex.

Outlook for 2014

Optimism in M&A circles appears to be growing as 2014 starts, despite ongoing economic uncertainties in many major foreign markets. Airports and related services look set to remain a key area of activity given the global ambitions and potential acquisition firepower possessed by many industry participants.

Swiss technical know-how, together with the country’s macro-economic performance and political and fiscal stability, should sustain healthy levels of foreign interest in acquiring Swiss firms.The supply of targets may be fed by succession issues at small and mid-sized Swiss firms, and there is a chance that succession plans will be brought forward depending on developments in Switzerland and the Eurozone.

Outbound interest by Swiss buyers also looks set to stay strong. The best positioned acquirers in 2014 may well be the ones who can pay with their own shares, though this remains to be seen depending on how stock markets move over the course of the year. (Rolf Langenegger, Director, Valuation Services)

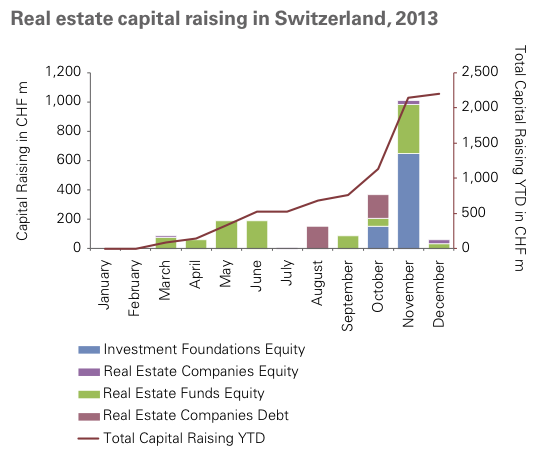

Levelling off: the price trend for Swiss investment property plateaus

In a reversal of fortune after years of continuously rising demand, prices for commercial investment properties are showing signs of weakness. Residential property prices meanwhile continue to climb, though pressure is observed in the luxury apartment segment. Despite this, construction of Swiss real estate continues at high levels, with the risk that supply may outstrip demand in some areas.

The Swiss investment property market remains highly active and sought after, continuing to attract investors through solid investment prospects and steady yields. While institutional investors such as insurers and pension funds in particular enjoy individually superior firepower, they are competing against a host of private individuals whose eyes remain fixed on real estate due to ongoing uncertainties in other markets. Demand for apartments in the economic centers is fuelled by stable net immigration into Switzerland of around 80,000 people per annum. Prices are climbing to heights that cause even enthusiastic property investors to shift uncomfortably in their seats and question for how long this trend can endure.

Office space: increasingly sub-optimal performance

At least that is the picture in Grade A locations. It is starkly different for peripheral areas and for commercial properties more generally. Prices for such properties are losing ground, with sub-indices lying in the negative range. Even in traditionally solid urban locations, demand is heavily impacted by uncertainty in the global economy. Structural transformation in such as the banking industry also plays a part as organizations seek to become leaner, optimizing and centralizing their use of space. Vacancy rates are therefore growing in some areas.

The hardest hit properties are in Grade B locations, especially buildings that require high capital expenditure. Increasing marketing periods are observed for older rental space with inflexible layout and sub-optimal accessibility. Even discounts on sale prices are sometimes insufficient to secure interest unless leases contain adequate covenants. Over the medium term, larger units may need to be subdivided into smaller ones for which demand in city centers is more robust.The work involved, however, may not be recovered through higher rents.

Residential property: an unaffordable luxury?

Switzerland has performed relatively well economically in recent years. The Suisse Romande in particular has seen an influx of international businesses. This led to an uptick in the construction of expensive apartments, yet prospective clients are now proving unwilling to splash out unnecessarily on high-end price levels. Legal and tax uncertainties due to international negotiations as well as steadily increasing living costs are also causing some multinational corporations to consider whether they might relocate abroad, taking senior management with them. Should this happen, the impact on office vacancy rates and on residential property might be dramatic. At 6.3% and 4.5%, office space availability rates in Geneva and Lausanne are already substantially higher than the Swiss average of 3.4%.

Demand for residential properties has shifted also due to self-regulation measures in the financial services industry, which see banks requiring a minimum cash deposit of 10% and amortization of the mortgage to two-thirds of its initial value within 20 years. Further, it is no longer accepted that individual purchasers make extensive use of their pension for this purpose, which hinders the ability of insufficiently cash-rich buyers to make up the shortfall.

Regulatory impacts

Observers also have an eye on what effects Basel III will have on affordability, including discussions to increase the countercyclical capital buffer (CCB), a pre-emptive measure that requires banks to gradually build up capital as imbalances develop in the credit market. Seeking to protect against the consequences of excessive credit growth, such measures increase the cost of providing credit and may cause mortgage rates to rise.

Revisions to the Spatial Planning Act may serve to restrict development zones. As well as limiting development rights, a capital gains tax of 20% will be levied on landowners in affected areas on whose land new construction takes place. Swiss voters have also approved a law to restrict the construction of holiday homes to 20% of residential areas and of an individual commune’s total surface area, heavily impacting touristic areas.

In a further development, the introduction of IFRS13 brings with it much discussion over balance sheet values. The standard requires landlords to appraise the highest and best use of properties, including whether sub-division could yield higher values. However, the overall impact has to date been minor.

For some, diversification is the name of the game

The combined results of these developments on corporate activity are mixed.The perceived scarcity of opportunities in Switzerland has for instance caused Intershop Holding to take a greater interest abroad via its new stake in Corestate Capital, which focuses on German real estate. 2013 saw Swiss Prime Site (SPS) acquire Tertianum, the leading company in the Swiss assisted living segment and elderly care. This purchase strengthens SPS’s role in a segment that features solid earnings stability and above-average growth potential. Swisslife has entered into a pre-purchase agreement for the “The Circle” development project at Zurich airport.

Despite concerns of the heatening real estate market in Switzerland, the last three months of 2013 saw a continuing trend of capital raises in real estate companies, funds and investment foundations, with approximately CHF1.5 billion being raised. Zurich Insurance Group has meanwhile placed a new investment foundation (Immobilien Europa Direkt) with European core and core+ assets and is raising new capital on top of the CHF200 million it already manages.

In a sign that confidence is not an ever-increasing commodity, however, the IPO of Ledermann Immobilien, which holds a focused portfolio in A-grade Zurich locations, was shelved in October 2013. This was seen as an initial indicator of a return of caution, calm and rationality to the Swiss real estate market. (Ulrich Prien, Partner, Head of Real Estate)

The Suisse Romande: transforming through M&A

The Suisse Romande has in recent years attracted a sharp influx of multinational corporations, helping make it the fastest-growing region in Switzerland economically, and complementing the expansion of its world-renowned luxury goods and precision engineering industries. Regional M&A activity in 2013 was brisk and is expected to increase this year, reflecting the consolidating forces affecting the region’s key industries.

Representing around 20% of both Swiss GDP and M&A deal flow, the Suisse Romande has witnessed strong growth in recent years, underscoring its position as a hotbed of activity, innovation and growth.

International trade fuels the region’s economy, so it is hardly surprising that the region is home to some of the world’s most famous corporate brands such as Nestlé, Cargill and Richemont. Such companies also generated some of the region’s largest M&A transactions in 2013, with major geographical expansion by Swatch, Philip Morris (PMI) and SGS. The number of multinational corporations in the region has tripled over the past 30 years and is estimated to have contributed 22% of Geneva’s GDP in 2010. These multinational organizations bring with them high-income senior management teams who spend on real estate, discretionary goods and services. It is no coincidence that in the Swiss areas around Lake Geneva, more children attend private schools than in any other part of Switzerland.

This influx of skills and resources also supports a strong innovative culture. The Suisse Romande is experiencing an unprecedented rise in the number of start-ups, particularly in medtech, biotech, IT and robotics. Lausanne alone saw 102 start-ups set up in the five years to the end of 2012. The sale of Endosense is a testament to the region’s start-up credentials. Set up in Geneva in 2003, this medtech company attracted a price tag of CHF309 million when it was acquired in 2013 by global medtech player St Jude Medical.

