Publications Insurance M&A Trends: A Year In Review And Predictions For 2016

- Publications

Insurance M&A Trends: A Year In Review And Predictions For 2016

- Christopher Kummer

SHARE:

By KPMG

Foreword

At the start of 2015, we made some predictions around how mergers and acquisitions (M&A) would impact the insurance sector. We did this in order to help clients plan their strategy in a rapidly evolving market.

We anticipated a highly active year, centered on a number of key themes including consolidation, particularly within the property and casualty (P&C) segment and where industry fundamentals are affected by regulation, such as the US health care market. Other key themes were efficiency and the importance of high-growth markets as primary motivators among dealmaker.

In this publication, we begin by looking back at how those key underlying drivers and supporting trends have developed and the resulting impact on the sector. In summary, our predictions proved largely accurate and M&A has certainly played a critical role in enabling insurers to pursue their strategic ambitions.

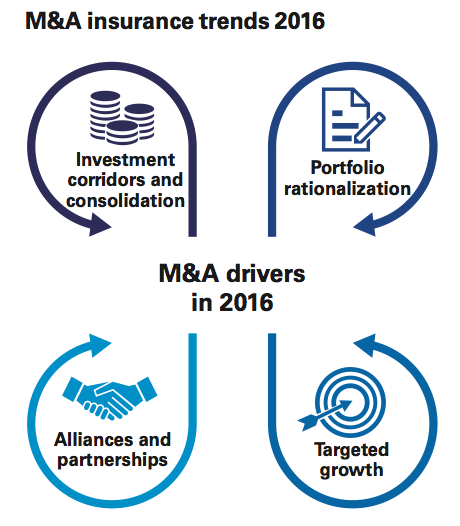

We then turn our focus to the unfolding year ahead. Building on the pattern of activity we witnessed over the past 12 months, we see M&A playing an even greater role in the insurance market. One might sum up the predominant mindset among key players as ‘grow or go’. With this philosophy setting the tone for the year ahead, we lay out our predictions for the year in terms of four key themes. They include: portfolio rationalization, targeted growth, the power of alliances and investment corridors and consolidation.

We hope you find this distillation of key events and trends from the past year as well as top-line predictions for the year ahead to be helpful as you consider future opportunities for your organization. In an industry that continues to experience shifting market dynamics and an ever-changing competitive landscape, M&A is expected be a key element of your strategy. (Gary Reader, Global Head of Insurance KPMG in the UK)

One might sum up the predominant mindset among key players as ‘grow or go’.

M&A trends: A look back on 2015

We began 2015 with expectations of considerable consolidation within the insurance sector. That prediction played out, particularly in terms of cross-border M&A and transactions driven by regulatory change or insurers’ focus on efficiency and service capabilities.

We saw high levels of activity driven by insurers seeking new or expanded opportunities in select high-growth markets in Asia and Africa, although high valuations acted as a deterrent. The year was also marked by an impressive volume of reverse deal flow as acquirers from Asia, particularly China and Japan invested in mature markets, such as Europe and the US.

Positive regulatory developments were often the catalyst for transactions, including increased Foreign Direct Investment limits in India, Obamacare in the US and in the UK, where pension reforms changed industry fundamentals. Solvency II has yet to exert a major influence as insurers continued to assess the impact of rules scheduled for rollout in 2016.

Many companies focused on divestments of non-core or under-performing assets or agreements with closed book consolidators to better manage their back books. Other insurers demonstrated more growth-minded ambitions, embarking on new ventures with FinTech or affinity partners to enhance their customer experience, market reach or technology capabilities.

The broking sector continued to experience significant transaction volumes as large players sought to build geographic reach or specific capability.

Additionally, alternative capital providers remained active, including private equity, pension funds and investment funds, completing deals in the insurance sectors across mature and high-growth markets.

Importance of high-growth markets

The pace of change in developing economies brings diverse challenges and opportunities for insurers that are active in, or considering entry to, a high-growth market.

Africa

The African region and, in particular sub-Saharan Africa, is becoming increasingly important to the insurance community. The potential for Africa is supported by positive demographic change such as the increasing population, a developing middle class and the adoption of technology, particularly leveraging mobile technology to grow financial services. Excluding South Africa, insurance penetration was estimated to remain close to just one percent of GDP.

In 2015, we predicted a number of global insurers, as well as insurance groups from South Africa, would look to capitalize on this underlying opportunity.

► What happened?

We witnessed a number of insurers making targeted acquisitions to support their growth ambitions in Africa. Recent examples include:

— Old Mutual’s acquisition of a 37.3 percent collective stake in UAP Holdings Limited from Abraaj Capital Holdings Limited, AfricInvest and Swedfund International AB for approximately US$155.5 million.

— Private equity firm ECP announced the sale of its stake in NSIA Participations SA to National Bank of Canada (20.9 percent interest) and Amethis Africa Finance (5.4 percent interest) in a deal valued at around US$106 million.

— South Africa’s Sanlam acquired nearly 30 percent of Morocco’s Saham Finances for around US$375 million.

— Barclays Africa acquired a 63.3 percent stake in First Assurance in Kenya for KES2.9 billion (~US$29 million), motivated in part to build out wealth management and insurance propositions.

Reverse deal flow

Referring to transactions involving acquirers from high-growth markets investing into mature markets, we predicted large insurers, particularly from Asia, would look for diversification, capability and access to international investment markets. In a related development, we also expected to see more real estate and infrastructure investment coming from countries like China.

► What happened?

This prediction proved correct by the year’s events with a number of Chinese firms diversifing their investment portfolios. Examples include:

— China Life Insurance invested over US$1 billion in US warehouses, marking its largest overseas real estate deal.

— Ping An Insurance bought London office property Tower Place for approximately US$490 million.

Fosun International and Anbang Insurance Group also remained active:

— Fosun committed to spending at least US$2.4 billion with plans to acquire five insurance companies in Asia, US and Europe. Among them, acquiring a 52 percent stake in the Phoenix Holdings Ltd., Israel’s fourth-largest insurance provider by market value from Delek Group Ltd. for a consideration of US$461.6 million plus interest accrued before the deal’s closing date, along with other possible adjustments.

— Anbang deals included the acquisition of Dutch insurer VIVAT for EUR1 billion and the acquisition of VIVAT Verzekeringen from SNS Reaal NV for a consideration of EUR150 million.

While the Japanese completed mega-deals in Europe and America, including:

— Acquisition of HCC Insurance Holdings Inc. in the US by Tokio Marine Holdings Inc. for a total consideration of approximately US$7.5 billion.

— Acquisition of Lloyd’s of London insurer Amlin PLC by Japan’s MS&AD Insurance Group Holdings Inc. for around US$5.3 billion in order to strengthen its presence and risk management capability in reinsurance.

— Acquisition of StanCorp Financial Group Inc. by MeijiYasuda Life Insurance for around US$5 billion.

The rest

We expected continued interest in the traditional high-growth markets in Asia and Latin America — following a quiet period for Latin American deals in 2014 — as well as countries like Turkey.

► What happened?

Consolidation, valuation expectations and a lack of quality targets resulted in a relatively quiet year. Latin America saw several deals but remained relatively quiet, possibly as a result of the ongoing economic situation. Deals included:

— Suramericana S.A., the Colombian insurance company, acquired the Latin America operations of RSA Insurance Group PLC for a cash consideration of GBP403 million (US$614 million).

— US insurer Liberty International agreed to acquire Penta Security, a Chilean provider of property and casualty insurance services for approximately US$162 million.

Deal flow into mature markets dominated 2015.

Impact of regulation

Regulation remained an important driver with a unique ability to quickly and fundamentally change the market landscape and, accordingly, potential for M&A.

A view from India

India is an important market given its scale and potential. Increased focus was driven by the change in the Foreign Direct Investment (FDI) limit from 26 percent to 49 percent. As a result, we expected to see a significant uptick in activity as existing joint venture (JV) partners consider whether to increase their stake and new entrants are attracted to the market. Furthermore, we saw potential for consolidation within the market and the increase in capital created through increasing foreign participation as a further enabler, with many foreign players operating in India keen to increase their stake.

Indian insurance industry expected to grow to US$350– 400 billion in 2020.

► What happened?

Many incumbents responded positively to the change in the FDI limit and have, or are in the process of increasing, their stake. Valuations have proved a challenge in some instances. Recent examples include:

— Standard Life PLC agreed to acquire an additional nine percent stake in HDFC Standard Life Insurance Company Limited for around US$264 million.

— Prudential Financial Inc of the US is planning to raise its stake in Pramerica Life Insurance Co Ltd. to 49 percent.

— Insurance Australia Group Limited (IAG) has also decided to increase its stake in SBI General Insurance Company Ltd. to 49 percent.

— Nippon Life has signed an agreement with Reliance Life Insurance to acquire an additional 23 percent stake for around US$348 million.

Other major insurers have also decided to increase their stake in their Indian JVs.

In addition, new entrants were also attracted to the market. Among them:

— Jardine Lloyd Thompson Group PLC plans to acquire Vantage Insurance Brokers & Risk Advisors Pvt Ltd, an India-based insurance broker specializing in life and general insurance.

— Willis Europe BV of the UK agreed to acquire a 49 percent stake in Almondz Insurance Brokers Pvt from India-based Avonmore Capital and Management Services Ltd.

The reinsurers have also responded with a number of license applications to set up a local operation.

A view from China

China remains a core growth market and one that is experiencing significant regulatory change, with a new risk-based solvency standard being introduced in 2015/2016. The market has seen recent changes to bank distribution, imminent detarrification of motor insurance, initiatives to develop health insurance and pension markets. Combined with relaxing foreign ownership restrictions and changes to local ownership requirements aimed to reduce government’s ownership stake in the insurance sector, China is poised to see an increased level of attention, particularly in the health insurance and pension markets.

► What happened?

Inbound activity and consolidation within the sector were lower than expected. However, there were a number of interesting deals, including Allianz JV with the Chinese search engine group Baidu and the investment group Hillhouse Capital targeting the online insurance market.

Among the larger deals:

— Baotou Huazi Industry Co Ltd. acquired a 51 percent stake in Huaxia Life Insurance Corporation Ltd. for cash consideration of around US$4.9 billion.

— Ageas agreed to sell its Hong Kong life insurance business to Chinese asset management company JD Capital for around US$1.4 billion to focus on the fast-growing emerging markets in Asia.

A view from the UK

The UK is a good example of how mature markets are responding to the impact of new regulation. Recent changes to pension products, which created enhanced flexibility and greater freedom for pensions and the continuing conduct-focused regulation are at the fore. We expected further consolidation in the UK, particularly in the life and mutual sectors, in response to recent changes as the importance of scale, capital efficiency and distribution capability grows.

► What happened?

As expected, the UK saw an increase in activity driven by pension reform and regulation. Examples include:

— Equitable Life sold its non-profit annuity business to Canada Life. The agreement involved transfer of 31,000 annuities valued at around GBP875 million.

— Rothesay Life Ltd. agreed to acquire 28,000 members from Zurich Assurance Ltd. for an undisclosed cash consideration.

Solvency II

To some degree, Solvency II acted as a break on deal activity due to uncertainty around future capital models. However, with the ‘go live’ date of 1 January 2016 and greater clarity realized, we expected to see this break released and increased confidence translate into more deal activity. Areas of the market that we viewed as likely to see the greatest impact included monoline insurers, companies with long-term guarantees on legacy business and annuity writers. Once capital requirements were clear, we expected to see an acceleration in M&A activity as some companies would require more capital and others would look to use M&A to achieve greater diversification and reduce capital requirements.

► What happened?

We are still waiting for the full impact of Solvency II to be understood and, as a result, activity in 2015 was somewhat muted. A number of organizations are assessing their strategies and commitment to certain businesses and, therefore, we expect this prediction to push out into 2016.

A small number of deals have occurred with insurers exiting businesses that will no longer be capital efficient after the implementation of Solvency II. For example:

— AstraZeneca UK is looking to dispose of its captive insurer IC Insurance to Randall & Quilter Investment Holdings Ltd. for a cash consideration of GBP17 million.

Efficiency and focus

The key drivers underpinning efficiency and focus are rationalization of non-core operations, driving improved cost and capital efficiency through effective management of back books and a focus on enhancing the customer experience and distribution.

Rationalization of non-core operations

In the current environment, a ‘flag planting’ strategy is not viable. Accordingly, there is increasing pressure and focus on management teams to determine core markets for their respective businesses. KPMG professionals expected to see the large global players exit, close or look to restructure certain underperforming operations that are not considered strategically important.

► What happened?

This prediction was spot-on. Increasing pressure on management teams to identify core markets has led many global insurers to divest non-core or underperforming businesses. Examples include:

— RSA Group, which is selling its operations in India, the Baltics, Poland and Latin America to focus on its core markets in the UK and Ireland, Scandinavia and Canada.

— Skandia is in agreement with Nordic Insurance Consolidation Group (NICG) to sell its life insurance company.

— Genworth Financial Inc. is in talks with AXA S.A. to sell its non-core lifestyle protection insurance business for around US$510 million.

Management of back books

The benefits of a successful program to enhance management of back books is self-evident, with insurers seeing reduced costs, enhanced capital position and, in certain instances, improvements in cross sell and up-sell revenues. As insurers continue to explore possibilities, and with remaining appetite from closed-book consolidators in certain markets, we expected a high chance of increased deal flow.

► What happened?

As predicted, consolidation continued. Key events included:

— In the UK, AdminRe entering into an agreement to acquire Guardian Financial Services for GBP1.6 billion to further strengthen its position as a leading closed-life book consolidator.

— RL360 Group also plans to acquire the international life business of Clerical Medical International Insurance Company Limited (CMI), which has been running as a closed book of business since March 2012.

— The German closed-life market has also developed, with the Cinven-backed platform being joined by Athene, following their acquisition of Delta Lloyd Deutschland AG and its subsidiaries and Fosun, which acquired the closed-life insurance portfolio of Baloise for around US$1.87 billion.

Insurers can no longer afford to ‘sit’ on businesses that are underperforming or sub-scale. Grow or go: Taking a portfolio approach to growth provides insights into the bold action required.

Enhancing the customer experience

Insurers are looking to continually improve and enhance the customer experience through better use of technology, data and interaction with the client.

Telematics is one example of increasing focus among some insurers to deliver improved underwriting profitability and enhanced customer service. Additionally, insurers are looking to transform their product design and claims management processes through innovations such as machine learning. A number of insurers are investing heavily in these areas through in-house research and development centers. However, we also see advantages for insures looking to acquire capability or enter into partnerships with firms that bring specific capability, such as collecting and analyzing vast amounts of data or in the development of digital distribution capability.

Accordingly, we expected to see more activity, either through outright acquisitions, joint ventures or partnerships involving insurers and FinTech companies.

► What happened?

Insurers continued to leverage technology to secure new and innovative distribution channels as well as build new capability to enhance customer engagement.

A great example of new innovation is the launch of Bolt Google Connect from BOLT Solutions Inc., a new distribution program that helps insurers join Google’s insurance aggregation site — Google Compare — and determines how it fits into their product and distribution strategies.

We have also seen insurers take steps to encourage the potential insurance tech community. One recent example is of AXA, which has launched Kamet, a EUR100 million accelerator program aimed specifically at insurance tech entrepreneurs.

They have also linked up with Niantic Labs (an internal Google start-up) to use the AXA logo in its reality game Ingress, allowing AXA to reach millions of new potential customers.

Throughout 2015 we also observed partnerships or acquisitions involving insurers and FinTech companies. For example, AEGON and HCL Technologies opened a joint studio to help Aegon’s existing and potential new customers find ways to manage their financial future through digital channels.

Insurers are also looking to develop affinity deals and partnerships to drive new business. For example:

— In Russia, new clients can access accident insurance via their mobile device.

— South America has seen significant growth in the sales of micro insurance through third parties, such as retailers, drug stores and supermarkets.

44% of insurance executives see strengthening customer loyalty as their biggest opportunity in next 2 years.

Bancassurance

Bancassurance remains a key distribution channel in many markets. It will also be an important channel in high-growth markets like Africa, where leveraging a mobile banking platform represents an excellent opportunity to increase insurance penetration.

In countries where banking and insurance capital reform is putting pressure on the common ownership model, we expected to see an increase in deal activity throughout 2015. An interesting example is Australia, where the life market is dominated by integrated bancassurers.

We expected to see certain banks look to divest their insurance operations and enter into distribution agreements.

► What happened?

In large part the success of bancassurance depends on number of external factors such as tax, regulation, banking penetration and even local customs. A key distribution channel in some markets, the trend played out as expected with the channel gaining importance in the Asia-Pacific region and Africa. While in North America, specifically the US and Canada, banassurance penetration remained relatively low.

In Asia-Pacific, recent examples include:

— EastWest Bank and Ageas Insurance entered into a 20-year distribution agreement for an estimated amount of US$65 million in the initial year.

— Manulife Financial Asia Ltd. entered into a 15-year distribution agreement with DBS Bank Ltd. for Singapore, Hong Kong, China and Indonesia for an initial payment of US$1.2 billion.

— In Africa, Old Mutual has partnered with Ghana’s Ecobank to offer life insurance services.

We also saw a number of banks unwind a fully owned model with the divestment of their insurance operations (partly driven capital pressure created by the adoption of Basel III). Examples include:

— Barclays is selling Spanish-based CNP Barclays Viday Pensiones Compania de Seguros, SA for around US$84 million.

— Bank of West has sold BW Insurance Agency, Inc. to Hub International Ltd. for an undisclosed consideration.

— Commercial International Bank (Egypt) SAE along with Legal & General Group PLC have agreed to sell Commercial International Life Insurance Co. to AXA Group for around US$98 million. AXA will also benefit from a 10-year exclusive Life & Savings distribution agreement with Commercial International Bank in Egypt.

For more information, please read The Power of alliances: Partnering for growth in the insurance sector, which focuses specifically on bancassurance, Financial Technology (FinTech) and innovative distribution.

Expanding broker sector

The broking sector has been the most dynamic from an M&A perspective as the large global brokers looked to enhance capability and geographic reach. We expected this trend to continue, with a focus on both mature and high-growth markets.

► What happened?

As expected, insurance broking was the most active segment in 2015, particularly in the Europe, Middle East and Africa region, with a wave of transactions throughout the year. For example:

— Global broker Willis Group Holdings was very active during the year, completing a number of transactions in addition to its merger with Tower Watson in a deal valued at US$18 billion.

— Willis Group also acquired the remaining 70 percent stake in Gras Savoye, a leading French insurance broker for EUR550 million. It also announced a joint venture with Miller Insurance Services LLP, which is a specialist insurance and reinsurance broker, operating internationally and at Lloyd’s.

Widespread interest from private equity players was also on display, including in France and the UK. A few examples include:

— France’s Ardian became the majority shareholder of SIACI SAINT HONORE, a leading provider of insurance broking and employee benefits services in France.

— Cobalt Capital became the majority shareholder of Eurodommages S.A, a France-based vehicles insurance broker.

— UK-based RFIB Holdings Limited, the international Lloyd’s insurance and reinsurance broker, was sold to Calera Capital.

— Bowmark Capital agreed to acquire Aston Scott Group (ASG), one of the UK’s largest independent Risk Management and Insurance broking groups, for an undisclosed consideration.

Consolidation

Reaction of reinsurers to continuing rate pressure

Excess capital in the reinsurance markets, both traditional and alternative, combined with relatively benign catastrophe experience has resulted in an increased focus on strategic M&A to build scale and drive efficiency.

We expected to see more consolidation within the reinsurance sector as well as activity from the Bermuda-based carriers. We also anticipated that a key trend for 2015 would be the linkage of alternative capital with underwriting capability.

► What happened?

In perhaps the most active part of the sector, the first half of 2015 in particular saw a number of mega-deals driven by continuing margin pressure, which created the need for scale and complementary underwriting capability.

Examples include:

— ACE acquired Chubb for US$28.3 billionin cash and stock. It was the largest deal the US insurance industry has ever witnessed. In terms of market capitalization, this acquisition will create the second-largest listed property and casualty insurer in the US. The Federal Trade Commission (FTC) has approved the acquisition.

— XL Group acquired Catlin Group Limited, the Bermuda-headquartered global insurance and reinsurance company, for around US$4.2 billion.

— Bermuda-based Endurance acquired Montpelier Re Holdings for US$1.83 billion in cash and stock.

We also saw further activity from alternative capital providers taking direct positions in the sector. For example, Italy’s Exor SpA has won the battle to acquire reinsurance group PartnerRe Ltd for US$6.9 billion. This deal demonstrated the commitment of alternative capital providers to enter the insurance or reinsurance market directly.

The US health insurance market

In the US, the Supreme Court rejecting a case that would have obstructed the implementation of the Affordable Care Act (ACA) of 2010 sparked a wave of consolidation across the US health insurance sector. For example:

— Aetna Inc., announced a deal for Humana Inc. for approximately US$37 billion in cash and stock.

— Cigna Corp and Anthem Inc. are in discussion talks for a deal valued around US$48 billion deal.

— Centene Corporation has agreed to acquire Health Net, Inc. for approximately US$6.8 billion, to help Centene increase its scale and increase product diversification.

Mega-deals were largely driven by continuing margin pressure.

Alternative capital providers

We expected to see continued appetite from private equity and other sources of capital to make acquisitions in the insurance sector, increasing competition for the incumbent players (e.g. CPPIB’s acquisition of Wilton Re in the US in 2014). We envisioned private equity investors using their existing assets to drive a roll up/consolidation strategy. Given private equity involvement in the insurance sector has existed for a number of years, we reasoned that we would see more private equity divestments in 2015, further encouraging deal activity.

► What happened?

As predicted, alternative capital providers were actively involved, investing across the sector including in the broking and reinsurance sectors.

We also saw a number of divestments, including:

— CVC Capital Partners Limited and Apollo Global Management LLC sold Lloyd’s of London insurer Brit Plc to Fairfax Financial Holdings Ltd for US$1.88 billion.

— Calera Capital, GCP Capital Partners LLC, GTCR LLC, Irving Place Capital, Lazard Technology Partners and TowerBrook Capital Partners L.P. sold an 80 percent stake in Ironshore Inc. to Fosun International Ltd. for US$1.84 billion.

Predictions for 2016

In 2016, we forecast that M&A will play an increasingly important role in the insurance market. The underlying market conditions will drive consolidation and exits from the sector and, when combined with a diverse group of potential buyers, create an ideal deal environment.

Our overarching view is based around the trend of ‘grow or go,’ which will lead to targeted M&A to support core markets and exits of underperforming or non-strategic businesses.

The pressure on margins created by the continuing low interest rate environment, combined with pricing pressure and an evolving regulatory agenda (particularly with Solvency II in Europe), will force insurers to challenge whether their existing businesses are sustainable.

We do not expect any of the underlying market fundamentals to change in the short term and, accordingly, we expect the key trends that started to emerge over the last 12 months to continue or accelerate throughout 2016.

Supporting that strategy are four key themes that we will explore in more detail:

1. Portfolio rationalization

2. Targeted growth

3. Power of alliances

4. Investment corridors and consolidation

M&A will continue to play a critical role in enabling insurers to pursue their strategic ambitions.

Portfolio rationalization

The sector has responded to the underlying market dynamics created by a continuing low interest rate environment, increasing competition and pressure on pricing combined with disruption from innovation and new entrants. We have witnessed a wave of M&A, cost-cutting and strategic rationalization over the last 12 months.

In Europe, we believe that Solvency II will act as a further accelerator of activity, forcing owners of insurance businesses to critically assess their strategy and geographic coverage, product development and distribution reach. Concentrated underwriters will be impacted hardest and, accordingly, are likely to be at the forefront of any activity.

As a result, we expect to see non-core, underperforming or sub-scale businesses being sold or shut down, both in mature and high-growth markets. Recent examples include AXA exiting Portugal, Zurich closing its general insurance business in the Middle East and Talanx selling its subsidiaries in Bulgaria and Ukraine in order to streamline its portfolio in Eastern Europe.

We also expect to see increasing attention on the management of back books and legacy portfolios (particularly in Europe) as Solvency II sharpens the focus on optimizing capital and emergence of profits.

The UK market is one of the more mature markets in this respect, but in Germany, there are now three closed-book consolidators backed by Cinven, Fosun and Apollo. We anticipate this expansion to continue into other European markets including the Netherlands, Italy and Switzerland.

Targeted growth

At the same time, we also expect to see targeted M&A to support growth in core markets, with acquisitions or distribution agreements that enhance geographic coverage, underwriting capability or provide access to new customers.

High-growth markets will continue to be a focus, with sub-Saharan Africa continuing to experience high deal volumes as insurers look to unlock untapped potential. Markets in Asia and Latin America are more developed and opportunities are less prevalent, but in the right circumstances, we expect to see focused activity. For example:

— Samsung Life looking to enter the Philippines.

— Spanish insurer Mutua Madrilena is acquiring 40 percent of BCI Seguros in Chile in a deal worth EUR209 million.

— Canada’s Manulife Financial is seeking acquisitions in Asia, particularly in Japan, Hong Kong, China, Philippines and Vietnam.

The broking segment is another good example of targeted M&A to build capability. We foresee the large brokers continuing to acquire smaller/niche players to expand their product capability, in service areas such as employee benefits.

Insurers are also expected to expand across the value chain, acquiring specialist broking firms with complementary capabilities. In the US, for instance, Orchid Underwriters, a leading specialty underwriter of excess & surplus (E&S) insurance, acquired Platinum Partners, a New England-based wholesale brokerage firm focused exclusively on the high-net-worth personal lines marketplace.

High-growth markets will continue to be a focus, with sub-Saharan Africa continuing to experience high deal volumes as insurers look to unlock untapped potential.

Power of alliances

One of the more interesting trends we expect to develop is a greater use of alliances and partnerships to create more efficient operating models both from a capital and capability perspective.

Insurers increasingly recognize the need to look outside of their organizations to drive growth and innovation.

Again, Solvency II could be an accelerator in European markets with insurers encouraged to simplify their business models and rely more on alliances. Insurers may find that breaking up composites can reduce complexity, although this needs to be balanced with diversification.

It is also clear that insurers will invest additional capital in FinTech, either through direct investments or by establishing innovation hubs to promote collaboration and new ways of doing business. We expect to see a mix of venture capital style investment models, innovation hubs and direct investments and partnerships.

Areas that are likely to receive attention include telematics, non-traditional distribution channels and technology solutions to engage with customers. These initiatives may leverage organizations like Google and Amazon, which have vast quantities of customer data and a brand that is trusted by consumers. One interesting recent example is the joint venture between Allianz and Chinese Internet giant Baidu Inc. to distribute insurance products over the Internet in China.

The sector is ripe for disruption and if insurers do not take an active approach, others will enter the market, capturing the most profitable segments of the value chain. The Fintech 100 companies have collectively raised in excess of US$10 billion and while there are only seven insurance-related ventures on that list, we expect that to expand significantly in 2016.

Other more traditional forms of partnership will also remain important including bancassurance in high-growth markets. Partnerships that enable insurers to use mobile banking platforms in Africa to reach customers also remain a hugely exciting opportunity.

The pace of change is extremely rapid and the combination of regulation, innovation and competition can quickly transform an established business model. Examples include:

— In Australia, a stable bank-owned insurance model is being unwound with the banks now responsible for distribution and an insurer for manufacturing, NAB has already made the move and we expect further activity to develop over the next 12 months.

— In Europe, where fully-owned bancassurance models will also be unwound, Eurobank Ergasias of Greece is planning to sell at least 80 percent stake in its insurance subsidiary, Eurolife in order to achieve its restructuring plans.

The sector is ripe for disruption and if insurers do not take an active approach, others will enter the market, capturing the most profitable segments of the value chain.

Investment corridors and consolidation

As the global insurance market becomes more integrated, we expect cross border deal flow to be a critical part of the M&A environment.

We believe there will be at least three key investment corridors:

— outbound deal flow from Japan to mature markets in Europe

— outbound deal flow from China to mature markets in Europe and the US

— deal flow between the UK, US and Bermuda in the P&C primary and reinsurance markets.

We may also see other countries that have historically been the recipient of foreign investments start to reverse the direction of deal flow and invest into mature markets. India is likely to be in this next wave of investment, although we do not expect to see material transaction flow in the next 12 months.

In 2015, the Japanese were one of the most active investors into the US and we now expect their focus to shift to Europe, driven by a continuing need to diversify and capture growth.

The Chinese have also been a key contributor to global deal activity. Given strong balance sheets, combined with the need to diversify, we see this activity continuing, with both direct investments in the insurance sector and into real estate and infrastructure. In the recent past, much of the activity has been dominated by a small number of players, but we expect this group to expand over the next 12 months.

One of the major themes underpinning deal flow in 2015 was consolidation in the P&C market, with a number of mega- deals announced. We believe that the underlying market dynamics will continue to support large deals. However, our belief is that size is not sufficient in itself. For these large deals to be successful, the combination must add complementary capabilities, such as underwriting, geographic coverage or distribution.

This activity is likely to occur in both the primary and reinsurance markets. The reinsurance markets continue to experience significant inflows of traditional and alternative capital and, in the absence of significant natural catastrophes, the soft market will encourage further consolidation. The mid-tier reinsurers may be forced into mergers to remain competitive globally, and deal flow in and out of Bermuda and London will follow.

We also expect to see further activity in the London market since the remaining listed underwriters may be subject to takeover offers, possibly from Japanese or Chinese investors as well as consolidation amongst the broking sector. We expect European and North American groups to explore the merits of establishing a Lloyd’s platform as a means of enhancing access to global markets.

The continued involvement of private equity and alternative investors should not be forgotten, since many of the large and small private equity funds are active in the insurance sector across both manufacturing and distribution. The relatively short investment horizon for these buyers results in a natural churn of businesses or exits via IPO, as well consolidation activity to build a valuation proposition. High-profile acquisitions in 2015 included:

— Exor’s acquisition of Partner Re demonstrated both their commitment and appetite.

— Private equity firm Cinven is acquiring ERGO Italia, the Italian subsidiary of the ERGO Insurance Group, and its two insurance entities ERGO Previdenza and ERGO Assicurazioni.

An additional theme we expect to develop is increased involvement from debt funds providing capital support to the insurance sector, either as a result of increasing capital requirements (eg. Solvency II) or to support M&A.

We believe that the underlying market dynamics will continue to support large deals.

Conclusions

Reflecting on our predictions for 2015, the year turned out to be a very energetic period for insurance M&A activity. Interestingly, we saw the focus shift away from high-growth markets, to consolidation and new entrants from Asia acquiring targets in mature markets in Europe and the US. At the same time, the continuing low interest rate environment and pressure on rates, combined with an active regulatory agenda, forced many insurers to focus on their core markets.

In light of the events that transpired in 2015 and the continuing or emerging conditions that we forecast for the coming months, we expect a sustained period of M&A across all parts of the value chain.

In an increasingly integrated economy, deal activity will flow both into and out of high-growth markets, combining with consolidation and rationalization in mature markets. Regulation, innovation and margin pressure, sparked by current industry dynamics, will fuel this activity, resulting in many insurers adopting a ‘grow‘ or ‘go’ strategy across their portfolio.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter