Publications Location Advantages, Governance Quality, Stock Market Development And Firm Characteristics As Antecedents Of African M&As

- Publications

Location Advantages, Governance Quality, Stock Market Development And Firm Characteristics As Antecedents Of African M&As

- Christopher Kummer

SHARE:

By Abongeh A. Tunyi, Collins G. Ntim

Abstract

This study explores firm- and country-specific antecedents of African M&As. We use one of the largest datasets to-date, consisting of 1490 unique African firms (11,183 firm-year observations) from 1996 to 2012 from 15 African countries. Our results suggest that improvements in time-varying country-level factors, including location advantages (market size, human capital and efficiency opportunities), national governance quality, and stock market development are associated with an increase in the volume of M&A activity. Consistent with the resource-curse paradox, high resource endowments are not associated with increased levels of M&A. In support of the management inefficiency, but contrary to the traditional firm size hypotheses, African targets are generally characterised by declining stock returns and accounting profitability, but are more likely to be larger firms; suggesting the presence of information asymmetry concerns in their selection. Notwithstanding, we find evidence of heterogeneity across countries with inconsistent support for the established target prediction hypotheses. Overall, our analysis suggests that a model which combines firm- and country-specific factors better explains the observed variations in African M&A activity.

1. Introduction

Despite substantial research on foreign direct investment (FDI), in general and merger and acquisitions (M&As), in particular, little can be said about factors that moderate these phenomena in unique institutional contexts, such as the African continent. In acknowledgment, Shimizu et al. (2004) call for more theoretical development and empirical examination of determinants of cross-border M&As across different institutional contexts. This paper seeks to contribute to the international business strategy (IBS) literature by investigating the degree to which changes in merger and acquisition (M&A) activity across key African markets are explained by firm- and country-specific factors. Noteworthy is the fact that prior research on the subject has either focused on environmental or country-level moderators of FDI and M&A (e.g., Rossi and Volpin, 2004) or on firm-level factors affecting the selection of merger targets (Powell and Yawson, 2007), but rarely on both. Arguably, FDI through M&A is more likely to occur if both country- and firm-level conditions are satisfied and hence, there is a need for greater linkage of the two literatures. Drawing from a transaction cost economics theoretical perspective (Coase, 1937; Dunning, 1980), we examine the extent to which location advantages (including; market size, resource endowments, human capital and efficiency opportunities), national governance quality and stock market development (i.e., country-level factors) explain observable variations in the volume of M&As across 15 African countries. Additionally, we explore the extent to which individual firm characteristics (i.e., firm-level factors) impact on the likelihood that specific firms within these countries will be acquired. Prior studies exploring country- and firm-level antecedents of M&A activity are generally rare (Martynova and Renneboog, 2008; Gorton et al., 2009), and particularly acute in the case of Africa (e.g., Rossi and Volpin, 2004). We focus on Africa for a number of reasons. First, Africa has become an important economy on the world stage, but has been largely ignored in contemporary business research.

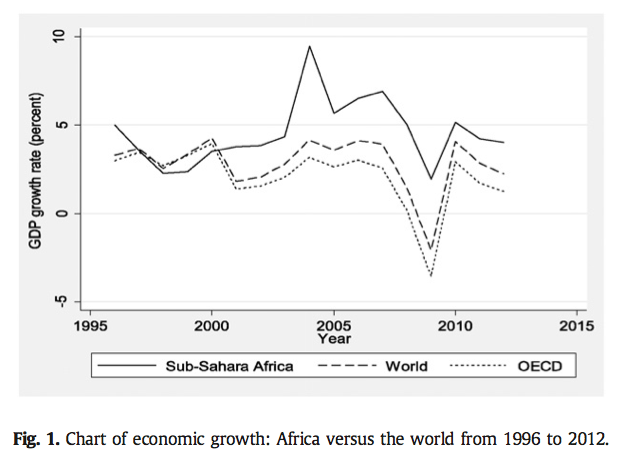

Fig. 1 shows the growth in the gross domestic product (GDP) between 1996 and 2012 for Sub-Sahara Africa, Organisation of Economic Development and Corporation (OECD) and the World. The average growth in GDP for Sub-Sahara Africa (4.57%) outstrips the average growth of OECD member countries (2.08%) and the World (2.83%) over the period. Despite this high level of growth, many African economies still lag behind the rest of the world in terms of development (McFerson, 2010).

M&A can, perhaps, bolster economic development in Africa by improving local business’ capabilities, creating an international presence for local companies, providing access to global markets, providing financing for growth and generating the level of market competition necessary to spur efficiency in local companies (Stoian and Filippaios, 2008; Ferraz and Hamaguchi, 2002). Stoian and Filippaios (2008), for example, argue that foreign direct investment (FDI) through cross-border mergers can foster development in local economies through three channels. These include; the improvement of capabilities of local labour through training programmes and new management techniques, the building of backward and forward linkages with other domestic firms (e.g., supply chain partners) and through cooperation with local research institutions and universities (Stoian and Filippaios, 2008). Ferraz and Hamaguchi (2002) contend that cross-border M&As can spur the improvement of regulatory frameworks and macroeconomic management strategies (through the restructuring of public finances and the prevention of massive private sector bankruptcies) and the modernisation of local corporate governance, as well as, production capabilities. Cross-border M&As into developing economies (such as those in Africa) sometimes target underperforming sectors and undervalued assets, which might otherwise be wiped out from the economy (Ferraz and Hamaguchi, 2002). Further, prior research suggests that M&A plays a disciplinary role (Palepu, 1986; Powell and Yawson, 2007) by replacing inefficient management. This lends it the ability to encourage and safeguard investments in times of regulatory and market failures. Many cross-country studies on M&A in emerging markets (e.g., Alvarez and Marin, 2010) typically ignore key markets across the African continent, while others (e.g., Rossi and Volpin, 2004) focus only on major African economies, such as South Africa. This means little is known about M&A in countries, such as Ghana, Nigeria and Kenya, which are gaining economic traction on the world stage (McFerson, 2010). An understanding of the antecedents of African M&A is likely to be useful in informing economic and development policies in this region.

Second, despite these potential benefits of M&A for Africa, prior research has focused on exploring factors driving inward FDI, in general, but not M&As in particular, into the region. One reason for this is, perhaps, the historically small number of M&As into the region, which constrains reliable statistical analysis. Like most emerging markets, several African countries are characterised by relatively low M&A volume (Gomes et al., 2012). Rossi and Volpin (2004) attribute the relatively low M&A volume across the continent (between 1990 and 1999) to poor financial reporting quality and low investor protection. Prior evidence (e.g., Mitchell and Mulherin, 1996; Andrade et al., 2001; Andrade and Stafford, 2004; Martynova and Renneboog, 2008; Gorton et al., 2009) suggests that takeovers are most likely to occur in periods of economic recovery, coinciding with rapid credit expansion, burgeoning external capital markets and stock market booms. The evidence also suggests that takeover waves are frequently driven by industrial and technological shocks with regulatory changes, such as deregulation, acting as a catalyst (e.g., Martynova and Renneboog, 2008; Rhodes-Kropft and Viswanathan, 2004). Over the last two decades, several African countries have witnessed substantial economic growth (see Fig. 1), credit expansion, technological advancement and industrial expansion and thus greater M&A activity can be expected in this region (Moghaddam et al., 2014). Some evidence (e.g., Moghaddam et al., 2014) also suggests that multinational corporations (MNC) from emerging markets have begun to improve their competitive positions in the world stage by expanding through M&A. This highlights the importance of M&A in this region and the need for further research on the phenomenon.

Third, evidence from Transparency International and the World Bank Group, suggests that several African economies are characterised by poor national governance (as demonstrated by high levels of corruption, lack of democracy, low levels of transparency, and the presence of conflict and instability) and low levels of economic development. This experience is, for the most part, unique to the African continent. Prior research argues that this trend of poor national governance across the continent stifles economic growth through FDI by raising uncertainty and transaction costs – “the grabbing hand hypothesis” (Voyer and Beamish, 2004; Wei, 2000; Zhao et al., 2003). However, recent years have witnessed observable improvements in national governance, democracy, transparency and public accountability in a number of African countries (McFerson, 2009, 2010). It is interesting to therefore explore how the efforts to improve the quality of national governance across different African countries impacts on M&A activity in the region.

Our study makes the following contributions to the extant IBS literature. First, we explore country-level factors, including the Dunning (1980) location advantages (including market size, resource endowments, human capital and efficiency opportunities), national governance quality and stock market development that impact on the volume of M&A activity across different African countries. Second, we test the established M&A theory in a new context (i.e., out-of-sample analysis) by assessing the impact of firm-level characteristics on the level of M&A activity across different African countries. Here, our objective is to deduce whether the selection of takeover targets in this context is systematic and whether bidders select takeover targets to accomplish specific objectives in line with prior M&A theoretical predictions. We redevelop the traditional firm size hypothesis to take account of the unique characteristics of our new sample. In this regard, we explain why takeover likelihood and firm size for African firms have a relationship inconsistent with the prediction of the traditional firm size hypothesis. Prior takeover prediction studies (Palepu, 1986; Brar et al., 2009) employ firm-level characteristics as determinants of takeover likelihood. We extend this literature by showing that traditional prediction models augmented with country-level factors better explain firm takeover likelihood.

To the best of our knowledge, this is the first large scale (i.e., a sample of 1490 unique firms from 1996 to 2012 from 15 African countries, giving a total of 11,183 firm-year observations) study looking at the time-varying country- and firm-level determinants of M&A across the African continent. Our key findings are as follows. First, our evidence suggests that improvements in time-varying measures of location advantages (including market, human capital and efficiency opportunities), national governance quality (as measured by World Bank governance indices), and stock market development (stock market capitalisation, market volatility and number of traded stocks) are associated with increased M&A activity. Nonetheless, contrary to Dunning (1980), but consistent with the resource-curse paradox, the volume of M&A declines with natural resource endowments. Second, we find that takeover likelihood for African firms declines with a firm’s stock market performance and accounting profitability, suggesting that target management inefficiency (Palepu, 1986) appears to drive the selection of suitable targets by domestic and international bidders. But contrary to the prior UK, US and EU evidence (Palepu, 1986, Powell and Yawson, 2007, Brar et al., 2009), takeover likelihood for African firms generally increases with firm size. This suggests that information asymmetry concerns, perhaps, shape the selection of potential targets by bidding firms. Our subsample results, however, show heterogeneity in firm-level antecedents of takeover likelihood across African countries. For example, we find that targets in Egypt and Morroco are more likely to be well-performing firms. Third, we find that our country-level factors can augment a traditional takeover prediction model to better explain the incidence of takeovers and the selection of takeover targets across Africa. This suggests that the likelihood that a firm will be acquired in a particular period is dependent not only on its individual characteristics but also on country-level and environmental conditions.

The rest of the paper is organised as follows. Section 2 discusses country-level antecedents of African M&As. Section 3 discusses firm-level antecedents of African M&As. Section 4 outlines the research design, data and method. Section 5 discusses the empirical results, whilst Section 6 presents the summary and conclusion.

2. Country-level antecedents of African M&As

Given the limited number of prior studies looking at antecedents of M&A – a particular mode of FDI – into developing countries, we draw from the general FDI literature to develop our theoretical postulations. Several studies in M&A prediction modelling implicitly assume that firm characteristics are the main time-varying factors that moderate their acquisition likelihood (Palepu, 1986; Powell, 2001). At a broader level, it can, perhaps, be argued that only when the surrounding environmental conditions are suitable, do individual firm characteristics moderate firm acquisition likelihood (Mitchell and Mulherin, 1996; Andrade et al., 2001; Rhodes-Kropft and Viswanathan, 2004; Andrade and Stafford, 2004; Martynova and Renneboog, 2008; Gorton et al., 2009). The relevance of suitable environmental conditions is, perhaps, even more critical in the context of developing countries, where issues such as the availability of factors of production, good governance and financial (stock market) development are particularly pertinent. To explore the country-level antecedents of M&As in Africa, we build on the well-established Eclectic paradigm or Ownership-Location-Internalisation (OLI) framework (Dunning, 1980, 1998) and consistent with Guisinger (2001), North (2005), Dunning (2009) and Stoian and Filippaios (2008), expand our model to incorporate institutional factors (such as national governance quality and stock market characteristics) which, perhaps, also moderate a country’s attractiveness to M&A. We discuss these next.

2.1. Dunning’s location advantages

The motivation for FDI has been subject to substantial research since the 1960s (Hymer, 1960a,b, 1968). While a significant amount of FDI activities tend to be in the form of M&A globally, this has not been the case in the African continent (OECD, 2006), explaining the sparse research on the subject. Indeed, Dikova and van Witteloostuijn (2007) note that 77% of FDI into developed countries is through M&A as compare to 33% for their developing counterparts. FDI provides an opportunity for growth for local firms, an alternative to diversifying within their home market or acquiring other local firms (Dunning, 1980, 1998). Dunning (1980) contends that some factors of production are company-specific (e.g., technology, knowledge, patents, trademarks, and brand names), while others (e.g., natural resources) are location-specific. The OLI paradigm (Dunning, 1980) stipulates that the decision to expand internationally makes economic sense when a firm “owns” certain assets (company-specific factors of production such as patents, knowledge and skill, and technology), which allows it to generate a competitive advantage over the challenges and costs of operating in an unfamiliar environment. The paradigm refers to these as “ownership advantages”. In the current research, we focus on understanding the factors that make some firms within certain countries suitable M&A targets and hence, “ownership advantages”, which generally pertain to the bidder’s characteristics and are considered as “mobile assets” (Franco et al., 2010), are not central to our work. In our model, these are somewhat captured by the characteristics of targets selected by bidders. “Location advantages” in OLI framework explain why certain regions attract particular types of firms. Consistent with Dunning (1980, 1998), this “location advantages”, perhaps, derive from the assets supplied by foreign markets, including new markets for products (market size), natural resources (resource endowments), low cost factors of production (efficiency-opportunities) and knowledge and skill (human capital). We discuss these issues and generate empirical predictions in the paragraphs that follow.

Prior research suggests that FDI is primarily driven by a market-seeking motive (Markusen, 1984; Brainard, 1997; Markusen and Venables, 1998, 2000). The goal of FDI per this motive is to exploit the host market by directly supplying it or its neighbours with goods and services (Franco et al., 2010). In this context, FDI (through M&A) allows firms to improve their competitiveness through a reduction in transportation costs or tariffs associated with exporting and by being more responsive to their customers (Brainard, 1997; Markusen and Venables, 2000; Franco et al., 2010). GDP figures from the African Development Bank and World Bank suggest that several African economies have witnessed tremendous market growth over the last decade. On average, year on year, African economies grew by 5.27% between 2000 and 2010 compared to the 2.77% global growth (see Fig. 1). The evidence, however, suggests significant variability within-country over time, as well as, across countries. Consistent with prior studies (Dunning, 1980; Maksimovic and Phillips, 2001; Harford, 2005), our first prediction is that market size (measured by GDP) explains variations in the volume of M&A across African markets. However, this might not be the case in the context of Africa as several MNCs expanding into developing markets have been shown to adopt a regional approach, where regional headquarters (RHQs) are sometimes used as vantage points for responding to customers across the entire region (Lasserre, 1996). As suggested by Luiz and Radebe (2012), the choice of RHQs in Africa is linked to advantages of agglomeration, economies of scale and the quality of the institutional environment. We consider the quality of the institutional environment at a later stage in this study.

Next, the OLI framework suggests that resource endowments (such as the presence of natural resources) might explain why firms choose to invest in some foreign countries (Dunning, 1980). Here, firms seek to acquire resources (i.e., raw materials), which are either unavailable or available at a higher cost in their home country through FDI. Inconsistent with Dunning (1980), prior research suggests a negative association between natural resource availability and FDI into developing economies (Sachs and Warner, 1995, 1997; Poelhekke and van der Ploeg, 2010; Asiedu and Lien, 2011). Asiedu and Lien (2011), for example, argue that such a counter-intuitive relation could persist as high natural resources lead to currency appreciation, making exports less competitive and, hence, crowding out investments in non-natural resource sectors. While initial exploration of natural resources require significant capital outlay, ongoing operations are not capital intensive, leading to a decline in FDI after the initial exploration phase (Asiedu and Lien, 2011). Poelhekke and van der Ploeg (2010) show that natural resources boost resource-related FDI, but crowds-out non-resource FDI to the extent that the net effect is a reduction in aggregate FDI into the country. Sachs and Warner (1995) also contend that natural resources (such as oil) deter FDI as resource-dependent economies are characterised by booms and busts, and because such economies are likely to be undiversified, this leads to significant volatility in exchange rates and added vulnerability to external shocks. This counter-intuitive position is consistent with the popular economic paradox – the Resource Curse – which explains the underperformance of resource-abundant countries, particularly those in Africa (Sachs and Warner, 1997). Further, even if resource endowments are important for FDI, they are likely to explain FDI in particular industries, such as oil & gas exploration, which are typically pursued through Joint Ventures and Greenfield investments as opposed to full-fledged M&As (OECD, 2006; Dikova and van Witteloostuijn, 2007). Following the literature, but contrary to the predictions of the OLI framework, our second prediction is that the incidence of M&As amongst African countries will decline with natural resource availability. We use “Total natural resources rents as a percentage of GDP” (compiled by the World Bank Group) as a measure of each country’s resource endowments.

Third, the OLI framework predicts that the presence of knowledge and skilled labour (human capital) can attract FDI into some countries (Dunning, 1980). Pfeffermann and Madarassy (1992) note that technological advances have led to a shift in FDI towards more knowledge- and skill-intensive industries, making economies with high education levels more attractive FDI destinations. Noorbakhsh et al. (2001) argue that MNCs enhance their competitiveness by organising themselves functionally, shifting key activities (such as R&D, IT, customer services, accounting, training, distribution and the production of components) to countries best suited (in terms of skills and costs) for such activities. A number of studies have examined the relation between human capital and FDI in different contexts, with inconclusive results. Early studies by Root and Ahmed (1979); Schneider and Frey (1985) and Narula (1996) do not find a significant relation between human capital in developing countries and inward FDI in the pre- 1990 period. A study by Noorbakhsh et al. (2001) covering the period up to 1994 finds human capital is one of the most important determinants of inward FDI into Africa, Asia and Latin America. Consistent with Noorbakhsh et al. (2001), we predict that M&A volume will increase with the level of human capital. We use “Total number of patent applications” (compiled by the World Bank Group) as our main measure of human capital. Additionally, for robustness, we explore other measures of human capital including “Total number of trademark applications” and “Research and Development expenditure (as a percentage of GDP)”.

Further, the OLI paradigm stipulates that opportunities to generate efficiencies (perhaps, through cost savings) may attract MNCs to expand to certain regions (Dunning, 1980). Local firms can service foreign markets through exports but this becomes unsustainable when transportation costs and tariff barriers are high (Coase, 1937). In situations where a foreign market is attractive enough, firms can improve their competitive position by substituting exports with local production. Indeed, several studies have empirically shown that efficiency opportunities such as low production costs attract FDI (Asiedu and Lien, 2011; Pfeffermann and Madarassy, 1992). Consistent with Dunning (1980) and Coase (1937), we anticipate that opportunities for low cost production in certain African countries can increase their attractiveness to FDI through M&A. Our fourth prediction is that the volume of M&A will increase with efficiency opportunities. We use the “Pump price of diesel fuel in USD” and “Average wage in USD” (compiled by the World Bank Group) as simple proxies for cost of production.

The final element of the OLI paradigm “Internalisation” explains why firms might prefer to engage in production abroad as opposed to subcontracting (through licensing or exporting) with foreign partners. The element contends that firms produce abroad due to “internalisation advantages”, which derives from the propensity to earn higher rents on firm assets and/or achieve lower transaction costs by engaging in production abroad rather than subcontracting (through licensing or exporting) with third parties abroad (Dunning, 1980). As noted above, the current study nonetheless only focuses on the “where” question as we seek to explore what location and institutional factors make certain African countries more attractive M&A hotspots than their counterparts.

2.2. National governance quality

The second country-level variable in our model explores the extent to which the quality of the institutional environment impacts on the volume of M&A in Africa. The African Development Bank views governance as the manner by which government power is exercised to attain social and economic development (Boas, 1998). Data from international organisations, such as the World Bank Group and Transparency International, suggests that when compared to Western nations, African countries are generally characterised by poor governance. This is supported by the often relatively high levels of corruption, political instability, low regulatory quality, lack of accountability and general ineffectiveness of government institutions across several African countries (McFerson, 2009; Kaufmann et al., 2010). This lack of national good governance is not only a salient characteristic to resource-rich countries – the so called ‘resource curse’ – but also shared by resource-poor African countries (McFerson, 2009). Recent research, nonetheless, suggests that some countries within the continent have shown significant improvements in terms of governance quality. Based on evidence from the results of the Ibrahim Index of African Governance and Data from the Freedom House annual global surveys of political rights and civil liberties, McFerson (2010), for example, argues that as a continent, Africa has made progress in terms of national governance improvements over time — with Botswana, Ghana, Mauritius, South Africa and Tunisia, often cited as examples of African countries that have recently experienced improvements in the quality of their national governance.

In a cross-country study, Rossi and Volpin (2004) find that countries with better accounting standards and stronger shareholder protection have a higher volume of M&A. Their sample includes a limited number of African countries, such as Kenya, Nigeria, South Africa and Zimbabwe. Other studies show that country-level factors, such as macroeconomic stability, level of corruption, natural resource endowments and level of financial development also explain the cross-sectional differences in the volume of M&As (e.g., Vencatachellum and Wilson, 2013). Li et al. (2012) find that Rule of Law (an indicator of the quality of national governance) affects value creation in international strategic alliances into BRIC countries (Brazil, Russia, India and China), by moderating the foreign partners’ willingness to share valuable knowledge assets. Another study by Karhunen and Ledyaeva (2012) also explore how corruption impacts on FDI choices, noting the choice can be modelled as a trade-off between the benefits of having a local partner and the costs associated with the existence of high levels of corruption. In general, poor national governance generates added political risk and acquirers will require equally high returns to justify their decision to invest in countries with relatively poor national governance credentials. National governance quality, therefore, should impact on M&A activity as more M&A, especially those involving cross-border bidders, are likely to be pursued in times of political stability, non-violence, low corruption, effective governments and high quality regulation (Rossi and Volpin, 2004; Martynova and Renneboog, 2008; Vencatachellum and Wilson, 2013). Consequently, our fifth prediction is that improvements in national governance quality across countries and over time will lead to an increase in M&A activity. As in prior studies, we measure the quality of National Governance and a country’s institutional environment using time-varying measures of corruption, including Transparency International’s Corruption Perception Index (CPI) and the World Bank’s Control of Corruption index (CCI), as well as, measures of political and legal maturity, including the World Bank’s Government Effectiveness index (GEI), Regulatory Quality Index (RQI) and Rule of Law Index (ROLI).

2.3. Stock market development

A key contribution of our study is that we focus on M&As distinguishing our study from the studies that look at FDI flows in Africa. The level of stock market development is perhaps critical to M&As, but not to other channels of FDI as M&A involving listed companies generally require active stock markets. Allen et al. (2012) document the poor state of the financial sectors of countries in sub-Saharan Africa, noting that development in this sector trails that of other developing nations. With the exception of South Africa, the level of financial development in the continent is, arguably, low. This is characterised by low access to debt and bond markets, small size of the banking sector, low size of deposits and loans, high level of non-performing assets and capital inadequacy (Hearn et al., 2010; Andrianaivo and Yartey, 2010; Wang et al., 2015). Recent years have seen the rapid development of African Stock Exchanges the adoption of international accounting and auditing standards by several African countries (Ntim et al., 2007; Ntim et al., 2011; Ntim et al., 2012; Ntim, 2012). The successful completion of M&A deals requires the existence of functioning stock markets, with reliable stock valuations and sufficient firms for bidders to choose from (Ntim et al., 2015). These markets will also provide liquidity to investors, reduce the cost of information gathering through collective wisdom in the pricing of assets and provide opportunities for the risk sharing and diversification. In the context of M&A, the pricing of targets, acquisition of toeholds, payment through stock and opportunity for investors to liquidate their investment, all need fully functioning capital markets. Consequently, our sixth prediction is that improvements in stock market development will lead to an increase in M&A activity.

3. Firm-level antecedents of African M&A

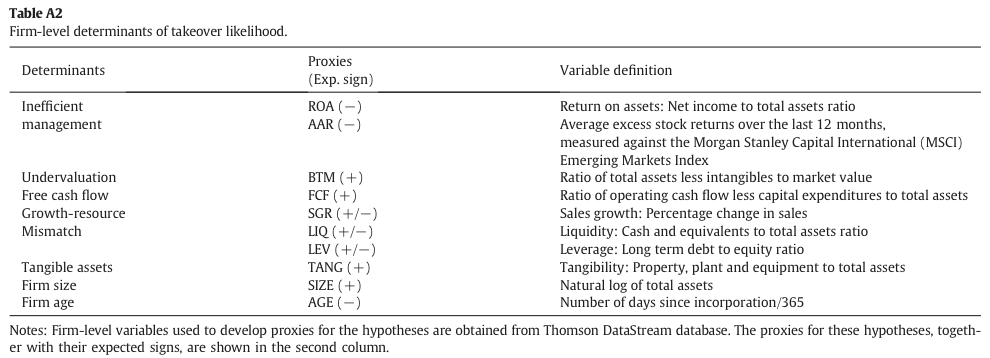

The first part of our model explores country-level factors (including location advantages, governance quality and stock market development) that moderate the volume of M&A across African countries. In this section, we explore individual firm-level factors affecting the selection of particular firms as suitable targets. Arguably, FDI through M&A is more likely to occur if country and firm-level conditions are met. Two main theories explaining the incidence of M&A amongst firms, the neoclassical and managerial theory, have been propounded. The neoclassical (or shareholder) theory of mergers proposes that mergers are planned and executed by managers aiming to create, increase or maximise shareholder wealth (Manne, 1965). Mueller (1969) contends that managers seeking to maximise shareholder wealth will engage in mergers when it increases the firm’s market power, enables the firm to achieve managerial or technological economies of scale, or when acquiring managers hold superior information about the target which is unavailable to the target’s stakeholders. A review of the literature (e.g., Trautwein, 1990) suggests that managers can maximise the wealth of shareholders through M&A in four key ways summarised under the efficiency theory of mergers (managers aim to create synergies through M&A), monopoly theory of mergers (managers aim to bolster market power), raider theory of mergers (managers aim to acquire undervalued assets through M&A), and valuation theory of mergers (managers have superior information about a target’s value compared to the stock market). These theories can be used to develop predictions on firm-level determinants of takeover likelihood amongst listed firms in the African context. Here, we build on a takeover model specification employed across several studies (e.g., Palepu, 1986; Powell, 1997; Powell and Yawson, 2007; Brar et al., 2009; Cremers et al., 2009). Palepu (1986) uses proxies of six propositions to build his takeover likelihood model. These six postulations include the inefficient management, firm undervaluation, growth-resource mismatch, firm undervaluation, price-earnings and industry disturbance. Other researchers, such as Ambrose and Megginson (1992); Powell (1997) and Brar et al. (2009) have suggested other drivers of takeover likelihood including real property, free cash flow and firm age. These postulations are discussed and adopted in the paragraphs that follow.

Prior research (Palepu, 1986; Morck et al., 1989) suggests that poorly performing managers or firms are more likely to be targeted in takeovers. Here, the objective of the bidder is to generate value by more efficiently managing the resources available to incumbent target managers with the neoclassical goal of maximising the wealth of shareholders. Management inefficiency is generally proxied by a firm’s accounting and stock market performance measures, such as its abnormal stock return, return on assets (sales or equity) and operating profit margin (Agrawal and Jaffe, 2003). Prior studies find evidence that targets experience a decline in stock returns (Powell and Yawson, 2007) and profitability (Cremers et al., 2009) prior to their acquisition.

Some takeovers are motivated by the desire to acquire underpriced firms (Palepu, 1986). In this case, the bidder perceives the potential target as relatively undervalued by the market given the book value of its assets. A bidder with superior management ability can benefit from this market discrepancy by purchasing the assets (target) and unearthing its true value. This could be through divestments and reorganisation. A European study by Brar et al. (2009) which revealed that takeover targets have significantly higher earnings to price ratios as well as dividend yields, provides some empirical support for this postulation.

Palepu (1986) contends that a mismatch between a firm’s growth levels and its available financial resources will lead to take-overs as bidders see opportunity to create synergies by correcting such an imbalance. In essence, low-growth high-resource firms as well as high-growth low-resource firms are most likely to receive takeover bids (Palepu, 1986; Powell, 2001). Low-growth high-resource firms, for example, are those with significant liquidity, strengthened by low debt levels, but lacking in suitable investment opportunities. Empirical support for the hypothesis is mixed. Whilst Palepu (1986) provides evidence to support this prediction, other studies, such as Espahbodi and Espahbodi (2003) and Powell (2004) do not find support for the hypothesis.

Firms with excess free cash flow are likely to be attractive takeover targets as the presence of excess free cash flow exacerbates the agency problem (Jensen, 1986; Lehn and Poulsen, 1989). In the presence of excess free cash flow, managers are likely to indulge in unprofitable projects or expropriate shareholder funds by securing managerial perquisites. More importantly, the presence of excess free cash flow within a target, potentially, reduces the bidders implicit cost of acquisition as these resources can be used to directly offset the bidder’s acquisition costs. Consistent with this view, prior studies such as Powell (1997); Espahbodi and Espahbodi (2003) and Brar et al. (2009) show that UK, US and European targets (respectively) have significantly higher levels of free cash flow when compared to their respective bidders.

Bidders are more likely to be attracted to firms with substantial tangible assets (property, plants and equipment) in their total asset portfolio (Ambrose and Megginson, 1992). There are several reasons for this. First, the acquisition of tangible property, potentially, reduces the bidders cost of borrowing as these assets can act as collateral security (Powell and Yawson, 2007). Second, tangible property (as compared to intangibles) is easier to value. Hence, the presence of substantial tangible property reduces the problem of information asymmetry faced by the bidder in valuing the target. Third, tangible assets which are not core to the bidder’s line of business can easily be sold post-acquisition to further reduce the cost of acquisition. Intangibles such as brands, networks, goodwill, do not confer such advantages. In support of the real property hypothesis, prior studies including Ambrose and Megginson (1992); Powell (1997) and Espahbodi and Espahbodi (2003) find that takeover probability increases with the proportion of tangible assets in a firm’s total asset portfolio.

Smaller firms are likely to face a higher takeover threat due to a lower cost of acquisition and the relative ease of post-merger restructuring (Palepu, 1986; Powell, 1997; Brar et al., 2009). Per this hypothesis, larger are firms are more expensive to acquire, more likely to resist acquisitions, more difficult to integrate/absorb and the pool of potential bidders for larger firms is smaller. This view, however, fails to take into account the dynamics associated with firm size. The problem of information asymmetry and its effect on the market mechanism – the market for lemons – has been discussed in prior research (Akerlof, 1970). The market for firms is, perhaps, not an exception to this problem which is likely to be more pervasive in the African context. Some researchers (e.g., Pettit and Singer, 1985) argue that, due to a lack of economies of scale in information production and distribution, smaller firms are inclined to produce and distribute less information about themselves, thus leading to a higher level of asymmetry between them and their stakeholders. This problem of comparatively higher information asymmetry in smaller firms is further exacerbated by the lack of significant analyst following in smaller firms (Eleswarapu et al., 2004). This suggests that, if bidders are cautious of purchasing ‘lemons’, they are likely to bid for low information asymmetry firms – those which produce and distribute large volumes of information about themselves and are followed by several analysts. Further, affordability and transaction costs are unlikely to be a major concern for foreign bidders of African targets given the substantial disparity in the market value of listed companies in developed and developing economies. The implication is that bidders for African targets will be, perhaps, more inclined to acquire larger than smaller targets on average.

Younger firms are more susceptible to acquisitions (Agarwal and Gort, 2002). Substantial research has been done in the firm life cycle literature which focuses on understanding the different stages in the life cycle of a typical firm (including industry entry, growth, decline and exit). This literature frequently attributes firm survival (age) to the ability of firms to learn actively or passively over time (Hopenhayn, 1992; Pakes and Ericson, 1998; Bhattacharjee et al., 2009). In line with the learning perspective, Bhattacharjee et al. (2009) contend that exit rates (due to the hazard of takeovers or bankruptcies) should decrease with age. Agarwal and Gort (2002) advanced the literature on firm age and survival by proposing that two key factors (learning-by-doing and firm endowments) define its probability of survival (and hence likelihood of industry exit). Agarwal and Gort (2002) contend that, over time, a firm gains knowledge about itself and its industry, which allows it to achieve cost reductions, product improvements, and develop new market techniques — learning-by-doing. In terms of endowments, Agarwal and Gort (2002) argue that firm endowments (i.e., a firm’s inherent or natural suitability for profitability) are generally low when firms are born, but increase over time as firms invest in research and development. Older firms are therefore more endowed and more knowledgeable about themselves. The implication is that the probability of firm survival within an industry increases as firms grow older, learn about themselves and improve their endowments.

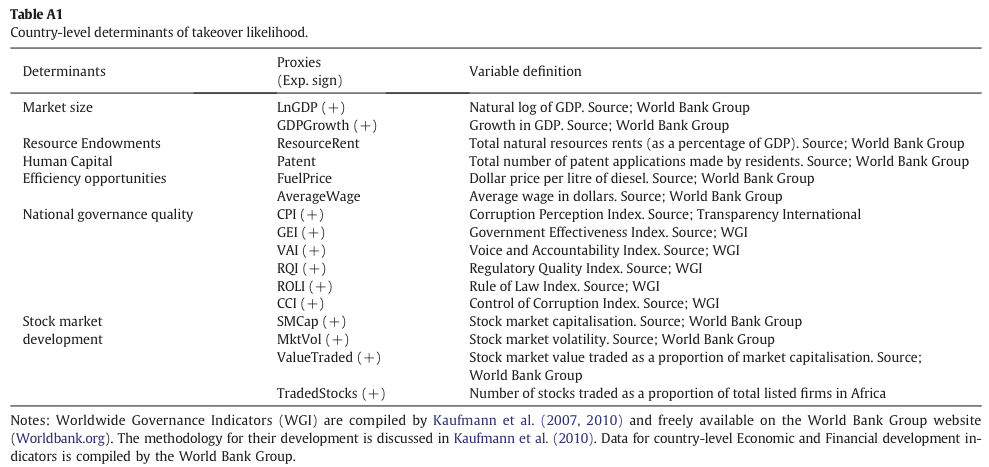

The country- and firm-level antecedents of M&A discussed above together with their selected proxies are presented in the Appendix (Table A1). The proxies adopted are in line with those used in prior studies (Palepu, 1986; Powell, 2004; Powell and Yawson, 2007; Brar et al., 2009 and Cremers et al., 2009). Our proxies for location advantages (market size, GDP; resource endowments, resource rent; human capital, patent applications; efficiency opportunities, pump fuel price and average wage), national governance (Worldwide Governance Indicators, Kaufmann et al., 2010) and stock market development have been widely used in prior research (McFerson, 2010; Vencatachellum and Wilson, 2013). We discuss our model in the next section.

4. Data and method

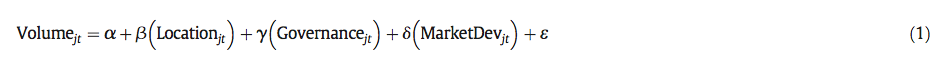

Our first model, examines the relation between time-varying country-level factors (including the quality of national governance, economic development and financial development) and the level of M&A activities (M&A volume) in African economies. To investigate the effect of our country-level time-variant factors on M&A activity, we collect data on M&A activities, involving listed companies across 15 African stock markets (including Botswana, Egypt, Ghana, Nigeria, Ivory Coast, Kenya, Mauritius, Namibia, Morocco, Tanzania, Tunisia, Uganda, South Africa, Zambia and Zimbabwe). We exclude some markets from our analysis (e.g., Cameroon, Sierra Leone, Libya and Sudan) as firm-level data for these markets is unavailable. Consistent with Rossi and Volpin (2004), we measure M&A volume (Volume) as the ratio of M&A bids to the number of listed companies in each country in each year. Our model specification is of the following general form.

For robustness, we use several alternative proxies available in public domain to measure location advantages (Location), national governance quality (governance) and stock market development (MarketDev). As discussed in Section 2.1, we proxy location advantages as follows: (1) market size; GDP, and GDP growth, (2) resource endowments; and resource rent as a proportion of GDP (3) quality of human capital; and number of patent applications, and (4) efficiency opportunities; price of fuel and average wage. As noted in Section 2.2, we proxy the level of National Governance (Governance) using time-varying measures of corruption including Transparency International’s Corruption Perception Index (CPI) and the World Bank’s Control of Corruption index (CCI), as well as, measures of political and legal maturity including the World Bank’s Government Effectiveness index (GEI), Regulatory Quality Index (RQI) and Rule of Law Index (ROLI). As discussed in Section 2.3, to assess capital market development, we use stock market capitalisation deflated by GDP, stock market total value traded deflated by GDP, market volatility and the number of listed companies in each year deflated by total number of listed companies in the sample. We discuss these measures further and provide information about the source of this data in the appendix (Table A1).

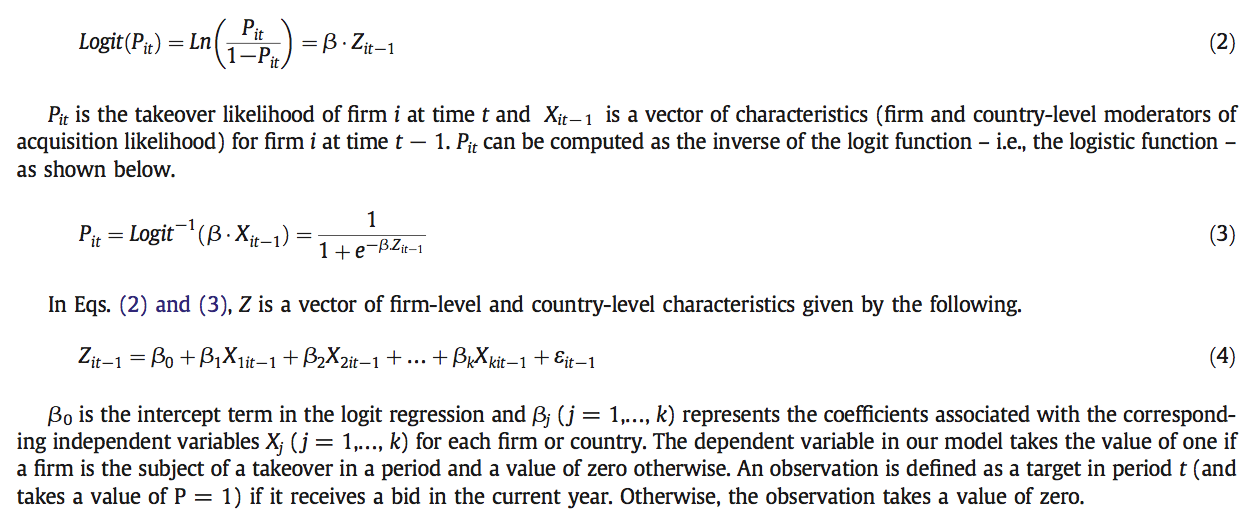

In our second model, we adopt the standard takeover likelihood modelling methodology, which posits that the likelihood for a firm to be selected as a merger or takeover target is based on observable firm characteristics (Powell, 2004). Given that our study has a cross-country focus, we extend this model by suggesting that a firm’s likelihood of being selected as a target is dependent on its observable characteristics, as well as the prevailing macro-environmental conditions (such as national governance, economic performance and financial development). Following prior studies (including Palepu, 1986; Powell, 2001; Cremers et al., 2009), we adopt a logit framework for computing firm acquisition likelihood. In this framework, we assume that a firm’s likelihood of being the subject of a takeover bid in period t, is a function of its last observable characteristics (in period t − 1). The basic model is shown below.

In additional analysis, we explore different lags in our model given the low volume of M&A activity and the inactive nature of the market for corporate control in the region. Given the perceived high information asymmetry between targets and bidders, we also consider that the decision to acquire a firm in a particular year may be related to its characteristics over a number of years (such as the last three years or the last five years). The modification of the lags used in standard prediction models allows us to explore the dynamics of takeover likelihood and changes in firm characteristics over time. We employ STATA v.13 in conducting our analyses. This allows us to perform panel regressions, adjusting our regression coefficients and standard errors for the effects of firm, year and country level clustering in our data.

To test our second model, we first obtain a comprehensive list of all listed African Companies, live and dead from the Thomson DataStream database. Each firm is identified by a unique DataStream code. We focus on the sample of all firms listed in the period 1996 to 2012 as very few M&A activity involving African targets is recorded prior to this period. Our sample consists of 1490 unique firms with DataStream codes. Unlike prior studies which utilise a match-sampling procedure (e.g., Palepu, 1986; Powell, 2001; Brar et al., 2009), we use a panel data set wherein each firm in our sample contributes an observation in every year between 1996 and 2012 until it exits the market through a bankruptcy, delisting or takeover. Notice that firms enter and exit the sample at different points over the sample period, and hence, over the 17-year period, the 1490 unique firms only contribute 11,183 firm-year observations. From the Thomson OneBanker database, we collect data on all announced takeover bids in every year between 1996 and 2012 where the target is a listed firm in Africa. We match both datasets using DataStream codes. Finally, we match our macro-level data (national governance quality, economic performance and financial development) to this dataset using a unique country-year identifier which we generate. We discuss our empirical results in the next section.

5. Empirical results and discussion

5.1. Trends in African M&A

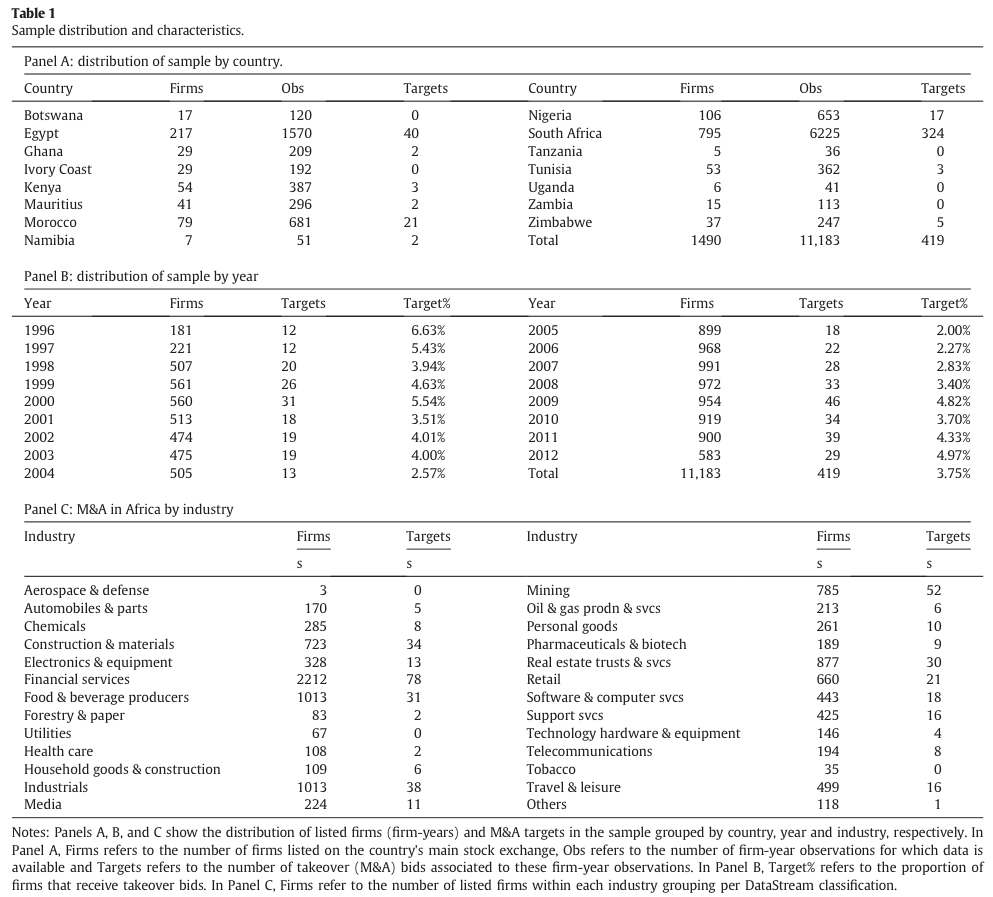

First, we explore the incidence of M&A activity across Africa. Table 1 (Panel A) shows the distribution of listed firms, firm-year observations and M&A targets by country. There were over 1490 firms in Africa during the period 1996–2012 — a total of 11,183 firm-year observations. South Africa, Egypt, Nigeria and Morocco are the countries with the highest number of listed firms as well as the highest level of M&A activity. Even though Nigeria has more listed firms than Morocco, it has fewer M&A bids during the period. When organised by year as in Table 1 (Panel B), we find that, although, the number of M&A bids have steadily increased since 1996, the number of listed firms has increased at a faster pace leading to a slight decline in the proportion of listed firms that receive taker bids. Some of the early years (1996, 1997 and 2000) saw levels of M&A activity above 5%. In line with trends in UK and US, M&A peaked in 2000. There is a decline in M&A activity after 2004 coinciding with an increase in number of listed firms. There is no evidence of a significant decline in M&A activity during the 2007–2012 Global Financial Crises and Recession. Levels of M&A in 2012 are similar to those in 2000 with about 3.93% of listed African firms receiving takeover bids over the 2007–2012 period. This level of M&A activity is only slightly less than the 5.00% reported in developed economies such as the UK (Danbolt et al., forthcoming).

As evident in Panel C, M&A activity in Africa cluster by industry. The most active M&A industries include financial services (including banking and insurance), mining, industrials (including transportation), construction and materials and food & beverage producers. Other industries with moderate levels of activities include real estate investment trusts & services, retail (including food & drugs), software & computer services, support services and travel & leisure. There is limited or no M&A activity in industries such as aerospace & defence, automobiles and parts, forestry & paper, utilities (electricity, gas & water), tobacco, technology hardware & equipment and healthcare equipment & services.

5.2. Country-level moderators of M&A activities

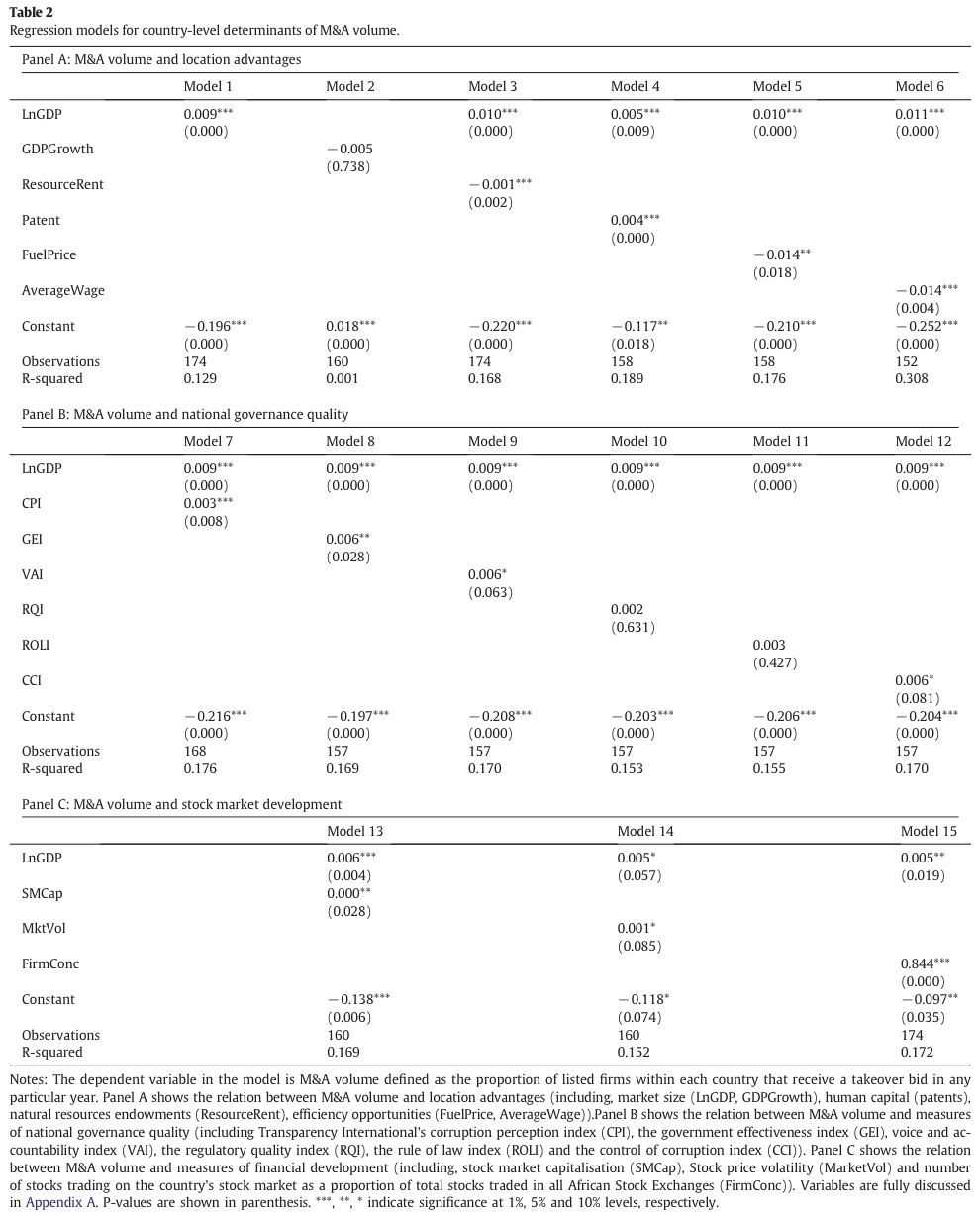

Next, we empirically examine the relation between time-variant country-level variables and the volume of M&A activity as specified by Eq. (1). The results are shown in Table 2. The dependent variable in all our regression models (models 1 to 15) is M&A Volume defined as the proportion of listed firms in each country which receive takeover bids in the respective year. The independent variables in the model include proxies of location advantages, national governance quality and stock market development. In models 1 to 6 (Panel A), we directly test our prediction of a direct relation between location advantages and M&A volume following Dunning (1980). Generally, the results in Table 2 (Panel A) support our contention that M&A volume across the 15 countries is moderated by location advantages. Consistent with Dunning (1980), M&A volume increases with market size (the market-seeking motive of FDI; Markusen and Venables, 2000). A change in Ln GDP of 1 unit increases the volume of M&A by 0.9%. In untabulated findings, our results remain robust when we adjust Economic performance by the size of the population (using GDP per Capita). The results also remain significant when we adjust for clustering by country using the Rogers (1993) methodology for computing clustered-robust standard errors. Consistent with Rossi and Volpin (2004), we do not find evidence that changes in the level of GDP growth from one year to another impacts on M&A volume. This suggests that while an increase in a country’s GDP over time might stimulate M&A activity, changes in the magnitude of the growth rate from one year to another, in itself, does not have a direct impact on the volume of M&A activity. In our subsequent regressions, we consider Ln GDP as a control variable to evaluate the effects of other location advantages, national governance and stock market development on the volume of M&A activity.

Inconsistent with eclectic paradigm (Dunning, 1980) but in line with the resource-curse paradox and prior empirical research (Sachs and Warner, 1995, 1997; Asiedu and Lien, 2011), we find a negative relation between M&A volume and resource endowments. As accentuated by the resource curse paradox, we find that an increase in resource endowment (proxied by resource rent) by 1 unit decreases M&A volume by 0.1% (significant at the 1% level). This suggests that, within our African sample, the presence of natural resources does not directly improve the volume of M&A activity as suggested by the OLI framework (Dunning, 1980, 1998).

Consistent with Dunning (1980, 1998) and Noorbakhsh et al., 2001, the results suggests a positive relation between human capital, knowledge and skill (as proxied by patent applications) and the volume of M&A. An increase in human capital by 1 unit increases the volume of M&A by 0.4% (significant at the 1% level). Finally, the results show that measures of cost of production (fuel price and average wages) are negatively related to the volume of M&A. An increase in average wage and fuel price by 1 unit decreases M&A volume by 1.4% (significant at the 1 and 5% levels, respectively). This suggests that, consistent with (Dunning, 1980) the presence of opportunities to generate efficiency through low cost production, perhaps, partly explain variations in M&A volume across African countries. In summary, these results show that, consistent with Dunning (1980), market size, human capital and efficiency opportunities partly explain the incidence of African M&As. Contrary to Dunning (1980), however, we find that resource endowments do not explain the choice of M&A destination in the context of Africa. Indeed, consistent with the resource curse paradox and the studies that show a negative relation between resource endowments and FDI (Sachs and Warner, 1997; Sachs and Warner, 1995; Asiedu and Lien, 2011; Poelhekke and van der Ploeg, 2010), we also find that resource endowments have a negative impact on the volume of M&A activity across African countries.

In models 7 to 12 (Table 2, Panel B), we consider the relation between proxies of the quality of national governance in each year across the 15 countries and the volume of M&A activities in each country in the respective period. The results show a positive relation between the quality of national governance and the volume of M&A activity. The relation is statistically significant when national governance is proxied by CPI, GEI, VAI and CCI. For example, an increase in GEI by 1 unit is associated with a 0.6% increase in the volume of M&A activity (significant at the 5% level). These results suggest that, when we control for economic conditions across different countries and different years, improvements in the quality of national governance are associated with an increase in the volume of M&A. That is, countries with more effective governance systems (particularly, in terms of low corruption, high government effectiveness and high voice and accountability) are likely to see higher volumes of M&A.

In models 13 to 15 (Table 2, Panel C), we further evaluate the relation between measures of stock market development and volume of M&A activity. The results reveal that, when we control for differences in market size between countries and across time, the volume of M&A activity increases with stock market capitalisation, stock market volatility, the availability of traded stocks. An increase in the concentration of traded stocks by 1 unit is associated to 84.4% increase in the volume of M&A activity. That is, African countries with more developed stock markets in terms of the number of listed companies are likely to see higher M&A volumes than their counterparts. Overall, in support of our prediction, the results suggest that the level of stock market development positively impacts M&A activity.

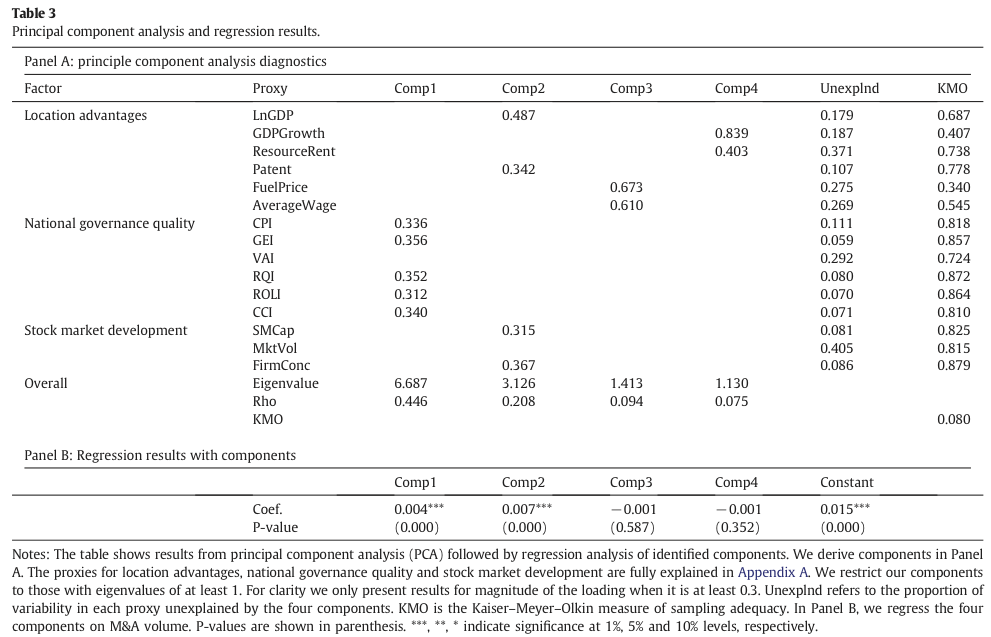

The results in Table 2 suggest that the volume of M&A activity across our sample of African firms is moderated by measures of location advantages, national governance quality and stock market development. Arguably, several of the 15 country-level variables used in our analysis are interrelated. We therefore use principal component analysis to compress these 15 country-level variables into theoretically meaningful components. This will act as a robustness check on the findings in Table 2. We restrict our components to those with eigenvalues of at least 1. This allows us to generate 4 components (Comp1, Comp2, Comp3 and Comp4) with eigenvalues of 6.687, 3.126, 1.413 and 1.130, respectively. These 4 components cumulatively explain 82.38% of variation in our variables. Table 3 shows the loadings on each of the four components. For clarity we, exclude results where the magnitude of loadings is less than 0.30. The overall Kaiser–Meyer–Olkin (KMO) measure of sampling adequacy is 0.80 which is above the recommended minimum of 0.50 for principal component analysis (Cerny and Kaiser, 1977).

Table 3 (Panel A) shows that measures of national governance quality load highly on the first component (Comp1). The second component (Comp2) has a mix of measures of stock market development, market size and human capital. Measures of efficiency opportunities (FuelPrice and AverageWage) load highly on Comp3. Our proxy for natural resource endowments, as well as GDP growth loads highly on Comp4. In Panel B (Table 3), we regress M&A volume (as the dependent variable) on our 4 components (as independent variables). We find a positive and significant relation between M&A volume and Comp1 and 2, suggesting that national governance, stock market development and market size impact on takeovers takeovers. The results also show a negative but statistically insignificant relation between M&A volume and Comp3, suggesting that efficiency opportunities increase the likelihood of M&As. Consistent with the finding that resource endowments do not stimulate M&A, we find a negative (though statistically insignificant) relation between M&A volume and component 4. We note however that much of the variability (37.12%) of the variability in our proxy for resource endowment is not captured by components 1 to 4. The adjusted R square of this regression model is 0.384.

5.3. Firm-level moderators of acquisition likelihood

Next, we investigate the time-varying firm-level factors that moderate firm acquisition likelihood. We start by looking at descriptive statistics for firm characteristics across our sample. In untabulated results, we find that the mean return on asset (ROA) for African firms over the sample period is 5.6%. Nonetheless, there is significant heterogeneity amongst firms and countries (standard deviation of 9.4%) with countries such as Botswana, Tanzania and Namibia achieving mean return on assets of over 10%. The mean excess monthly return (AAR) as against the Morgan Stanley Capital International (MSCI) Emerging Markets Index is close to zero as expected. This suggests that on average firms in these African countries perform in line with the all other emerging markets. The results show that book to market (BTM) values for African firms are above 1 on average, with Egypt, Tunisia, Uganda and Zimbabwe, particularly, experiencing depressed market values. Such depressed market values could partly be explained by the political, economic and regulatory climate within these countries. We find significant differences between countries in terms of average firm size (SIZE), but these results cannot be given too much meaning due to the significant differences in the number of listed companies. For example, as shown in Table 1, Tanzania, Uganda and Namibia have less than 7 listed firms each while South Africa has over 795 firms. The average age (since incorporation) of firms in the panel sample is 7.8 years, with countries such as Botswana, Ghana, Tanzania and Uganda having several newly incorporated firms.

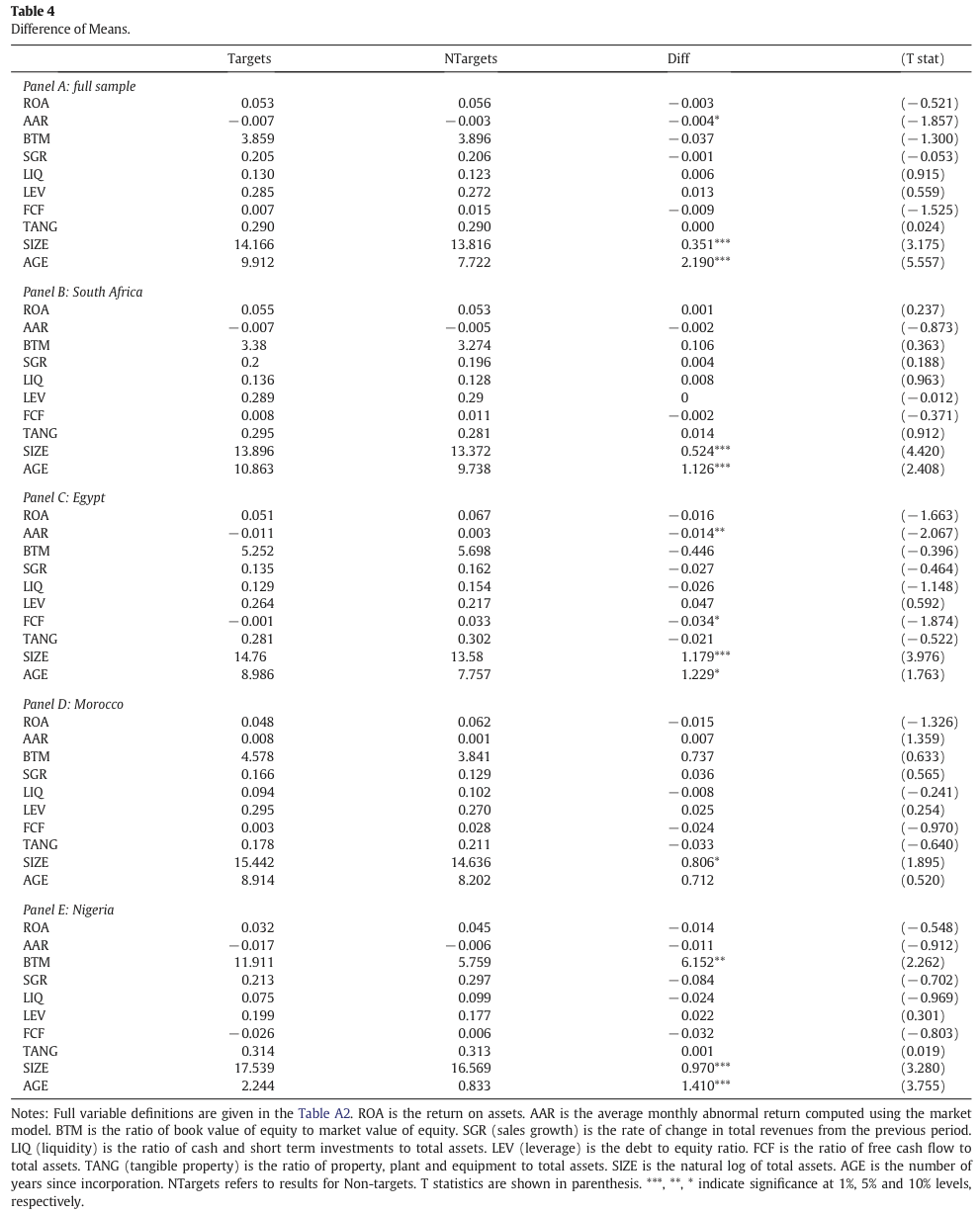

Table 4 presents results of univariate analysis (difference of means tests) comparing the financial characteristics of targets to non-targets. Panel A compares the firm (financial) characteristics of targets to non-targets for all firms in the sample. Panels B, C, D and E report the results obtained for South Africa, Egypt, Morocco and Nigeria, respectively.

The full sample results (Panel A) suggest that targets are more likely to be poorly performing (in terms of stock market returns), larger and older firms. On average, targets earn average monthly abnormal returns of −0.70% prior to receiving takeover bids compared −0.30% earned by non-targets. The difference is significant at the 10% level. We find that, on average, targets also generate lower accounting profits (ROA) when compared to non-targets. This result is consistent with the predictions of management inefficiency hypotheses as well as the empirical evidence from other markets (Powell and Yawson, 2007; Cremers et al., 2009; Brar et al., 2009). The average target has a size (Ln total assets) of 14.166 and age of 9.912 years compared to 13.816 and 7.722 years for non-targets, respectively. The difference in size and age is significant at the 1% level. This finding does not support prior evidence from other regions (e.g., UK, US, Europe) suggesting that targets are more likely to be smaller and younger than non-targets (Powell, 1997; Powell and Yawson, 2007; Cremers et al., 2009; Brar et al., 2009; Bhattacharjee et al., 2009). The finding suggests that the selection of African targets hinges on information asymmetry concerns as larger and more established firms (even in major economies such as South Africa, Egypt and Morocco, as shown in Panels B, C and D) are more likely to receive takeover bids. It also suggests that that affordability argument for the preference of smaller over big firms as potential targets (Palepu, 1986) might not be relevant in the African context. The univariate results for the other hypotheses do not reveal significant differences in the firm characteristics of African targets and non-targets. The full sample results are largely consistent with the results from subsample analysis (Panel B: South Africa, Panel C: Egypt, Panel D: Morocco, Panel E: Nigeria).

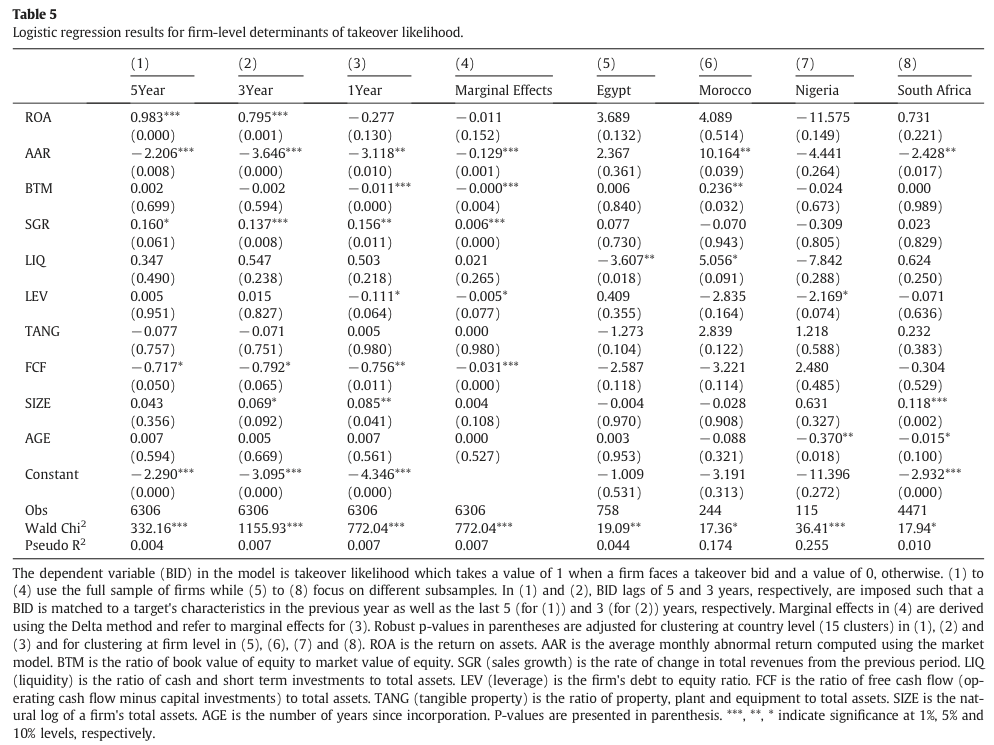

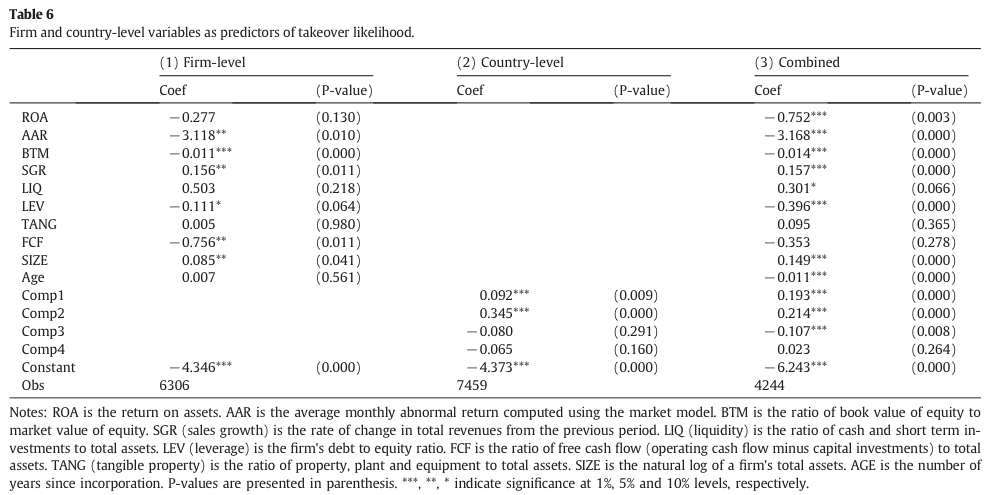

We further explore the results of the univariate analysis (Table 4) through logit regression analysis. Prior to running the model, we assess the likelihood of multicollinearity between our variables by computing Pearson and Spearman correlation coefficients, as well as, variance inflation factors (VIF) and tolerance values. The results from our multicollinearity diagnostics (untabulated) show a significant correlation between the independent variables. Nonetheless, the Pearson and Spearman correlation coefficients are quite low and are therefore unlikely to lead to issues of multicollinearity. The VIFs for all our variables are below the 3.0 threshold thus further eliminating any concerns of multicollinearity. These results are available upon request. In our logit models (Table 5), the dependent variable is a binary measure of takeover likelihood (it takes a value of 1 when a firm receives a takeover bid and zero, otherwise) and the independent variables the firm-level determinants of M&A activity.

In Table 5 we compare the characteristics of targets in the 5 years [Model (1)], 3 years [Model (2)], and 1 year [Model (3)] leading up to the bid to the characteristics of non-targets using a multivariate logit framework. In addition, we report results for marginal effects using the Delta method [Model (4)] as well as results for [Model (3)] based on different subsamples; Egypt [Model (5)], Morocco [Model (6)], Nigeria [Model (7)] and South Africa [Model (8)]. In essence, we use 5-, 3- and 1-year lags in models (1) to (3) to model the dynamics of target characteristics in the five-year period leading up to the takeover bid. In Models (5) to (8), we model takeover likelihood as a function of a firm’s last observable characteristics (i.e., characteristics in the previous period).The results in Table 5 are based on clustered (by country and firm) robust standard errors. The results do not change qualitatively when we alternatively add country dummies, industry dummies or firm fixed effects. For brevity, we do not report alternative model specifications.

Targets appear to be firms that are profitable prior to the bid but lose profitability in the years leading up to the bid. We find that takeover likelihood increases with firm profitability in the five-year period leading up to the merger bid but declines with profitability in the bid year. Takeover likelihood also declines with monthly abnormal stock returns. These results support the management inefficiency hypothesis as it suggests that targets are, potentially, profitable firms which are inefficiently managed (i.e., experiencing decline in performance) in the period leading up to the merger bid. The results for Nigeria (insignificant) and South Africa (significant) provide some support to our finding that M&A plays a disciplinary role in African financial markets. Notwithstanding, we find that takeover likelihood in Morocco (significant) and Egypt (insignificant) increases with firm accounting and stock performance. The business environment in these North African countries (Middle East and North Africa or MENA region) is, perhaps, significantly different from the environment in Sub-Sahara Africa. Prior research on firms in the MENA region suggests that these firms are characterised by concentrated family ownership and blockholding (Bloom and van Reenen, 2007; Claessens et al., 2000). Nepotism and managerial entrenchment persists, as family members are typically selected to manage these corporations over long periods of time (Gedajlovic and Shapiro, 1998; Bloom and van Reenen, 2007; Claessens et al., 2000). As evident in our findings, the implication of this ownership and management structure is that the market for corporate control has a limited effect in this context. To a bidder, there are therefore no substantial benefits in merging with poorly performing firms as their managers cannot, generally, be easily replaced. This, perhaps, explains why well-performing firms make comparatively more suitable targets as bidders may directly benefit from the firm’s continuing success without the need to replace incumbent management.

Our full sample evidence does not support the undervaluation argument (Palepu, 1986) as we do not find that takeover likelihood increases with potential firm undervaluation. One reason for this might be our earlier finding that African firms have very high book to market (BTM) ratios on average. Nonetheless, our results for Morocco shows that, consistent with the undervaluation hypothesis, potentially undervalued firms are more likely to receive takeover bids. Recall, that we find no evidence that M&A has a disciplinary role in this particular market. The role of M&A here is, perhaps, one of correcting market inefficiencies in firm valuation as opposed to managerial inefficiencies in managing firm performance.

Takeover likelihood increases with growth in sales (suggesting that targets possess potential for future growth or those in growth industry) but declines with firm leverage. The results from Models (1), (2) and (3) taken together suggest that targets reduce their levels of leverage in the years leading up to the merger bid. Targets also appear to increase their holdings of tangible assets in the period leading up to the merger bid. Consistent with the tangible property argument (Ambrose and Megginson, 1992), we find that takeover likelihood increases with the level of tangible assets held by firms. Nonetheless, the results are not significant at the 10% level. Inconsistent with the free cash flow argument (Jensen, 1986; Lehn and Poulsen, 1989; Powell, 1997), takeover probability declines with level of free cash flow. These results, when taken together with our finding on sales growth, suggests that takeover likelihood for African firms increases when firms have growth opportunities but lack free cash flow to exploit them. This suggests that takeovers in this region are motivated by the generation of synergies through the injection of financial resources.

Further, in support of the results from Table 4, our results from Table 5 show that takeover likelihood for African firms increases in firm size i.e., larger firms are more likely to receive takeover bids. As noted earlier, these results do not mirror the findings from other markets (UK, US, EU). In the African context, larger firms are more likely to be established entities with better corporate governance, more transparency, less information asymmetry and more stock market liquidity than their small counterparts making them more attractive as potential targets. Looking at the results from Models (1) to (3) together, there is some evidence, that a continuous increase in a firm’s size (at least over the five year period) increases its visibility to bidders and its suitability as a potential target. The results of multivariate tests on firm age suggest that takeover probability generally increases with firm age across the sample. However, the regression coefficient of the firm age variable is not statistically significant at the 10% level. Subsample analysis shows a significant negative relation in the case of Nigeria and South Africa where younger firms are more likely to receive takeover bids.

5.4. Country- and firm-level factors as moderators of firm acquisition likelihood

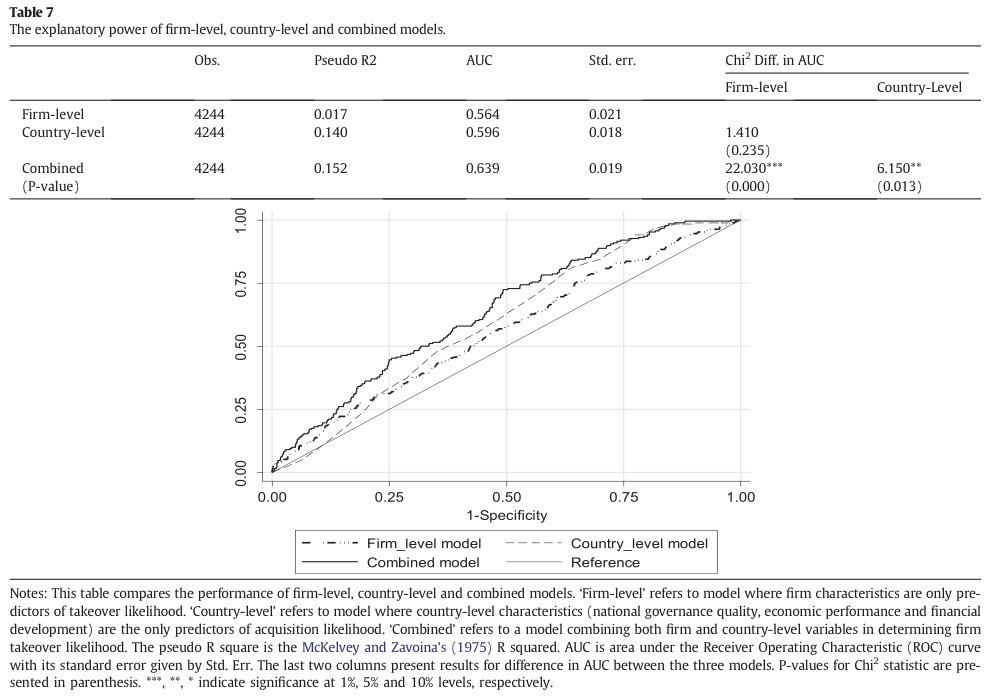

We noted earlier that several prior studies explore country- and firm-level determinants on FDI and M&As in isolation. We argued this is, perhaps, a limited view as FDI through M&As will only be pursued under suitable country- and firm-level conditions. We next explore the extent to which firm- and country-level factors together explain a firm’s takeover likelihood. Our design is to explore whether a model which combines both country- and firm-level factors has an incremental predictive ability over that which employees either. As shown in Table 6, we generate a firm-level takeover prediction model using only firm-level data, a country-level prediction model using only country-level data and a combined model which uses a combination of firm- and country-level data. We assess the performance of the three models using standard Pseudo R squares and Area under the Receiver Operating Curve (AUC) diagnostics (Table 7). AUC comparison is based on the non-parametric method discussed in DeLong et al. (1988). A model whose ROC curve equal to the diagonal line in the graphic (AUC = 0.50) has a predictive ability similar to a random guess. The bigger the differential between a model’s ROC curve and the diagonal line (i.e., the larger its AUC), the higher is its predictive ability. A perfect model has an AUC of 1.

We find that, in this sample, our country-level determinants of M&A activity better explain firm takeover likelihood when compared to traditional firm-level factors. As shown in Table 7, the McKelvey and Zavoina’s pseudo R square (and AUC) of the logit model that uses only country-level variables to assign firm takeover likelihood is 0.140 (0.596) and this is higher than the pseudo R square and AUC (0.017 and 0.564, respectively) of a model that uses only firm-level variables. Note that low pseudo R squares of this nature are typical in takeover likelihood modelling literature. For example, Powell and Yawson (2007) reports pseudo r squares of 0.02 (or 2%) for their main binomial logit model. The pseudo R square of the country-level model is over eight times that of the firm-level model. These results are qualitatively similar when other measures of pseudo R squares (including Cragg and Uhler’s, Cox and Snell, McFadden’s and Efron’s R Squares) are employed. The difference in AUC between the two models is, nonetheless, not statistically significant at the 10% level (P-value of 0.235). A model which combines both firm-level and country-level factors as moderators of firm acquisition likelihood outperforms either models. The AUC achieved by the combined model (0.639) is also significantly higher than that achieved by either models. These results suggest that our country-level factors have significant implications for firm takeover likelihood. In fact, country-level factors which we advance in this study appear to better explain the incidence of takeovers amongst African firms when compared to traditional firm-level factors. Put differently, established merger prediction propositions (based on firm characteristics) do not fully explain the incidence of takeovers amongst listed African firms. This raises fresh questions about the value relevance of financial information produced by these firms as well as our understanding of what drives M&A in this context.

5.5. Additional analyses and sensitivity checks

Here, we conduct further robustness checks on some of our key results. First, in our analysis, we considered all bids irrespective of whether the bids were successful or eventually failed in resulting to a completed takeover. In untabulated results, we find that our conclusions do not materially change when we focus on the subset of completed or successful bids only (i.e., exclude failed bids). The results we obtain from this additional analysis are consistent with those in Tables 4 to 7. These results are available upon request.

Second, we explore the factors driving bids for control — those where the bidder aims to acquire more than 50% of the voting rights in the target. These acquisitions generally represent substantial investment in the target. In untabulated results, we find that this sub sample is characterised by two distinct features. First, although targets involved in such bids generally experience a decline in monthly abnormal returns prior to takeovers (as hypothesised), the likelihood of receiving a control bid in our African sample increases with firm accounting profitability. This suggests bidders are keen to gain control of firms with a track record and potential for profitability. Second, unlike other bids, the likelihood of receiving a control bid increases with firm free cash flow. Given that control bids are significant investments the presence of excess free cash flow in the target potentially allows the bidder to reduce some of the implicit acquisition costs. We did not restrict our sample to control bids in the main part of our study as this significantly reduces the number of bids in our sample.

For our third robustness check, we explore differences in the characteristics of targets of domestic and cross-border bids. We define domestic bids as bids from other African firms and cross-border bids as bids from outside the continent. In untabulated results, we find that the results for domestic bids are consistent with those presented in Table 5. Also consistent with the results in Table 5, the results for cross-border bids show that a decline in accounting profitability (management inefficiency) and a large firm size (information asymmetry concerns) are the main firm-specific factors explaining the selection of targets in the region by cross-border bidders.

Finally, Manne (1965) contends that the takeover market makes the corporate world a more efficient one by ensuring that managers who deviate from the best interest of their shareholders are replaced by more efficient management teams. A contentious issue which particularly relates to this region is whether the market for corporate control or takeover market as an external monitoring mechanism can enforce managerial discipline when the legal system is ineffective (Manne, 1965; Jensen and Ruback, 1983; Jensen, 1986). In untabulated results, we interact National governance variables with measures of management inefficiency in our logit analysis. We find some evidence that the market for corporate control works more efficiently (i.e., management inefficiency is associated with takeover bids) in the presence of strong national governance (as measured by Rule of Law index (ROLI) and Control of Corruption index (CCI)). That is, national governance and the market for corporate control are, perhaps, complements not substitutes in addressing management inefficiencies.

6. Summary and Conclusion

6.1. Summary of Findings

This study has investigated the antecedents of FDI through M&A for listed firms in African markets. Generally, the results support our contention that M&A volume across the 15 countries is moderated by location advantages prescribed in

Dunning’s (1980) eclectic paradigm. Consistent with Dunning (1980), M&A volume increases with market size (the market-seeking motive of FDI: Markusen and Venables, 2000), human capital (the presence of knowledge and skilled labour: Noorbakhsh et al., 2001) and efficiency opportunities (low production cost opportunities: Asiedu and Lien, 2011). Inconsistent with eclectic paradigm (Dunning, 1980), but in line with the resource-curse paradox and prior empirical research on the subject (Sachs and Warner, 1995, 1997; Asiedu and Lien, 2011), we find a negative relation between M&A volume and resource endowments. We find evidence of a positive relation between a country’s national governance quality and the volume of M&A in attracts. Better institutional environments (lower corruption, more effective governments, appropriate rule of law and government accountability) attract higher levels of FDI through M&A. Further, we find that the presence of an active stock market is a key ingredient in stimulating FDI through M&A. Countries with more developed stock markets (i.e., stock markets with several listed firms which are actively being traded) do attract more M&A. Overall, these results from country-level antecedents support our postulations that improvements in national governance, economic performance and stock market development over time, potentially, lead to improvements in the volume of M&A activity and the likelihood that firms will be acquired.

The results from firm-level antecedents suggest that M&A plays a key disciplinary role in many African financial markets, perhaps more efficient than the role of regulation given the challenges of enforcement in these markets. We find that the experience is heterogeneous across the continent with M&As in Morocco appearing to be more focused on correcting perceived market efficiencies in the valuation of firms than the inefficiencies in the management of firms. Further, in full sample and subsample (South Africa) analyses, we find evidence that M&A targets are more likely to be larger listed firms. This evidence is inconsistent with the traditional firm size hypothesis, but consistent with our argument that information asymmetry concerns underlie bidders’ selection of suitable takeover targets in key African markets.

Our study is based on the premise that M&A activity fosters regional and national economic development by channelling resources to promising businesses, by correcting market inefficiency in the pricing of assets and through its ability to enforce managerial discipline, amongst others. Our results suggest that regulators have a pivotal role to play in the development of the market for corporate control as we find a strong association between national governance, economic conditions, stock market development and the volume of M&A activity, as well as, the likelihood that individual firms will receive takeover bids. Indeed, our evidence suggests that in this region, country-level factors are stronger determinants of firm acquisition likelihood than firm specific factors.

Our paper makes several unique contributions. The results show that time-varying country-level factors, such as the quality of national governance, economic performance and capital market development have a significant impact on M&A activity both in terms of the volume of activity and the likelihood that individual firms will be acquired. For the first time, we present large-sample cross-country evidence from Africa, which suggests that improvements in the quality of national governance, economic performance and stock market development are likely to lead to improvements in M&A activity. As expected, we also find that the likelihood that individual firms will receive takeover bids can be explained by factors beyond their characteristics i.e., country-level factors. Our results suggest that in this sample, these country-level factors better explain the incidence of takeovers when compared to traditional firm-level variables.

6.2. Limitations and areas for further research