Global players: a valuable commodity

In a remarkable development, commodity houses have moved from a very low base to represent 10% of Geneva’s GDP by 2010. Cargill and Louis-Dreyfus Commodities are now household names due to the substantial media coverage their growth has generated. From 50% of the world’s coffee and sugar trades to 35% of the world’s oil-based transactions, cereals and rice trades, Geneva-based firms handle colossal volumes. Despite forecasts of continued growth, margins in many trading activities are thinning. As a result, business models are shifting as firms seek to occupy key positions in commodity supply chains in a bid to enhance profits. This is resulting in considerable outbound M&A activity with acquisitions from Trafigura and Puma Energy being among the top ten regional transactions of 2013.

Watching future growth

An equally high profile yet more established industry in the Suisse Romande is watch making and its supply chain. Exports broke the CHF20 billion mark in 2012 for the first time. The sector has been a key export motor for the region for most of the past ten years, prospering from high sales to Asian markets, though growth in Chinese demand is now slowing.

Developing out of the foundations of the watch making industry, medtech is widely recognized for its quality and innovation. For both this and the watch industry, the region should continue to benefit from the “Swiss made” label that is synonymous with quality and reliability. Going forward, efforts must be made to determine how to compete most effectively in global markets. Geographical footprint is a key component of success and is reflected in Swatch’s recent acquisition of US-based manufacturer and retailer of diamond watches and jewellery, Harry Winston. Continued consolidation is expected, including vertical integration into component manufacturers.

Banking on international success

Fundamental change is meanwhile taking place in another of the Suisse Romande’s most pre-eminent industries, private banking. Amid increasingly complex regulations and a dynamic marketplace, banks face challenges to their cost structures and abilities to conduct cross-border business. Long-anticipated consolidation is finally underway. Employing 82% of Switzerland’s private bankers, Geneva will be significantly impacted by any shifts in the industry. Many of its private banks will be active consolidators and will also grow organically to achieve critical mass. Others may enter into liquidation, partly as a result of higher costs arising from the US Tax Program – witness Banks Frey and Wegelin having recently closed their doors – and many more will bring forward their succession plans.

A taxing environment, but substantial opportunities remain The international flavor of the Suisse Romande brings with it challenges as well as opportunities. Given the high number of multinational businesses, events around the world can substantially affect the performance of groups either globally or regionally headquartered in the region. China’s slowdown has led to an approximately one-third decline in that country’s demand for Swiss watches between 2012 and 2013.

Most worrying to some in the region, discussions with the EU regarding tax structures might encourage some international headquarters to relocate abroad. The Swiss Corporate Tax Reform III heralds changes to cantonal taxation rules for holding, administrative and mixed companies that have been challenged by the EU. The possible abolition of differentiated taxation of Swiss and foreign sourced income has a potentially considerable impact on Swiss-based multinationals through transfer pricing rules, and is creating fears in Switzerland for longer-term prosperity. A further area of concern is the tax breaks granted to some multinationals when moving into the region. The failure or inability of Swiss authorities to extend such tax arrangements in the medium-term might further encourage relocations.

M&A as a strategic instrument for growth

Aside from the satisfactory resolution of such issues, diversification and focus will both be central to future economic resilience. In this, M&A may have a pivotal role to play. Inbound acquisitions bring fresh perspectives, while key players in areas including commodities, technology and some luxury goods segments are rapidly moving along the supply chain both domestically and internationally. Against a backdrop of ongoing consolidation pressures, concentrating on core competences through the divestment of under-performing or non-core businesses will continue to be a theme that cuts across the region’s industries.

Successfully harnessing the dynamism, innovation and appetite for transformational change displayed by many of its industries will help ensure that the Suisse Romande emerges from present challenges even stronger than before. (James Carter, Director, Transaction Services and Joshua Martin, Director, Transaction Services)

List of 2013 Swiss M&A Transactions

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter